Overview

This article examines advanced debt collection methodologies that significantly enhance financial risk management. By establishing strategic frameworks, leveraging technology, implementing customer-centric communication, and ensuring compliance with ethical standards, organizations can optimize their operations. Evidence suggests that integrating data analytics and AI-driven tools allows for improved retrieval processes and personalized engagement, which ultimately strengthens customer relationships. Furthermore, adherence to legal requirements is paramount, leading to better recovery outcomes. In summary, adopting these methodologies not only addresses compliance challenges but also positions organizations to navigate the complexities of enterprise-level debt collection effectively.

Introduction

In an increasingly complex financial landscape, organizations confront the dual challenge of managing debt collection while sustaining positive customer relationships. Advanced methodologies in debt collection not only enhance recovery rates but also align with broader financial risk management strategies. This intersection raises critical questions for businesses:

- How can they effectively implement these innovative approaches to navigate the intricacies of debt recovery while ensuring compliance and upholding ethical standards?

This article explores strategic frameworks, technological advancements, and customer-centric communication that empower organizations to optimize their debt collection processes and achieve sustainable success.

Establish Strategic Frameworks for Debt Collection

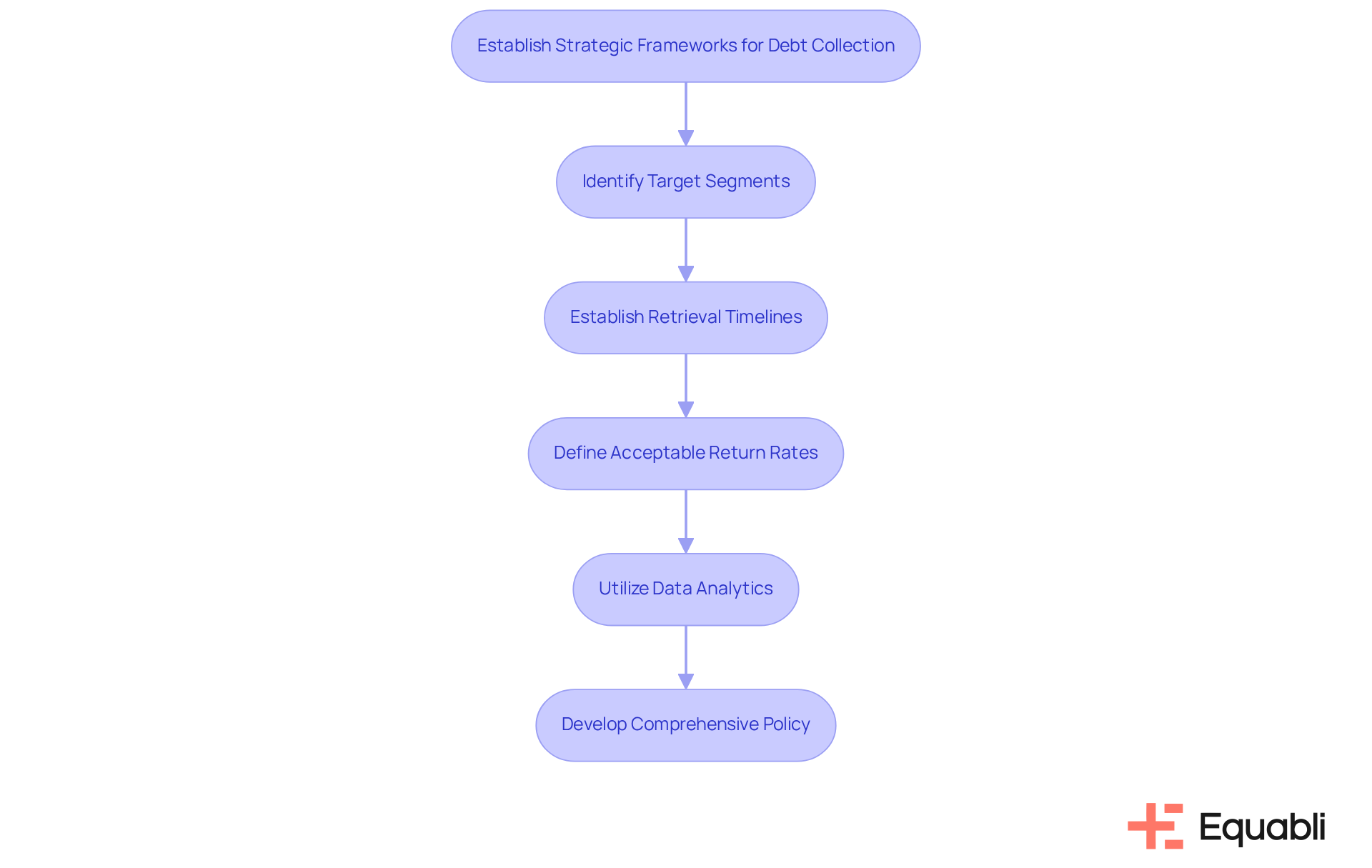

To establish an effective strategic framework for debt recovery, organizations must prioritize the definition of clear objectives that align with overarching business goals. This process involves:

- Identifying target segments

- Establishing retrieval timelines

- Defining acceptable return rates

Utilizing data analytics to evaluate past asset performance is essential for guiding these objectives, as can lead to a 15-25% improvement in retrieval rates. The case study on 'Real-Time Performance Tracking' illustrates how timely updates on customer account status can significantly enhance outcomes.

A comprehensive policy should be developed to delineate procedures for various types of debt, ensuring consistency and fairness throughout the recovery process. Regular reviews and adjustments based on performance metrics and market dynamics are vital for maintaining the framework's effectiveness and relevance. Organizations that embrace this structured approach not only improve their recovery outcomes but also cultivate positive customer relationships, ultimately supporting long-term business success.

As John Sanders emphasizes, "We know what works, and we can help you implement the right solutions—fast." By aligning collection strategies with business objectives, companies can utilize advanced debt collection methodologies for corporate financial risk management to navigate the complexities of financial risk management more effectively.

Leverage Technology for Enhanced Collection Efficiency

Investing in advanced debt collection methodologies for corporate financial risk management, such as Equabli's EQ Suite, is vital for entities looking to optimize their retrieval processes. The EQ Suite provides a comprehensive range of tools designed to automate retrieval workflows and enhance repayment strategies. For instance, the no-code file-mapping tool significantly shortens vendor onboarding timelines, while automated workflows reduce execution errors and reliance on manual resources. By leveraging AI-driven analytics, organizations can accurately predict borrower behavior, enabling them to tailor retrieval methods to individual circumstances. This level of personalization not only fosters better engagement but also boosts the probability of successful repayments.

Additionally, cloud-native platforms within the EQ Suite enable real-time data access and collaboration among team members, markedly improving operational efficiency. With unparalleled clarity and insights through , organizations can ensure smarter orchestration and enhanced performance. Regular training on these technologies is crucial, as it equips staff with the necessary skills to effectively utilize these tools, thereby amplifying their impact on outcomes. Notably, organizations that have adopted AI-driven analytics have reported improved recovery rates and reduced compliance risks, highlighting the transformative potential of advanced debt collection methodologies for corporate financial risk management in the debt collection arena.

Implement Customer-Centric Communication Strategies

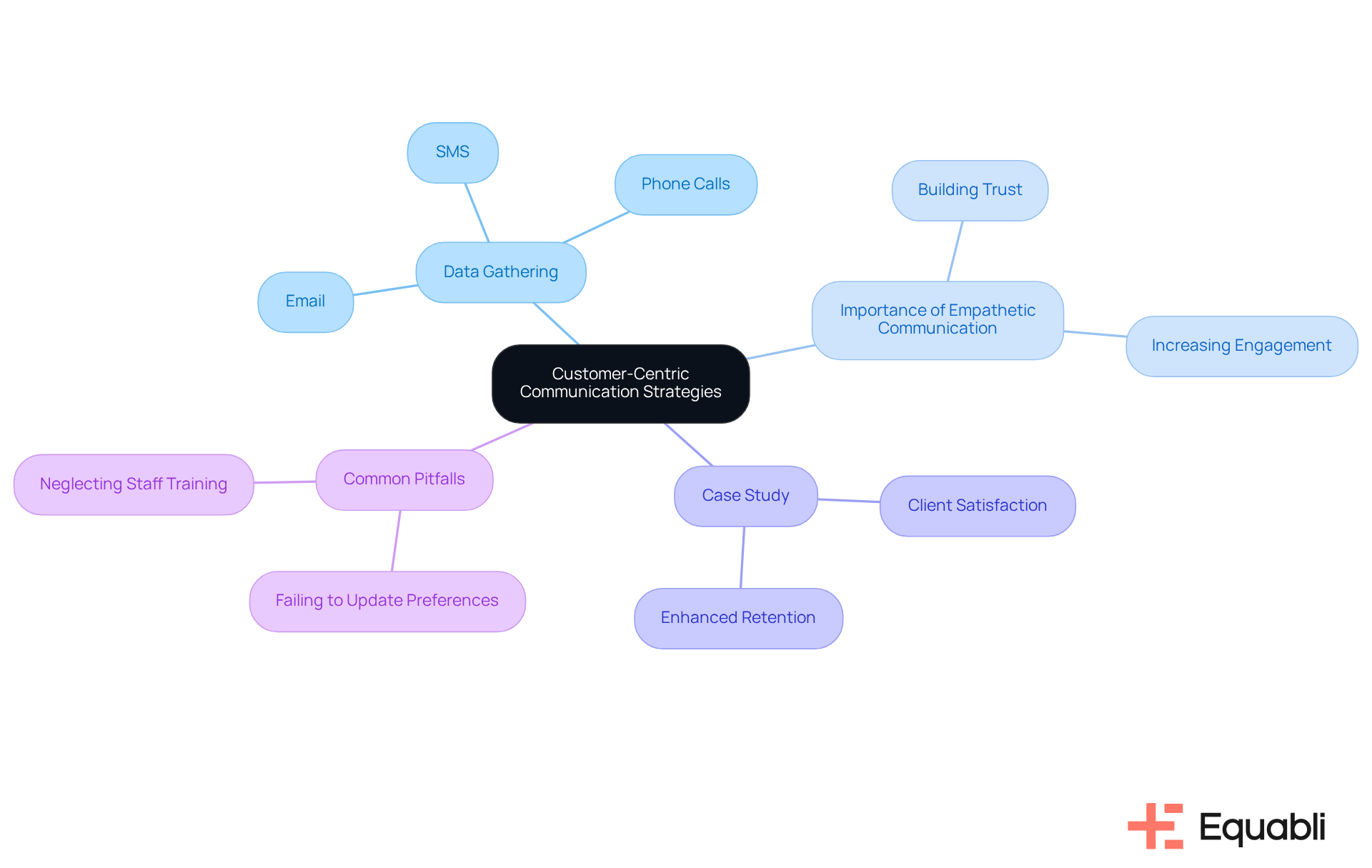

To effectively implement customer-centric communication strategies, organizations must prioritize the gathering of data on client preferences regarding communication channels such as email, SMS, or phone calls. This customized approach ensures that outreach initiatives resonate with clients, thereby improving engagement and response rates.

Industry insights indicate that customer satisfaction is a key pillar for success in the banking sector, underscoring the critical role of effective communication in enhancing recovery rates. Furthermore, employing empathetic communication methods is essential for establishing rapport and trust, significantly increasing individuals' willingness to engage in discussions about repayment alternatives.

A case study titled 'Enhancing Client Satisfaction through Customer-Centric Communication' exemplifies how a genuine customer-focused communication strategy can enhance client satisfaction and trust, ultimately improving customer retention. By providing clear and concise information about repayment plans and the potential consequences of non-payment, organizations empower individuals to make informed choices. This and contributes to higher recovery rates, as individuals feel more supported and understood throughout the repayment process.

However, organizations must remain vigilant to common pitfalls, such as:

- Failing to regularly update borrower preferences

- Neglecting to train staff in empathetic communication techniques

As these oversights can impede the effectiveness of these strategies.

Ensure Compliance and Ethical Standards in Collections

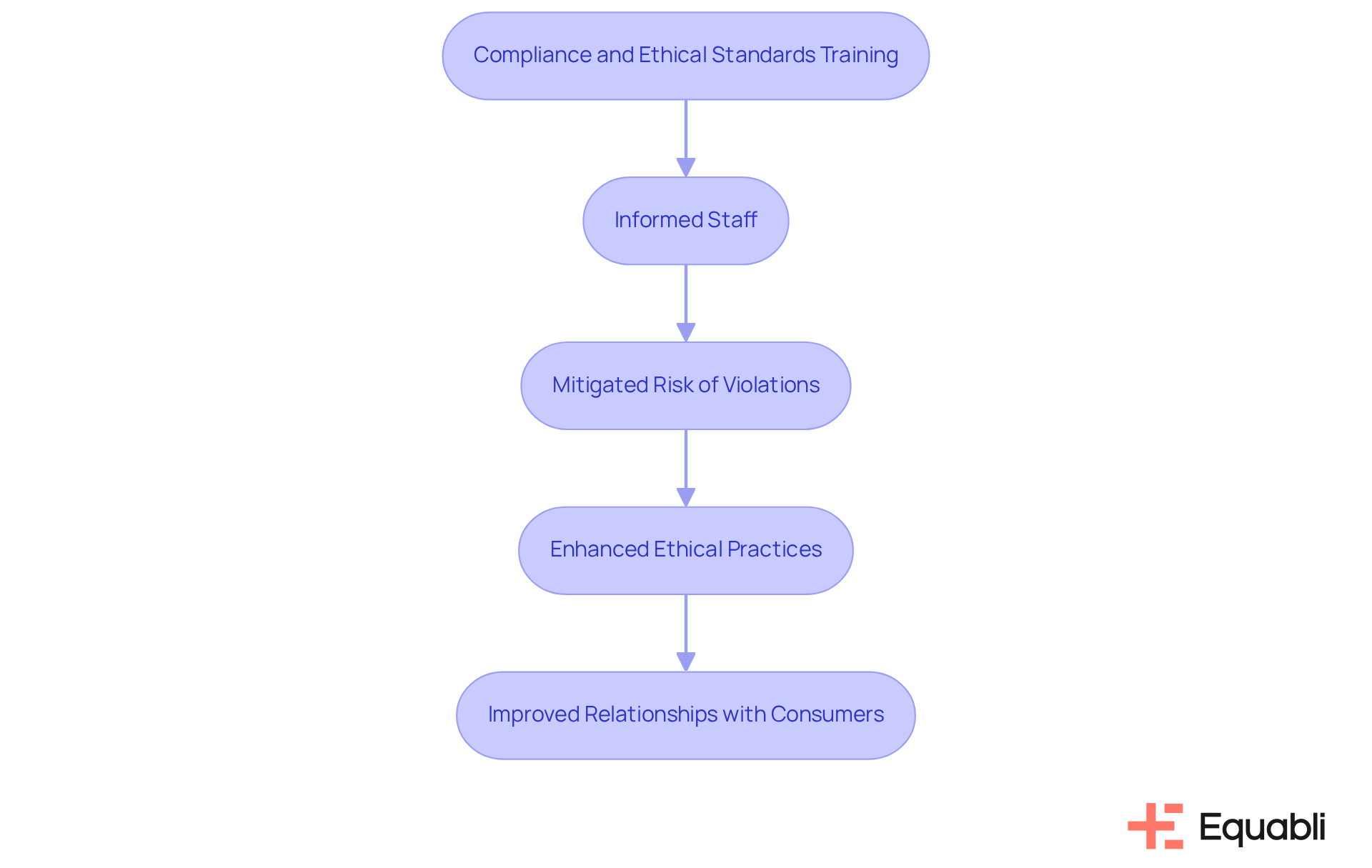

Organizations must remain vigilant regarding the legal frameworks governing debt management, particularly the Fair Debt Collection Practices Act (FDCPA) in the United States. Evidence suggests that regular training sessions focused on compliance and ethical standards are essential for ensuring all team members understand their responsibilities. Successful training initiatives demonstrate that a well-informed staff can significantly mitigate the risk of violations, thereby fostering a culture of transparency and accountability.

This proactive approach not only aids in before they escalate but also enhances ethical practices within the organization. By prioritizing these elements, companies can ensure that their collection efforts are conducted fairly and respectfully, which ultimately leads to improved relationships with consumers and better recovery outcomes.

In conclusion, maintaining a robust training framework is not merely a regulatory requirement but a strategic imperative for organizations engaged in debt collection. By embedding compliance awareness into the organizational culture, companies position themselves to navigate the complexities of the regulatory landscape effectively.

Conclusion

Establishing advanced debt collection methodologies is essential for organizations aiming to enhance their financial risk management strategies. By prioritizing strategic frameworks, leveraging technology, implementing customer-centric communication, and ensuring compliance with ethical standards, companies can significantly improve their debt recovery outcomes. This structured approach not only aligns collection efforts with business objectives but also fosters positive relationships with clients, ultimately contributing to long-term success.

Key insights from the article underscore the importance of:

- Data-driven strategies

- The role of technology in optimizing collection processes

- The necessity of empathetic communication

Organizations adopting these methodologies can anticipate:

- Improved retrieval rates

- Enhanced customer satisfaction

- A robust compliance culture

Each component, from clear objectives to the utilization of AI-driven analytics, plays a vital role in effectively navigating the complexities of debt collection.

In a rapidly evolving financial landscape, it is imperative for organizations to embrace these advanced methodologies. By doing so, they not only enhance operational efficiency but also build trust and transparency with their clients. As the debt collection industry continues to evolve, staying informed about best practices and emerging technologies will be essential for organizations seeking to thrive in this competitive environment.

Frequently Asked Questions

What is the first step in establishing a strategic framework for debt collection?

The first step is to define clear objectives that align with overarching business goals, which includes identifying target segments, establishing retrieval timelines, and defining acceptable return rates.

How can data analytics improve debt recovery outcomes?

Utilizing data analytics to evaluate past asset performance can lead to evidence-driven strategies, resulting in a 15-25% improvement in retrieval rates.

Why is it important to have a comprehensive policy for debt recovery?

A comprehensive policy ensures consistency and fairness throughout the recovery process for various types of debt, which is vital for maintaining effective and relevant practices.

How often should organizations review their debt collection frameworks?

Organizations should conduct regular reviews and adjustments based on performance metrics and market dynamics to maintain the framework's effectiveness and relevance.

What is the benefit of aligning collection strategies with business objectives?

Aligning collection strategies with business objectives allows companies to utilize advanced debt collection methodologies, enhancing their ability to navigate financial risk management complexities.

What is the impact of real-time performance tracking on debt collection?

Real-time performance tracking provides timely updates on customer account status, significantly enhancing debt recovery outcomes.

How can a structured approach to debt collection affect customer relationships?

Organizations that embrace a structured approach not only improve their recovery outcomes but also cultivate positive customer relationships, supporting long-term business success.