Overview

The article delineates three strategic debt management solutions aimed at mitigating corporate financial risks:

- Prioritizing high-interest obligations

- Leveraging technology for enhanced operational efficiency

- Cultivating a culture of financial discipline

These strategies are substantiated by examples such as the 'debt snowball' method and the deployment of automated tools. Such approaches illustrate how organizations can effectively diminish liabilities and bolster creditworthiness within a complex financial landscape.

Introduction

Navigating the intricate landscape of corporate debt management is increasingly critical as organizations confront rising interest rates, regulatory pressures, and evolving consumer expectations. This article examines three strategic debt management solutions that empower corporations to effectively mitigate financial risks. Given the multitude of approaches available, how can businesses discern the most effective strategies to not only reduce debt but also enhance their overall financial health?

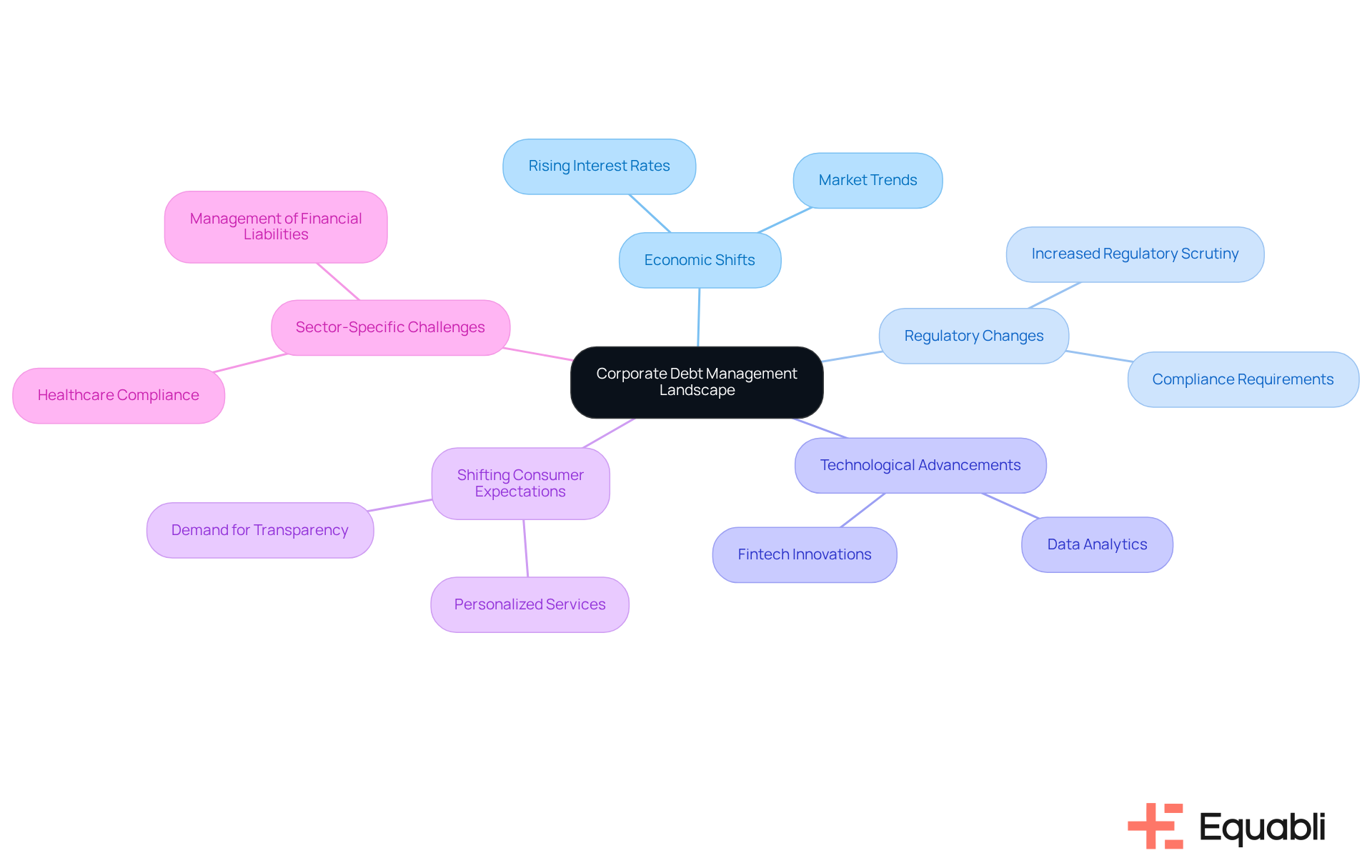

Understand the Landscape of Corporate Debt Management

Corporate financial management has undergone significant evolution in recent years, driven by economic shifts, regulatory changes, and technological advancements. Organizations are now tasked with navigating a complex landscape characterized by:

- Rising interest rates

- Increased regulatory scrutiny

- Shifting consumer expectations

Comprehending these dynamics is essential for formulating effective financial management strategies. For instance, organizations in sectors such as fintech and healthcare face unique challenges, including:

- The management of substantial minor financial liabilities

- Ensuring compliance with stringent regulations

By analyzing market trends and borrower behaviors, organizations can enhance their positioning, thereby mitigating risks and improving recovery efforts. This foundational knowledge empowers businesses to to meet the specific demands of their industry and clientele.

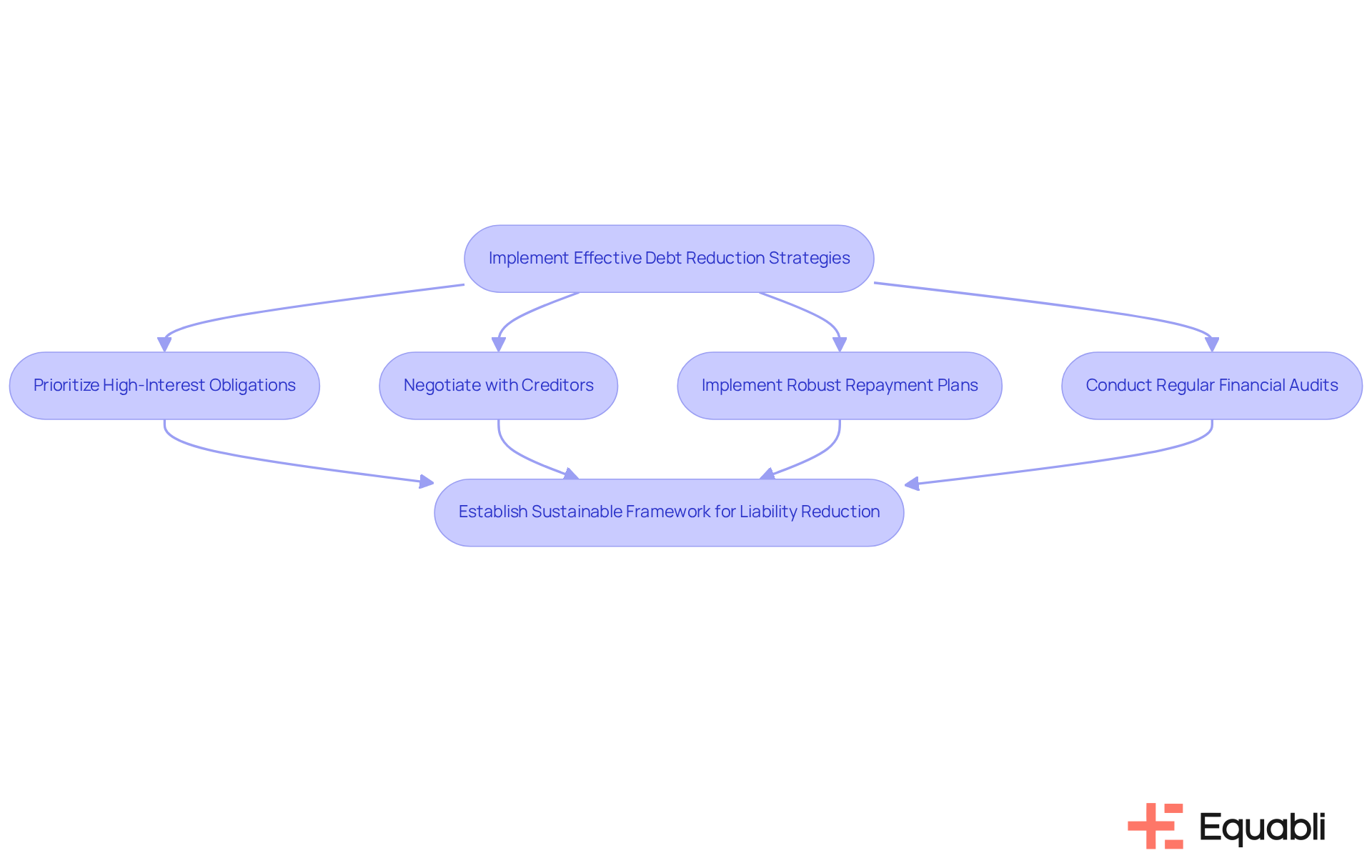

Implement Effective Debt Reduction Strategies

To effectively mitigate corporate liabilities, organizations must adopt for corporate financial risk mitigation that prioritize high-interest obligations, negotiate with creditors, and implement robust repayment plans.

A proven approach is the 'debt snowball' method, which emphasizes settling smaller obligations first to build momentum.

Evidence suggests that conducting regular financial audits can further benefit organizations by identifying areas of overspending and potential savings.

For example, a telecom firm that restructured vendor agreements and optimized its operations successfully reduced its liabilities by 30% within a year.

By fostering a culture of financial discipline and accountability, businesses can establish a sustainable framework for liability reduction that incorporates strategic debt management solutions for corporate financial risk mitigation, thereby enhancing creditworthiness.

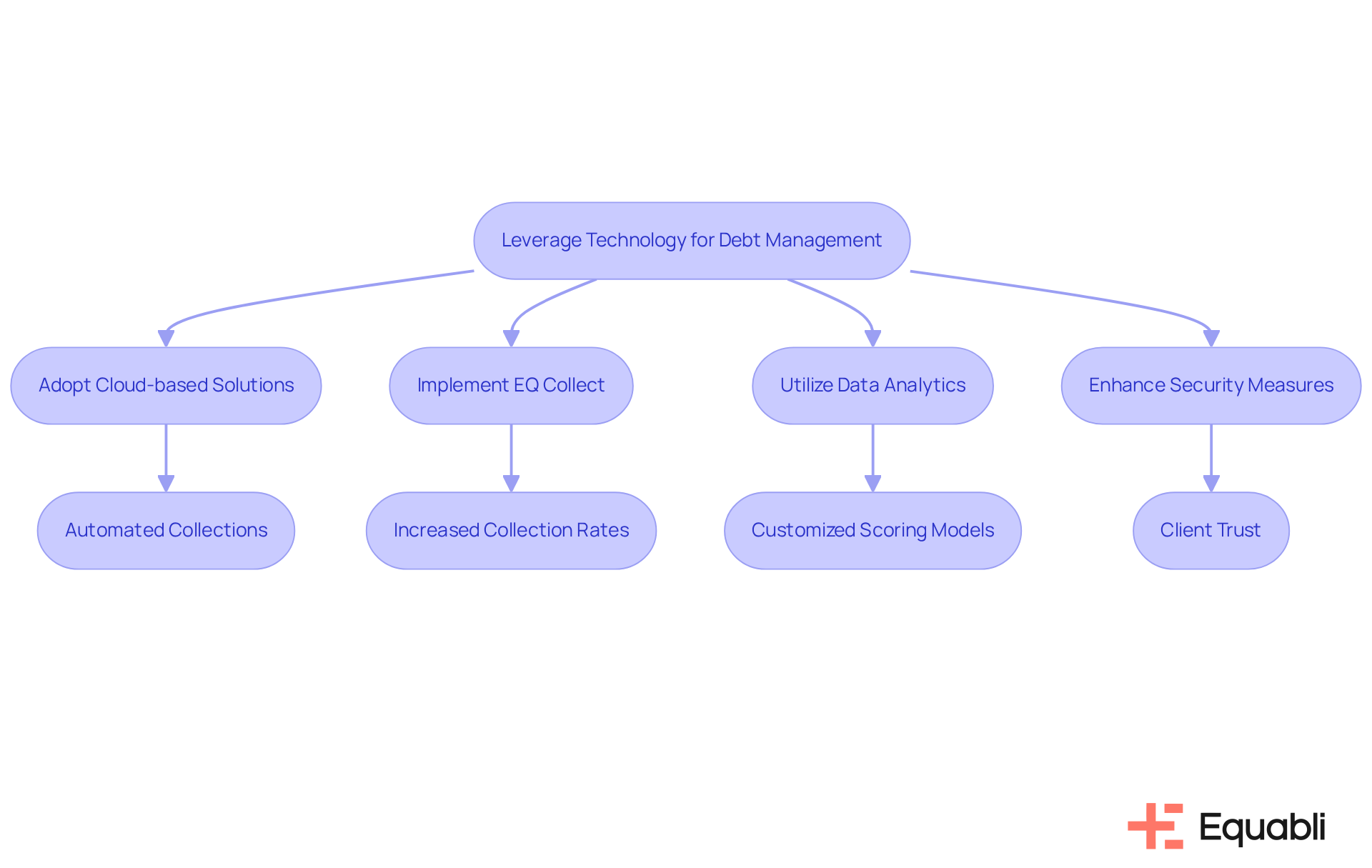

Leverage Technology for Enhanced Debt Management

In the current digital landscape, technology is integral to optimizing strategic debt management solutions for corporate financial risk mitigation. Organizations must consider the adoption of cloud-based solutions, such as Equabli's EQ Suite, which includes EQ Collect. This tool , refines repayment strategies, and enhances client engagement. For example, the no-code file-mapping tool and automated workflows in EQ Collect significantly reduce vendor onboarding timelines and diminish execution errors, resulting in enhanced operational efficiency and increased collection rates.

By leveraging data analytics, companies can construct customized scoring models that forecast repayment behaviors, allowing for tailored communication strategies. A notable case is a financial institution that, after implementing automated reminders and self-service repayment options, experienced a 25% rise in on-time payments. Furthermore, with stringent compliance oversight and real-time reporting, the integration of advanced security measures ensures the protection of sensitive data, thereby fostering client trust.

Embracing these technological advancements not only streamlines operations but also enables organizations to implement strategic debt management solutions for corporate financial risk mitigation, allowing them to respond swiftly to market dynamics and borrower demands.

Conclusion

Understanding the complexities of corporate debt management is essential for organizations aiming to mitigate financial risks effectively. As the landscape evolves with rising interest rates and increased regulatory scrutiny, businesses must adapt their strategies to navigate these challenges successfully. By prioritizing tailored debt management solutions, companies can enhance their financial resilience and position themselves for sustainable growth.

Key insights highlight the importance of implementing effective debt reduction strategies, including:

- The debt snowball method

- Regular financial audits

These approaches not only assist in reducing liabilities but also cultivate a culture of financial discipline. Furthermore, leveraging technology is pivotal in optimizing debt management processes; tools such as cloud-based solutions and data analytics can significantly enhance operational efficiency and improve collection rates.

Proactive debt management is not merely a reactive measure; it is a fundamental aspect of corporate financial health. Organizations are encouraged to embrace innovative technologies and strategic practices to stay ahead of market dynamics. By prioritizing these debt management solutions, companies can mitigate risks while capitalizing on growth opportunities in an increasingly competitive environment.

Frequently Asked Questions

What are the main factors influencing corporate debt management today?

The main factors influencing corporate debt management include rising interest rates, increased regulatory scrutiny, and shifting consumer expectations.

Why is it important to understand the dynamics of corporate financial management?

Understanding these dynamics is essential for formulating effective financial management strategies that can help organizations navigate challenges and enhance their positioning in the market.

What unique challenges do sectors like fintech and healthcare face in corporate debt management?

Organizations in sectors such as fintech and healthcare face unique challenges such as managing substantial minor financial liabilities and ensuring compliance with stringent regulations.

How can organizations improve their recovery efforts in corporate debt management?

By analyzing market trends and borrower behaviors, organizations can enhance their positioning, mitigate risks, and improve recovery efforts.

What is the benefit of tailoring financial strategies to specific industry demands?

Tailoring financial strategies to meet the specific demands of an industry and clientele empowers businesses to effectively address their unique challenges and opportunities.