Overview

Modern recovery solutions for effective financial risk management encompass:

- predictive analytics

- custom scoring models

- automated communication strategies.

These data-driven approaches are instrumental in enhancing recovery rates and operational efficiency. By leveraging analytics, financial institutions can tailor collection efforts and improve borrower engagement. This strategic alignment addresses key challenges faced by the industry, positioning recovery solutions as essential tools for operational success.

Introduction

Effective financial risk management has emerged as a critical focus for institutions navigating an increasingly volatile economic landscape. This emphasis is driven by the need for organizations to understand the fundamentals of risk management and leverage modern recovery solutions, thereby significantly enhancing their resilience against potential monetary setbacks.

However, as institutions strive to implement these strategies, they often encounter complex challenges, including:

- Regulatory compliance

- Technological integration

- Evolving consumer behaviors

How can financial institutions effectively overcome these obstacles to optimize their recovery efforts and safeguard their financial stability?

Understand Financial Risk Management Fundamentals

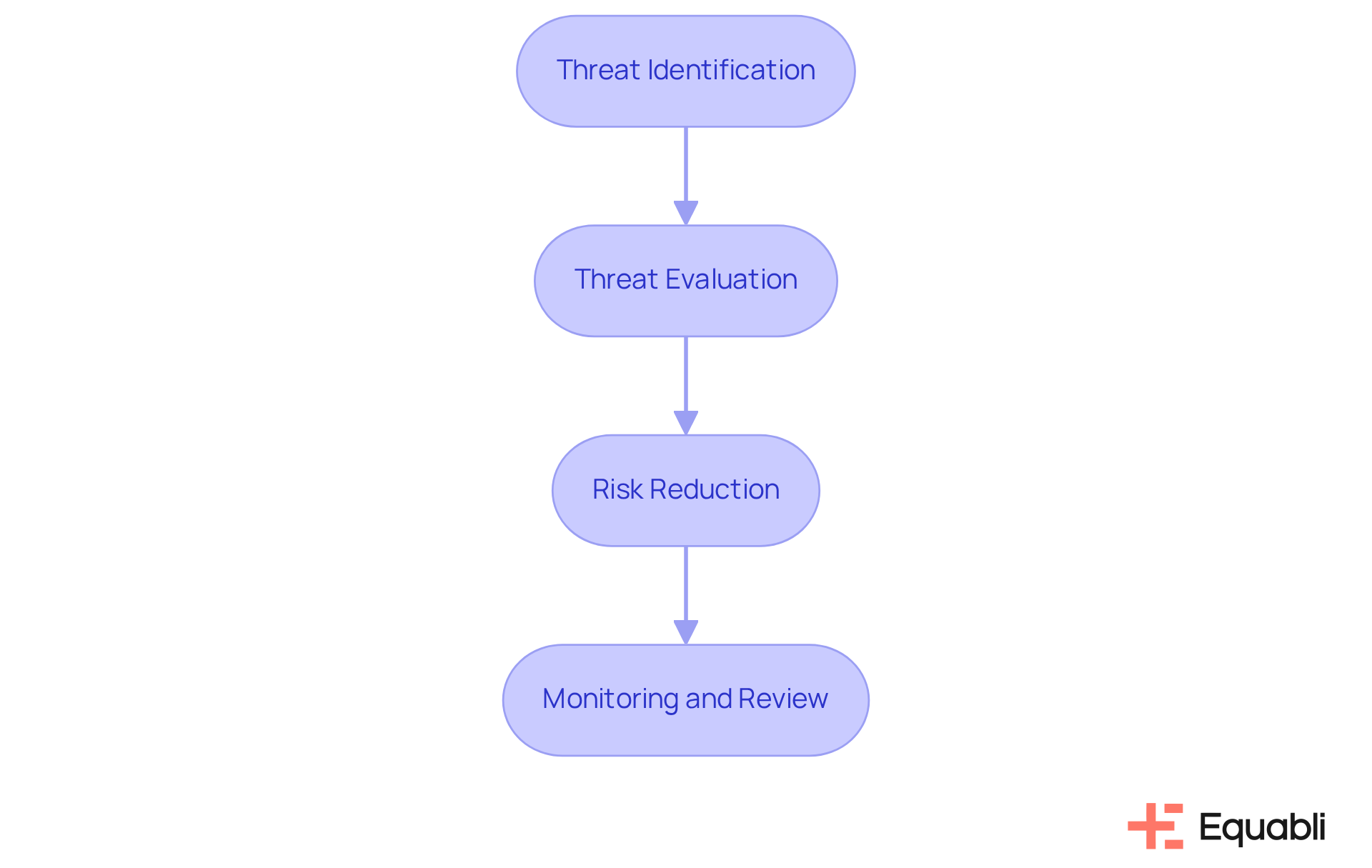

Effective financial loss management encompasses the recognition, evaluation, and mitigation of potential monetary setbacks. A comprehensive understanding of market uncertainties, credit challenges, operational issues, and liquidity concerns is essential. Institutions must adopt a structured approach to risk management, which includes:

- Threat Identification: Recognizing potential dangers that could jeopardize , such as market fluctuations or borrower defaults.

- Threat Evaluation: Assessing the likelihood and potential impact of identified hazards through both quantitative and qualitative techniques.

- Risk Reduction: Developing strategies to mitigate the effects of risks, including portfolio diversification and robust collection procedures.

- Monitoring and Review: Continuously tracking threat factors and evaluating strategies to adapt to changing conditions.

By establishing a comprehensive management framework for challenges, financial organizations can enhance their preparedness for uncertainties and strengthen their recovery efforts using modern recovery solutions for enterprise financial risk management.

Identify Key Challenges in Financial Institutions

Monetary organizations encounter significant obstacles that can impede effective economic threat management and the implementation of modern recovery solutions for enterprise financial risk management. These challenges include:

- Regulatory Compliance: Navigating complex regulatory frameworks is resource-intensive, potentially leading to compliance risks if not managed effectively. Deloitte reports that the annual cost of financial crime compliance in the US and Canada totals $61 billion, underscoring the necessity for institutions to remain vigilant to avoid costly penalties and operational disruptions.

- Technological Integration: Institutions often struggle to integrate new technologies with existing systems seamlessly. This challenge can hinder operational efficiency and limit the effective use of data, which is crucial for informed decision-making and the application of modern recovery solutions for enterprise financial risk management. Deloitte's research indicates that banks plan to increase technology spending despite economic uncertainties, highlighting the critical role of modernization in addressing these challenges.

- Data Management: Effective restoration techniques depend on accurate and timely information. However, institutions frequently face difficulties related to data collection, analysis, and security, particularly due to fragmented and incompatible data systems. This situation jeopardizes their ability to implement effective restoration measures, emphasizing the need for integrated data pipelines and centralized cloud-based platforms.

- Changing Consumer Behavior: Adapting to shifts in consumer preferences and repayment behaviors is vital for effective collections. Institutions must leverage insights into consumer trends to tailor their approaches and enhance engagement. Notably, 46% of monetary services companies reported , highlighting the importance of understanding consumer behavior in recovery strategies.

- Economic Volatility: Economic fluctuations can significantly affect borrowers' repayment capabilities, necessitating agile and responsive plans. Institutions must be prepared to adjust their strategies in response to changing economic conditions, as numerous large European banks are expected to face cost increases exceeding revenue growth in 2024, indicating the need for proactive fiscal management.

By recognizing and addressing these challenges, institutions can better align their restoration plans with modern recovery solutions for enterprise financial risk management, ultimately enhancing their resilience and capacity to manage monetary risks.

Implement Data-Driven Recovery Strategies

Data-driven recovery approaches leverage analytics to enhance decision-making and streamline collection processes. Key practices include:

- Predictive Analytics: By analyzing historical data, financial institutions can anticipate borrower repayment behaviors, facilitating customized collection strategies tailored to individual circumstances. Equabli's EQ Engine employs machine learning to predict delinquency risk for active accounts, enabling institutions to develop intelligent servicing methods. Approximately 57% of debt collection agencies currently utilize AI for predictive analytics, highlighting its increasing significance in the industry.

- Custom Scoring Models: Implementing scoring models that assess the likelihood of repayment based on various factors allows for targeted outreach to high-risk borrowers. Organizations can evaluate over 300 factors per account to prioritize collections efficiently. For instance, Firstsource experienced a 30% increase in retrieval rates shortly after adopting such models. Similarly, Encore Capital Group through machine learning to forecast payment probability, reflecting Equabli's commitment to improving debt collection efficiency.

- Automated Communication: Utilizing technology to automate communication with borrowers ensures timely reminders and personalized engagement through preferred channels. Equabli's intelligent automation solutions can significantly lower operational costs while improving borrower interactions. While AI-powered chatbots and automated systems are essential, Equabli maintains human oversight to effectively manage complex borrower situations.

- Performance Monitoring: Continuously analyzing the effectiveness of recovery methods through key performance indicators (KPIs) enables institutions to refine their strategies and enhance outcomes. This iterative approach is vital for adapting to evolving borrower behaviors and market conditions, further supported by the predictive capabilities of Equabli's EQ Engine.

- Feedback Loops: Establishing systems for gathering borrower input enhances engagement strategies and proactively addresses issues. Understanding clients' economic situations can lead to more effective negotiation tactics and mutually beneficial solutions. Additionally, ongoing training for collection teams is essential to equip them with the latest techniques and resources for efficient debt collection.

By adopting these data-driven strategies, particularly those powered by Equabli's advanced solutions, financial institutions can significantly enhance recovery rates and reduce operational costs, ultimately promoting modern recovery solutions for enterprise financial risk management.

Conclusion

Effective financial risk management is imperative for institutions navigating the complexities of today's economic landscape. By grasping the fundamentals of risk management, identifying key challenges, and implementing data-driven recovery strategies, organizations can significantly bolster their resilience against potential financial setbacks.

This article delineates essential steps for managing financial risks, including:

- Threat identification

- Evaluation

- Reduction

It underscores the pressing challenges faced by financial institutions, such as:

- Regulatory compliance

- Technological integration

- Data management

- Shifting consumer behavior

- Economic volatility

Furthermore, it emphasizes the necessity of adopting data-driven recovery strategies, including:

- Predictive analytics

- Automated communication

These strategies aim to enhance decision-making and streamline collection processes.

In light of these insights, financial institutions are advised to prioritize modern recovery solutions for enterprise financial risk management. By embracing innovative technologies and strategies, organizations can adeptly navigate current challenges while positioning themselves for sustainable growth and stability in the future. The importance of proactive financial risk management is paramount; it is essential for cultivating a resilient financial ecosystem capable of adapting to ever-evolving market conditions.

Frequently Asked Questions

What is financial risk management?

Financial risk management involves recognizing, evaluating, and mitigating potential monetary setbacks to enhance financial stability.

Why is it important to understand market uncertainties in financial risk management?

Understanding market uncertainties is essential as it helps institutions identify potential dangers that could threaten their financial stability.

What are the key components of a structured approach to risk management?

The key components include threat identification, threat evaluation, risk reduction, and monitoring and review.

What does threat identification involve?

Threat identification involves recognizing potential dangers such as market fluctuations or borrower defaults that could jeopardize financial stability.

How is threat evaluation conducted?

Threat evaluation is conducted by assessing the likelihood and potential impact of identified hazards using both quantitative and qualitative techniques.

What strategies can be employed for risk reduction?

Strategies for risk reduction include portfolio diversification and implementing robust collection procedures.

Why is monitoring and review important in financial risk management?

Monitoring and review are important as they involve continuously tracking threat factors and evaluating strategies to adapt to changing conditions.

How can financial organizations enhance their preparedness for uncertainties?

By establishing a comprehensive management framework for challenges and utilizing modern recovery solutions, financial organizations can enhance their preparedness and strengthen recovery efforts.