Overview

Debt management represents a strategic approach to organizing and controlling liabilities, a critical component for minimizing economic risks and enhancing financial stability. Effective debt management yields substantial benefits, including improved credit ratings and reduced financial stress. By implementing structured repayment plans and seeking professional assistance, individuals can empower themselves to regain control over their financial situations. This proactive approach not only mitigates risks but also fosters a pathway to long-term financial health.

Introduction

Debt management stands as a critical yet often overlooked element of personal finance, wielding substantial influence over an individual's economic stability and mental well-being. By effectively organizing and controlling liabilities, borrowers can alleviate financial burdens, enhance their credit ratings, and pave the way for a more secure future.

However, with a myriad of strategies available—ranging from do-it-yourself approaches to professional assistance—how can one determine the most effective path to financial freedom?

This article delves into the key components of debt management, exploring its significance and the profound impact it has on both credit health and overall financial wellness.

Define Debt Management and Its Significance

Debt management represents a strategic approach to organizing and controlling liabilities, which aims to minimize economic risk while maximizing the ability to meet monetary obligations. This encompasses a variety of strategies and resources designed to assist both individuals and organizations in effectively managing their debt management responsibilities. The significance of loan oversight is underscored by its capacity for effective debt management, which can prevent monetary distress, enhance credit ratings, and foster long-term economic stability. For instance, organized repayment schemes and debt management plans (DMPs) empower borrowers to regain control over their financial situations, paving the way toward achieving freedom from obligations.

Recent statistics reveal that disciplined borrowers utilizing DMPs can save thousands in interest payments and significantly shorten their repayment timelines. Specifically, on $25,000 in credit card liabilities, a DMP could yield substantial interest savings and markedly reduce the payoff duration. Typically, a DMP can lower card interest rates by over 50%, consolidating various obligations into a single monthly payment, which streamlines economic oversight. Real-world examples illustrate the transformative impact of effective borrowing strategies; for example, individuals facing high-interest credit card debts have successfully negotiated reduced rates through credit counseling agencies, leading to enhanced economic well-being.

Moreover, expert perspectives emphasize that debt management is not only a necessity for resources but also a crucial aspect of emotional health. As Barry Cripps articulates, 'Debt is not merely an economic vulnerability, it’s also an emotional one.' As financial burdens are alleviated, individuals often experience increased peace of mind and security. Current trends indicate a growing recognition of the importance of fiscal literacy and mindset oversight in loan handling strategies, further bolstering the effectiveness of these methods. By concentrating on debt management, borrowers can navigate their monetary challenges more adeptly, ensuring a more stable and secure economic future.

Explore Methods of Debt Management: DIY vs. Professional Help

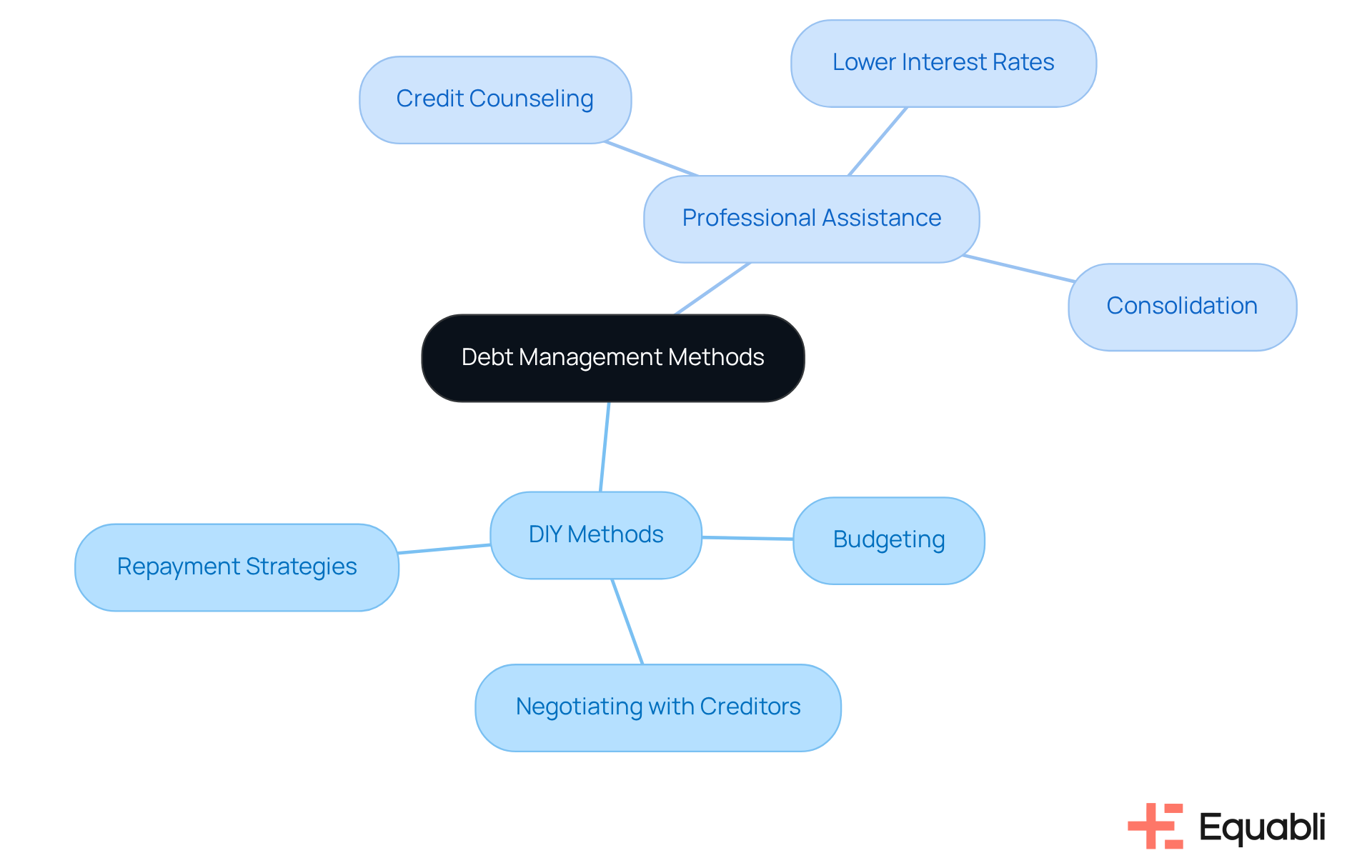

Debt management can be approached through two primary avenues: do-it-yourself (DIY) methods and professional assistance.

-

DIY monetary oversight empowers individuals to take charge of their economic situations by creating budgets, negotiating with creditors, and developing repayment strategies independently. This self-directed approach can save on fees, yet it often demands considerable time and a solid understanding of financial principles.

-

Conversely, professional debt management services, such as credit counseling organizations, provide structured programs aimed at negotiating lower interest rates and consolidating payments. While these services generally involve charges, they offer valuable knowledge and assistance that can lead to more effective financial resolution.

Financial experts emphasize that the decision between DIY and professional assistance for debt management hinges on personal circumstances, including the complexity of the financial issues and the individual's financial knowledge. Recent statistics reveal that individuals utilizing professional services frequently achieve a higher success rate in financial resolution compared to those who attempt to manage their obligations independently.

Ultimately, grasping the nuances of each approach is crucial for making informed choices regarding debt management.

Analyze Key Components of Effective Debt Management Plans

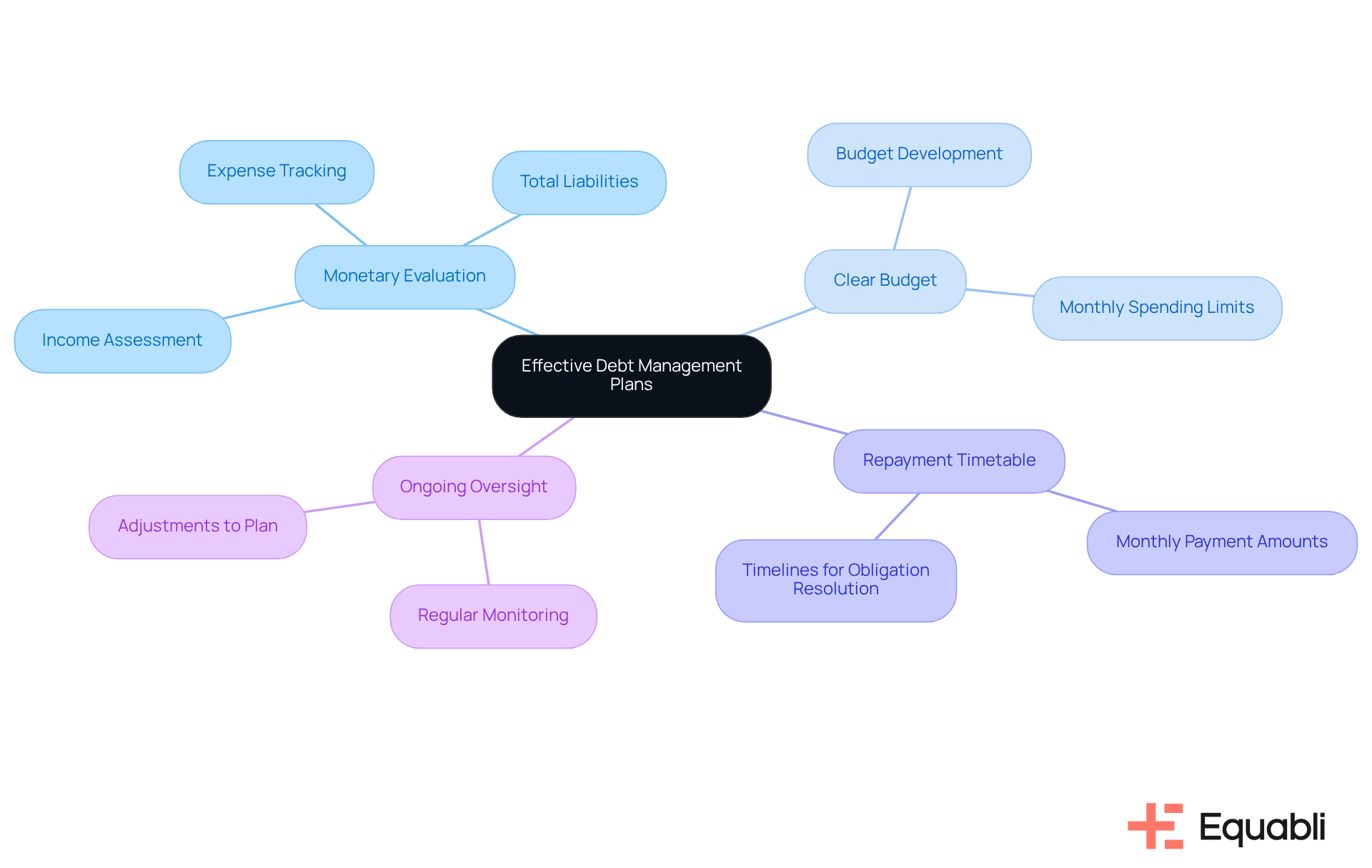

Efficient debt management strategies encompass several vital elements:

- A comprehensive monetary evaluation

- A clear budget

- A structured repayment timetable

- Ongoing oversight

The preliminary economic evaluation is crucial; it determines total liabilities, income, and expenses, thereby facilitating the development of a practical budget. For instance, in 2025, total consumer liabilities reached $18.203 trillion, underscoring the necessity for meticulous monetary planning. A clearly outlined repayment schedule specifies monthly payment amounts and timelines for resolving obligations, which is essential for maintaining accountability. Furthermore, ongoing monitoring guarantees that the plan remains on track, enabling timely adjustments as circumstances evolve. By integrating these components, individuals not only manage their existing obligations more effectively but also cultivate healthier monetary habits for the future. Economic specialists assert that a systematic approach to debt management can significantly alleviate pressure and enhance overall fiscal wellbeing.

Understand the Impact of Debt Management on Credit and Financial Health

Efficient financial management is crucial for enhancing credit scores and overall financial well-being. A structured repayment plan not only demonstrates reliability to lenders but also fosters a positive financial history, which can lead to improved scores over time. Recent research indicates that individuals who proactively manage their financial obligations can experience significant increases in their ratings, particularly when they consistently make timely payments. Conversely, poor financial practices, such as missed payments and accumulating high-interest debt, can lead to increased borrowing costs and potential bankruptcy, severely damaging credit ratings.

Moreover, responsible management of financial obligations alleviates the stress and anxiety often associated with economic uncertainty. By effectively managing their debts through debt management, individuals can allocate their resources more efficiently, facilitating better budgeting and financial planning. This proactive approach not only contributes to a more secure financial future but also empowers individuals to pursue their monetary goals with confidence.

Industry experts emphasize the importance of creating a budget and seeking professional advice to navigate the complexities of borrowing effectively. As Kevin Roth, Ph.D., observes, "Americans need to feel more equipped to take actionable steps." As a result, many Americans are increasingly recognizing the value of organized borrowing strategies, which can lead to improved financial stability and well-being. Notably, implementing a debt management plan can reduce credit card interest rates by half or more, further highlighting the potential financial benefits of debt management strategies.

Conclusion

Debt management stands as a pivotal element of financial health, serving as a systematic approach to organizing and controlling liabilities. Effectively managing debt allows individuals and organizations to minimize economic risks, enhance credit ratings, and achieve long-term financial stability. The strategies outlined underscore the significance of both DIY methods and professional assistance, demonstrating that informed choices can yield substantial improvements in one’s financial situation.

This article delineates several key components of effective debt management, including:

- Comprehensive evaluations

- Clear budgeting

- Structured repayment schedules

- Ongoing monitoring

These elements not only facilitate the management of existing obligations but also cultivate healthier financial habits. Moreover, the positive impact of responsible debt management on credit scores and overall financial well-being is profound; timely payments and organized strategies foster greater financial confidence and reduce stress.

In conclusion, prioritizing debt management is essential for anyone aiming to secure their financial future. By understanding the various strategies available and recognizing the importance of fiscal literacy, individuals can navigate their monetary challenges more effectively. Embracing these practices not only alleviates financial burdens but also empowers individuals to pursue their economic goals with assurance. Taking actionable steps toward effective debt management today can pave the way for a more stable and prosperous tomorrow.

Frequently Asked Questions

What is debt management?

Debt management is a strategic approach to organizing and controlling liabilities aimed at minimizing economic risk while maximizing the ability to meet monetary obligations. It includes various strategies and resources designed to help both individuals and organizations effectively manage their debt responsibilities.

Why is debt management significant?

Debt management is significant because it can prevent monetary distress, enhance credit ratings, and foster long-term economic stability. Effective debt management allows borrowers to regain control over their financial situations and work towards achieving freedom from obligations.

How can debt management plans (DMPs) benefit borrowers?

Debt management plans (DMPs) can benefit borrowers by saving them thousands in interest payments and significantly shortening their repayment timelines. A DMP can lower credit card interest rates by over 50% and consolidate various obligations into a single monthly payment, making financial oversight easier.

What are some real-world examples of effective debt management?

Real-world examples include individuals with high-interest credit card debts successfully negotiating reduced rates through credit counseling agencies, which leads to improved economic well-being.

How does debt management impact emotional health?

Debt management impacts emotional health by alleviating financial burdens, which can lead to increased peace of mind and security. As noted by experts, debt is not only an economic vulnerability but also an emotional one.

What current trends are influencing debt management strategies?

Current trends indicate a growing recognition of the importance of fiscal literacy and mindset oversight in loan handling strategies, which further enhance the effectiveness of debt management methods.