Overview

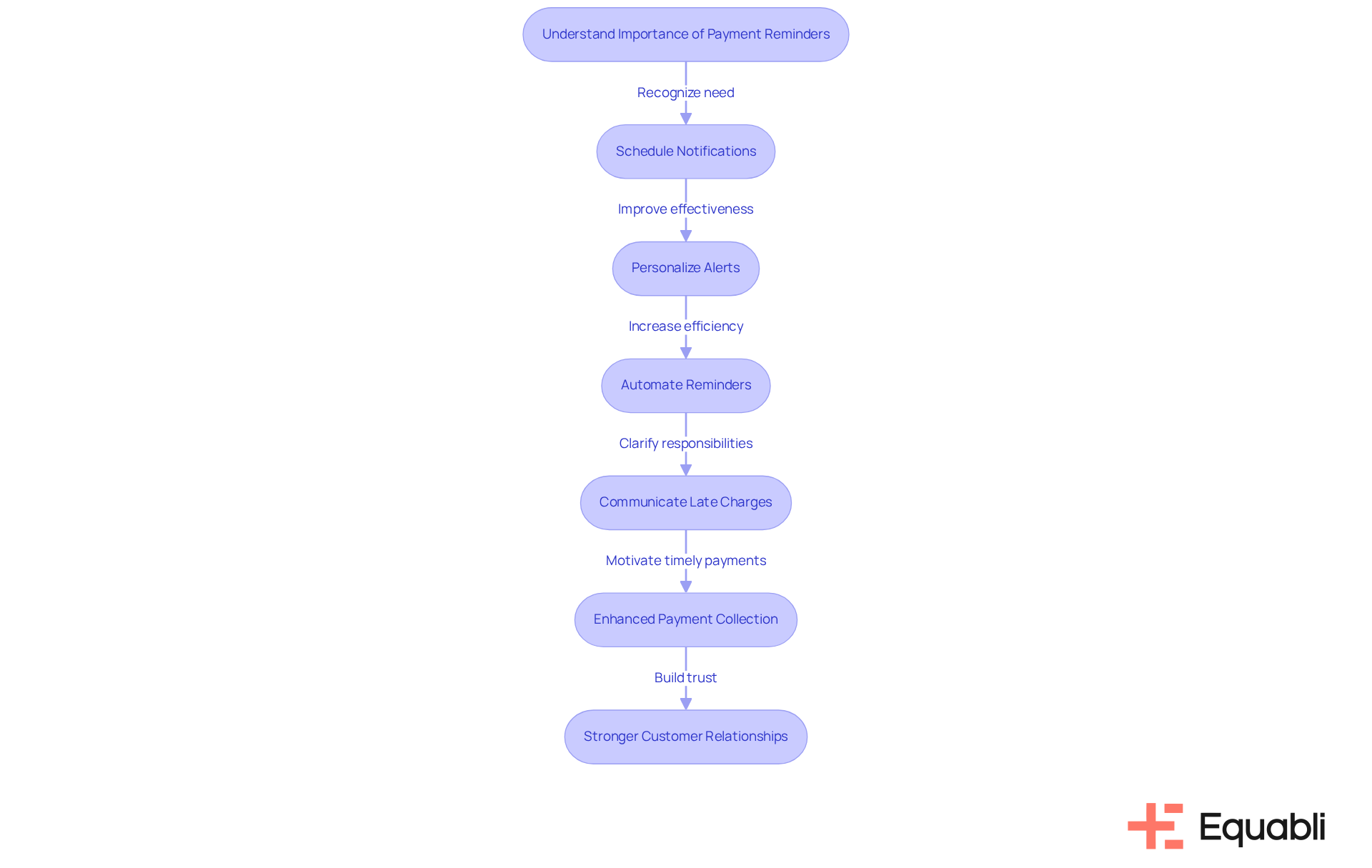

The article provides a comprehensive overview of sample email templates and strategies for effective payment reminders in corporate finance, aimed at enhancing timely collections. It asserts that well-structured notifications, personalized communication, and strategic timing are critical factors that can significantly improve payment rates. Research indicates that timely reminders can lead to payments being received an average of 14 days faster, underscoring the importance of these practices in fostering stronger client relationships.

By implementing these strategies, organizations can not only enhance their cash flow but also strengthen their partnerships with clients. The evidence suggests that a proactive approach to payment reminders is essential in today’s competitive financial landscape. As such, executives must prioritize these methods to optimize their debt collection processes and mitigate risks associated with delayed payments.

Introduction

Payment reminders are not merely a courtesy; they serve as essential tools in corporate finance that can significantly influence cash flow and operational efficiency. Evidence shows that leveraging sample email templates for payment reminders enhances collection strategies, ensuring timely payments while fostering stronger client relationships. This approach not only informs clients but also engages them, prompting necessary action. However, amidst the myriad of available strategies, how can organizations effectively craft reminders that resonate with their clients and drive compliance?

Understand the Importance of Payment Reminders in Corporate Finance

Payment notifications serve as critical instruments in corporate finance, especially when using sample email templates for payment reminder strategies in corporate finance to ensure clients remain informed of their financial obligations. Prompt notifications not only help avoid overdue transactions but also mitigate disruptions to cash flow, which can lead to increased operational costs. Research indicates that organizations utilizing effective payment notifications can receive payments an average of 14 days faster than those relying on traditional follow-up methods.

By strategically scheduling notifications—such as sending the first alert seven days before the due date—companies can significantly enhance their collection rates and utilize sample email templates for payment reminder strategies in corporate finance to foster stronger customer relationships. Furthermore, personalizing notifications with specific customer information can amplify their effectiveness; nearly 60% of consumers are more likely to pay on time when they receive well-crafted alerts. Establishing grace periods allows clients to settle their accounts without incurring late fees, thereby nurturing positive relationships and encouraging timely payments.

Additionally, automating invoice reminders through sample email templates for payment reminder strategies in corporate finance can improve efficiency and consistency in collections. Understanding the optimal timing and frequency of these communications is crucial, as it directly influences the likelihood of receiving payments punctually, thus contributing to a more stable financial environment for the organization. Clear communication regarding the implications of late charges reinforces the significance of these strategies, ensuring clients are aware of their responsibilities and the potential consequences of delays.

Identify Key Elements of an Effective Payment Reminder Email

An effective payment reminder email must encompass several essential elements to ensure clarity and prompt action:

-

Subject Line: A clear and concise subject line is crucial. For instance, "Payment Reminder: Invoice #1234 Due Soon" effectively conveys the email's purpose.

-

Personalization: Addressing the recipient by name fosters a personal connection, significantly enhancing engagement and response rates.

-

Invoice Details: Prominently displaying the invoice number, amount due, and due date within the email body provides all necessary information at a glance, facilitating quick reference.

-

Transaction Instructions: Clearly outlining how to make the transaction, including direct links or accepted methods, streamlines the payment process, ensuring efficiency.

-

Polite Tone: Maintaining a friendly yet professional tone throughout the email encourages timely settlement while preserving the client relationship.

-

Attachments: Including the original invoice as an attachment allows for easy reference, further streamlining the transaction process for the recipient.

-

Timing: Dispatching the invoice notification email approximately one week prior to the due date assists in maintaining timely transactions, aligning with best practices in accounts receivable management.

-

Incentives: Offering a 2% discount for settling within 10 days can motivate early payments, enhancing cash flow.

-

Automation: Automating billing notification emails increases efficiency and ensures consistency in follow-ups, reducing manual workload.

Incorporating these elements not only enhances the likelihood of prompt compensation but also fortifies client relationships by showcasing professionalism and attentiveness, particularly when using sample email templates for payment reminder strategies in corporate finance. The timing of notifications can significantly influence their effectiveness, underscoring the importance of strategic communication in financial operations.

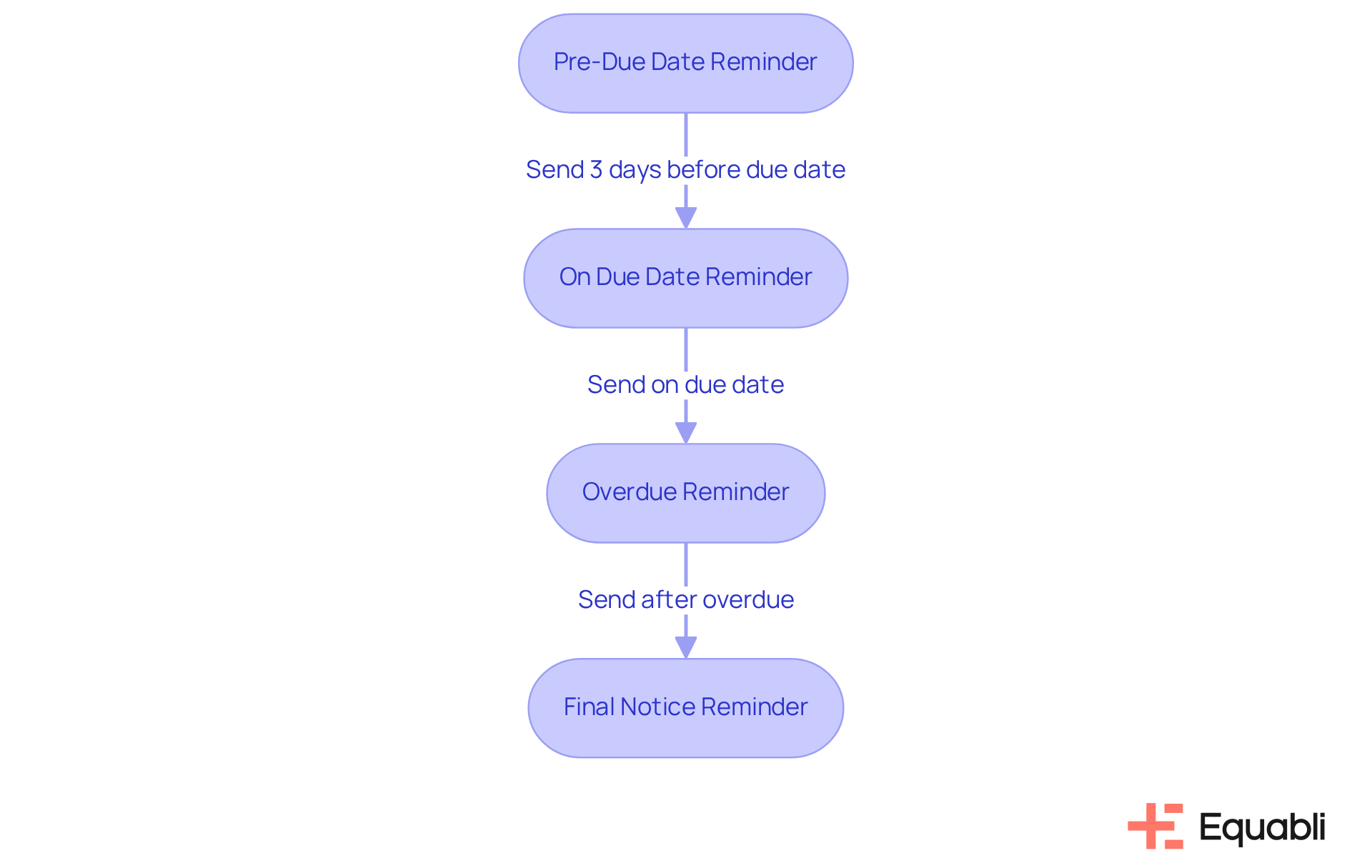

Implement Sample Email Templates for Different Payment Scenarios

Here are sample email templates tailored for various payment scenarios:

-

Pre-Due Date Reminder:

Subject: Reminder: Invoice #1234 Due Soon

Body: Dear [Client's Name],

This message serves as a reminder that your payment for Invoice #1234 is due on [Due Date]. Sending this notice a few days in advance can facilitate timely settlement. Should you have any inquiries, please do not hesitate to reach out. Thank you for your attention to this matter. -

On Due Date Reminder:

Subject: Payment Due Today: Invoice #1234

Body: Hello [Client's Name],

This is a reminder that Invoice #1234 is due today. We appreciate your prompt attention to this obligation. Thank you. -

Overdue Reminder:

Subject: Overdue Payment Reminder: Invoice #1234

Body: Dear [Client's Name],

We have noted that Invoice #1234, due on [Due Date], remains unpaid. We kindly request that you address this transaction at your earliest convenience. It is important to note that 87% of businesses experience challenges with delayed payments, highlighting the need for sample email templates for payment reminder strategies in corporate finance to facilitate your swift action. Thank you for your cooperation. -

Final Notice Reminder:

Subject: Final Notice: Payment Required for Invoice #1234

Body: Dear [Client's Name],

This is a final notice regarding Invoice #1234, which is now [Number of Days] days overdue. Please ensure the transaction is completed by [Final Due Date] to avoid any late fees. Clearly specifying due dates is essential to prevent misunderstandings. Thank you for your prompt attention.

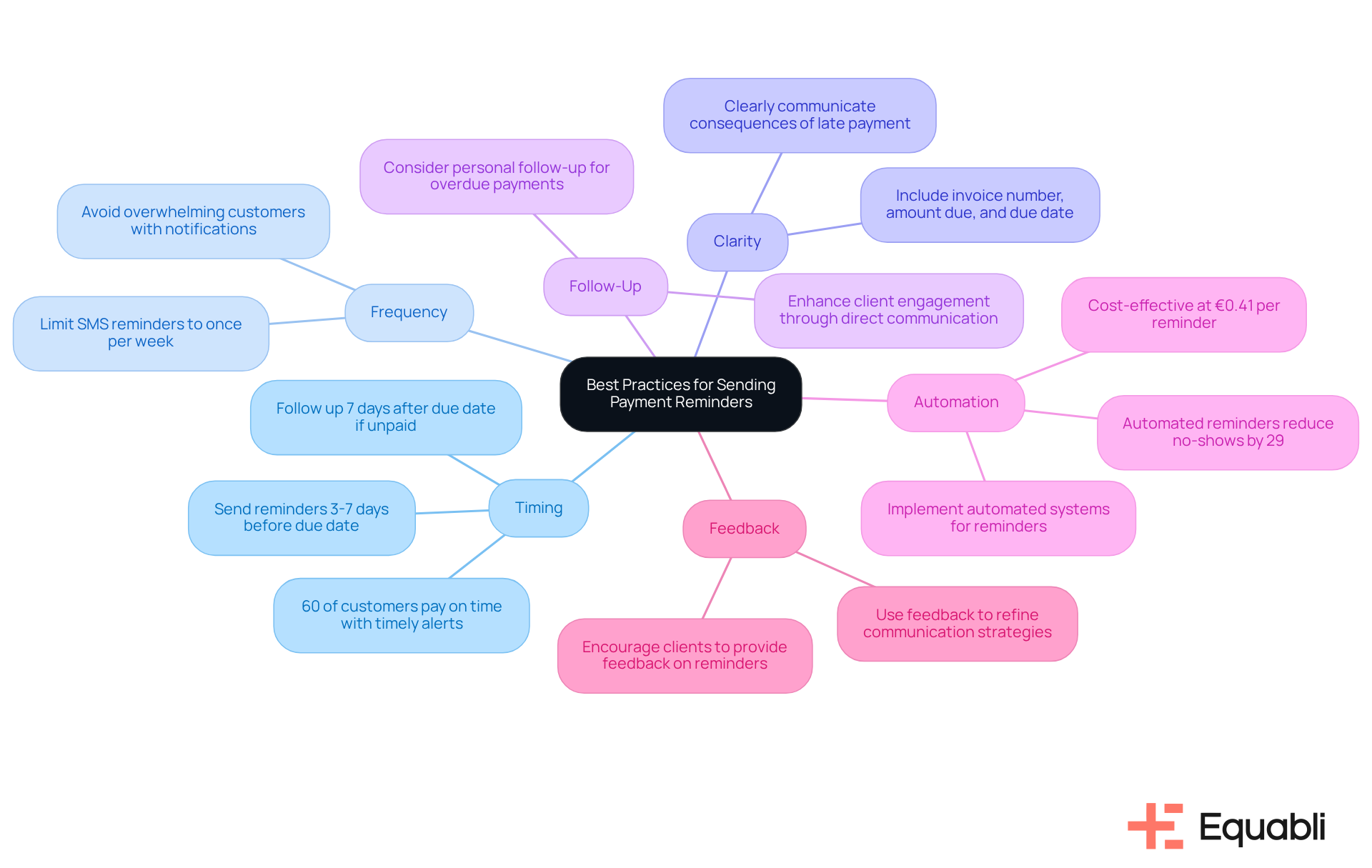

Adopt Best Practices for Sending Payment Reminders

To maximize the effectiveness of payment reminders, consider the following best practices:

-

Timing: Thoughtful arrangement of notifications is crucial. Send reminders 3-7 days before the due date, on the due date itself, and follow up 7 days later if the amount remains unpaid. Research indicates that timely notifications significantly enhance the likelihood of on-time payments, with 60% of customers paying promptly when they receive a well-timed alert. This approach not only improves cash flow but also reinforces customer accountability.

-

Frequency: Striking a balance in communication is essential; avoid overwhelming customers with excessive notifications. For instance, SMS reminders should be limited to once per week for the same invoice. Spacing out notifications helps maintain a professional relationship while ensuring customers remain aware of their obligations, ultimately fostering a more positive payment experience.

-

Clarity: Each reminder must be clear and concise, reiterating essential details such as the invoice number, amount due, due date, and potential consequences of late submission. This clarity aids customers in understanding their obligations and promotes prompt action, thereby reducing the risk of overdue payments.

-

Follow-Up: For overdue payments, consider a follow-up phone call or direct communication method to emphasize the importance of the payment. This personal touch can enhance client engagement and prompt quicker responses, reinforcing the relationship and demonstrating commitment to customer service.

-

Automation: Implementing automated systems for dispatching notifications can save time and ensure consistent communication. Automated notifications have been shown to decrease no-shows by 29% and can effectively manage large-scale campaigns, enabling businesses to maintain high-quality messaging without incurring additional staffing costs.

-

Feedback: Encourage customers to reach out with any inquiries or issues regarding their transactions. Gathering client feedback on communication preferences can enhance the payment reminder process, fostering trust and leading to improved payment behaviors, as clients feel supported and valued. This proactive approach not only strengthens relationships but also contributes to a more efficient payment cycle through the use of sample email templates for payment reminder strategies in corporate finance.

Conclusion

Implementing effective payment reminder strategies is crucial for maintaining healthy cash flow and fostering robust client relationships in corporate finance. Utilizing well-crafted sample email templates streamlines communication, ensuring clients are promptly informed of their financial obligations. By strategically scheduling reminders and personalizing communications, organizations can significantly enhance their collection rates and encourage timely payments.

Key insights from the article underscore the importance of clarity, timing, and automation in payment reminders. Essential elements such as clear subject lines, detailed invoice information, and polite tones contribute to effective communication. Moreover, adopting best practices like thoughtful timing of notifications and encouraging client feedback can lead to improved payment behaviors and a more efficient payment cycle. Evidence indicates that organizations prioritizing these strategies experience tangible benefits, including faster payment turnaround and reduced operational disruptions.

In conclusion, the significance of payment reminders is paramount. Businesses must recognize the impact of effective communication on their financial health and customer relationships. By leveraging sample email templates and adhering to best practices, organizations can enhance their cash flow management while cultivating a culture of accountability among clients. Embracing these strategies represents a proactive step toward achieving financial stability and fostering long-term partnerships in the corporate finance landscape.

Frequently Asked Questions

What is the role of payment reminders in corporate finance?

Payment reminders are critical tools that help ensure clients are informed of their financial obligations, avoid overdue transactions, and mitigate disruptions to cash flow, ultimately reducing operational costs.

How do effective payment notifications impact payment speed?

Organizations using effective payment notifications can receive payments an average of 14 days faster than those relying on traditional follow-up methods.

What is the recommended timing for sending payment reminders?

It is suggested to send the first payment reminder seven days before the due date to enhance collection rates.

How can personalizing payment notifications affect customer behavior?

Personalizing notifications with specific customer information can increase their effectiveness, as nearly 60% of consumers are more likely to pay on time when they receive well-crafted alerts.

What is the benefit of establishing grace periods for payments?

Grace periods allow clients to settle their accounts without incurring late fees, which helps nurture positive relationships and encourages timely payments.

How can automation improve the payment reminder process?

Automating invoice reminders can enhance efficiency and consistency in collections, making the process smoother for both the company and its clients.

Why is understanding the timing and frequency of payment reminders important?

Knowing the optimal timing and frequency of communications directly influences the likelihood of receiving payments on time, contributing to a more stable financial environment for the organization.

How do late charges impact payment reminders?

Clear communication regarding the implications of late charges reinforces the importance of payment reminders, ensuring clients are aware of their responsibilities and the potential consequences of delays.