Overview

The article delineates three pivotal strategies for effective bad debt recovery within corporate finance:

- Establishing clear communication channels

- Implementing customized payment plans

- Leveraging data-driven insights

Evidence substantiates that these strategies significantly enhance repayment rates and foster improved relationships with clients. Moreover, advancements in technology, such as automated communication tools and predictive analytics, further optimize the recovery process, aligning operational practices with compliance requirements.

Introduction

The financial landscape presents significant challenges, particularly in managing bad debts, which constitute an average of 9% of credit-based B2B sales in the U.S. For organizations, the stakes are considerable; effective recovery strategies not only safeguard cash flow but also preserve essential client relationships. As economic conditions fluctuate and borrower behaviors evolve, companies must adapt their approaches to optimize debt recovery. This article explores three key strategies that harness communication, technology, and data-driven insights to enhance bad debt recovery efforts in corporate finance.

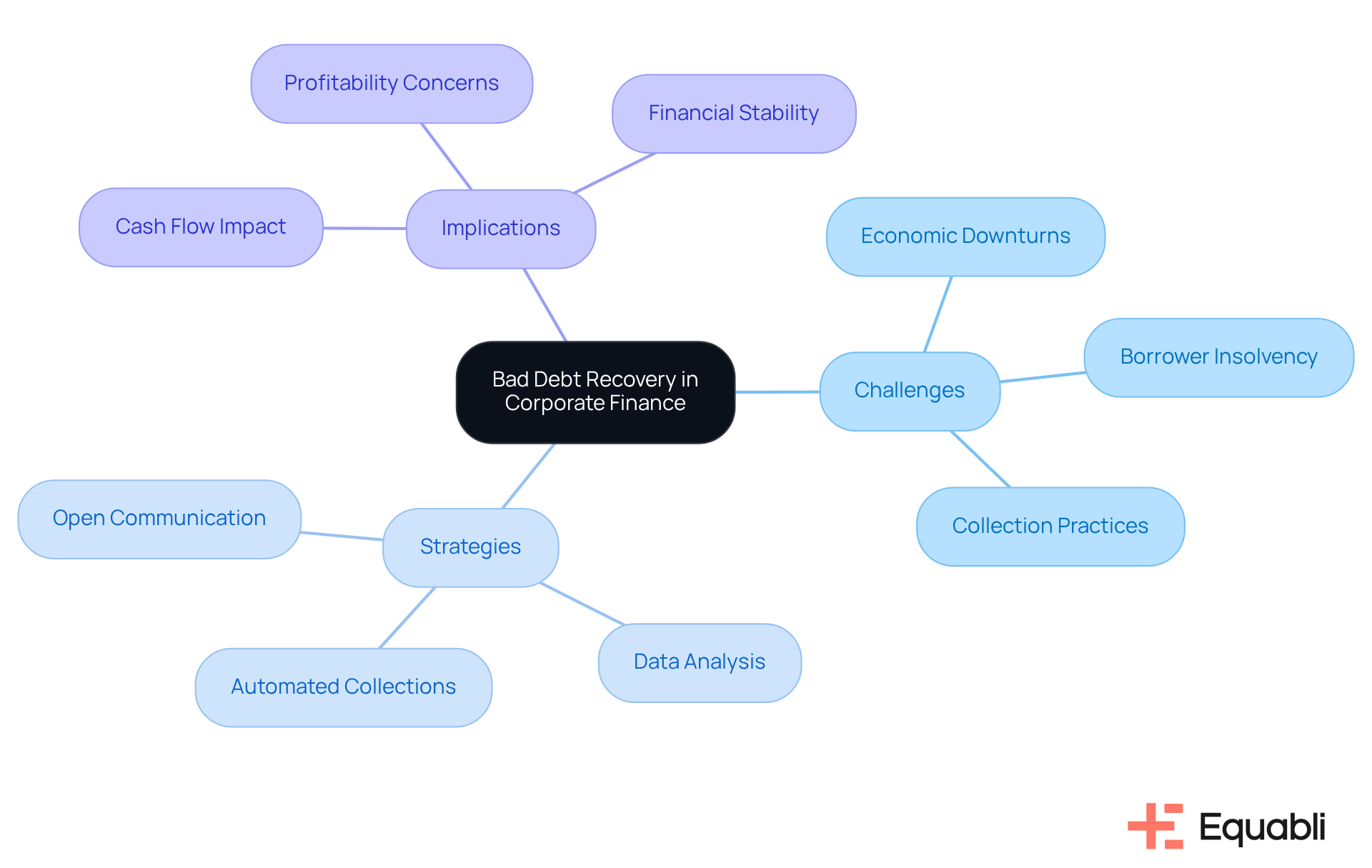

Understanding Bad Debt Recovery in Corporate Finance

Poor credit recovery in corporate finance involves the strategies for effective bad debt recovery in corporate finance that organizations employ to recover funds that are owed but are unlikely to be paid. This challenge is often intensified by economic downturns, borrower insolvency, and ineffective collection practices. For financial institutions, comprehending the implications of poor credit is essential, as it significantly impacts cash flow, profitability, and overall financial stability. In fact, bad debts constitute an average of 9% of all credit-based B2B sales in the US, highlighting the financial risks involved.

Strategies for effective bad debt recovery in corporate finance not only mitigate losses but also enhance relationships with borrowers by fostering open communication and understanding. As economic conditions evolve, organizations must adapt their approaches; for instance, 55% of businesses foresee an increase in Days Sales Outstanding (DSO) in 2024, highlighting the pressing need for strategies for effective bad debt recovery in corporate finance.

By leveraging historical data and analyzing repayment behaviors, financial institutions can more effectively anticipate challenges and tailor their collection efforts. Successful examples include banks that have implemented automated collections systems, recovering amounts 30% faster and at a 25% reduced cost compared to traditional methods. This strategic shift not only improves cash flow but also empowers institutions to adeptly , ensuring resilience and growth in a challenging economic landscape.

Proven Strategies for Effective Debt Recovery

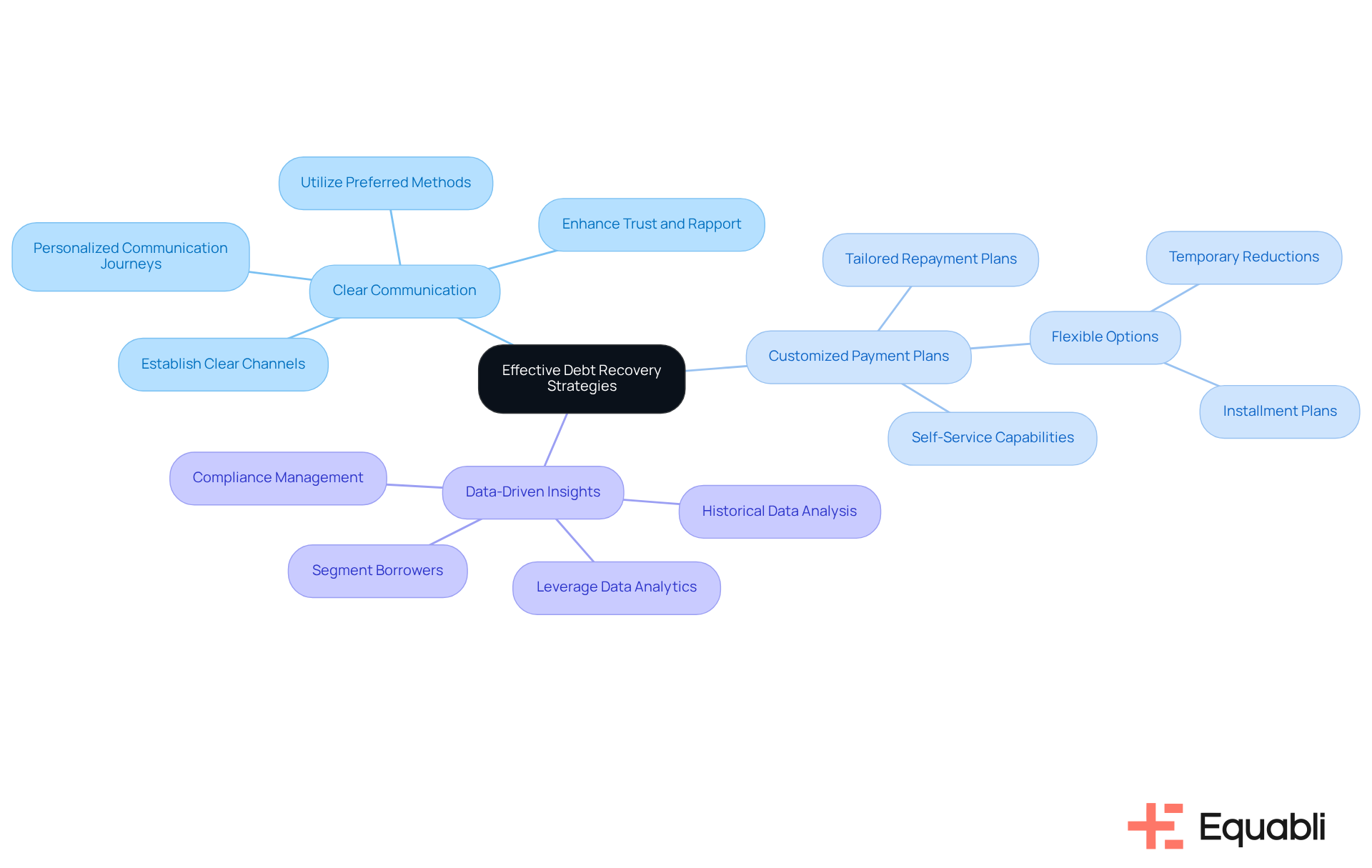

- Establishing clear communication channels is essential for the strategies for effective bad debt recovery in corporate finance. Organizations must establish clear and consistent channels for interacting with clients, utilizing their preferred methods—be it phone calls, emails, or text messages. Evidence shows that with EQ Engage, financial institutions can design, automate, and execute client contact strategies, thereby enhancing trust and rapport. This approach, as part of strategies for effective bad debt recovery in corporate finance, not only increases the probability of repayment but also cultivates a stronger relationship with clients through personalized communication journeys, ultimately raising repayment rates.

- Implementing customized payment plans is one of the strategies for effective bad debt recovery in corporate finance, as tailoring repayment plans to suit the unique financial situations of individuals can significantly enhance recovery rates. By leveraging EQ Engage's capabilities to extend customized discounts and flexible repayment options, such as installment plans or temporary reductions in payment amounts, organizations can motivate clients to engage and fulfill their obligations. This strategy enables individuals to self-service with customized repayment plans, making the process more manageable and attractive.

- Utilizing is vital for developing strategies for effective bad debt recovery in corporate finance by leveraging data analytics to gain insights into loan recipient behavior and repayment patterns. EQ Engage's analytics engine empowers entities to segment and target borrowers based on performance history and behavior, facilitating the creation of focused strategies that resonate with specific borrower segments. Furthermore, compliance management functionalities ensure that entities adhere to regulations while examining historical data to recognize trends and enhance results, ultimately maximizing NPV in asset collection.

Leveraging Technology for Enhanced Debt Recovery

Incorporating technology into strategies for effective bad debt recovery in corporate finance can lead to significant improvements in both efficiency and effectiveness. Automated communication tools serve as a pivotal advancement in this domain. Utilizing automated messaging systems allows organizations to maintain consistent communication with clients while reducing the workload on staff. These tools can send reminders, payment confirmations, and follow-up messages, ensuring that individuals stay informed about their obligations. Digital-first communication tools provide 24/7 support and flexible payment options, thereby enhancing borrower engagement. As noted by industry leaders, "Borrowers today demand more than robotic reminders—they expect understanding, context, and flexibility."

Another critical advancement is the implementation of cloud-based debt collection solutions. By adopting cloud-native platforms, such as Equabli's EQ Collect, entities can utilize strategies for effective bad debt recovery in corporate finance to manage their collections more effectively. EQ Collect features a simple, no-code file-mapping tool that reduces vendor onboarding timelines and improves efficiency. With and customer data, teams can track progress, analyze performance metrics, and implement strategies for effective bad debt recovery in corporate finance as needed. The platform's automated workflows minimize execution errors and manual resources, while its industry-leading compliance oversight ensures secure operations. Additionally, the user-friendly, scalable interface of EQ Collect enhances agility and responsiveness in debt management, facilitating seamless integration with existing systems.

Finally, employing predictive analytics allows organizations to forecast repayment behaviors and identify high-risk accounts early. Advanced analytics assist in identifying at-risk accounts and enhancing collection efforts, which are crucial strategies for effective bad debt recovery in corporate finance, facilitating proactive engagement with borrowers. This insight increases the chances of successful recovery before debts become severely delinquent, making it easier for financial institutions to navigate the complexities of debt management in today's economic landscape. However, organizations should also be aware of potential pitfalls, such as data quality issues and the need for staff training to effectively utilize these technologies.

Conclusion

Implementing effective strategies for bad debt recovery in corporate finance is essential for maintaining financial stability and fostering positive relationships with clients. Organizations must recognize the importance of adapting their approaches to meet the evolving challenges of the economic landscape, ensuring that they not only recover owed funds but also enhance communication and trust with borrowers.

The article highlights three key strategies for successful debt recovery:

- Establishing clear communication channels

- Implementing customized payment plans

- Leveraging data-driven insights

By prioritizing open dialogue, tailoring repayment options, and utilizing analytics to understand borrower behavior, financial institutions can significantly improve their recovery rates. Furthermore, the integration of technology, such as automated communication tools and cloud-based solutions, enhances efficiency and effectiveness in debt management.

Ultimately, the significance of effective bad debt recovery extends beyond mere financial metrics; it plays a crucial role in the overall health of an organization. As businesses navigate the complexities of debt recovery, embracing these strategies and technologies will not only safeguard their financial interests but also foster a culture of understanding and cooperation with clients. Taking proactive steps toward improving bad debt recovery processes is not just a best practice—it is a vital investment in the future resilience and growth of any organization.

Frequently Asked Questions

What is bad debt recovery in corporate finance?

Bad debt recovery in corporate finance refers to the strategies organizations use to recover funds that are owed but are unlikely to be paid, especially during economic downturns or borrower insolvency.

Why is understanding poor credit recovery important for financial institutions?

Understanding poor credit recovery is essential for financial institutions because it significantly impacts cash flow, profitability, and overall financial stability.

What percentage of credit-based B2B sales in the US constitutes bad debts?

Bad debts constitute an average of 9% of all credit-based B2B sales in the US.

How can organizations enhance their bad debt recovery efforts?

Organizations can enhance their bad debt recovery efforts by fostering open communication with borrowers and adapting their strategies to changing economic conditions.

What trend is anticipated regarding Days Sales Outstanding (DSO) in 2024?

In 2024, 55% of businesses foresee an increase in Days Sales Outstanding (DSO), indicating a pressing need for effective bad debt recovery strategies.

How can historical data be utilized in bad debt recovery?

Financial institutions can leverage historical data and analyze repayment behaviors to better anticipate challenges and tailor their collection efforts.

What are some successful methods used in bad debt recovery?

Successful methods include the implementation of automated collections systems, which can recover amounts 30% faster and at a 25% reduced cost compared to traditional methods.

What benefits do strategic shifts in bad debt recovery provide to financial institutions?

Strategic shifts in bad debt recovery improve cash flow and empower institutions to manage challenges of poor financial collections, ensuring resilience and growth in a challenging economic landscape.