Overview

Optimizing automated payment reminder text message templates is crucial for financial institutions aiming to enhance collection processes and strengthen client relationships. Effective templates that incorporate clear identification, personalization, and timely notifications can significantly improve collection rates and operational efficiency. This aligns with the digital transformation objectives that these organizations are pursuing.

From a compliance perspective, utilizing well-structured templates not only boosts operational performance but also ensures adherence to regulatory standards. Evidence shows that personalized communication fosters better client engagement, which is essential in today’s competitive landscape. By implementing these strategies, financial institutions can mitigate risks associated with debt collection while enhancing their overall service delivery.

To operationalize this strategy, institutions should focus on developing templates that resonate with their client base. This involves analyzing client data to tailor messages effectively, ensuring that reminders are not only timely but also relevant. The impact of such initiatives extends beyond immediate collection efforts, contributing to long-term client loyalty and satisfaction.

Introduction

Automated payment reminders have emerged as a critical component for financial institutions aiming to enhance their collection processes and foster strong client relationships. These reminders, when optimized through effective text message templates, not only facilitate timely notifications regarding upcoming and overdue payments but also significantly bolster cash flow and operational efficiency.

However, the challenge lies in crafting messages that resonate with a diverse customer base while adhering to compliance standards and best practices.

How can financial institutions effectively balance automation with personalization to maximize the impact of their payment reminders?

Understand the Importance of Automated Payment Reminders

The automated payment reminder text message template optimization for financial institutions is critical for organizations aiming to enhance their collection procedures. These proactive alerts keep customers informed about upcoming and overdue payments, significantly reducing the risk of late fees and missed payments. By automating this communication, organizations can maintain consistency, which not only improves cash flow but also strengthens client relationships. Furthermore, automated notifications alleviate the administrative burden on personnel, allowing them to focus on more complex tasks that require human expertise. This strategic approach aligns seamlessly with the digital transformation goals of financial entities, making automated payment reminder text message template optimization for financial institutions a vital component of a modern debt collection strategy.

The benefits of implementing automated billing notifications are well-documented. Research indicates that organizations utilizing these systems can experience a notable increase in collection rates, with some reporting up to a 5% improvement in revenue recovery. Additionally, timely notifications have been shown to positively influence payment behavior; this shift not only accelerates the payment lifecycle but also enhances overall operational efficiency.

Successful implementation of automated reminders necessitates their integration into existing workflows and customization to user preferences. For instance, leveraging text and email as primary communication channels has proven effective, as these methods are preferred by the majority of customers. By adopting a multi-channel strategy, financial organizations can cater to diverse customer needs, further boosting engagement and transaction compliance.

In conclusion, the automated payment reminder text message template optimization for financial institutions is not merely a convenience; it represents a strategic necessity for financial organizations seeking to enhance their collection efforts and foster stronger client relationships.

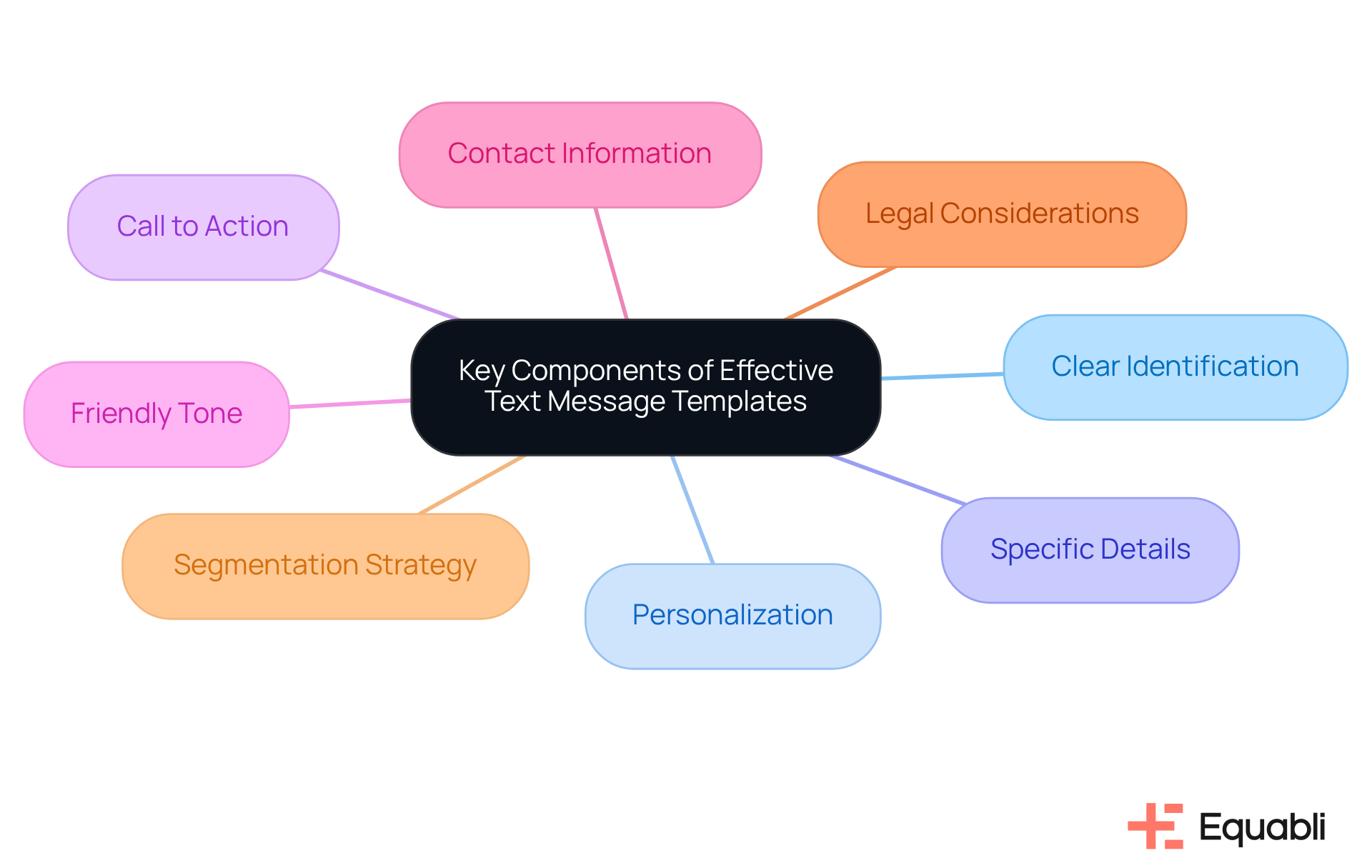

Identify Key Components of Effective Text Message Templates

To develop effective text message templates for payment reminders, it is crucial to incorporate several key components that align with Equabli's commitment to enhancing debt collection through integrated operations:

- Clear Identification: Establish trust and credibility by beginning with your institution's name.

- Personalization: Foster a connection by addressing the recipient by name, making the message feel customized.

- Specific Details: Clearly state the amount due, due date, and invoice number to eliminate confusion and provide necessary context.

- Call to Action: Include a direct instruction, such as 'Click here to settle your bill,' ideally with a direct link to facilitate immediate action.

- Friendly Tone: Employ a polite and approachable tone to encourage a positive response and maintain customer relationships.

- Contact Information: Provide a way for recipients to reach out with questions or for assistance, enhancing communication and support.

- Legal Considerations: Ensure compliance with relevant laws and regulations, including obtaining customer consent and providing opt-out options.

- Segmentation Strategy: Consider segmenting your phone database to tailor messages based on how long an invoice has been overdue, allowing for more personalized communication.

Integrating these components not only renders the messages informative but also significantly enhances the likelihood of timely settlements by utilizing automated payment reminder text message template optimization for financial institutions. Statistics indicate that SMS notifications are a key component of automated payment reminder text message template optimization for financial institutions, boasting an impressive open rate of approximately 98% and costing under a penny per message, making them a potent and economical resource for financial organizations aiming to improve their collection procedures. By tailoring messages and ensuring clarity, organizations can effectively engage clients and promote prompt transactions, ultimately streamlining operations and enhancing performance with Equabli's EQ Collect.

Customize Templates for Your Financial Institution's Needs

To effectively customize payment reminder templates for your financial institution, consider the following strategies:

-

Branding: Ensure your organization's logo and color scheme are prominently displayed to maintain brand consistency and recognition. This not only reinforces your identity but also fosters trust among clients.

-

Language Style: Adjust the language and tone to match your institution's voice—whether it’s formal, friendly, or casual. This alignment builds rapport with customers, enhancing their engagement with your communications.

-

Target Audience: Tailor the message according to the demographics of your customers. For instance, younger clients may respond more positively to a casual tone, while older clients might prefer a more traditional approach. Understanding your audience's preferences is crucial for effective communication.

-

Specific Offers: Include any relevant special promotions or payment plans that could encourage prompt payment. Highlighting these offers enhances the attractiveness of your notifications and can lead to improved payment rates.

-

Feedback Loop: Encourage recipients to provide input on the notifications. This feedback is invaluable for refining future communications and enhancing customer engagement. Furthermore, monitoring response rates to billing notifications can assist you in modifying your strategies for improved results.

By applying these strategies, financial organizations can achieve automated payment reminder text message template optimization for financial institutions, developing customized templates that not only represent their brand identity but also connect with clients, significantly enhancing the chances of prompt transactions. Notably, 85% of customers wish to pay punctually, underscoring the significance of efficient notifications. Incorporating expert insights, such as those from Alvin Amoroso, emphasizes that an effective notice for transactions is clear, concise, and includes all essential information for prompt action. Additionally, case studies like the 'Invoice Reminder for Overdue Invoice' illustrate how efficient notifications can enhance the collection of dues and strengthen relationships with customers.

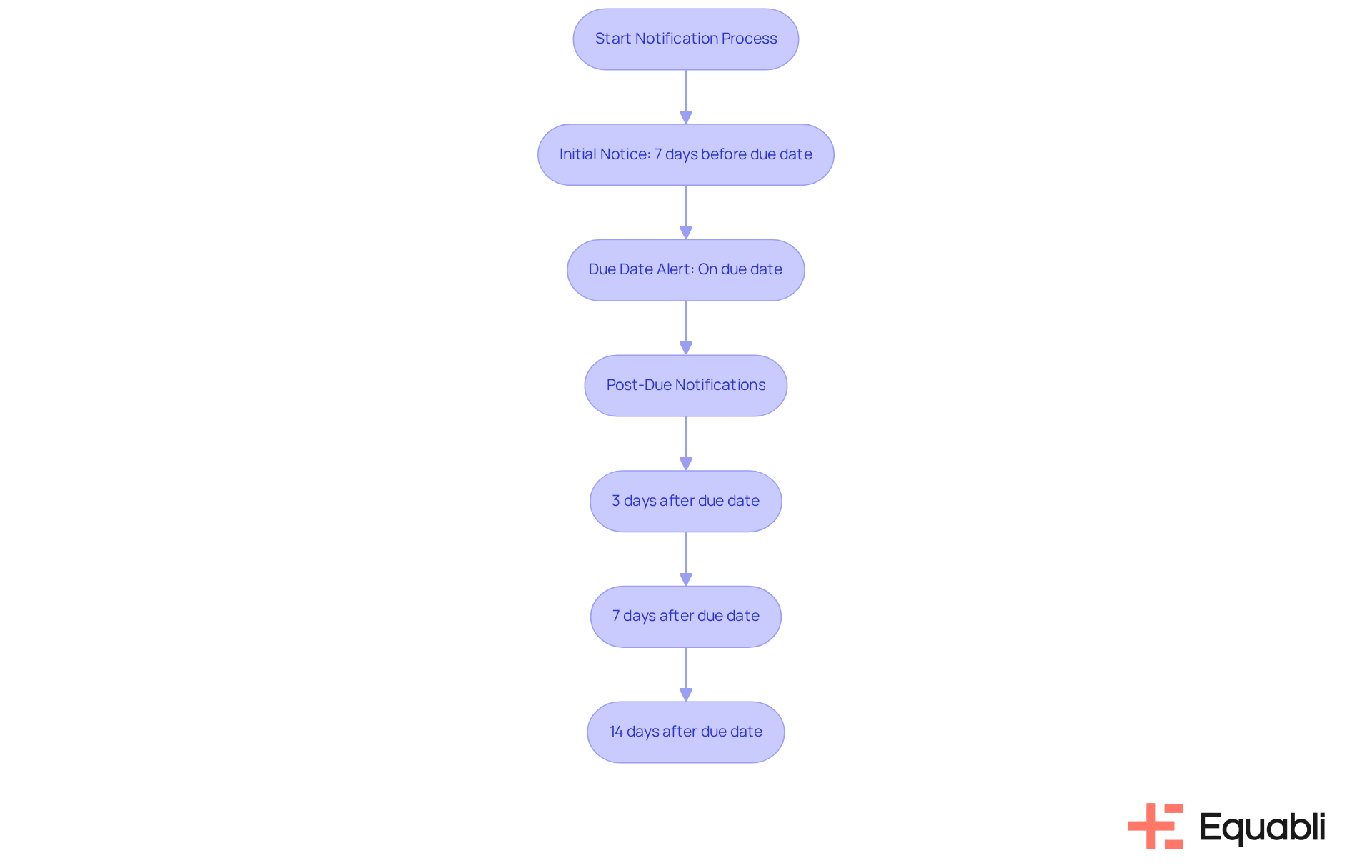

Determine Optimal Timing and Frequency for Sending Reminders

Setting the appropriate timing and frequency for billing notifications is crucial for maximizing their effectiveness.

Initial Notice: Dispatch the first notification 7 days prior to the due date. This advance notice provides clients with ample time to arrange for payment, thereby reducing the likelihood of late fees.

Due Date Alert: A second notification should be sent on the due date itself. This serves to underscore the urgency of the payment and reinforces the expectations set forth in prior communications.

Post-Due Notifications: If payment is not received, follow up with notices at regular intervals—3 days, 7 days, and 14 days after the due date. This consistent follow-up maintains pressure on clients and encourages prompt action.

Consider Customer Preferences: Tailor communication methods to align with customer preferences. Some clients may respond more effectively to text messages, while others may prefer emails. Offering multiple communication options can significantly enhance engagement and response rates.

Monitor Response Rates: Regularly analyze the effectiveness of your notification timing and frequency by tracking response rates. This data-driven approach allows for strategic adjustments to optimize collection efforts.

By implementing these timing strategies, financial institutions can enhance their chances of securing prompt settlements while utilizing automated payment reminder text message template optimization for financial institutions to foster positive client relationships. Furthermore, automating the notification process through Equabli's EQ Suite—featuring data analytics and intuitive interfaces—can contribute to automated payment reminder text message template optimization for financial institutions, streamline operations, and improve collection rates. Transitioning from manual processes to intelligent, cloud-based solutions not only enhances efficiency but also transforms the debt collection experience into a more user-friendly operation.

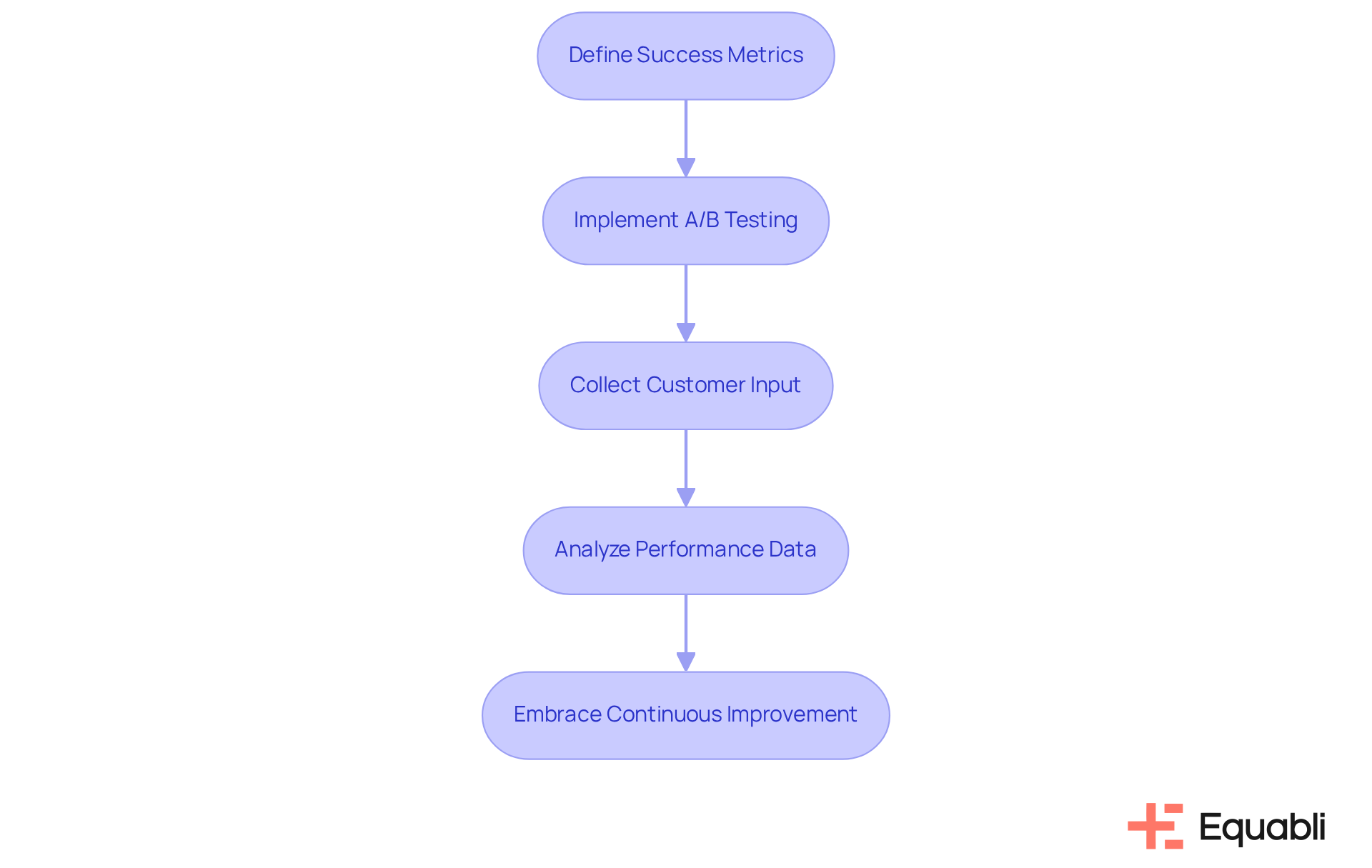

Test and Refine Templates Based on Performance Metrics

To optimize the efficiency of billing notification templates, adopting a structured method for testing and improvement based on performance metrics is essential.

-

Define Success Metrics: Establishing clear metrics for success—such as response rates, payment completion rates, and customer satisfaction scores—provides the clarity needed to guide testing efforts. This foundational step ensures that all subsequent actions are aligned with measurable outcomes.

-

Implement A/B Testing: Conducting experiments with various versions of templates allows for the identification of formats that yield the best results. Testing different wording, tones, and calls-to-action can reveal what resonates most with the audience. Research indicates that emails typically have open rates between 40% and 50%, while SMS messages can achieve open rates as high as 98%. This data underscores SMS as an effective tool for urgent notifications.

-

Collect Customer Input: After dispatching notifications, soliciting feedback from customers about their experience provides qualitative data that can uncover insights into messaging effectiveness. As Marcus Kallavus from Messente notes, effective prompts are respectful, action-oriented messages that significantly enhance client engagement. This feedback loop is crucial for continuous improvement.

-

Analyze Performance Data: Utilizing analytics tools to monitor notification performance over time is vital. Identifying trends in payment behavior allows for adjustments to templates based on these insights, enhancing engagement. For instance, case studies have shown that optimal timing for dispatching notifications can lead to higher conversion rates.

-

Embrace Continuous Improvement: Regularly reviewing and updating templates in response to collected data ensures that notifications remain effective and aligned with evolving customer preferences. This iterative process is essential for adapting to shifting market conditions and consumer expectations.

By adopting a data-driven approach to testing and refining automated payment reminder text message template optimization for financial institutions, they can significantly enhance their collection strategies. This leads to improved payment rates and stronger client relationships, ultimately positioning organizations for greater success in the competitive landscape of debt collection.

Conclusion

Optimizing automated payment reminder text message templates is crucial for financial institutions aiming to enhance their collection processes and improve customer relations. This optimization streamlines communication and fosters a proactive approach to managing payments, ultimately leading to increased revenue recovery and operational efficiency.

Key insights emphasize the importance of:

- Clear identification

- Personalization

- Specific details in crafting effective reminders

Evidence suggests that employing a multi-channel strategy, tailoring templates to the institution's brand, and implementing data-driven testing are essential steps for maximizing the impact of these notifications. By understanding customer preferences and continuously refining communication strategies based on performance metrics, financial organizations can significantly boost engagement and ensure timely payments.

In an evolving landscape of customer expectations, embracing automated payment reminders transcends mere trend; it is a strategic imperative. Financial institutions are urged to implement these best practices, enhancing their collection strategies while building stronger, more trusting relationships with clients. By prioritizing effective communication, organizations can transform their payment processes and position themselves for sustained success in the competitive financial sector.

Frequently Asked Questions

Why are automated payment reminders important for financial institutions?

Automated payment reminders are crucial as they keep customers informed about upcoming and overdue payments, reducing the risk of late fees and missed payments. This automation improves cash flow, strengthens client relationships, and alleviates the administrative burden on staff.

What benefits do organizations experience by implementing automated billing notifications?

Organizations can see a notable increase in collection rates, with some reporting up to a 5% improvement in revenue recovery. Additionally, timely notifications positively influence payment behavior, accelerate the payment lifecycle, and enhance overall operational efficiency.

What are the key components of effective text message templates for payment reminders?

Effective text message templates should include clear identification of the institution, personalization by addressing the recipient by name, specific details about the amount due and due date, a call to action, a friendly tone, contact information for assistance, legal compliance, and a segmentation strategy for tailored messaging.

How can financial organizations enhance customer engagement through automated reminders?

By adopting a multi-channel strategy that includes text and email notifications, organizations can cater to diverse customer preferences, boosting engagement and transaction compliance.

What are the advantages of using SMS notifications for payment reminders?

SMS notifications have an impressive open rate of approximately 98% and are cost-effective, costing under a penny per message. This makes them a powerful tool for improving collection procedures in financial organizations.

What legal considerations should be taken into account when sending automated payment reminders?

It is important to ensure compliance with relevant laws and regulations, which includes obtaining customer consent and providing opt-out options in the communications.

How can personalization in payment reminders impact customer response?

Personalization fosters a connection by making the message feel customized, which can encourage a positive response and help maintain customer relationships.