Overview

The article examines credit collections optimization strategies tailored for U.S. financial institutions, presenting various innovative approaches aimed at enhancing debt recovery processes. It underscores the critical role of technology—encompassing automation, data analytics, and customized scoring models—in improving repayment behaviors and operational efficiency. This strategic focus ultimately fosters superior recovery outcomes for both lenders and borrowers, demonstrating the importance of aligning technological advancements with compliance and operational objectives.

Introduction

The landscape of debt recovery is undergoing significant transformation, propelled by technological advancements and evolving borrower expectations. Financial institutions now confront the imperative of optimizing their credit collections strategies, aiming not only to enhance recovery rates but also to cultivate trust and engagement with their clients. As lenders navigate this intricate landscape, a critical question arises: how can they effectively harness innovative tools and strategies to improve outcomes while ensuring compliance and operational efficiency? This article delves into ten essential credit collections optimization strategies specifically designed for U.S. financial institutions, providing insights into how technology can revolutionize the debt recovery process.

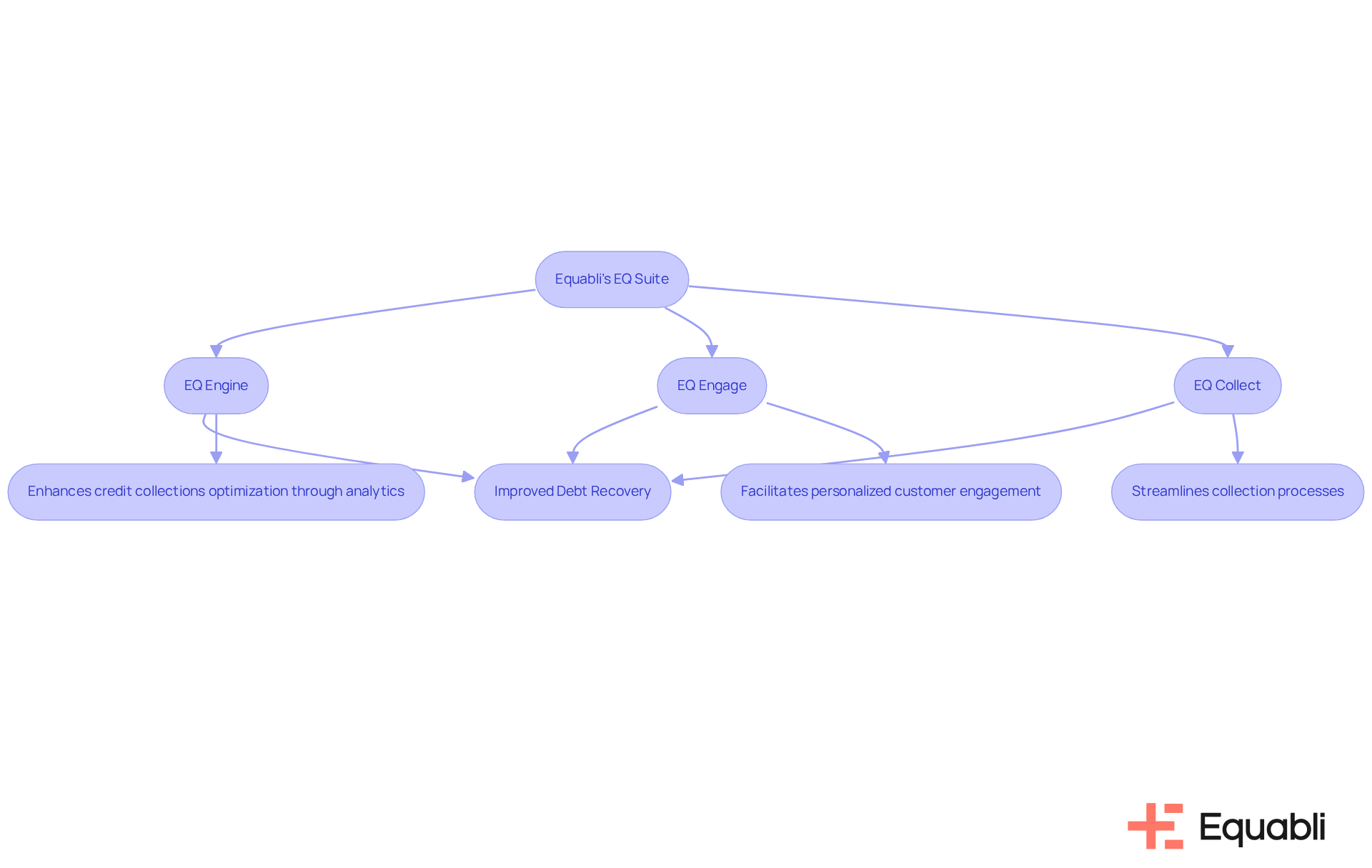

Equabli's EQ Suite: Intelligent Tools for Data-Driven Debt Recovery

Equabli's EQ Suite represents a significant advancement in debt recovery, offering a comprehensive array of tools tailored for intelligent, data-driven strategies. This suite, which includes the EQ Engine, EQ Engage, and , enhances multiple facets of the recovery process.

By leveraging sophisticated analytics and adaptable scoring models, financial institutions can enhance their credit collections optimization strategies for U.S. financial institutions, accurately predicting repayment behaviors and refining their recovery strategies. This optimization, specifically credit collections optimization strategies for U.S. financial institutions, not only streamlines operations but also ensures adherence to industry regulations.

Consequently, the EQ Suite serves as an indispensable asset for lenders and creditors striving to improve their recovery outcomes. The integration of these data-informed solutions markedly boosts retrieval success rates, empowering organizations to navigate the complexities of modern financial management with efficacy.

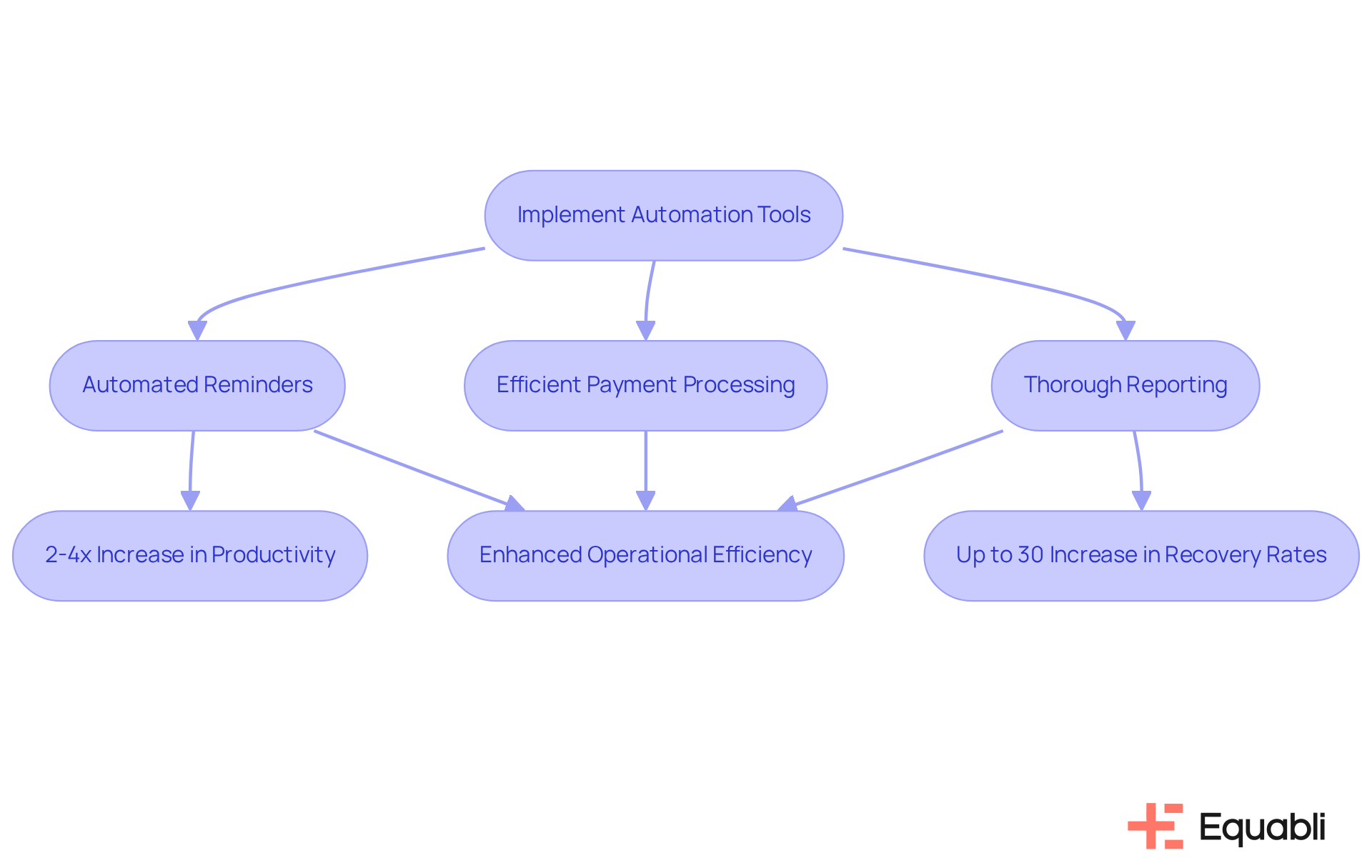

Automation Tools: Streamline Debt Collection Processes

Automation tools are fundamentally transforming debt recovery by significantly reducing manual intervention and enhancing operational efficiency. Evidence suggests that the implementation of automated reminders, efficient payment processing, and thorough reporting allows monetary organizations to drastically decrease the time and resources allocated to recovering debts. Research indicates that automated payment systems can lead to a 2-4x increase in collector productivity. Furthermore, automated reminders facilitate timely communications, thereby mitigating the risk of human error. This dual approach not only accelerates the recovery process but also improves the overall experience for borrowers, who increasingly expect instant, secure, and frictionless self-service options.

Moreover, organizations that adopt these technologies report recovery rate increases of up to 30% and operational cost reductions of up to 90%. This enables them to allocate resources more effectively and focus on strategic initiatives. As the sector evolves, embracing automation is no longer optional; it has become a competitive necessity for monetary organizations aiming to improve their credit collections optimization strategies for U.S. financial institutions. To operationalize this strategy effectively, consider investing in , which can streamline operations and optimize recovery efforts.

Member-Centric Communication: Enhance Engagement and Trust

Member-focused communication approaches are vital for enhancing engagement and trust between lenders and borrowers. By leveraging preferred communication channels—such as SMS, email, and phone calls—institutions can customize their outreach to align with the unique preferences of each borrower. This cultivates trust and promotes timely repayments, as borrowers feel recognized and valued.

The role of a Client Success Representative at Equabli exemplifies this strategy. They manage customer accounts, conduct proactive check-ins, and identify upsell opportunities, ensuring a smooth transition and a strong start to the client relationship.

Implementing feedback loops and regular check-ins can further solidify these relationships, driving product adoption and enhancing overall client engagement.

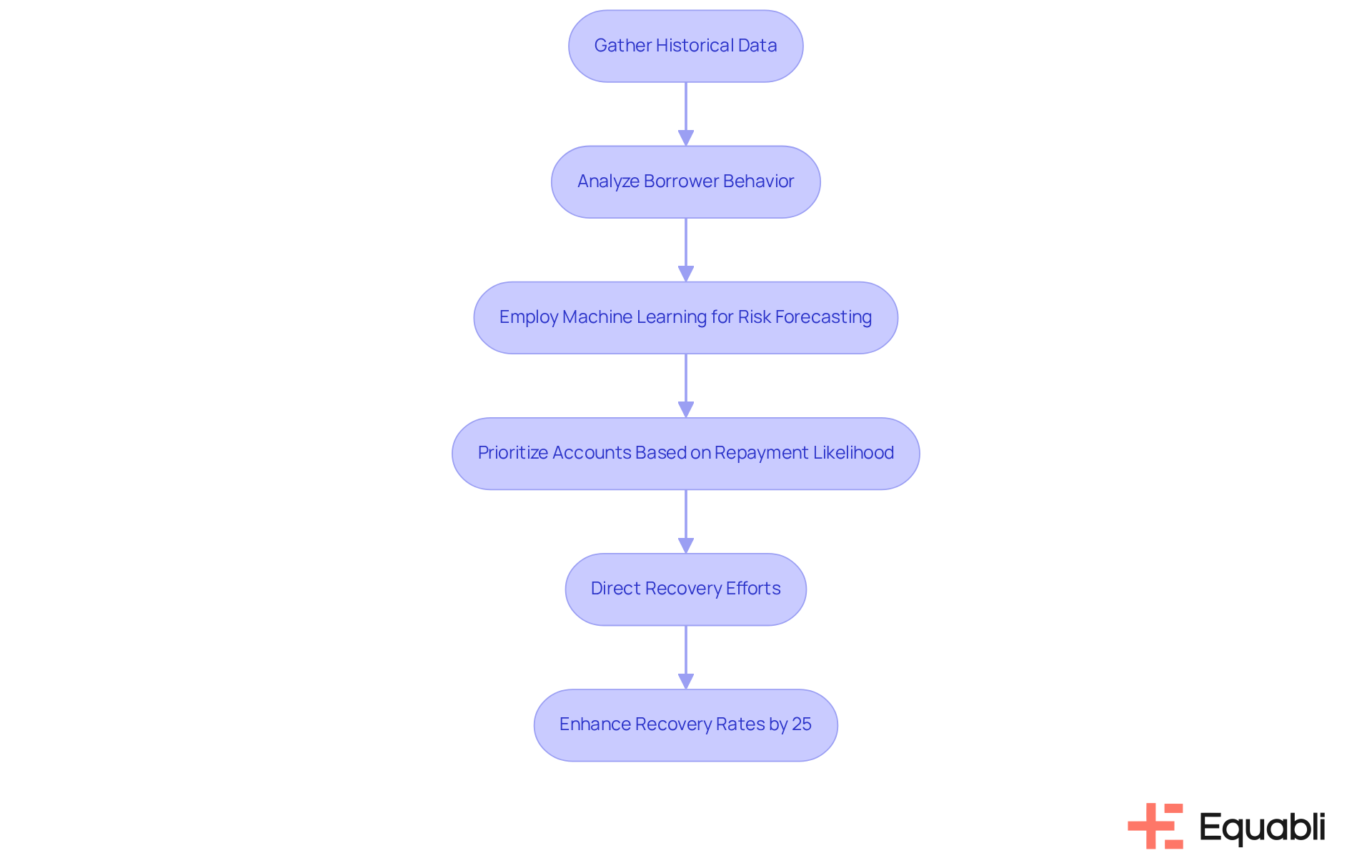

Data Analytics: Optimize Collection Strategies with Insights

Data analytics plays a pivotal role in enhancing gathering strategies, offering deep insights into borrower behavior and repayment trends. By leveraging historical data, financial organizations can discern patterns that inform strategic adjustments.

For instance, Equabli's EQ Engine empowers organizations to operate more efficiently by employing machine learning to forecast the risk of delinquency in active accounts. This capability allows organizations to prioritize accounts based on their repayment likelihood, directing recovery efforts toward those with the highest potential for retrieval.

This data-centric approach not only enhances recovery rates—reportedly by 25% when utilizing AI for predictive analytics—but also boosts operational efficiency through automation. This simplification of the gathering process enables institutions to more effectively.

As Jack Mahoney, Chief Analytics Officer, notes, 'Predictive analytics has emerged as a cornerstone of credit collections optimization strategies for U.S. financial institutions,' underscoring its transformative impact on improving collection processes.

Digital Payment Solutions: Increase Flexibility for Borrowers

Digital payment solutions are pivotal in enhancing flexibility for loan repayment. By providing a diverse array of payment options—including online platforms, mobile apps, and automated payment schemes—financial institutions can effectively respond to the evolving preferences of borrowers. This adaptability not only simplifies financial management for borrowers but also significantly improves the likelihood of .

Institutions that adopt these modern solutions are likely to experience heightened borrower satisfaction and loyalty, leading to better recovery outcomes. The increasing trend of mobile payments, with 51% of Gen Z and 42% of Millennials favoring debit cards for recurring bills, highlights the imperative for lenders to adjust their payment strategies.

Furthermore, implementing proactive communication strategies, such as sending reminders via short-code SMS messages, can enhance engagement and promote timely payments. By prioritizing adaptable payment alternatives, lenders can cultivate a more responsive and supportive environment for borrowers, which aligns with credit collections optimization strategies for U.S. financial institutions, ultimately driving improved economic outcomes.

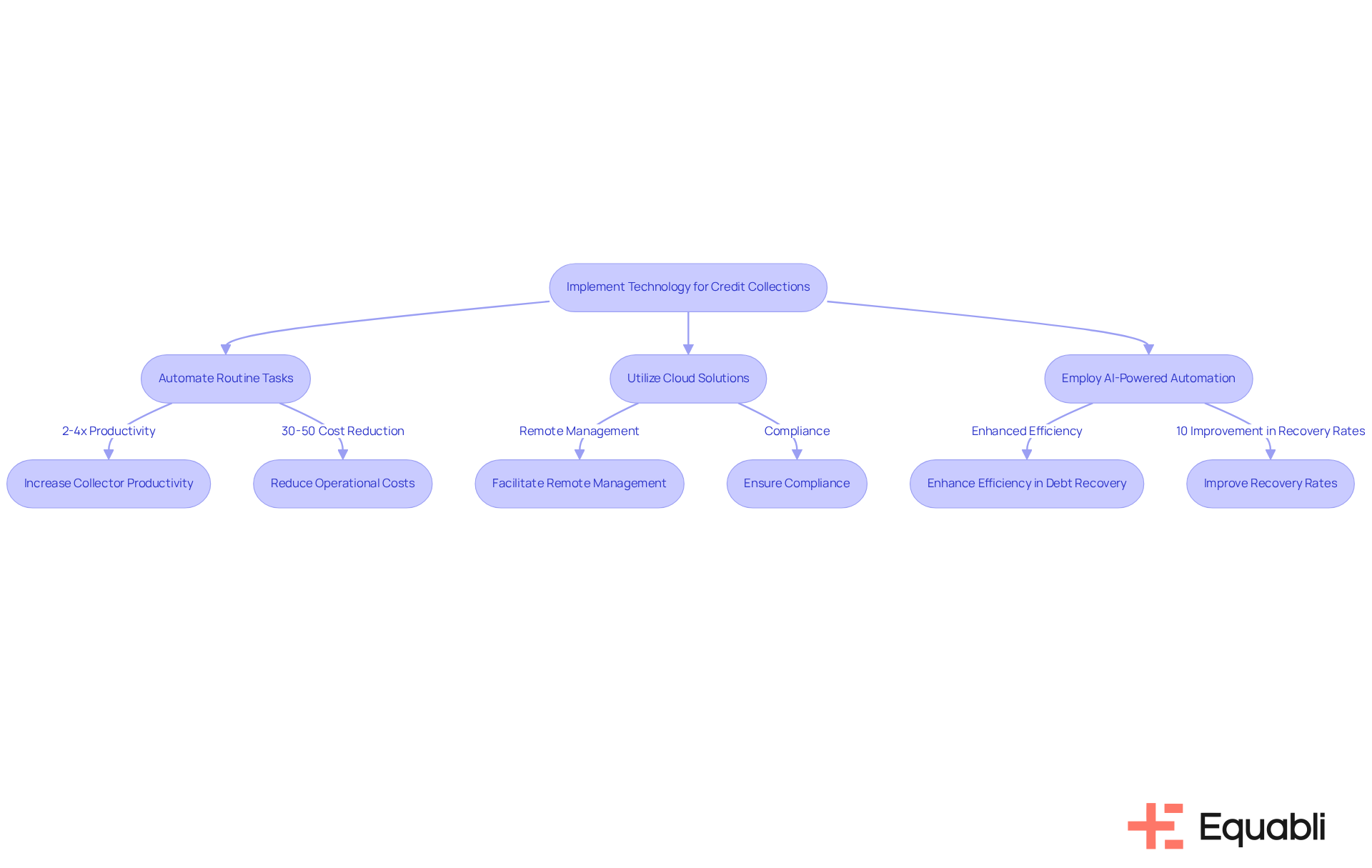

Cost Reduction Strategies: Utilize Technology for Efficiency

Implementing technology-driven credit collections optimization strategies for U.S. financial institutions is essential for enhancing efficiency in debt recovery. By automating routine tasks and utilizing cloud-based solutions, financial organizations can achieve significant reductions in operational costs.

For instance, AI-powered automation can increase collector productivity by 2-4 times while simultaneously reducing operational costs by 30-50%. Automating follow-up communications and payment reminders decreases reliance on manual labor, allowing staff to focus on more complex cases.

This transformation not only lowers costs but also of the retrieval process, with organizations employing AI in recoveries experiencing a 40% reduction in operational expenses and a 10% improvement in recovery rates.

Furthermore, cloud solutions facilitate remote management and scalability by eliminating the need for physical hardware, thereby improving operational efficiency and enabling institutions to adapt swiftly to changing demands while ensuring compliance through automated logging of communications.

Consequently, organizations can optimize workflows, reduce operational expenses, and ultimately enhance recovery rates by adopting credit collections optimization strategies for U.S. financial institutions, positioning technology as a vital resource in contemporary financial recovery strategies.

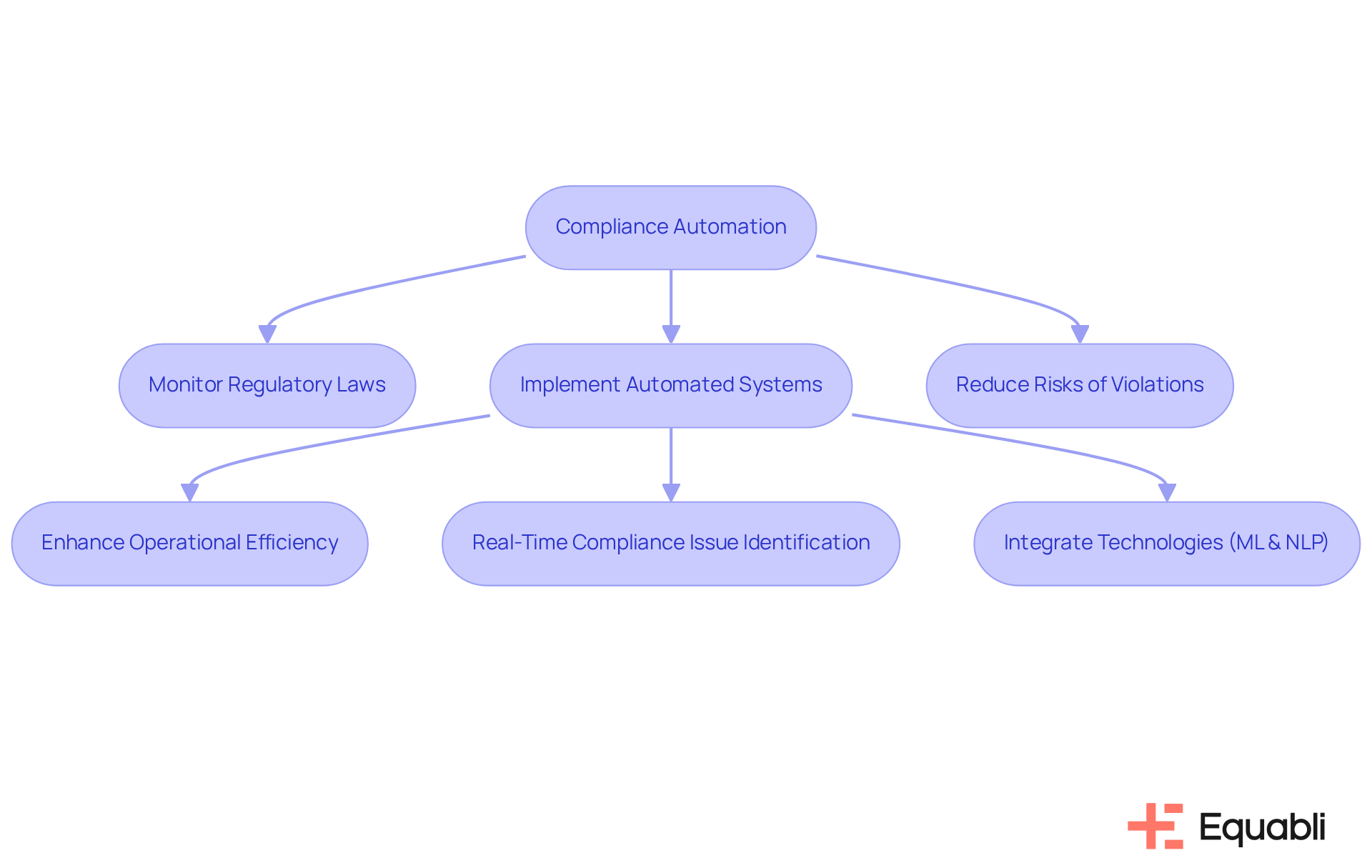

Compliance Automation: Navigate Regulatory Challenges Effectively

Compliance automation is crucial for effectively navigating the intricate regulatory landscape of financial recovery. By implementing automated systems that continuously monitor and enforce adherence to laws such as the Fair Debt Collection Practices Act (FDCPA)—which restricts debt collectors to a maximum of seven calls regarding a specific debt within seven consecutive days—financial entities can significantly reduce the risk of violations and the accompanying penalties. These automated compliance assessments ensure that all communications and retrieval practices align with legal standards, fostering trust between organizations and borrowers while reducing disputes and minimizing operational costs.

Moreover, automation enhances operational efficiency by integrating compliance into each stage of the collection process. This proactive methodology enables agencies to identify potential compliance issues in real-time, facilitating immediate corrective actions rather than reactive measures that could result in costly disputes. Consequently, financial organizations can focus on their core mission—collecting payments and assisting clients—while maintaining a robust compliance framework.

Effective strategies for addressing regulatory challenges include leveraging advanced technologies such as machine learning and natural language processing, which can analyze consumer behavior and forecast compliance risks. TEC Services Group highlights that agencies viewing compliance automation as a learning tool can refine call strategies and enhance training programs. By adopting these innovative solutions, organizations not only streamline their operations but also build trust with consumers through clear and compliant interactions. Ultimately, serves as a foundational element for sustainable growth within the debt recovery sector.

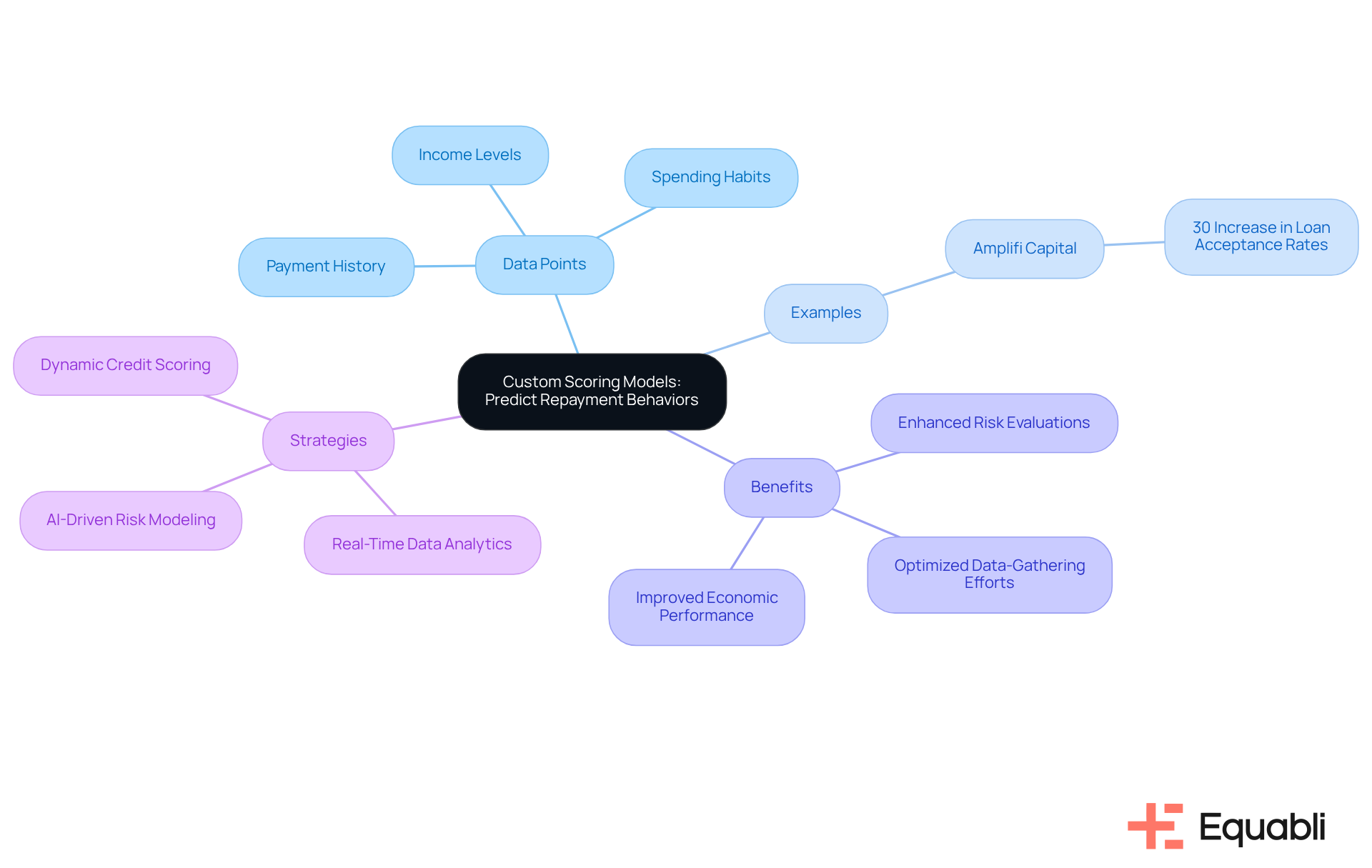

Custom Scoring Models: Predict Repayment Behaviors Accurately

Custom scoring models represent a crucial asset for accurately predicting repayment behaviors. By leveraging a diverse array of data points—such as payment history, income levels, and spending habits—financial organizations can create tailored scoring models that reflect the distinct characteristics of their borrower base. This approach not only facilitates more precise risk evaluations but also enables organizations to effectively.

For example, organizations that have implemented AI-driven models have reported substantial enhancements in loan acceptance rates and recovery outcomes. Amplifi Capital, for instance, achieved a 30% increase in loan offer acceptance rates by employing a machine learning-driven behavioral model to refine their loan offers. Furthermore, with credit card delinquencies rising to 7.1%, the necessity for effective scoring models has never been more pressing.

Banks can analyze millions of data points to identify early warning signs of default risk, underscoring the importance of data-driven methodologies in risk assessment. Equabli's EQ Engine enhances this landscape by predicting the risk of delinquency for active accounts, allowing organizations to develop intelligent servicing strategies that leverage predictive capabilities across various communication channels.

Such implementations underscore the importance of customized scoring models in enhancing retrieval success rates, ultimately leading to improved economic performance for organizations. As the landscape of financial recovery evolves, financial organizations must implement credit collections optimization strategies for U.S. financial institutions to accurately anticipate repayment behaviors, manage rising delinquencies, and refine their collection strategies.

Self-Service Repayment Plans: Empower Borrowers for Better Recovery

Self-service repayment plans empower borrowers by equipping them with the necessary resources to manage their obligations on their own terms. Online platforms facilitate the establishment of payment schedules, modification of amounts, and monitoring of progress, significantly enhancing the repayment experience. This empowerment not only increases borrower satisfaction but also correlates with ; borrowers are more likely to adhere to plans they have actively chosen and managed.

A McKinsey study substantiates this, revealing that in-app notifications achieve a 92% success rate in securing full payment, while push notifications demonstrate an 88% success rate. Furthermore, TrueAccord's self-serve portal has enabled 98% of delinquent consumers to settle their obligations without human intervention, underscoring the effectiveness of these platforms.

A McKinsey report further indicates a 15% increase in cured accounts following the implementation of self-service options, with 60% of consumers expressing a preference for self-service bill payment. By adopting self-service tools such as Equabli's EQ Collect, organizations can implement credit collections optimization strategies for U.S. financial institutions, thereby cultivating a more respectful and customer-centric debt collection process that ultimately leads to improved outcomes for both borrowers and agencies.

However, it is crucial to address challenges such as data integration complexities and digital literacy gaps among debtors when deploying these systems.

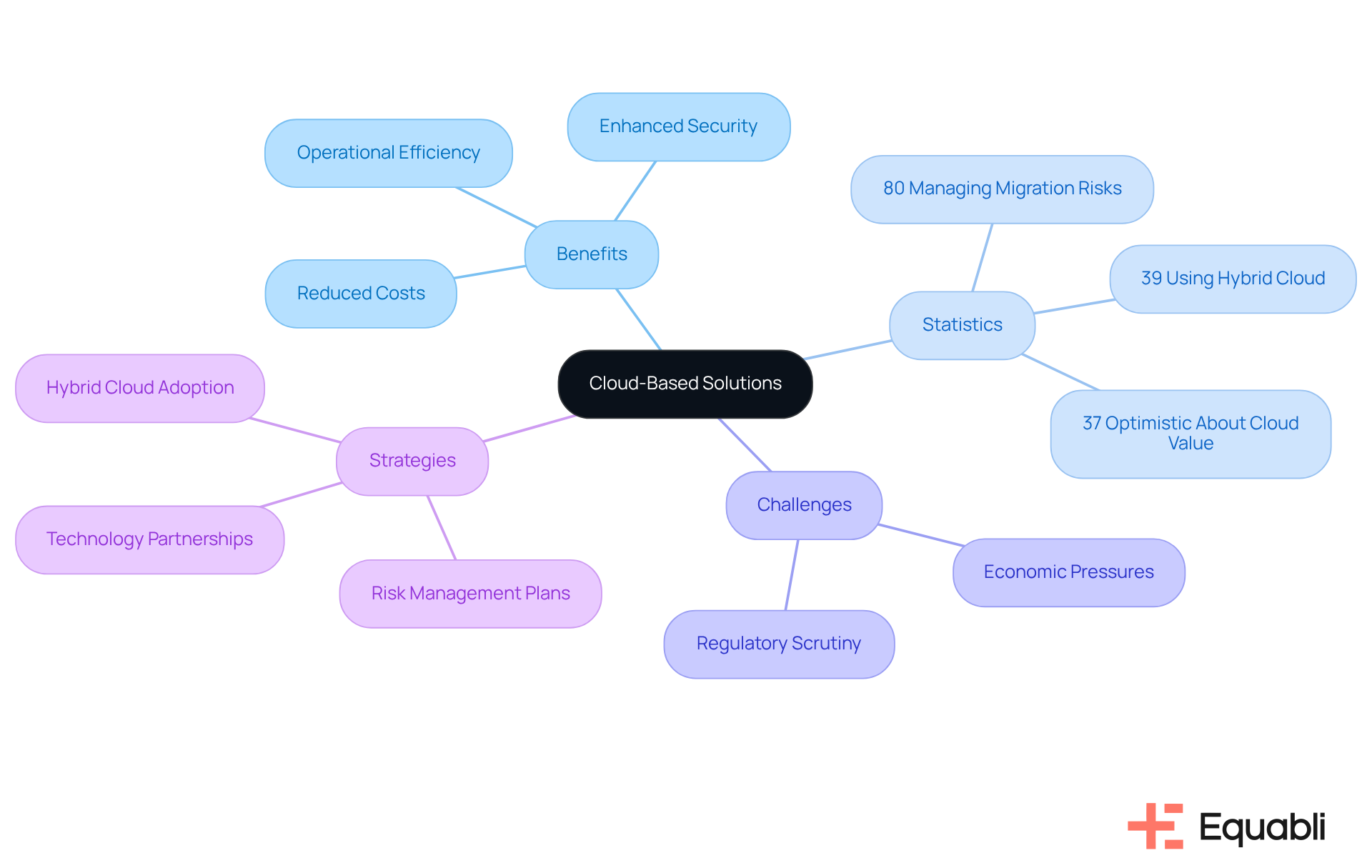

Cloud-Based Solutions: Scale Operations with Security and Efficiency

Cloud-based solutions empower monetary organizations to scale operations securely and efficiently. By transitioning to cloud platforms, these organizations gain access to advanced tools and analytics, alleviating the burden of extensive on-site infrastructure. This transition not only reduces operational costs but also significantly enhances data security and compliance. As Matt Pacheco observes, "Cloud computing can assist monetary entities in rising to meet expectations in a digital-first world." With real-time data access, monetary institutions can adopt for U.S. financial institutions, allowing them to make informed choices and implement more responsive collection strategies, ultimately leading to improved recovery outcomes. Furthermore, 37% of service companies express optimism regarding the value that cloud and edge computing can deliver to their businesses.

However, it is crucial to acknowledge the economic pressures impacting the financial services sector, including higher interest rates and tighter regulatory scrutiny, which underscore the urgency of adopting cloud solutions. Additionally, 80% of leaders in organizations utilizing core processing technologies have implemented strategies to manage the risks associated with migrating to the cloud, emphasizing the necessity of a comprehensive risk management plan. Notably, 39% of firms employ a hybrid cloud model, integrating public and private cloud environments to enhance flexibility and security.

Conclusion

Implementing effective credit collections optimization strategies is essential for U.S. financial institutions aiming to enhance their recovery processes. Advanced technologies, such as Equabli's EQ Suite, automation tools, and data analytics, empower organizations to refine their collection methods and improve operational efficiency. This integration fosters stronger relationships with borrowers, ultimately enhancing recovery rates and borrower satisfaction.

Key strategies discussed throughout the article include:

- The importance of member-centric communication

- The implementation of digital payment solutions

- The use of custom scoring models

Each of these elements plays a vital role in creating a more effective and responsive debt recovery environment. Furthermore, compliance automation and self-service repayment options enhance the borrower experience while ensuring adherence to regulatory requirements.

As the landscape of financial recovery continues to evolve, embracing these innovative strategies is not only beneficial but necessary for sustainable growth. Financial institutions must prioritize the adoption of technology-driven solutions and customer-centric approaches to remain competitive. By addressing the challenges of modern debt collection effectively, they can significantly improve their credit collections optimization strategies, leading to better outcomes for both lenders and borrowers in the years to come.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of intelligent tools designed for data-driven debt recovery, which includes the EQ Engine, EQ Engage, and EQ Collect. It enhances various aspects of the debt recovery process for financial institutions.

How does the EQ Suite improve credit collections?

The EQ Suite utilizes sophisticated analytics and adaptable scoring models to optimize credit collections strategies for U.S. financial institutions, allowing them to predict repayment behaviors and refine their recovery strategies while ensuring compliance with industry regulations.

What are the benefits of automation tools in debt collection?

Automation tools significantly reduce manual intervention and enhance operational efficiency, leading to a 2-4x increase in collector productivity. They facilitate timely communications through automated reminders and efficient payment processing, which accelerates the recovery process and improves borrower experience.

How much can organizations improve their recovery rates by adopting automation?

Organizations that implement automation technologies can report recovery rate increases of up to 30% and operational cost reductions of up to 90%, allowing for more effective resource allocation and focus on strategic initiatives.

What is the importance of member-centric communication in debt recovery?

Member-centric communication enhances engagement and trust between lenders and borrowers by using preferred communication channels like SMS, email, and phone calls. This tailored approach helps borrowers feel recognized and valued, promoting timely repayments.

What role does a Client Success Representative play at Equabli?

A Client Success Representative at Equabli manages customer accounts, conducts proactive check-ins, and identifies upsell opportunities, ensuring a smooth transition and fostering strong client relationships.

How can feedback loops and regular check-ins enhance client engagement?

Implementing feedback loops and regular check-ins can solidify relationships between lenders and borrowers, driving product adoption and improving overall client engagement.