Overview

To effectively manage collection agency calls, executives must:

- Remain composed

- Verify the legitimacy of the debt

- Document all communications

- Fully understand their rights under debt collection laws

It is crucial to be informed about regulations such as the Fair Debt Collection Practices Act (FDCPA) and to employ strategic negotiation techniques. These elements collectively empower executives to navigate these interactions, safeguarding their organizations from potential legal issues. By taking these steps, executives not only protect their interests but also enhance their negotiating position.

Introduction

Navigating the complex world of collection agency calls presents a significant challenge for executives, particularly as the debt recovery landscape evolves with new regulations and practices. Understanding the roles and rights involved is not merely beneficial; it is essential for safeguarding an organization’s financial health. This article explores actionable steps that empower executives to manage these communications effectively, from recognizing the legal framework surrounding debt collection to implementing best practices for negotiation and documentation.

How can executives ensure they are compliant and strategic in their interactions with collection agencies?

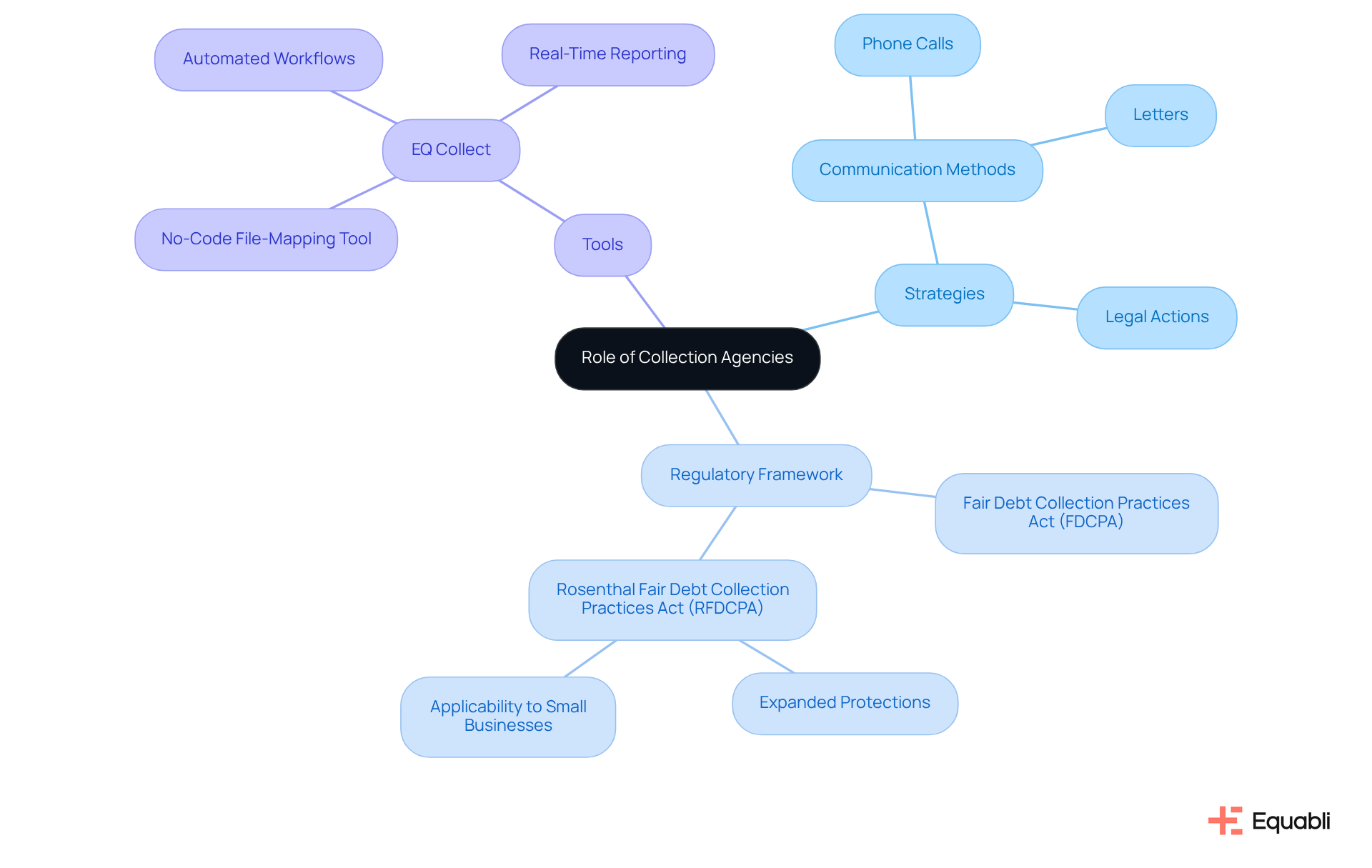

Understand the Role of Collection Agencies

Recovery firms serve as vital external partners for lenders, tasked with securing unpaid obligations. Their operations encompass a variety of strategies, including direct communication through phone calls and letters, as well as potential legal actions to ensure repayment. Understanding the regulatory framework governing these entities is crucial for executives, particularly the Fair Debt Recovery Practices Act (FDCPA), which prohibits abusive practices and guarantees consumer protection.

Recent changes in financial recovery practices, notably the expansion of the Rosenthal Fair Financial Recovery Practices Act (RFDCPA) in California, have broadened consumer protections, influencing how organizations operate and negotiate repayment plans. For instance, the updated regulations now encompass the financial obligations of small enterprises, compelling organizations to adapt their strategies accordingly.

Recognizing these dynamics empowers executives to engage more effectively with recovery firms, safeguarding their organizations against potential legal challenges. Financial experts underscore the necessity of being well-informed about these regulations, as they are instrumental in crafting successful recovery strategies and enhancing creditor recovery rates.

Leveraging EQ Collect can markedly boost efficiency and compliance in this context. With features such as a no-code file-mapping tool, , and real-time reporting, EQ Collect minimizes execution errors and manual resources, ensuring smarter orchestration and improved performance in recovery efforts while aiding organizations in adhering to the FDCPA and RFDCPA.

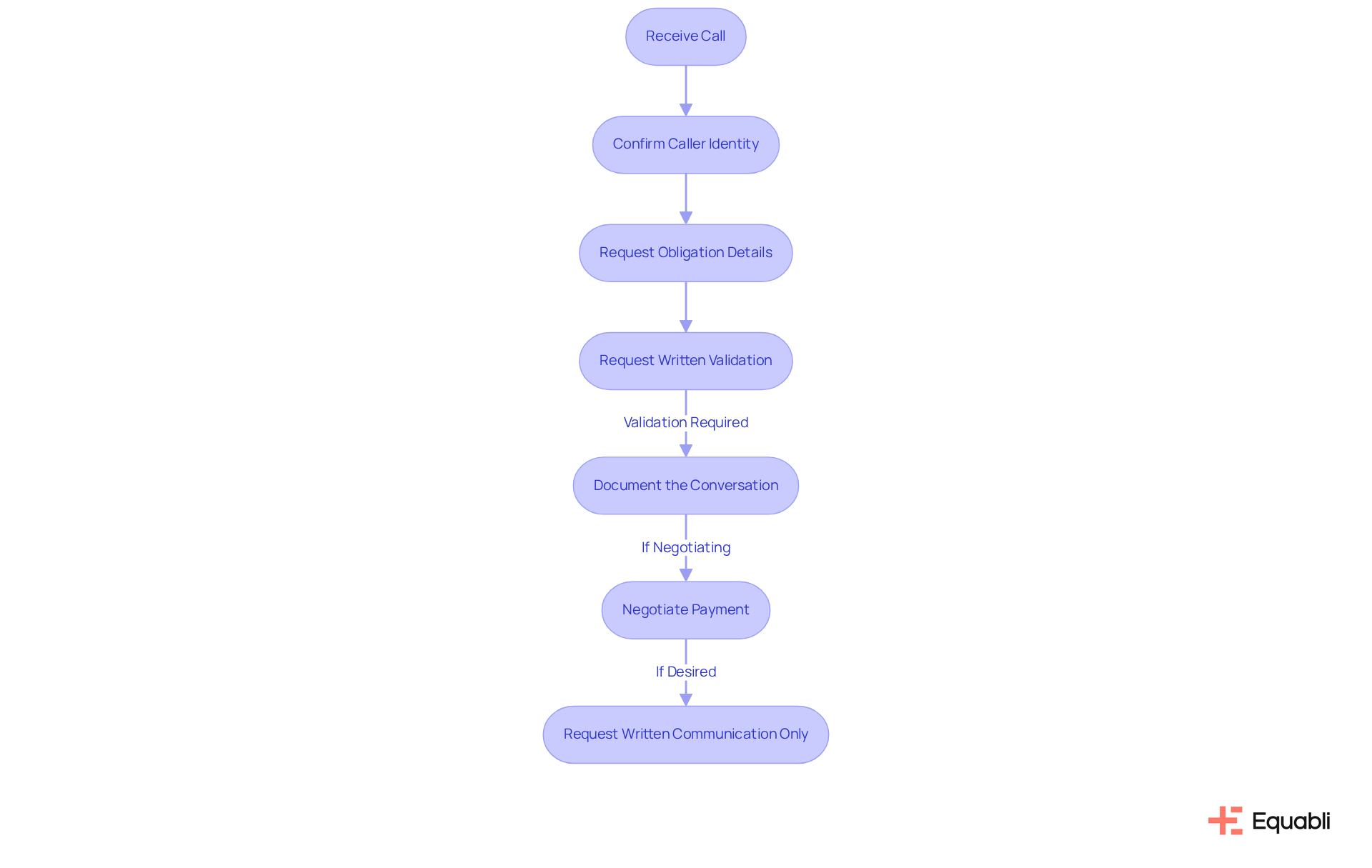

Respond Effectively to Collection Agency Calls

When a collection agency calls, it is crucial to . Start by confirming the identity of the caller and the validity of the obligation. Politely inquire for information regarding the obligation, including the amount due and the original lender. If you are uncertain about the obligation, request written validation before proceeding. This validation must be provided within five days of initial contact, as mandated by law. Remember, you have 30 days to contest the amount in writing after receiving the validation notice.

Always document the conversation, noting the date, time, and key points discussed. Be sure to note the collector's name, company, and contact information during the call, as this can be invaluable if disputes arise later. If you decide to negotiate, be clear about what you can afford and propose a realistic payment plan. Additionally, you have the right to request that all future communications be conducted in writing, which can help you manage the situation more effectively.

Considering the substantial rise in financial recovery calls—up 150% nationwide over the past year, with Houstonians receiving the fourth-highest number of these calls among major cities—being proactive and informed is essential. Financial advisors emphasize how to handle collection agency calls by verifying the legitimacy of the debt to protect yourself from potential scams and ensure compliance with the Fair Debt Collection Practices Act, which prohibits harassment and deceptive practices. By following these steps, you can effectively understand how to handle collection agency communications and work towards a solution that aligns with your financial objectives.

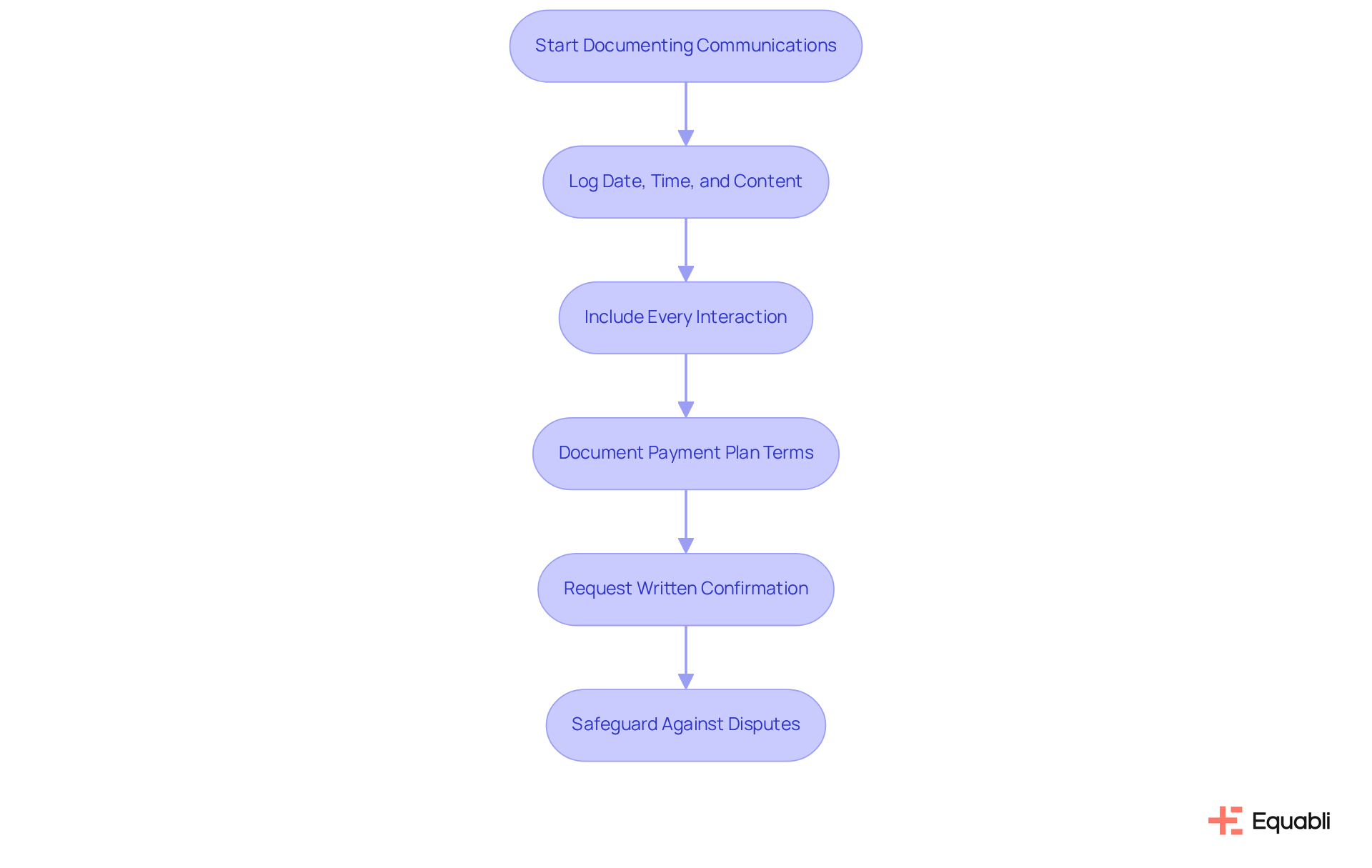

Document All Communications with Collection Agencies

Knowing how to handle collection agency is crucial for effective communication, which hinges on maintaining comprehensive records of all interactions. This includes documenting phone calls, emails, and letters. Start by creating a detailed log that captures the date, time, and content of each communication, along with the names of individuals involved.

As Lauren M. emphasizes, "Include Every Interaction - Regardless of how small or minor, include every interaction that you have with a debtor in your documentation records." When or settlement, meticulously document the agreed-upon terms and request written confirmation from the agency. This thorough documentation serves as a safeguard against potential disputes and is invaluable in knowing how to handle collection agency situations if legal issues arise.

Moreover, it allows you to monitor your progress in addressing the obligation, which is essential when learning how to handle collection agency, ensuring transparency and responsibility throughout the process. Legal professionals assert that knowing how to handle collection agency matters and keeping precise records is not just a recommended approach; it is crucial for adhering to regulations, including the Fair Debt Recovery Practices Act (FDCPA), and for safeguarding your rights as a debtor.

Inadequate documentation can lead to misunderstandings and disputes, which may escalate into legal challenges, negatively impacting financial health and business reputation. Furthermore, poor documentation practices can hinder receivable recovery efficiency, causing companies to waste time and resources on the same amounts. This highlights the importance of a solid record-keeping strategy in financial negotiations.

Know Your Rights Under Debt Collection Laws

As an executive, it is crucial to understand your rights under collection laws, particularly the Fair Debt Collection Practices Act (FDCPA). This act prohibits collectors from engaging in abusive, deceptive, or unfair practices. For instance, they cannot:

- Contact you during unreasonable hours

- Threaten legal action without genuine intent

- Misrepresent the amount owed

Furthermore, creditors are prohibited from reaching out to consumers if a written request has been made to cease such contact. Violations of these regulations can result in significant consequences for collection agencies, including for successful claims against them.

Recent updates to the FDCPA have bolstered consumer protections, mandating that collectors confirm amounts upon request and refrain from harassing individuals through excessive communication. Collectors are limited to no more than seven calls regarding a specific debt within a seven-day period. If you suspect a breach has occurred, you possess the right to file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general, potentially leading to inquiries and sanctions for the offending organization.

Understanding these rights not only safeguards you but also empowers you on how to handle collection agency negotiations more effectively. For example, if a collector fails to provide evidence of the obligation, they are legally barred from pursuing recovery efforts. This knowledge serves as a powerful asset in managing your financial responsibilities and learning how to handle collection agency interactions to ensure fair treatment throughout the recovery process. Furthermore, with approximately 100 million Americans burdened by over $220 billion in medical debt, being informed about your rights has never been more critical.

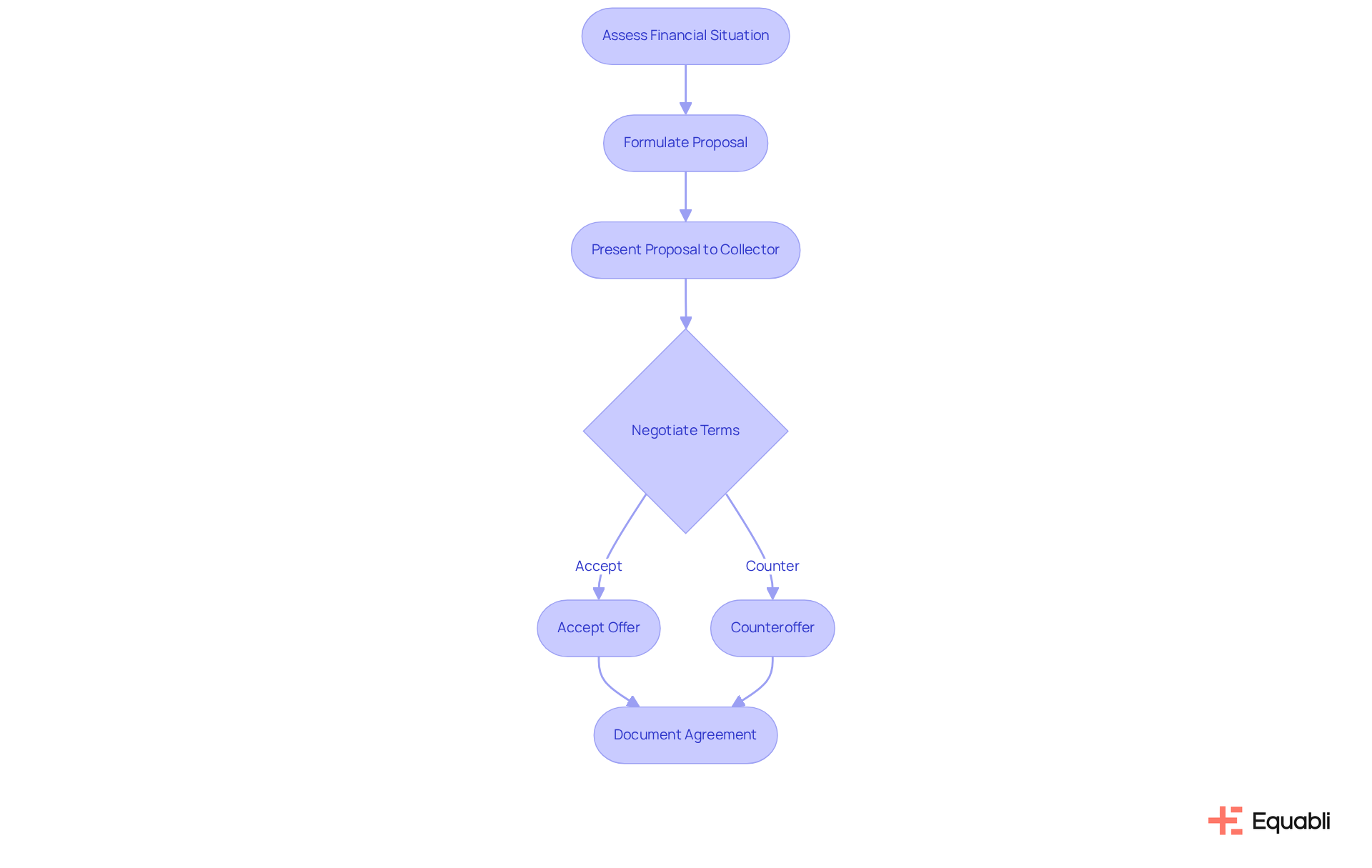

Negotiate Payment Terms with Collection Agencies

To learn how to handle collection agency, negotiating payment terms with a collection service begins with a thorough assessment of your financial situation to identify what you can realistically manage. Formulate a clear proposal, whether that entails a lump-sum payment or a structured payment plan. It is essential to articulate your financial circumstances and the reasoning behind your proposed terms. Debt collectors often consider agreements that reduce the balance by 30% to 50%, making it imperative to present a compelling argument. Remember, collectors typically acquire debts for mere pennies on the dollar, allowing room for negotiation flexibility.

If the agency is reluctant to accept your initial offer, stay adaptable and receptive to counteroffers. Documenting any agreement reached is crucial; ensure that the payment schedule and any conditions are confirmed in writing. This formalizes the agreement and protects against potential disputes in the future.

Moreover, understanding how to handle collection agency situations can significantly improve your chances of success. Strong negotiators often while maintaining respectful communication throughout the process. As you navigate these discussions, remember that composure and professionalism can lead to more productive negotiations and favorable outcomes. Additionally, seeking professional guidance on how to handle collection agency issues can be advantageous, as experts can provide valuable insights and strategies tailored to your situation. Be mindful that debt settlement may adversely affect your credit score; therefore, weigh the consequences against potential savings before proceeding.

Conclusion

Effectively managing collection agency calls is crucial for executives navigating the complexities of debt recovery. It is essential to be well-informed about the roles and regulations surrounding collection agencies, as well as the rights afforded to debtors under laws such as the Fair Debt Collection Practices Act (FDCPA). By equipping oneself with the right knowledge and strategies, executives can mitigate risks and engage constructively with collection agencies.

Key insights include:

- The necessity of verifying the legitimacy of debts

- Maintaining comprehensive documentation of all communications

- Recognizing one’s rights to protect against abusive practices

Moreover, the importance of negotiation skills cannot be overlooked, with practical advice on how to approach payment terms in a manner that is both realistic and beneficial. Utilizing tools like EQ Collect can enhance compliance and efficiency, ensuring organizations navigate recovery efforts with confidence.

Ultimately, the significance of being proactive and informed cannot be overstated. By adopting these best practices, executives safeguard their organizations from potential legal pitfalls while fostering a more respectful and effective dialogue with collection agencies. Embracing these strategies can lead to successful outcomes in debt recovery, ultimately contributing to the financial health and reputation of the organization.

Frequently Asked Questions

What is the role of collection agencies?

Collection agencies serve as external partners for lenders, tasked with securing unpaid obligations through various strategies, including direct communication, legal actions, and compliance with regulatory frameworks like the Fair Debt Recovery Practices Act (FDCPA).

What are the key regulations governing collection agencies?

The key regulations include the Fair Debt Recovery Practices Act (FDCPA), which prohibits abusive practices and ensures consumer protection, and the Rosenthal Fair Financial Recovery Practices Act (RFDCPA) in California, which has expanded consumer protections to include small enterprises.

How can organizations enhance their recovery strategies?

Organizations can enhance their recovery strategies by being well-informed about regulatory changes and leveraging tools like EQ Collect, which offers features such as no-code file-mapping, automated workflows, and real-time reporting to improve efficiency and compliance.

What should I do when a collection agency calls?

When a collection agency calls, remain calm, confirm the caller's identity, and inquire about the obligation details. Request written validation of the debt if uncertain, which must be provided within five days, and document the conversation for future reference.

How long do I have to contest a debt after receiving validation?

You have 30 days to contest the amount in writing after receiving the validation notice from the collection agency.

What steps can I take to negotiate with a collection agency?

When negotiating, be clear about what you can afford and propose a realistic payment plan. You also have the right to request that all future communications be in writing.

Why is it important to be proactive when dealing with collection agency calls?

Being proactive is essential due to the significant rise in financial recovery calls, which have increased by 150% nationwide. Verifying the legitimacy of the debt helps protect against scams and ensures compliance with the Fair Debt Collection Practices Act.