Overview

Effective creditors management solutions are crucial for mitigating financial risks by equipping organizations with the tools and strategies necessary to manage accounts receivable efficiently.

Employing data-driven techniques and customizable scoring models, complemented by robust compliance features and continuous performance evaluation, significantly enhances risk management practices.

This approach not only improves profitability for lenders but also aligns with industry standards and regulatory requirements, thus fostering a more resilient financial environment.

Introduction

In an increasingly complex financial landscape, effective creditors management solutions have emerged as vital tools for organizations aiming to mitigate risks associated with accounts receivable. These solutions enhance decision-making through data-driven insights and empower lenders to proactively address potential delinquencies before they escalate.

However, the challenge lies in understanding how to implement these strategies effectively—what essential components ensure success? This article delves into best practices for creditors management, offering insights into optimizing risk mitigation efforts while navigating the intricacies of financial management.

Understand Creditors Management Solutions and Their Importance in Risk Mitigation

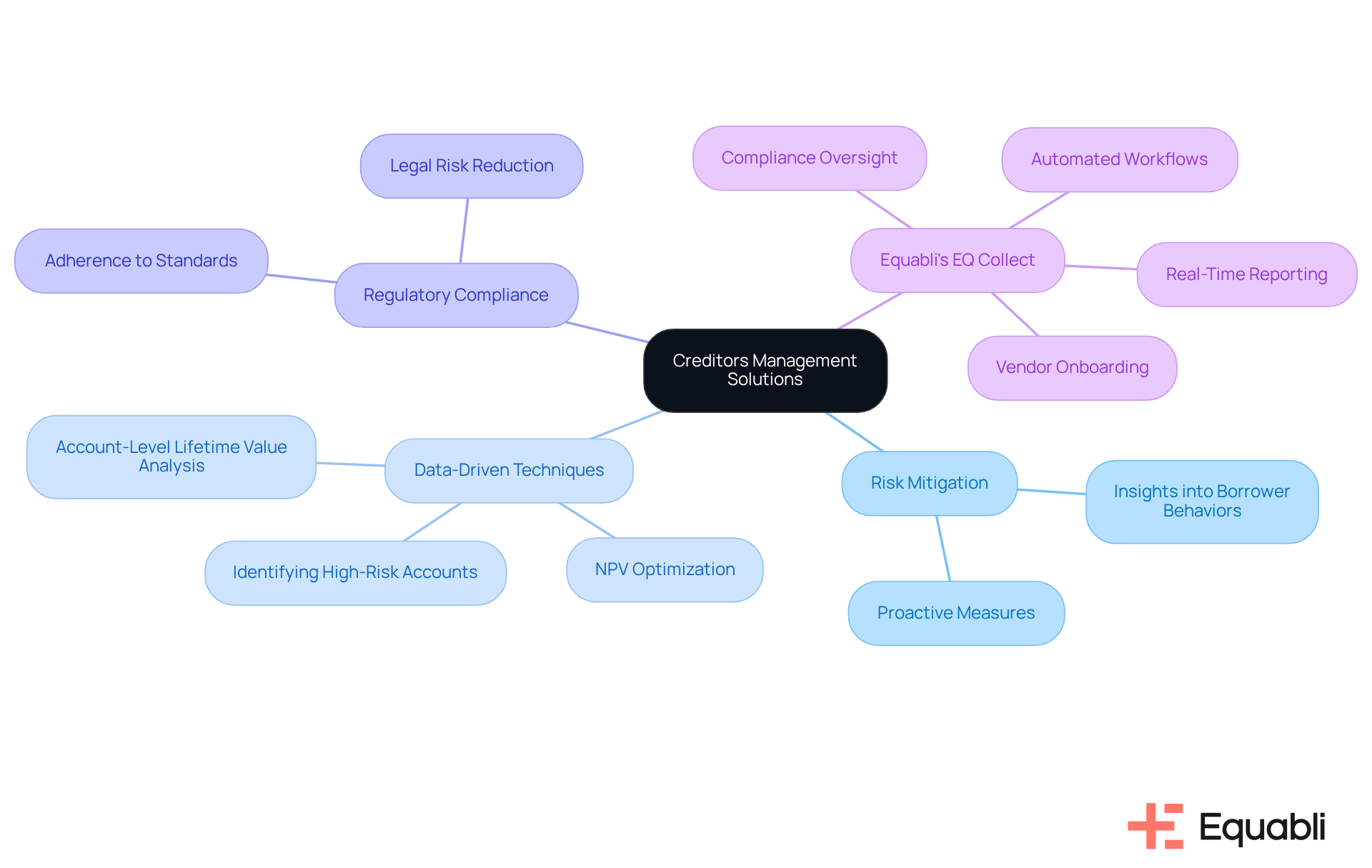

Effective creditors management solutions for enterprise financial risk mitigation encompass a range of tools and strategies designed to assist entities in efficiently managing their accounts receivable. These methodologies are crucial for risk reduction as they provide insights into borrower behaviors, which are essential for creditors management solutions for enterprise financial risk mitigation, enabling informed decisions regarding collections. By employing data-driven techniques, organizations can identify high-risk accounts early, facilitating proactive measures before debts escalate into unmanageable situations. Furthermore, these strategies support adherence to regulatory standards, thereby reducing the risk of legal complications that may arise from improper collection practices. Ultimately, understanding creditors management solutions for enterprise financial risk mitigation is essential for any lender aiming to enhance their risk management practices and improve profitability.

Equabli's EQ Collect augments these capabilities by streamlining vendor onboarding timelines through a user-friendly, no-code file-mapping tool, while enhancing collections via data-driven methodologies. The platform reduces execution errors and reliance on manual resources through automated workflows, offering unparalleled transparency and insights via real-time reporting. Additionally, it guarantees industry-leading compliance oversight, both internally and externally, through automated monitoring. With its intuitive, scalable, cloud-native interface, lenders can revolutionize their debt recovery processes, leveraging and machine learning tools to improve collection performance and optimize recovery strategies through NPV optimization and account-level lifetime value analysis.

Identify Key Components for Effective Creditors Management Implementation

To implement creditors management solutions effectively, organizations must concentrate on several key components:

- Data Integration: Seamless integration of data from diverse sources is essential. This integration provides a comprehensive view of borrower behaviors and financial histories, facilitating more accurate risk assessments. Utilizing Equabli's EQ Engine enhances this process through , which forecasts the risk of delinquency for active accounts. This capability enables entities to develop intelligent servicing strategies that directly address the challenges of debt recovery.

- Customizable Scoring Models: Implementing scoring models tailored to the specific needs of the entity significantly improves the ability to predict repayment behaviors. Such customization ensures that employed strategies remain relevant and effective, particularly when bolstered by Equabli's data-driven insights.

- User-Friendly Interfaces: Solutions must be intuitive and easy to navigate, allowing staff to utilize them efficiently without extensive training. Equabli's EQ Suite modernizes manual processes, transforming collections into an intelligent and intuitive operation, thereby increasing adoption rates and ensuring optimal use of the tools.

- Compliance Features: Integrated compliance tools assist entities in adhering to regulatory requirements, thereby minimizing the risk of penalties and legal complications. Equabli's solutions encompass compliance management features that streamline this critical aspect of debt collection.

- Analytics and Reporting: Robust analytics capabilities enable companies to monitor performance metrics and adjust strategies using real-time data, fostering a culture of continuous improvement. With the EQ Engine, entities can enhance recovery rates and expand their collections operations without sacrificing performance.

By focusing on these elements, organizations can establish a solid foundation for their financial management strategies, ensuring they are well-prepared to utilize creditors management solutions for enterprise financial risk mitigation while evolving their debt recovery practices.

Apply Best Practices for Tailored Implementation of Creditors Management Solutions

To effectively tailor the implementation of for enterprise financial risk mitigation, organizations must adopt best practices that ensure strategic alignment and operational efficiency.

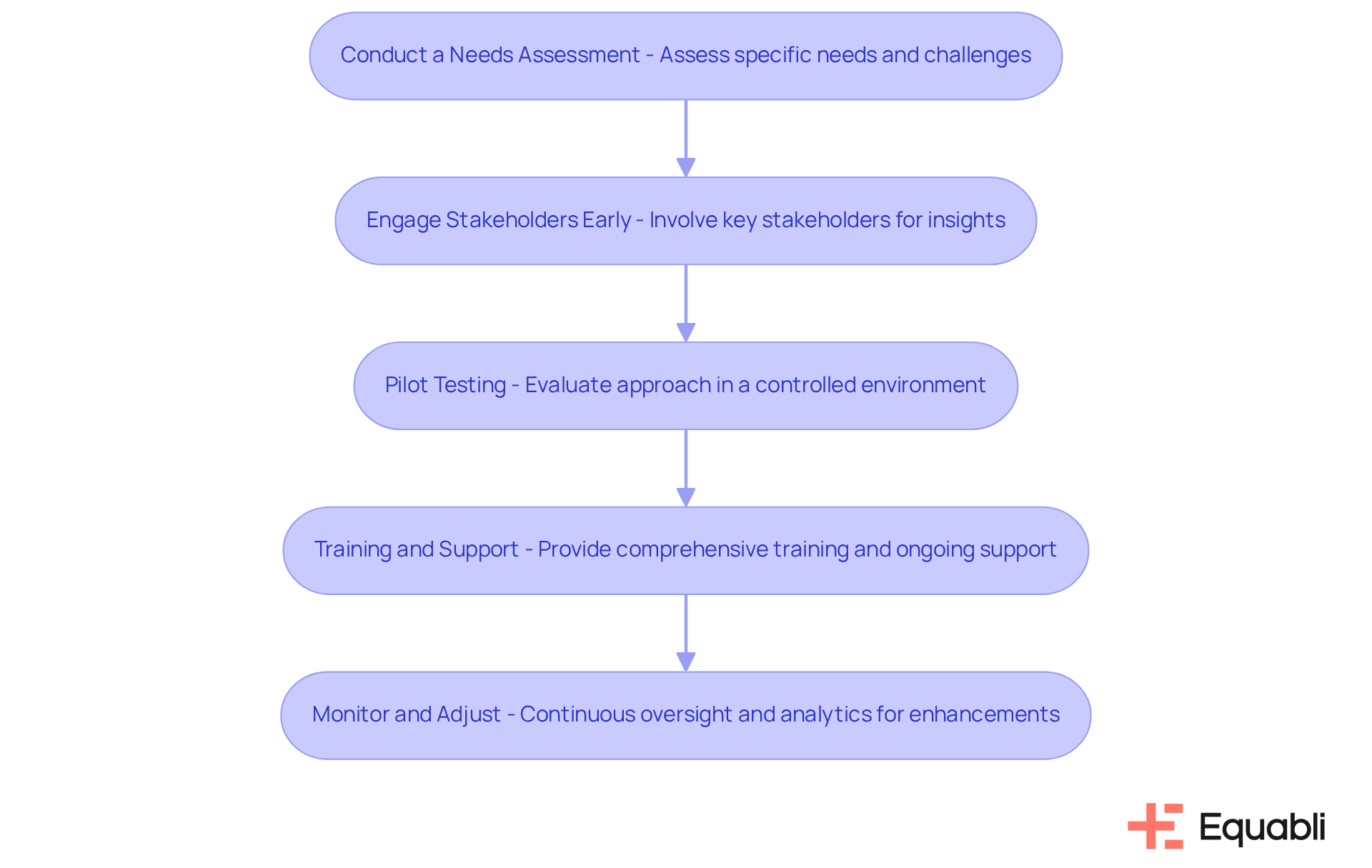

- Conduct a Needs Assessment: A thorough assessment of the organization's specific needs and challenges is essential prior to implementation. This foundational step guides the selection of features and functionalities that are most relevant, enhancing the overall effectiveness of the solution.

- Engage Stakeholders Early: Involving key stakeholders from various departments early in the process is critical for gathering insights and fostering buy-in. This collaborative approach ensures that the outcome meets the requirements of all users, thereby increasing the likelihood of successful adoption.

- Pilot Testing: Implementing a pilot program allows organizations to evaluate the approach in a controlled environment. This strategy enables necessary adjustments based on feedback before a full-scale rollout, minimizing risks associated with broader implementation.

- Training and Support: Comprehensive training for staff is vital to ensure comfort with the new tools. Ongoing support is equally essential to address any challenges that may arise post-implementation, reinforcing user confidence and operational effectiveness.

- Monitor and Adjust: Continuous oversight of the debt management system's performance post-implementation is crucial. By utilizing analytics, organizations can pinpoint areas for enhancement and modify approaches accordingly, ensuring sustained operational excellence.

By adhering to these best practices, entities can ensure a seamless and efficient execution of creditors management solutions for enterprise financial risk mitigation, ultimately leading to improved risk reduction outcomes.

Evaluate Outcomes and Optimize Creditors Management Strategies for Continuous Improvement

To ensure continuous improvement in creditors management solutions for enterprise financial risk mitigation, organizations must adopt a systematic approach to evaluating outcomes.

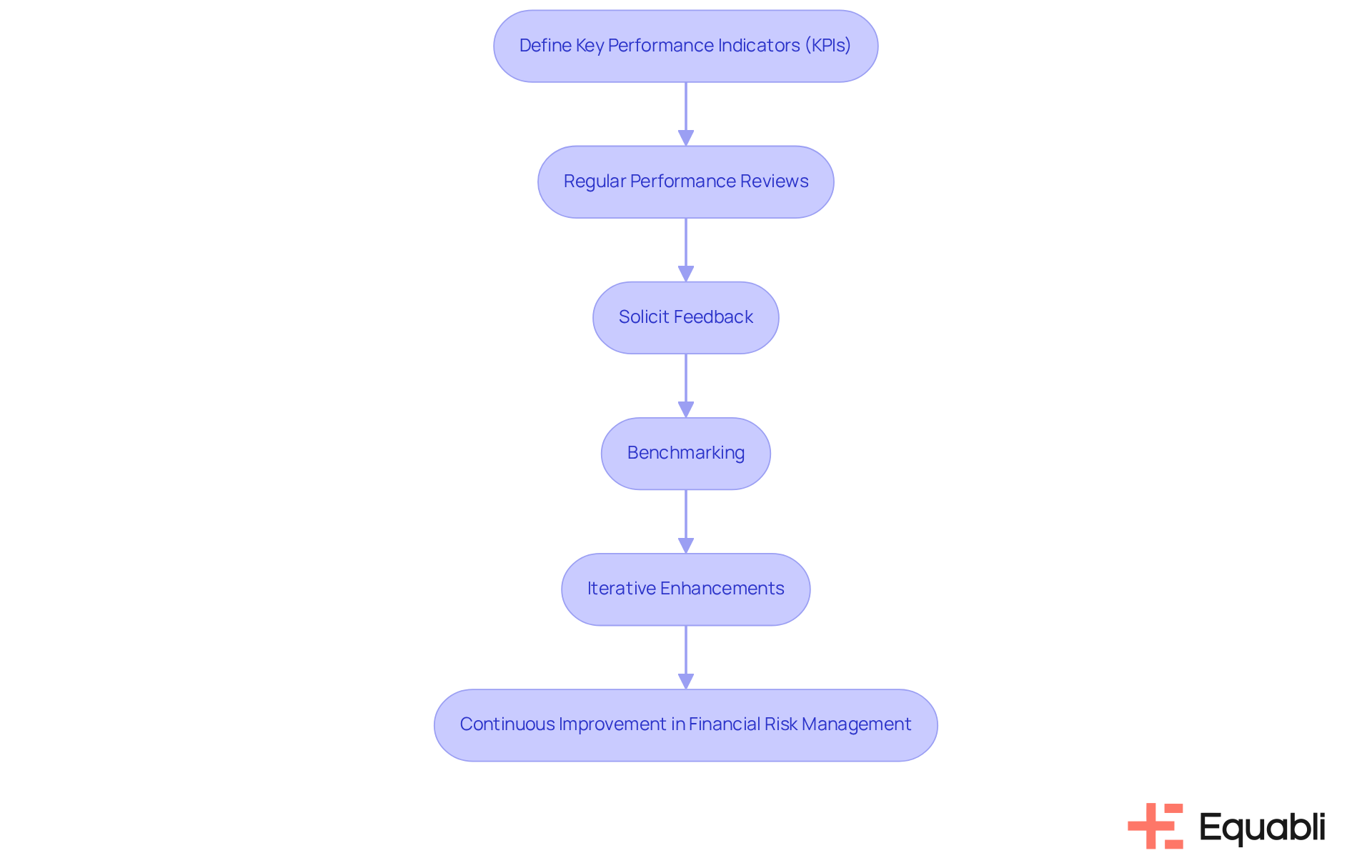

- Define Key Performance Indicators (KPIs): Establish clear KPIs that align with organizational goals. Metrics such as recovery rates, time to collect, and customer satisfaction scores serve as critical indicators of performance. By defining these KPIs, organizations can create a framework for assessing effectiveness and driving improvements.

- Regular Performance Reviews: Conduct regular reviews of performance against the defined KPIs. This practice assists in recognizing trends and identifying areas where approaches may need modification. Regular assessments not only foster accountability but also facilitate strategic adjustments in response to emerging patterns.

- Solicit Feedback: Gather feedback from staff and borrowers to gain insights into the effectiveness of creditors management solutions. This qualitative data complements quantitative metrics, providing a comprehensive view of performance. Engaging stakeholders in feedback processes enhances the alignment of strategies with operational realities.

- Benchmarking: Compare performance against industry standards or competitors to identify areas for improvement and best practices that can be adopted. Benchmarking serves as a critical tool for organizations to understand their competitive positioning and drive strategic enhancements.

- Iterative Enhancements: Utilize insights acquired from assessments to make to approaches and processes. This agile method ensures that organizations can adapt to evolving market conditions and borrower behaviors. Continuous improvement is essential for maintaining relevance and effectiveness in creditors management strategies.

By committing to ongoing evaluation and optimization, organizations can enhance their creditors management solutions for enterprise financial risk mitigation, which leads to more effective risk management and improved financial outcomes.

Conclusion

Effective creditors management solutions are essential for mitigating financial risks within enterprises. By implementing comprehensive strategies and leveraging data-driven techniques, organizations can proactively manage accounts receivable, identify high-risk accounts, and ensure adherence to regulatory standards. This understanding is crucial for lenders aiming to enhance their risk management practices and ultimately improve profitability.

Key components such as:

- Data integration

- Customizable scoring models

- User-friendly interfaces

- Compliance features

- Robust analytics

are vital for the successful implementation of creditors management solutions. Focusing on these elements allows organizations to establish a solid foundation for effective financial management, enabling them to navigate the complexities of debt recovery and risk mitigation.

In summary, continuous evaluation and optimization of creditors management strategies are imperative for sustained success. By defining key performance indicators, soliciting feedback, and benchmarking against industry standards, organizations can cultivate a culture of continuous improvement. Embracing these best practices not only enhances risk management outcomes but also positions lenders to adapt to evolving market dynamics, ultimately driving improved financial results.

Frequently Asked Questions

What are creditors management solutions?

Creditors management solutions are tools and strategies designed to help organizations efficiently manage their accounts receivable, providing insights into borrower behaviors to assist in informed decision-making regarding collections.

How do creditors management solutions contribute to risk mitigation?

They help reduce financial risk by identifying high-risk accounts early, allowing organizations to take proactive measures before debts become unmanageable, and ensuring adherence to regulatory standards to avoid legal complications.

Why is it important for lenders to understand creditors management solutions?

Understanding these solutions is essential for lenders to enhance their risk management practices and improve profitability by effectively managing their accounts receivable.

What role does Equabli's EQ Collect play in creditors management?

EQ Collect streamlines vendor onboarding and enhances collections through data-driven methodologies, reducing execution errors and manual resource reliance while providing real-time reporting and compliance oversight.

What features does EQ Collect offer to improve debt recovery processes?

It offers automated workflows, intelligent automation, machine learning tools, NPV optimization, and account-level lifetime value analysis to improve collection performance and optimize recovery strategies.

How does EQ Collect ensure compliance in creditors management?

EQ Collect guarantees industry-leading compliance oversight through automated monitoring, ensuring adherence to both internal and external regulatory standards.