Overview

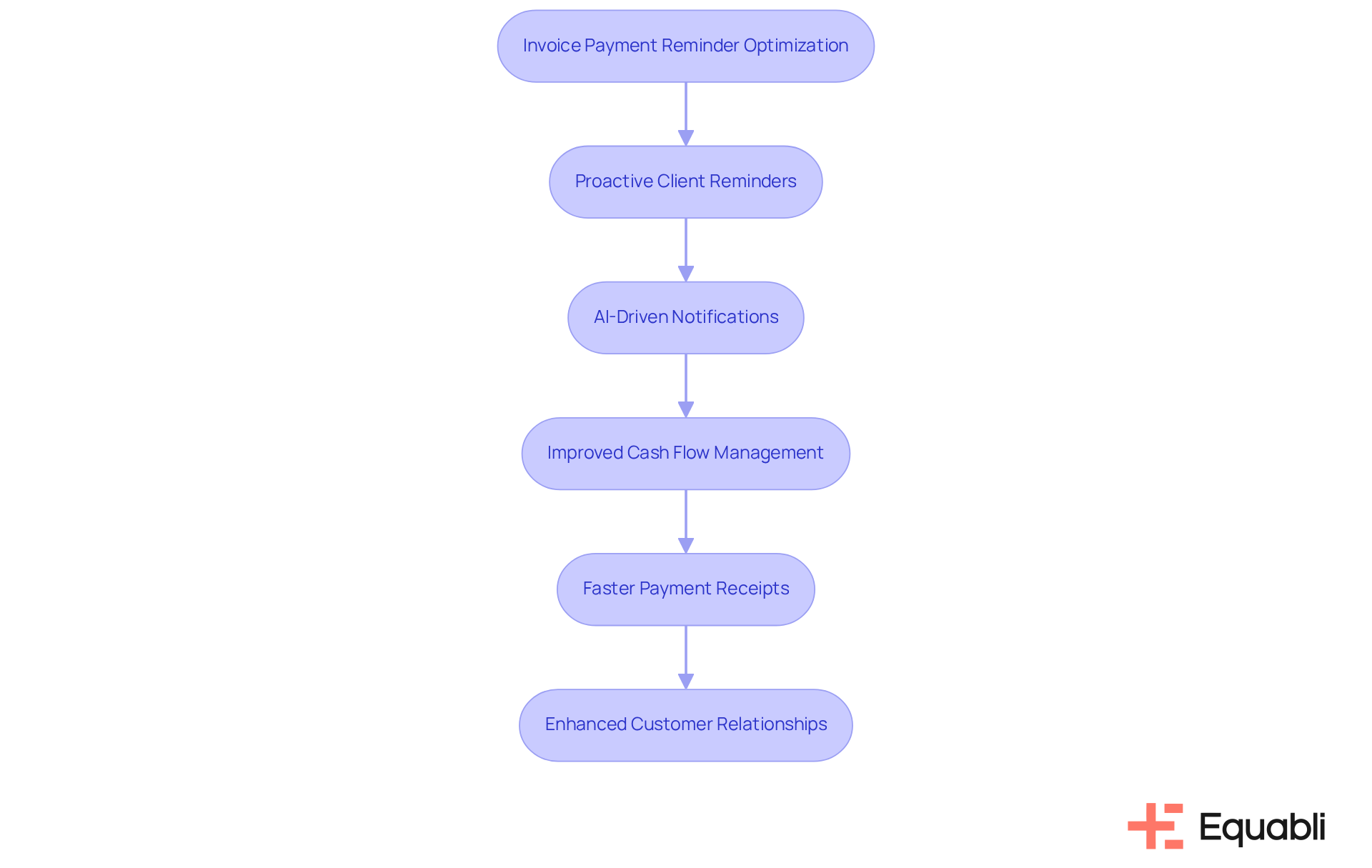

This article examines the optimization of invoice payment reminder email templates specifically for corporate finance departments, aiming to enhance cash flow and strengthen customer relationships.

Effective reminders are crucial; they should feature clear communication, strategic scheduling, and personalization. Evidence suggests that these elements can significantly reduce late payments and improve collection rates. For instance, data indicates that companies employing such strategies experience faster payment timelines and heightened customer engagement.

From a compliance perspective, implementing these practices not only streamlines operations but also mitigates risks associated with delayed payments. By prioritizing clarity and personalization in communications, finance departments can foster stronger relationships with clients, ultimately leading to improved financial outcomes.

To operationalize this strategy, finance teams should consider integrating data analytics to tailor reminders based on customer behavior and payment history. This approach not only enhances the effectiveness of reminders but also aligns with broader compliance frameworks, ensuring that all communications meet regulatory standards.

In conclusion, optimizing invoice payment reminder emails is not merely a tactical adjustment; it represents a strategic initiative that can yield significant benefits in cash flow management and customer relations. By adopting these practices, corporate finance departments position themselves as proactive partners in the financial ecosystem.

Introduction

In corporate finance, managing cash flow effectively relies heavily on timely communications, particularly through invoice payment reminders. These reminders serve not just as administrative tasks; they function as strategic tools that can significantly enhance customer relationships and ensure financial stability.

By optimizing invoice payment reminder email templates, organizations can facilitate faster payments and minimize late fees. However, the challenge persists: how can businesses craft these reminders to resonate with diverse client scenarios and encourage prompt action?

Understand the Importance of Invoice Payment Reminders

The invoice payment reminder email template optimization for corporate finance departments serves as a critical strategy for ensuring timely remittances from customers, significantly impacting cash flow and fostering strong customer relationships. By proactively reminding clients of their financial obligations with the help of invoice payment reminder email template optimization for corporate finance departments, businesses can effectively mitigate the incidence of late payments and associated penalties. For instance, firms that implemented AI-driven email and voice notifications experienced a 45% reduction in late dues within six months, underscoring the tangible benefits of consistent communication.

Timely notifications, including the invoice payment reminder email template optimization for corporate finance departments, not only enhance repayment behaviors but also reinforce the importance of financial commitments. The invoice payment reminder email template optimization for corporate finance departments helps ensure that clients are more likely to prioritize their transactions, which leads to improved cash flow management. Data indicates that companies benefiting from invoice payment reminder email template optimization for corporate finance departments receive payments an average of 14 days faster than those relying on traditional follow-up methods, highlighting the efficacy of this approach.

Moreover, maintaining a consistent reminder schedule contributes to building positive relationships with customers. Clear communication regarding financial expectations reduces misunderstandings and frustration, making clients feel valued and understood. As noted by an industry expert, astute businesses leverage strategic incentives and transparent processes to promote timely transactions, creating a mutually beneficial scenario that enhances both cash flow and customer loyalty.

Integrating features from EQ Collect can further optimize this process. With its no-code file-mapping tool, financial institutions can streamline vendor onboarding timelines, while automated workflows reduce execution errors and reliance on manual resources. Real-time reporting offers unparalleled transparency and insights, enabling organizations to effectively monitor compliance. By harnessing these capabilities, businesses can refine their accounts receivable processes and bolster their debt collection strategies, particularly in the realm of invoice settlement notifications.

In conclusion, the invoice payment reminder email template optimization for corporate finance departments is vital for organizations aiming to enhance their accounts receivable processes. By prioritizing timely notifications and adopting best practices such as personalizing messages and optimizing timing, companies can not only improve their financial health but also cultivate lasting relationships with their clients.

Identify Essential Elements of Effective Payment Reminder Emails

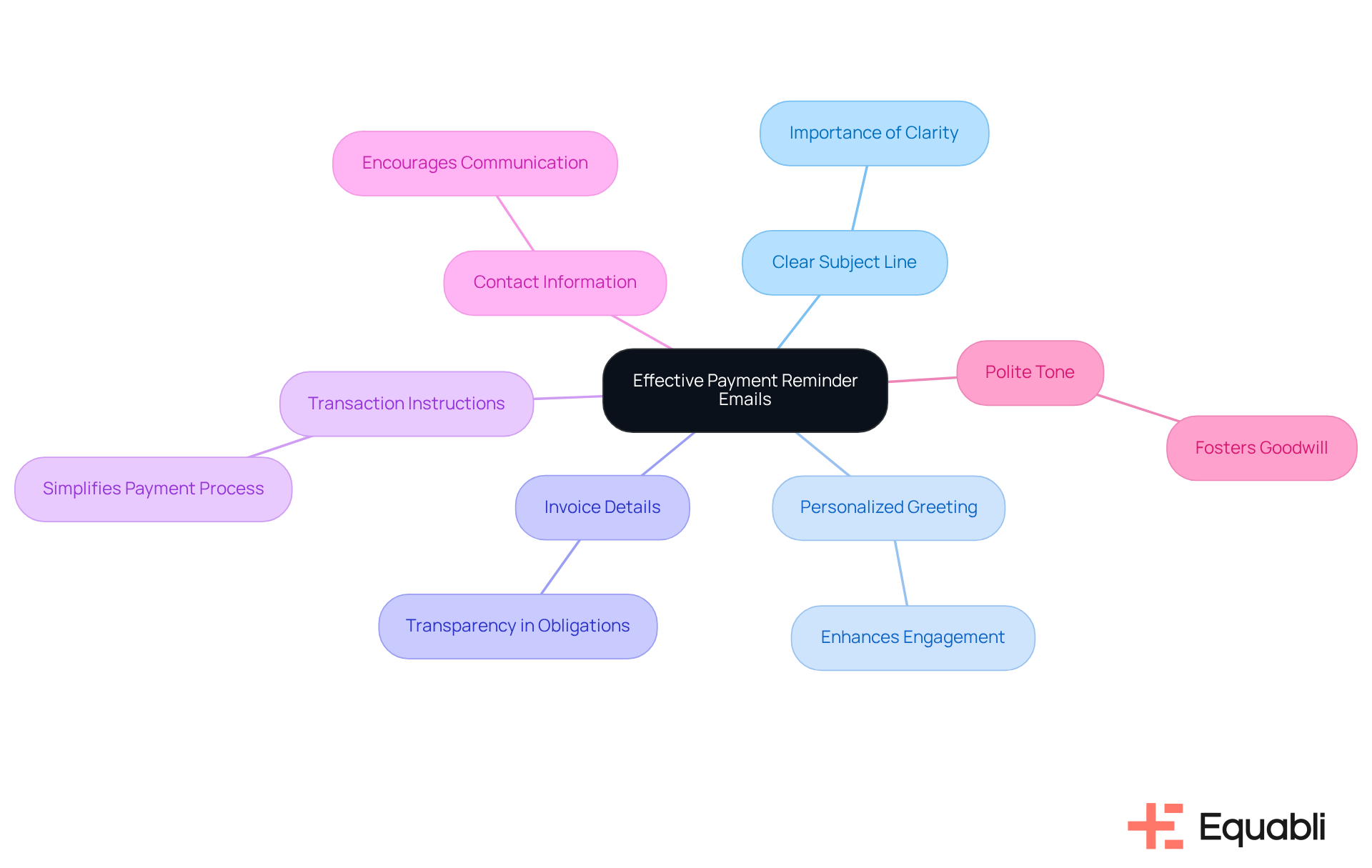

An effective payment reminder email must encompass several key components to ensure clarity and prompt action:

-

Clear Subject Line: A straightforward subject line is essential. For instance, using 'Payment Reminder: Invoice #12345 Due Soon' helps recipients quickly determine the email's relevance. This clarity is crucial for timely responses.

-

Personalized Greeting: Starting with a personalized greeting, addressing the recipient by name, significantly enhances engagement. This small touch fosters a positive relationship and encourages prompt action.

-

Invoice Details: Clearly outlining essential invoice information—such as the invoice number, amount due, and due date—provides transparency. This allows recipients to understand their obligations at a glance, reducing confusion and potential delays.

-

Transaction Instructions: Providing clear guidance on how to proceed with the transaction, including links to transaction portals or accepted methods, simplifies the process. Streamlining these instructions can lead to quicker responses and improved collection rates.

-

Contact Information: Prominently including your contact details encourages communication. This openness allows recipients to seek clarification, alleviating any concerns they may have regarding the payment process.

-

Polite Tone: Maintaining a professional and courteous tone throughout the message reflects well on your organization. A polite approach fosters goodwill, making recipients more likely to respond positively.

Integrating these optimal strategies can greatly improve the efficiency of invoice payment reminder email template optimization for corporate finance departments. For example, statistics indicate that tailored messages can enhance open rates by as much as 26%, underscoring the importance of a customized greeting. Furthermore, successful financial organizations often utilize invoice payment reminder email template optimization for corporate finance departments, which includes clear transaction instructions and contact details, resulting in enhanced collection rates.

However, many financial institutions still rely on manual debt collection processes, leading to inefficiencies and missed opportunities. By leveraging modern, data-driven tools like Equabli's EQ Suite, financial institutions can streamline operations and enhance performance in collections. This suite simplifies the creation of these emails, ensuring all necessary elements are included efficiently, ultimately improving collection rates and strengthening client relationships.

Establish a Strategic Schedule for Sending Payment Reminders

To maximize the effectiveness of payment reminders, invoice payment reminder email template optimization for corporate finance departments is essential to establish a strategic schedule that leverages the capabilities of EQ Collect.

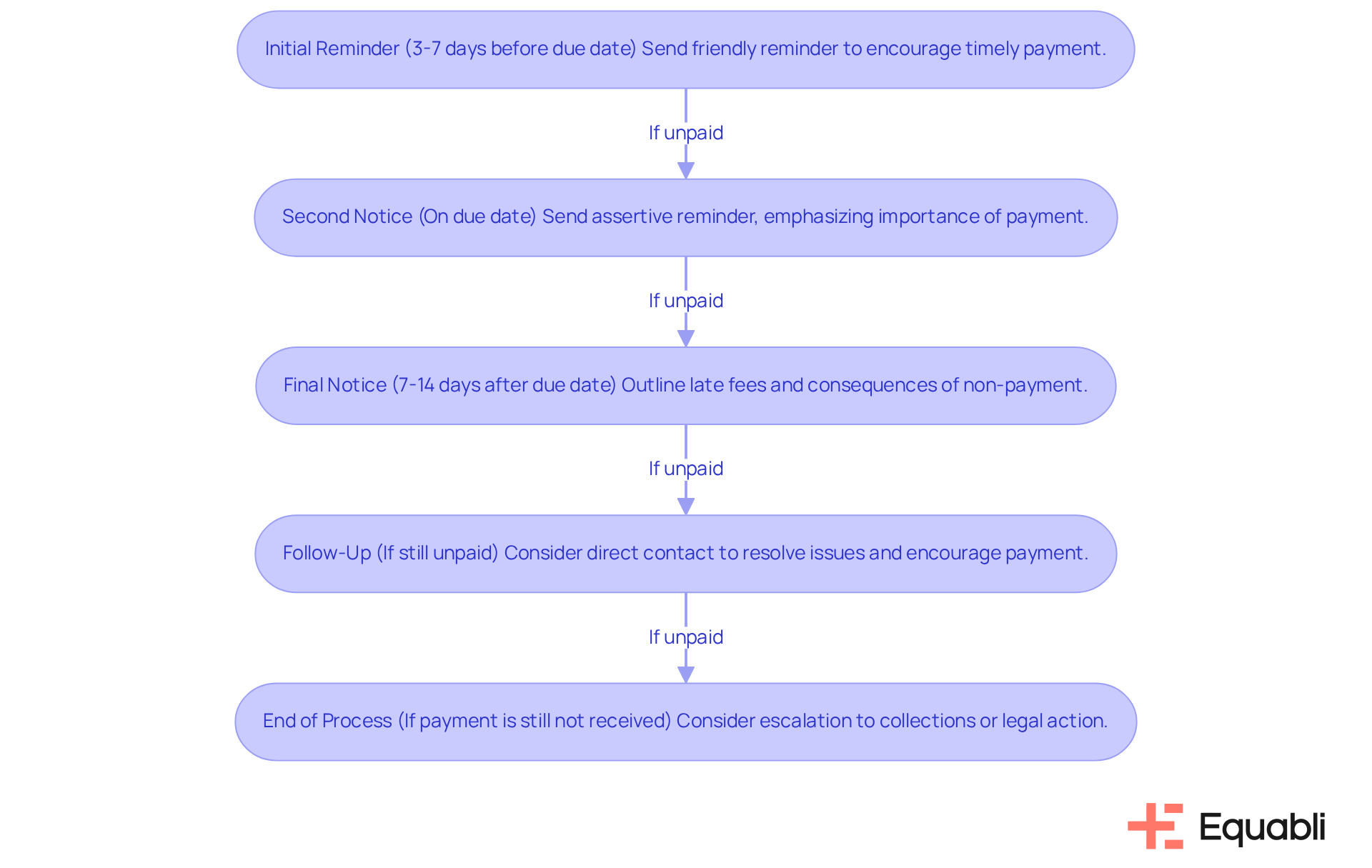

Initial Reminder: Sending the first reminder 3-7 days before the due date is a proactive strategy that significantly enhances the likelihood of prompt transactions. Data indicates that 60% of clients settle their dues on time when they receive a well-timed notification. By utilizing EQ Collect's automated workflows, organizations can simplify this process, ensuring notifications are dispatched consistently and efficiently.

Second Notice: If funds are not received, a second notification should be sent on the due date. This communication must maintain a courteous yet assertive tone, emphasizing the importance of the dues while providing clear guidance on how to resolve the invoice. Employing EQ Collect's real-time reporting allows for monitoring transaction statuses and facilitates invoice payment reminder email template optimization for corporate finance departments accordingly.

Final Notice: Should the invoice remain unpaid, a final notice should be issued 7-14 days after the due date, clearly outlining any late fees or potential consequences of non-payment. This notification serves as a critical prompt, as the likelihood of receiving funds diminishes considerably over time—only 30% after three months and 90% after a year. EQ Collect's data-driven strategies can assist in identifying customers who may require further follow-up.

Follow-Up: If the balance is still outstanding after the final reminder, consider a follow-up call or email. Direct interaction with customers can help resolve any issues and underscore the importance of prompt settlement. With EQ Collect's user-friendly, scalable, cloud-native interface, accessing insights and transparency to guide these conversations becomes straightforward.

This organized approach ensures that customers receive regular reminders through invoice payment reminder email template optimization for corporate finance departments without feeling overwhelmed, ultimately enhancing the chances of prompt remittances and fostering stronger relationships with patrons, all while utilizing the robust functionalities of EQ Collect, including compliance monitoring.

Customize Templates for Various Client Scenarios

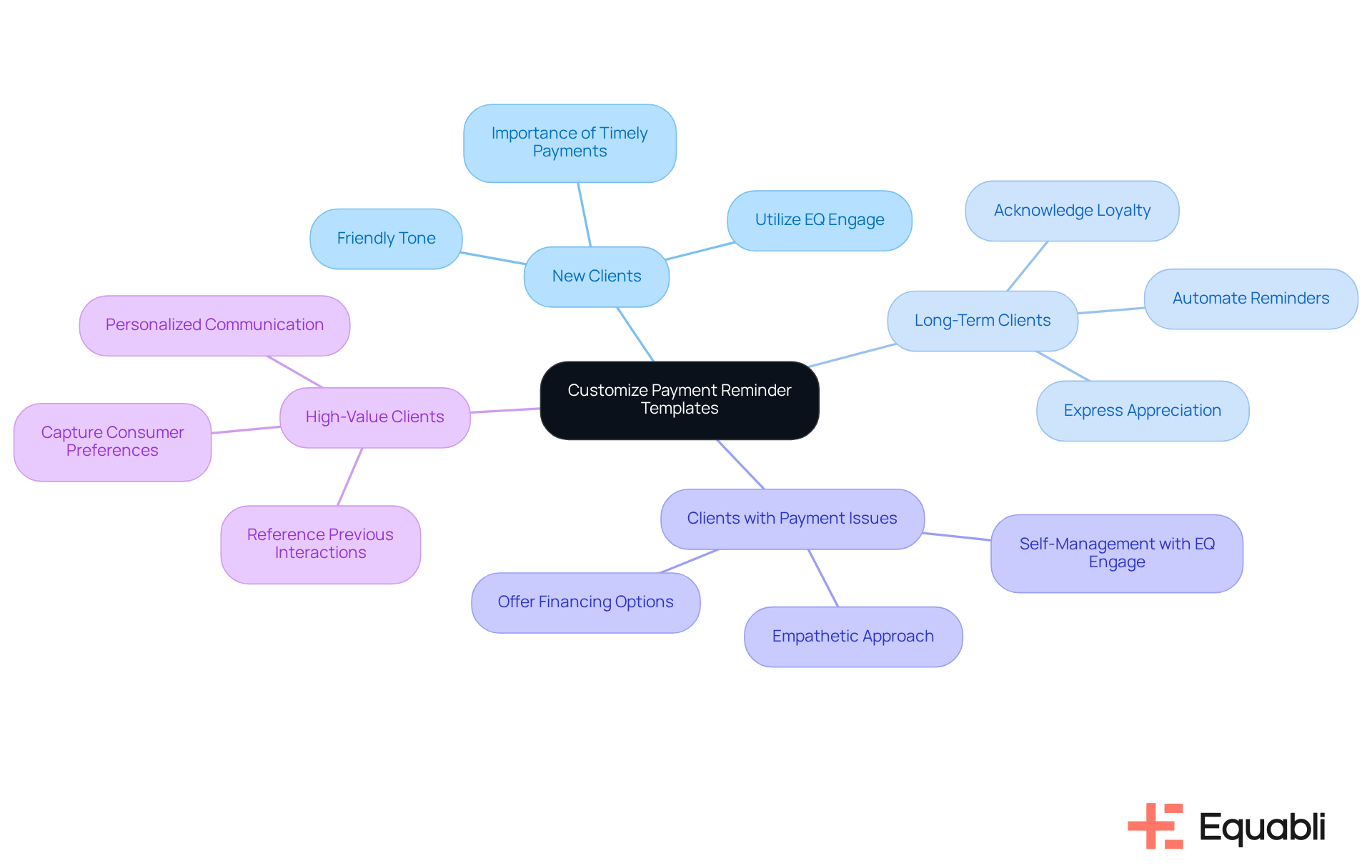

When crafting payment reminder templates, it is crucial to customize them for various client scenarios:

-

New Clients: Establish a friendly and welcoming tone that underscores the importance of timely payments in fostering a positive business relationship. This approach not only sets clear expectations but also supports invoice payment reminder email template optimization for corporate finance departments from the outset. Utilizing EQ Engage's intelligent outreach capabilities can further personalize these communication journeys, enhancing the overall borrower experience while reducing costs.

-

Long-Term Clients: Acknowledge their loyalty by recognizing their history with your company. Express appreciation for their past payments while gently reminding them of the current due invoice. This reinforces their value to your business and encourages continued compliance. With EQ Engage, the invoice payment reminder email template optimization for corporate finance departments allows you to automate these reminders while maintaining your brand voice, ensuring consistent and meaningful engagement, all while adhering to regulatory compliance.

-

Clients with Payment Issues: Approach these clients with empathy. Offer adaptable financing options or discuss potential funding strategies to alleviate their concerns. EQ Engage enables borrowers to self-manage with customized repayment plans, significantly enhancing collection rates and strengthening relationships. Research indicates that effective communication is largely influenced by emotions rather than just knowledge, highlighting the necessity for empathy in these interactions.

-

High-Value Clients: Personalize communication by referencing previous interactions or specific projects. This not only reinforces the value of their business but also demonstrates your commitment to their needs. By capturing consumer preferences, EQ Engage ensures that your communication remains relevant and impactful.

Statistics show that personalized communication can significantly improve transaction rates, with studies suggesting that 80% of success is influenced by communication abilities. Customizing your strategy according to client situations not only enhances the likelihood of prompt settlements but also contributes to invoice payment reminder email template optimization for corporate finance departments, nurturing stronger connections and ultimately benefiting your organization.

Adopt Best Practices for Professional Communication in Reminders

To maintain professionalism in payment reminder emails, it is essential to adhere to best practices that resonate with industry standards:

-

Proofread: Always verify spelling and grammatical accuracy prior to dispatch. This step is critical in upholding the credibility of your communication.

-

Be Concise: Craft messages that are succinct and focused on essential information. Clarity in communication is paramount for effective engagement.

-

Use a Professional Email Address: Ensure that emails are sent from a company domain rather than personal accounts. This reinforces the legitimacy of the correspondence.

-

Follow Up: Should there be no response, consider a follow-up phone call or another message to underscore the importance of the transaction. This proactive approach can enhance engagement.

-

Maintain a Positive Tone: Even when addressing overdue balances, it is vital to keep the tone constructive and solution-oriented. This fosters cooperation and encourages timely resolution.

Research indicates that courteous and succinct phrasing in follow-up emails can lead to a 20-30% increase in response rates. This statistic underscores the importance of professionalism in communication. Organizations that prioritize clear and respectful communication in their invoice payment reminder email template optimization for corporate finance departments not only improve collection rates but also bolster client trust and satisfaction.

Conclusion

The optimization of invoice payment reminder email templates stands as a critical strategy for corporate finance departments seeking to enhance cash flow and strengthen client relationships. Effective reminder systems can significantly reduce late payments, thereby improving overall financial health. This proactive approach not only ensures timely remittances but also fosters a culture of accountability among clients, ultimately benefiting both parties involved.

Key insights emphasize the necessity of clear communication, strategic scheduling, and personalization in payment reminders. Effective templates should incorporate essential elements such as:

- Clear subject lines

- Detailed invoice information

- A polite tone to encourage prompt action

Furthermore, a systematic approach to sending reminders—spanning initial notifications to follow-ups—ensures that clients remain informed without feeling overwhelmed. Customizing communication based on client scenarios enhances engagement and promotes timely settlements.

In light of these considerations, it is imperative for organizations to prioritize the development and implementation of optimized invoice payment reminder email templates. By leveraging modern tools and best practices, businesses can improve cash flow while cultivating long-lasting relationships with clients. Embracing this strategy will lead to a more efficient accounts receivable process, ultimately positioning companies for sustained success in their financial endeavors.

Frequently Asked Questions

Why are invoice payment reminders important for businesses?

Invoice payment reminders are crucial as they ensure timely payments from customers, significantly impacting cash flow and fostering strong customer relationships. They help mitigate late payments and associated penalties.

How effective are AI-driven payment reminders?

Firms that implemented AI-driven email and voice notifications experienced a 45% reduction in late dues within six months, demonstrating the tangible benefits of consistent communication.

How do timely notifications affect repayment behaviors?

Timely notifications enhance repayment behaviors by ensuring clients prioritize their transactions, which leads to improved cash flow management. Companies using these reminders receive payments an average of 14 days faster than those using traditional follow-up methods.

What role does consistent communication play in customer relationships?

Consistent communication regarding financial expectations reduces misunderstandings and frustration, making clients feel valued and understood, which contributes to building positive relationships.

What are the essential elements of an effective payment reminder email?

Key components include a clear subject line, personalized greeting, invoice details, transaction instructions, contact information, and a polite tone.

How does a clear subject line benefit payment reminder emails?

A straightforward subject line helps recipients quickly determine the email's relevance, which is crucial for timely responses.

Why is it important to personalize the greeting in payment reminder emails?

Addressing the recipient by name enhances engagement and fosters a positive relationship, encouraging prompt action.

What information should be included in the invoice details?

Invoice details should clearly outline the invoice number, amount due, and due date to provide transparency and reduce confusion.

How can transaction instructions improve payment collection rates?

Providing clear guidance on how to proceed with the transaction simplifies the process, leading to quicker responses and improved collection rates.

Why is including contact information important in payment reminder emails?

Prominently including contact details encourages communication, allowing recipients to seek clarification and alleviating concerns regarding the payment process.

What benefits do tailored messages provide in payment reminders?

Tailored messages can enhance open rates by as much as 26%, highlighting the importance of customization in communication.

How can modern tools like Equabli's EQ Suite help financial institutions?

Equabli's EQ Suite streamlines the creation of payment reminder emails, ensuring all necessary elements are included efficiently, which ultimately improves collection rates and strengthens client relationships.