Overview

This article examines the optimization of payment request email templates as a critical strategy for enhancing debt recovery success. By integrating essential components such as a professional tone, personalization techniques, effective structure, and follow-up strategies, organizations can significantly improve their recovery outcomes.

Evidence suggests that clarity and empathy in communication are paramount; tailored messages not only foster engagement but also elevate response rates. This approach ultimately leads to more successful debt recovery outcomes, aligning with the operational goals of enterprises in the financial sector.

Incorporating these strategies allows lenders and debt buyers to navigate the complexities of debt collection more effectively, ensuring compliance while maximizing recovery efforts. The insights provided herein serve as a strategic framework for enhancing communication practices within the industry.

Introduction

Crafting an effective payment request email is crucial for timely debt recovery and mitigating financial strain. Research indicates that well-structured communications can significantly enhance recovery rates. By incorporating essential components—from a compelling subject line to clear remittance instructions—businesses can refine their communication strategies.

How can organizations ensure their emails not only get opened but also elicit a positive response? This article explores the optimization of payment request email templates, providing valuable insights and techniques to transform standard communications into powerful tools for successful debt recovery.

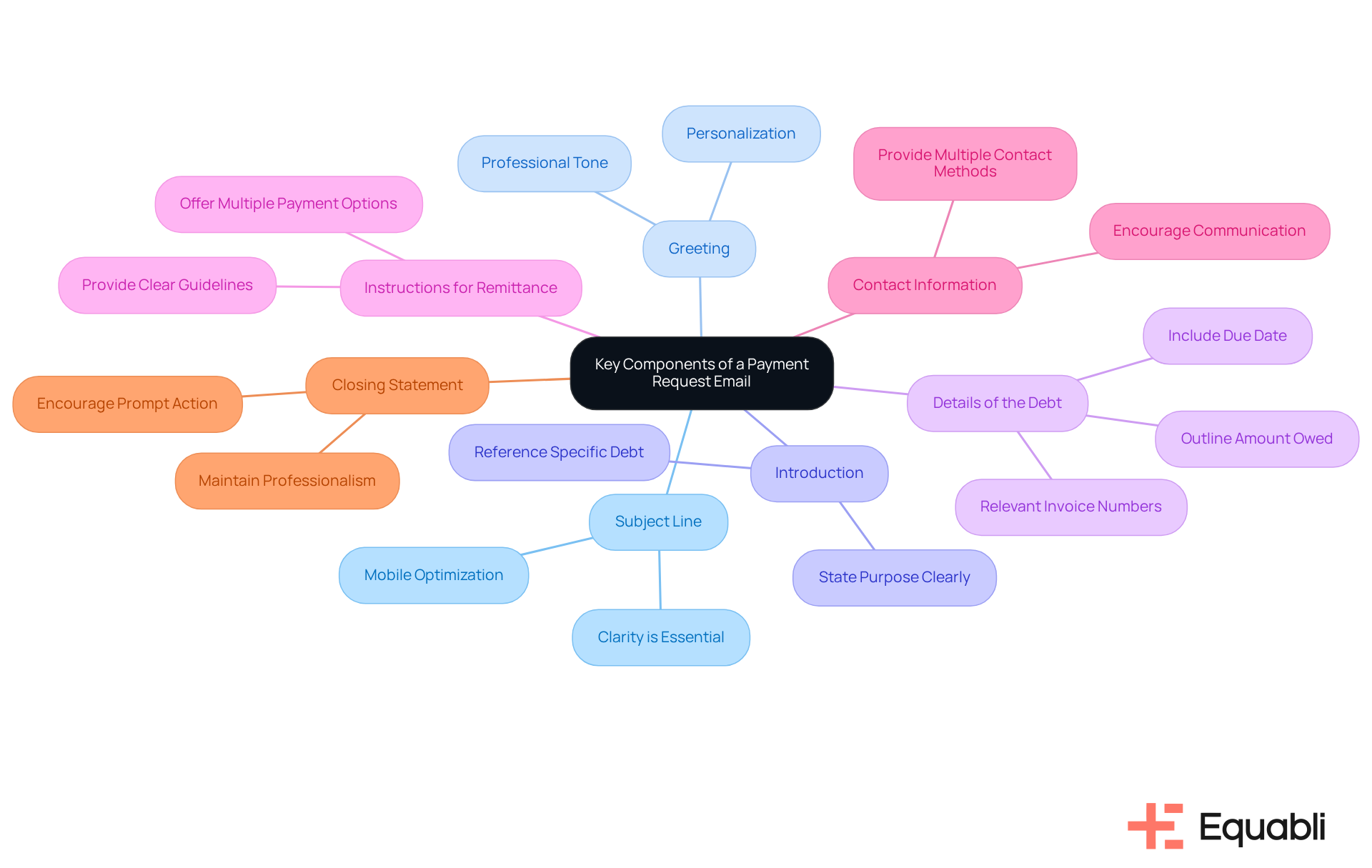

Understand the Key Components of a Payment Request Email

To create a successful payment request email, several key components must be included:

-

Subject Line: A clear and concise subject heading is essential, indicating the purpose of the message, such as 'Payment Request for Invoice #12345.' Research shows that a well-optimized subject line can significantly influence open rates; approximately 50% of individuals will discard a message that is not mobile-optimized. This highlights the necessity of clarity in initial communication.

-

Greeting: Employ a courteous salutation that addresses the individual by name, if possible. Personalization fosters a connection, increasing the likelihood of a positive response. This approach not only enhances engagement but also reflects professionalism.

-

Introduction: Briefly state the purpose of the message, referencing the specific debt or invoice. This sets the context for the recipient, clarifying the email's intent and ensuring that the recipient understands the urgency of the matter.

-

Details of the Debt: Clearly outline the amount owed, the due date, and any relevant invoice numbers. Clarity in this section is crucial to prevent misunderstandings and emphasizes the urgency of the transaction. Accurate details facilitate prompt action from the recipient.

-

Instructions for Remittance: Provide clear guidelines on how to complete the transaction, including methods and links if applicable. Offering various transaction options can cater to client preferences and simplify the process, which is essential for improving the chances of timely settlements.

-

Contact Information: Include your contact details for any questions or clarifications. This openness encourages communication and can help resolve any issues that may arise, reinforcing the importance of maintaining a professional rapport.

-

Closing Statement: Conclude with a polite closing that encourages prompt action, such as 'Thank you for your attention to this matter.' A courteous conclusion not only strengthens professionalism but also underscores that well-composed billing messages promote prompt transactions, foster trust, and reduce misunderstandings.

By adhering to these best practices, businesses can implement payment request email template optimization for corporate debt recovery strategies, ensuring their communications are effective and conducive to timely payments.

Establish a Professional Tone and Clear Messaging

To establish a professional tone in debt collection emails, organizations should implement the following strategies:

-

Use Formal Language: Avoid slang and overly casual phrases. Clear, straightforward language conveys respect and professionalism, essential in maintaining credibility with clients.

-

Be Concise: Messages should be brief and focused. Eliminating unnecessary jargon ensures that key points are easily understood, facilitating effective communication.

-

Express Empathy: Acknowledge that financial difficulties can arise and express understanding. This approach builds rapport and aligns with the trend towards customer-centric debt collection, where empathy is crucial in fostering trust.

-

Maintain a Positive Outlook: Frame appeals positively, emphasizing resolution rather than the issue. For example, stating 'We appreciate your prompt attention to this matter' is more constructive than 'You owe us money.' This positive framing can significantly enhance the individual's willingness to engage and respond favorably.

Implementing these strategies can improve communication effectiveness, which is essential for payment request email template optimization for corporate debt recovery strategies, leading to better outcomes in debt recovery efforts. Notably, empathetic communication can increase the likelihood of repayment by 71% when customers feel respected and understood, highlighting the importance of a strategic approach in debt collection.

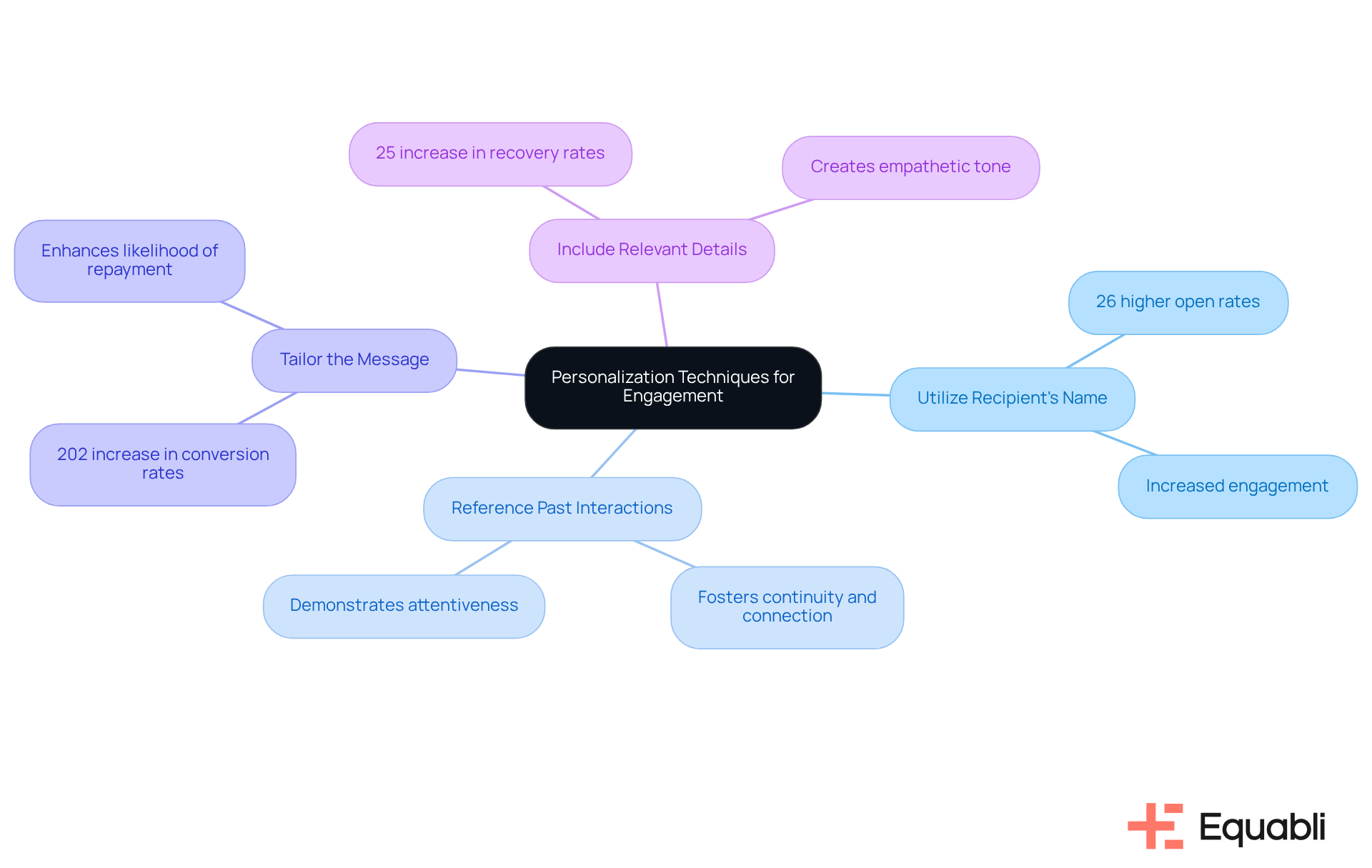

Incorporate Personalization Techniques for Better Engagement

To enhance the effectiveness of payment request emails, consider implementing the following personalization techniques:

-

Utilize the Recipient's Name: Addressing the recipient by their first name in both the greeting and throughout the message significantly boosts engagement. Personalized subject lines can increase open rates by 26%, making your emails more likely to be noticed. According to the Bill Gosling Insights Team, "Email personalization typically delivers significant performance improvements: 26% higher open rates for personalized subject lines, 202% increase in conversion rates with personalized calls-to-action."

-

Reference Past Interactions: Mentioning previous communications or transactions fosters a sense of continuity and connection. This approach not only demonstrates attentiveness but also reinforces the relationship, which is crucial in the payment request email template optimization for corporate debt recovery strategies.

-

Tailor the Message: Customize the content based on the individual's history with your company, including their financial behavior and any prior agreements. Tailored messages can lead to a 202% increase in conversion rates when personalized calls to action are included, particularly through payment request email template optimization for corporate debt recovery strategies, thereby enhancing the likelihood of repayment.

-

Include Relevant Details: Acknowledge any particular reasons for the individual's delay in settling the account. Demonstrating understanding of their situation can create a more empathetic tone, which is essential for effective communication in the context of payment request email template optimization for corporate debt recovery strategies. Personalization has led to a 25% increase in recovery rates, as it makes customers feel valued and understood.

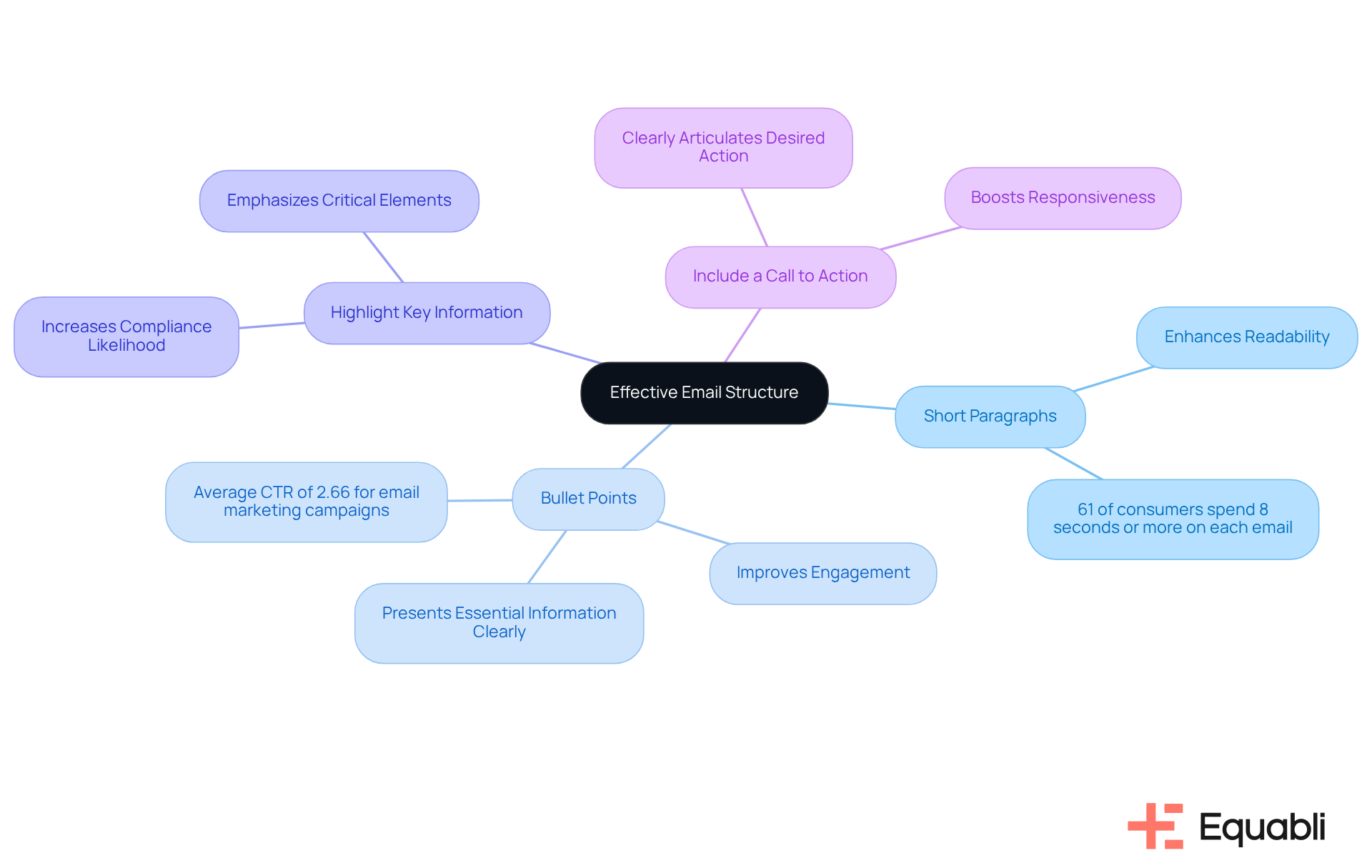

Design an Effective Email Structure with Essential Elements

To establish an effective email structure for payment requests, implementing payment request email template optimization for corporate debt recovery strategies is essential to resonate with enterprise-level communication.

Use Short Paragraphs: Breaking content into concise, digestible paragraphs significantly enhances readability. Research indicates that messages with shorter paragraphs are more likely to be read in full, as recipients often skim lengthy texts. Notably, 61% of consumers spend eight seconds or more on each email, underscoring the necessity for engaging content that captures attention quickly.

Bullet Points: Employ bullet points to present essential information, such as payment details or deadlines. This format not only enhances visual appeal but also enables recipients to quickly grasp key points. Effective formatting strategies can lead to improved engagement; for instance, the average click-through rate (CTR) of 2.66% for email marketing campaigns highlights the importance of clear presentation in driving user interaction.

Highlight Key Information: Utilize bold or italic text to emphasize critical elements, such as the total amount due or the due date. Highlighting these details can significantly improve compliance likelihood, as recipients are more inclined to act on clearly marked information. This approach aligns with best practices in communication, ensuring that vital data stands out.

Include a Call to Action: Clearly articulate the desired action, such as 'Please complete your transaction by [date].' Crafting compelling calls to action is pivotal for driving user engagement, as noted by industry experts. A well-defined call to action can greatly enhance responsiveness, aligning with the ideal CTR of 2.66% for marketing campaigns.

By applying these strategies, you can enhance the effectiveness of your payment request email template optimization for corporate debt recovery strategies, ensuring they are not only viewed but also acted upon.

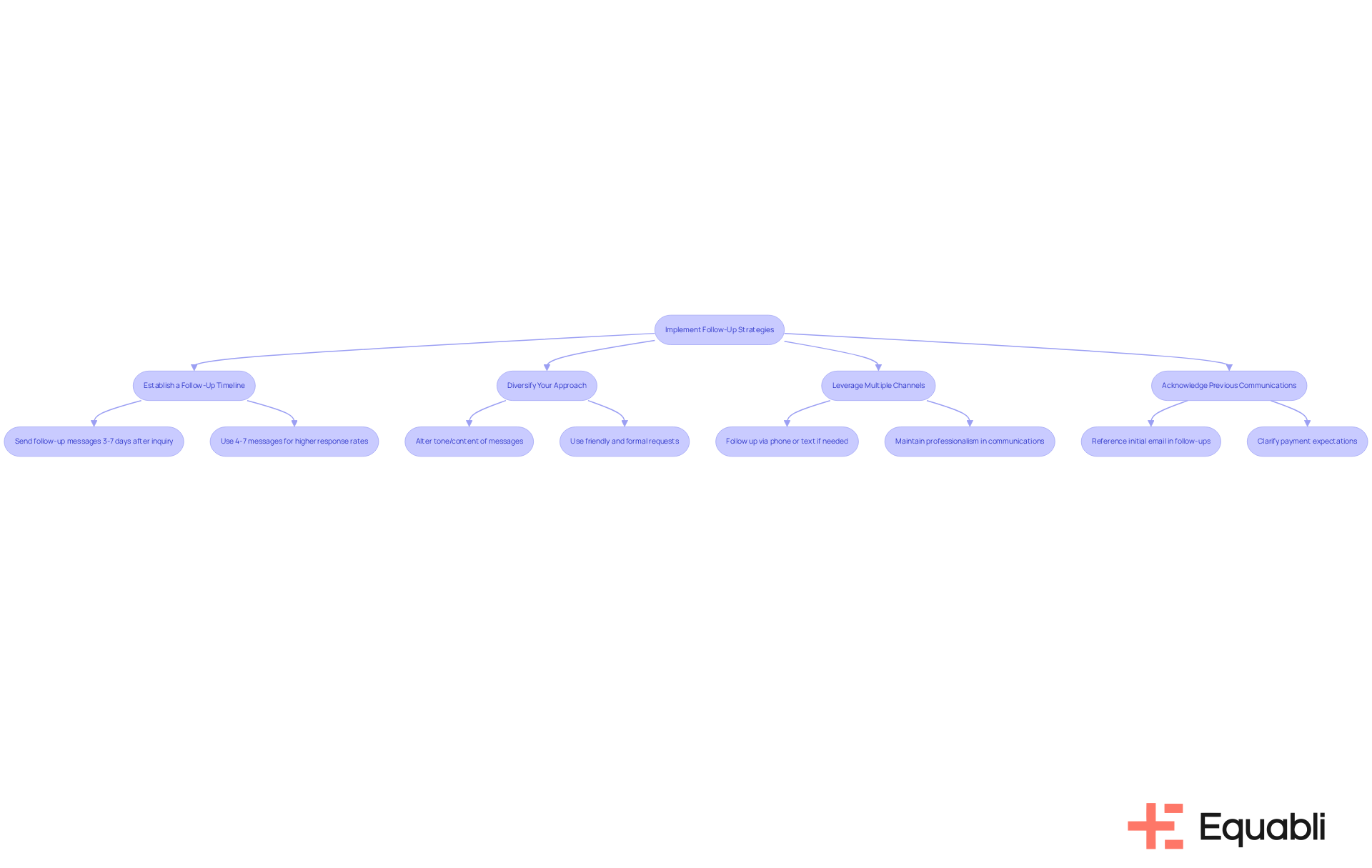

Implement Follow-Up Strategies to Enhance Response Rates

To implement effective follow-up strategies in debt recovery, organizations should consider the following approaches:

-

Establish a Follow-Up Timeline: Sending follow-up messages 3-7 days after the initial inquiry is crucial. Research shows that campaigns with 4-7 messages achieve a 27% response rate, compared to just 9% for those with 1-3 messages. This timing keeps the payment appeal fresh in the recipient's mind without overwhelming them.

-

Diversify Your Approach: Altering the tone or content of follow-up messages is essential for maintaining engagement. For example, a friendly reminder can be succeeded by a more formal request, ensuring dynamic communication. As Nina Cvijovic highlights, prioritizing follow-ups is as vital as the initial outreach.

-

Leverage Multiple Channels: If electronic mail responses are insufficient, consider following up through phone calls or text messages. This multi-channel strategy can significantly enhance visibility and prompt quicker responses. It is imperative to maintain professionalism in these communications to avoid provoking customer frustration.

-

Acknowledge Previous Communications: In follow-ups, referencing the initial email serves to remind the recipient of the pending amount. This continuity reinforces the importance of the request and demonstrates attentiveness to their situation. Clear communication regarding payment expectations can help mitigate disputes.

By implementing these strategies, organizations can achieve payment request email template optimization for corporate debt recovery strategies, which can enhance their response rates and improve overall debt recovery outcomes. Additionally, referencing case studies on systematic follow-up in debt collection can provide practical examples of how these strategies lead to improved results.

Conclusion

Crafting an effective payment request email is essential for successful debt recovery. By employing the right strategies, organizations can significantly enhance their communication efforts. Focusing on clarity, professionalism, and personalization allows emails to convey necessary information while fostering positive client relationships, ultimately leading to timely payments.

Key components such as:

- A clear subject line

- Courteous greetings

- Detailed debt information

- Explicit payment instructions

are foundational elements that should not be overlooked. Establishing a professional tone through formal language and concise messaging, while expressing empathy, can greatly improve engagement and response rates. Furthermore, incorporating personalization techniques—such as addressing recipients by name and referencing past interactions—can enhance the effectiveness of these communications.

In summary, optimizing payment request emails transcends mere task completion; it represents a strategic approach that can yield significant results in debt recovery. By implementing these best practices, organizations can improve immediate outcomes and build a more respectful and understanding relationship with clients. Embracing these techniques will lead to better recovery rates and establish a foundation for future interactions, underscoring the importance of clear and respectful communication in all business dealings.

Frequently Asked Questions

What are the essential components of a payment request email?

A successful payment request email should include a clear subject line, a courteous greeting, a brief introduction stating the purpose, details of the debt (amount owed, due date, invoice numbers), instructions for remittance, contact information, and a polite closing statement.

How important is the subject line in a payment request email?

The subject line is crucial as it indicates the purpose of the message. A well-optimized subject line can significantly influence open rates, with approximately 50% of individuals discarding messages that are not mobile-optimized.

Why is personalization important in the greeting of a payment request email?

Personalization fosters a connection with the recipient, increasing the likelihood of a positive response and reflecting professionalism.

What details should be included regarding the debt in the email?

The email should clearly outline the amount owed, the due date, and any relevant invoice numbers to prevent misunderstandings and emphasize the urgency of the transaction.

What instructions should be provided for remittance?

Clear guidelines on how to complete the transaction should be included, along with methods and links if applicable, catering to client preferences to facilitate timely payments.

Why is it important to include contact information in the email?

Including contact information encourages communication for any questions or clarifications, reinforcing a professional rapport and helping to resolve any issues that may arise.

How should the email be concluded?

The email should conclude with a polite closing that encourages prompt action, such as thanking the recipient for their attention to the matter, which strengthens professionalism and promotes timely transactions.

What strategies can help establish a professional tone in debt collection emails?

Strategies include using formal language, being concise, expressing empathy, and maintaining a positive outlook in the messaging.

How can expressing empathy in debt collection emails impact outcomes?

Expressing empathy can build rapport and trust, and it has been noted that empathetic communication can increase the likelihood of repayment by 71% when customers feel respected and understood.

What is the significance of maintaining a positive outlook in the messaging?

A positive outlook emphasizes resolution rather than the issue, which can enhance the recipient's willingness to engage and respond favorably.