Overview

The article delineates ten strategies aimed at optimizing the debt recovery process within financial institutions. It emphasizes the integration of technology, data analytics, and personalized communication as pivotal elements to enhance recovery rates and operational efficiency. Supporting this assertion, the article details methods such as:

- Segmenting debtors

- Utilizing multi-channel communication

- Implementing predictive analytics

These strategies collectively improve engagement and compliance while effectively reducing costs, thereby addressing the operational challenges faced by executives in the sector.

Introduction

The landscape of debt recovery is undergoing significant transformation, propelled by the imperative for financial institutions to adjust to evolving consumer behaviors and regulatory frameworks. As organizations strive to refine their recovery processes, they encounter a multitude of strategies aimed at optimizing efficiency and enhancing outcomes. This article examines ten innovative strategies for optimizing the debt recovery process, which not only promise improved financial results but also cultivate stronger relationships with debtors.

How can financial institutions effectively implement these strategies to navigate the complexities of contemporary debt collection while ensuring compliance and customer satisfaction?

Equabli's EQ Suite: Comprehensive Tools for Debt Recovery Optimization

Equabli's EQ Suite presents a robust suite of tools designed specifically for debt recovery process optimization strategies for financial institutions. This suite, which includes the EQ Engine, EQ Engage, and EQ Collect, empowers financial organizations to implement that accurately forecast repayment behaviors, refine collection strategies, and facilitate digital collections through self-service repayment plans. Notably, EQ Collect features a no-code file-mapping tool and automated monitoring capabilities that significantly enhance operational efficiency and compliance oversight.

By integrating these innovative solutions, institutions can realize considerable reductions in operational costs while simultaneously improving borrower engagement. Furthermore, the EQ Suite's cloud-based architecture streamlines workflows and guarantees real-time data access, thereby fostering collaboration and operational efficiency. As organizations increasingly emphasize automation, the EQ Suite emerges as a vital instrument for modernizing debt collection efforts, which are part of debt recovery process optimization strategies for financial institutions, ultimately leading to enhanced financial outcomes and improved customer satisfaction.

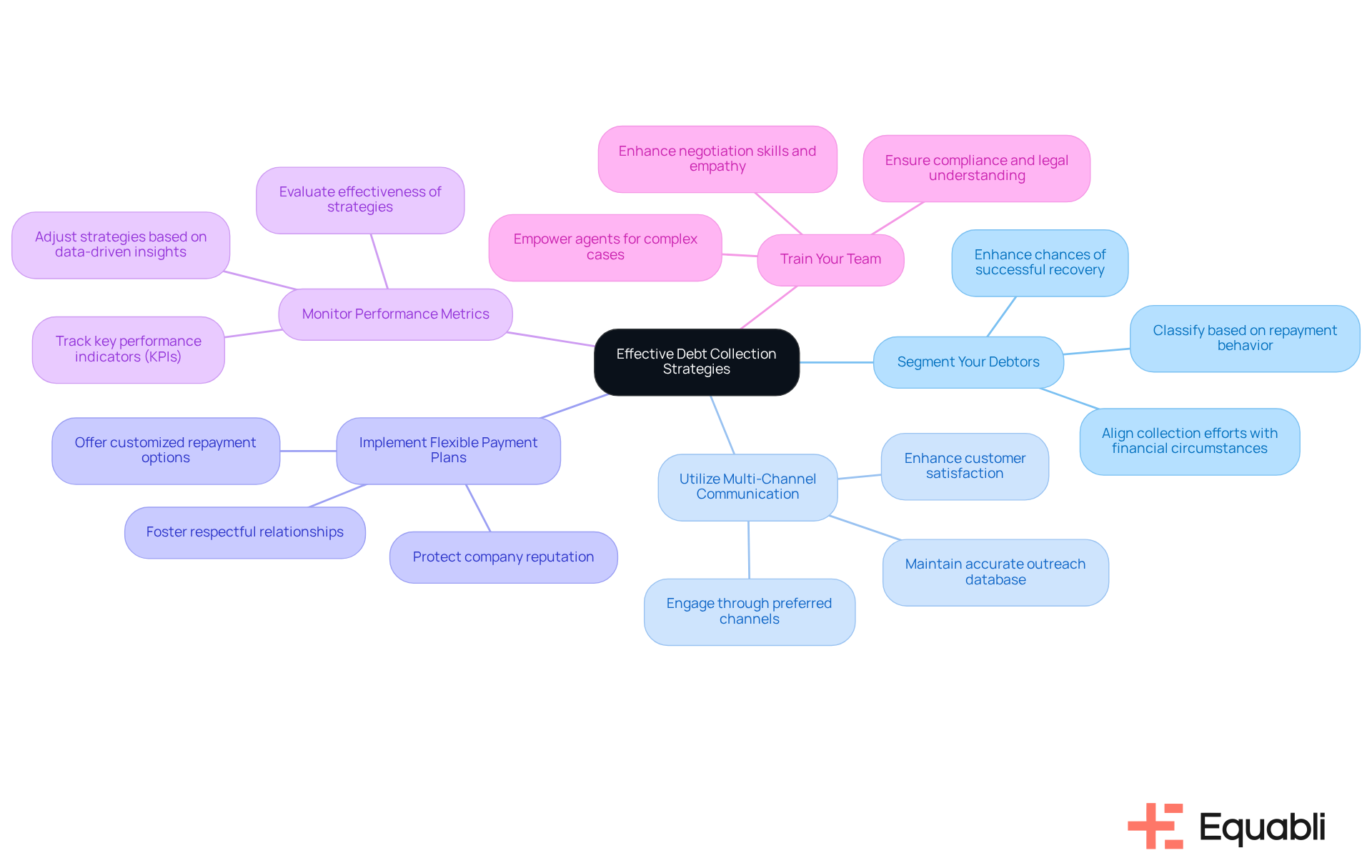

Temenos: 5 Must-Have Strategies for Effective Debt Collection

- Segment Your Debtors: Classifying debtors based on their repayment behavior and risk profiles is essential. This focused method enables customized strategies that enhance the chances of restoration. Segmenting debtors boosts the likelihood of successful results by aligning collection efforts with individual financial circumstances. According to industry insights, implementing debt recovery process optimization strategies for financial institutions, such as segmenting debtors based on risk and payment behavior, significantly enhances collection rates and improves operational efficiency.

- Utilize Multi-Channel Communication: Engaging debtors through their preferred channels—such as SMS, email, or phone calls—proves beneficial. Digital communication tools have demonstrated the ability to enhance outcomes and customer satisfaction by providing flexibility, enabling debtors to settle accounts on their terms. Regularly updating contact information is crucial for maintaining an accurate outreach database. As noted by industry experts, the shift towards digital communication channels is essential for meeting consumer expectations in today's landscape, which aligns with debt recovery process optimization strategies for financial institutions to enhance collection efforts.

- Implement Flexible Payment Plans: Offering customized repayment options that accommodate various financial situations is a strategic imperative. By providing reasonable repayment options and clear communication, organizations can recover debts while protecting their reputation. This approach fosters respectful relationships with debtors, who may become future clients or partners. Emphasizing flexibility in repayment plans aligns with the evolving needs of consumers and enhances long-term engagement.

- Monitor Performance Metrics: Regularly evaluating the effectiveness of retrieval strategies by tracking key performance indicators (KPIs), such as recovery rates and debtor engagement levels, is critical. Data-driven insights from performance measurement can reveal opportunities for refinement and enhance operational efficiency by implementing debt recovery process optimization strategies for financial institutions. Ongoing monitoring is essential for adjusting to the ever-changing inventory environment, ensuring that strategies remain effective and relevant.

- Train Your Team: Ensuring that staff responsible for gathering debts are well-trained in compliance and customer service is paramount. Continuous training programs that enhance negotiation skills, empathy, and legal understanding empower agents to handle complex cases effectively. This ultimately and increases repayment success. As John Sanders highlights, investing in training is essential for adapting to changes in the debt recovery industry, reinforcing the importance of a knowledgeable workforce.

Predictive Analytics: Enhancing Debt Recovery Through Data Insights

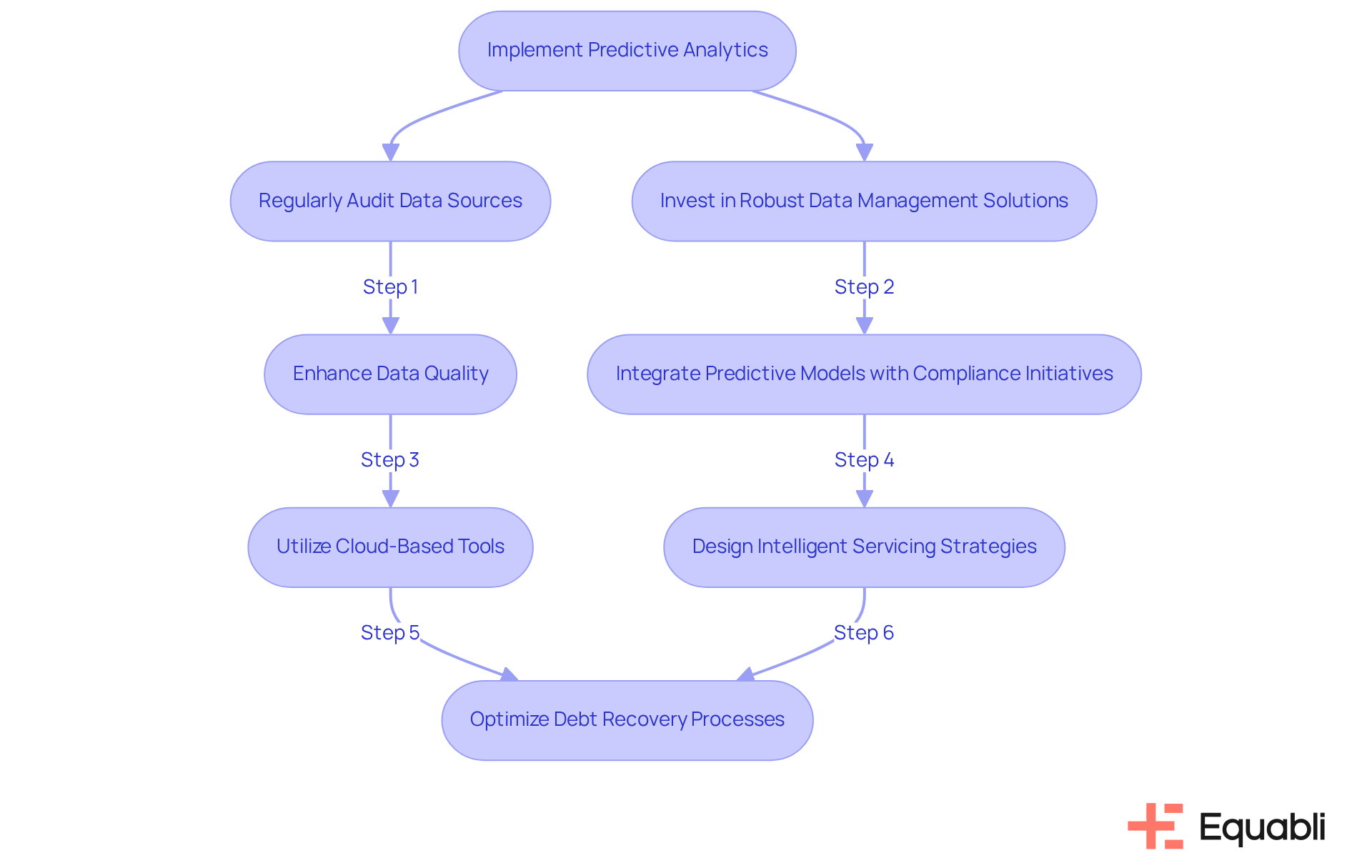

Predictive analytics serves as a crucial tool for financial entities, leveraging historical data to forecast future repayment behaviors. This capability enables organizations to discern patterns within debtor profiles, thereby identifying high-risk accounts. By prioritizing debt recovery process optimization strategies for financial institutions more effectively, institutions can enhance their operational strategies. Equabli's EQ Engine exemplifies this advancement by predicting the risk of delinquency in active accounts, empowering organizations to design intelligent servicing strategies tailored to each communication channel. This proactive approach not only but also employs debt recovery process optimization strategies for financial institutions, ultimately enhancing overall operational efficiency.

Moreover, the EQ Suite's cloud-based solutions modernize traditional debt management procedures by utilizing debt recovery process optimization strategies for financial institutions, transforming recoveries into intelligent and intuitive processes. However, the efficacy of predictive analytics is contingent upon data quality; low-quality data can lead to erroneous insights, compromising strategies for information gathering. Additionally, integrating predictive models with compliance initiatives ensures that organizations adhere to regulations while refining their retrieval strategies.

To implement predictive analytics effectively, financial institutions must:

- Regularly audit their data sources

- Invest in robust data management solutions

Leveraging cloud-based tools can facilitate the transition from manual to data-driven approaches, ensuring that insights remain both accurate and actionable. Such strategic measures not only enhance compliance but also position organizations to navigate the complexities of debt recovery process optimization strategies for financial institutions with greater confidence.

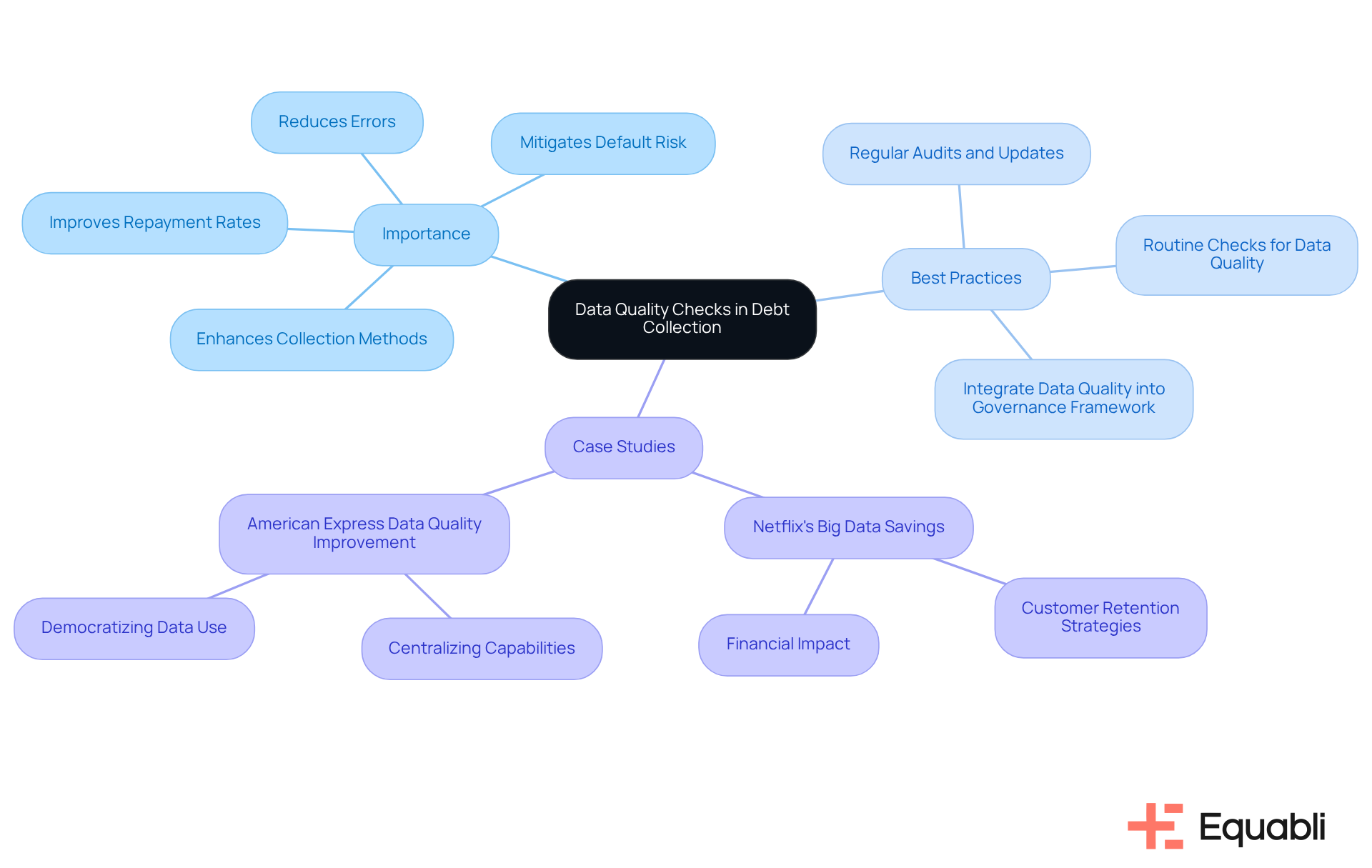

Data Quality Checks: Ensuring Accuracy in Debt Collection Efforts

Routine data quality assessments are critical for upholding the integrity of debt recovery process optimization strategies for financial institutions. This process entails verifying debtor information, confirming the currency of contact details, and of data sources. Emphasizing data precision not only enhances collection methods but also significantly reduces the likelihood of errors that can impede restoration efforts. High-quality data mitigates the risk of default by ensuring that loans are extended to creditworthy clients, ultimately improving repayment rates.

Statistics indicate that businesses incur losses of approximately £24.9 billion annually due to inaccurate or incomplete customer data, highlighting the financial ramifications of neglecting data quality. Furthermore, case studies, such as Netflix's utilization of big data to bolster customer retention, illustrate that organizations prioritizing data accuracy cultivate stronger relationships with consumers, thereby enhancing trust and loyalty.

By implementing best practices such as:

- Regular audits and updates

- Ensuring that routine checks to maintain data quality are integrated into the governance framework

financial organizations can establish a robust foundation for effective debt recovery process optimization strategies for financial institutions, ensuring that their strategies are both efficient and compliant.

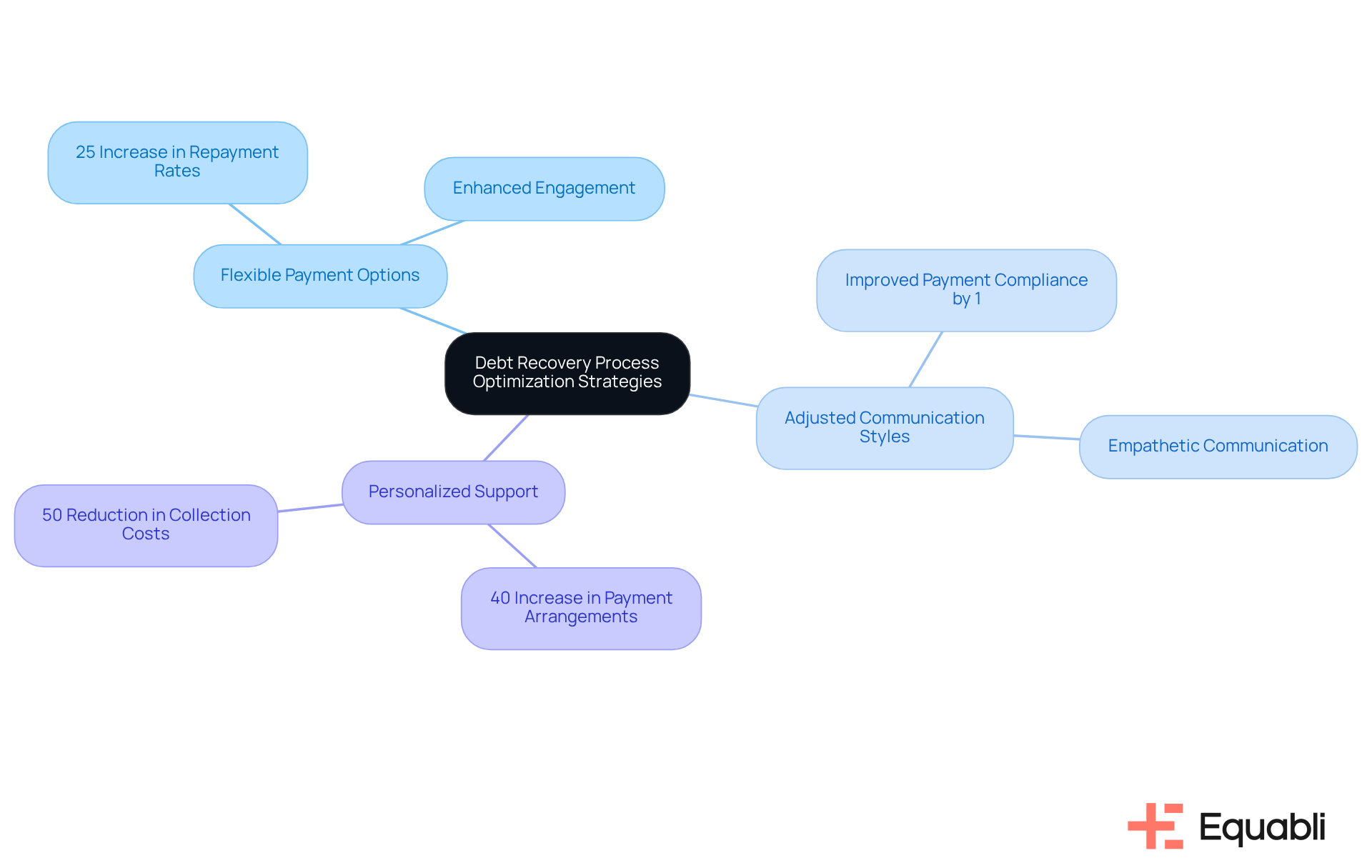

Tailored Collection Strategies: Customizing Approaches for Better Recovery

Creating customized retrieval strategies is essential for understanding the distinct requirements and situations of each debtor as part of debt recovery process optimization strategies for financial institutions. Evidence indicates that debt recovery process optimization strategies for financial institutions, which include:

- Offering flexible payment options

- Adjusting communication styles

- Providing personalized support

can significantly enhance debtor connections. Financial organizations that apply debt recovery process optimization strategies for financial institutions may see repayment rates increase by as much as 25%. Furthermore, personalized communication, such as incorporating the debtor's name in messages, has been shown to improve payment compliance by approximately 1 percentage point. Implementing debt recovery process optimization strategies for financial institutions can lead to a 40% increase in payment arrangements and a 50% reduction in collection costs. By emphasizing empathy and understanding in engagements, financial organizations can utilize debt recovery process optimization strategies for financial institutions to enhance recovery rates and foster greater customer satisfaction, ultimately positioning themselves as reliable partners in their clients' financial journeys.

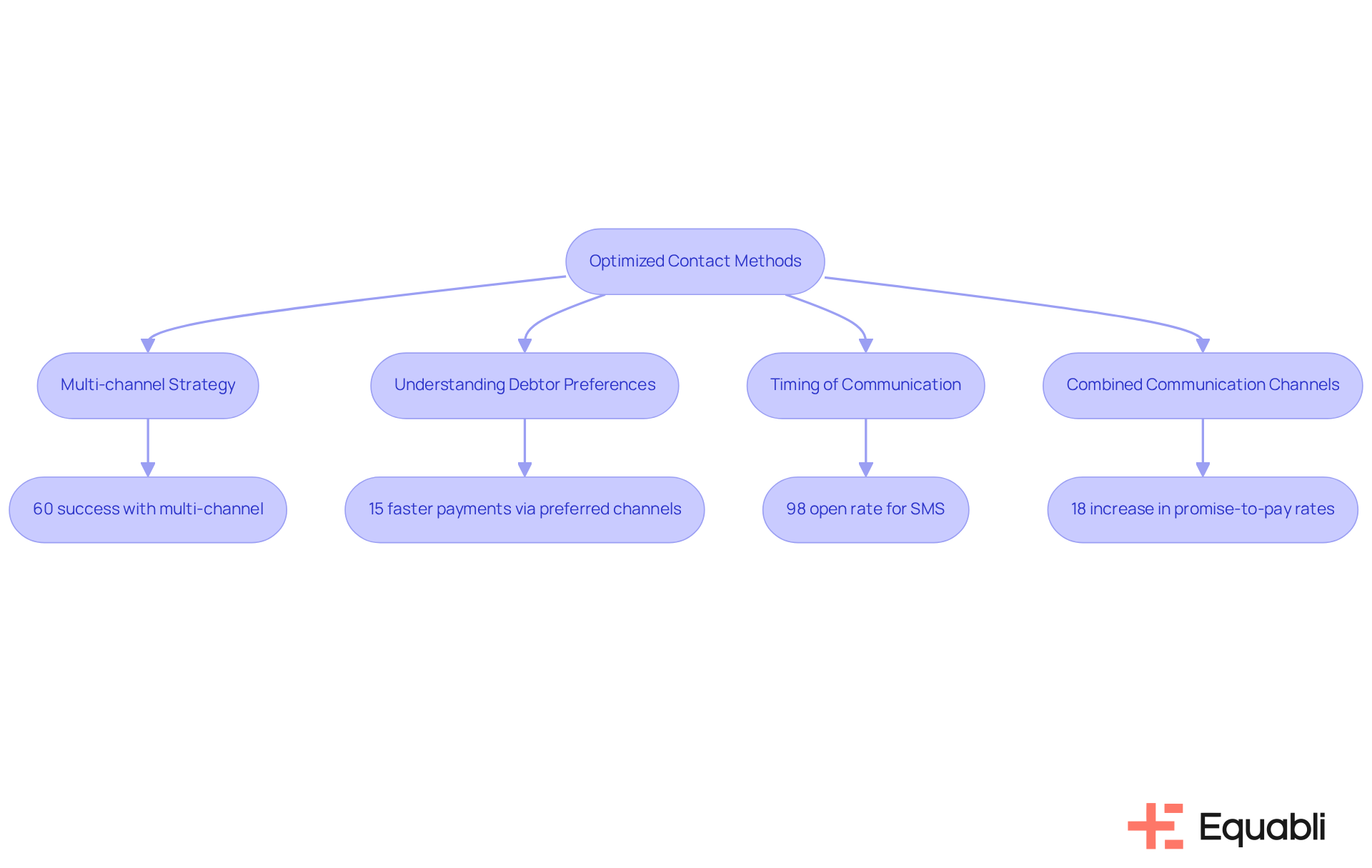

Optimized Contact Methods: Improving Communication for Debt Recovery

To enhance communication in the debt recovery process, optimization strategies for financial institutions, it is essential for organizations to implement a multi-channel strategy that includes phone calls, emails, SMS, and social media. Research indicates that 60% of successful collections are linked to debt recovery process optimization strategies for financial institutions, involving at least two distinct communication channels, which underscores the effectiveness of a diverse approach.

Understanding is critical in the context of debt recovery process optimization strategies for financial institutions, as individuals contacted through their preferred channels tend to pay 15% faster on average. Furthermore, timing is pivotal in communication success. Engaging debtors at optimal times is crucial for implementing debt recovery process optimization strategies for financial institutions, as it can significantly increase response rates, with text messages achieving an impressive 98% open rate within five minutes of delivery.

Additionally, the use of debt recovery process optimization strategies for financial institutions, which combine calls with follow-up texts, enhances promise-to-pay rates by 18%. By leveraging these insights and utilizing Equabli's EQ Collect for smarter orchestration and integrated operations, financial organizations can adopt debt recovery process optimization strategies for financial institutions to cultivate more effective interactions and improve repayment outcomes.

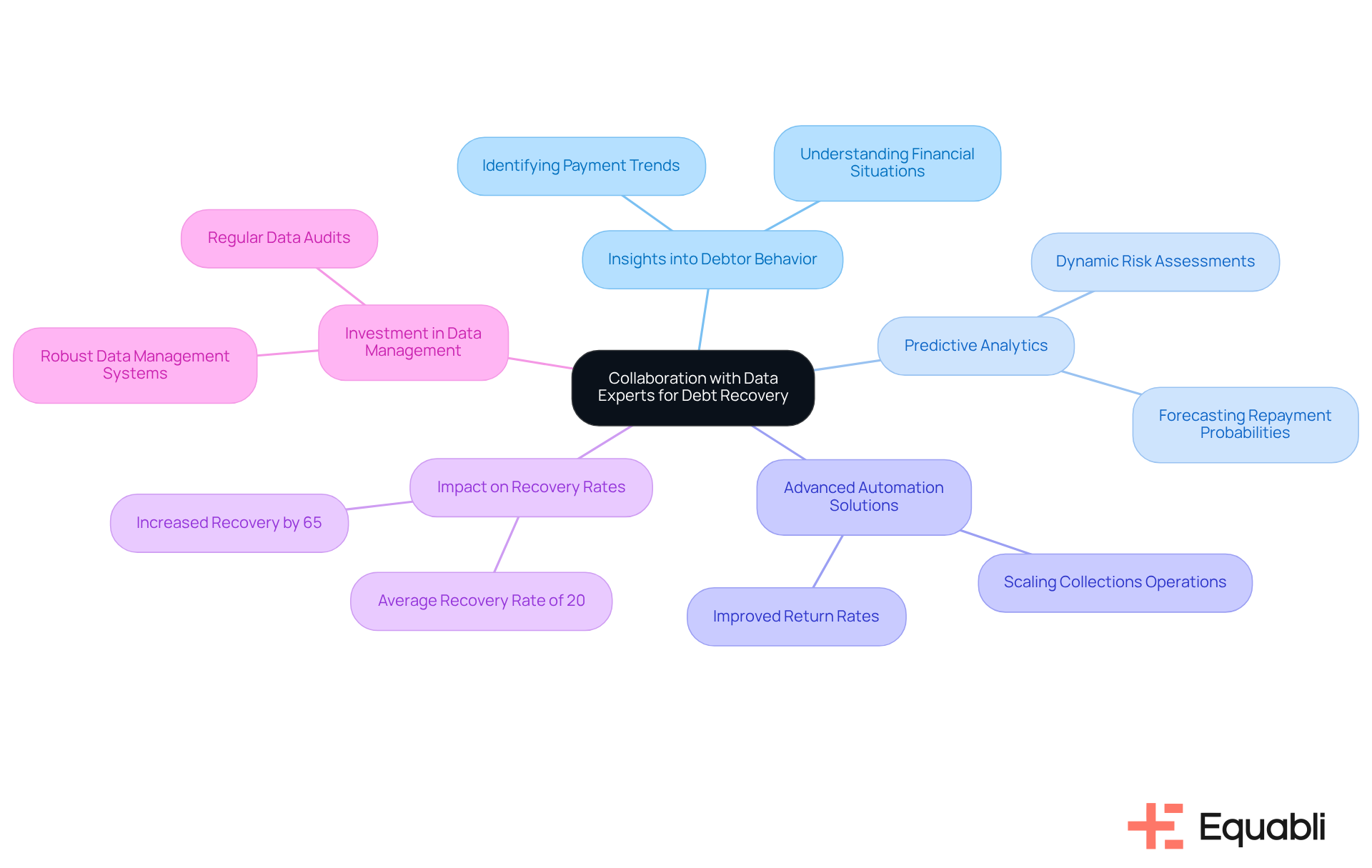

Collaboration with Data Experts: Leveraging Expertise for Debt Recovery

Collaborating with data specialists equips financial organizations with critical insights into debtor behavior and emerging trends. These specialists meticulously analyze extensive data sets to identify patterns that inform strategic decision-making. By leveraging their expertise alongside Equabli's EQ Engine, organizations can utilize debt recovery process optimization strategies for financial institutions to enhance their financial retrieval methods and develop intelligent servicing strategies, leading to improved efficiency in recoveries.

For instance, predictive analytics driven by machine learning enables organizations to forecast repayment probabilities, allowing them to prioritize high-risk accounts and customize communication strategies accordingly. Furthermore, advanced automation solutions can significantly improve return rates, empowering institutions to scale their collections operations without compromising performance.

Industry reports indicate that advanced technologies have improved financial recoveries by 65%, underscoring the substantial impact of data analysis on retrieval rates. This data-driven methodology not only enhances recovery outcomes but also promotes a more empathetic engagement with debtors, ultimately contributing to improved financial results.

As the financial recovery sector evolves, implementing debt recovery process optimization strategies for financial institutions through the integration of advanced analytics and intelligent servicing strategies will be vital for organizations aiming to stay competitive and responsive to changing consumer behaviors. To fully capitalize on these advantages, financial organizations should prioritize investments in and conduct regular audits to ensure data accuracy.

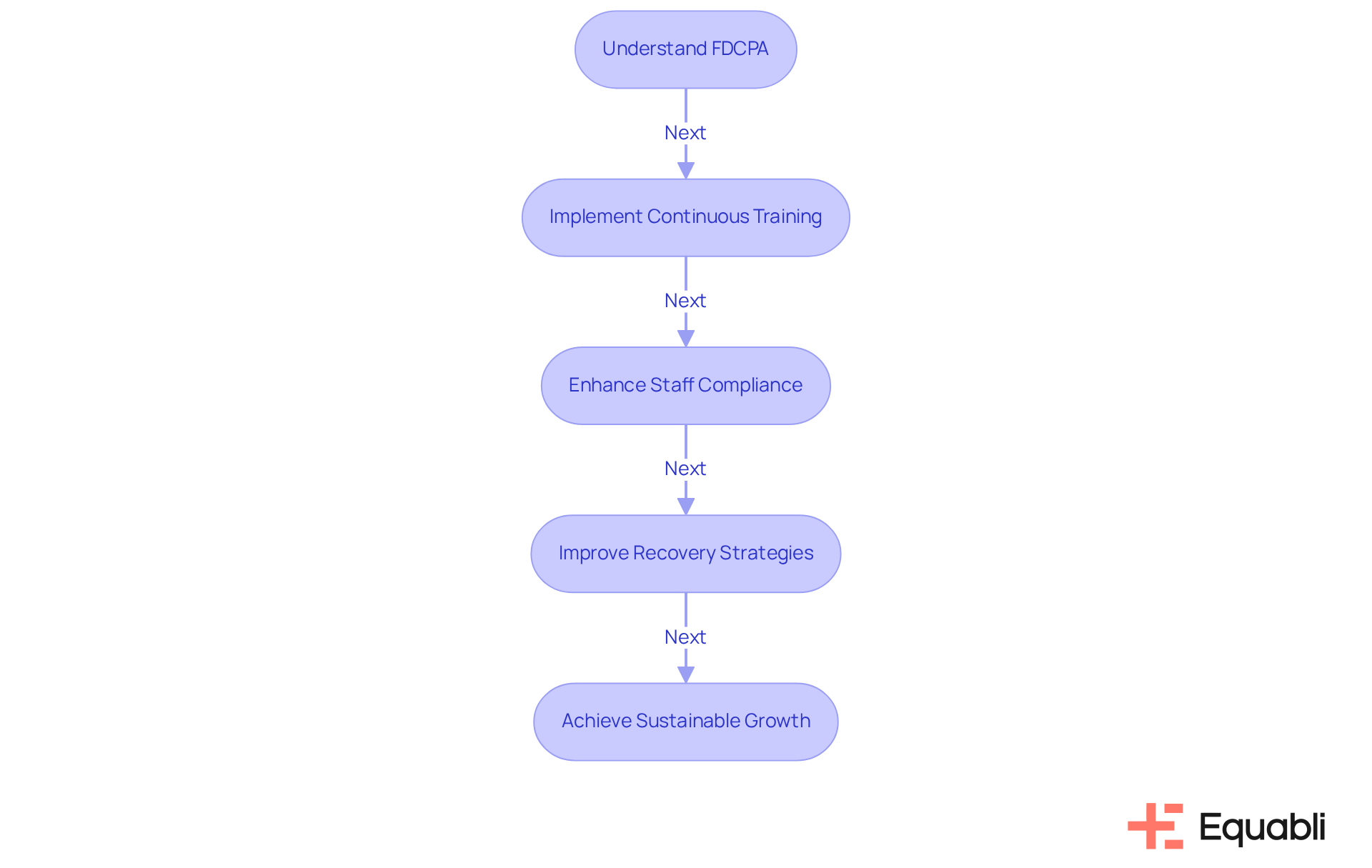

Legal Compliance: Navigating Regulations in Debt Recovery

Financial organizations must remain vigilant regarding the legal frameworks governing loan recovery methods, particularly the Fair Debt Recovery Practices Act (FDCPA). Continuous training for recovery personnel on compliance is not merely beneficial; it is essential for ensuring that all interactions with debtors adhere to legal standards. Evidence indicates that institutions prioritizing FDCPA compliance experience higher recovery rates and improved staff performance. Specifically, organizations implementing observe a significant enhancement in the effectiveness of their recovery strategies.

As of 2025, revisions to the FDCPA underscore the necessity for transparency and ethical practices in financial collections, further emphasizing the importance of ongoing education for collection teams. Institutions that allocate resources to FDCPA training not only mitigate legal risks but also bolster their reputation and cultivate trust with debtors. Industry experts assert that 'in a world inundated with liabilities, power shifts to lenders,' highlighting the imperative for financial organizations to equip their personnel with the knowledge and resources necessary to address these challenges effectively. By prioritizing FDCPA training, financial institutions can refine their collection processes using debt recovery process optimization strategies for financial institutions to achieve sustainable growth.

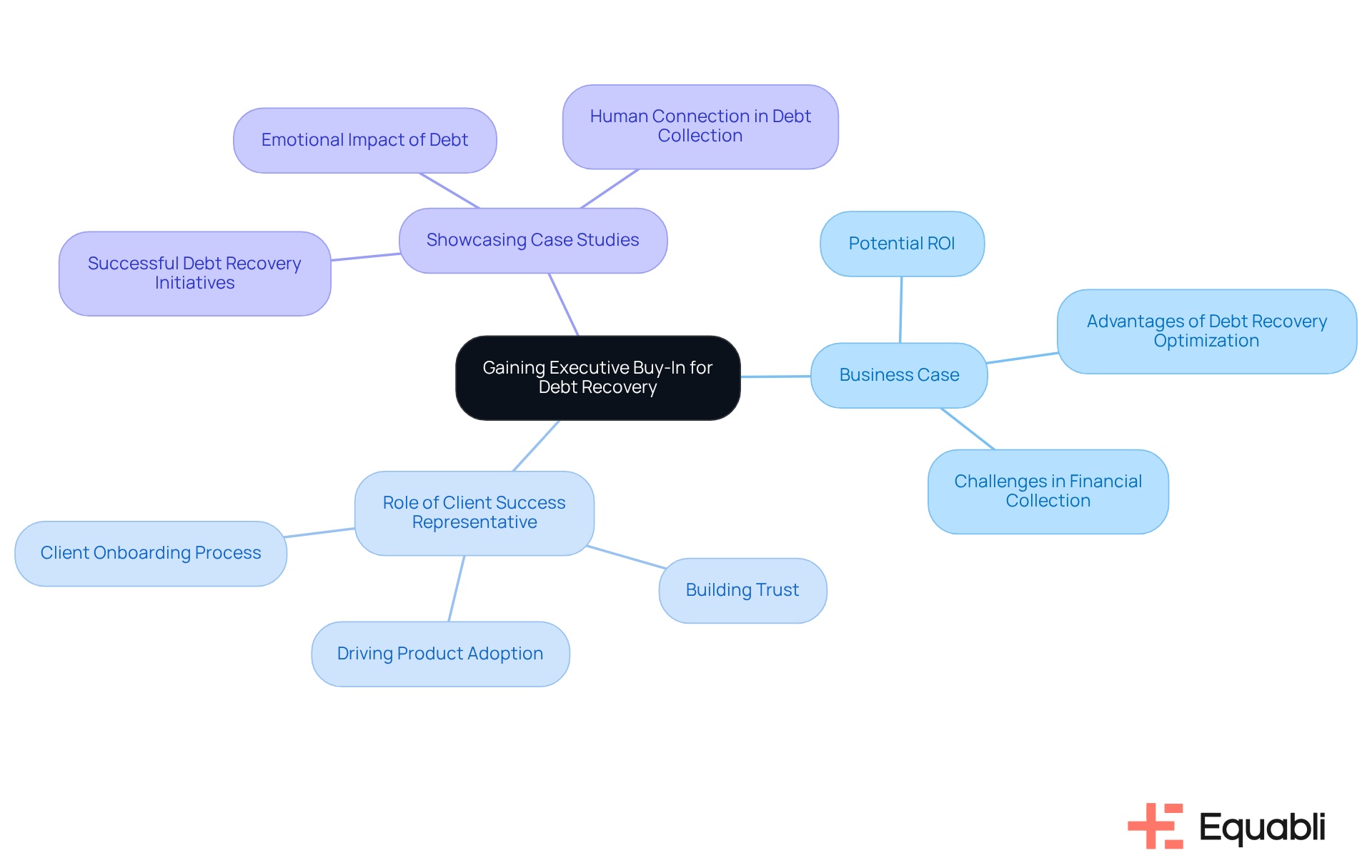

Executive Buy-In: Gaining Support for Debt Recovery Initiatives

To secure executive support for financial collection initiatives, presenting a clear business case that outlines the potential ROI and the advantages of for financial institutions is essential. Engaging executives in discussions about the challenges faced in financial collection and how proposed solutions can address these issues fosters backing.

A pivotal element of this strategy is the role of a Client Success Representative at Equabli, who spearheads the setup and implementation process during client onboarding, ensuring a seamless transition and a robust foundation for the client relationship. By managing a portfolio of customer accounts, these representatives cultivate trust and serve as primary advocates for clients, thereby driving product adoption and engagement.

Furthermore, showcasing successful case studies that highlight how dedicated client success initiatives have led to improved outcomes can further validate the effectiveness of new strategies in financial collection.

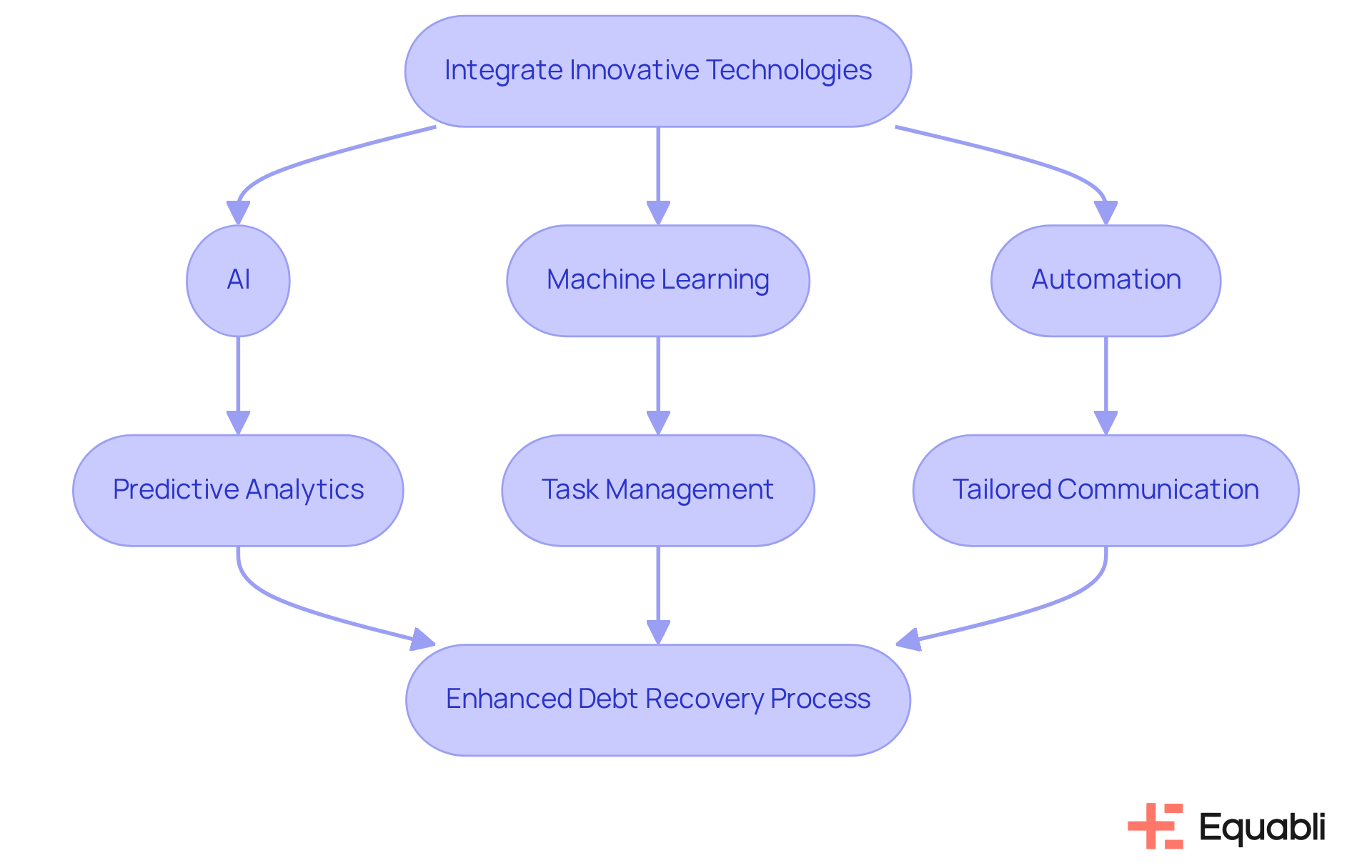

Innovative Technologies: Transforming Debt Collection for Financial Institutions

The integration of innovative technologies, particularly artificial intelligence (AI), machine learning, and automation, is essential for implementing effective debt recovery process optimization strategies for financial institutions. These advancements streamline processes by utilizing debt recovery process optimization strategies for financial institutions, significantly enhancing operational efficiency and debtor engagement. Agencies employing AI-driven predictive analytics, for instance, have reported success rates that exceed the traditional 20-30% average. This underscores the effectiveness of in prioritizing high-probability accounts.

Automation is pivotal in improving the debt recovery process optimization strategies for financial institutions by managing repetitive tasks such as payment reminders and data entry. This allows human agents to concentrate on more complex interactions. Solutions like Equabli's EQ Collect utilize a no-code file-mapping tool alongside a user-friendly, scalable, cloud-native interface, which reduces vendor onboarding timelines and automates workflows. Consequently, this minimizes execution errors and reliance on manual resources. Such a shift not only lowers operational costs but also enhances compliance through standardized communication and automated audit trails, which are essential for the effective implementation of debt recovery process optimization strategies for financial institutions in navigating regulatory requirements.

Furthermore, the application of AI in debt recovery process optimization strategies for financial institutions enables organizations to customize communication strategies based on debtor preferences, which leads to heightened engagement rates. Organizations that have implemented tailored outreach strategies have observed payment rates increase by up to 30% compared to generic methods. As financial institutions continue to embrace these technologies, they position themselves to thrive in a competitive environment, ensuring they meet evolving consumer expectations while upholding robust compliance frameworks.

Conclusion

In the realm of financial institutions, optimizing the debt recovery process is not merely an operational necessity but a strategic imperative. By embracing innovative tools and methodologies, such as Equabli's EQ Suite, organizations can significantly enhance their recovery efforts, streamline operations, and improve borrower engagement. The integration of advanced technologies and tailored strategies positions these institutions to navigate the complexities of debt recovery effectively.

Key strategies highlighted throughout the article include:

- The importance of data quality

- The benefits of multi-channel communication

- The necessity of training recovery teams

Segmenting debtors and utilizing predictive analytics further empower financial organizations to make informed decisions, ultimately leading to higher recovery rates and improved customer satisfaction. Each strategy reinforces the central theme of optimizing debt recovery processes to achieve better financial outcomes while maintaining compliance and fostering positive relationships with debtors.

As financial institutions continue to evolve, the call to action is clear: prioritize the implementation of these optimization strategies. By investing in robust data management systems and leveraging advanced analytics, organizations can not only enhance their operational efficiency but also adapt to the changing landscape of consumer expectations. This proactive approach will ensure that they remain competitive and responsive, ultimately transforming the debt recovery process into a more effective and empathetic endeavor.

Frequently Asked Questions

What is Equabli's EQ Suite and what does it offer?

Equabli's EQ Suite is a comprehensive set of tools designed for optimizing debt recovery processes for financial institutions. It includes the EQ Engine, EQ Engage, and EQ Collect, allowing organizations to implement customized scoring models, refine collection strategies, and facilitate digital collections through self-service repayment plans.

How does EQ Collect enhance operational efficiency?

EQ Collect features a no-code file-mapping tool and automated monitoring capabilities that significantly improve operational efficiency and compliance oversight for financial institutions.

What benefits does the EQ Suite provide to financial institutions?

The EQ Suite helps institutions reduce operational costs, improve borrower engagement, streamline workflows, and ensure real-time data access, ultimately modernizing debt collection efforts and enhancing financial outcomes.

What is the importance of segmenting debtors in debt collection?

Segmenting debtors based on their repayment behavior and risk profiles allows organizations to customize strategies that align with individual financial circumstances, significantly enhancing collection rates and operational efficiency.

Why is multi-channel communication important in debt collection?

Engaging debtors through their preferred communication channels (such as SMS, email, or phone calls) improves customer satisfaction and flexibility, allowing debtors to settle accounts on their terms.

What role do flexible payment plans play in debt recovery?

Offering customized repayment options that accommodate various financial situations helps organizations recover debts while maintaining respectful relationships with debtors, which can lead to future business opportunities.

How should organizations monitor their debt recovery performance?

Organizations should regularly evaluate retrieval strategies by tracking key performance indicators (KPIs) such as recovery rates and debtor engagement levels to identify opportunities for refinement and enhance operational efficiency.

Why is training important for debt collection teams?

Continuous training in compliance and customer service equips staff with the necessary skills to handle complex cases effectively, improving interactions with debtors and increasing repayment success.

How does predictive analytics enhance debt recovery?

Predictive analytics uses historical data to forecast future repayment behaviors, allowing organizations to identify high-risk accounts and prioritize their recovery strategies, thereby enhancing operational efficiency.

What are essential steps for implementing predictive analytics in debt recovery?

Financial institutions should regularly audit their data sources and invest in robust data management solutions to ensure the quality and accuracy of insights derived from predictive analytics.