Overview

This article presents ten credit risk management solutions tailored for financial institutions, with a particular focus on the Equabli EQ Suite. This suite integrates predictive analytics and automation, significantly enhancing loan oversight and borrower engagement. The collective aim of these solutions is to:

- Streamline collections

- Ensure compliance with regulatory standards

- Ultimately improve operational efficiency in managing credit risk in an evolving financial landscape

Introduction

In an era marked by heightened scrutiny of financial institutions and shifting market dynamics, effective credit risk management has become paramount. This article examines ten innovative solutions that equip organizations to adeptly navigate the complexities of credit risk, thereby enhancing both operational efficiency and compliance. However, with a plethora of options available, how can institutions ascertain which tools will genuinely transform their risk management strategies and yield optimal outcomes?

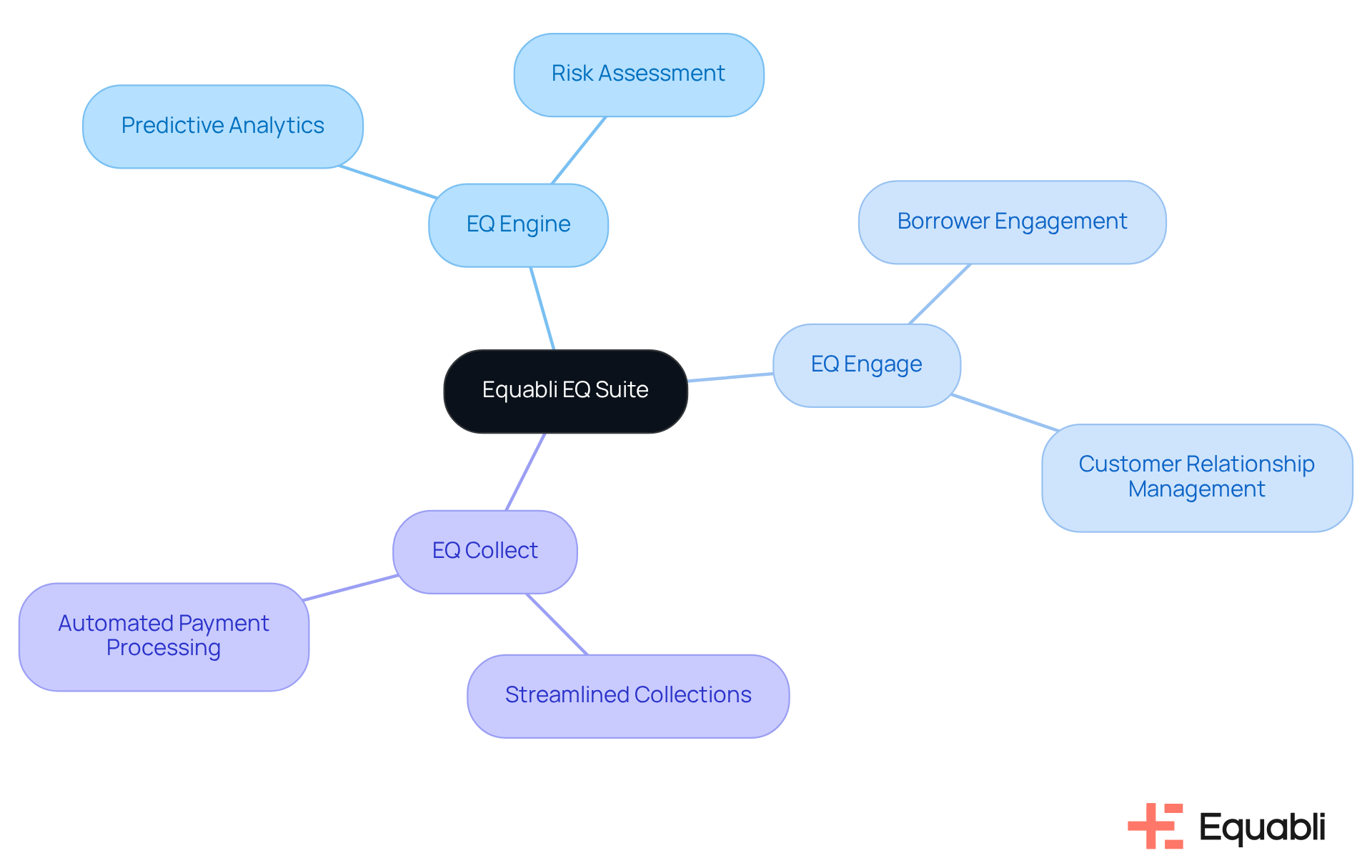

Equabli EQ Suite: Comprehensive Credit Risk Management Tools

The Equabli EQ Suite serves as a robust foundation for enhancing loan exposure oversight within financial organizations. This suite comprises innovative tools such as EQ Engine, EQ Engage, and EQ Collect, which empower organizations to leverage , improve borrower engagement, and streamline collections. By employing cloud-based technology, the EQ Suite enables organizations to tailor their strategies to meet the unique needs of their clients while adhering to strict security standards. This adaptability is crucial in today's rapidly evolving financial landscape, where digital transformation is reshaping lending assessment practices. As organizations increasingly adopt credit risk management solutions for financial institutions, they can expect improved operational efficiency and a more agile approach to managing credit risk.

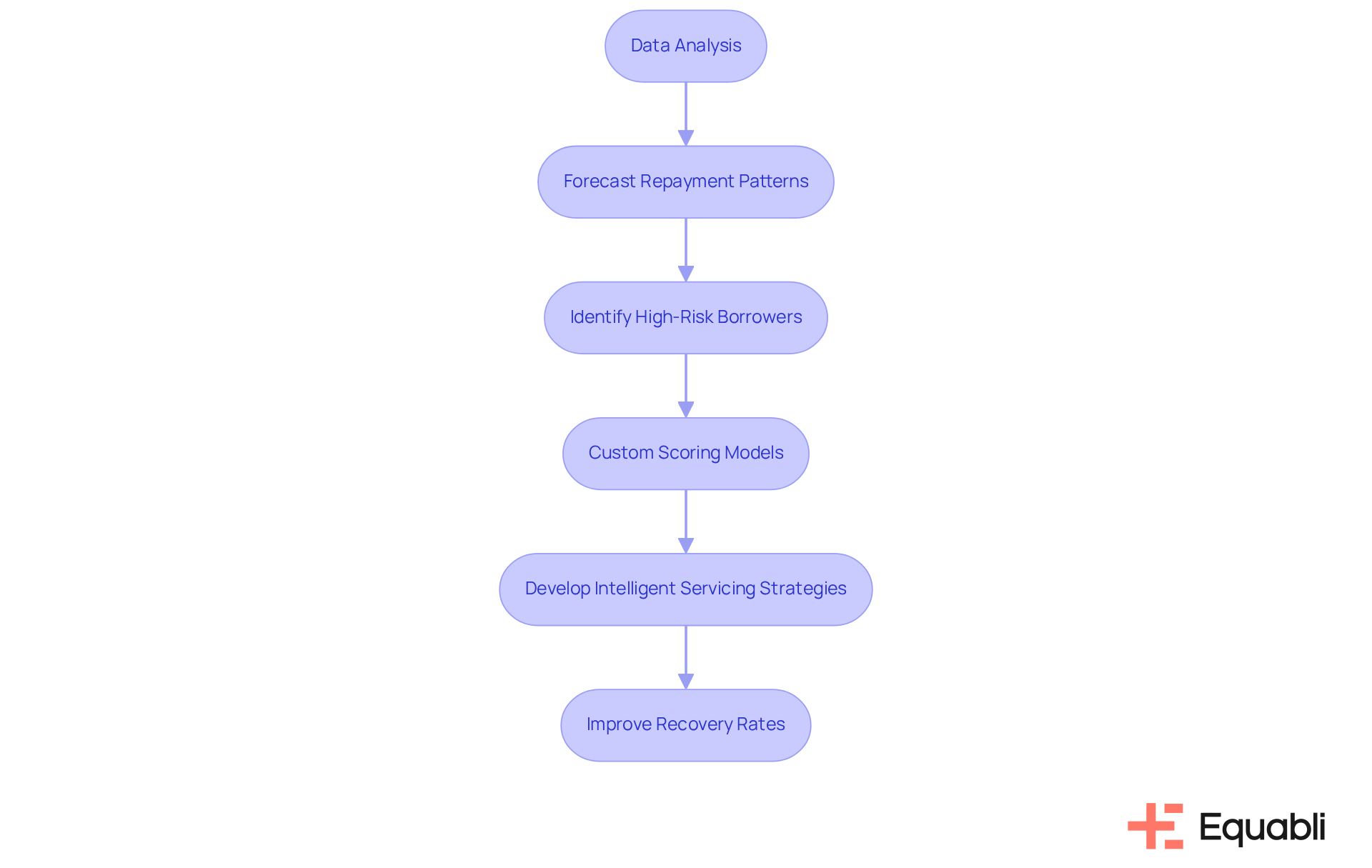

Equabli EQ Engine: Predictive Analytics for Repayment Behavior

The EQ Engine represents a significant advancement in debt recovery through the application of sophisticated machine learning algorithms, which analyze historical data to forecast repayment patterns. This capability enables financial organizations to enhance without increasing effort at each stage of debt recovery. By implementing custom scoring models, organizations can effectively identify high-risk borrowers and develop intelligent servicing strategies tailored to their unique needs. Such a proactive approach not only improves recovery rates via automation but also mitigates potential losses, positioning the EQ Engine as an essential tool for maximizing debt collection efficiency and delivering credit risk management solutions for financial institutions.

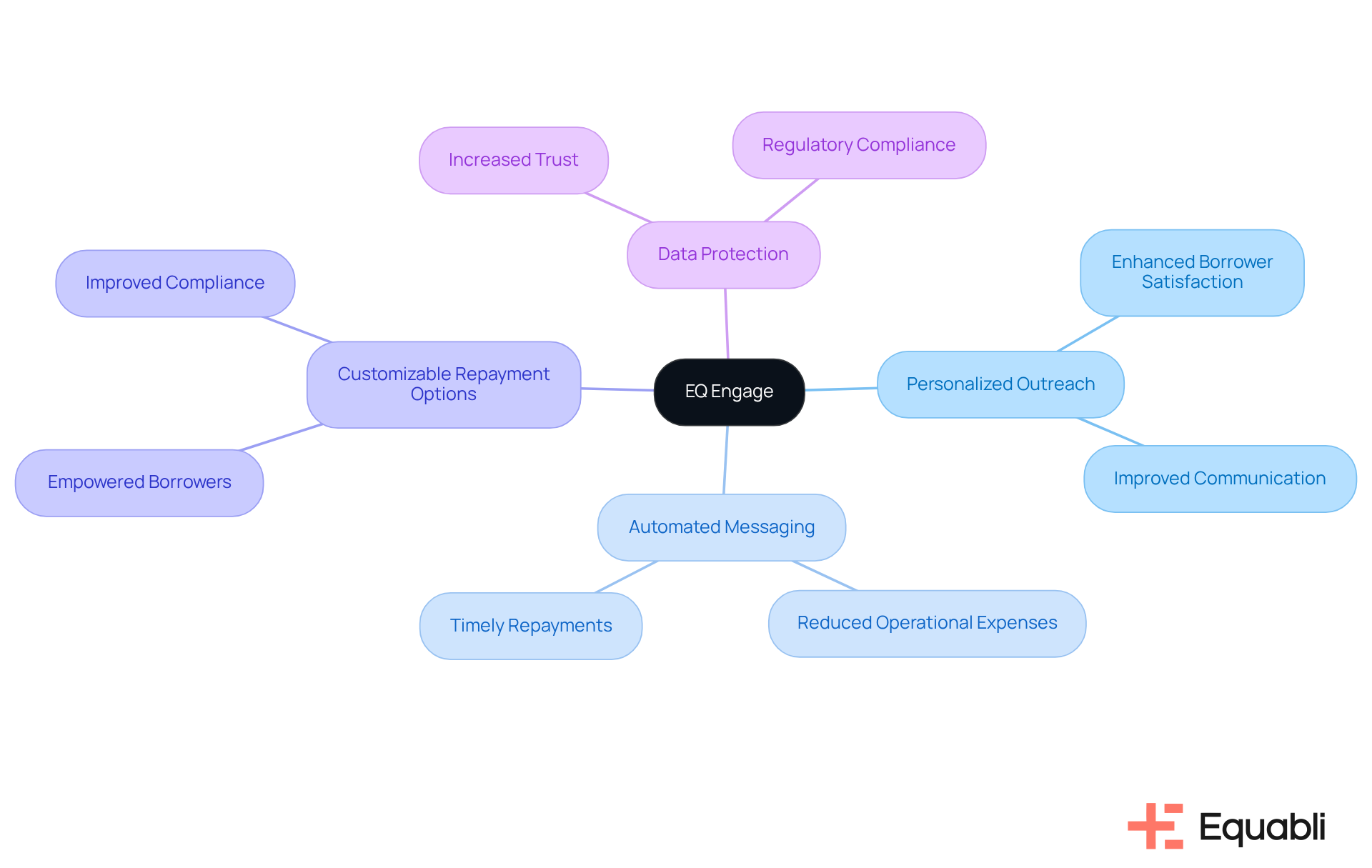

Equabli EQ Engage: Enhancing Borrower Engagement and Communication

EQ Engage serves as a pivotal tool in enhancing borrower communication through personalized outreach and automated messaging. By leveraging preferred communication channels, such as SMS and email, financial organizations can effectively keep borrowers informed about their obligations and available repayment options. This intelligent outreach not only enhances borrower satisfaction but also reduces operational expenses while increasing the likelihood of timely repayments, thereby serving as effective for financial institutions.

Furthermore, with customizable repayment options and tailored communication journeys, EQ Engage empowers borrowers to self-manage their repayment plans. This ensures an improved user experience while upholding compliance with regulatory standards. Equabli's commitment to data protection further bolsters the confidence that financial organizations can place in our solutions, reinforcing the importance of compliance and security in the debt collection landscape.

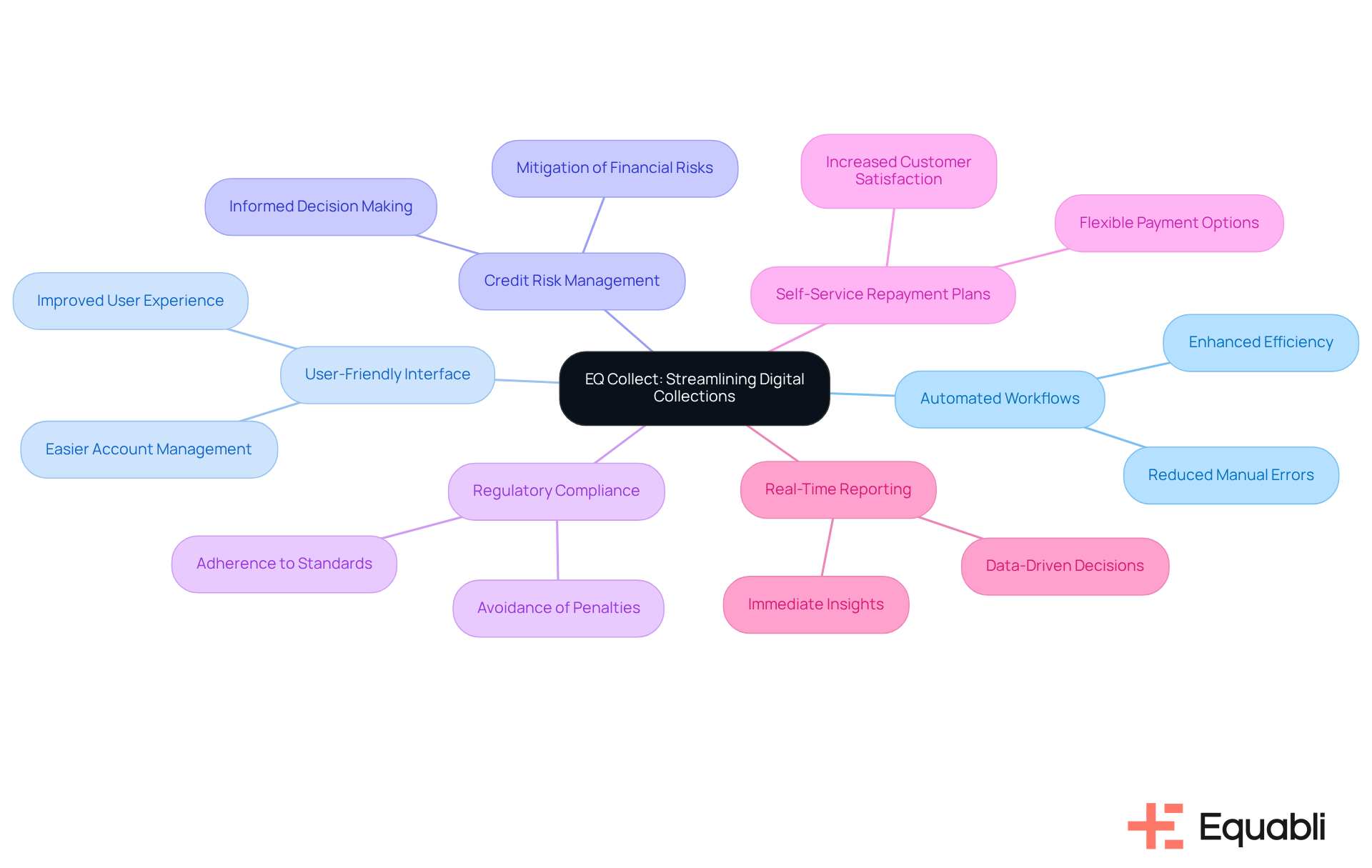

Equabli EQ Collect: Streamlining Digital Collections for Efficiency

EQ Collect streamlines the collections process by automating workflows and providing a user-friendly interface for managing overdue accounts. This digital solution for financial institutions by implementing credit risk management solutions for financial institutions while ensuring compliance with regulatory standards. Notably, features such as self-service repayment plans and real-time reporting significantly reduce collection expenses and improve recovery rates. Consequently, EQ Collect emerges as an essential component for effective financial oversight, offering credit risk management solutions for financial institutions to navigate the complexities of debt collection with greater precision.

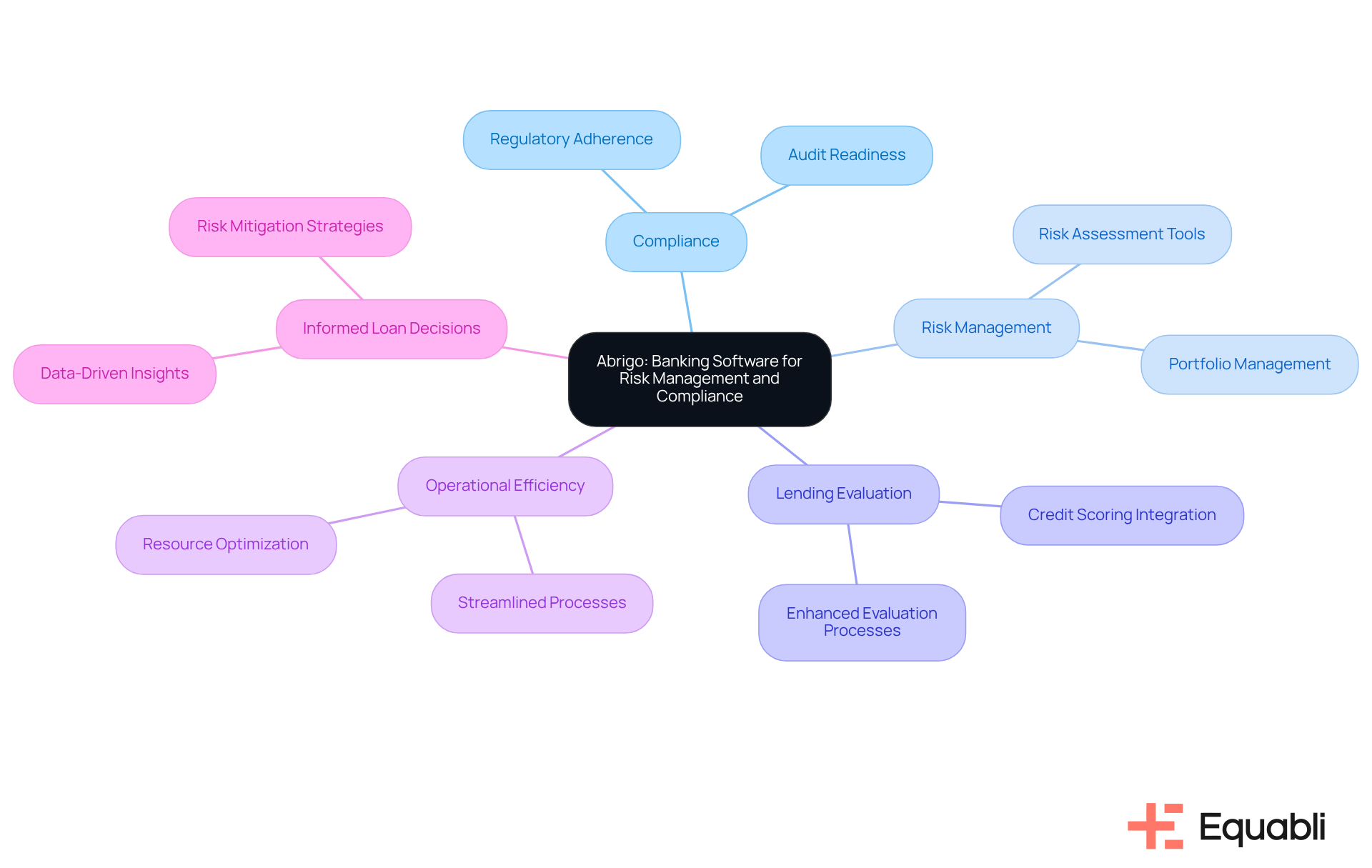

Abrigo: Banking Software for Risk Management and Compliance

Abrigo provides comprehensive banking software solutions focused on compliance and risk management. Their tools enable financial organizations to enhance their lending evaluation processes, ensuring adherence to regulatory standards while boosting operational efficiency. By integrating risk oversight capabilities with lending functionalities, Abrigo empowers organizations to make informed loan decisions and manage their portfolios effectively. This dual focus on compliance and operational efficiency positions Abrigo as a strategic partner in navigating the complexities of for financial institutions.

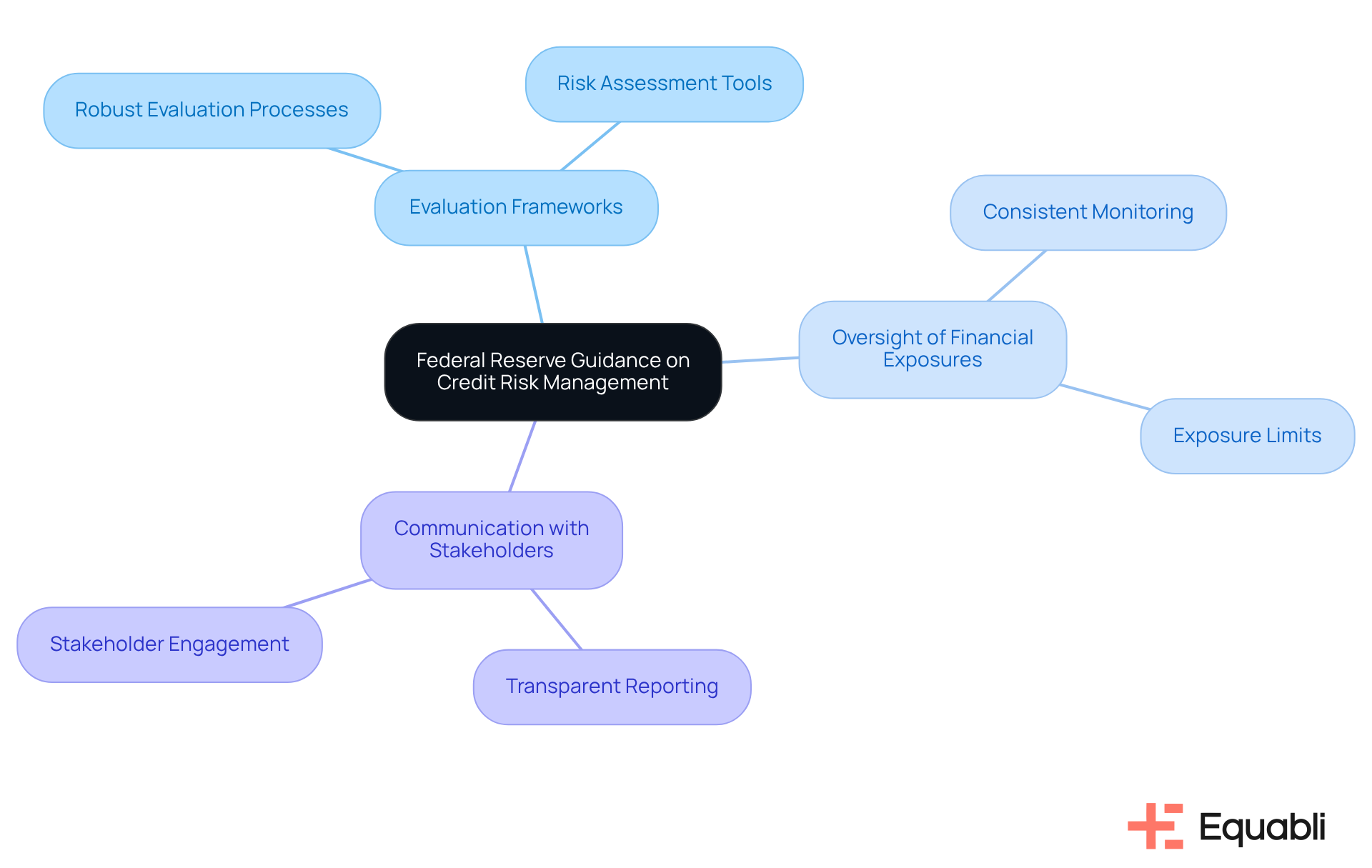

Federal Reserve Guidance: Supervisory Policies for Credit Risk Management

The Federal Reserve provides essential guidance on lending risk oversight, outlining supervisory policies that financial entities must comply with. These guidelines underscore the importance of , consistent oversight of financial exposures, and effective communication with stakeholders. Adhering to these standards enables organizations to mitigate risks and ensure compliance, thereby enhancing their debt assessment practices.

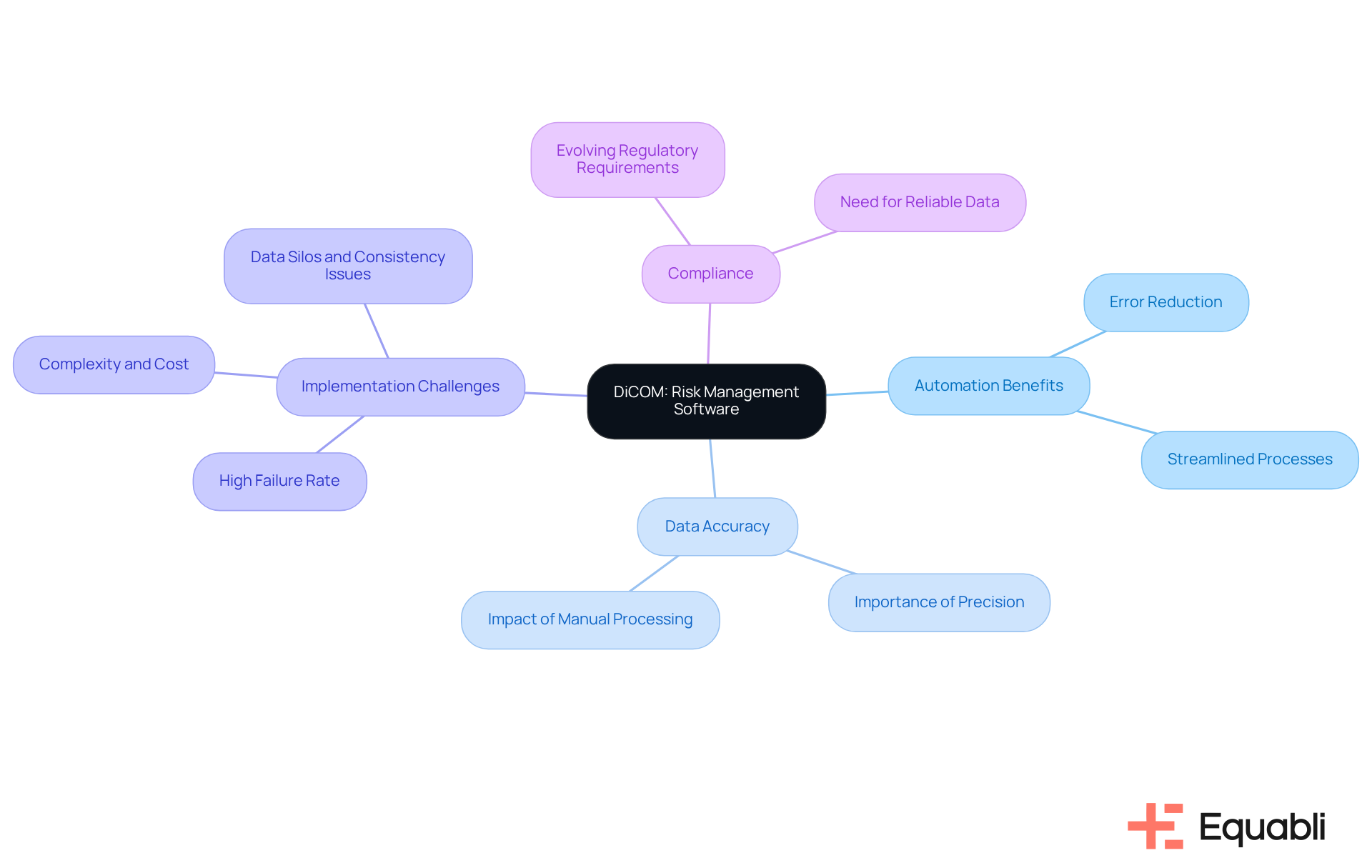

DiCOM: Specialized Software for Risk Management in Financial Institutions

DiCOM offers specialized software aimed at enhancing management procedures within financial organizations. This solution automates credit evaluations, significantly improving data accuracy, which is essential for informed lending decisions and is part of credit risk management solutions for financial institutions. As we approach 2025, the finance sector is witnessing a pivotal shift towards automation. Research indicates that organizations employing automated systems can substantially reduce errors associated with manual data processing, thereby mitigating the risks of inaccurate data entry. This transition not only streamlines oversight processes but also .

As Nathan Myers, a leading expert in the field, asserts, "data that is not 100% accurate is completely useless," emphasizing the critical importance of achieving precision in data handling. Successful implementations of DiCOM's credit risk management solutions for financial institutions demonstrate that these entities can enhance efficiency and reliability in their lending evaluations, ultimately leading to improved decision-making and reduced operational costs. However, it is crucial to recognize that approximately 80% of data warehouse projects fail to meet their intended objectives, underscoring the challenges inherent in traditional data management practices.

Addressing potential data silos and consistency issues is vital for maintaining integrated and reliable data for decision-making. By prioritizing these aspects, financial organizations can better navigate the complexities of compliance and operational efficiency, positioning themselves for success in an increasingly automated landscape.

TPG Software: Tools for Managing Credit Risk and Compliance

TPG Software provides credit risk management solutions for financial institutions, offering a robust suite of tools designed to empower these organizations in effectively addressing lending challenges while ensuring regulatory compliance. Their solutions include advanced loan scoring systems, portfolio management functionalities, and comprehensive regulatory reporting capabilities. By leveraging TPG Software, organizations can significantly enhance their management processes, leading to improved adherence to industry regulations.

The integration of scoring tools is crucial for maintaining compliance with laws such as the Equal Opportunity Act (ECOA), which prohibits discrimination in lending. These instruments enable institutions to make , thereby minimizing the risk of disparate treatment and ensuring alignment with fair lending practices. Statistical models utilized in scoring have been shown to improve the accuracy of financial decisions, making lending more cost-effective and compliant with regulatory standards. A pertinent case study, "Statistical Models for Lending Decisions," demonstrates how these models standardize and refine lending decisions based on historical borrower characteristics.

Successful implementations of TPG Software's scoring and portfolio management tools have yielded measurable improvements in compliance and have enhanced credit risk management solutions for financial institutions. Organizations adopting credit risk management solutions for financial institutions report enhanced operational efficiency and a deeper understanding of their financial portfolios, which facilitates proactive risk management strategies. Additionally, TPG's Capital Markets Revenue surged by over 30% in Q1 2025, highlighting the effectiveness of TPG Software's tools in boosting financial performance. As financial entities navigate the intricate landscape of regulatory requirements in 2025, TPG Software emerges as a vital partner in fostering a culture of compliance and effective lending oversight. Jon Winkelried, CEO, indicated that TPG anticipates significantly increasing its capital in 2025, reflecting the company's strong market position and growth potential.

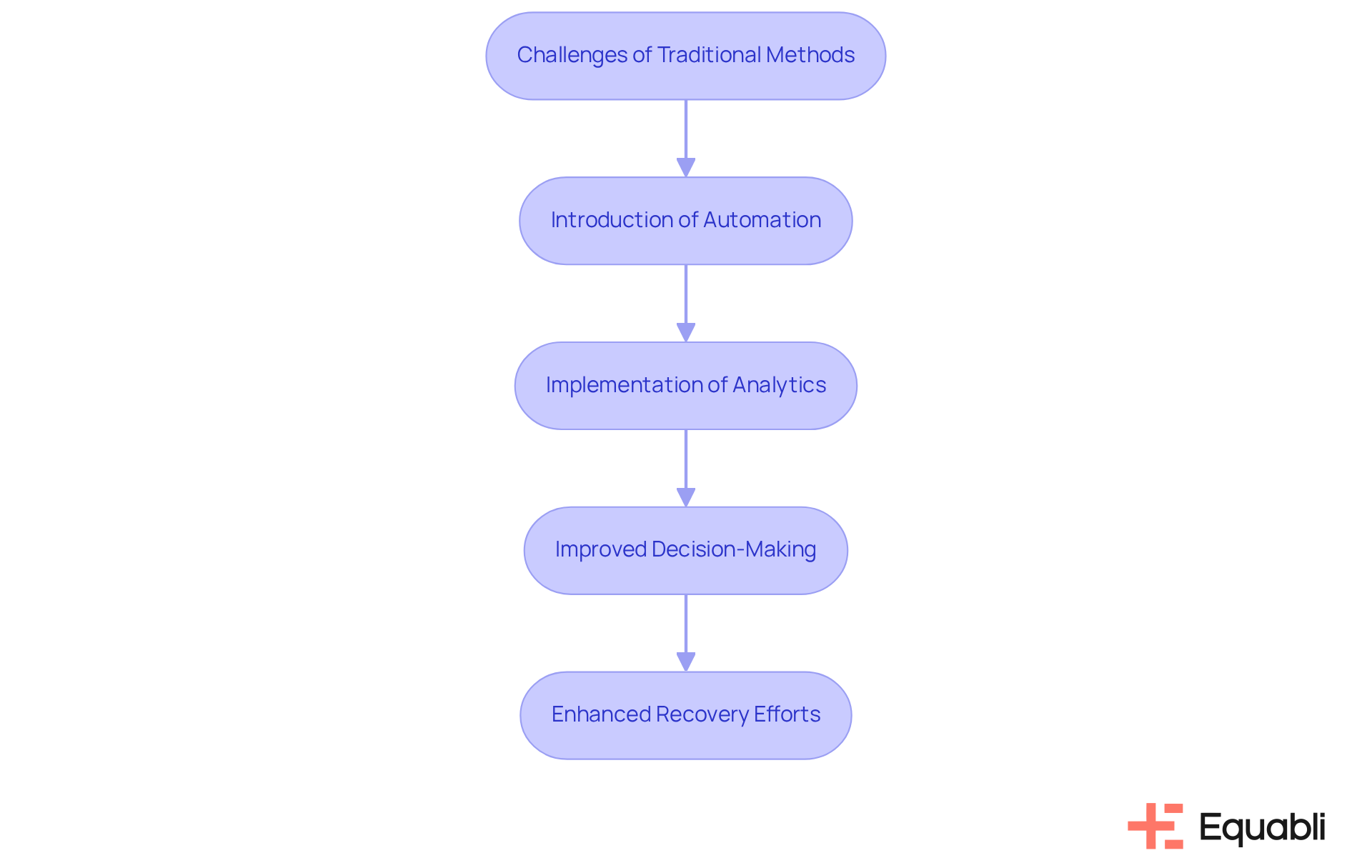

Automation and Analytics: Key Features in Modern Credit Risk Management Solutions

Contemporary financial management solutions leverage automation and analytics to optimize processes and enhance decision-making. By employing sophisticated algorithms and data analysis, financial organizations can assess lending potential with greater precision and effectiveness. Many teams encounter challenges with manual collections tasks, resulting in inefficiencies and lost opportunities.

Equabli's EQ Suite serves as a prime example of this transformation, modernizing these processes and empowering lenders with intelligent, cloud-based credit risk management solutions for financial institutions that address the limitations of traditional methods. Through a tailored launch strategy and expert support from our skilled team, and accelerates workflows. This enables organizations to focus on strategic decision-making and management while simultaneously improving overall recovery efforts.

Compliance Resources: Best Practices for Credit Risk Management in Financial Institutions

Financial institutions must prioritize adherence to best practices in lending oversight to ensure compliance and effectively mitigate potential challenges. Essential resources include guidelines from regulatory bodies, such as the Bank Holding Company Supervision Manual, which outlines supervisory expectations for loan administration and internal credit-risk ratings. Furthermore, industry standards and internal policies are crucial in defining threat assessment procedures, monitoring practices, and reporting requirements.

Adopting these best practices enhances financial exposure oversight frameworks and guarantees conformity with regulatory guidelines. Efficient monitoring procedures, including routine assessments of borrowers and loan portfolios, are critical for identifying early warning signs of potential financial trouble, such as declines in revenue or rises in debt levels. This proactive approach enables institutions to implement timely corrective actions, thereby improving overall risk management.

Utilizing advanced scoring models can significantly enhance the speed and impartiality of financial decisions. These models assess essential elements such as payment history, borrowing usage, and recent inquiries, providing a solid foundation for evaluating borrower trustworthiness. TrustDecision's scoring model, for instance, ensures high precision with a KS score of 0.40 or higher and stability with a PSI score of 0.01 or lower, greatly enhancing decision-making processes.

Liquidity ratios, including the current ratio and quick ratio, are vital indicators that assess a firm's capacity to meet short-term obligations, offering additional insights into financial stability. The incorporation of automated procedures in financial assessment decision-making also plays an essential role, enhancing data precision and increasing team efficiency by minimizing manual mistakes.

Utilizing for financial institutions, diversification—distributing loans across various industries and borrower types—can mitigate the impact of adverse events on the credit portfolio. This strategy, along with the implementation of loan covenants that protect lenders while ensuring borrowers maintain financial stability, is vital for sustainable growth in lending operations. By integrating these strategies, financial institutions can not only comply with regulatory requirements but also utilize credit risk management solutions for financial institutions to foster sustainable growth in their lending operations.

Conclusion

In the realm of financial institutions, effective credit risk management solutions are paramount for ensuring compliance, mitigating risks, and enhancing operational efficiency. The importance of leveraging innovative tools, such as the Equabli EQ Suite, Abrigo, DiCOM, and TPG Software, cannot be overstated. These solutions empower organizations to navigate the complexities of lending with greater precision. By integrating advanced analytics, predictive modeling, and automated processes, they streamline operations and foster improved borrower engagement and satisfaction.

Key insights from this discussion emphasize the necessity of predictive analytics to forecast repayment behavior. Enhanced communication through personalized outreach and the adoption of compliance best practices are critical to safeguarding against potential risks. The strategic implementation of these tools is essential for financial institutions aiming to optimize their credit risk management strategies and ensure a robust oversight framework.

Ultimately, the significance of adopting modern credit risk management solutions is profound. As the financial landscape continues to evolve, organizations must prioritize these innovations to remain competitive and compliant. Embracing automation and analytics enhances decision-making and paves the way for sustainable growth and improved financial health in the lending sector. By investing in these advanced tools, financial institutions can better position themselves for success in an increasingly complex environment.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of tools designed for enhancing loan exposure oversight within financial organizations. It includes innovative tools such as EQ Engine, EQ Engage, and EQ Collect, which utilize predictive analytics, improve borrower engagement, and streamline collections.

How does the EQ Suite leverage technology?

The EQ Suite employs cloud-based technology, allowing organizations to customize their strategies to meet the unique needs of their clients while adhering to strict security standards.

What are the benefits of using the EQ Suite in credit risk management?

The EQ Suite helps organizations improve operational efficiency and adopt a more agile approach to managing credit risk, which is essential in the rapidly evolving financial landscape influenced by digital transformation.

What is the EQ Engine and how does it work?

The EQ Engine is a tool that employs sophisticated machine learning algorithms to analyze historical data and forecast repayment patterns, enhancing operational efficiency in debt recovery without increasing effort at each stage.

How can organizations benefit from the EQ Engine?

Organizations can benefit from the EQ Engine by identifying high-risk borrowers through custom scoring models and developing intelligent servicing strategies, which improve recovery rates and mitigate potential losses.

What role does EQ Engage play in borrower communication?

EQ Engage enhances borrower communication through personalized outreach and automated messaging via preferred channels like SMS and email, keeping borrowers informed about their obligations and repayment options.

How does EQ Engage improve borrower satisfaction?

By providing customizable repayment options and tailored communication journeys, EQ Engage empowers borrowers to self-manage their repayment plans, improving their experience and increasing the likelihood of timely repayments.

What measures are in place to ensure compliance and security in the EQ Suite?

Equabli emphasizes data protection and compliance with regulatory standards, reinforcing the confidence that financial organizations can place in their solutions while navigating the debt collection landscape.