Overview

The article presents an authoritative overview of various automated payment collection reminder systems for enterprises, emphasizing their role in enhancing operational efficiency and improving cash flow management. These systems are evidenced to reduce vendor onboarding times and minimize missed payments, which significantly boosts recovery rates. This analysis underscores their critical importance in modernizing financial operations for businesses, offering strategic insights relevant to executives and financial professionals.

Introduction

The landscape of financial operations is rapidly evolving, with automation emerging as a pivotal factor for enterprises aiming to optimize their payment collection processes. Automated payment collection reminder systems significantly enhance operational efficiency and drive improvements in cash flow management. As businesses confront the challenge of overdue payments, the critical question is: how can organizations effectively leverage these advanced systems to ensure timely collections and strengthen client relationships? This article examines ten innovative automated payment collection reminder systems that are poised to transform the management of financial operations within enterprises.

Equabli EQ Suite: Comprehensive Automated Payment Collection Solutions

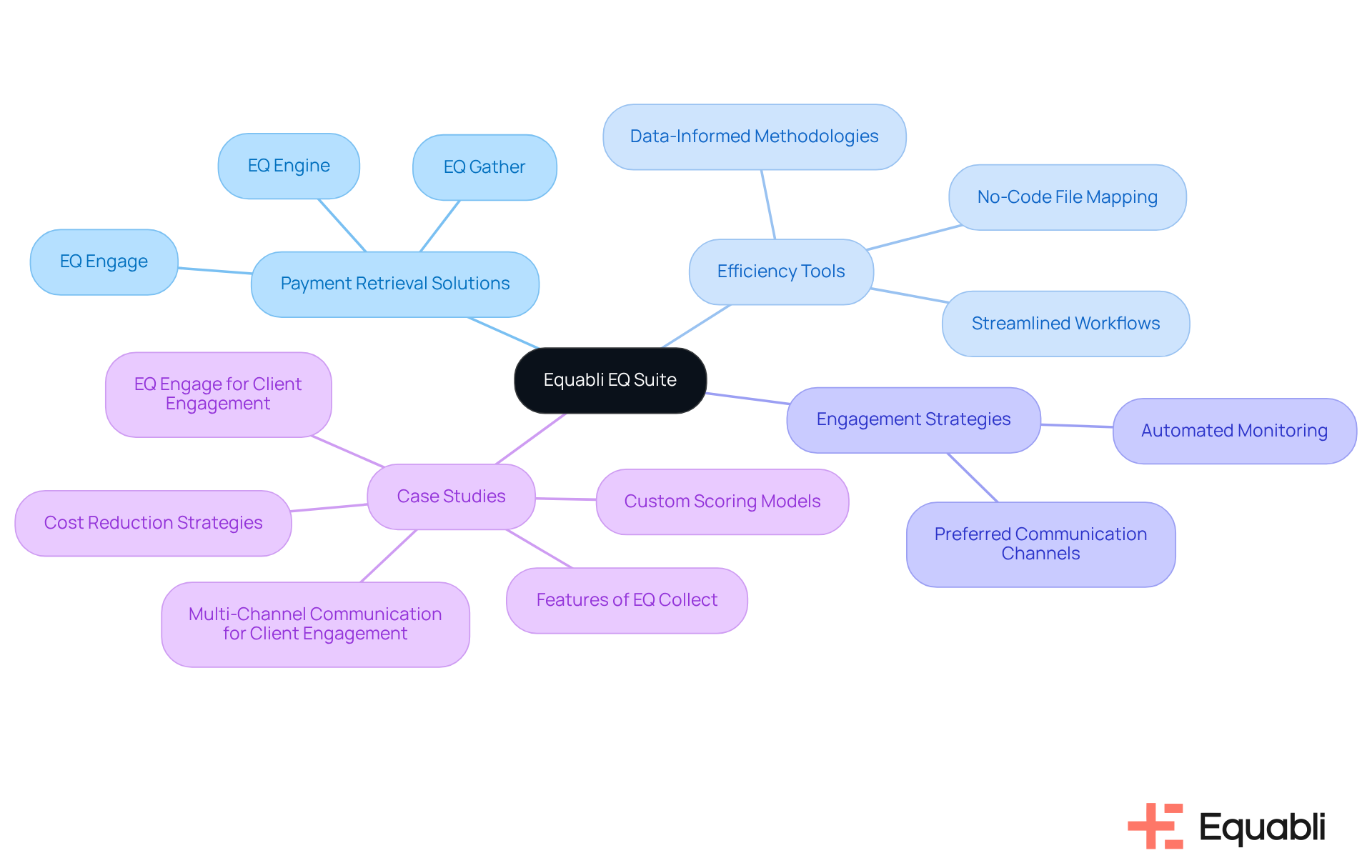

The Equabli EQ Suite presents a robust selection of payment retrieval solutions aimed at enhancing operational efficiency for lenders and agencies. This suite includes tools such as EQ Engine, EQ Engage, and EQ Gather, which empower clients to develop personalized scoring models that predict repayment behaviors, optimize collection strategies, and facilitate digital collections through self-service repayment plans.

With EQ Collect, organizations can significantly reduce vendor onboarding timelines via a no-code file-mapping tool, improve efficiency through data-informed methodologies, and minimize execution errors through streamlined workflows. By leveraging advanced predictive analytics, organizations can pinpoint high-risk accounts and tailor recovery strategies, thereby notably boosting recovery rates.

Moreover, the EQ Suite enhances borrower engagement by enabling communication through preferred channels, including SMS, email, or phone calls, which fosters a more personalized experience. EQ Engage facilitates the design and automation of borrower contact strategies, allowing borrowers to self-service with customized repayment plans while ensuring compliance with regulatory standards through automated monitoring.

As John Sanders, Managing Partner and CEO, asserts, "Digital adoption is no longer optional—it’s a competitive necessity." Successful implementations of the EQ Suite, as shown in various case studies, demonstrate significant reductions in operational expenses and improved recovery performance, highlighting its role as an essential solution for enterprises aiming to modernize their retrieval processes through automated payment collection reminder systems for enterprise financial operations.

Furthermore, the transition from SMS to Rich Communication Services (RCS) is reshaping consumer engagement, enabling interactive and personalized communication that enhances outcomes.

Gaviti: Automated Payment Reminders for Enhanced Collection Efficiency

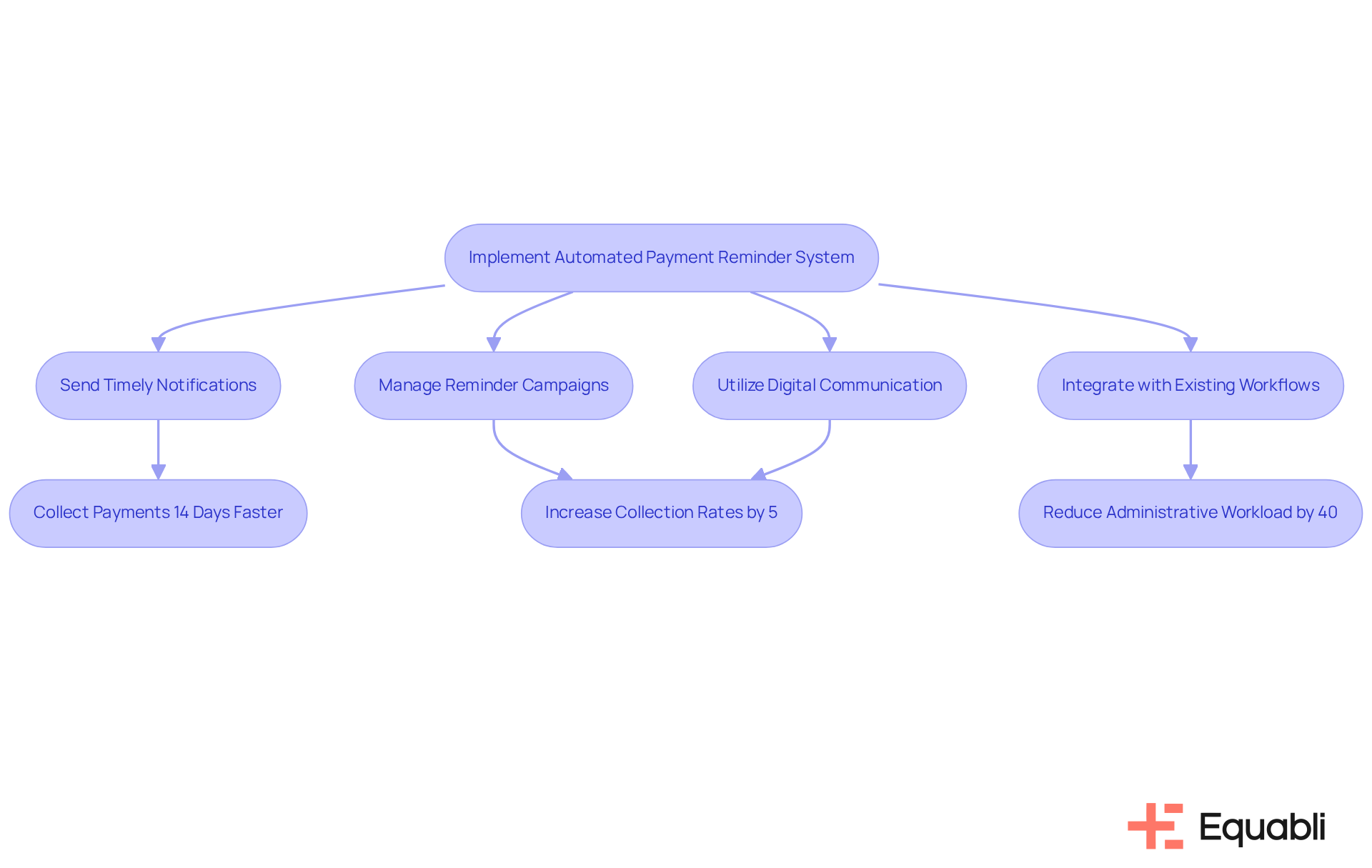

Equabli enhances collection efficiency for businesses by utilizing automated payment collection reminder systems for enterprise financial operations. Equabli minimizes missed payments and bolsters cash flow by using automated payment collection reminder systems for enterprise financial operations to send timely notifications to clients. Evidence suggests that companies utilizing automated payment collection reminder systems for enterprise financial operations typically collect payments 14 days faster than those relying on traditional follow-up methods, underscoring the effectiveness of this approach. Furthermore, robotic systems can handle thousands of simultaneous interactions; an automated payment collection reminder system for enterprise financial operations can manage reminder campaigns for businesses with over 10,000 customers, ensuring that no client is overlooked.

The seamless integration of Equabli's EQ system with existing workflows allows enterprises to utilize automated payment collection reminder systems for enterprise financial operations, ensuring a consistent communication strategy without the need for manual intervention. This not only conserves time and resources but also diminishes administrative workload by up to 40%, permitting staff to concentrate on more complex tasks. Organizations that adopt automated payment collection reminder systems for enterprise financial operations report a 5% increase in collection rates, as evidenced by various case studies that demonstrate the tangible benefits of this approach.

Current trends reveal a rising preference for digital communication, with 85% of patients opting for electronic payment methods instead of traditional billing. This shift emphasizes the importance of adopting technological solutions like EQ Gather, which align with consumer demands for convenience and speed. With features such as a no-code file-mapping tool, data-driven methodologies, and real-time reporting, EQ emerges as a vital solution for optimizing revenue cycles and enhancing overall financial health. Companies seeking to improve cash flow should consider incorporating automated payment collection reminder systems for enterprise financial operations into their recovery strategies.

Convin: Streamlined Automated Debt Collection Software

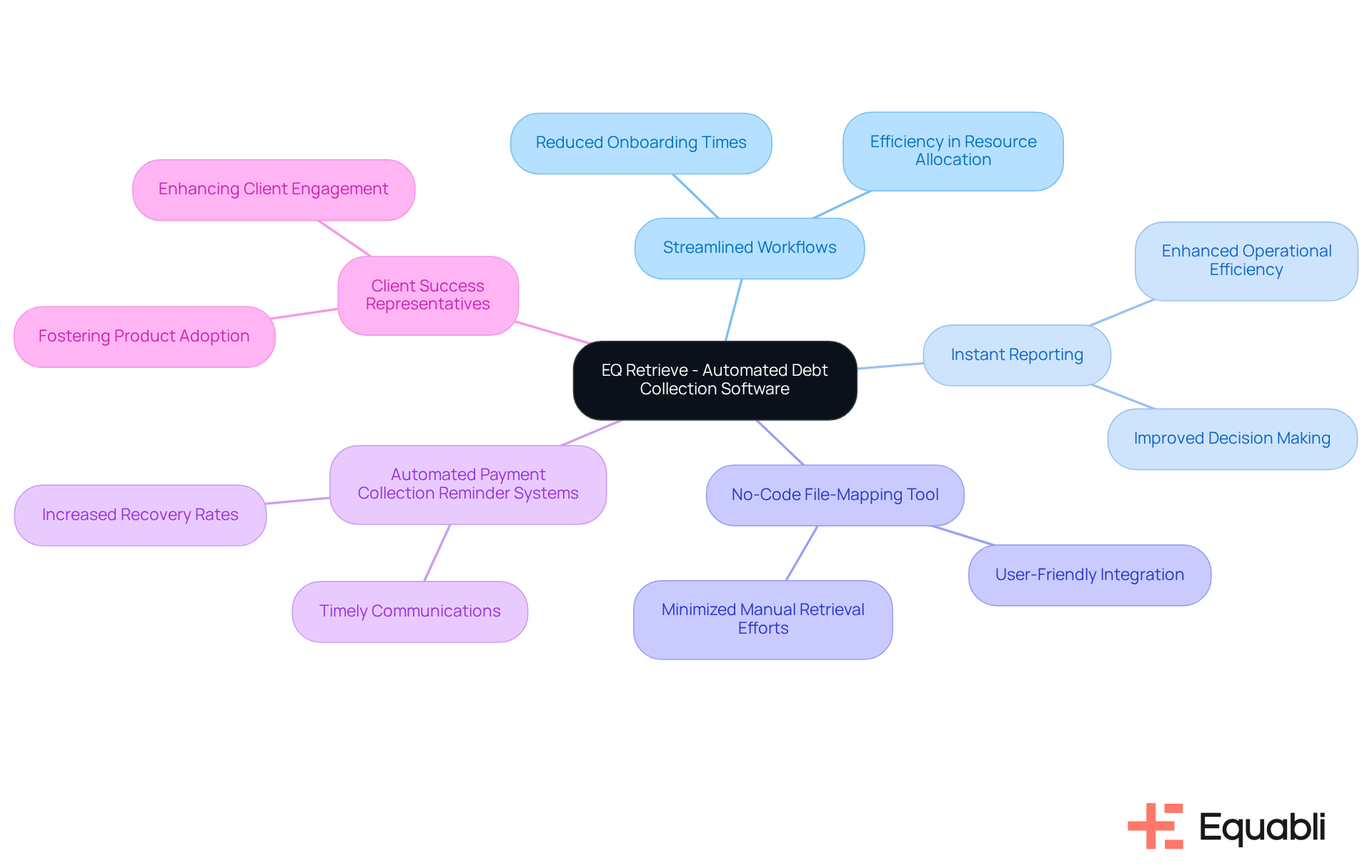

Equabli provides a cutting-edge debt recovery software, EQ Retrieve, designed to enhance the effectiveness of recovery processes significantly. By incorporating features such as streamlined workflows, instant reporting, and a no-code file-mapping tool that reduces vendor onboarding times, EQ Retrieve minimizes reliance on manual retrieval efforts. This enables businesses to allocate resources more efficiently, thereby accelerating recovery rates and improving overall performance. Evidence of user satisfaction with automated payment collection reminder systems for enterprise financial operations indicates a notable increase, with numerous organizations reporting enhanced operational efficiency and lower costs.

The adoption of automated payment collection reminder systems for enterprise financial operations is essential for maintaining competitiveness in the market, as these systems promote timely communications and ensure that no accounts are overlooked. From a compliance perspective, the role of Client Success Representatives at Equabli is crucial in fostering product adoption and client engagement, ensuring that clients effectively utilize these intelligent automation solutions. Consequently, organizations leveraging Equabli's offerings are witnessing substantial improvements in their recovery rates, showcasing how automated payment collection reminder systems for enterprise financial operations can transform debt retrieval.

Tratta: Automation Tools for Effective Payment Reminders

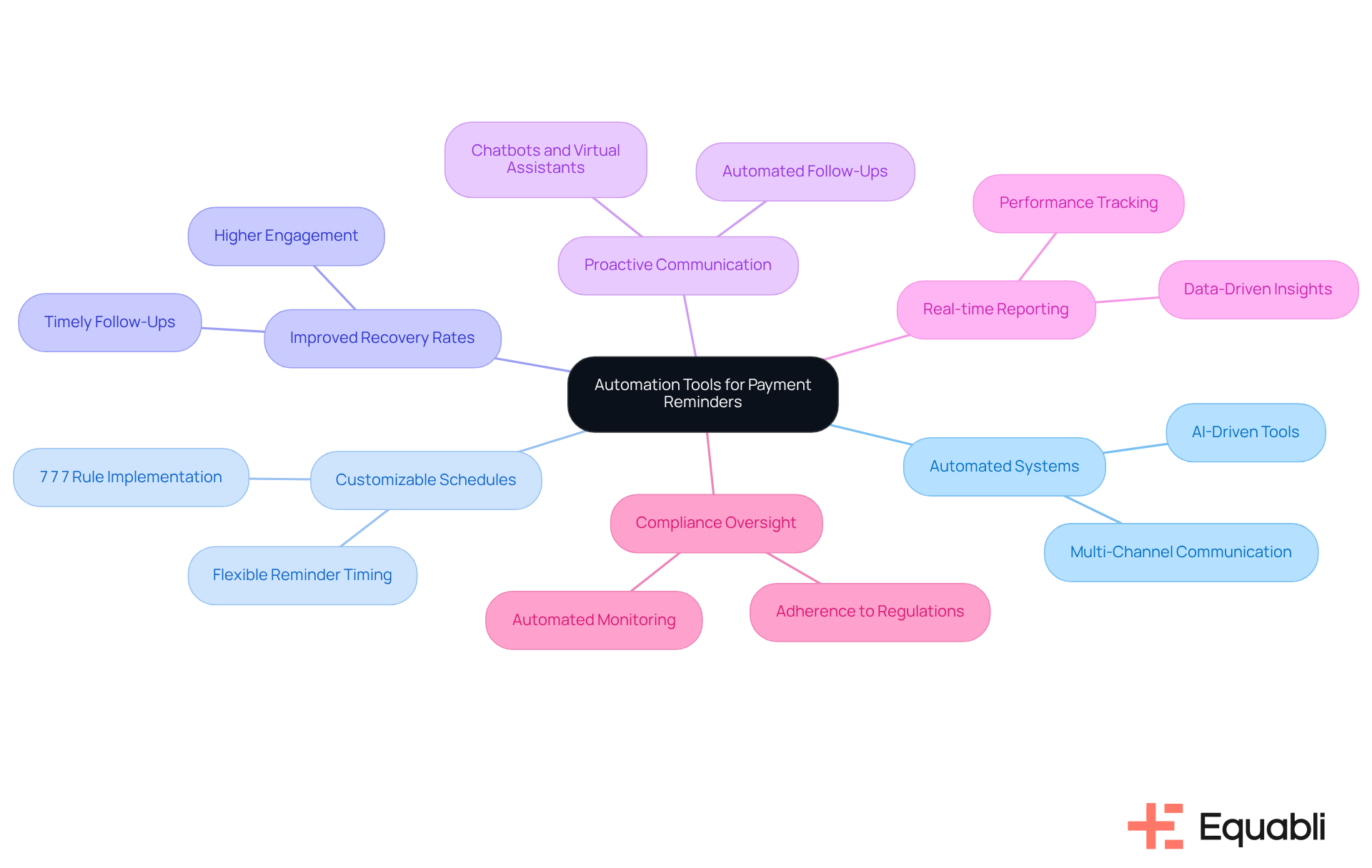

Equabli's EQ platform transforms payment reminders by implementing automated payment collection reminder systems for enterprise financial operations that are designed to enhance efficiency and compliance. This solution enables businesses to significantly reduce vendor onboarding timelines via a straightforward, no-code file-mapping tool. By facilitating customizable reminder schedules, it ensures that clients receive notifications at optimal times.

Utilizing data-driven strategies, EQ Gather not only improves recovery rates but also fosters stronger client relationships through proactive communication. The platform minimizes execution errors and manual resource allocation by employing automated payment collection reminder systems for enterprise financial operations, which guarantees smarter orchestration and superior performance in debt recovery management.

Furthermore, with real-time reporting and rigorous compliance oversight, EQ Gather provides unmatched clarity and insights. This empowers financial institutions to manage their receivables effectively, reinforcing the importance of compliance and operational efficiency in the realm of enterprise-level debt collection.

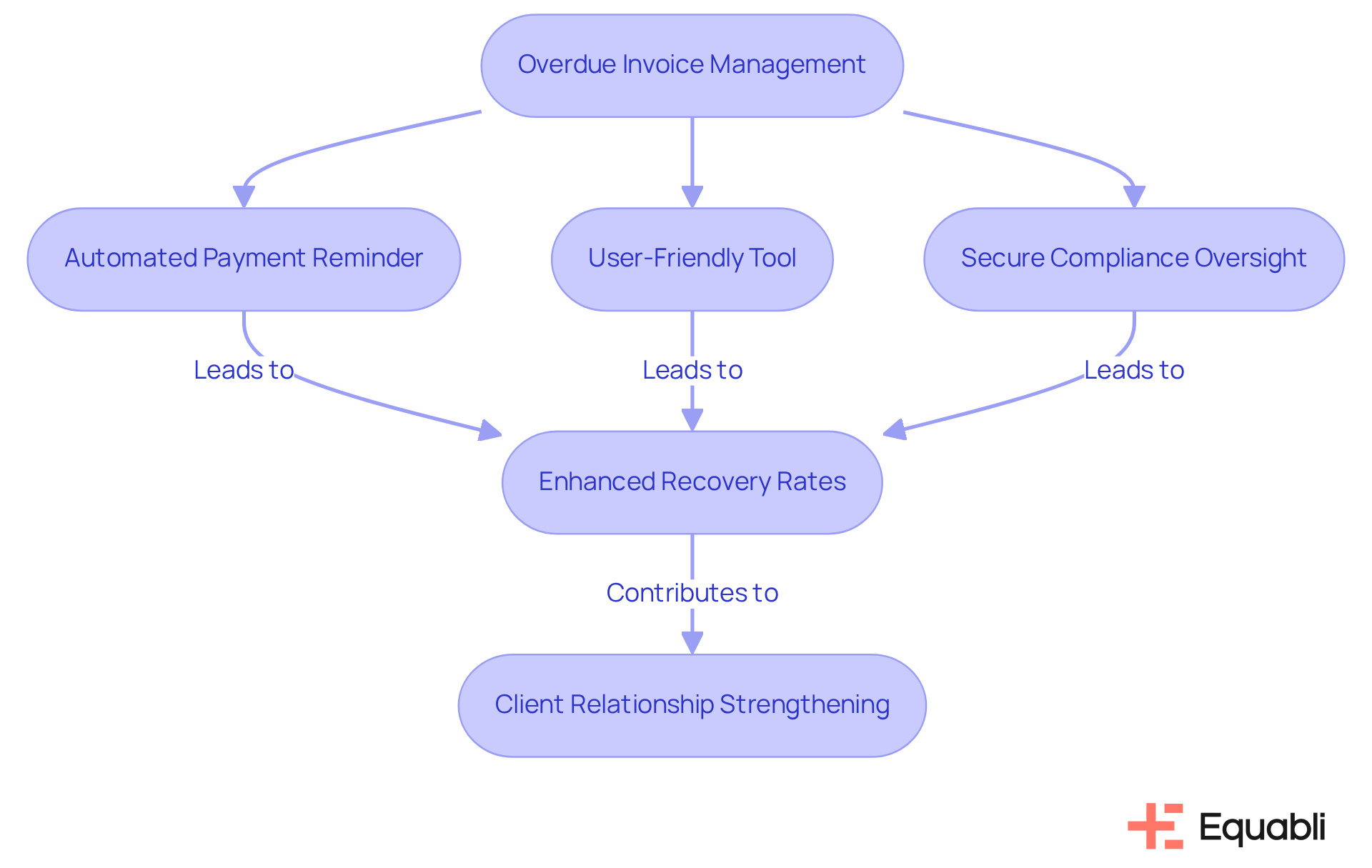

Invoiced: Advanced Solutions for Managing Past Due Invoices

Equabli delivers sophisticated solutions for managing overdue invoices, enabling businesses to implement automated payment collection reminder systems for enterprise financial operations efficiently with EQ. The platform features a user-friendly, no-code file-mapping tool, automated workflows, and secure, industry-leading compliance oversight. As a result, EQ Collect significantly enhances the recovery of overdue payments using automated payment collection reminder systems for enterprise financial operations while minimizing administrative burdens.

Strong analytical capabilities provide unmatched clarity and insights through real-time reporting, allowing organizations to consistently track performance and refine strategies. This data-driven approach is vital; businesses utilizing automated payment collection reminder systems for enterprise financial operations have reported recovery rate enhancements of up to 80% compared to traditional methods. Additionally, a significant 86% of businesses indicate that up to 30% of their monthly invoiced sales are overdue, highlighting the critical need to address overdue payments.

As Carey O’Connor Kolaja, CEO of Versapay, asserts, financial agility is now a necessity for leveraging advanced tools like EQ Collect. By adopting these solutions, companies can recover outstanding balances more effectively and cultivate stronger client relationships, ultimately contributing to enhanced financial stability.

To optimize effectiveness, businesses should consider dispatching the first reminder three days post-due date, ensuring timely communication and prompting prompt action.

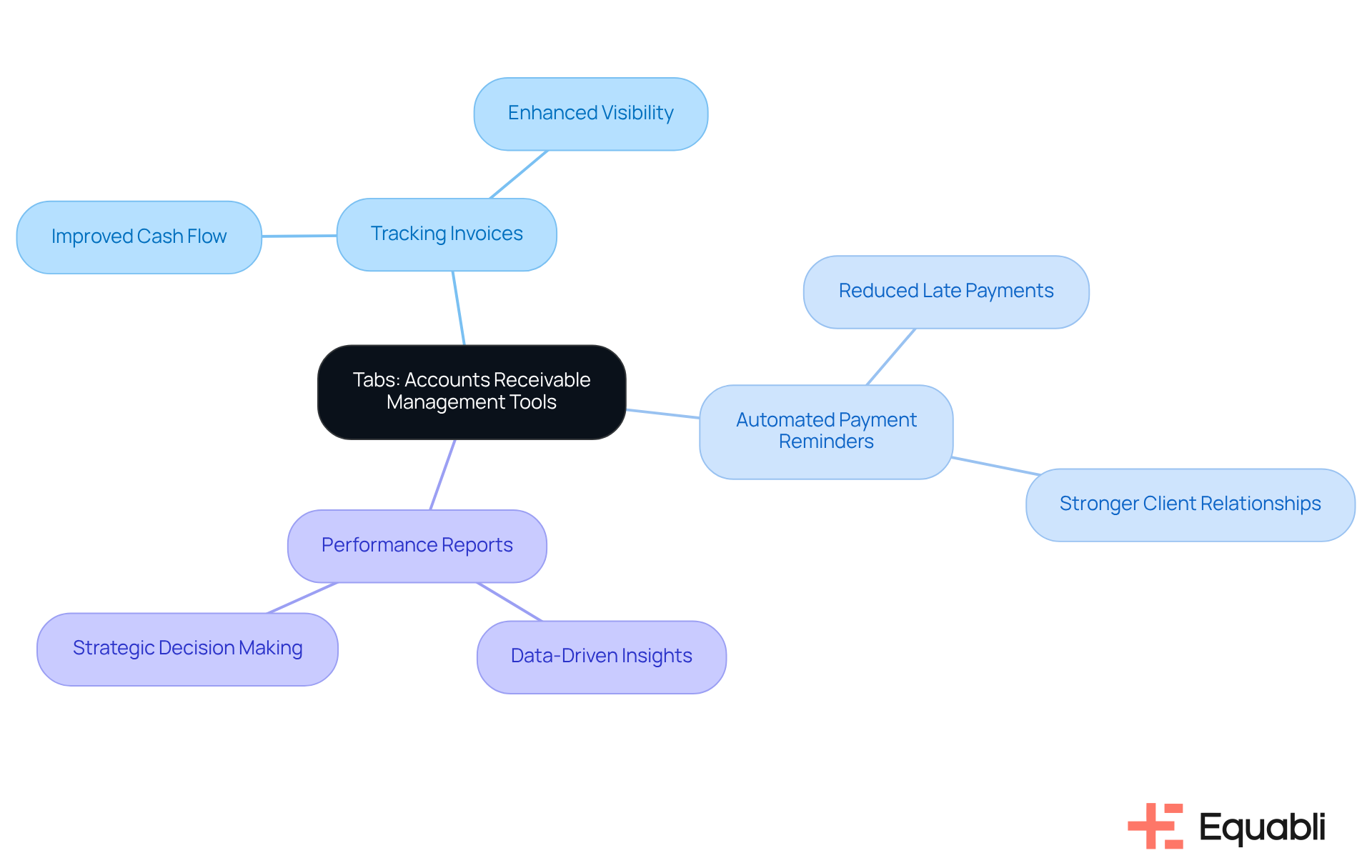

Tabs: Essential Accounts Receivable Management Tools

Tabs offers essential accounts receivable management tools designed to enhance retrieval efficiency for businesses. Their platform encompasses functionalities for:

- Tracking outstanding invoices

- Implementing automated payment collection reminder systems for enterprise financial operations

- Generating detailed performance reports on payment collection

By centralizing accounts receivable management, Tabs empowers businesses with improved control over their cash flow, leading to superior recovery rates.

Significantly, 91% of mid-sized firms utilizing fully automated AR systems report increased savings, enhanced cash flow, and growth, underscoring the effectiveness of automation in bolstering financial health. Industry experts highlight that effective AR management is becoming increasingly strategic, with 75% of finance leaders recognizing its growing importance. As Ali Hussain, CEO of Tabs, articulated, "The manual era ends here," signifying a decisive shift towards automation.

The integration of automated payment collection reminder systems for enterprise financial operations has proven to elevate retrieval rates, as organizations that adopt these systems can streamline their processes and reduce the time spent on manual follow-ups. This transition not only mitigates the risk of late payments but also cultivates stronger client relationships, ultimately driving sustainable growth. Furthermore, the accounts receivable automation market is projected to expand at a CAGR of 12.9% over the next five years, highlighting the urgency for businesses to embrace these innovative solutions.

Credit Management Source: Insights and Tools for Effective Collections

Credit Management Source provides a comprehensive suite of insights and tools designed to enhance recovery efforts. Their resources encompass best practices for managing credit risk, with strategies that prioritize automation in recovery processes. Industry leaders recognize that automated payment collection reminder systems for enterprise financial operations not only increase operational efficiency but also significantly boost borrower engagement. For instance, organizations that utilize automated payment collection reminder systems for enterprise financial operations can decrease operational costs by as much as 35% while effectively managing five times more accounts. This transition to automation allows credit teams to utilize automated payment collection reminder systems for enterprise financial operations, enabling them to concentrate on high-value accounts and ensuring resources are allocated for maximum impact.

Moreover, businesses employing predictive analytics and behavioral scoring have reported marked improvements in recovery outcomes. By leveraging data-driven insights, these organizations can tailor their retrieval strategies to address the distinct needs of their customers, ultimately fostering stronger relationships and improving recovery rates. As the credit management landscape evolves, adopting these best practices will be crucial for enterprises aiming to navigate the complexities of debt recovery in 2025 and beyond.

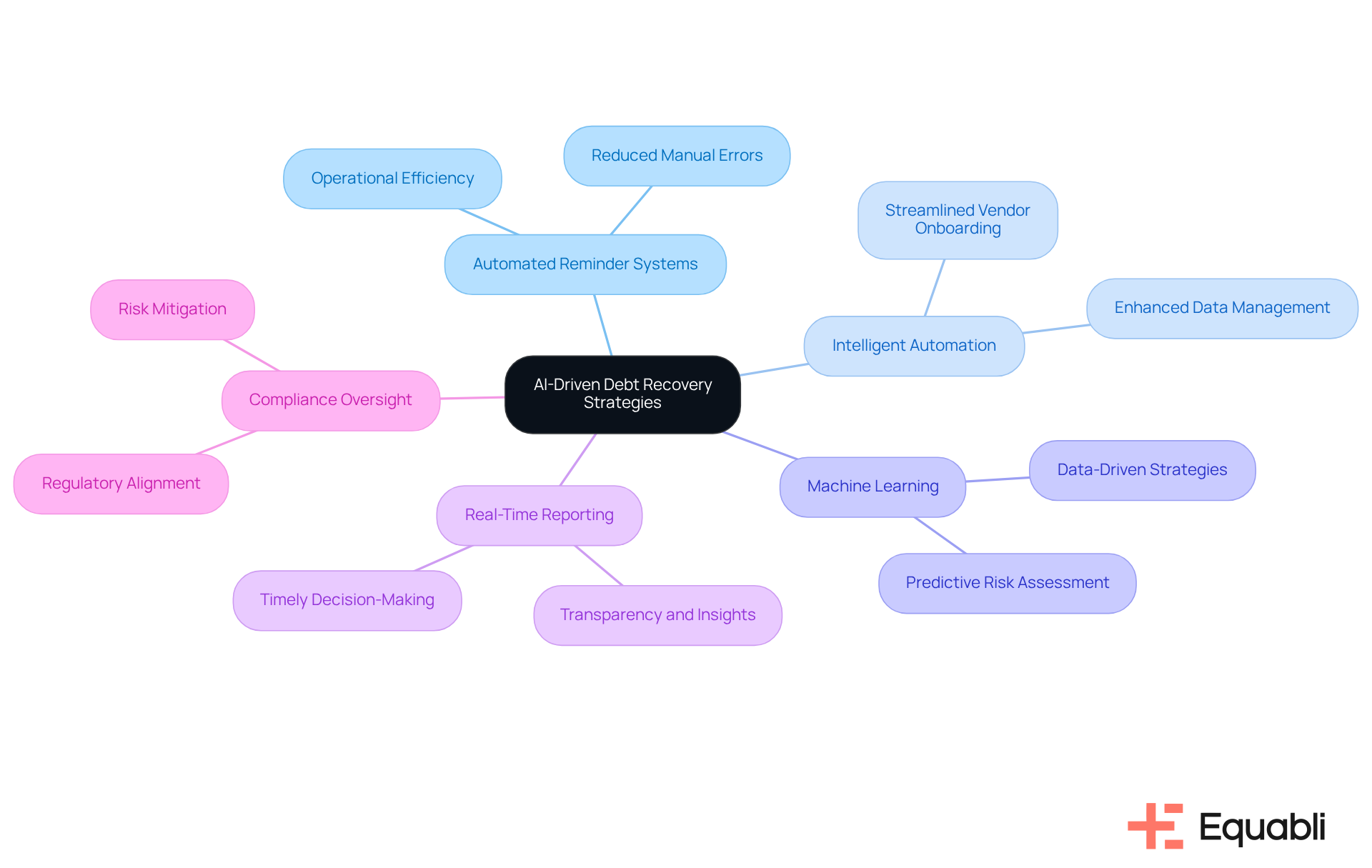

CallMiner: AI-Driven Debt Recovery Strategies

Equabli's EQ system signifies a significant advancement in debt recovery processes by incorporating automated payment collection reminder systems for enterprise financial operations, along with intelligent automation and machine learning solutions. By utilizing a no-code file-mapping tool, EQ effectively reduces vendor onboarding timelines, which enhances operational efficiency and accelerates collections via data-driven strategies. This automated approach, which incorporates automated payment collection reminder systems for enterprise financial operations, not only minimizes execution errors but also reduces reliance on manual resources, thereby ensuring a seamless experience for financial institutions.

Moreover, EQ's real-time reporting capabilities, along with automated payment collection reminder systems for enterprise financial operations, provide clients with unparalleled transparency and insights, facilitating timely decision-making and fostering improved engagement with debtors. The platform's commitment to industry-leading compliance oversight guarantees that all operations align with regulatory standards, thereby empowering organizations to manage their accounts receivable effectively. The user-friendly, scalable, cloud-native interface of EQ further enhances accessibility and adaptability for users, positioning it as a robust solution in the market.

In contrast to CallMiner's AI-driven strategies, which focus on analyzing customer interactions to optimize communication, EQ Gather offers a comprehensive solution that integrates predictive risk assessment and intelligent servicing strategies. This integration ultimately drives superior collection performance. The role of the Client Success Representative is pivotal in this context; they actively promote client engagement and product adoption, ensuring that organizations leverage the full capabilities of EQ to navigate the complexities of debt recovery.

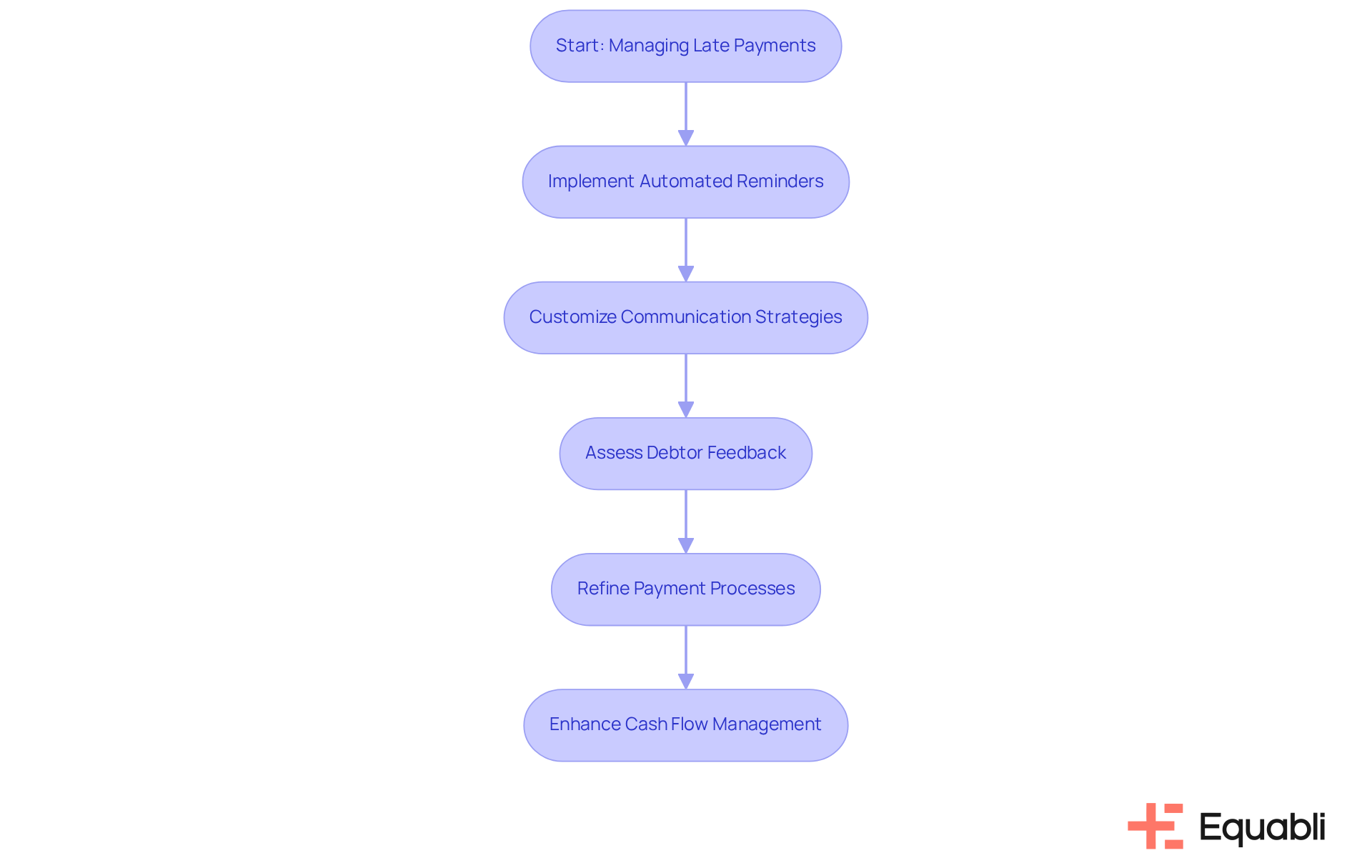

FlexPoint: Solutions for Managing Late Payments

Equabli delivers tailored solutions for the effective management of late payments, underscoring the importance of proactive communication and automated reminders. Their EQ Collect platform empowers businesses to create customizable workflows that incorporate automated payment collection reminder systems for enterprise financial operations, which automatically trigger reminders based on payment due dates. This significantly reduces vendor onboarding timelines through a straightforward, no-code file-mapping tool. Such a proactive strategy not only aids in recovering overdue payments but also mitigates the risk of future delinquencies. By adopting automated payment collection reminder systems for enterprise financial operations, organizations can enhance their cash flow management. Notably, 91% of mid-sized firms utilizing computerized accounts receivable systems report increased savings and improved financial performance, demonstrating the efficacy of automation in this domain.

Furthermore, industry leaders recognize that customized communication strategies are vital; companies that offer adaptable payment options and transparent communication are more likely to excel in debt recovery, especially considering that 55% of all B2B invoiced sales in the U.S. are overdue. The integration of automated reminders has emerged as a transformative factor, enabling companies to maintain professionalism and cultivate trust with debtors, which ultimately leads to higher recovery rates. Additionally, EQ Collect's data-informed methodologies and real-time reporting afford financial institutions unparalleled transparency and insights, facilitating more intelligent orchestration and enhanced performance in managing late payments.

To optimize the effectiveness of these systems, organizations should routinely assess and refine their communication strategies based on debtor feedback and payment behaviors. This continuous improvement approach ensures that enterprises remain agile and responsive to the evolving landscape of debt collection.

Gestion Credit Expert: Transformative Automated Payment Reminder Solutions

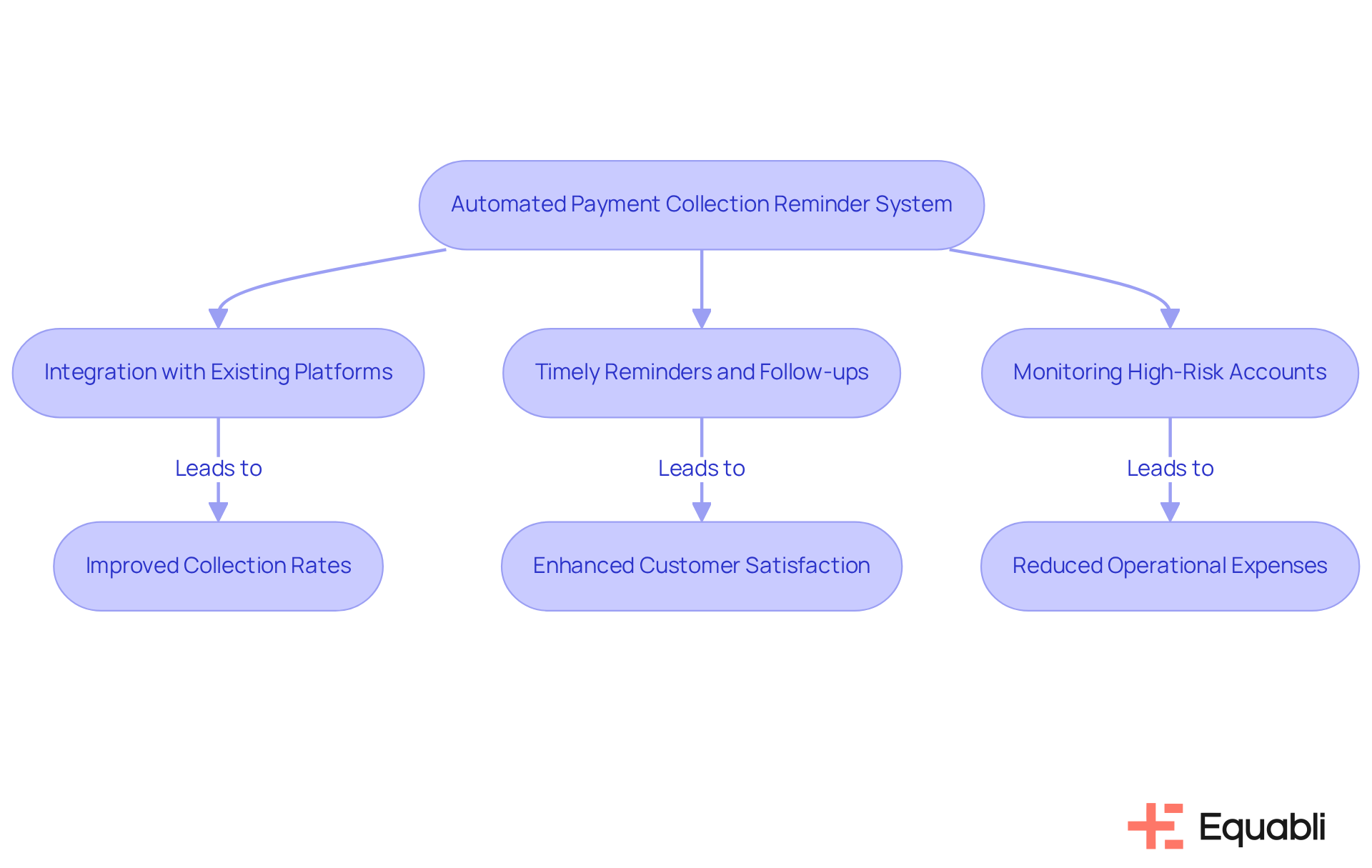

Gestion Credit Expert provides innovative automated payment collection reminder systems for enterprise financial operations that significantly enhance recovery processes for businesses. By seamlessly integrating with existing platforms, their system ensures timely reminders and follow-ups, thereby maintaining client engagement. This automation enables enterprises to focus on strategic initiatives, ultimately improving collection outcomes through automated payment collection reminder systems for enterprise financial operations.

Industry specialists indicate that prompt reminders can lead to a substantial increase in recovery rates, with technology-driven systems reducing operational expenses by 30-50%. Furthermore, businesses employing these solutions have reported improved customer satisfaction, as personalized messaging cultivates stronger connections and encourages timely payments.

The integration of automated payment collection reminder systems for enterprise financial operations not only streamlines data management but also enables organizations to effectively monitor high-risk accounts, ensuring a proactive approach to debt recovery. With EQ Collect, organizations can minimize vendor onboarding timelines through a straightforward, no-code file-mapping tool, enhance efficiency with data-driven strategies, and access real-time reporting for unparalleled transparency. This intelligent automation and machine learning solution empowers enterprises to improve collection performance and ensure compliance oversight, thereby transforming the debt recovery landscape.

Conclusion

The implementation of automated payment collection reminder systems is fundamentally transforming how enterprises manage their financial operations. By leveraging advanced technologies, organizations can significantly enhance their recovery processes, improve cash flow, and foster stronger relationships with clients. The key to success lies in adopting systems that not only streamline communication but also integrate seamlessly with existing workflows, ensuring that no account is overlooked.

Throughout this article, various solutions have been highlighted, including:

- Equabli EQ Suite

- Gaviti

- Convin

- Others

Each offering unique features tailored to meet the diverse needs of businesses. These systems provide significant benefits such as increased efficiency, reduced operational costs, and higher recovery rates, underscoring the importance of automation in today’s competitive landscape. The shift towards digital communication and proactive engagement strategies further emphasizes the necessity for enterprises to embrace these innovative tools.

In conclusion, the transition to automated payment collection reminder systems is not merely a trend but a critical step for enterprises aiming to thrive in a rapidly evolving financial environment. Organizations should prioritize the adoption of these solutions to optimize their recovery strategies and ensure sustainable growth. By doing so, they can navigate the complexities of debt collection with greater agility and responsiveness, ultimately leading to improved financial stability and enhanced client satisfaction.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of automated payment collection solutions designed to enhance operational efficiency for lenders and agencies. It includes tools like EQ Engine, EQ Engage, and EQ Gather, which help clients create personalized scoring models, optimize collection strategies, and facilitate digital collections through self-service repayment plans.

How does EQ Collect improve payment collection processes?

EQ Collect reduces vendor onboarding timelines with a no-code file-mapping tool, enhances efficiency through data-informed methodologies, and minimizes execution errors with streamlined workflows. It utilizes predictive analytics to identify high-risk accounts and tailor recovery strategies, thus boosting recovery rates.

How does the EQ Suite enhance borrower engagement?

The EQ Suite enhances borrower engagement by allowing communication through preferred channels such as SMS, email, or phone calls. EQ Engage helps automate borrower contact strategies and enables self-service repayment plans, while ensuring compliance with regulatory standards through automated monitoring.

What are the benefits of using automated payment collection reminder systems?

Automated payment collection reminder systems help minimize missed payments and improve cash flow by sending timely notifications to clients. Companies using these systems typically collect payments 14 days faster than those using traditional methods and can manage campaigns for businesses with over 10,000 customers.

What impact does Equabli's system have on administrative workload?

The integration of Equabli's EQ system with existing workflows reduces administrative workload by up to 40%, allowing staff to focus on more complex tasks while maintaining a consistent communication strategy without manual intervention.

What trends are influencing the adoption of Equabli's solutions?

There is a rising preference for digital communication, with 85% of patients opting for electronic payment methods over traditional billing. This trend highlights the importance of adopting technological solutions like EQ Gather, which cater to consumer demands for convenience and speed.

What features does EQ Retrieve offer for debt recovery?

EQ Retrieve includes features such as streamlined workflows, instant reporting, and a no-code file-mapping tool that reduces vendor onboarding times. These features help minimize manual retrieval efforts and improve overall recovery rates.

How do Client Success Representatives contribute to the effectiveness of Equabli's products?

Client Success Representatives play a crucial role in fostering product adoption and client engagement, ensuring that clients effectively utilize Equabli's intelligent automation solutions, which leads to improved recovery rates.