Overview

The article delineates ten essential compliance strategies that financial executives must adopt to effectively align with CFPB regulations. It underscores the critical role of technology integration, ongoing training, and proactive monitoring of regulatory changes. Collectively, these strategies not only enhance operational efficiency but also significantly mitigate compliance risks within financial institutions.

Introduction

In the complex realm of finance, adherence to the Consumer Financial Protection Bureau (CFPB) is not merely a regulatory obligation; it is an essential pillar of operational integrity. Financial executives encounter the dual challenge of navigating intricate regulations while ensuring their organizations maintain competitiveness and efficiency. This article examines ten critical strategies designed to empower financial leaders in enhancing compliance efforts, streamlining processes, and cultivating a culture of accountability.

How can institutions not only meet but also exceed these regulatory expectations in an ever-evolving landscape?

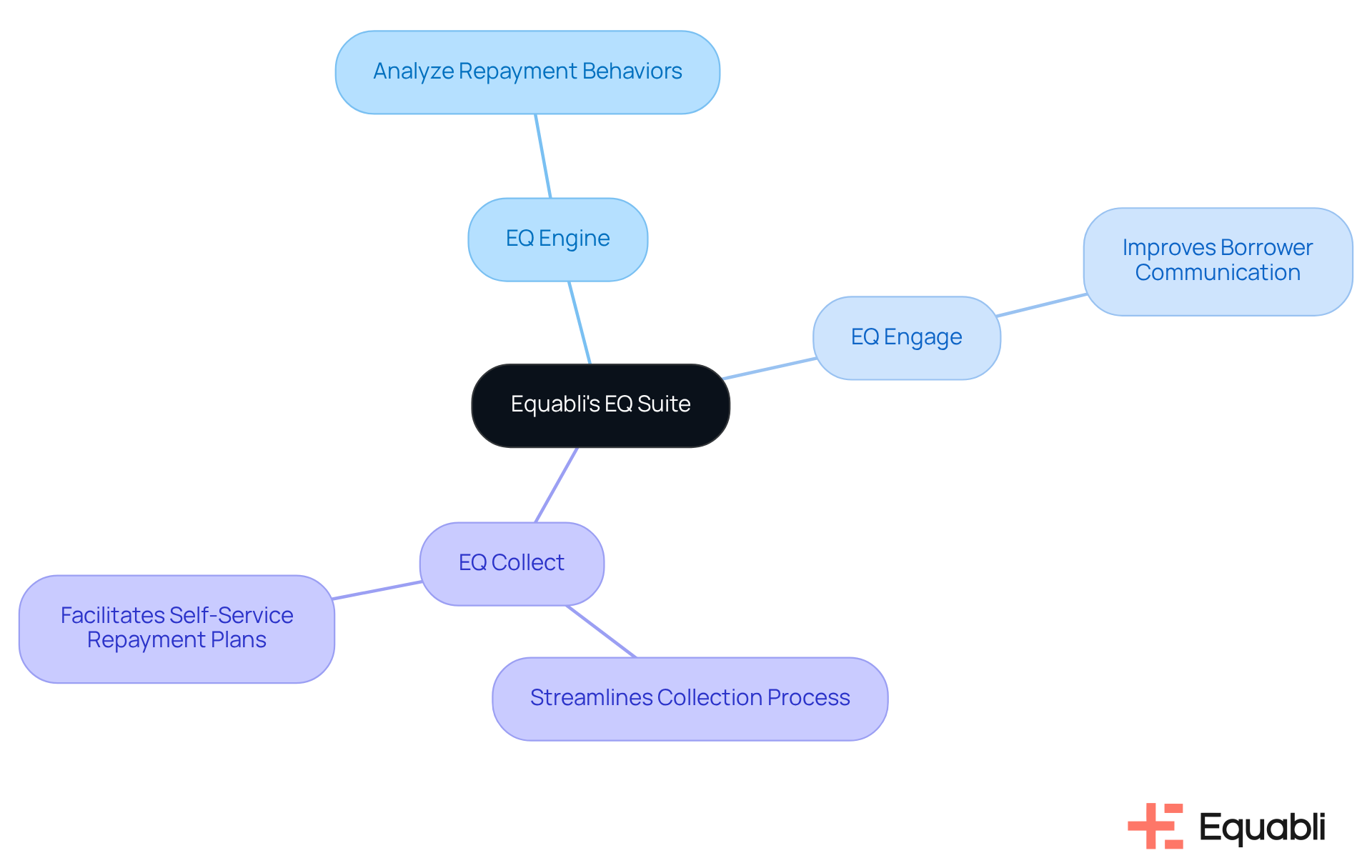

Equabli's EQ Suite: Streamline Compliance with Intelligent Debt Collection Solutions

Equabli's EQ Suite provides a robust array of tools designed to ensure adherence to CFPB compliance strategies for financial institutions and risk management executives. By leveraging the EQ Engine, EQ Engage, and EQ Collect, financial institutions can create custom scoring models and refine collection strategies that meet legal standards. These intelligent solutions markedly enhance while embedding regulations into every facet of the debt collection process, thereby mitigating the risk of violations and associated penalties.

For example, the EQ Engine empowers institutions to analyze repayment behaviors, guaranteeing that collection efforts are both effective and compliant. EQ Engage improves borrower communication through preferred channels, cultivating a more positive interaction that aligns with regulatory expectations. Concurrently, EQ Collect streamlines the collection process, facilitating the implementation of self-service repayment plans that comply with regulations.

The integration of these technologies not only bolsters adherence to CFPB compliance strategies for financial institutions and risk management executives but also enables institutions to navigate the complexities of debt collection with assurance. As industry leaders have noted, the adoption of such intelligent adherence tools is essential for maintaining a competitive edge in today’s regulatory landscape.

Stay Informed: Monitor CFPB Regulatory Changes and Updates

To ensure for financial institutions and risk management executives, fiscal executives must implement a robust system for tracking updates from the Consumer Financial Protection Bureau (CFPB). This system may include:

- Subscribing to industry newsletters

- Attending webinars

- Engaging with professional associations

A proactive approach is crucial; research indicates that approximately 70% of financial institutions consistently monitor CFPB compliance strategies for financial institutions and risk management executives, underscoring the need for vigilance. Industry leaders emphasize that swiftly adjusting policies and procedures in response to legal changes is essential for maintaining standards and mitigating risks.

Effective CFPB compliance strategies for financial institutions and risk management executives include:

- Establishing alerts for new CFPB announcements

- Participating in forums dedicated to compliance discussions

Moreover, the CFPB's recent rule requiring financial institutions to transfer a person's data to another provider upon request underscores the importance of being attentive to policy changes. By cultivating a culture of continuous learning and vigilance, organizations can adeptly navigate the evolving regulatory landscape.

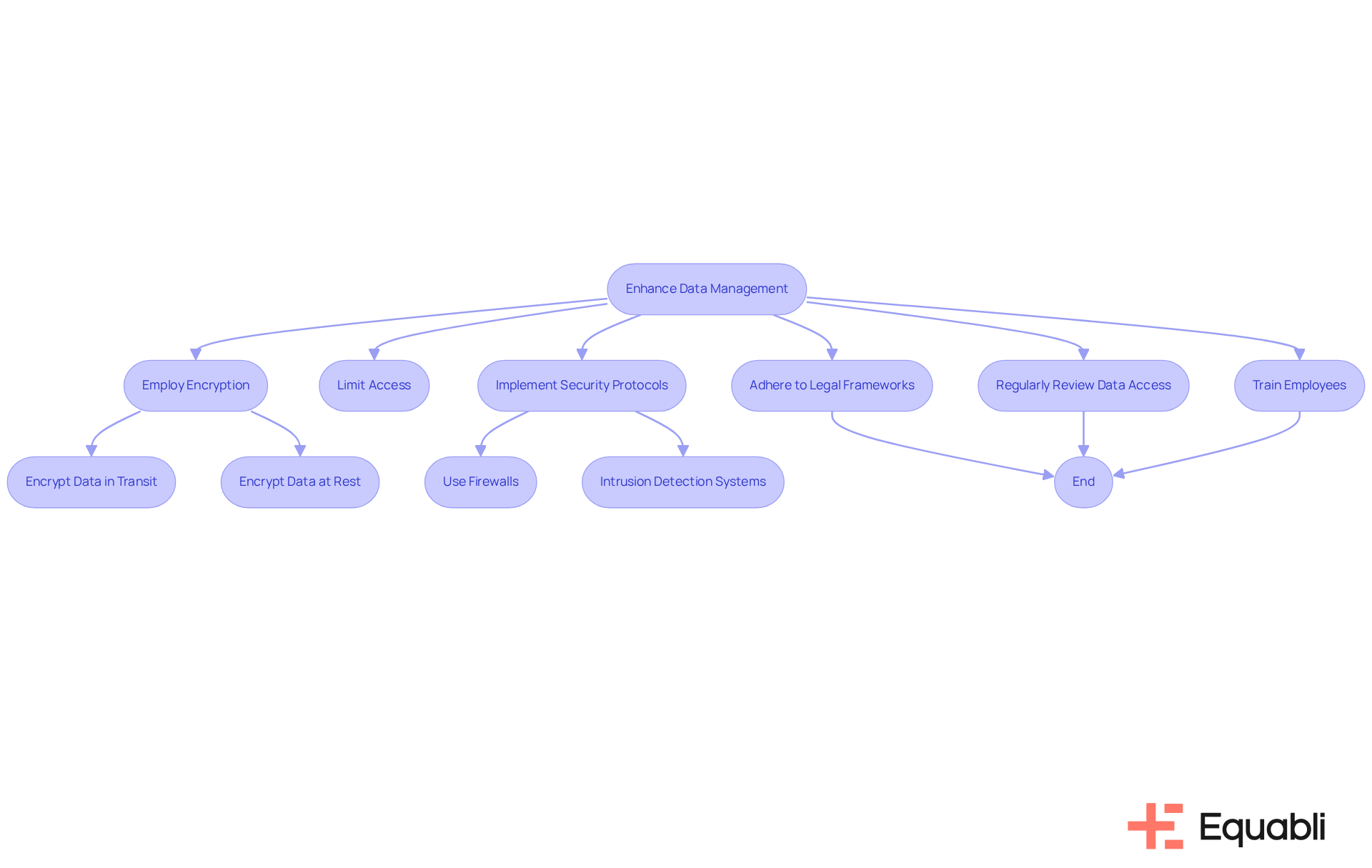

Enhance Data Management: Adopt Best Practices for Handling Sensitive Information

Applying best practices for data management is essential for implementing cfpb compliance strategies for financial institutions and risk management executives. Financial leaders must ensure that sensitive consumer data is securely stored, accessible only to authorized personnel, and regularly reviewed for adherence. Equabli exemplifies this commitment through comprehensive measures designed to protect personal information in debt collection. This includes:

- Employing encryption for data both in transit and at rest

- Limiting access to personal information to individuals with a business need

- Implementing robust security protocols such as firewalls and intrusion detection systems

By strictly prohibiting the sharing of customer information with third parties, Equabli reinforces its dedication to data privacy.

Additionally, Equabli adheres to legal frameworks such as the FDCPA, GLBA, and HIPAA, which guide its data protection practices. Employees are trained to uphold the highest standards of confidentiality, effectively preventing unauthorized disclosures and safeguarding customer data. The utilization of cfpb compliance strategies for financial institutions and risk management executives not only protects data integrity and confidentiality but also helps mitigate the risk of data breaches and associated penalties. In this way, Equabli positions itself as a leader in cfpb compliance strategies for financial institutions and risk management executives, providing a model for others in the industry.

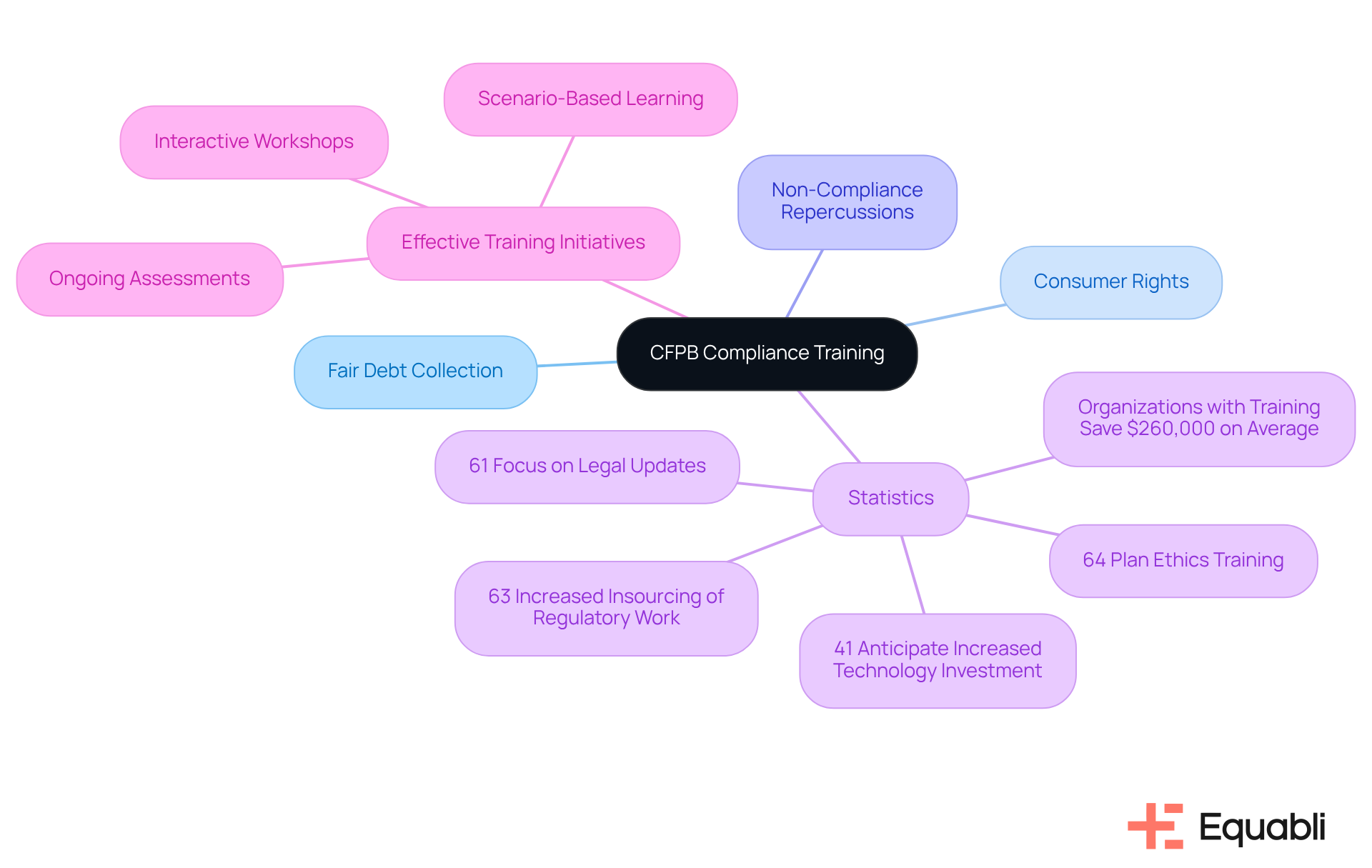

Conduct Regular Training: Educate Staff on CFPB Compliance Requirements

Regular training sessions on CFPB compliance strategies for financial institutions and risk management executives are essential. These sessions should encompass critical topics such as:

- Fair debt collection practices

- Consumer rights

- The repercussions of non-compliance

Research indicates that 63% of corporate risk and adherence professionals have increased insourcing of regulatory work, underscoring a growing acknowledgment of the need for robust training programs. Moreover, 61% of corporate risk and oversight professionals recognize staying updated on legal changes as their primary strategic priority for the upcoming 12 to 18 months, emphasizing the significance of continual education.

By promoting a culture of adherence through education, entities can adopt CFPB compliance strategies for financial institutions and risk management executives, empowering their personnel to make informed choices and significantly minimizing the risk of regulatory breaches. Effective training initiatives can include:

- Interactive workshops

- Scenario-based learning

- Ongoing assessments to ensure employees are well-versed in compliance standards

Notably, 64% of entities intend to offer training on ethics and code of conduct in the next 2-3 years, which aligns with the necessity for comprehensive training programs. Additionally, organizations with employee training have experienced breaches costing $260,000 less on average, highlighting the financial benefits of effective training initiatives.

Furthermore, 41% of regulatory leaders anticipate that technology will be a crucial sector for heightened investment this year, indicating that incorporating technology into training can enhance engagement and retention. As Paul Koziarz emphasizes, businesses must maintain a constant state of remediation and education to keep pace with sophisticated cybercriminals. Ultimately, a not only fulfills legal requirements but also enhances the institution's overall adherence stance, paving the way for CFPB compliance strategies for financial institutions and risk management executives.

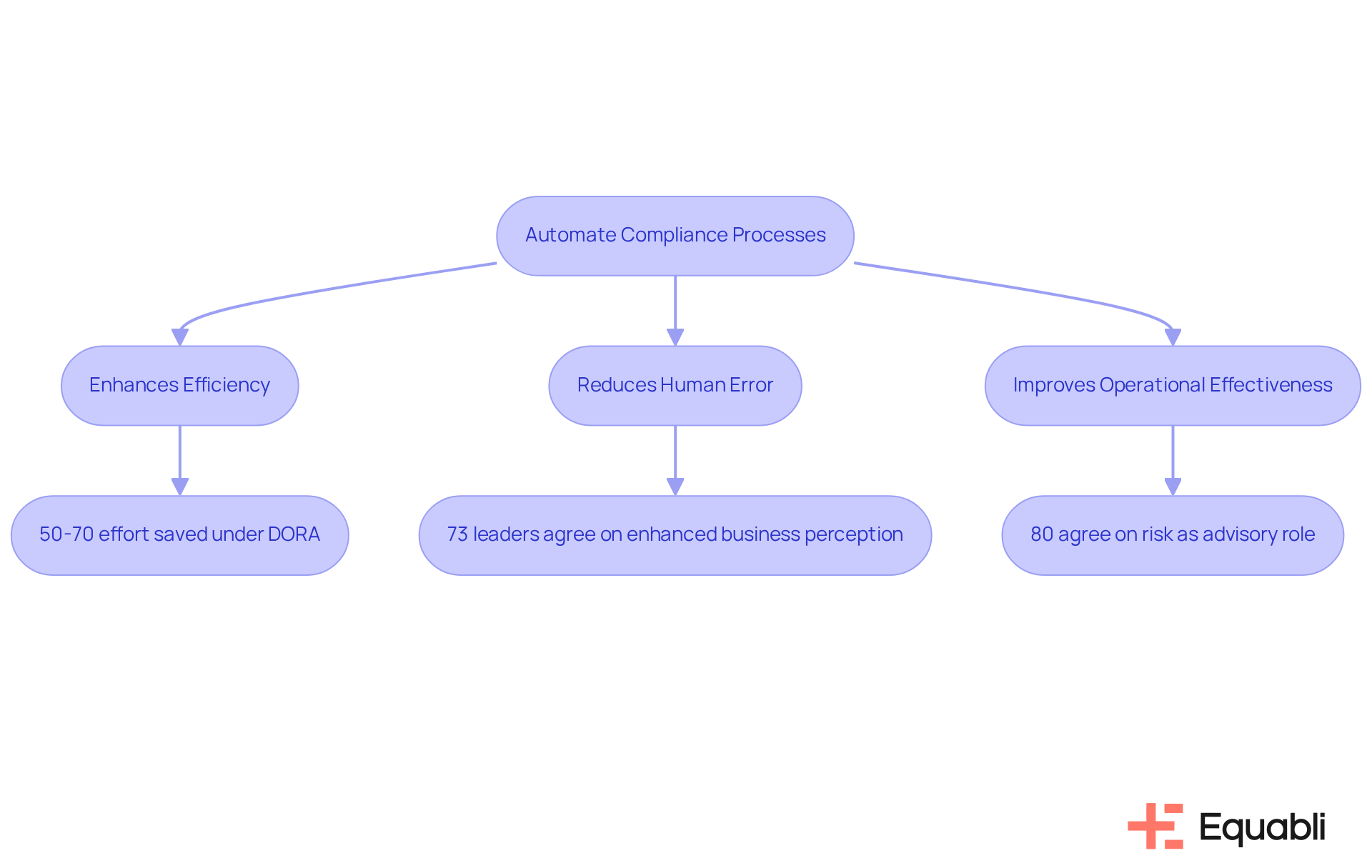

Leverage Technology: Automate Compliance Processes for Greater Efficiency

Utilizing technology to is essential for implementing cfpb compliance strategies for financial institutions and risk management executives, significantly enhancing efficiency and precision. Evidence shows that by employing software tools that automatically monitor regulatory changes, generate adherence reports, and manage documentation, organizations can substantially reduce the risk of human error while implementing cfpb compliance strategies for financial institutions and risk management executives. This transition simplifies regulatory efforts and allows staff to concentrate on strategic initiatives, thereby improving overall operational effectiveness.

For instance, automation can enable European banks to save between 50% to 70% of the effort required to comply with the Digital Operational Resilience Act (DORA), contingent on customer usage and internal research. Furthermore, 80% of corporate risk and regulatory professionals agree that adopting cfpb compliance strategies for financial institutions and risk management executives, which view risk and oversight as valuable business advisory roles, is essential for success.

As cybersecurity risk management specialist Rick Stevenson notes, "73% of leaders indicate that adhering to regulations enhances the perception of their business." The integration of advanced tools like ActiveDocs has proven effective in accelerating document creation and adherence monitoring, which is essential for implementing cfpb compliance strategies for financial institutions and risk management executives, allowing organizations to respond swiftly to regulatory requirements.

Consequently, financial institutions can achieve a more robust regulatory posture by adopting cfpb compliance strategies for financial institutions and risk management executives while optimizing resource allocation for critical business operations.

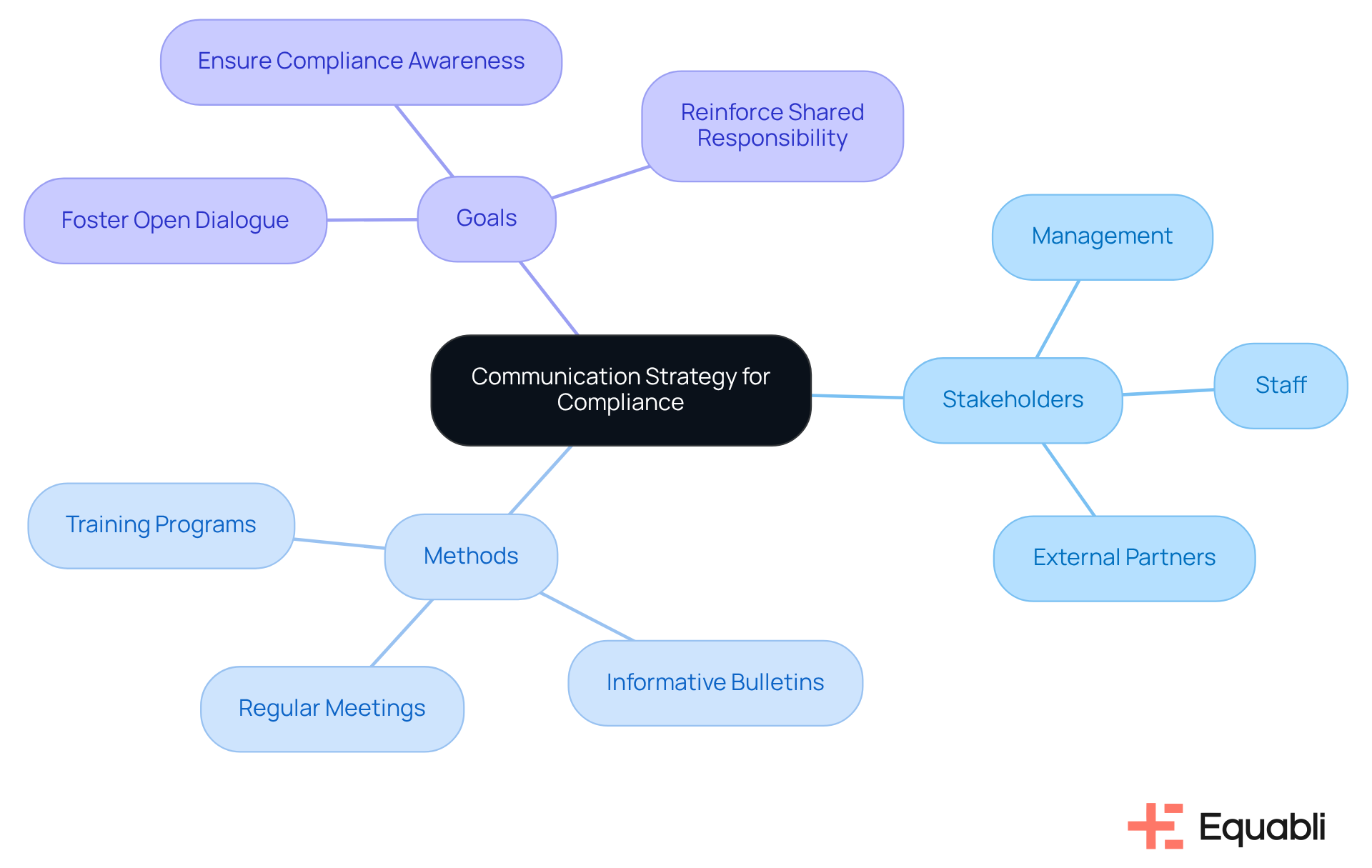

Develop Communication Plans: Engage Stakeholders on Compliance Issues

A robust communication strategy is vital for engaging stakeholders in regulatory matters. Financial executives must ensure that all relevant parties—including management, staff, and external partners—are kept informed about regulatory requirements and updates. Regular meetings, informative bulletins, and foster open dialogue and collaboration, reinforcing that compliance remains a shared responsibility across the organization.

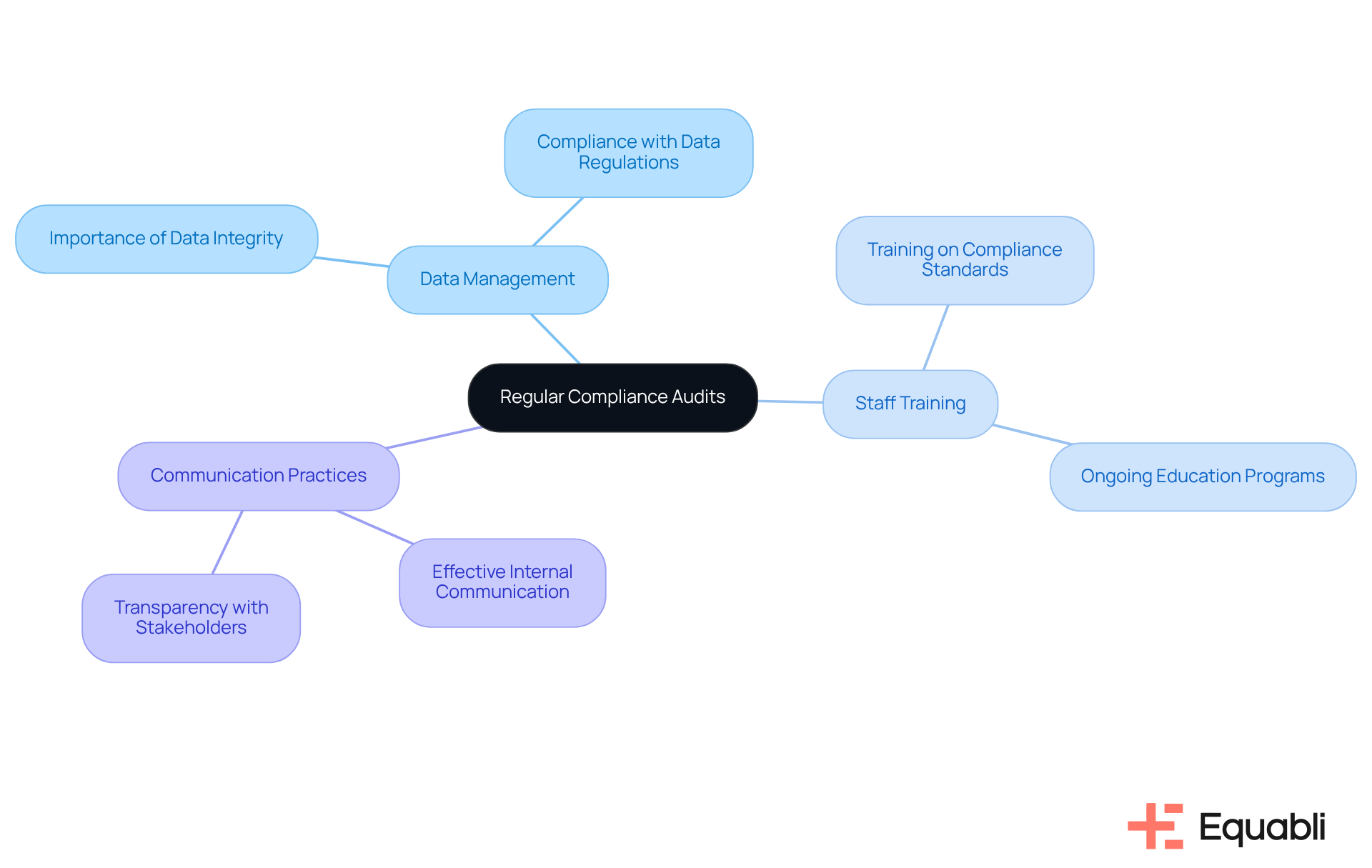

Implement Audits: Conduct Regular Compliance Assessments

Regular adherence audits are essential for identifying compliance gaps and ensuring alignment with CFPB compliance strategies for financial institutions and risk management executives. To ensure CFPB compliance strategies for financial institutions and risk management executives, it is essential for financial institutions to implement a structured schedule for internal audits, emphasizing critical areas such as:

- Data management

- Staff training

- Communication practices

Proactively evaluating CFPB compliance strategies for financial institutions and risk management executives allows organizations to address potential issues before they escalate into penalties or reputational damage. Notably, 37% of businesses conduct one or more internal regulatory audits annually, highlighting the significance of these evaluations as a benchmark for effective management. As Jonathan Gould, Comptroller of the Currency, asserts, effective risk management is vital for implementing CFPB compliance strategies for financial institutions and risk management executives.

Furthermore, with 46% of leaders acknowledging the evolving regulatory landscape as a substantial risk, it is crucial to integrate CFPB compliance strategies for financial institutions and risk management executives through ongoing adherence evaluations to adapt to these changes. By prioritizing regular audits, financial institutions not only bolster compliance but also mitigate the financial repercussions of rising regulatory costs, as indicated by 76% of financial services firms reporting increased expenditures in this domain.

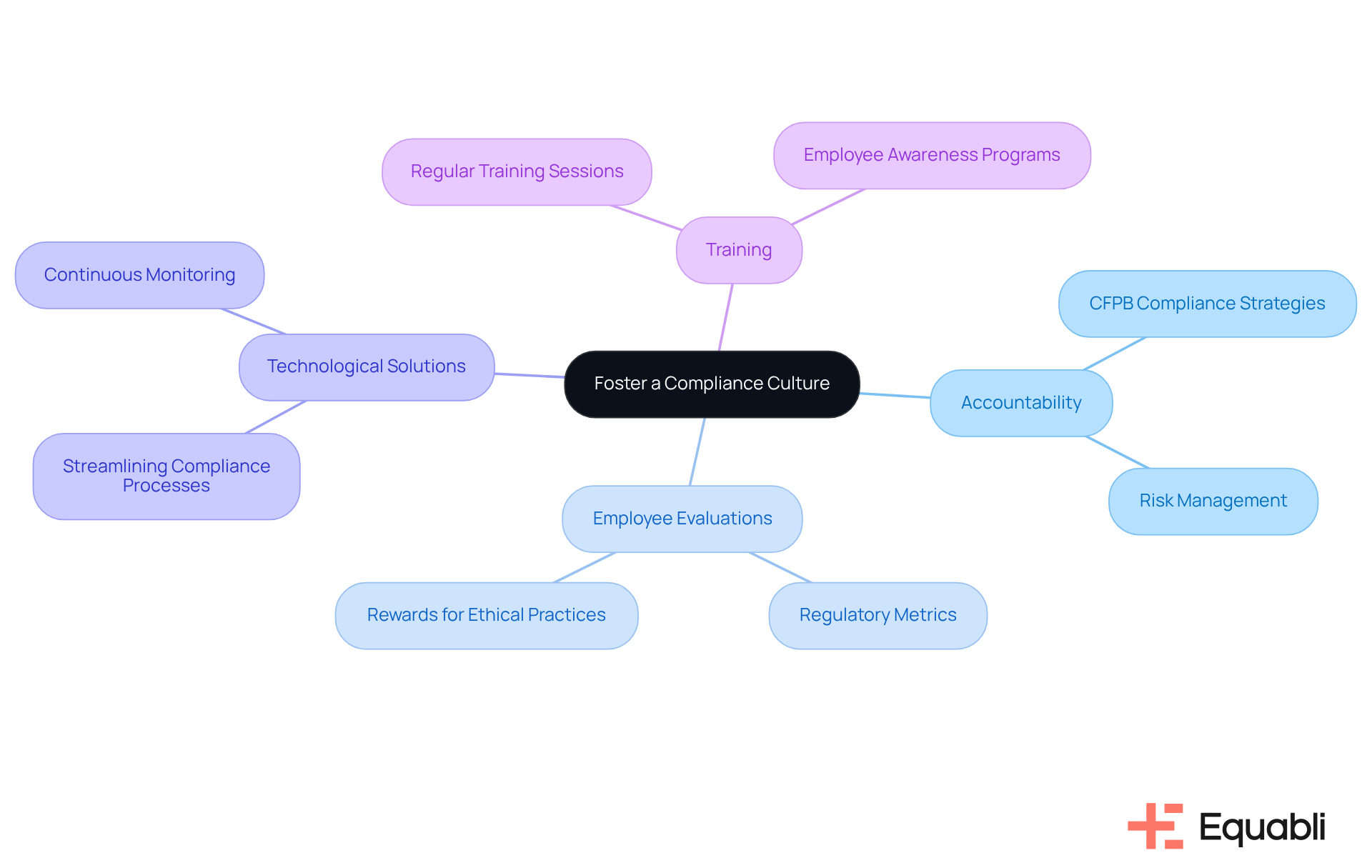

Foster a Compliance Culture: Encourage Accountability Across the Organization

Fostering a strong adherence culture is essential for the sustained success of any organization. Financial leaders are pivotal in promoting accountability by integrating cfpb compliance strategies for financial institutions and risk management executives into performance assessments. Research indicates that approximately 70% of organizations that incorporate into employee evaluations experience enhanced adherence to standards. Acknowledging and rewarding employees who exemplify a commitment to ethical practices not only reinforces these values but also fosters an environment where adherence is prioritized in daily operations.

Furthermore, leveraging technological solutions can streamline adherence processes, facilitating compliance for employees. Continuous monitoring of legal modifications is critical for ensuring effective cfpb compliance strategies for financial institutions and risk management executives, as it keeps organizations informed and able to adapt their adherence strategies accordingly. By prioritizing adherence as a core value and providing regular training sessions, leaders empower their teams to take ownership of regulatory compliance, ultimately enhancing the organization's reputation and operational integrity.

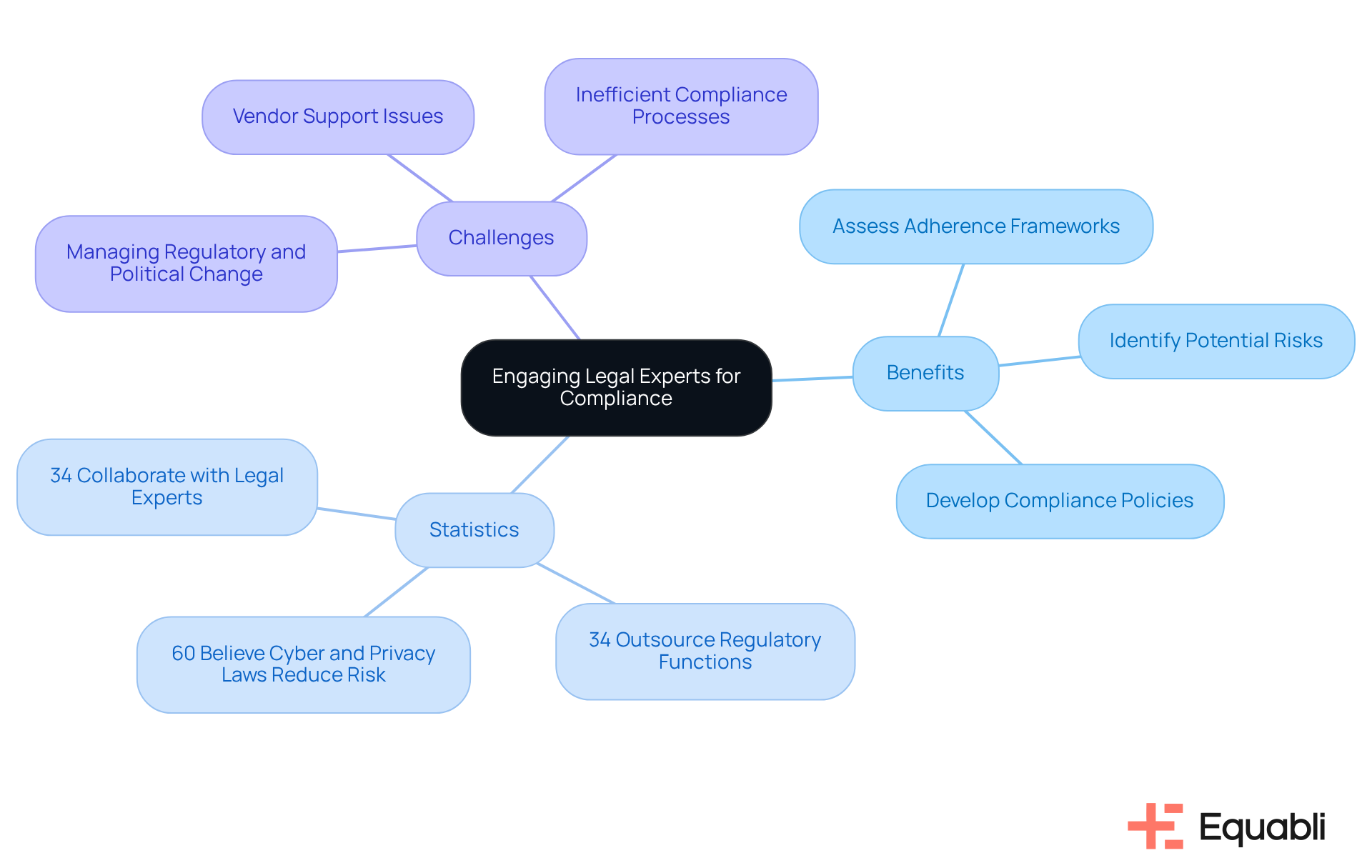

Engage Legal Experts: Collaborate for Comprehensive Compliance Guidance

Engaging legal experts is critical for effectively navigating the complexities of CFPB compliance strategies for financial institutions and risk management executives. Approximately 34% of financial institutions actively collaborate with legal experts to enhance their regulatory strategies. This partnership allows organizations to:

- Assess adherence frameworks

- Identify potential risks

- Develop policies that are in line with CFPB compliance strategies for financial institutions and risk management executives

Furthermore, the trend of outsourcing regulatory functions is evident, with 34% of organizations opting for external expertise. Legal experts offer valuable insights that help organizations anticipate regulatory challenges, particularly as 60% of leaders believe that cyber and privacy laws significantly reduce risk. Effective collaborations demonstrate that integrating legal counsel not only strengthens adherence efforts but also aligns with CFPB compliance strategies for financial institutions and risk management executives, fostering a proactive approach to regulatory changes.

Richard Stevenson, a Shared Assessment Certified Third-Party Risk Assessor, emphasizes that the intricacies of compliance necessitate a strategic alliance with legal experts to adeptly navigate evolving regulations and tackle the challenges faced by 39% of oversight teams in managing regulatory and political shifts.

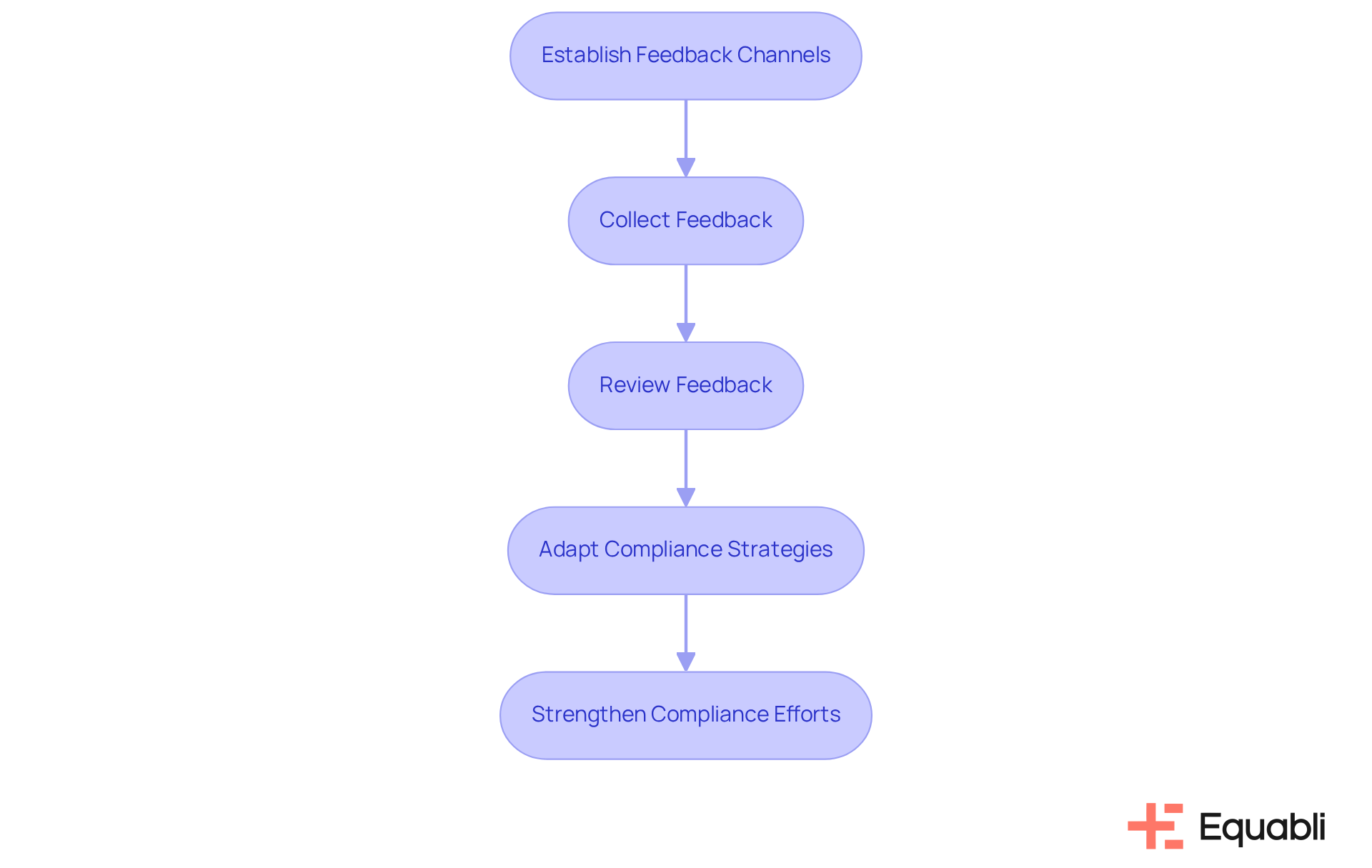

Create Feedback Mechanisms: Continuously Improve Compliance Strategies

Establishing feedback systems is essential for the continuous enhancement of adherence strategies. Financial organizations must create channels that enable employees and stakeholders to provide feedback on regulatory practices and suggest improvements. This proactive approach not only facilitates but also allows organizations to adapt to evolving regulations. By doing so, they can strengthen their overall compliance efforts through cfpb compliance strategies for financial institutions and risk management executives, positioning themselves advantageously to navigate potential challenges.

Conclusion

Implementing effective CFPB compliance strategies is essential for financial executives navigating the intricate regulatory landscape. Leveraging innovative technologies, such as Equabli's EQ Suite, streamlines compliance processes and enhances operational efficiency. By prioritizing data management, regular training, and proactive monitoring of regulatory changes, financial institutions can ensure adherence to legal standards while cultivating a culture of compliance.

Key insights underscore the importance of:

- Continuous education for staff

- The role of technology in automating compliance tasks

- The necessity of engaging legal experts for comprehensive guidance

Regular audits and feedback mechanisms support organizations in identifying gaps and refining their compliance strategies. These practices not only mitigate risks but also position financial institutions as leaders in regulatory adherence.

As the regulatory environment evolves, financial executives must adopt a proactive approach to compliance. By integrating these best practices and fostering a culture of accountability, organizations can enhance their reputation, protect sensitive information, and ultimately thrive in a competitive landscape. Embracing these strategies will safeguard against potential penalties and empower institutions to navigate future challenges with confidence.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a collection of tools designed to help financial institutions and risk management executives comply with CFPB regulations in debt collection processes. It includes the EQ Engine, EQ Engage, and EQ Collect, which enhance operational efficiency and embed legal standards into debt collection practices.

How does the EQ Engine assist financial institutions?

The EQ Engine allows institutions to analyze repayment behaviors, ensuring that their collection efforts are both effective and compliant with regulations.

What role does EQ Engage play in the debt collection process?

EQ Engage improves borrower communication by facilitating interactions through preferred channels, which helps create positive experiences that align with regulatory expectations.

What functionality does EQ Collect provide?

EQ Collect streamlines the debt collection process by enabling institutions to implement self-service repayment plans that comply with regulatory standards.

Why is it important for financial institutions to monitor CFPB regulatory changes?

Monitoring CFPB regulatory changes is essential for maintaining compliance and mitigating risks. Approximately 70% of financial institutions actively track these updates to adjust their policies and procedures promptly.

What strategies can financial institutions use to stay informed about CFPB updates?

Financial institutions can stay informed by subscribing to industry newsletters, attending webinars, engaging with professional associations, establishing alerts for new CFPB announcements, and participating in compliance forums.

What best practices should be adopted for managing sensitive consumer data?

Best practices include securely storing sensitive data, limiting access to authorized personnel, employing encryption for data in transit and at rest, and implementing robust security protocols like firewalls and intrusion detection systems.

How does Equabli ensure data privacy in its practices?

Equabli ensures data privacy by prohibiting the sharing of customer information with third parties, adhering to legal frameworks such as the FDCPA, GLBA, and HIPAA, and training employees to maintain confidentiality and prevent unauthorized disclosures.

What is the significance of the CFPB's recent rule regarding data transfer?

The CFPB's recent rule requiring financial institutions to transfer a person's data to another provider upon request highlights the importance of being vigilant about policy changes and adapting compliance strategies accordingly.

How does Equabli position itself in terms of CFPB compliance?

Equabli positions itself as a leader in CFPB compliance strategies by implementing comprehensive measures to protect personal information and serving as a model for other financial institutions in the industry.