Overview

Effective debt recovery strategies for financial institutions are centered on:

- Evaluating delinquency

- Segmenting borrowers

- Establishing clear policies

- Leveraging technology

Evidence suggests that:

- Data-driven insights

- Automated communication

- Compliance training

significantly enhance recovery efforts. This approach not only leads to improved outcomes but also reduces losses for institutions. By integrating these strategies, organizations can navigate the complexities of debt recovery with greater efficiency and effectiveness.

Introduction

Financial institutions are currently navigating a complex landscape characterized by rising household debt and increasing delinquency rates, which have reached an alarming $18.04 trillion. To effectively address these challenges, organizations must implement robust debt recovery strategies that not only enhance recovery rates but also foster positive relationships with borrowers.

This raises a critical question: what innovative approaches can financial institutions adopt to ensure compliance, leverage technology, and engage diverse customer segments while navigating the intricate dynamics of debt recovery?

This article explores essential components and best practices that can transform debt recovery efforts into successful outcomes.

Understand Key Components of Debt Recovery Strategies

Effective debt recovery strategies hinge on several essential components:

- Evaluation of Delinquency: Financial entities must assess the level of delinquency by classifying debts based on age, amount, and borrower behavior. This assessment is crucial for prioritizing recovery efforts, particularly as total household debt reached $18.04 trillion in Q4 2024, with a notable increase in delinquency rates affecting various loan types. Utilizing EQ Collect's data-driven strategies can further enhance this assessment, allowing institutions to make informed decisions based on real-time insights.

- Segmentation of Borrowers: A comprehensive understanding of borrower demographics and repayment behaviors enables targeted strategies. Different segments may require tailored approaches based on their financial situations. For instance, applying behavioral science techniques can enhance debtor segmentation, resulting in more effective communication and increased collection rates. EQ Collect's automated workflows simplify the segmentation process, ensuring that institutions can concentrate on the most promising revitalization opportunities.

- Clear Policies and Procedures: Establishing well-defined internal policies for debt collection ensures consistency and compliance throughout the organization. This includes outlining escalation processes and timelines for follow-ups, which are vital for maintaining operational efficiency and reducing non-performing loans (NPL). Specific steps might include defining clear communication protocols and setting deadlines for each stage of the restoration process. With EQ Collect's industry-leading and user-friendly, scalable, cloud-native interface, organizations can automate monitoring to ensure adherence to these policies.

- Performance Metrics: Implementing robust metrics to evaluate the effectiveness of restoration strategies is essential. Metrics such as return rates, time to regain, and customer satisfaction scores offer valuable insights into performance and highlight areas for enhancement. For example, organizations that implement dynamic collection propensity scoring models can significantly improve their retrieval strategies by incorporating both static and dynamic data. EQ Collect's real-time reporting features enable organizations to monitor these metrics efficiently, ensuring ongoing enhancement in their debt collection efforts.

By focusing on these elements and leveraging the advanced capabilities of EQ Collect, including its intuitive interface, financial organizations can establish effective debt recovery strategies for financial institutions, which will ultimately result in enhanced outcomes and reduced losses. Additionally, referencing case studies such as "Data-Driven Customer Insights for Debt Collection" can illustrate how aggregating structured and unstructured data across business lines can provide a comprehensive view of customer behavior, aiding in the identification of characteristics and trends among defaulters.

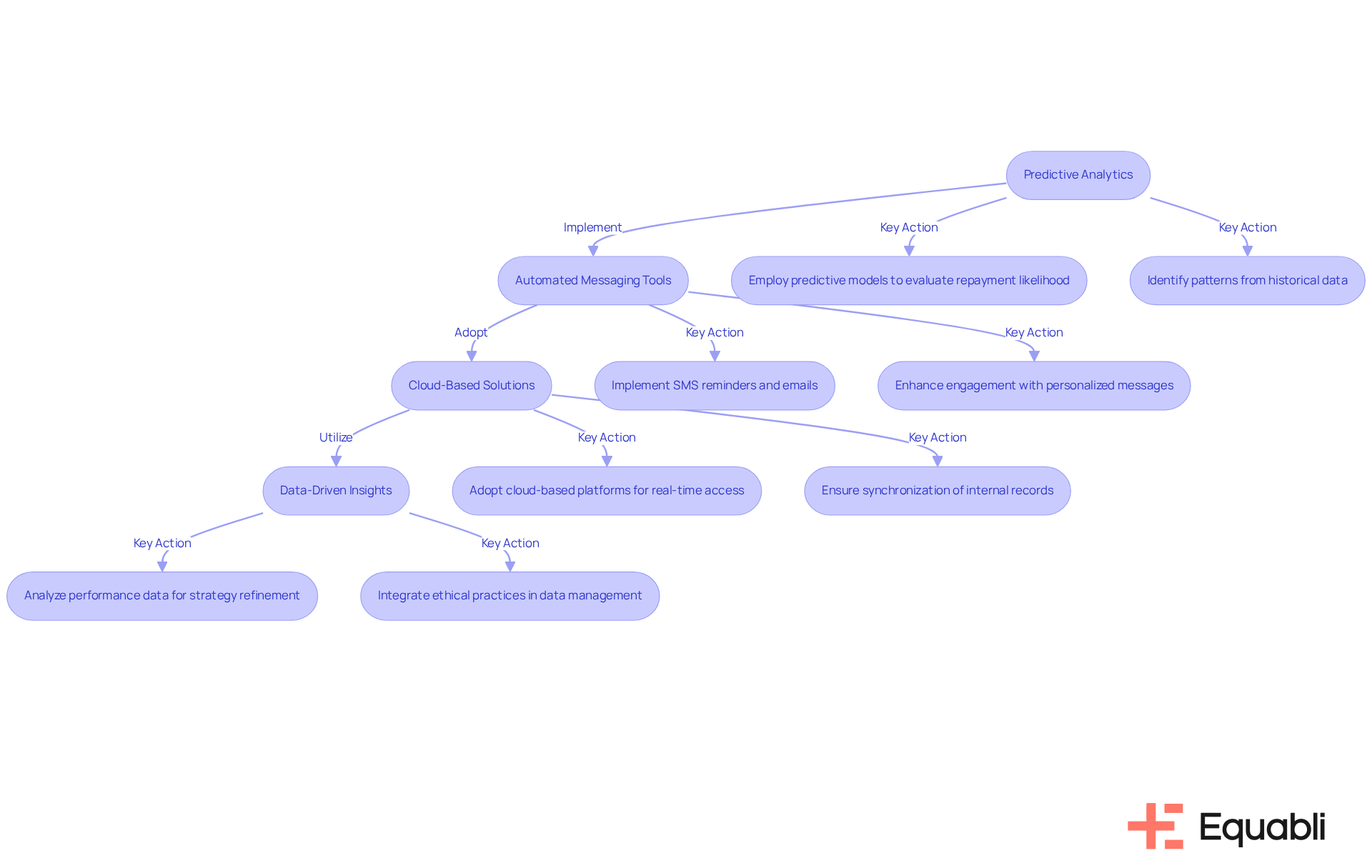

Leverage Technology and Data Analytics for Enhanced Recovery

To enhance debt recovery, financial institutions should leverage technology and data analytics in the following ways:

- Predictive Analytics: Employing predictive models to evaluate the likelihood of repayment allows institutions to prioritize accounts for collection efforts effectively. Analyzing historical data facilitates the identification of patterns, enabling tailored strategies focused on high-risk accounts. Agencies utilizing machine learning tools, such as those found in Equabli's EQ Suite, have reported a 25% increase in recovery rates, demonstrating the role of [effective debt recovery strategies for financial institutions](https://blog.equabli.com/effective-financial-debt-recovery-solutions-for-corporate-risk-management) in enhancing recovery through predictive analytics. This increase results directly from predictive analytics, which aids agencies in allocating resources more efficiently and designing intelligent servicing strategies.

- Automated Messaging Tools: Implementing automated messaging systems facilitates timely and consistent outreach to borrowers. Tools such as SMS reminders, emails, and chatbots enhance engagement without overwhelming staff. These automated systems not only streamline communication but also improve debtor responsiveness, as personalized messages can be crafted based on individual circumstances. This shift from manual outreach to automated systems addresses the inefficiencies frequently encountered by organizations relying on conventional methods.

- Cloud-Based Solutions: Adopting cloud-based debt collection platforms, such as Equabli's EQ Suite, provides real-time access to data and analytics, significantly improving decision-making and operational efficiency. Centralized data platforms ensure synchronization between internal records and client databases, enhancing data accuracy and reducing operational costs. Transitioning from manual methods to enables organizations to react quickly to evolving situations and expand their collections operations without compromising performance.

- Data-Driven Insights: Regularly analyzing performance data related to restoration allows institutions to continuously refine their strategies. By understanding which approaches yield the best results, they can adapt their processes to maximize effectiveness. This data-driven method not only improves success rates but also promotes a culture of ongoing enhancement within the organization. Moreover, integrating ethical practices in data management and interaction fosters consumer trust, which is vital for long-term success in debt collection.

By incorporating these technological innovations, particularly through the application of Equabli's EQ Suite, financial organizations can adopt effective debt recovery strategies for financial institutions, resulting in improved engagement and increased recovery rates.

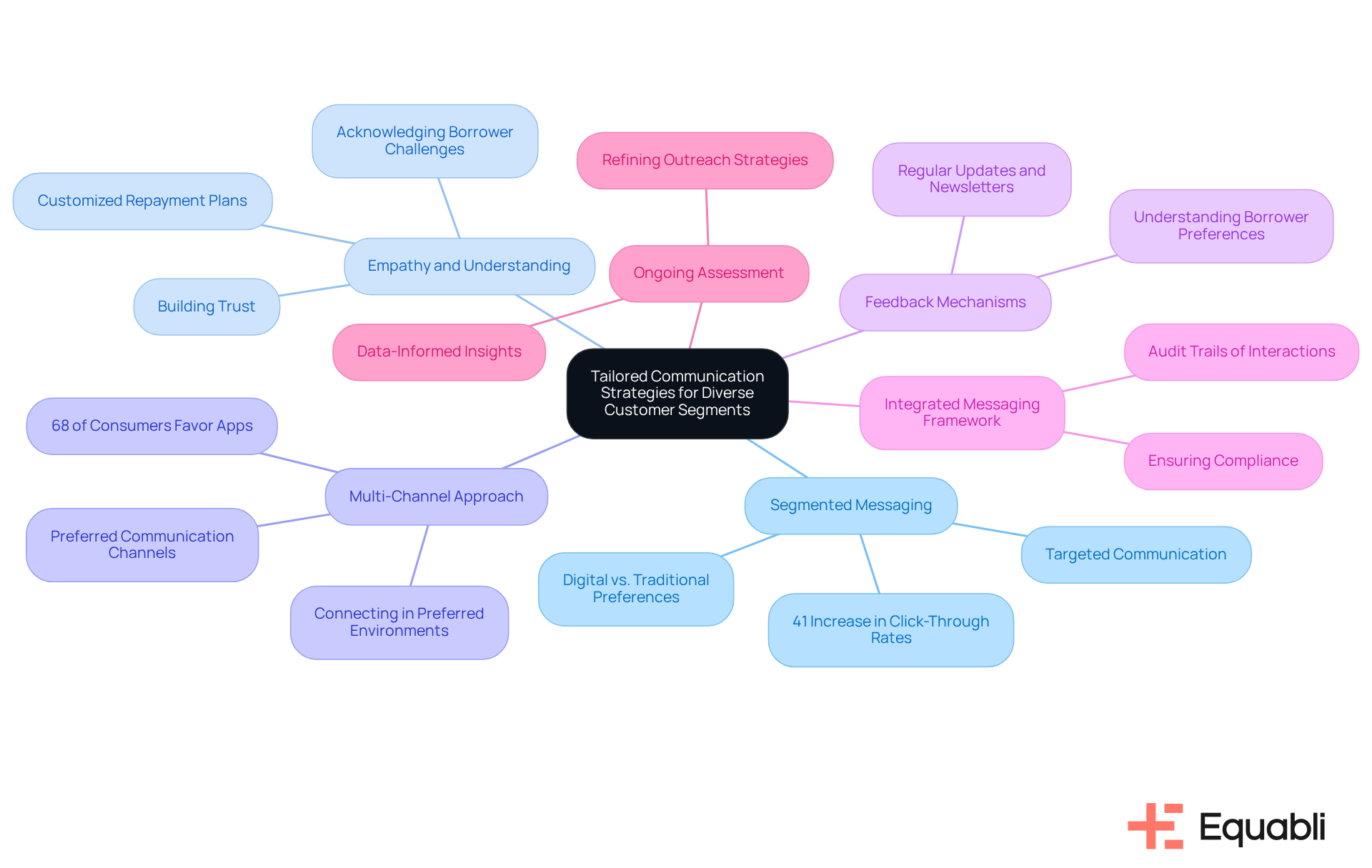

Implement Tailored Communication Strategies for Diverse Customer Segments

To effectively engage borrowers, financial institutions must implement tailored communication strategies that leverage the innovative features of EQ Engage.

- Segmented Messaging: Financial institutions should create messaging that appeals to specific client segments. For instance, younger borrowers may prefer digital interactions, whereas older borrowers might respond more favorably to phone calls. According to Salesforce, personalized interactions can increase click-through rates by 41%, underscoring the effectiveness of tailored messaging. With EQ Engage, institutions can design and automate these personalized communication journeys, ensuring that messages align with the brand voice and visual identity.

- Empathy and Understanding: Communication must reflect empathy toward the circumstances of borrowers in need. Acknowledging their challenges fosters trust and encourages cooperation. As noted, "By demonstrating empathy and providing adaptable solutions, loan officers can assist clients in navigating challenging periods while still striving to meet their loan obligations." EQ Engage empowers individuals with customized repayment plans, enhancing their experience and promoting self-service options.

- Multi-Channel Approach: Utilizing —such as phone, email, SMS, and social media—allows institutions to connect with clients in their preferred environments. This strategy increases the likelihood of engagement, particularly given that 68% of consumers favor apps for financial transactions. EQ Engage facilitates this multi-channel strategy, enabling institutions to connect with a broader customer base effectively.

- Feedback Mechanisms: Establishing feedback channels is crucial for understanding borrower preferences and concerns. This information can be used to refine interaction strategies further. Regular updates, such as monthly newsletters, help build trust and keep individuals informed about their debt status. EQ Engage captures consumer preferences, ensuring that interactions remain relevant and effective.

- Integrated Messaging Framework: Implementing an integrated messaging framework provides clear audit trails of interactions, ensuring transparency and accountability in communications with loan recipients. This practice is essential for maintaining compliance and enhancing trust among clients.

- Ongoing Assessment: Financial organizations should consistently assess and adjust their outreach strategies to remain attuned to evolving customer preferences. With EQ Engage's data-informed insights, organizations can refine their strategies to optimize engagement and outcomes.

By adopting these customized communication techniques, bolstered by the innovative features of EQ Engage, financial organizations can significantly enhance borrower engagement, which is essential for implementing effective debt recovery strategies for financial institutions, resulting in improved outcomes and nurturing long-term relationships.

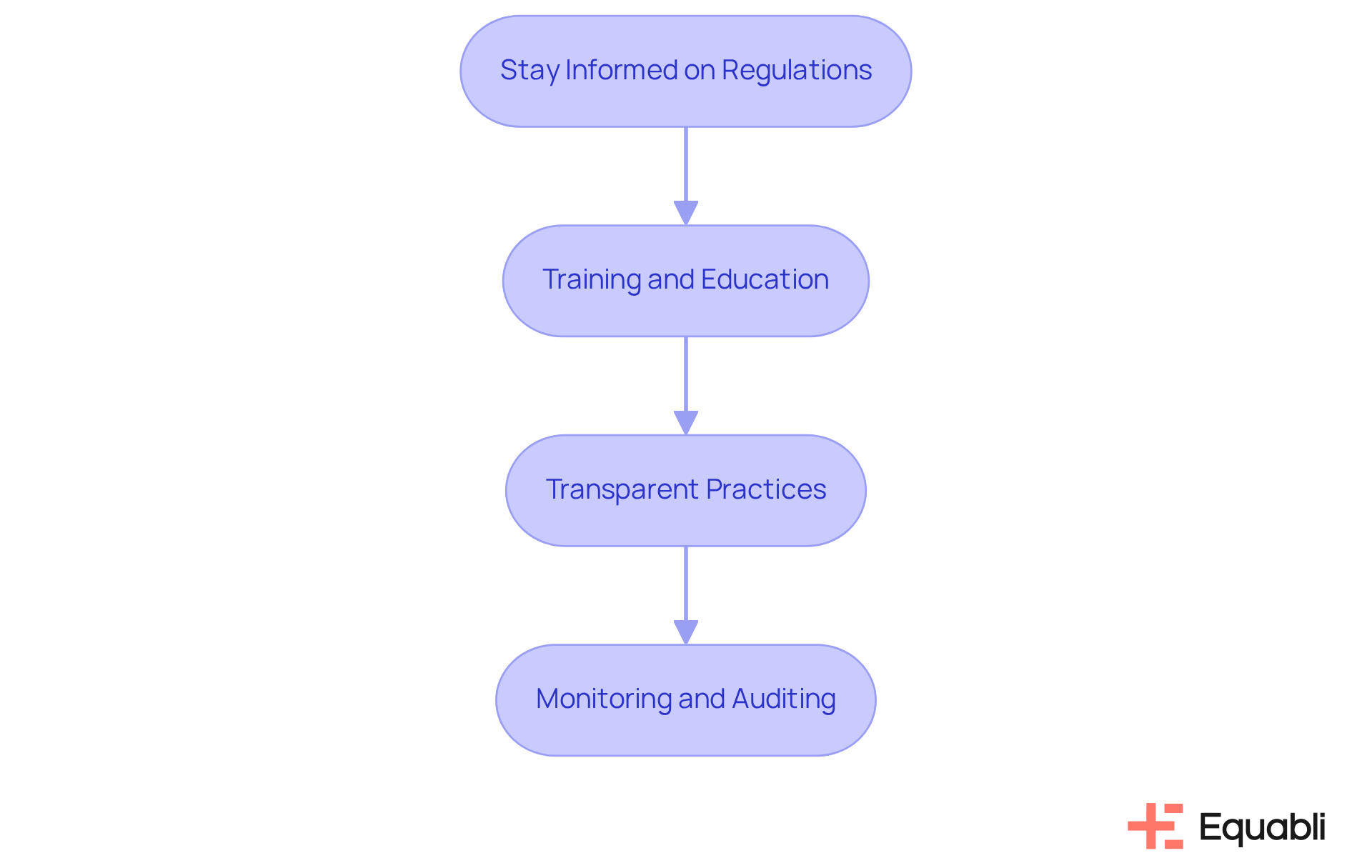

Ensure Compliance and Ethical Standards in Debt Recovery Practices

To ensure compliance and uphold ethical standards in debt recovery, financial institutions should adopt a multifaceted approach:

- Stay Informed on Regulations: It is imperative to regularly review and update knowledge of relevant laws, including the Fair Debt Collection Practices Act (FDCPA) and local regulations. This vigilance guarantees that all restoration practices remain compliant, particularly in a landscape where the Consumer Financial Protection Bureau (CFPB) reported over 109,000 debt collection complaints in 2023 alone.

- Training and Education: Ongoing training for staff on compliance and ethical standards is essential. Research indicates that organizations with robust training programs see a significant reduction in compliance violations. For instance, companies that introduced extensive training reported a 43% rise in payment retrieval, showcasing the efficiency of well-informed teams. Furthermore, it is essential to acknowledge that merely 17% of charged-off credit card balances were retrieved over a four-year span, highlighting the significance of effective training and adherence in enhancing retrieval rates.

- Transparent Practices: Upholding regarding their debts, fees, and collection processes promotes trust and reduces conflicts. Clear communication aligns with consumer expectations, as most account holders now prefer to manage their obligations quickly and securely online.

- Monitoring and Auditing: Regular audits of debt recovery practices are crucial for identifying potential compliance issues. Proactive monitoring not only reduces risks but also improves operational integrity, ensuring that organizations can adjust to changing regulations and consumer demands. This proactive approach is essential in light of the significant number of complaints received by the CFPB, emphasizing the need for compliance and ethical practices.

By prioritizing adherence to regulations and ethical standards, financial organizations can develop effective debt recovery strategies for financial institutions that safeguard against legal consequences while fostering positive relationships with borrowers. This commitment to ethical practices not only protects the institution but also contributes to a more sustainable and responsible debt recovery environment.

Conclusion

Effective debt recovery strategies are essential for financial institutions seeking to minimize losses and sustain healthy cash flow. By understanding and implementing key components—such as borrower segmentation, technology utilization, clear policies, and adherence to compliance standards—organizations can establish a robust framework for successful debt recovery. This multifaceted approach not only enhances recovery rates but also cultivates trust and cooperation between lenders and borrowers.

The evaluation of delinquency is critical in prioritizing recovery efforts. Tailored communication strategies enable financial institutions to connect with borrowers in ways that resonate with their unique circumstances. Leveraging technology and data analytics, including predictive models and automated messaging, facilitates more efficient outreach and improved engagement. Furthermore, maintaining compliance and ethical practices safeguards organizations from legal repercussions and bolsters their reputation in the market.

The significance of effective debt recovery strategies is paramount. Financial institutions must embrace innovative technologies and data-driven insights to continuously refine their approaches. By prioritizing empathy in communications and adhering to ethical standards, organizations can enhance recovery outcomes and foster lasting relationships with clients. As the financial landscape evolves, a proactive and adaptable stance will be crucial for success in debt recovery.

Frequently Asked Questions

What are the key components of effective debt recovery strategies?

The key components include evaluation of delinquency, segmentation of borrowers, clear policies and procedures, and performance metrics.

How is delinquency evaluated in debt recovery?

Delinquency is assessed by classifying debts based on age, amount, and borrower behavior, which helps prioritize recovery efforts.

Why is borrower segmentation important in debt recovery?

Understanding borrower demographics and repayment behaviors allows for targeted strategies that cater to different financial situations, enhancing communication and collection rates.

What role do clear policies and procedures play in debt recovery?

Well-defined internal policies ensure consistency and compliance, outlining escalation processes and timelines for follow-ups, which helps maintain operational efficiency and reduce non-performing loans.

What performance metrics are important for evaluating debt recovery strategies?

Important metrics include return rates, time to regain, and customer satisfaction scores, which provide insights into performance and highlight areas for improvement.

How can EQ Collect enhance debt recovery strategies?

EQ Collect offers data-driven strategies, automated workflows for borrower segmentation, compliance oversight, and real-time reporting features that help organizations improve their debt collection efforts.

What additional resources can help illustrate effective debt recovery strategies?

Case studies, such as 'Data-Driven Customer Insights for Debt Collection,' can provide insights into how structured and unstructured data can enhance understanding of customer behavior and trends among defaulters.