Overview

The article outlines strategies for optimizing payment reminder letters within financial institutions, aiming to enhance customer engagement and compliance. It highlights the critical role of timing, personalization, clear communication, and automation in this process. Evidence indicates that well-timed and tailored reminders significantly improve response rates and customer satisfaction, underscoring the necessity for financial entities to adopt these practices.

From a compliance perspective, timely reminders not only foster better customer relationships but also align with regulatory expectations. Data shows that institutions implementing personalized communication strategies see a marked increase in compliance adherence, which is essential in today’s regulatory landscape. This approach not only mitigates risk but also enhances operational efficiency.

To operationalize this strategy, financial institutions should invest in automated systems that facilitate timely and personalized reminders. By leveraging technology, organizations can ensure that communications are not only consistent but also tailored to individual customer needs. This level of customization is crucial for maintaining customer trust and satisfaction.

In conclusion, optimizing payment reminder letters through strategic timing and personalization is not merely a best practice; it is a necessity for financial institutions aiming to enhance customer engagement and compliance. Executives must prioritize these strategies to navigate the complexities of debt collection and risk management effectively.

Introduction

Crafting effective payment reminder letters is crucial for financial institutions seeking to enhance customer engagement and ensure timely transactions. Evidence shows that optimizing the timing, frequency, and personalization of these notifications can significantly improve response rates and customer satisfaction. However, the challenge lies in balancing clarity and urgency without overwhelming clients with reminders.

How can financial institutions refine their strategies to create reminders that not only inform but also resonate with their customers? This question underscores the need for a strategic approach to communication in the context of enterprise-level debt collection.

Determine Optimal Timing and Frequency for Payment Reminders

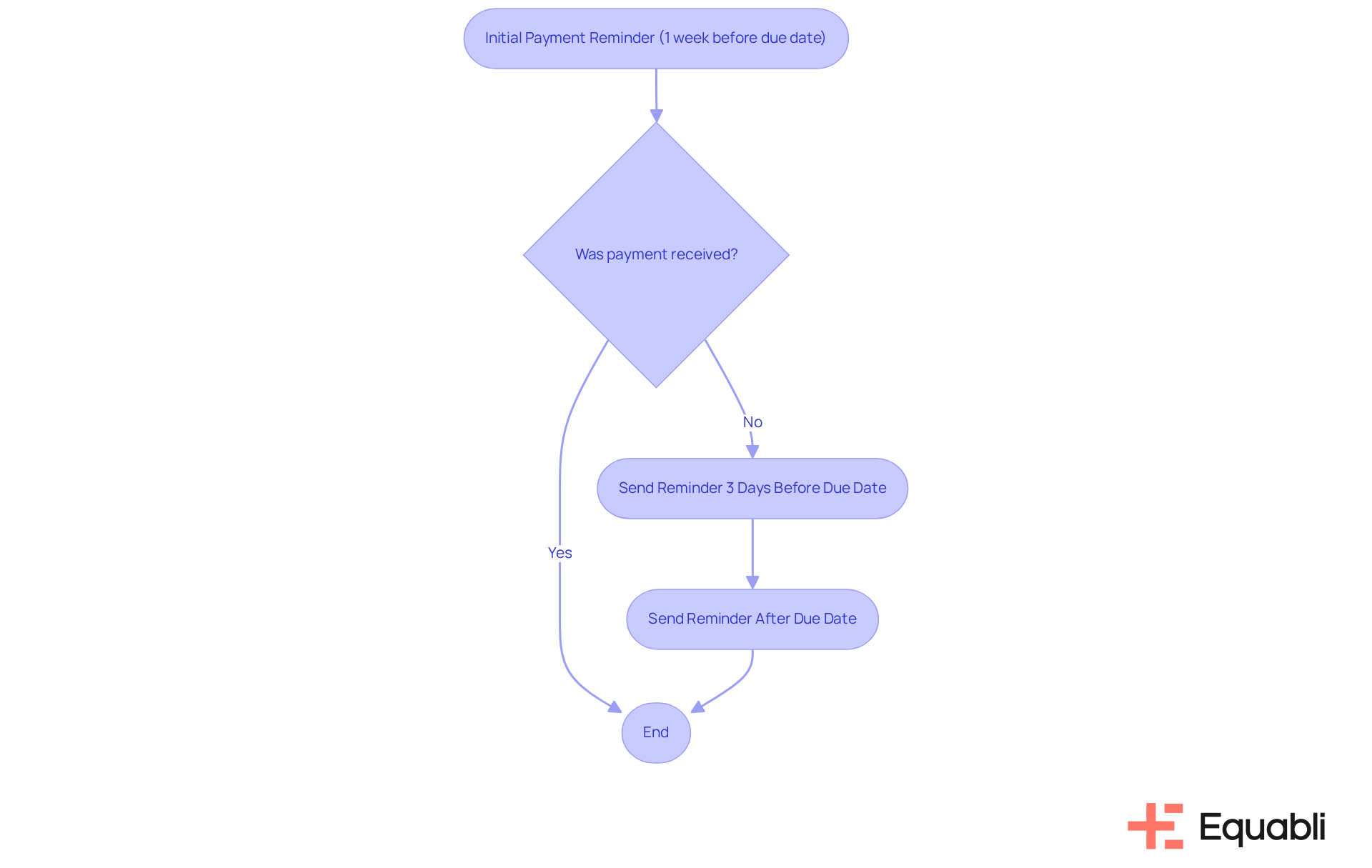

To enhance billing notifications, financial organizations should consider using payment reminder letter optimization strategies for financial institutions by dispatching the initial notice approximately one week prior to the due date. This timing allows customers sufficient opportunity to prepare for the transaction. Research indicates that notifications sent within this timeframe yield higher response rates. For instance, a study found that sending notices one day before the due date significantly improves adherence rates.

Following the initial notice, subsequent notifications can be dispatched at strategic intervals, in line with payment reminder letter optimization strategies for financial institutions, such as three days prior to the due date and immediately after the due date if funds have not been received. This approach not only reinforces the importance of timely payments but also aligns with compliance best practices.

Furthermore, organizations should tailor the frequency of notifications based on client billing history. Clients with a record of delayed transactions may require more frequent alerts to encourage prompt action. By implementing payment reminder letter optimization strategies for financial institutions, they can enhance operational efficiency and reduce the risk of non-compliance.

Personalize Payment Reminders to Enhance Customer Engagement

To enhance customer engagement, financial institutions must prioritize the customization of notifications, which is essential in their payment reminder letter optimization strategies for financial institutions. Personalizing messages by including the customer's name, specific transaction details, and a friendly tone can significantly improve response rates. For example, instead of a generic reminder, a tailored message could read:

'Hi there, just a friendly reminder that your balance of $[Amount] is due on [Due Date]. We genuinely appreciate your dedication to prompt transactions!'

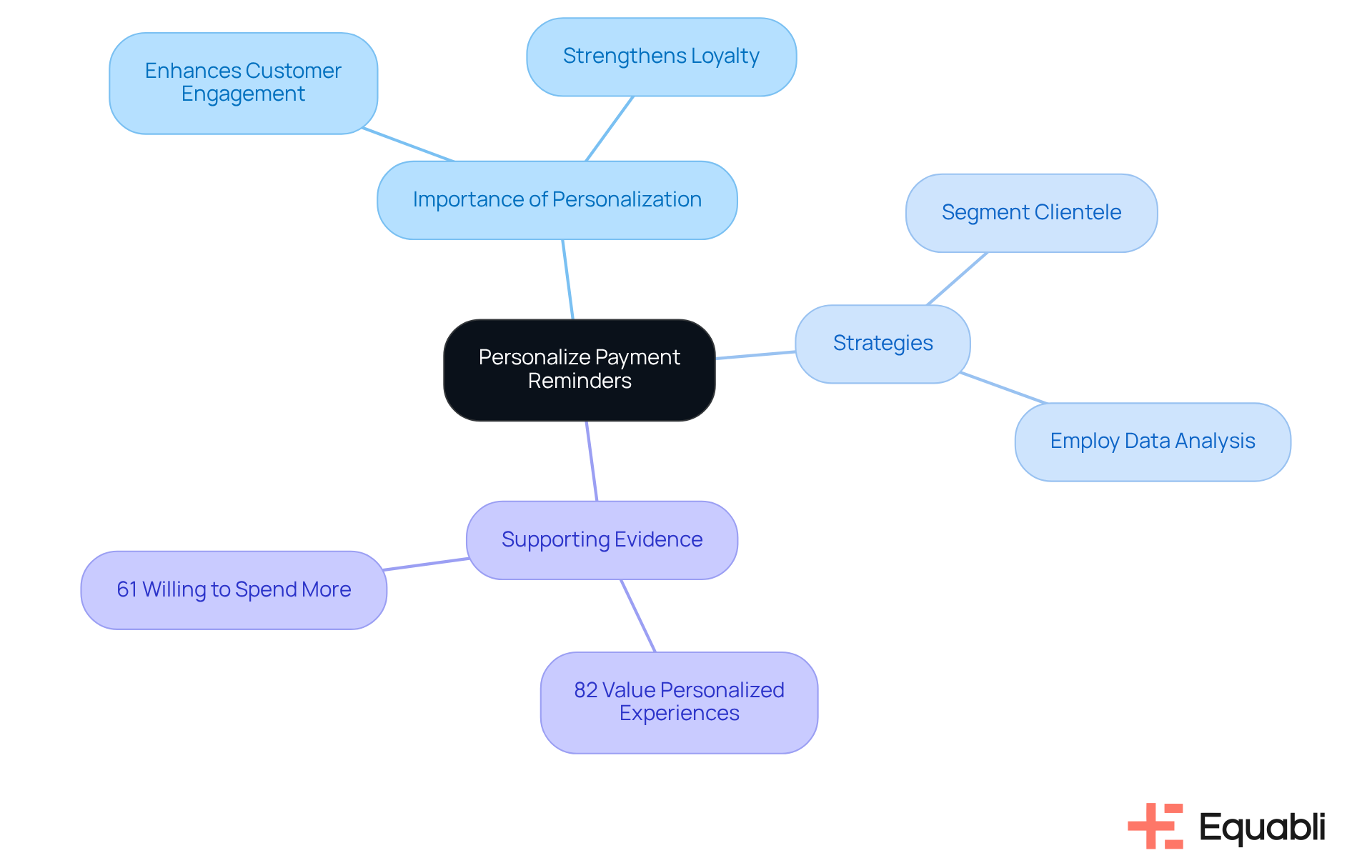

Evidence supports this approach: studies indicate that 82% of consumers value personalized experiences, which greatly influence their brand choices. Furthermore, 61% of consumers are willing to spend more with companies that customize their services. This data underscores the financial benefits of personalization, suggesting that institutions can strengthen customer loyalty and drive revenue through payment reminder letter optimization strategies for financial institutions.

To operationalize this strategy, institutions should:

- Segment their clientele based on payment history, preferences, and communication channels.

- Employ data analysis to understand client behavior to further refine these notifications, ensuring they resonate with recipients.

By adopting a data-driven approach, financial institutions can enhance their engagement efforts, ultimately leading to improved customer satisfaction and loyalty.

Communicate Clearly and Effectively in Payment Reminders

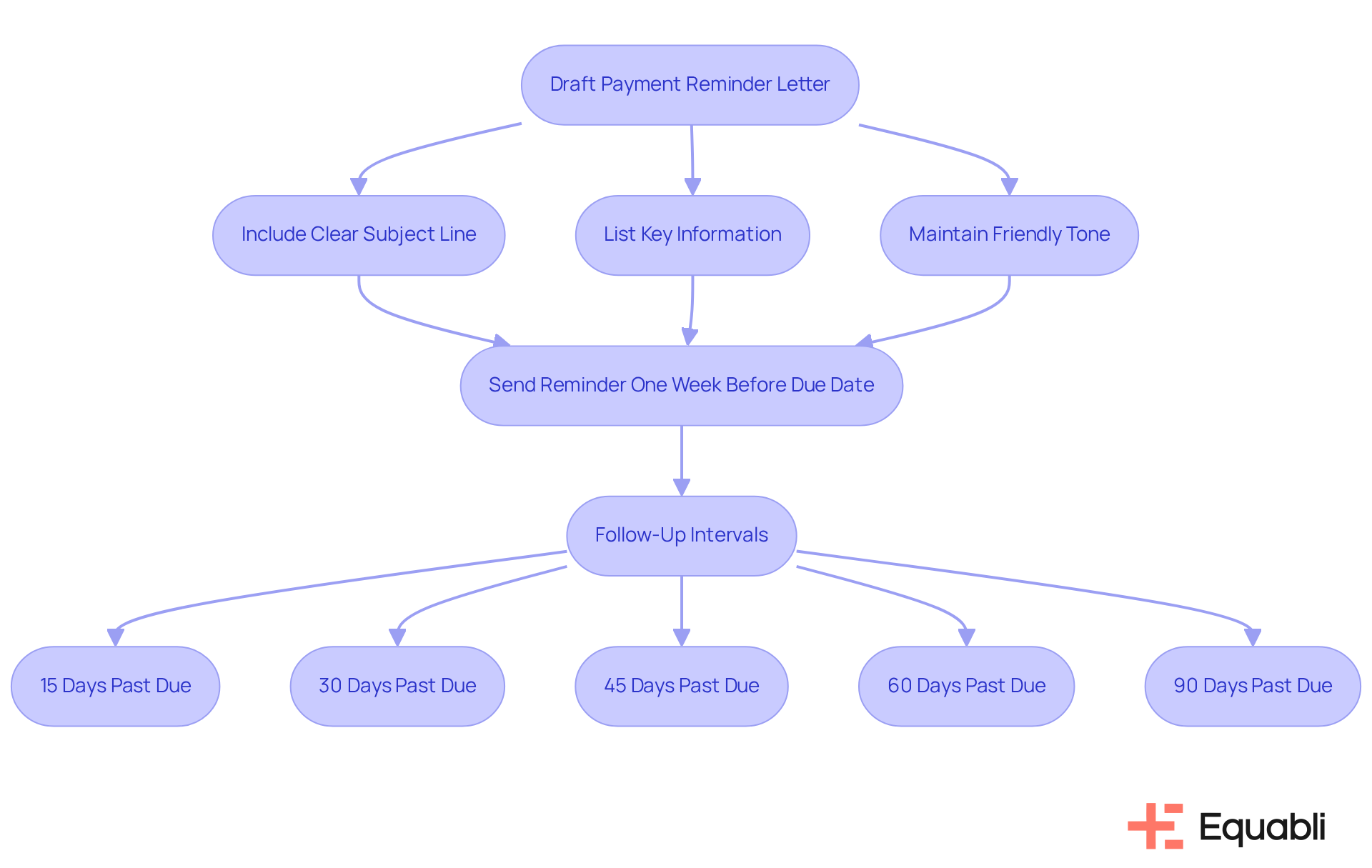

To implement payment reminder letter optimization strategies for financial institutions, payment notices must be concise, direct, and easily comprehensible. A clear subject line is essential; for instance, 'Payment Reminder: Invoice #12345 Due Date Approaching' effectively conveys the message's intent. The payment reminder letter optimization strategies for financial institutions should succinctly present critical information: the invoice number, the amount owed, the due date, and available payment methods. For example, a well-organized reminder might state: 'Dear John Doe, your amount of $500 is due on November 15, 2025.' You can complete your transaction using a credit card or bank transfer. Thank you for your prompt attention.

Utilizing bullet points can effectively highlight key information, facilitating easier digestion for customers:

- Invoice Number: 12345

- Amount Due: $500

- Due Date: November 15, 2025

- Payment Methods: Credit Card, Bank Transfer

Avoiding jargon is crucial; instead, maintain a friendly yet professional tone to foster positive relationships. Furthermore, consider incorporating specific outcomes for overdue transactions, such as late charges or interest fees, in prior notifications as part of payment reminder letter optimization strategies for financial institutions, which can encourage prompt replies. By customizing messages and expressing gratitude for previous transactions, you can further enhance client engagement and promote timely responses.

To implement payment reminder letter optimization strategies for financial institutions, it is essential to send notifications strategically at intervals such as one week before the due date, and follow up at 15, 30, 45, 60, and 90 days past due.

Leverage Technology and Automation for Efficient Payment Reminders

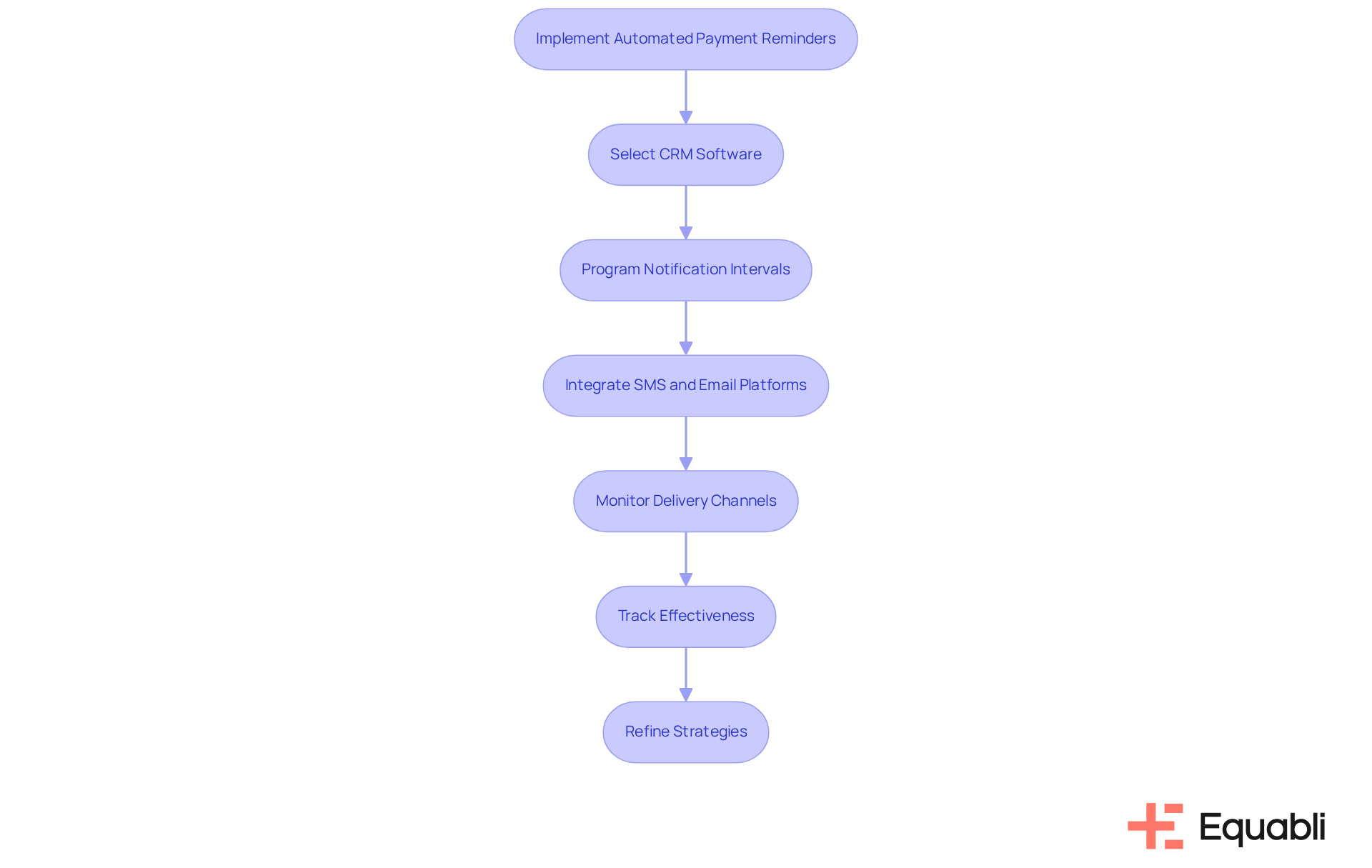

Financial organizations should consider utilizing payment reminder letter optimization strategies for financial institutions by implementing automated systems for dispatching billing notifications. Such systems can be programmed to send notifications at predetermined intervals, ensuring that no client is overlooked. For instance, by utilizing CRM software, organizations can establish automated notifications that trigger based on the client's payment schedule.

From a communication efficiency perspective, integrating SMS and email platforms enhances the delivery of notifications through the customer's preferred channels. This automation not only accelerates response times but also enables staff to concentrate on more complex tasks, ultimately leading to improved resource allocation.

Moreover, tracking and analyzing the effectiveness of payment reminder letter optimization strategies for financial institutions through these technologies can yield valuable insights for continuous improvement. By leveraging data-driven approaches, organizations can refine their strategies, ensuring compliance and optimizing operational efficiency in debt collection processes.

Conclusion

Implementing effective payment reminder letters is essential for financial institutions seeking to enhance customer interactions and ensure timely payments. By optimizing strategies such as timing, personalization, clear communication, and leveraging technology, organizations can significantly improve response rates and customer satisfaction.

Key strategies include:

- Sending initial reminders one week before the due date

- Personalizing messages to foster engagement

- Maintaining clarity in communication to avoid confusion

Evidence suggests that utilizing automation tools can streamline the notification process, allowing for timely reminders and freeing up staff to focus on more complex tasks. These approaches not only promote prompt payments but also contribute to building stronger relationships with clients.

In conclusion, optimizing payment reminder letters transcends mere debt collection; it fosters a positive customer experience that encourages loyalty and trust. Financial institutions are advised to adopt these best practices, continuously analyze their effectiveness, and refine their strategies. By doing so, they can ensure compliance, enhance operational efficiency, and ultimately drive revenue growth while fostering lasting customer relationships.

Frequently Asked Questions

What is the recommended timing for sending the initial payment reminder notice?

The initial payment reminder notice should be dispatched approximately one week prior to the due date to give customers sufficient opportunity to prepare for the transaction.

Why is the timing of payment reminders important?

Research indicates that notifications sent within one week of the due date yield higher response rates, improving adherence to payment schedules.

What are the suggested intervals for subsequent payment reminders?

Subsequent notifications can be sent three days prior to the due date and immediately after the due date if funds have not been received.

How does tailoring notification frequency based on client billing history help?

Tailoring the frequency of notifications based on client billing history can encourage prompt action, especially for clients with a record of delayed transactions.

What benefits do organizations gain from implementing payment reminder letter optimization strategies?

By implementing these strategies, organizations can enhance operational efficiency and reduce the risk of non-compliance regarding payment collections.