Overview

The article provides a comparative analysis of debt management solutions platforms tailored for enterprise financial institutions, emphasizing their transformation through technological advancements and regulatory compliance. It highlights how modern platforms, such as Equabli's EQ Suite, enhance operational efficiency and borrower engagement via automation, advanced analytics, and multi-channel communication. These enhancements ultimately position financial institutions for sustainable growth within a competitive landscape, underscoring the critical role of compliance and technology in enterprise-level debt management.

Introduction

The landscape of debt management solutions for enterprise financial institutions is undergoing significant transformation, influenced by the increasing complexity of financial regulations and the pressing need for enhanced operational efficiency.

For instance, platforms such as Equabli's EQ Suite leverage advanced cloud technologies and artificial intelligence, enabling organizations to refine their recovery strategies while ensuring compliance and fostering improved customer engagement.

However, as the market for receivables collection software is anticipated to expand considerably in the coming years, enterprises are faced with the challenge of navigating a diverse array of options to identify solutions that genuinely yield optimal results.

This article provides a comparative analysis of leading debt management platforms, examining their features, benefits, and costs to assist institutions in making informed decisions amidst a competitive landscape.

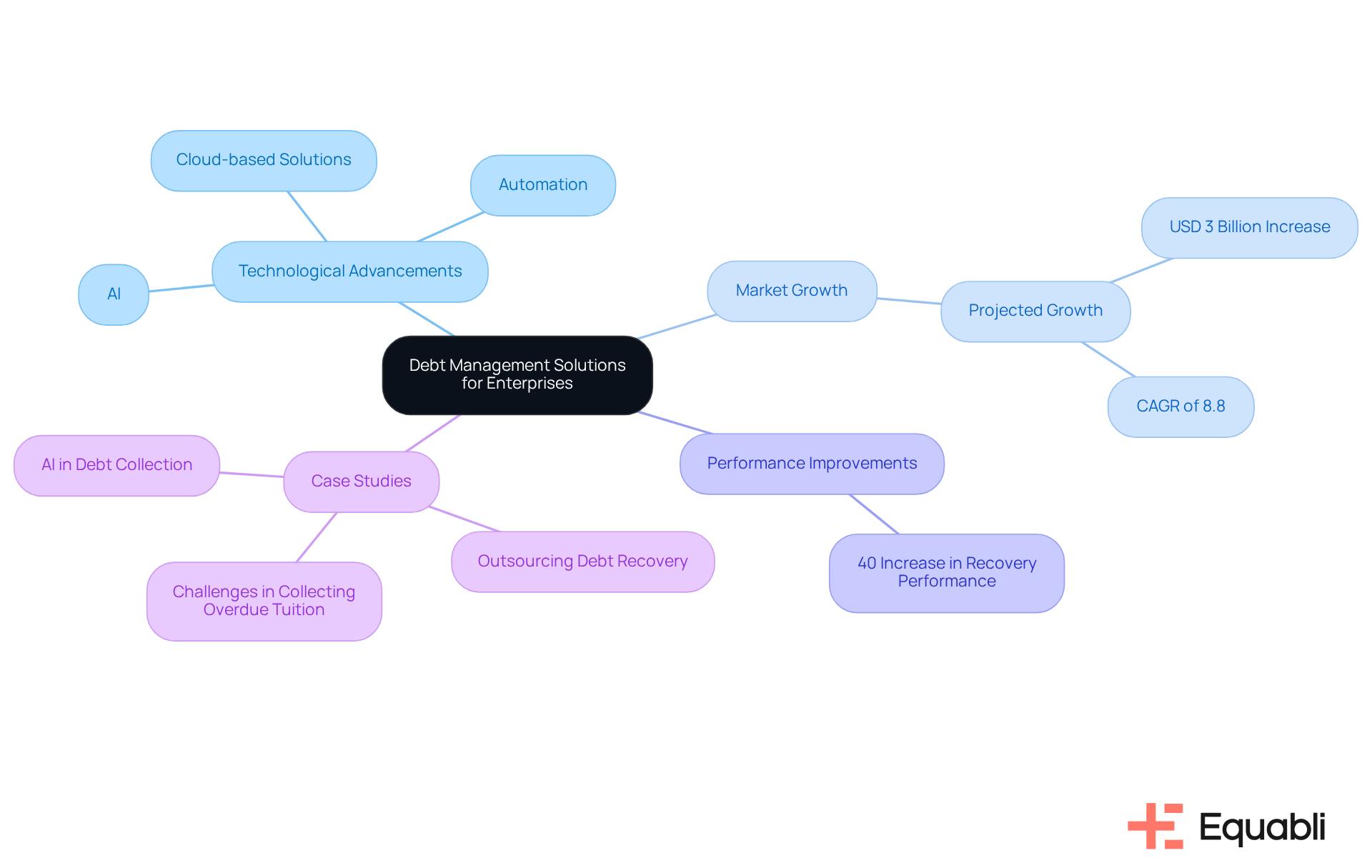

Overview of Debt Management Solutions for Enterprises

The for enterprise has undergone a significant transformation, driven by the complexities of financial regulations and the pressing need for . Modern platforms, such as , leverage to streamline operations, enhance borrower engagement, and ensure compliance with evolving regulations. These solutions serve as a debt management solutions platform for enterprise financial institutions, specifically designed to address the unique challenges faced by various sectors, including fintech, healthcare, and telecom.

The digital transformation in financial management has enabled the integration of , equipping enterprises to refine their . Notably, the global receivables collection software market is projected to grow by USD 3 billion from 2024 to 2029, reflecting a compound annual growth rate (CAGR) of 8.8%. This growth highlights the increasing dependence on that improve operational efficiency and elevate customer experience.

Case studies illustrate the efficacy of these systems; for instance, organizations employing AI-driven tools have achieved a 40% increase in compared to traditional methods. As the market continues to expand, understanding the landscape of the debt management solutions platform for enterprise financial institutions is crucial for businesses seeking to enhance their financial management capabilities and achieve sustainable growth.

Key Features of Leading Debt Management Platforms

The for enterprise financial institutions, like Equabli's EQ Suite, exemplifies advanced capabilities aimed at optimizing the collections process. serve as a pivotal feature, streamlining communication and follow-ups. This significantly reduces manual effort, thereby enhancing operational efficiency. Such automation minimizes busywork, enabling teams to concentrate on strategic initiatives, which ultimately improves recovery rates.

further augment these platforms by leveraging predictive models to assess loan applicant behavior. This allows institutions to effectively customize collection strategies. For example, organizations utilizing AI-driven insights can pinpoint accounts with the highest likelihood of repayment, facilitating tailored outreach that resonates with individual circumstances.

are critical for engaging clients through their preferred channels, including SMS, email, and phone calls. This approach ensures consistent and personalized messaging, which is essential for building trust and strengthening relationships with clients.

empower organizations to develop tailored systems that forecast repayment probabilities based on historical data, thereby enhancing decision-making processes. Additionally, automate adherence to regulatory requirements, significantly mitigating risks associated with non-compliance.

Equabli's no-code file-mapping tool simplifies vendor onboarding, while its user-friendly, scalable, cloud-native interface enhances the overall user experience. These integrated features not only bolster operational efficiency but also elevate borrower satisfaction by delivering a more personalized and responsive experience. Ultimately, these advancements position financial institutions for by utilizing a [debt management solutions platform](https://indebted.co/en-us/blog/guides/the-2025-buyer-s-guide-to-debt-collection-software) for enterprise financial institutions in a competitive landscape.

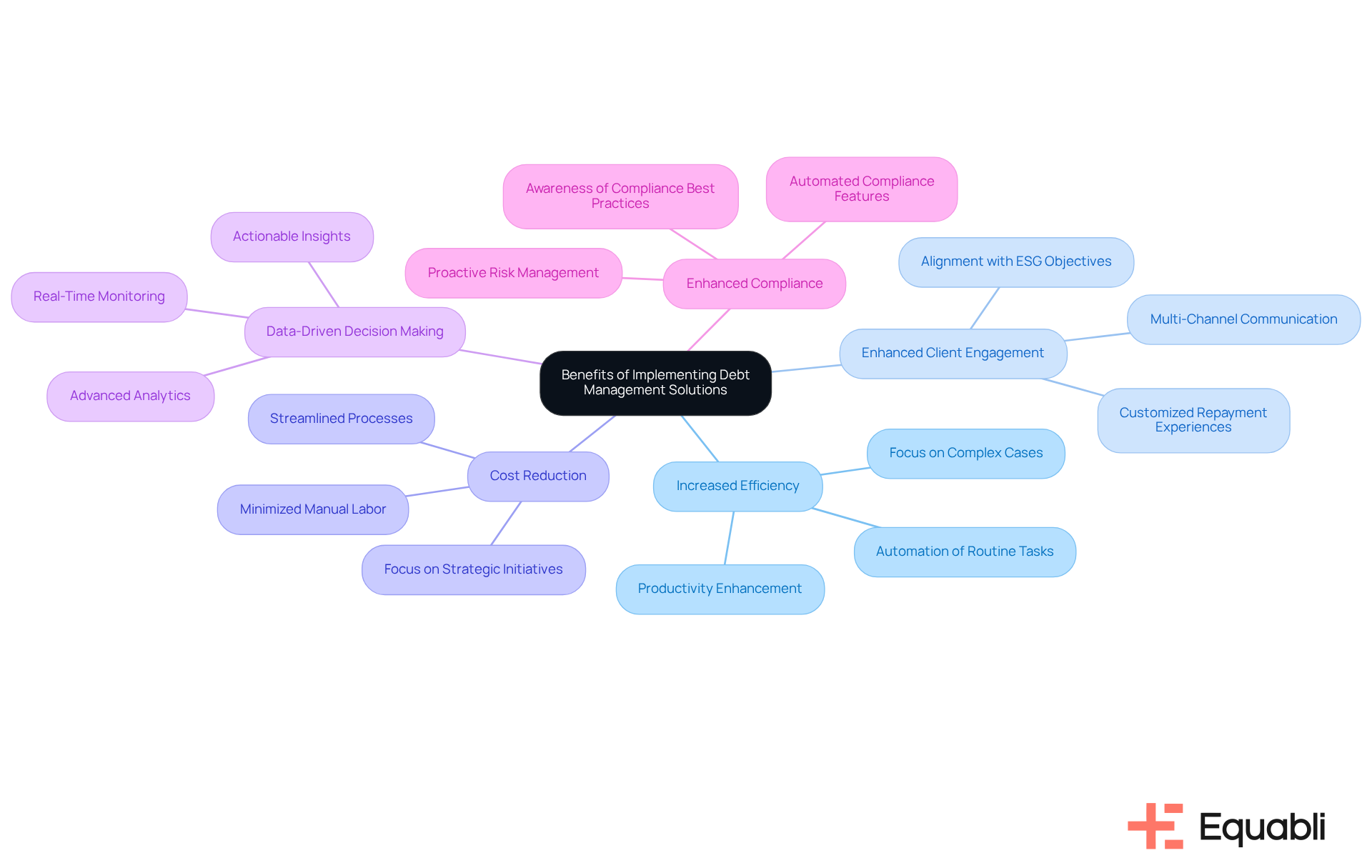

Benefits of Implementing Debt Management Solutions

Implementing a for enterprise financial institutions offers a range of significant benefits.

- Increased Efficiency: Automation of routine tasks minimizes the time and resources allocated to collections, allowing staff to concentrate on more complex cases. This shift not only enhances productivity but also aligns with the growing demand for , projected to drive the to $7.89 billion by 2031. The Client Success Representative at Equabli plays a crucial role in ensuring clients are effectively onboarded and supported, maximizing the efficiency of these automated processes through proactive check-ins.

- : Utilizing multi-channel communication strategies fosters improved interactions with clients, resulting in higher repayment rates and increased customer satisfaction. Customized, ethical repayment experiences developed through AI-driven systems demonstrate alignment with ESG objectives while improving recovery rates. promote product usage by comprehending client business objectives, ensuring that the platform effectively enhances user engagement.

- : Streamlining processes and minimizing manual labor can lead to substantial reductions in operational costs related to financial recovery. Automated solutions free finance teams from routine tasks, enabling them to focus on strategic initiatives that drive profitability. The proactive approach of Client Success Representatives in identifying upsell and cross-sell opportunities contributes to cost-effective solutions tailored to client needs.

- : into lending behavior, facilitating more effective strategy formulation and execution. RegTech tools facilitate real-time observation of borrower interactions, improving the capacity to customize financial management plans to personal situations. Client Success Representatives play a crucial role in translating product usage data into actionable insights, helping clients make informed decisions.

- Enhanced Compliance: significantly reduce risks associated with regulatory violations, protecting organizations from potential fines and reputational harm. As compliance becomes increasingly complex, leveraging technology for proactive risk management is essential. The collaborative efforts of Client Success Representatives with internal teams ensure that clients are aware of compliance features and best practices.

These benefits collectively promote a more efficient and sustainable financial management approach, positioning businesses for long-term success in a changing economic environment, particularly through the use of a debt management solutions platform for enterprise financial institutions, while enhancing client involvement and product uptake through committed assistance.

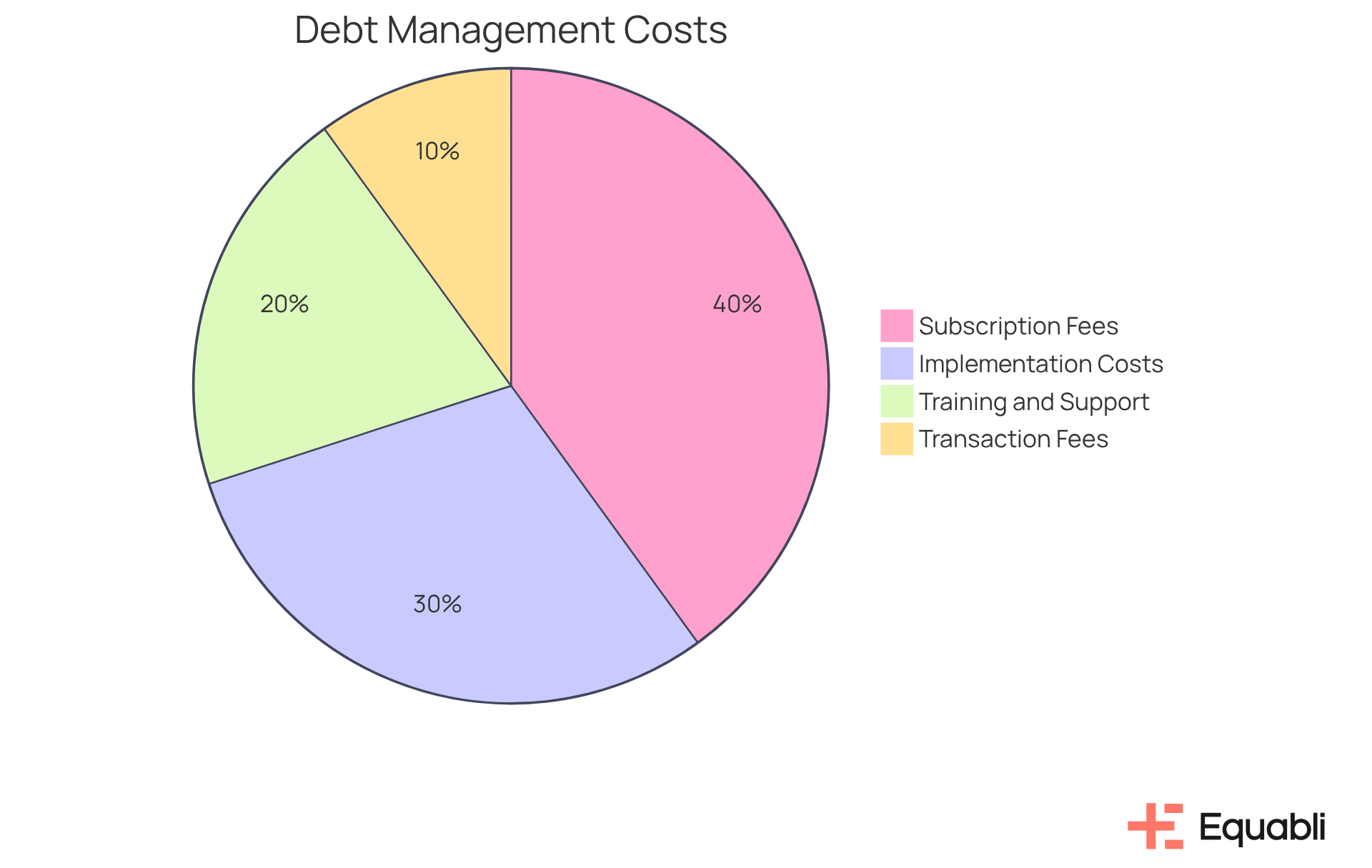

Cost Analysis of Debt Management Platforms

When evaluating a for enterprise financial institutions, enterprises must consider various , including , , , and .

- Subscription Fees: Most platforms operate on a subscription model, with costs varying based on the features and number of users. This variability necessitates careful consideration to align platform capabilities with organizational needs.

- Implementation Costs: Initial setup and integration can incur significant expenses, particularly for larger organizations with complex systems. Understanding these costs is crucial for .

- Training and Support: Ongoing training for staff and customer support services can add to the total cost of ownership. Investing in comprehensive training ensures that staff can effectively utilize the platform, thereby enhancing operational efficiency.

- Transaction Fees: Certain services may impose charges based on the volume of transactions processed, influencing overall expenses. This aspect can greatly affect the cost structure, particularly for organizations with high transaction volumes.

For instance, Equabli's that reflect its extensive feature set, making it a aiming to modernize their debt collection procedures. By analyzing these costs in relation to the expected benefits, enterprises can better assess the associated with the debt management solutions platform for enterprise financial institutions, thereby facilitating informed decision-making.

Conclusion

The evolution of debt management solutions for enterprise financial institutions underscores technology's pivotal role in navigating the complexities of financial recovery. Modern platforms, exemplified by Equabli's EQ Suite, not only streamline operations but also enhance borrower engagement and ensure compliance with ever-evolving regulations. By leveraging cloud-based technologies and advanced analytics, these solutions empower organizations to address unique challenges across various sectors, ultimately fostering sustainable growth.

Key insights indicate that:

- Automation

- AI-driven analytics

- Multi-channel communication

are essential features that significantly enhance the efficiency and effectiveness of debt recovery strategies. The benefits of implementing such platforms are extensive, encompassing:

- Increased operational efficiency

- Improved client engagement

- Cost reductions

- Data-driven decision-making

- Enhanced compliance management

Collectively, these advantages position financial institutions to thrive in a competitive landscape while meeting the demands of their clients.

As the demand for innovative debt management solutions escalates, organizations must prioritize the integration of these advanced platforms to maintain competitiveness. Embracing technology streamlines processes, enriches client relationships, and drives profitability. Financial institutions investing in robust debt management solutions are better equipped to navigate market complexities, ensuring long-term success and stability in an ever-evolving financial environment.

Frequently Asked Questions

What is the main focus of the debt management solutions for enterprises?

The main focus is to provide a platform that addresses the unique challenges faced by enterprise financial institutions, driven by the complexities of financial regulations and the need for enhanced efficiency in collections.

What technologies do modern debt management platforms utilize?

Modern platforms, such as Equabli's EQ Suite, utilize cloud-based technologies to streamline operations, enhance borrower engagement, and ensure compliance with evolving regulations.

Which sectors benefit from these debt management solutions?

The debt management solutions are specifically designed to address challenges faced by various sectors, including fintech, healthcare, and telecom.

How has digital transformation impacted financial management?

Digital transformation has enabled the integration of advanced analytics, artificial intelligence, and automation, allowing enterprises to refine their recovery strategies effectively.

What is the projected growth of the global receivables collection software market?

The global receivables collection software market is projected to grow by USD 3 billion from 2024 to 2029, with a compound annual growth rate (CAGR) of 8.8%.

What benefits have organizations seen from using AI-driven debt management tools?

Organizations employing AI-driven tools have achieved a 40% increase in recovery performance compared to traditional methods.

Why is it important for businesses to understand the landscape of debt management solutions?

Understanding the landscape is crucial for businesses seeking to enhance their financial management capabilities and achieve sustainable growth as the market continues to expand.