Overview

The article emphasizes the mastery of strategic follow-up email protocols as a critical component for effective payment recovery in corporate finance. Establishing clear communication channels and implementing systematic follow-up schedules are essential practices supported by industry data. These strategies not only enhance operational efficiency but also improve client relationships, which are vital for increasing payment recovery rates. By documenting all interactions, organizations can further solidify these communication efforts, ensuring compliance and fostering trust with clients.

Introduction

In the fast-paced world of corporate finance, the ability to recover payments efficiently is critical to an organization’s financial health. Strategic follow-up email protocols act as a vital lifeline, enabling companies to maintain clear communication and strengthen client relationships while navigating the complexities of payment recovery.

However, the challenge lies in the effective implementation of these protocols. How can organizations ensure that their follow-up strategies are not only systematic but also personalized to meet the unique needs of each client?

This inquiry underscores the necessity for a structured approach that balances efficiency with tailored communication.

Establish Clear Communication Channels for Follow-Up Emails

To enhance the efficiency of subsequent emails, it is essential to establish strategic follow-up email protocols for payment recovery in corporate finance. This entails identifying the preferred communication channels for your clients, whether through email, SMS, or phone calls. Utilizing tools like Equabli's EQ Engage can automate and effectively manage these channels, allowing your team to drive product adoption and enhance client engagement.

To ensure consistency in messaging, all team members should be trained on the strategic follow-up email protocols for payment recovery in corporate finance. For instance, if a client prefers email interaction, all subsequent communications should be conducted through this medium to prevent confusion and strengthen the client relationship.

Furthermore, consider implementing a centralized interaction platform that enables the tracking and management of all exchanges in one location. This approach ensures that no messages are overlooked and that responses are timely. Such a strategy not only addresses client needs but also supports upsell and renewal opportunities, contributing to a seamless customer experience.

By prioritizing strategic follow-up email protocols for payment recovery in corporate finance, organizations can significantly enhance their operational efficiency and client satisfaction.

Implement a Systematic Follow-Up Schedule

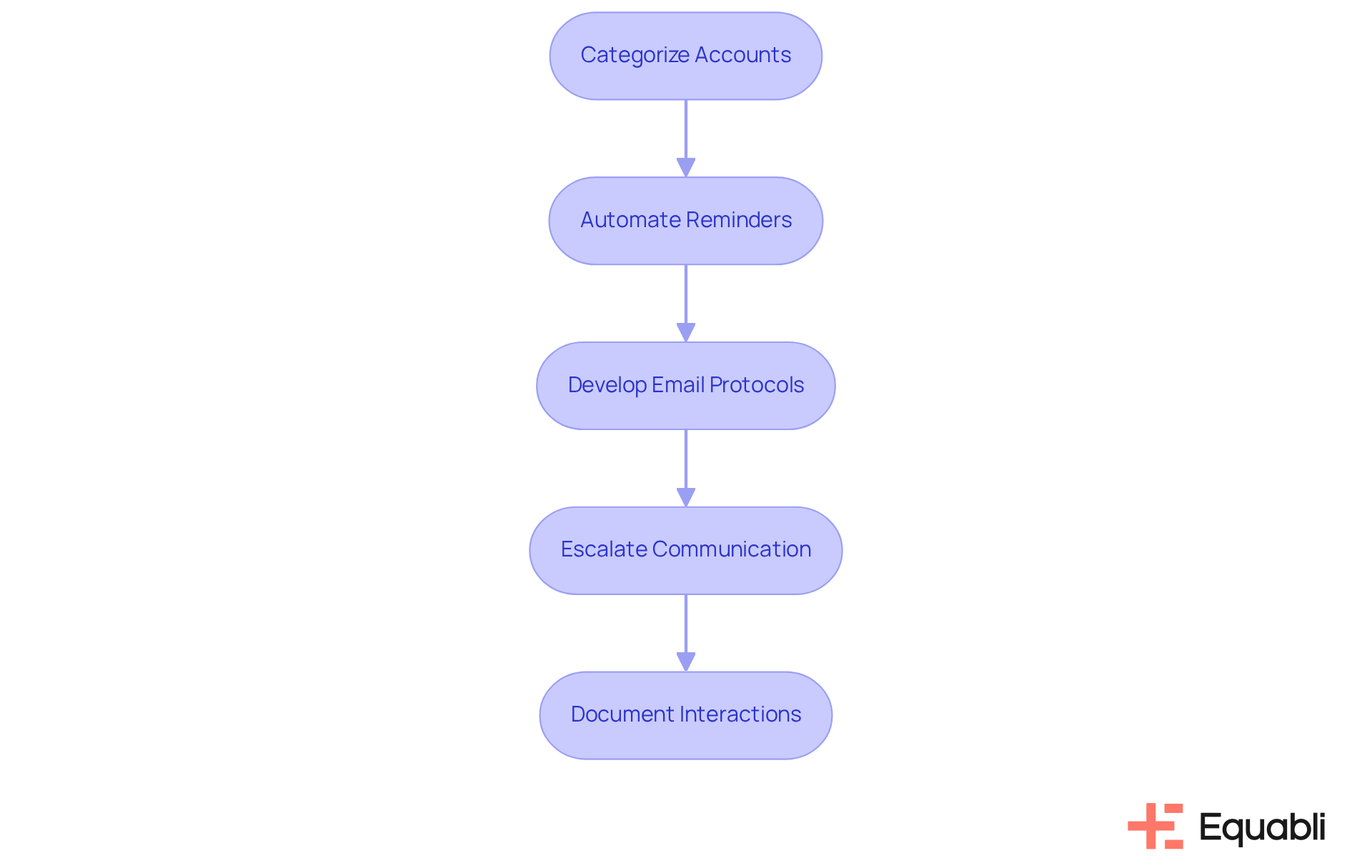

Creating a systematic tracking timetable is essential for ensuring consistent communication with borrowers. Categorizing accounts according to their payment status and urgency is critical; for instance, accounts that are 30 days past due should receive more frequent reminders than those that are only a few days late.

Utilizing Equabli's EQ Collect can streamline this process by automating reminders and scheduling subsequent actions based on these classifications. A best practice involves developing strategic follow-up email protocols for payment recovery in corporate finance, which include a series of emails that escalate in urgency, starting with a friendly reminder and progressing to more assertive messages if dues remain unresolved.

This organized approach not only enhances operational efficiency but also employs strategic follow-up email protocols for payment recovery in corporate finance, ensuring that individuals are consistently reminded of their financial responsibilities and ultimately improving payment recovery rates.

Incorporating timestamped documentation for tracking and accountability is crucial, as it provides a clear record of all interactions. By gradually escalating communication, organizations can balance persistence with consideration, reinforcing the seriousness of the debt resolution process.

This comprehensive strategy, supported by the distinct features of Equabli's EQ Suite, not only boosts recovery rates but also fosters positive relationships with clients.

Utilize Personalized Communication Strategies

Personalization is essential for effective strategic follow-up email protocols for payment recovery in corporate finance within the debt collection sector. By categorizing your loan applicants based on criteria such as:

- Payment history

- Preferences for contact

- Demographic details

you can enhance engagement through strategic follow-up email protocols for payment recovery in corporate finance. Utilizing Equabli's EQ Engage facilitates the creation of tailored interaction routes that significantly improve the likelihood of individuals managing their debt effectively. For example, if an applicant has previously communicated financial difficulties, it is crucial to acknowledge this in your follow-up and propose flexible repayment options, including customized discounts or installment plans.

Moreover, tools like EQ Engage play a pivotal role in analyzing client data to develop strategic follow-up email protocols for payment recovery in corporate finance, which predict repayment behaviors. This allows for more effective communication strategies that incorporate strategic follow-up email protocols for payment recovery in corporate finance, tailored to individual circumstances. Additionally, integrating compliance management into your outreach strategies is vital to meet regulatory requirements. By demonstrating compassion and leveraging an analytics engine for focused outreach, organizations can substantially enhance engagement rates and encourage timely settlements.

Document All Interactions and Agreements for Accountability

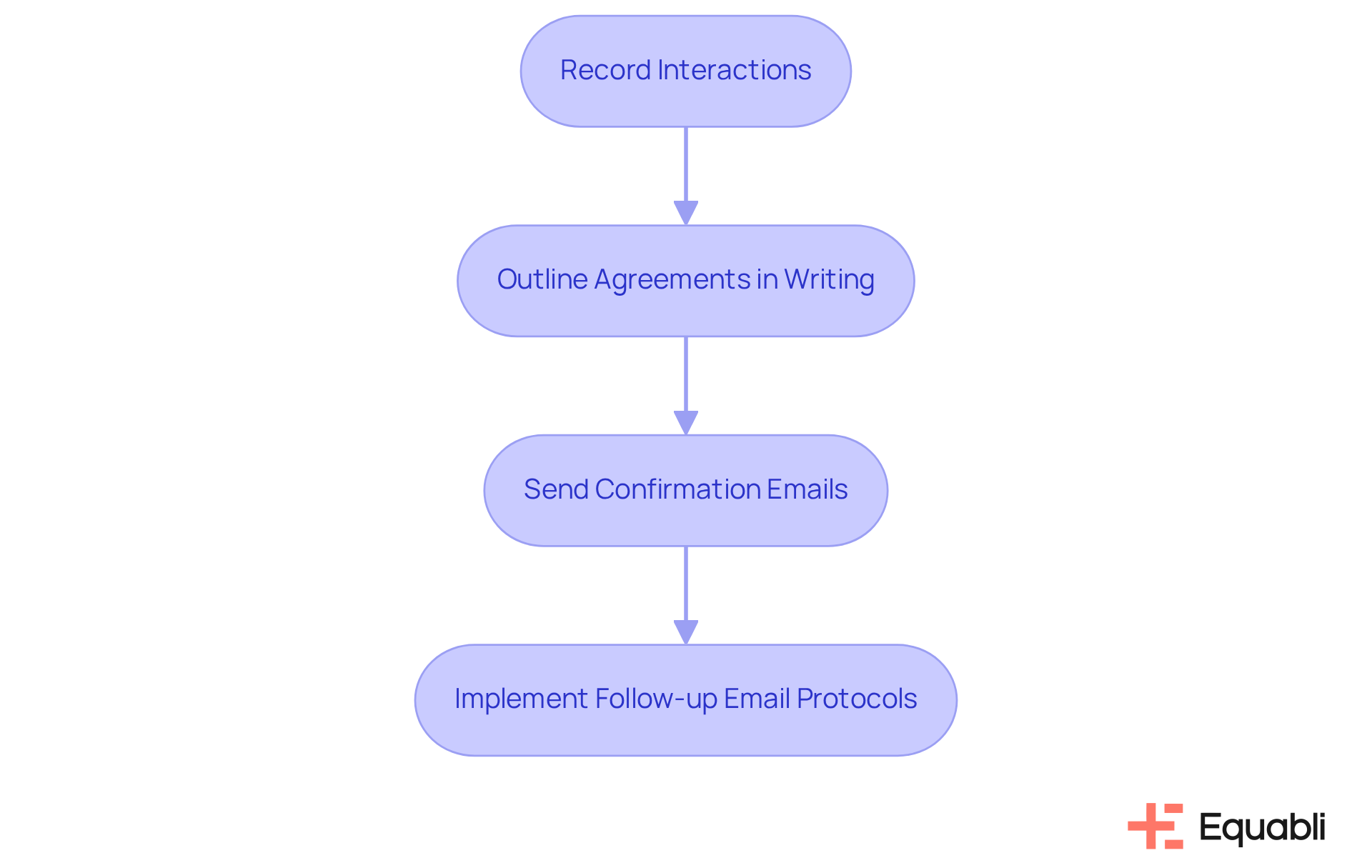

Recording all interactions and agreements with individuals seeking loans is essential for promoting accountability and trust. A robust system that captures every communication—whether emails, phone calls, or arrangements related to financial plans—must be established. Equabli's cloud-based tools simplify this process, enabling seamless tracking and documentation of all interactions.

Clearly outlining all agreements in writing and sharing them with clients eliminates potential confusion. For instance, if an individual agrees to a revised financial plan, it is imperative that the conditions are recorded, and a confirmation email detailing the arrangement is dispatched. This practice not only safeguards your organization but also fortifies trust with clients, allowing them to refer to documented agreements when necessary.

Effective communication strategies, particularly strategic follow-up email protocols for payment recovery in corporate finance, significantly enhance borrower accountability and compliance with payment obligations. From a compliance perspective, these practices establish a framework that supports operational integrity and fosters a culture of transparency within financial dealings.

Conclusion

Establishing strategic follow-up email protocols for payment recovery is essential for enhancing communication and operational efficiency within corporate finance. By prioritizing:

- Clear communication channels

- Systematic scheduling

- Personalized strategies

- Thorough documentation

Organizations can significantly improve their payment recovery processes and foster stronger client relationships.

The significance of identifying preferred communication methods cannot be overstated. Creating a systematic follow-up schedule based on payment status, coupled with personalized communication strategies tailored to individual client needs, enhances engagement and responsiveness. Furthermore, documenting all interactions ensures accountability and trust, reinforcing the integrity of financial agreements and promoting compliance among borrowers.

Ultimately, implementing these best practices not only boosts recovery rates but also enhances client satisfaction and fosters a culture of transparency. Organizations are encouraged to adopt these strategic approaches, leveraging tools such as Equabli’s EQ Suite to streamline their payment recovery efforts. This creates a more effective, client-centered experience that aligns with the evolving demands of the financial landscape.

Frequently Asked Questions

Why is it important to establish clear communication channels for follow-up emails in corporate finance?

Establishing clear communication channels enhances the efficiency of follow-up emails for payment recovery, ensuring that clients receive consistent and timely communications.

What are some preferred communication channels for clients?

Preferred communication channels can include email, SMS, or phone calls, depending on the client's preference.

How can tools like Equabli's EQ Engage help in managing communication channels?

Tools like Equabli's EQ Engage can automate and effectively manage communication channels, helping teams drive product adoption and enhance client engagement.

Why is it necessary for team members to be trained on follow-up email protocols?

Training ensures consistency in messaging across the team, preventing confusion and strengthening client relationships by adhering to the client's preferred communication method.

What is the benefit of implementing a centralized interaction platform?

A centralized interaction platform allows for tracking and managing all exchanges in one location, ensuring no messages are overlooked and responses are timely, which enhances client satisfaction.

How does prioritizing strategic follow-up email protocols impact organizations?

Prioritizing these protocols can significantly enhance operational efficiency and client satisfaction, while also supporting upsell and renewal opportunities for a seamless customer experience.