Overview

The role of a collection agency in debt recovery is pivotal. These agencies implement effective strategies, including personalized communication, flexible payment plans, and advanced technology, to enhance recovery rates while strictly adhering to legal standards. This approach balances assertive debt retrieval with ethical practices, ensuring compliance with regulations such as the Fair Debt Collection Practices Act. This Act not only protects consumer rights but also promotes transparency in the collection process, reinforcing the agency's commitment to ethical standards.

Introduction

Navigating the complexities of debt recovery presents significant challenges, particularly given the multitude of regulations and practices that govern this field. Debt collection agencies serve a critical function in this ecosystem, acting as intermediaries that facilitate the recovery of outstanding payments while adhering to legal frameworks designed to protect consumers. As these agencies strive to balance their responsibilities, ethical implications surrounding their methods and the rights of debtors come to the forefront.

What are the fundamental roles of these agencies, and how can stakeholders ensure compliance while promoting equitable practices in debt recovery?

Define Debt Collection Agencies and Their Functions

Collection firms serve as specialized entities that operate as a [collect agency](https://equabli.com/engine) dedicated to recovering outstanding payments on behalf of creditors. Understanding their primary functions is crucial for stakeholders navigating the debt recovery landscape:

- Contacting Debtors: These firms initiate communication with individuals or businesses that owe money, utilizing various methods such as phone calls, emails, or letters.

- Negotiating Payment Plans: They engage with debtors to establish feasible repayment plans through a collect agency, which may encompass full payments or settlements tailored to the debtor's situation.

- Verification of Obligation: A collect agency confirms the validity of the debt, ensuring that borrowers are fully informed about the amount due and the identity of the lender.

- Collect Agency: Many organizations use a collect agency to report delinquent accounts to credit bureaus, a practice that can significantly impact the debtor's credit score.

- Legal Action: In instances where obligations remain unpaid, a collect agency may pursue legal proceedings to recover the owed sums; however, they typically do not represent creditors in court.

By comprehensively understanding these functions, stakeholders can more effectively navigate the debt recovery process and appreciate the critical importance of compliance with relevant regulations.

Explore Legal Regulations and Consumer Rights in Debt Collection

Debt recovery operates within a framework of regulations designed to protect individuals from abusive practices, with the Fair Debt Recovery Practices Act (FDCPA) serving as a cornerstone in the United States. Understanding these regulations is crucial for the collect agency to ensure compliance and uphold .

Key regulations include:

- Communication Restrictions: Debt collectors are prohibited from contacting consumers at inconvenient times or employing harassing tactics, ensuring respectful engagement.

- Disclosure Requirements: Collectors must clearly identify themselves and inform consumers of their rights regarding the obligation, promoting transparency in the retrieval process.

- Consumer Rights: Consumers have the right to contest obligations and seek validation before any recovery efforts begin, empowering them in the resolution process.

Equabli's SMS communication policy underscores the importance of user consent in debt retrieval. By providing their mobile number and opting in, individuals affirm their ownership rights or permission to use the number, which is essential for compliance with communication regulations. Moreover, individuals have the option to opt-out of SMS messages, ensuring they maintain control over their interactions with the collect agency. This aligns with the broader regulatory framework that emphasizes the collect agency of customer rights and the importance of ethical communication practices.

Recent legislative developments, such as the proposed amendments to the FDCPA introduced on April 8, 2025, aim to further safeguard consumers by prohibiting collectors from pursuing obligations for which the statute of limitations has expired. This change reflects the evolving landscape of financial recovery regulations and the necessity for agencies to remain informed.

Additionally, California's extension of the Rosenthal Fair Collection Practices Act (RFDCPA), effective July 1, 2025, introduces stricter collection practices for commercial obligations, enhancing protections for individual borrowers and personal guarantors. Legal specialists emphasize that compliance with these regulations not only mitigates legal risks but also enhances public confidence. Collection firms that implement robust protections for individuals can foster positive relationships with borrowers, ultimately leading to more effective recovery strategies when working with a collect agency. By aligning their practices with contemporary legal standards, organizations can adeptly navigate the complexities of financial recovery while prioritizing consumer rights.

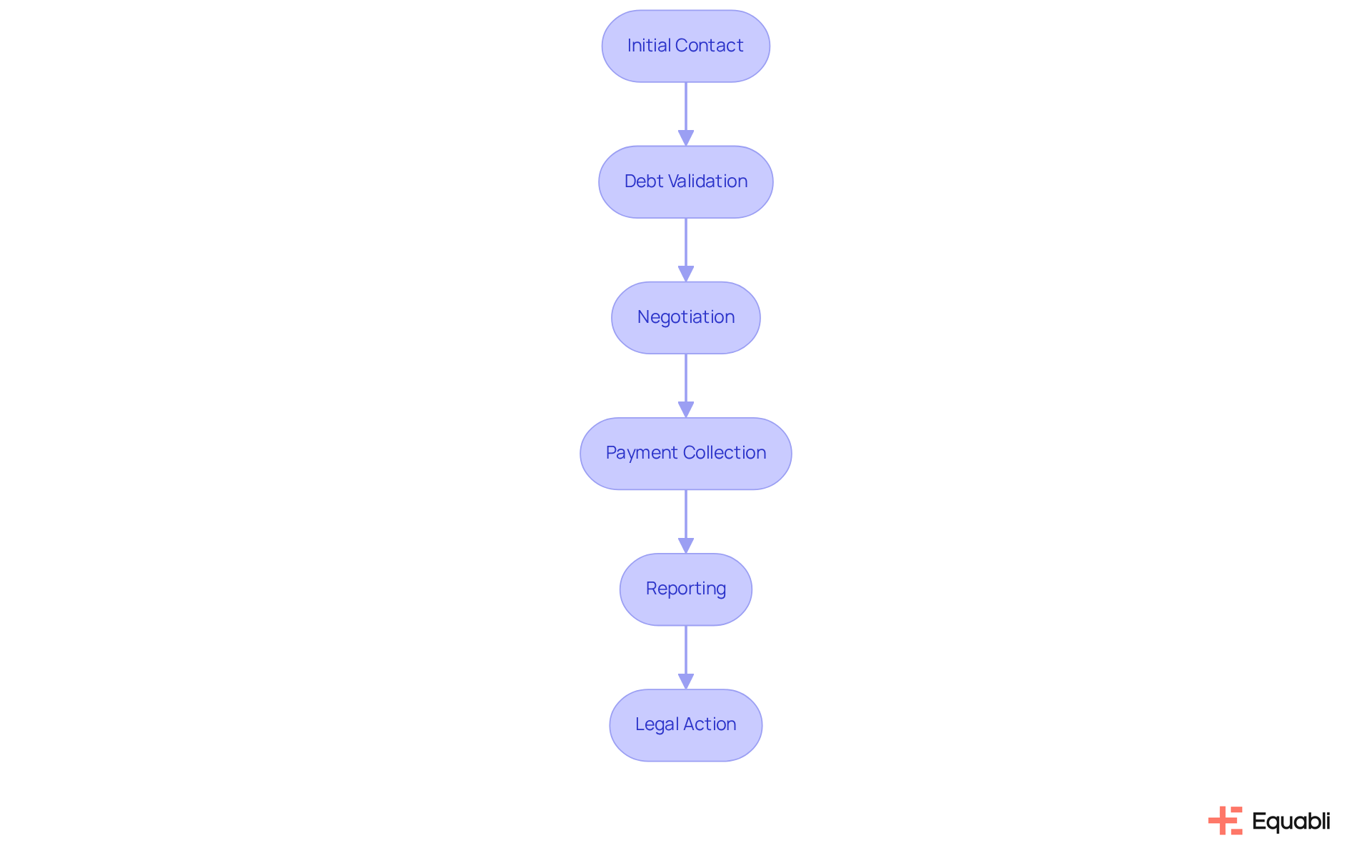

Understand the Debt Collection Process

The debt collection process typically follows several key stages, and with Equabli's innovative solutions, these stages can be transformed for enhanced efficiency.

- Initial Contact: The collection firm reaches out to the borrower to notify them of the outstanding balance, offering information about the amount due and the original creditor. With EQ Suite, this initial outreach can be automated, ensuring timely and consistent communication.

- Debt Validation: The borrower has the right to request verification of the debt, which the organization must supply to confirm its legitimacy. Equabli's tools streamline this process, allowing for quick access to necessary documentation and compliance management.

- Negotiation: The organization may negotiate payment terms with the debtor, offering options such as payment plans or settlements. EQ Collect enhances this stage by providing customizable repayment options that cater to individual borrower needs, improving engagement and satisfaction.

- Payment Collection: Once an agreement is reached, the organization collects payments according to the agreed-upon terms. Automated workflows within EQ Collect minimize execution errors and ensure efficient payment processing.

- Reporting: If the obligation remains unpaid, the organization may notify the delinquency to credit bureaus, affecting the borrower's credit score. Real-time reporting functions offer clarity and insights, enabling organizations to handle their reporting responsibilities efficiently.

- Legal Action: If all attempts to collect the debt fail, the organization may pursue legal action to recover the owed amount. With the backing of from Equabli, organizations can better evaluate risk and make informed choices about pursuing legal options.

Understanding this process allows debtors to navigate their obligations and rights effectively, while creditors can leverage Equabli's intelligent, cloud-based solutions to better manage their expectations regarding recovery efforts. By transitioning from manual processes to these modern tools, agencies can collect agency information to enhance their operational efficiency and compliance management.

Conclusion

Understanding the role of collection agencies in debt recovery is essential, as it highlights their crucial function in balancing effective retrieval of outstanding payments with adherence to ethical and legal standards. These agencies serve as intermediaries, facilitating communication between creditors and debtors while ensuring that recovery processes respect consumer rights and comply with relevant regulations.

The article underscores several key aspects of debt collection, including:

- The initial contact with debtors

- The negotiation of payment plans

- The verification of obligations

Legal regulations, such as the Fair Debt Collection Practices Act, are paramount; they protect consumers from abusive practices and ensure transparent communication. Furthermore, the integration of innovative solutions, like those offered by Equabli, significantly enhances the efficiency of the debt collection process, enabling agencies to manage operations effectively while prioritizing compliance and consumer empowerment.

Ultimately, the significance of collection agencies extends beyond mere recovery of debts; they play a vital role in fostering trust and transparency in financial interactions. As regulations evolve, stakeholders must remain informed and adaptable, ensuring that debt recovery practices not only meet legal standards but also respect the rights of individuals. Embracing ethical practices and innovative solutions will benefit collection agencies and contribute to a more equitable financial landscape for all.

Frequently Asked Questions

What are collection agencies and what is their purpose?

Collection agencies are specialized organizations that focus on retrieving funds for creditors, primarily for overdue or defaulted obligations. They act as intermediaries between creditors and debtors, employing various strategies to recover outstanding sums.

What are the two primary types of collection agencies?

The two primary types of collection agencies are first-party organizations, which are internal divisions of creditors, and third-party firms, which are independent entities contracted to recover amounts owed.

What key functions do collection agencies perform?

Collection agencies perform several key functions, including debt recovery through various methods, credit reporting to credit bureaus, and negotiation to establish payment plans or settlements with debtors.

How do collection agencies recover debts?

Collection agencies utilize diverse methods for debt recovery, including phone calls, letters, and, if necessary, legal action. Their proactive approach can significantly enhance the chances of recovering debts, especially when intervention occurs promptly.

How do collection agencies impact credit scores?

Collection agencies frequently report the status of debts to credit bureaus, which can adversely affect an individual's credit score. This practice motivates individuals with debts to resolve their overdue amounts quickly, improving recovery rates.

What regulations do collection agencies adhere to during negotiations?

Collection agencies adhere to ethical practices and regulations, such as the Fair Debt Collection Practices Act (FDCPA), while negotiating payment plans or settlements with debtors.

What trends are expected in collection agencies by 2025?

By 2025, there is an expected increasing reliance on technology and data-driven approaches within debt recovery firms, which will enhance their efficiency in retrieving funds.

Can you provide an example of effective debt recovery by a collection agency?

An example of effective debt recovery is a case study involving City Medical Center contracting Fast Recovery Collections Agency, which illustrates how timely intervention can lead to significant recoveries.