Overview

The article provides an overview of ten cloud-based debt collection software solutions specifically designed for financial institutions, emphasizing their features and benefits in enhancing debt recovery processes. Each solution, including Equabli's EQ Suite and Invoiced, showcases capabilities such as:

- Automation

- Data-driven insights

- Customer engagement

These tools are instrumental in optimizing operational efficiency and improving recovery rates, particularly in a competitive financial landscape. By leveraging these advanced solutions, financial institutions can strategically enhance their debt collection efforts, ensuring compliance and maximizing recovery outcomes.

Introduction

As financial institutions confront the complexities of debt recovery, the demand for innovative solutions has reached unprecedented levels. Cloud-based debt collection software presents a transformative approach, empowering organizations to streamline their processes, enhance borrower engagement, and utilize data-driven insights. Given the multitude of options available, how can institutions pinpoint the most effective tools to optimize their recovery strategies while ensuring compliance? This article examines ten leading cloud-based debt collection software solutions, emphasizing their unique features and the substantial benefits they offer to financial organizations navigating an increasingly competitive landscape.

Equabli EQ Suite: Comprehensive Cloud-Based Debt Collection Solution

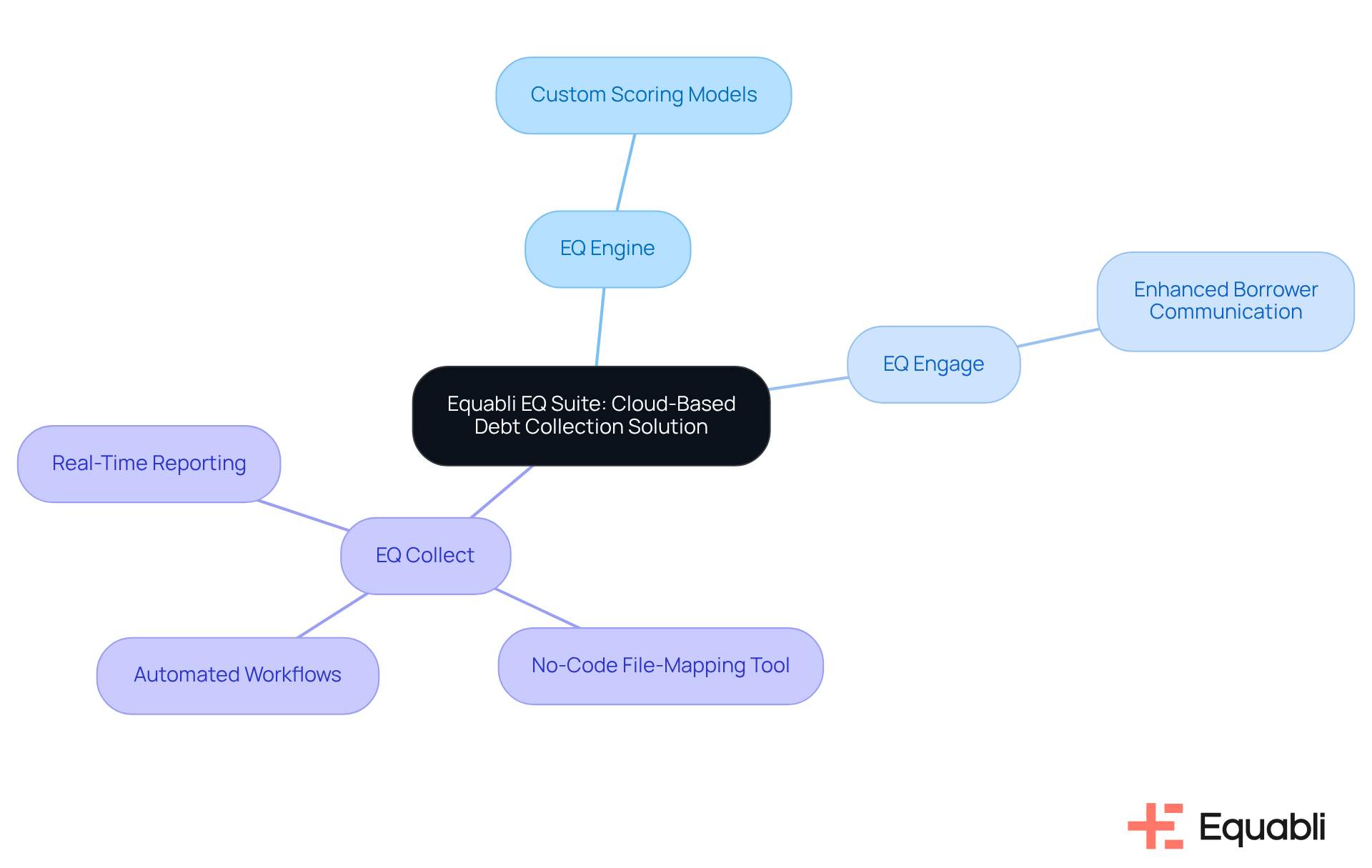

The EQ Suite by Equabli presents a robust set of tools designed to optimize the recovery process, with a strong emphasis on data security. Notable features include:

- The EQ Engine, which facilitates custom scoring models

- EQ Engage for enhanced borrower communication

- EQ Collect for efficient digital retrievals

These tools collectively strengthen recovery strategies through the use of cloud-based debt collection software solutions for financial institutions.

Key functionalities of EQ Collect encompass:

- A no-code file-mapping tool that significantly shortens vendor onboarding timelines

- Automated workflows that reduce execution errors

- Real-time reporting that offers unparalleled transparency and insights

These capabilities empower organizations to leverage data-driven insights, enabling them to predict repayment behaviors and fine-tune their strategies.

Ultimately, this leads to cost reductions and while ensuring compliance and safeguarding personal information. By adopting cloud-based debt collection software solutions for financial institutions, organizations can enhance their operational efficiency and align their recovery processes with regulatory standards.

Kolleno: User-Friendly Debt Collection Software with Automation Features

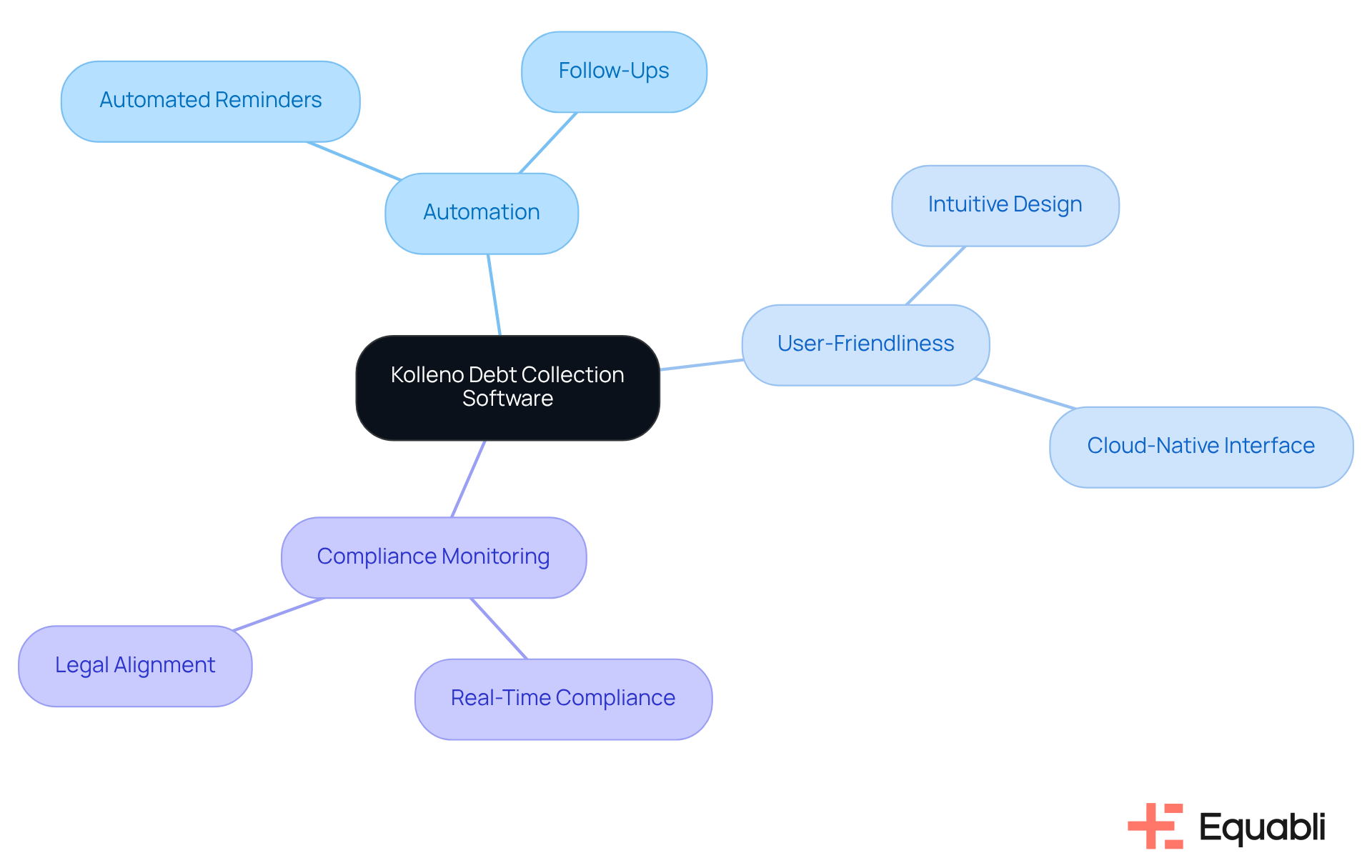

Equabli distinguishes itself through an intuitive design and robust automation features that streamline the debt retrieval process. The EQ Collect software empowers users to automate reminders and follow-ups, facilitating timely communication with debtors. This capability is crucial in the current economic landscape, where many consumers are grappling with due to rising inflation. Such automation is particularly advantageous for small to medium-sized organizations aiming to enhance their retrieval efforts without overburdening their teams.

Furthermore, EQ Collect incorporates real-time compliance monitoring, ensuring alignment with legal standards and safeguarding businesses against potential penalties. The user-friendly, cloud-native interface enables staff to adapt quickly and utilize the software effectively, promoting a smooth transition to automated processes.

As financial organizations increasingly adopt cloud-based debt collection software solutions for financial institutions, Equabli exemplifies how automation can bolster operational efficiency and retrieval rates, reflecting prevailing trends in the industry.

Invoiced: Cloud-Based Invoicing and Payment Collection Software

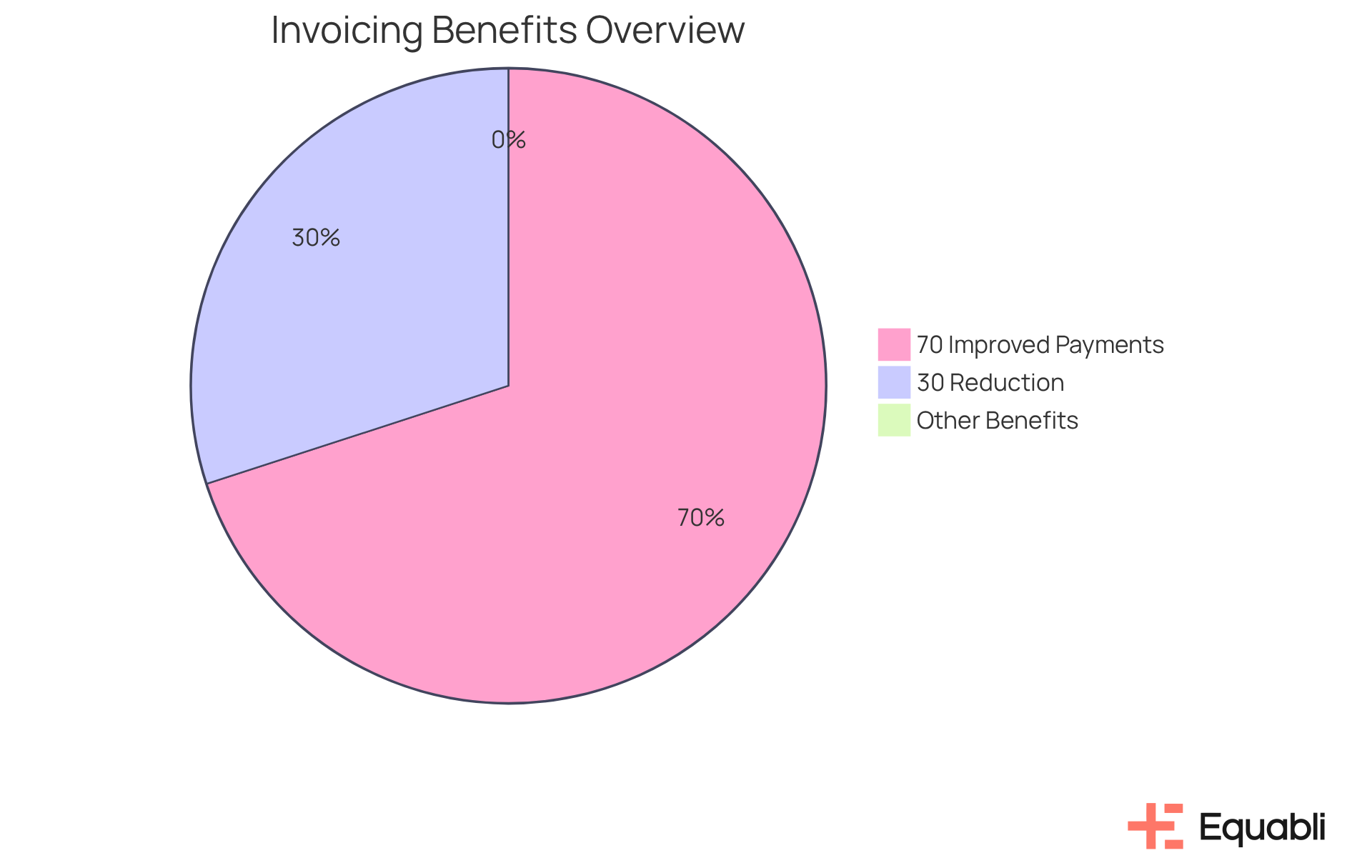

Invoiced is among the leading cloud-based debt collection software solutions for financial institutions, effectively integrating invoicing with payment processing and positioning itself as an essential tool for financial organizations. Its robust features—automated invoicing, timely payment reminders, and customizable payment plans—are designed to enhance cash flow management. By streamlining the invoicing process, Invoiced significantly improves the likelihood of timely payments, a critical factor in today's competitive landscape where effective cash flow is vital for sustainability. Companies utilizing automated invoicing systems have reported a reduction in their average receivable period by up to 30%. Furthermore, approximately 70% of businesses that provide detailed payment instructions on their invoices experience improved payment times, underscoring the importance of clear invoicing practices. This efficiency not only benefits organizations but also creates a smoother experience for debtors, fostering better relationships and trust.

As industry specialists highlight, the integration of invoicing with cloud-based debt collection software solutions for financial institutions is becoming increasingly significant. Many monetary organizations recognize that a contemporary approach to recoveries is essential for sustaining economic well-being and expansion. As Or Hillel articulates, 'Gone are the days when manual invoicing, paper trails, and follow-up emails defined the accounts receivable experience.' This shift emphasizes the need for financial organizations to adopt for financial institutions that meet contemporary operational demands.

Tesorio: Predictive Analytics for Enhanced Cash Flow Management

Equabli is revolutionizing cash flow prediction for monetary entities by harnessing the power of predictive analytics and smart automation. By meticulously analyzing historical data, Equabli empowers organizations to accurately forecast future revenues and proactively identify potential cash flow challenges before they materialize. This strategic approach facilitates , optimizes resource allocation, and enhances overall financial health. As industry leaders emphasize, effective forecasting is crucial for financial recovery, enabling organizations to anticipate client needs and improve resource distribution.

Equabli's machine learning capabilities significantly enhance recovery rates and assess the risk of delinquency for active accounts, allowing for the development of sophisticated servicing strategies. Furthermore, Equabli provides cloud-based debt collection software solutions for financial institutions, enabling organizations to scale their expanding collections operations without compromising performance, thereby maximizing net present value (NPV) in debt recovery. The growing trend of utilizing data analytics to shift business banking from reactive to proactive services underscores Equabli's strategic relevance in the current market landscape.

Clean data is imperative for precise forecasting, and Equabli's solutions ensure that organizations can depend on high-quality data to inform their predictive analytics. By aligning with these overarching trends, Equabli establishes itself as a leader in cash flow management, providing actionable insights that resonate with enterprise-level executives.

Upflow: Customer Engagement-Focused Debt Collection Software

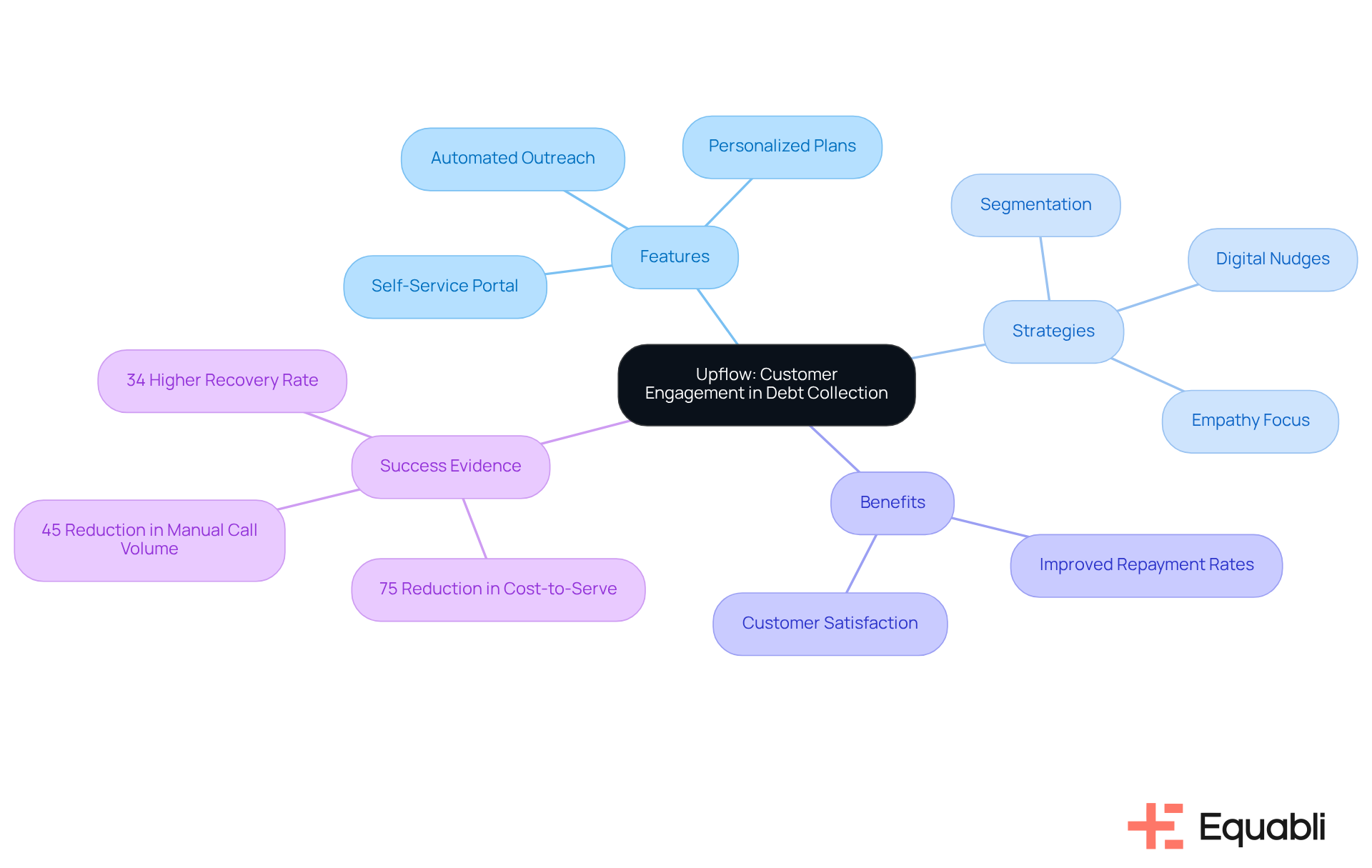

Equabli's EQ Engage emphasizes customer interaction, offering features that enhance communication between financial entities and their borrowers. By enabling organizations to design, automate, and execute borrower contact strategies, EQ Engage provides personalized repayment plans and flexible payment options, including a user-friendly self-service portal. This approach not only helps maintain but also effectively manages collections.

Financial organizations can leverage segmentation capabilities to tailor their outreach based on borrower behavior and preferences. Such strategies improve repayment rates and enhance customer satisfaction. Financial experts assert that personalized repayment strategies significantly boost borrower satisfaction and contribute to long-term loyalty. For example, a recent study indicated that targeted digital nudges can lead to a 34% higher recovery rate in early-stage delinquencies.

Success narratives from organizations utilizing EQ Engage illustrate its efficacy in strengthening borrower connections, underscoring that a focus on empathy and adaptability can yield tangible improvements in repayment outcomes. As the debt recovery sector is projected to grow at a rate of 10.3% over the next five years, adopting contemporary strategies such as cloud-based debt collection software solutions for financial institutions provided by EQ Engage is increasingly essential for financial organizations aiming to capitalize on this growth.

HighRadius Accounts Receivables: Advanced Automation for Large Institutions

HighRadius Accounts Receivables provides advanced automation capabilities tailored for large monetary institutions. This suite encompasses , payment matching, and dispute resolution, collectively minimizing manual intervention and enhancing operational efficiency. By streamlining these critical processes, organizations can redirect their focus toward strategic decision-making, thus freeing valuable resources otherwise consumed by administrative tasks. This strategic shift not only accelerates cash flow but also fosters a more agile response to market demands, ultimately leading to improved economic outcomes.

As Seamus Smith from FIS stated, "Manual inefficiencies, data errors, limited visibility, and high-stakes security issues continue to exert pressure on today’s CFOs and their corporate finance teams."

Furthermore, HighRadius aims for over 90% automation within the Office of the CFO by 2027, underscoring its commitment to transforming operational processes. Success stories, such as Danone North America's recovery of $20 million annually in invalid deductions through HighRadius solutions, exemplify the tangible benefits of automation in enhancing efficiency and performance.

Quadient Accounts Receivable by YayPay: Seamless Integration for Debt Collection

Quadient Accounts Receivable by YayPay offers seamless integration with existing monetary systems, enabling organizations to enhance their debt recovery processes without overhauling their current infrastructure. This compatibility allows organizations to leverage existing data and workflows while accessing advanced features of for financial institutions, presenting a practical and efficient solution for many financial entities.

The ability to integrate smoothly not only improves operations but also significantly increases retrieval efficiency, as organizations can maintain established practices while benefiting from modern technology. Financial specialists emphasize that compatibility in cloud-based debt collection software solutions for financial institutions is crucial for maximizing operational efficiency and ensuring compliance with regulatory requirements.

Success stories from organizations utilizing Quadient illustrate notable improvements in their retrieval metrics, demonstrating how the software has transformed their approach to managing accounts receivable.

Gaviti: Data-Driven Insights for Optimized Collection Strategies

Equabli leverages data-driven insights through EQ Collect, providing cloud-based debt collection software solutions for financial institutions to enhance their recovery strategies. By meticulously analyzing debtor behavior and payment patterns, EQ Collect delivers actionable recommendations that enable organizations to utilize cloud-based debt collection software solutions for financial institutions, allowing them to tailor their approaches for optimal effectiveness. This data-centric methodology enables to strategies, significantly improving retrieval outcomes through cloud-based debt collection software solutions for financial institutions.

Key features of cloud-based debt collection software solutions for financial institutions include:

- A no-code file-mapping tool

- Automated workflows

- Real-time reporting

These features reduce execution errors and manual resource requirements, thereby streamlining processes while fostering respectful relationships with debtors. Industry leaders recognize that employing analytics in receivables management is crucial for maximizing the effectiveness of cloud-based debt collection software solutions for financial institutions, as it boosts recovery rates and ensures compliance with regulatory standards.

As Viktoria Bajari notes, 'By merging data insights, technological progress, and adherence to creditor-friendly methods, companies can effectively reclaim owed amounts while preserving positive relationships.' In the evolving landscape of receivable recovery, understanding borrower behavior and adhering to updated regulatory guidelines have become essential; organizations that leverage cloud-based debt collection software solutions for financial institutions to adeptly evaluate these trends can anticipate a substantial increase in their recovery success rates.

Versapay: Enhanced Payment Experience for Better Collection Outcomes

Equabli's EQ Engage transforms the payment experience for borrowers, a critical component in the implementation of cloud-based debt collection software solutions for financial institutions. By leveraging the capabilities of EQ Engage, organizations can develop, automate, and implement borrower contact strategies that streamline the payment journey. This platform facilitates customer interactions in their brand voice, establishes personalized communication paths, and empowers borrowers with . Such enhancements not only elevate the likelihood of timely payments but also cultivate a positive relationship between banks and their customers.

The capacity to capture consumer preferences while ensuring regulatory compliance further enriches the borrower experience, contributing to enhanced repayment rates. Intelligent automation solutions within EQ Engage simplify processes, enabling organizations to adeptly manage borrower interactions and adapt to their needs.

Success stories from various financial institutions illustrate how cloud-based debt collection software solutions for financial institutions have resulted in more efficient payment procedures, ultimately fostering improved recovery outcomes.

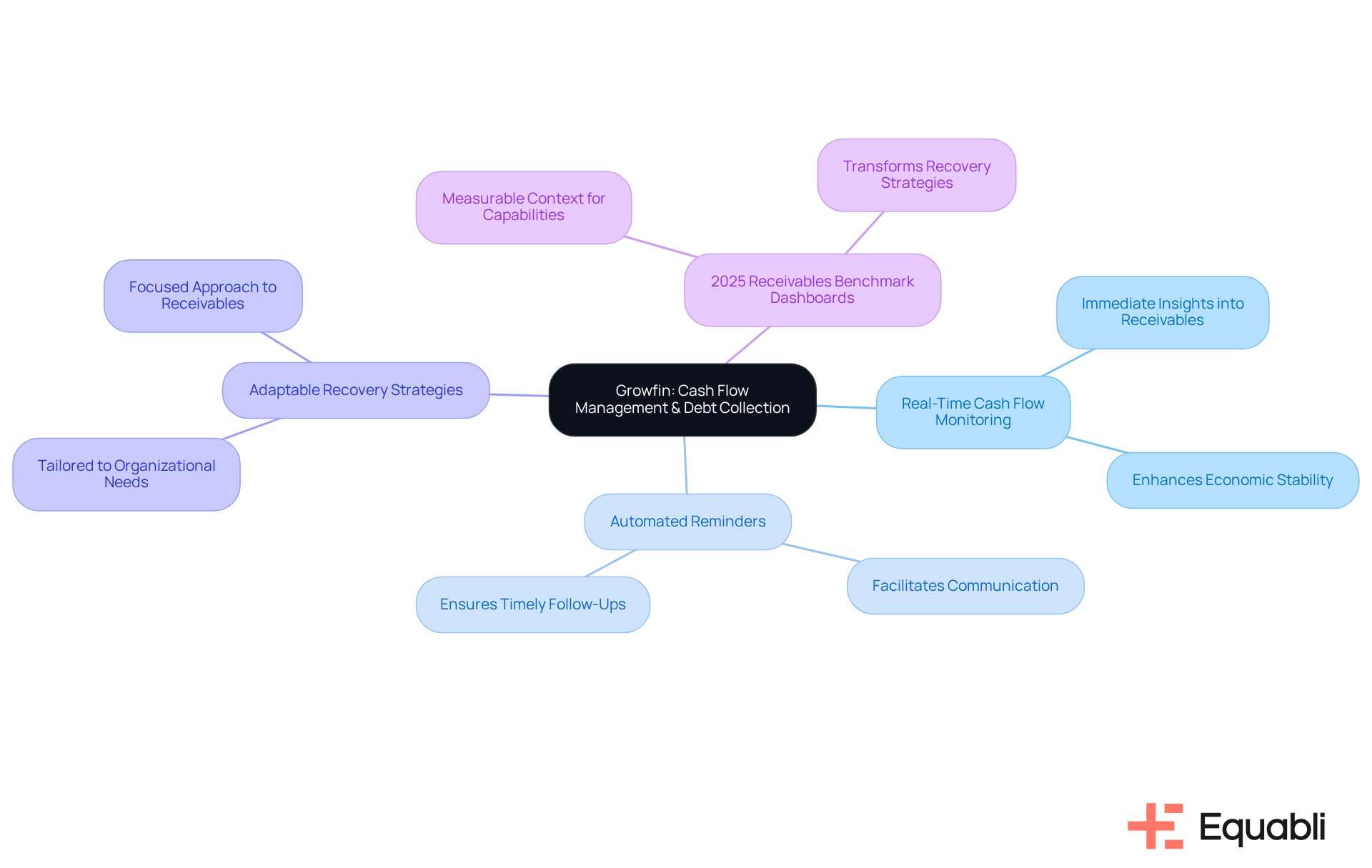

Growfin: Cash Flow Management and Recovery-Focused Debt Collection Software

Growfin demonstrates leadership in cash flow management and recovery by offering cloud-based debt collection software solutions for financial institutions that enhance debt recovery processes. Notably, real-time cash flow monitoring enhances economic stability by delivering immediate insights into receivables. Automated reminders facilitate communication, ensuring timely follow-ups with clients.

Furthermore, Growfin offers adaptable recovery strategies tailored to the specific needs of each organization, fostering a more focused approach to receivables. The recent introduction of Growfin's 2025 Receivables Benchmark Dashboards exemplifies its commitment to innovation, offering measurable context to its capabilities. User success stories illustrate how these features have , resulting in improved cash flow predictability and overall economic health.

As Aravind Gopalan, Co-founder and CEO, states, "Our partnership with Zuora reinforces our strong commitment to bringing the power of Agentic AI to transform cash flow predictability." By prioritizing both cash flow and recovery, Growfin empowers institutions to manage collections effectively using cloud-based debt collection software solutions for financial institutions, ensuring robust financial stability.

Conclusion

The landscape of debt collection is undergoing a significant transformation, primarily driven by the imperative for financial institutions to implement innovative cloud-based solutions. These software systems not only enhance operational efficiency but also prioritize data security, borrower engagement, and compliance with regulatory standards. By leveraging advanced features such as predictive analytics, automation, and real-time reporting, organizations can streamline their recovery processes while fostering improved relationships with their clients.

In this context, various cloud-based debt collection software solutions have been examined, including:

- Equabli EQ Suite

- Kolleno

- Invoiced

- Tesorio

Each platform provides distinct functionalities tailored to meet the diverse requirements of financial institutions, ranging from automated invoicing and cash flow management to customer engagement strategies. The focus on data-driven insights and predictive capabilities highlights the necessity of adapting to market demands and enhancing recovery rates.

Ultimately, the adoption of cloud-based debt collection software transcends mere improvements in collection metrics; it signifies a transformation in the overall financial health of institutions and their relationships with borrowers. As the industry continues to evolve, organizations that invest in these advanced solutions will be strategically positioned to navigate challenges, refine recovery strategies, and secure sustainable economic success. The imperative is clear: financial institutions must prioritize the integration of these technologies to maintain competitiveness in an increasingly challenging landscape.

Frequently Asked Questions

What is the EQ Suite by Equabli?

The EQ Suite by Equabli is a comprehensive cloud-based debt collection solution that includes tools designed to optimize the recovery process with a focus on data security.

What are the key features of the EQ Suite?

Key features of the EQ Suite include the EQ Engine for custom scoring models, EQ Engage for improved borrower communication, and EQ Collect for efficient digital retrievals.

How does EQ Collect enhance debt recovery?

EQ Collect enhances debt recovery through a no-code file-mapping tool for quicker vendor onboarding, automated workflows to reduce errors, and real-time reporting for transparency and insights.

What benefits does the EQ Suite provide to organizations?

The EQ Suite allows organizations to leverage data-driven insights for predicting repayment behaviors, leading to cost reductions, improved borrower engagement, and compliance with regulatory standards.

How does Kolleno differentiate itself in the debt collection software market?

Kolleno distinguishes itself with an intuitive design and robust automation features that streamline the debt retrieval process, making it user-friendly for small to medium-sized organizations.

What automation features does EQ Collect offer?

EQ Collect offers automation for reminders and follow-ups, ensuring timely communication with debtors, which is particularly beneficial in the current economic climate.

How does EQ Collect ensure compliance?

EQ Collect incorporates real-time compliance monitoring to ensure alignment with legal standards, protecting businesses from potential penalties.

What is Invoiced, and how does it function?

Invoiced is a cloud-based invoicing and payment collection software that integrates invoicing with payment processing, enhancing cash flow management for financial organizations.

What are the key features of Invoiced?

Key features of Invoiced include automated invoicing, timely payment reminders, and customizable payment plans, all aimed at improving the likelihood of timely payments.

What impact does automated invoicing have on businesses?

Companies using automated invoicing systems have reported a reduction in their average receivable period by up to 30%, and providing detailed payment instructions can improve payment times for about 70% of businesses.

Why is the integration of invoicing with debt collection software important?

The integration is important as it reflects a contemporary approach to recoveries, essential for sustaining economic well-being and expansion in the financial sector.