Overview

This article emphasizes the critical role of effective credit collection services in optimizing payment strategies for financial institutions. It presents evidence through the capabilities of Equabli's EQ Suite, which integrates predictive analytics, client engagement methodologies, and automation. These tools significantly enhance debt recovery efforts and operational efficiency by enabling tailored communication and streamlined processes. Such advancements are essential for financial institutions aiming to improve their debt collection practices and align with compliance standards.

Introduction

In an increasingly competitive financial landscape, optimizing payment collection strategies is paramount for organizations aiming to enhance their debt recovery efforts. This article examines ten innovative credit collection services that have the potential to transform how financial institutions manage their payment processes. These services offer tools and strategies designed to maximize recovery rates while minimizing operational costs. However, with a plethora of options available, organizations must critically assess which services genuinely deliver on their promises and align with their unique needs.

Equabli's EQ Suite: Comprehensive Tools for Payment Optimization

Equabli's EQ Suite represents a pivotal advancement in credit collection services payment optimization strategies for financial institutions, while simultaneously enhancing client success management. By integrating predictive analytics, client engagement methodologies, and streamlined processes, the EQ Suite empowers customers to significantly bolster their recovery efforts.

Our dedicated team expertly facilitates the setup and implementation process during client onboarding, ensuring a seamless transition and a robust foundation for the client relationship. Each component of the suite functions cohesively to address the distinct challenges faced in debt recovery, establishing it as an indispensable asset for modern debt management practices.

Moreover, we foster product adoption and by aligning our solutions with their business objectives, guaranteeing that our platform achieves the desired outcomes.

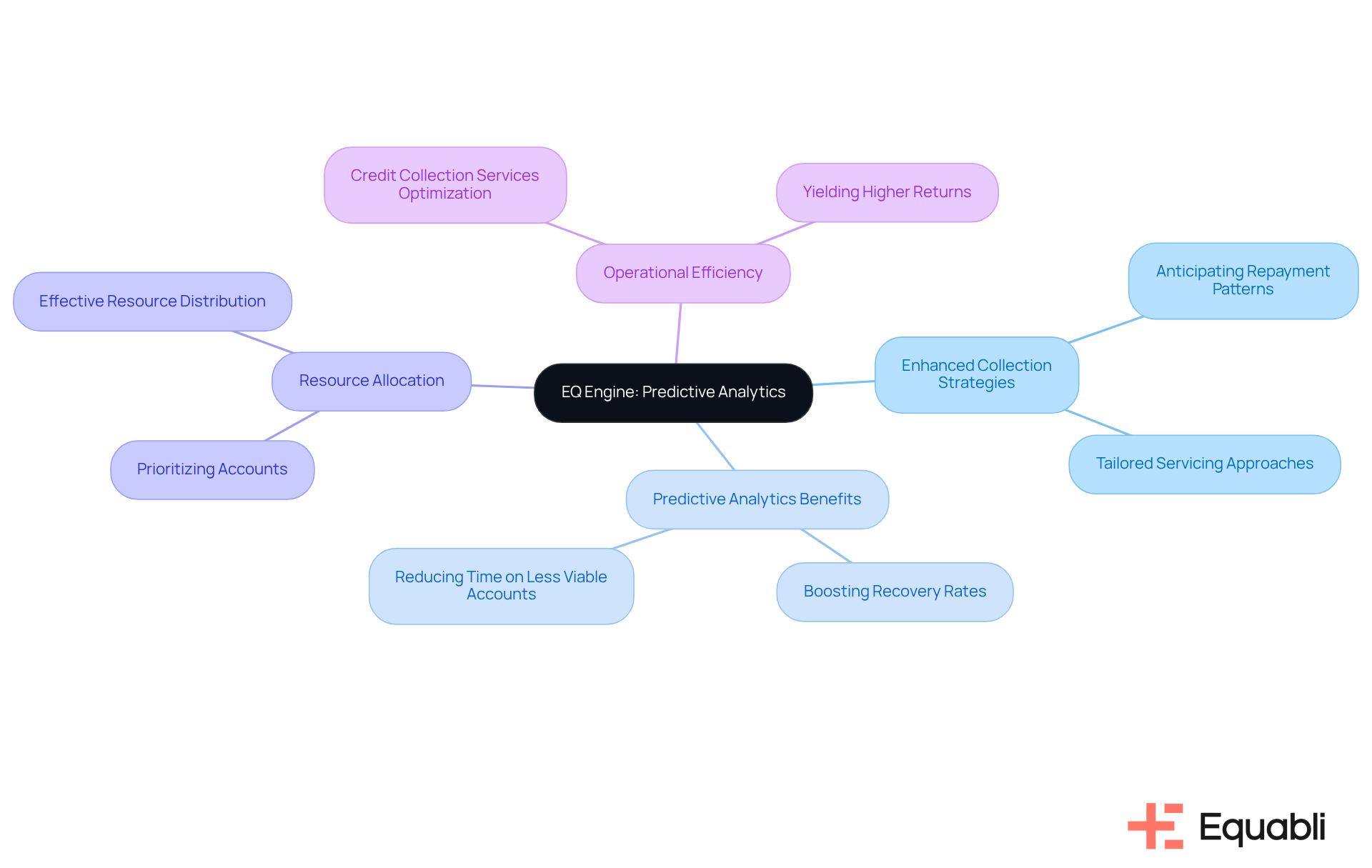

EQ Engine: Predictive Analytics for Enhanced Collection Strategies

The EQ Engine fundamentally transforms debt recovery by leveraging predictive analytics to anticipate borrower repayment patterns and assess delinquency risks. This capability empowers organizations to refine their collection strategies, developing intelligent servicing approaches tailored for each communication channel. By analyzing historical data and recognizing emerging patterns, the EQ Engine enables clients to prioritize accounts and allocate resources effectively. Such a data-driven approach not only boosts recovery rates but also reduces time spent on less viable accounts.

As a result, financial institutions can enhance operational efficiency by implementing credit collection services payment optimization strategies for financial institutions that yield the highest returns. To fully leverage the advantages of predictive analytics, organizations should integrate from the EQ Engine into their overall credit collection services payment optimization strategies for financial institutions, ensuring a robust and effective approach.

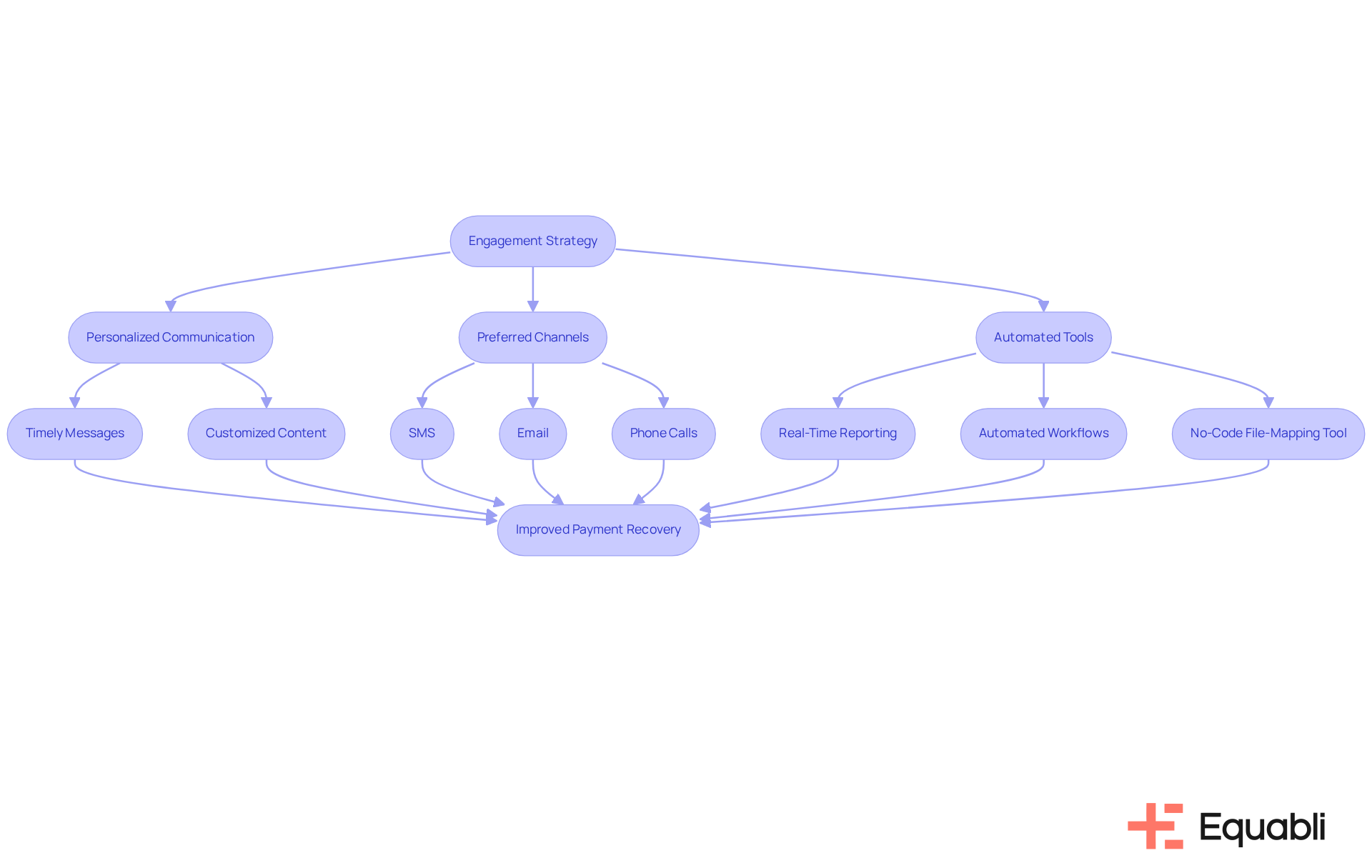

EQ Engage: Boost Borrower Engagement for Better Payment Recovery

EQ Engage enhances client engagement through personalized communication strategies, leveraging the automation and data-driven insights provided by EQ Collect. By utilizing preferred communication channels—such as SMS, email, or phone calls—organizations can effectively reach their clients. This tool nurtures a positive connection between lenders and borrowers, which is essential for long-term success, while also enhancing payment probability through .

Furthermore, with EQ Collect's real-time reporting, automated workflows, and features such as the no-code file-mapping tool and automated monitoring, financial institutions can adopt credit collection services payment optimization strategies for financial institutions to ensure their communication strategies are efficient and aligned with the overarching goal of improving debt recovery results.

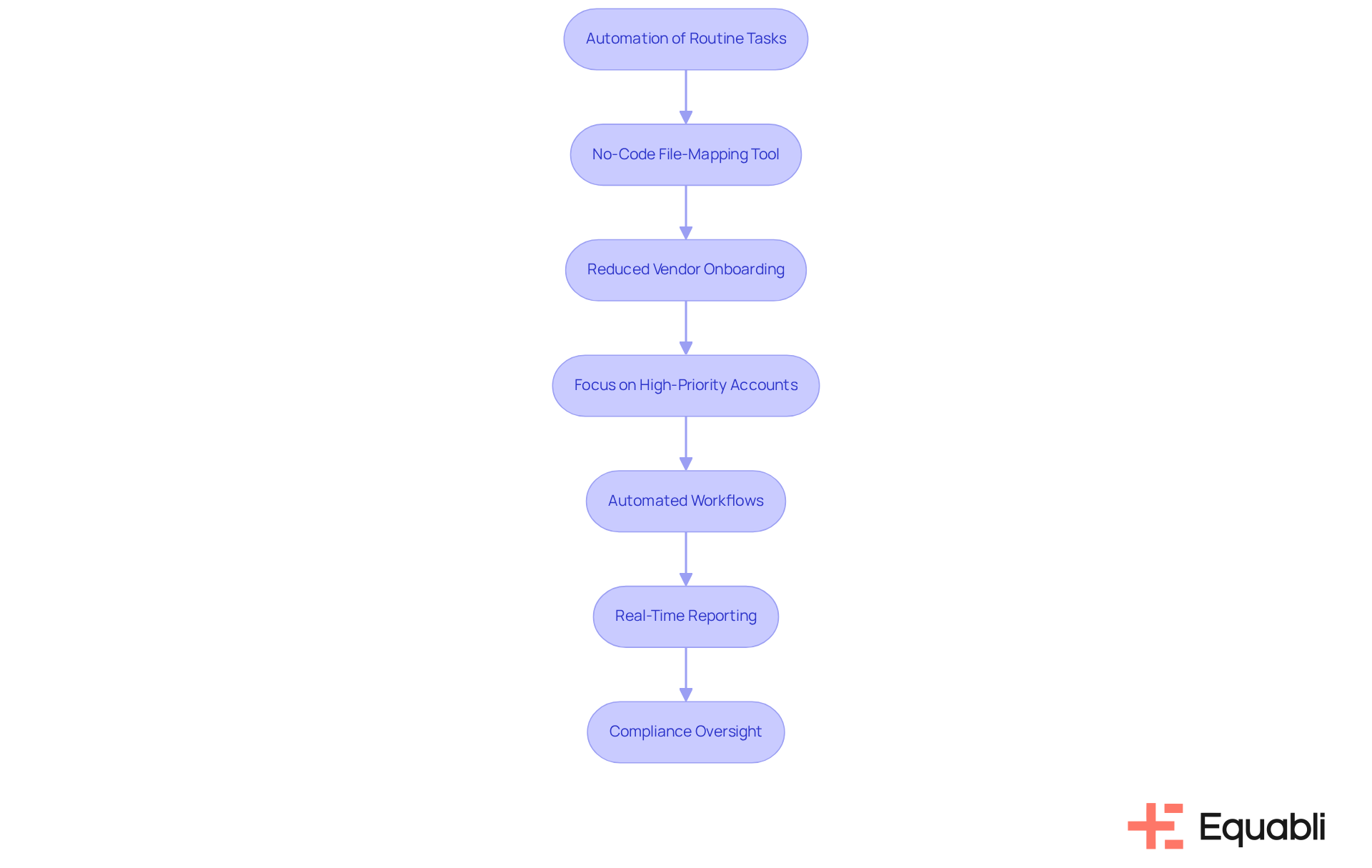

EQ Collect: Streamlined Processes for Efficient Debt Recovery

EQ Collect streamlines the debt collection process through automation of routine tasks and enhancement of workflows. By implementing a no-code file-mapping tool, EQ Collect significantly reduces vendor onboarding timelines, allowing collection agencies to focus on high-priority accounts. This tool alleviates operational bottlenecks via , thereby enhancing overall efficiency and facilitating quicker resolutions alongside improved performance rates.

Furthermore, real-time reporting offers unparalleled transparency and insights, while industry-leading compliance oversight guarantees adherence to both internal and external standards. Leveraging these capabilities, EQ Collect empowers financial institutions with credit collection services and payment optimization strategies for financial institutions to optimize their debt collection strategies effectively.

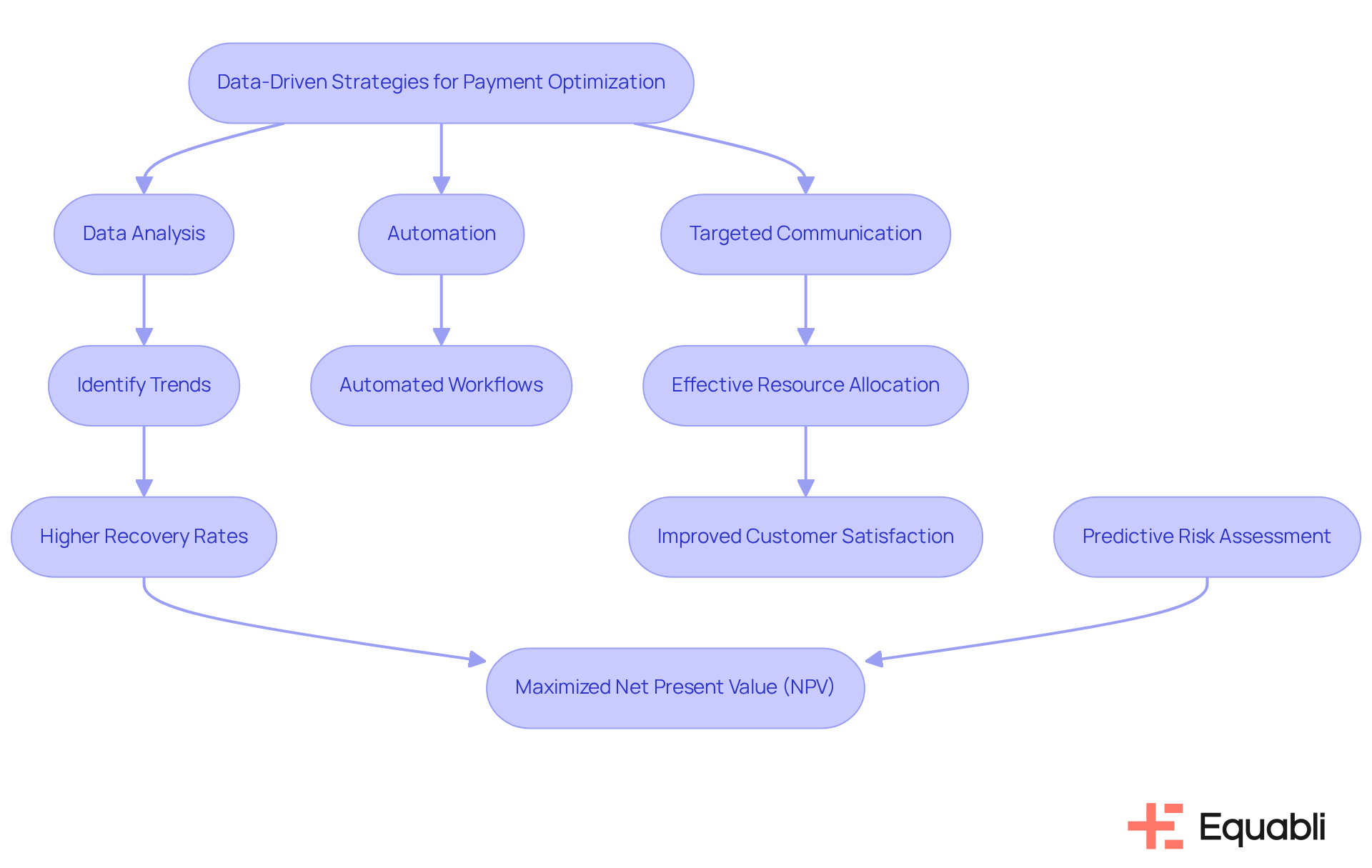

Data-Driven Strategies: Leverage Analytics for Payment Optimization

Data-driven strategies are critical for [credit collection services payment optimization strategies](https://blog.equabli.com/10-trends-shaping-consumer-lending-in-2025) for financial institutions. Utilizing EQ Collect's no-code file-mapping tool and analyzing loaner data enables organizations to identify trends and adjust their retrieval strategies accordingly. This proactive approach, underpinned by automated workflows and real-time reporting, facilitates more effective targeting of communication and resources. Consequently, this leads to higher recovery rates and improved customer satisfaction.

With a user-friendly interface and industry-leading compliance oversight, EQ Collect empowers financial institutions to utilize for financial institutions to enhance their collection performance and streamline operations, maximizing net present value (NPV) while leveraging predictive risk assessment.

Self-Service Repayment Plans: Empower Borrowers to Pay on Their Terms

Self-service repayment plans represent a strategic advantage for organizations, enabling individuals to manage their payments in alignment with personal preferences. Evidence shows that by offering flexible options—such as customizable payment schedules and amounts—organizations can effectively address the unique needs of each client. This tailored approach not only enhances recovery rates but also fosters increased customer satisfaction and loyalty.

Financial advisors assert that when individuals perceive control over their repayment processes, they are more inclined to engage positively with their lenders, thereby cultivating a more sustainable relationship.

Ultimately, the implementation of serves as a strategic initiative that enhances overall revenue effectiveness while employing credit collection services payment optimization strategies for financial institutions to prioritize the borrower experience.

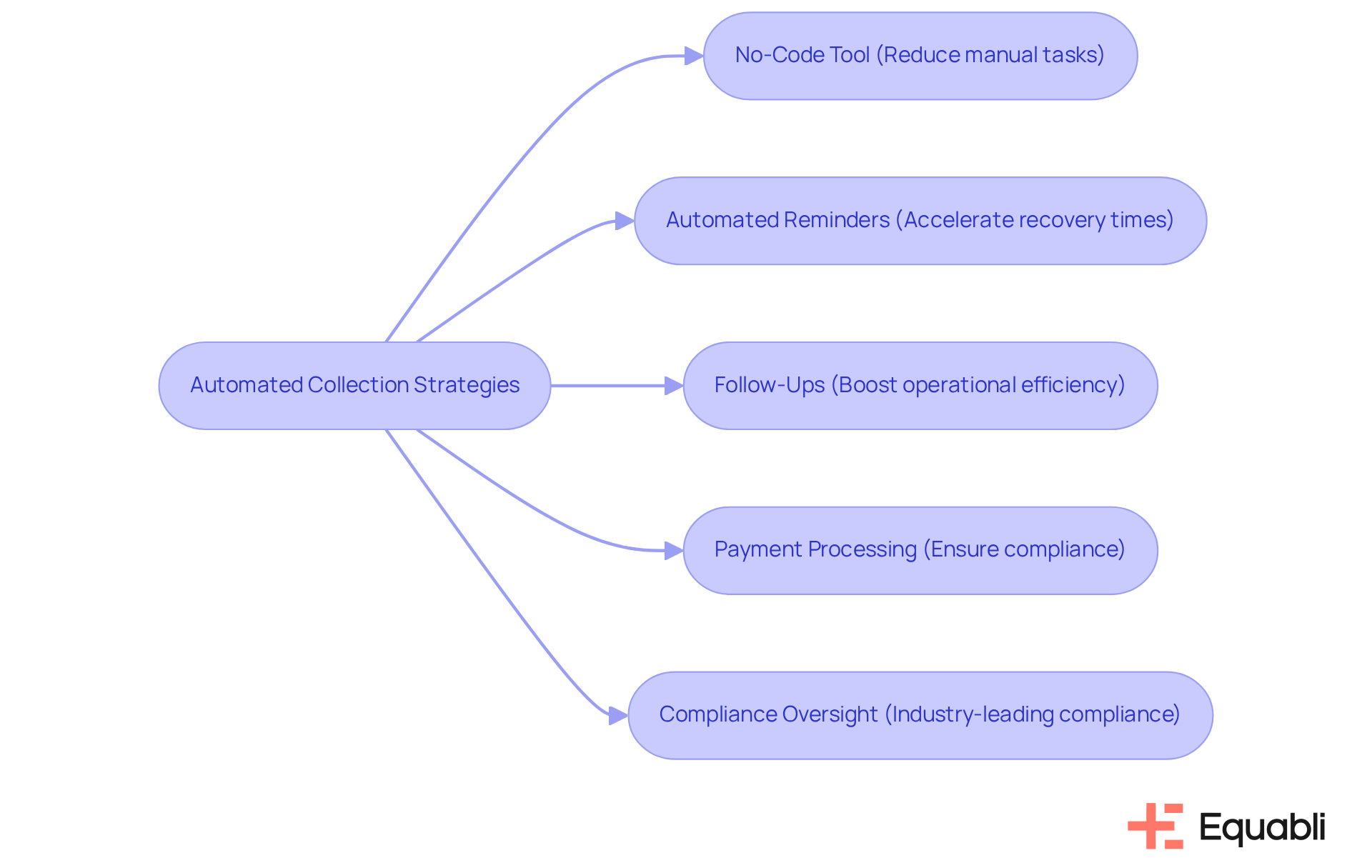

Automated Collection Strategies: Enhance Efficiency and Compliance

Automated retrieval strategies significantly enhance the debt management process by reducing manual tasks and ensuring compliance with regulations. EQ Collect offers organizations a straightforward, no-code file-mapping tool that minimizes vendor onboarding timelines and boosts operational efficiency. By automating reminders, follow-ups, and payment processing, EQ Collect not only accelerates recovery times but also guarantees adherence to legal requirements through industry-leading compliance oversight, supported by automated monitoring. Furthermore, the user-friendly, scalable, cloud-native interface and real-time reporting deliver unparalleled transparency and insights, empowering organizations to make while mitigating the risk of errors.

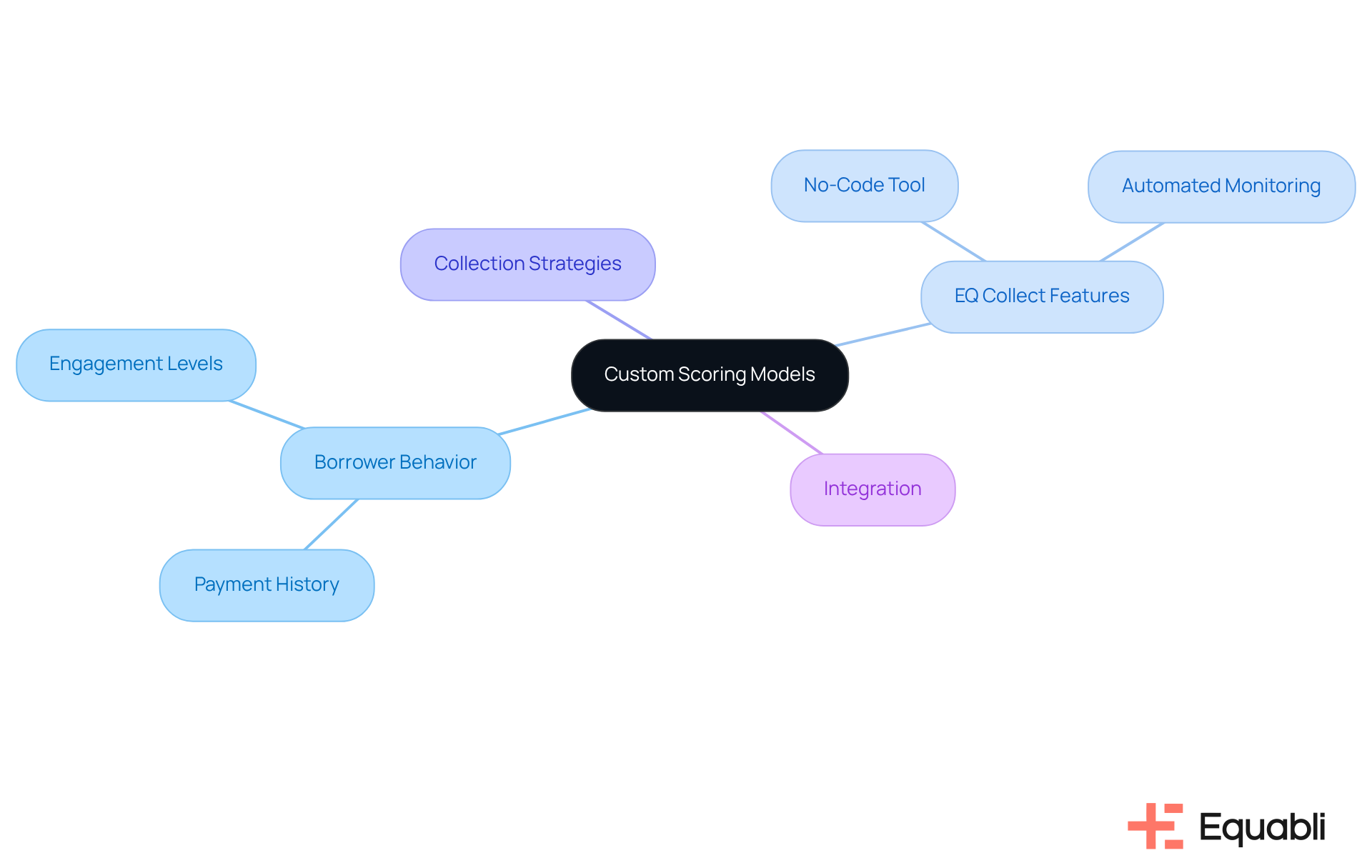

Custom Scoring Models: Tailor Collection Approaches to Borrower Behavior

Custom scoring models empower organizations to tailor their collection strategies according to individual loan recipient behavior, a capability significantly enhanced by the features of EQ Collect. By analyzing various factors, such as payment history and engagement levels, these models facilitate the identification of the most effective approaches for each client.

With EQ Collect's data-oriented methodologies, including a no-code file-mapping tool and automated monitoring, financial institutions can utilize for financial institutions to enhance their processes and operational efficiency. This bespoke strategy not only increases the probability of successful recovery but also fosters a more favorable client experience, supported by real-time insights and rigorous compliance oversight.

To fully leverage these advantages, financial institutions must actively integrate these scoring models into their credit collection services payment optimization strategies for financial institutions.

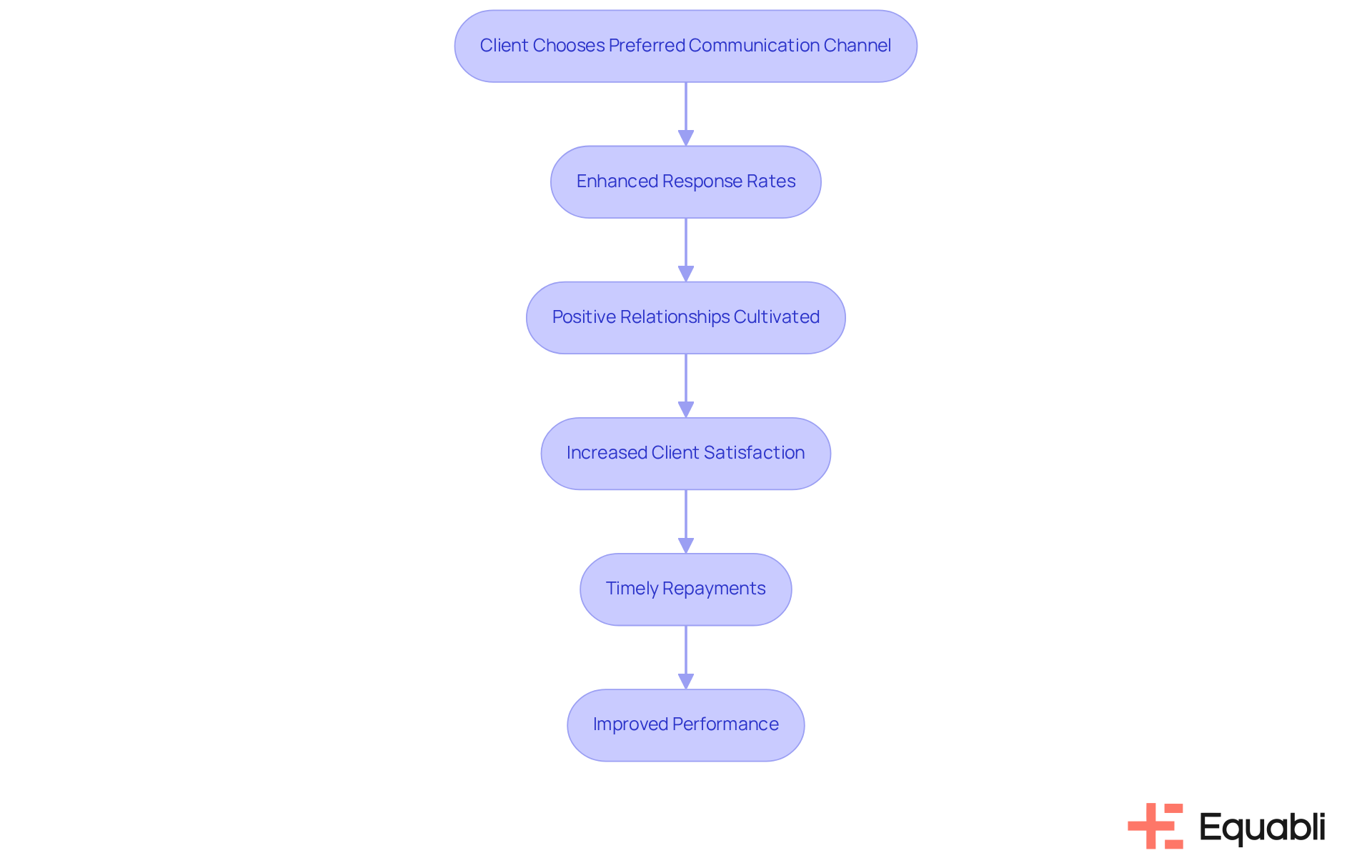

Preferred Communication Channels: Enhance Engagement for Better Recovery

Utilizing preferred communication channels is essential for maximizing engagement with clients. When organizations allow individuals to select their preferred method of contact—be it text, email, or phone—they not only enhance response rates but also cultivate a more positive relationship. Research indicates that this customized communication approach can lead to a 30% increase in loan recipient response rates, demonstrating its effectiveness. Furthermore, aligning communication methods with client preferences enhances overall satisfaction, fostering loyalty and encouraging timely repayments.

With EQ Collect, financial institutions can streamline this process through automated workflows that are part of for financial institutions, contributing to enhanced retrieval rates. Real-time reporting ensures that communication is both personalized and efficient. The intuitive, scalable, cloud-native interface of EQ Collect further enhances these capabilities, enabling organizations to adjust their outreach strategies to meet the distinct requirements of borrowers. This ultimately leads to improved performance and sustainable financial outcomes by implementing credit collection services payment optimization strategies for financial institutions.

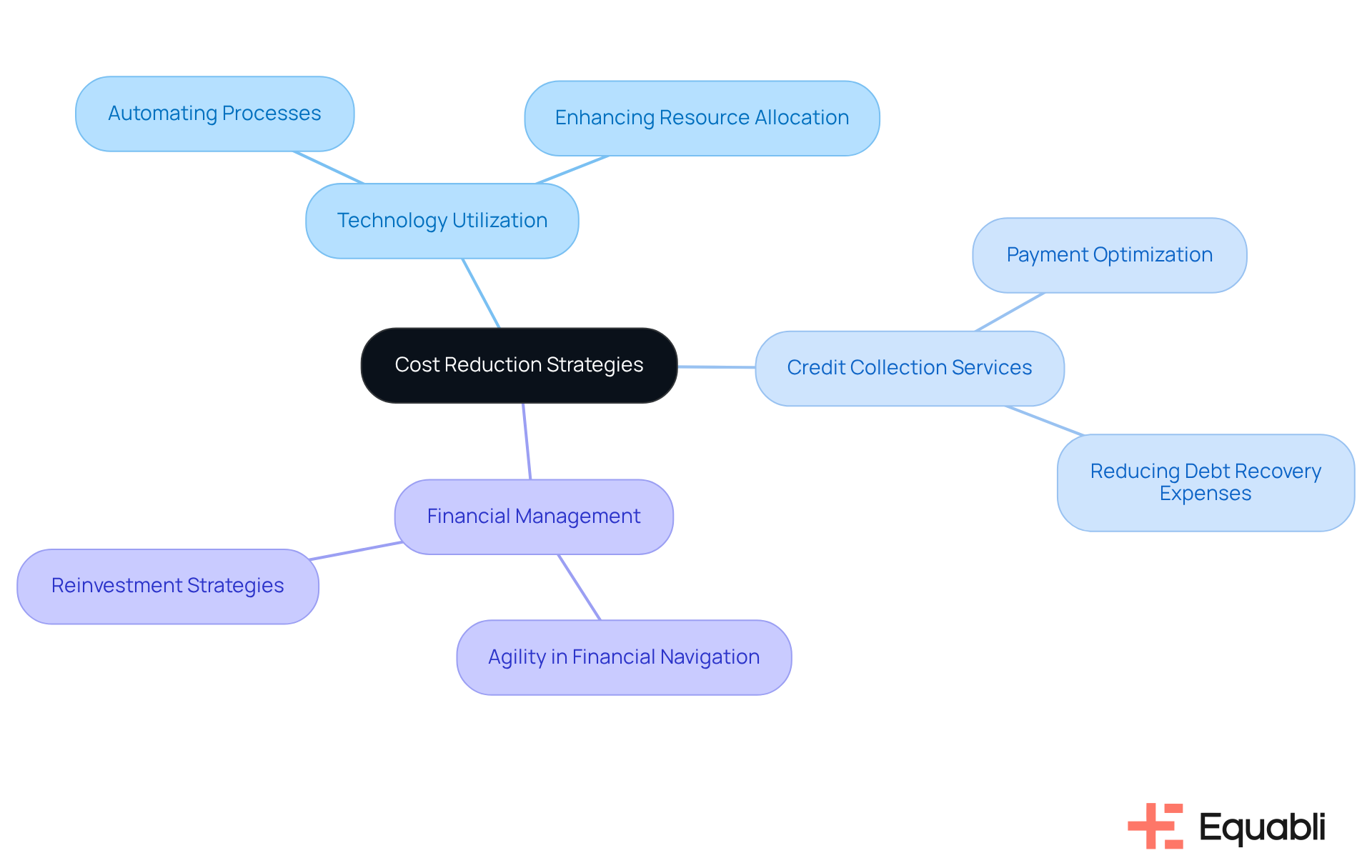

Cost Reduction Strategies: Maximize Recovery While Minimizing Expenses

Implementing cost-cutting approaches is crucial for maximizing recovery while minimizing operational expenses. Evidence suggests that by utilizing technology to automate processes and enhance resource allocation, organizations can adopt [credit collection services payment optimization strategies](https://blog.equabli.com/10-key-debt-recovery-firm-selection-criteria-for-financial-institutions) for financial institutions to significantly reduce expenses associated with debt recovery. This strategy not only improves the bottom line but also facilitates reinvestment in for financial institutions, thereby positioning enterprises to navigate the complexities of financial management with greater agility.

Conclusion

Equabli's suite of credit collection services presents a transformative approach to optimizing payment strategies, merging advanced technology with tailored client engagement. By utilizing tools such as the EQ Suite, EQ Engine, and EQ Collect, organizations can enhance their debt recovery processes, ensuring they address the unique needs of borrowers while maximizing recovery rates. This integrated approach streamlines operations and fosters stronger relationships between lenders and borrowers, ultimately leading to sustainable financial outcomes.

Key insights throughout the article underscore the significance of predictive analytics, personalized communication, and automated processes in modern debt management. The EQ Engine's data-driven strategies enable institutions to anticipate borrower behavior and refine their collection efforts. Meanwhile, EQ Engage and EQ Collect empower organizations to sustain positive engagement through preferred communication channels and efficient workflows. Additionally, the implementation of self-service repayment plans and custom scoring models highlights the importance of flexibility and personalization in enhancing borrower satisfaction and recovery success.

In a rapidly evolving financial landscape, adopting these innovative credit collection services is imperative for organizations striving to navigate the complexities of debt recovery effectively. Embracing technology and data analytics not only maximizes recovery while minimizing costs but also positions financial institutions to cultivate lasting relationships with their clients. By prioritizing these strategies, organizations can achieve greater operational efficiency and drive long-term success in their payment collection efforts.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed for payment optimization in credit collection services, aimed at enhancing client success management for financial institutions.

How does the EQ Suite improve debt recovery efforts?

The EQ Suite integrates predictive analytics, client engagement methodologies, and streamlined processes to empower customers to significantly improve their recovery efforts.

What support does Equabli provide during client onboarding?

Equabli offers expert assistance in the setup and implementation process during client onboarding to ensure a seamless transition and a strong foundation for the client relationship.

What is the purpose of the EQ Engine?

The EQ Engine utilizes predictive analytics to anticipate borrower repayment patterns and assess delinquency risks, allowing organizations to refine their collection strategies and prioritize accounts effectively.

How does the EQ Engine enhance operational efficiency?

By analyzing historical data and recognizing patterns, the EQ Engine helps financial institutions allocate resources more effectively, boosting recovery rates and reducing time spent on less viable accounts.

What is EQ Engage and how does it work?

EQ Engage is a tool that enhances client engagement through personalized communication strategies, utilizing preferred channels like SMS, email, or phone calls to improve payment recovery.

What features does EQ Collect offer to support communication strategies?

EQ Collect provides real-time reporting, automated workflows, a no-code file-mapping tool, and automated monitoring to ensure communication strategies are efficient and aligned with improving debt recovery results.