Overview

The article underscores the transformative impact of seven pivotal financial recovery technologies on debt collection processes. It asserts that these innovations—especially data-driven solutions such as predictive analytics and automated communication tools—significantly enhance recovery rates and borrower engagement. This optimization not only boosts the efficiency of debt collection strategies but also fortifies their effectiveness in a competitive landscape. By leveraging these technologies, organizations can navigate the complexities of debt recovery with greater confidence and success.

Introduction

The landscape of debt collection is experiencing a significant transformation, propelled by the integration of advanced financial recovery technologies. As organizations navigate the complexities of retrieving owed funds, these innovative tools promise not only to streamline processes but also to enhance communication and compliance. However, as the reliance on data-driven strategies intensifies, a critical question emerges: how can institutions effectively leverage these technologies to improve recovery rates and foster stronger relationships with borrowers? This article explores seven key technologies that are reshaping the debt collection industry, providing insights into their capabilities and the potential they hold for financial recovery in 2025 and beyond.

Equabli: Intelligent EQ Suite for Data-Driven Recovery

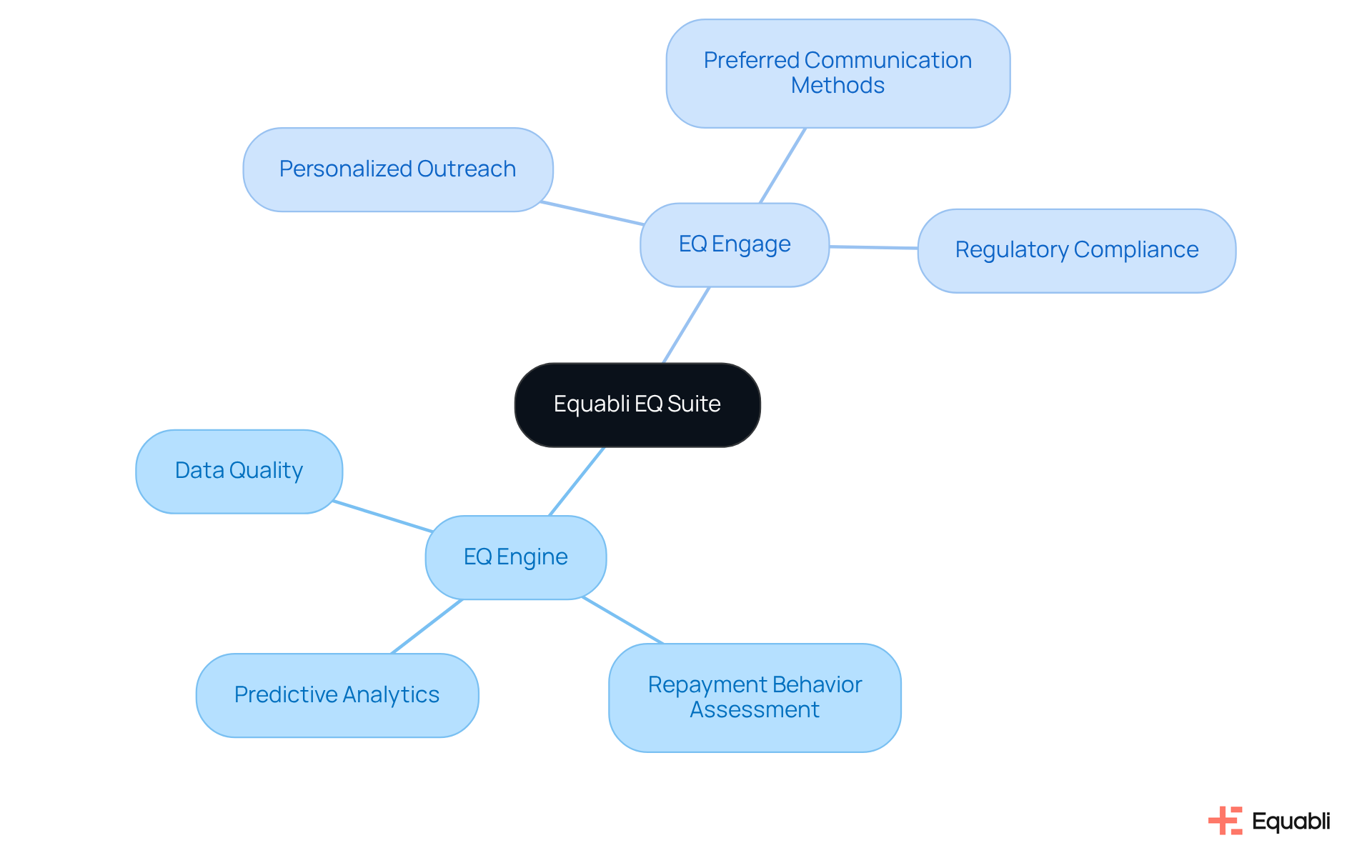

The Equabli EQ Suite stands out as a formidable platform that revolutionizes debt collection by utilizing financial recovery technologies and intelligent, data-informed strategies. At the heart of this suite lies the EQ Engine, which employs financial recovery technologies and predictive analytics to assess repayment behaviors, empowering lenders and agencies to effectively anticipate borrower actions. This capability is vital, as high-quality data is the cornerstone of developing robust predictive models that incorporate financial recovery technologies, ensuring that strategies are not only informed but also actionable.

Supporting the EQ Engine is EQ Engage, a tool crafted to elevate borrower communication through personalized outreach, leveraging financial recovery technologies. By utilizing preferred communication methods, this feature fosters deeper engagement, ultimately leading to improved success rates. The integration of these financial recovery technologies allows financial institutions to execute tailored strategies that comply with regulatory standards while maximizing operational efficiency.

Industry leaders underscore the significance of data literacy in this landscape, asserting that data is increasingly perceived as the new currency in business. As organizations navigate the complexities of debt collection, the capacity to effectively leverage financial recovery technologies becomes essential. With merely 20% of anticipated to produce business outcomes, the emphasis on high-quality data and predictive analytics is more critical than ever. The EQ Suite not only tackles these challenges but also equips clients to flourish in a competitive environment.

Financial Recovery Technologies (FRT): Class Action Recovery Solutions

Financial Recovery Technologies (FRT) is at the forefront of class action restitution solutions, offering a robust platform that leverages financial recovery technologies to maximize returns for institutional investors. Their comprehensive suite of services includes:

All powered by advanced technology that simplifies the often complex process of class action litigation. By leveraging cutting-edge data analytics, financial recovery technologies enhance the efficiency and effectiveness of retrieval efforts, allowing clients to reclaim funds with minimal hassle. Notably, over 60% of Australian class actions secured funding this year, underscoring the critical nature of prompt action in restitution initiatives.

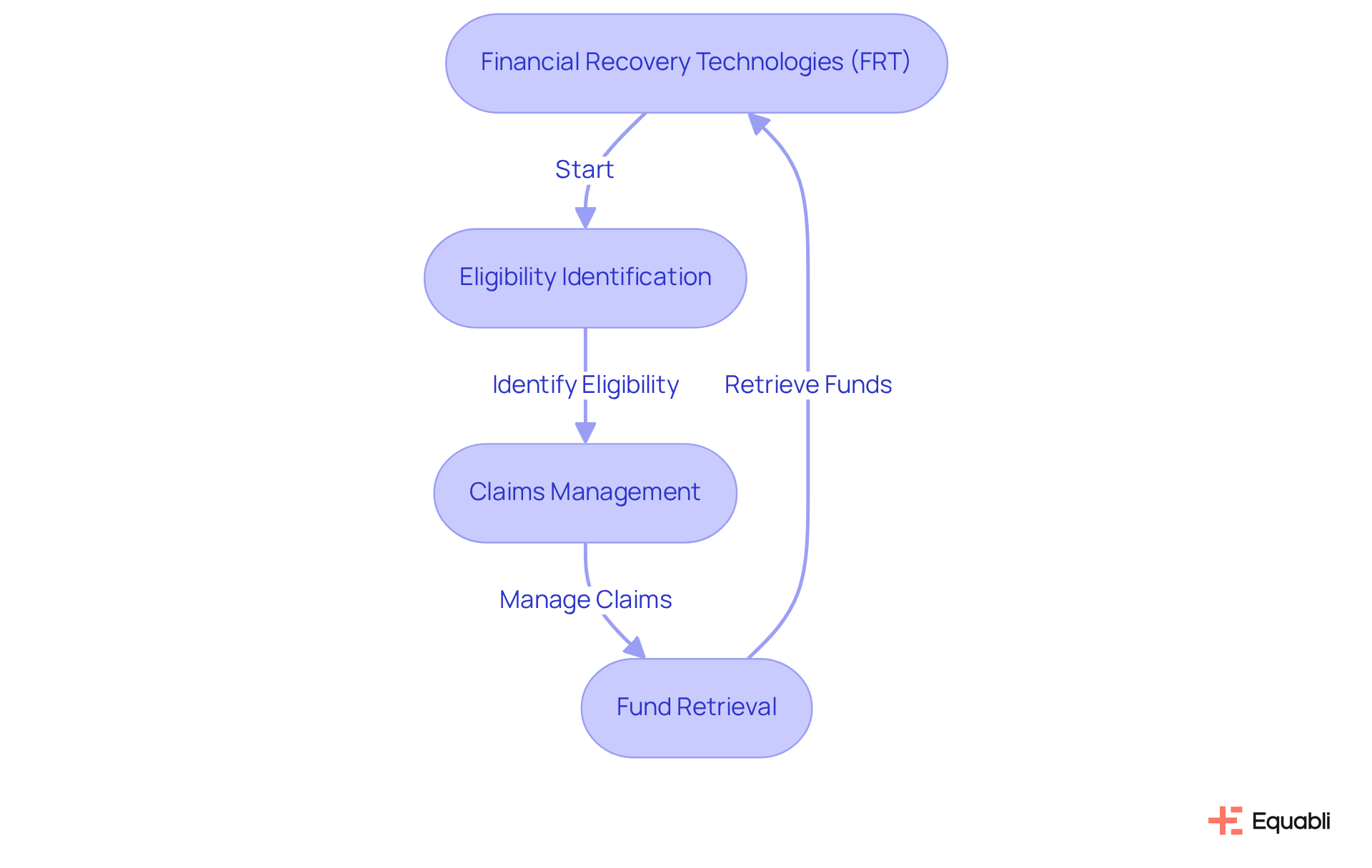

As Rob Adler, a representative of financial recovery technologies, articulates, 'Financial recovery technologies is a leading technology-based services firm that assists institutional investors in identifying eligibility, filing claims, and collecting funds made available in securities class action settlements.' This capability is essential in a landscape where , such as FRT's collaboration with BNY Mellon, significantly bolster their efficiency in optimizing returns for institutional investors.

Charles Schwab: Global Class Action Recovery Services

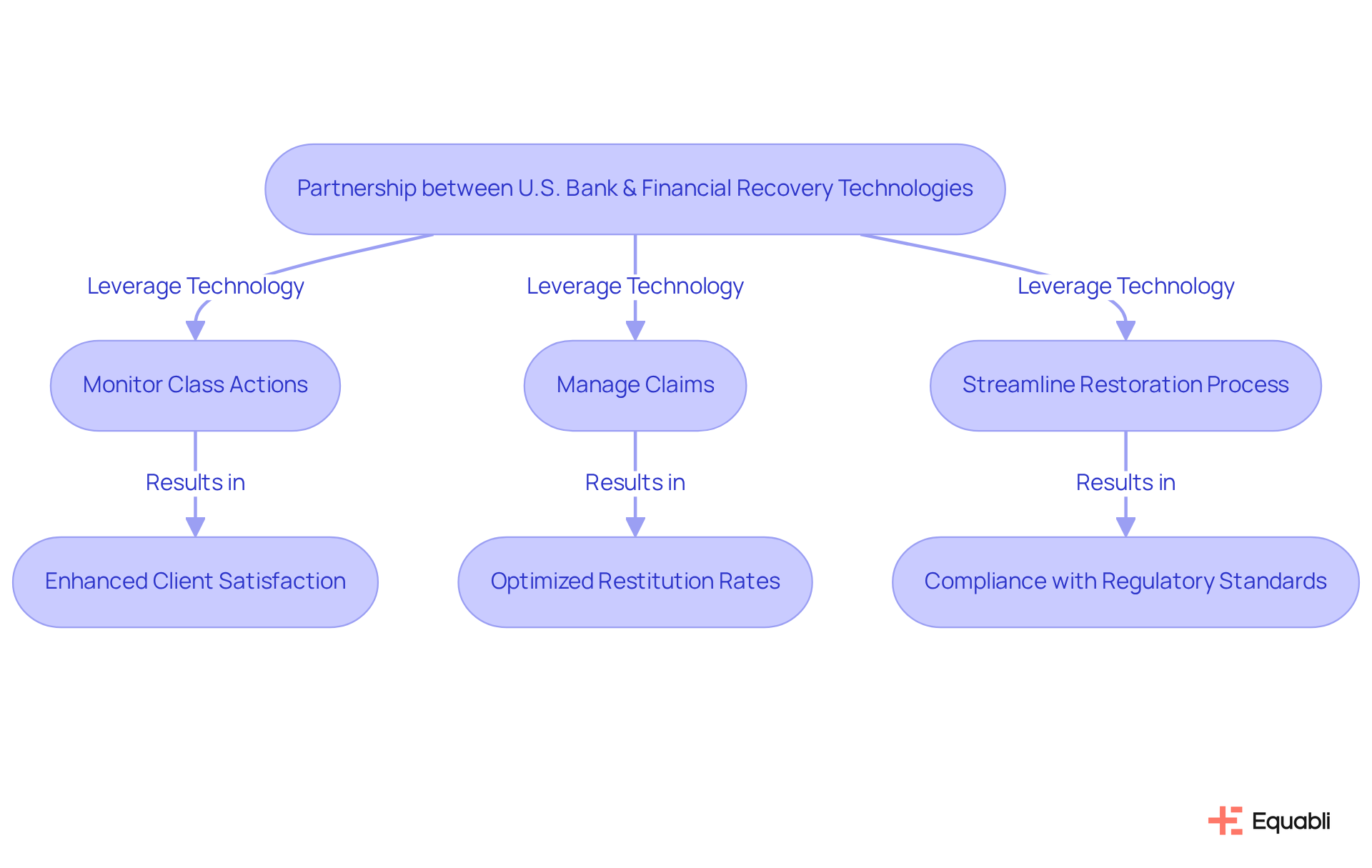

U.S. Bank has strategically partnered with financial recovery technologies to elevate its . By leveraging financial recovery technologies' advanced platform, the bank can effectively monitor class actions and manage claims for its custody clients. This partnership streamlines the restoration process using financial recovery technologies while ensuring compliance with evolving regulatory standards, significantly enhancing client satisfaction and outcomes.

Financial executives recognize that financial recovery technologies are essential for optimizing restitution rates in securities litigation; notably, there was an 18% rise in securities-related class action recoveries in 2023 compared to the prior year.

The integration of financial recovery technologies (FRT) positions U.S. Bank to navigate the complexities of class action claims management more efficiently, ultimately benefiting its clients in a competitive landscape.

Interactive Brokers: Securities Class Action Recovery Tools

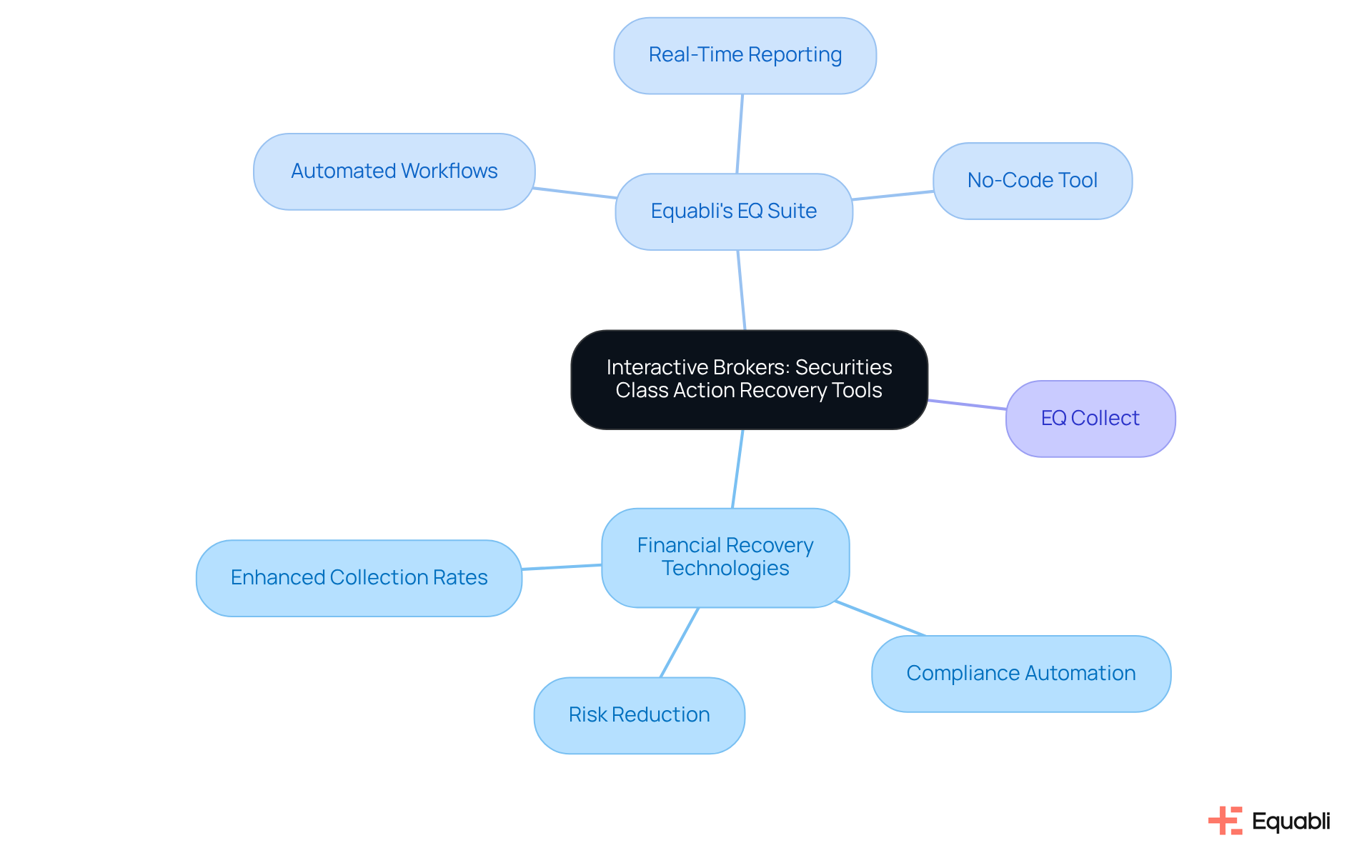

Financial Recovery Technologies (FRT) offers comprehensive compliance solutions that are meticulously designed for global class action restitution. Their platform guarantees adherence to international regulations in all restoration initiatives, significantly reducing the risk of legal repercussions. By automating compliance checks and providing real-time updates on regulatory changes, financial recovery technologies empower organizations to enhance their restoration efforts without sacrificing legal integrity. This automation streamlines compliance processes and boosts collection rates, underscoring the pivotal role of .

In this evolving landscape, Equabli's EQ Suite and EQ Collect emerge as viable options that automate manual processes, equipping lenders with intelligent, cloud-based tools. EQ Collect minimizes manual tasks and enhances profitability through features such as:

- Automated workflows

- Real-time reporting

- A no-code file-mapping tool

These capabilities facilitate smarter orchestration, improved performance, and integrated operations, effectively addressing the challenges posed by fragmented systems. A case study with LG Super illustrates the success of financial recovery technologies in establishing a best-in-class shareholder litigation restitution process, highlighting effective implementation. Furthermore, with global settlements projected to rise by 26% in 2024, the necessity for robust compliance measures is increasingly evident. Legal experts emphasize the importance of mitigating legal risks in rehabilitation efforts, reinforcing the demand for FRT's innovative solutions alongside Equabli's offerings, which assist institutional investors in meeting fiduciary and regulatory responsibilities while enhancing efficiency and oversight.

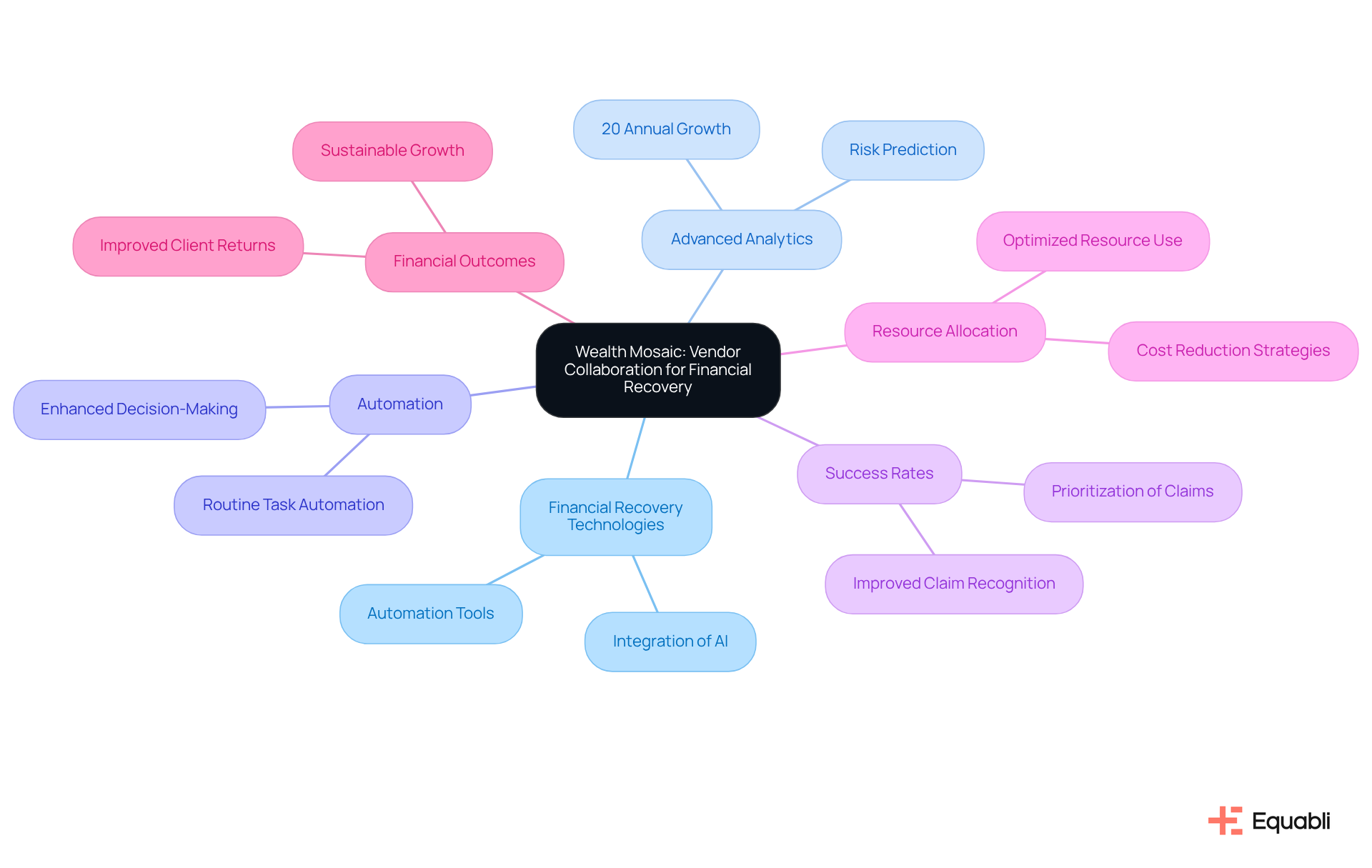

The Wealth Mosaic: Vendor Collaboration for Financial Recovery

Asset managers are increasingly adopting financial recovery technologies to enhance their retrieval strategies. This strategic shift, driven by , enables firms to efficiently recognize and prioritize claims, significantly boosting success rates. Not only does this approach optimize resource allocation, but it also leads to improved financial outcomes for clients.

For instance, firms utilizing AI-driven analytics have reported a remarkable 20% annual growth in asset flows, underscoring the tangible benefits of these technologies. As the asset management landscape evolves, integrating financial recovery technologies is essential for maintaining a competitive edge and achieving sustainable growth in 2025 and beyond.

ZipRecruiter: Job Opportunities in Financial Recovery Technologies

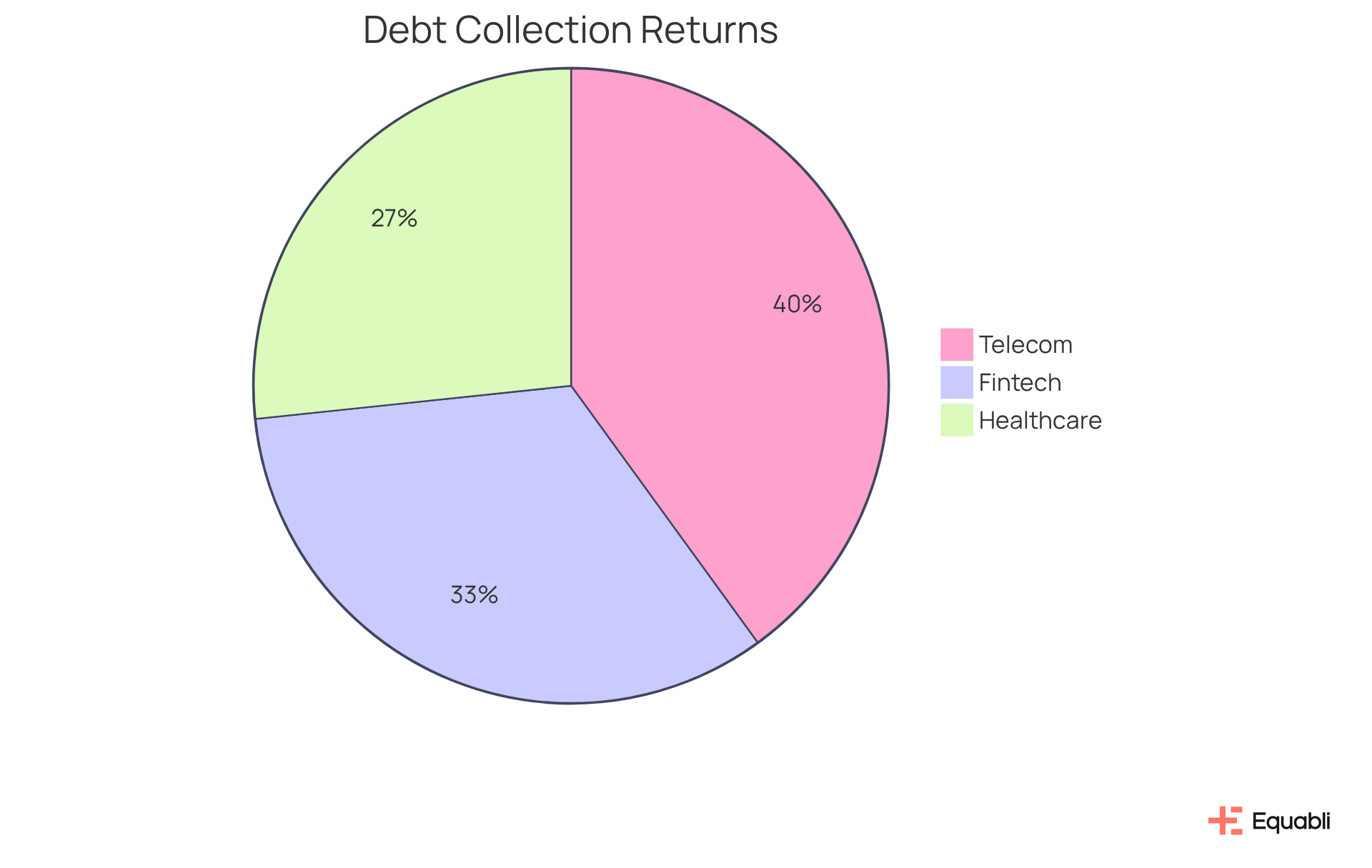

The company's solutions are meticulously crafted to be customizable, effectively addressing the distinct needs of various industries, including healthcare, telecom, and fintech. By implementing tailored debt collection strategies, the company empowers organizations to confront the unique challenges inherent in their collection efforts. This adaptability not only enhances rehabilitation rates—evidenced by a remarkable reported by a California-based orthopedic practice after integrating medical liens—but also fosters stronger relationships with borrowers.

Notably, healthcare debt collections typically achieve a return rate of 15%-25%, further underscoring the efficiency of Equabli's offerings in this field. Telecom firms have experienced return rates ranging from 20% to 40%, supported by case studies that illustrate the effectiveness of personalized communication strategies.

As the landscape of debt collection transforms in 2025, agencies must adjust strategies based on evolving market changes and trends. The company remains at the forefront, providing innovative solutions that align with the specific needs of each sector. Furthermore, adherence to legal regulations is essential for sustaining success rates and agency reputation—challenges that this service adeptly assists organizations in managing.

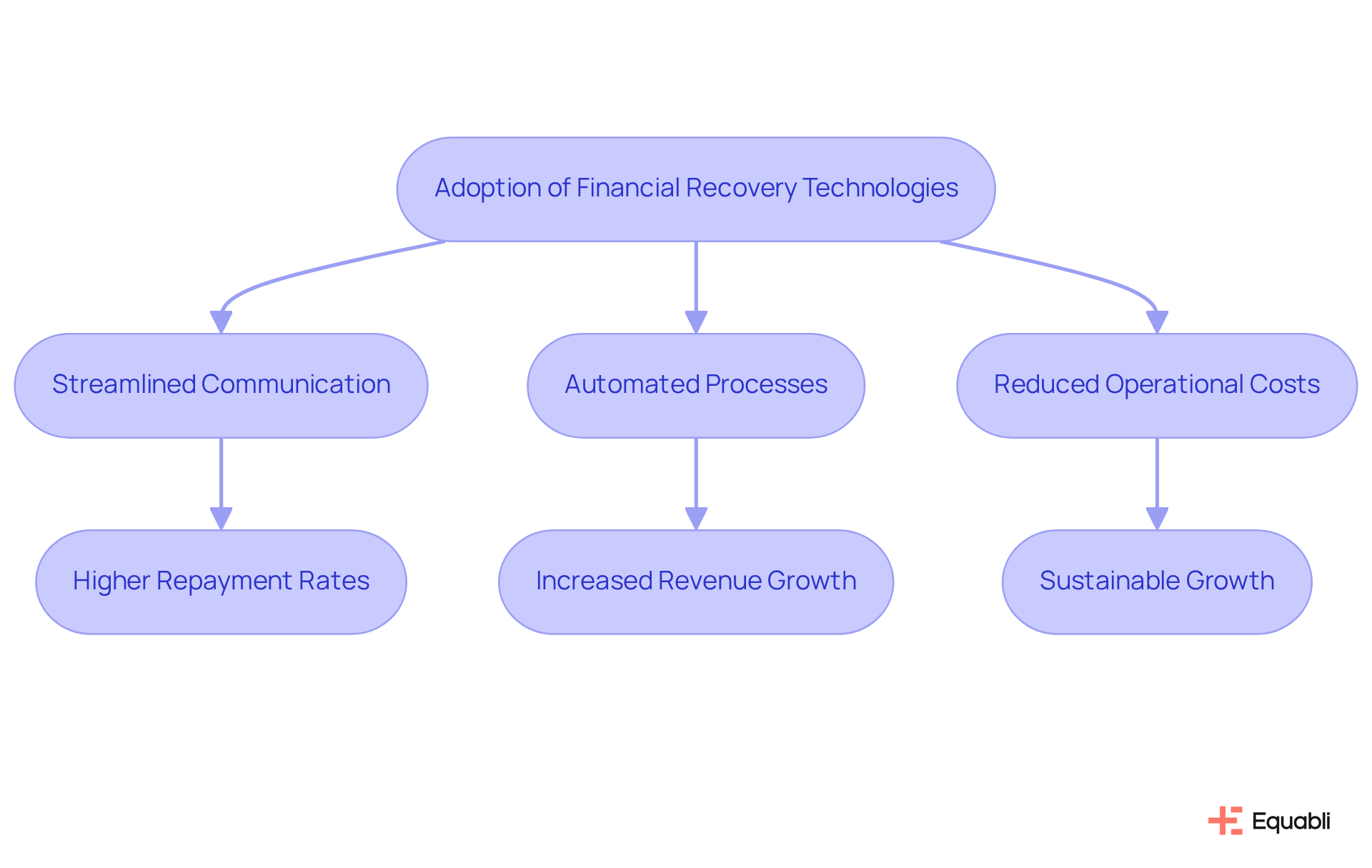

Finextra: BNY Mellon Partners with Financial Recovery Technologies

Equabli spearheads digital transformation in debt collection by utilizing financial recovery technologies, providing a suite of innovative tools designed to enhance collection processes. Their cloud-hosted services, including EQ Collect and EQ Engage, streamline communication and automate critical components of debt collection. By harnessing these technologies, organizations can drastically reduce operational costs—research indicates that large enterprises with digitally savvy leadership teams outpace their peers by over 48% in revenue growth and valuation. This transition not only enhances efficiency but also fosters , resulting in higher repayment rates.

The impact of cloud-centered strategies is evident in real-world applications, as demonstrated in a recent webinar focused on digital debt collection within the BFSI sector. Participants learned how AI-driven automation and real-time analytics can revolutionize loan collection strategies, underscoring the effectiveness of tools provided by Equabli. As the industry progresses, adopting these innovative financial recovery technologies is essential for organizations striving to optimize their debt recovery processes and achieve sustainable growth.

Conclusion

The integration of financial recovery technologies is fundamentally transforming the debt collection landscape. Organizations are now empowered to enhance their processes, improve borrower engagement, and ensure compliance. In an evolving industry, leveraging these advanced solutions has become essential for maximizing recovery rates and navigating the complexities of modern financial environments.

Key players such as Equabli, Financial Recovery Technologies (FRT), and Charles Schwab exemplify innovation with their tools and partnerships that streamline debt collection processes. From predictive analytics and automated workflows to comprehensive compliance solutions, these technologies are pivotal in driving efficiency and effectiveness in recovery efforts. The emphasis on data-driven insights and personalized communication strategies has emerged as a vital factor in achieving successful outcomes in debt collection.

As the demand for effective and ethical debt recovery strategies continues to rise, embracing these technological advancements is crucial for organizations seeking to maintain a competitive edge. The future of debt collection lies in the ability to adapt to ongoing changes and invest in solutions that enhance operational efficiency while fostering positive relationships with borrowers. By prioritizing the integration of financial recovery technologies, businesses can position themselves for sustainable growth and success in the years to come.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a platform that transforms debt recovery through intelligent, data-driven solutions, utilizing financial recovery technologies. It includes the EQ Engine, which uses predictive analytics to assess repayment behaviors, and EQ Engage, which enhances borrower communication.

How does the EQ Engine function?

The EQ Engine harnesses predictive analytics to assess borrower repayment behaviors, allowing lenders and agencies to anticipate borrower actions effectively. High-quality information is essential for building these predictive models.

What role does EQ Engage play in the EQ Suite?

EQ Engage is designed to improve borrower communication through personalized outreach, utilizing preferred communication channels to foster stronger engagement and improve recovery rates.

Why is information quality important in financial recovery technologies?

High-quality information is crucial for constructing effective predictive models and ensuring that financial recovery strategies are informed and actionable. Poor quality information can hinder the effectiveness of these models.

What is Financial Recovery Technologies (FRT)?

Financial Recovery Technologies (FRT) is a leading provider of class action solutions that help investors navigate securities litigation complexities. Their platform streamlines the claims process, allowing for efficient filing and management of claims.

How does FRT enhance the claims process for investors?

FRT leverages advanced data analytics to improve the precision of retrieval efforts and accelerate the overall timeline for reclaiming losses, which is essential for successful restoration initiatives.

What resources does FRT provide to investors?

FRT publishes a Quarterly Newsletter titled 'Shareholder Litigation Insights,' which summarizes the latest developments in shareholder class actions and provides ongoing insights into the industry.

What partnership has U.S. Bank formed regarding financial recovery technologies?

U.S. Bank has partnered with FRT, effective June 9, 2025, to enhance its securities litigation services, allowing the bank to leverage FRT’s platform for monitoring class actions and managing claims.

What benefits does U.S. Bank expect from this partnership?

The partnership is expected to streamline the restoration process, ensure compliance with regulatory standards, and enhance client satisfaction and restoration outcomes through the use of financial recovery technologies.

What impact did financial recovery technologies have on securities litigation in 2023?

Financial recovery technologies contributed to an 18% increase in securities-related class action returns in 2023 compared to the previous year, highlighting their importance in improving restitution rates.