Overview

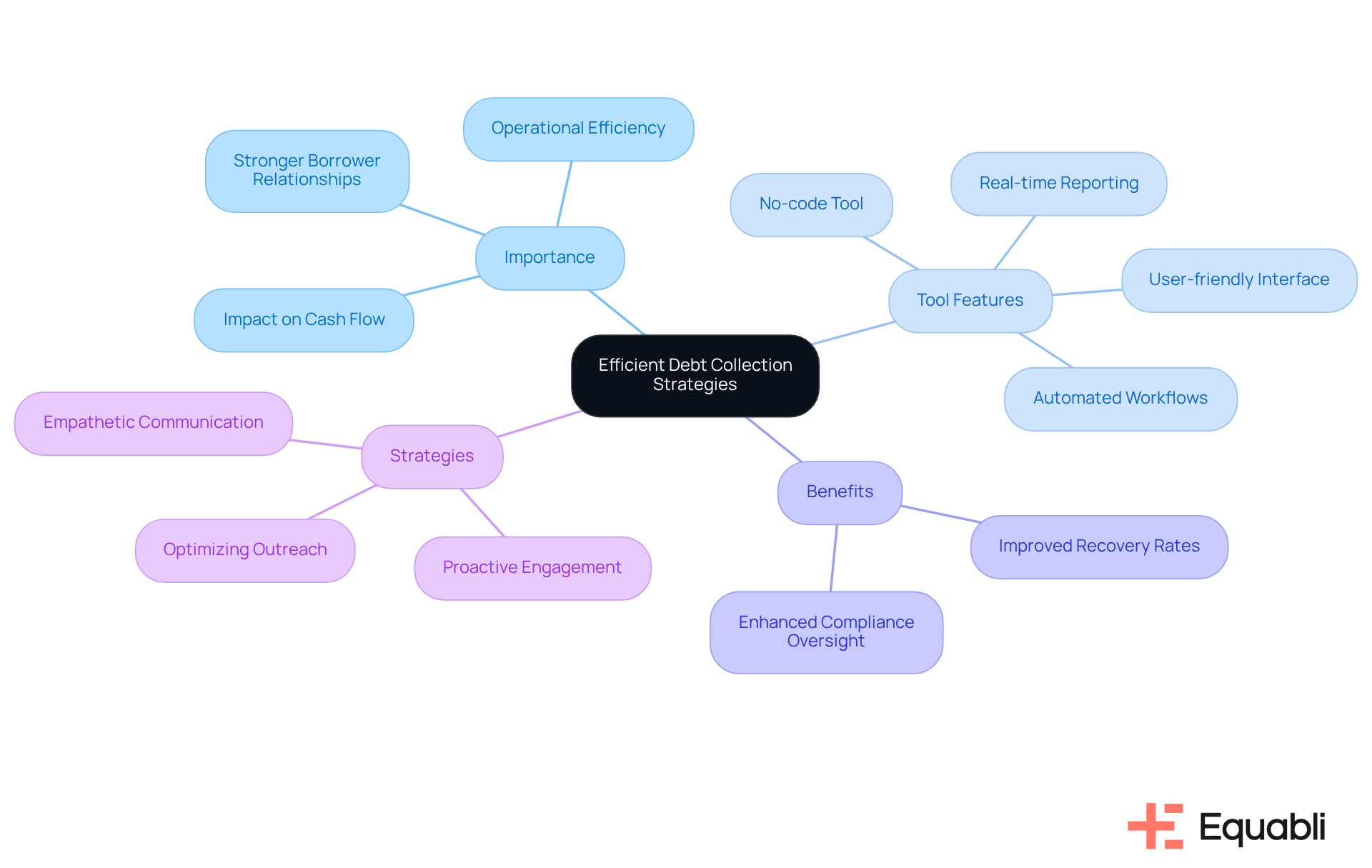

The article emphasizes the enhancement of collections efficiency for financial institutions through the implementation of various proven strategies. These include:

- Improved communication

- Flexible payment options

- Automation

- Data analysis

Evidence supports that these strategies can significantly increase recovery rates, streamline operations, and foster better relationships with borrowers. Ultimately, these improvements lead to stronger financial outcomes, underscoring the importance of strategic debt collection practices.

Introduction

Efficient debt collection is not merely a necessity for financial institutions; it serves as a critical component that directly influences cash flow and operational success. By implementing proven strategies to enhance collections efficiency, organizations can substantially decrease the time and resources allocated to retrievals, ultimately resulting in improved recovery rates and stronger borrower relationships. As the financial landscape continues to evolve, it is essential to consider the most effective methods for institutions to navigate the complexities of debt recovery while ensuring compliance and fostering trust.

Understand the Importance of Efficient Debt Collection Strategies

Effective debt recovery methods are essential for financial organizations, significantly impacting cash flow and operational expenses. By implementing strategies to [enhance collections process efficiency for financial institutions](https://equabli.com/eqsuite), organizations can minimize the time and resources allocated to retrievals, leading to enhanced recovery rates. A well-structured approach to fund collection not only improves financial outcomes but also fosters stronger relationships with borrowers by prioritizing communication and understanding their financial circumstances. This trust and loyalty are vital in today's competitive landscape.

Utilizing can substantially improve these strategies. Its features include:

- A user-friendly, scalable, cloud-native interface

- A no-code file-mapping tool that expedites vendor onboarding

- Automated workflows that reduce execution errors

- Real-time reporting for unparalleled transparency

These capabilities enable financial institutions to adopt strategies to enhance collections process efficiency for financial institutions. Additionally, the platform ensures top-tier compliance oversight through automated monitoring, allowing organizations to focus on strategic recovery efforts rather than manual tasks.

For instance, a study by Experian highlighted that organizations employing robust retrieval strategies experienced a 30% increase in recovery rates compared to those relying on traditional methods. This underscores the importance of adopting contemporary strategies to enhance collections process efficiency for financial institutions, particularly in a rapidly evolving financial environment. By integrating intelligent automation and data-driven strategies, institutions can revolutionize their debt recovery processes and enhance recovery strategies through NPV optimization and account-level lifetime value analysis.

Implement Proven Best Practices for Enhanced Collections Efficiency

To enhance collections efficiency, financial institutions should consider implementing the following best practices:

- Prioritize Communication: Establish clear and consistent communication channels with clients. Evidence indicates that strategies to enhance collections process efficiency for financial institutions, such as regular updates and reminders, can significantly improve repayment rates; personalized messages sent through clients' preferred communication channels can elicit responses from up to 80% of delinquent accounts. Equabli's EQ Engage provides personalized communication tools that enhance engagement, ensuring that messages resonate with individual needs.

- Flexible Payment Options: Providing various payment methods and plans accommodates diverse client needs. This adaptability can lead to increased repayment rates, as individuals are more inclined to pay when financial institutions implement strategies to enhance collections process efficiency that suit their financial circumstances. With EQ Collect, institutions can implement that cater to varied borrower situations, further enhancing recovery efforts.

- Automate Processes: Transitioning from manual debt retrieval to automation simplifies the payment acquisition process. Utilizing automation tools for reminders, payment processing, and reporting is one of the strategies to enhance collections process efficiency for financial institutions, saving time and reducing human error while allowing staff to concentrate on more complex cases. The EQ Suite's advanced retrieval software can decrease operational expenses by as much as 90% and manage up to 70% of customer interactions independently, significantly enhancing efficiency and enabling a more intelligent recovery strategy.

- Employing data analysis to recognize patterns is one of the strategies to enhance collections process efficiency for financial institutions. By analyzing repayment behaviors, institutions can tailor their strategies to different borrower segments, improving overall effectiveness. Research shows that strategies to enhance collections process efficiency for financial institutions can yield a 15-25% improvement in recovery rates by swiftly identifying and resolving bottlenecks—a capability supported by the EQ Suite through its data-driven insights.

- Training and Development: Investing in training for recovery personnel ensures they are equipped with the latest techniques and compliance knowledge. Well-trained personnel can manage recoveries more efficiently and compassionately, enhancing borrower interactions. Training agents to handle debt-related discussions with empathy can reduce tensions and foster constructive conversations, ultimately leading to improved outcomes in debt collection. Equabli's expert team offers support and guidance to ensure that staff are prepared to utilize the EQ Suite effectively.

Leverage Technology and Data Analytics to Optimize Collection Strategies

In today's digital environment, leveraging technology and data analytics is imperative for implementing strategies to enhance collections process efficiency for financial institutions. Key areas where technology can significantly enhance efficiency include:

- Predictive Analytics: Employ predictive analytics to anticipate repayment behaviors and identify high-risk accounts. Collections groups utilize predictive models that assess multiple variables to pinpoint individuals likely to default. This enables institutions to implement strategies to enhance collections process efficiency for financial institutions, thereby strategically prioritizing their recovery efforts and resulting in improved recovery rates.

- Automated Communication Tools: Integrate chatbots and automated messaging systems to manage routine inquiries and follow-ups. These tools efficiently handle a high volume of communications, ensuring borrowers receive while alleviating the workload on staff. Notably, organizations employing AI-driven communication have reported a 40% increase in payment agreements, with 11% of debt recovery firms utilizing AI for functions such as payment reminders.

- Customer Relationship Management (CRM) Systems: Invest in CRM systems that seamlessly integrate with gathering processes. These systems provide a comprehensive view of borrower interactions, which supports strategies to enhance collections process efficiency for financial institutions through more personalized communication approaches that improve customer engagement.

- Data Visualization Tools: Utilize data visualization tools to analyze performance metrics of the gathered information. Visualizing data enables institutions to swiftly identify trends, bottlenecks, and areas for improvement, which is essential for developing strategies to enhance collections process efficiency for financial institutions and facilitating data-driven decision-making. For instance, organizations that effectively leverage data visualization can quickly adapt their strategies based on real-time insights.

- Compliance Management Software: Implement compliance management software to stay informed about changes in debt recovery regulations and automate compliance reporting. This proactive approach utilizes strategies to enhance collections process efficiency for financial institutions, minimizing legal risks and enhancing operational efficiency, while ensuring that compliance protocols are integrated within analytics platforms, allowing compliance and efficiency to coexist seamlessly in modern debt collection practices.

- Speech Analytics: Deploy speech analytics to extract insights from customer conversations. This technology identifies keywords and emotions, assisting agents in making informed decisions, such as offering restructured repayment plans to customers facing financial hardships. This proactive measure helps prevent defaults and potential lawsuits.

Conclusion

Enhancing collections efficiency is paramount for financial institutions aiming to sustain robust cash flow and minimize operational costs. By adopting innovative strategies and leveraging technology, organizations can streamline their debt recovery processes, cultivate positive relationships with borrowers, and ultimately enhance financial outcomes. This multifaceted approach not only maximizes recovery rates but also positions institutions competitively within a rapidly evolving financial landscape.

The article delineates several best practices that can significantly enhance collections efficiency. Key strategies encompass:

- Prioritizing effective communication with clients

- Offering flexible payment options

- Automating processes

- Utilizing data analysis for tailored approaches

- Investing in personnel training

Each of these components plays a critical role in establishing a more responsive and effective collections framework, enabling institutions to adapt to diverse borrower needs and bolster their recovery efforts.

As financial institutions navigate the complexities of debt collection, embracing technology and data analytics emerges as a transformative solution. The integration of predictive analytics, automated communication tools, and robust CRM systems can empower organizations to make informed decisions and optimize their strategies. By prioritizing these advancements, institutions can not only enhance their collections efficiency but also foster trust and loyalty among borrowers, ultimately contributing to a healthier financial ecosystem.

Frequently Asked Questions

Why are efficient debt collection strategies important for financial organizations?

Efficient debt collection strategies are crucial for financial organizations as they significantly impact cash flow and operational expenses, minimizing the time and resources allocated to debt retrievals and enhancing recovery rates.

How do effective debt recovery methods benefit relationships with borrowers?

A well-structured approach to debt collection improves financial outcomes and fosters stronger relationships with borrowers by prioritizing communication and understanding their financial circumstances, which builds trust and loyalty.

What tools can improve debt collection strategies?

Tools like EQ Collect can enhance debt collection strategies through features such as a user-friendly, scalable interface, a no-code file-mapping tool for vendor onboarding, automated workflows to reduce errors, and real-time reporting for transparency.

What role does compliance oversight play in debt collection strategies?

Compliance oversight is ensured through automated monitoring, allowing organizations to focus on strategic recovery efforts rather than manual tasks, which enhances the overall efficiency of the collections process.

What evidence supports the effectiveness of robust retrieval strategies?

A study by Experian indicated that organizations employing robust retrieval strategies experienced a 30% increase in recovery rates compared to those using traditional methods, highlighting the importance of adopting contemporary strategies.

How can financial institutions revolutionize their debt recovery processes?

Financial institutions can revolutionize their debt recovery processes by integrating intelligent automation and data-driven strategies, focusing on NPV optimization and account-level lifetime value analysis to enhance recovery strategies.