Overview

The article presents a comprehensive analysis of enhanced recovery solutions tailored for corporate lending portfolios, emphasizing tools and strategies that significantly improve debt recovery outcomes. It illustrates how platforms such as Equabli's EQ Suite leverage data-driven insights, predictive analytics, and automation to optimize processes, ensure compliance, and ultimately elevate recovery rates. These solutions are positioned as indispensable assets for contemporary financial institutions, addressing the operational and compliance challenges faced by executives in the debt collection landscape.

Introduction

In an era where financial institutions face increasing complexities in debt recovery, the need for innovative solutions is more critical than ever. Enhanced recovery strategies not only promise improved collection rates but also foster stronger relationships with borrowers, ultimately driving sustainable growth. However, with a multitude of options available, lenders must effectively navigate this landscape to optimize their corporate lending portfolios while ensuring compliance in an evolving regulatory environment.

Equabli EQ Suite: Comprehensive Debt Recovery Solutions for Corporate Lending

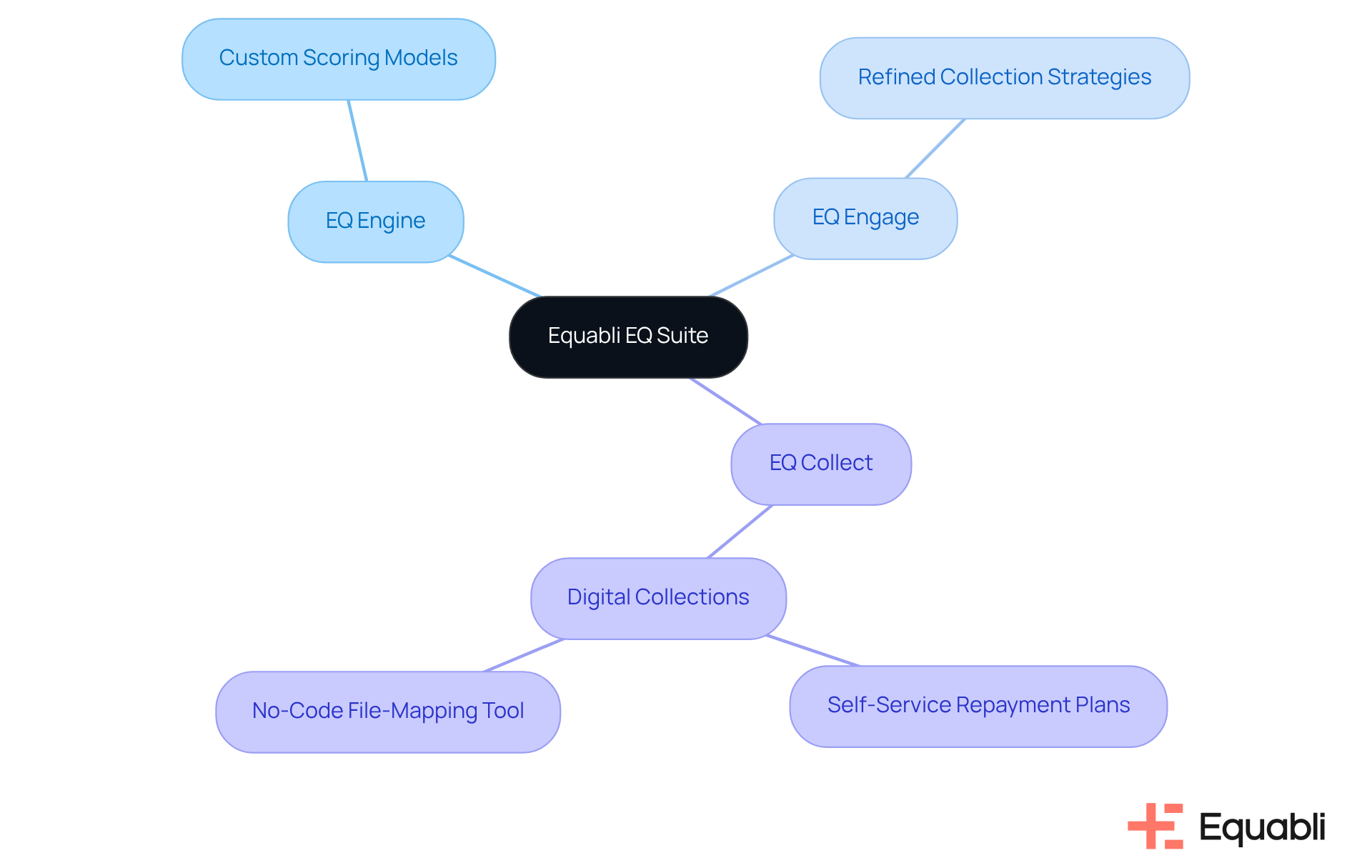

The EQ Suite by Equabli represents enhanced recovery solutions for corporate lending portfolios, prioritizing data security and regulatory compliance in credit collection. This suite, which includes EQ Engine, EQ Engage, and EQ Collect, allows lenders to:

- Develop custom scoring models

- Refine collection strategies

- Implement digital collections via self-service repayment plans

Notably, EQ Collect features a no-code file-mapping tool that streamlines vendor onboarding and offers a cloud-native interface, significantly enhancing user experience. By harnessing data-driven insights and ensuring industry-leading compliance oversight, the EQ Suite empowers organizations to implement enhanced recovery solutions for corporate lending portfolios while improving borrower engagement, lowering operational costs, and safeguarding sensitive information. This positions it as an indispensable resource for modern financial collection.

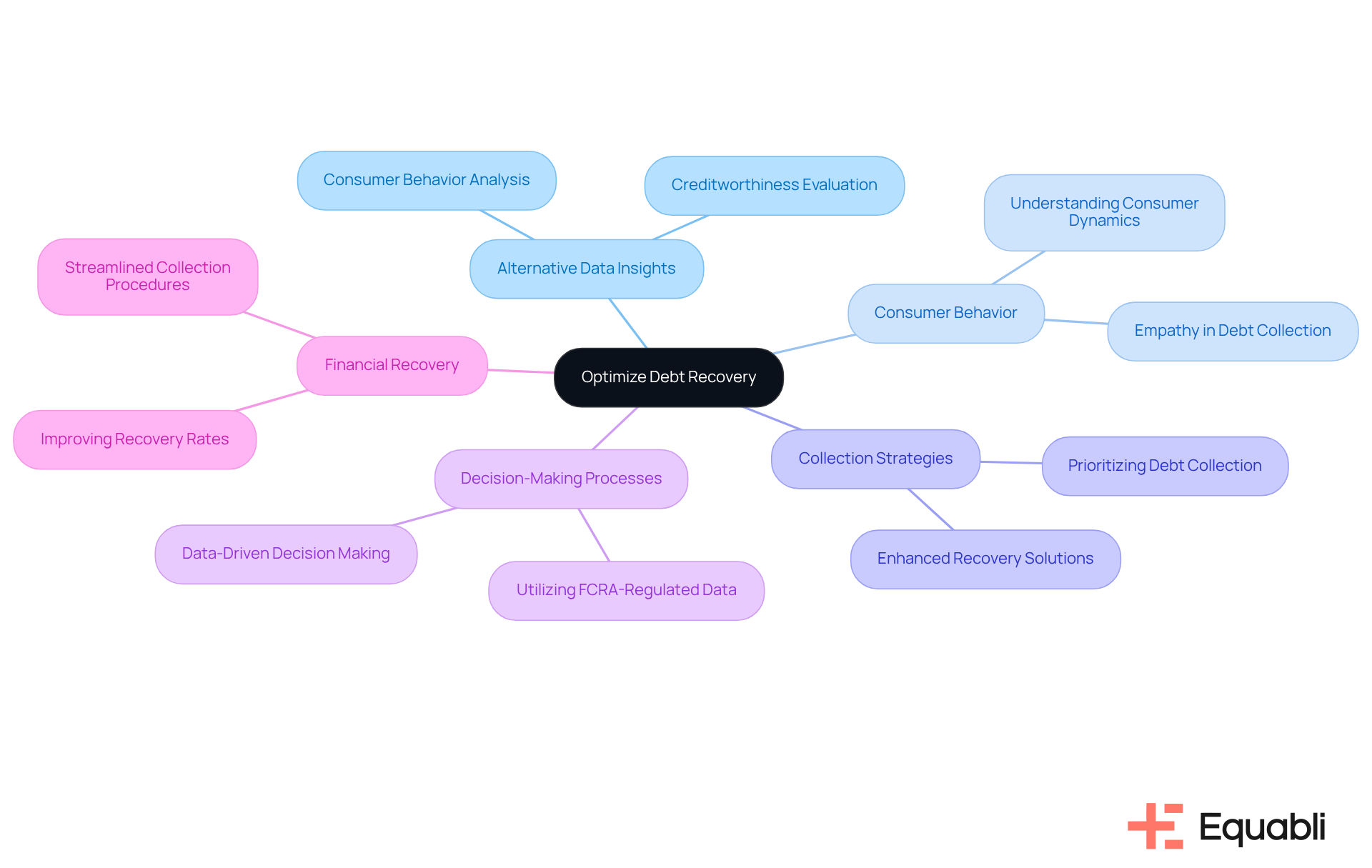

LexisNexis Risk Solutions: Optimize Debt Recovery with Alternative Data Insights

LexisNexis Risk Solutions provides advanced tools that leverage alternative data to significantly enhance collection efforts. By delivering deep insights into consumer behavior and creditworthiness, lenders can refine their collection strategies, thereby improving decision-making processes. This not only increases contact rates but also markedly enhances the probability of successful financial recovery.

Consequently, utilizing these insights is vital for optimizing corporate lending portfolios, particularly through enhanced recovery solutions for corporate lending portfolios, in an environment where comprehending consumer dynamics is essential for achieving sustainable financial results.

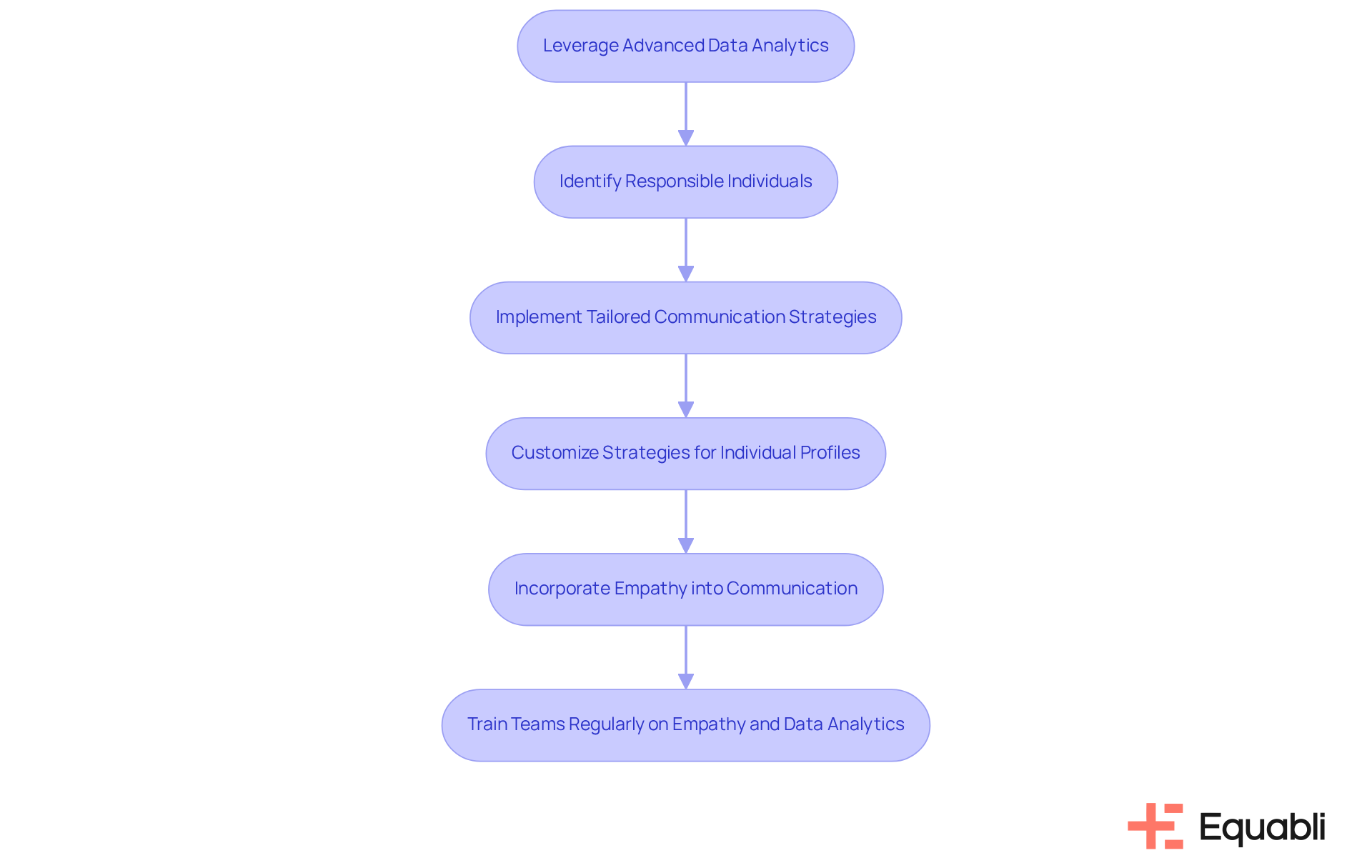

Experian: Enhance Right-Party Contact Rates for Effective Debt Recovery

Improving right-party contact rates is essential for effective debt collection. By leveraging advanced data analytics, lenders can accurately identify and engage individuals responsible for repayment through enhanced recovery solutions for corporate lending portfolios. This targeted approach not only enhances the likelihood of successful collections but also fosters , leading to improved outcomes.

Organizations utilizing predictive analytics have reported a 25% increase in recovery rates, demonstrating the transformative potential of enhanced recovery solutions for corporate lending portfolios. Furthermore, case studies illustrate how tailored communication methods, informed by data insights, can significantly boost engagement and repayment success.

Customizing strategies for individual debtor profiles is critical, as a one-size-fits-all approach often proves ineffective. Incorporating empathy into communication can further strengthen borrower relationships, acknowledging their feelings and enhancing overall interactions.

By prioritizing right-party contact and employing sophisticated analytics, financial institutions can implement enhanced recovery solutions for corporate lending portfolios, effectively navigating the complexities of debt recovery while ensuring a more ethical and customer-centric approach.

As a strategic recommendation, financial institutions should implement regular training sessions focused on empathy and data analytics to enhance their teams' capabilities in these areas.

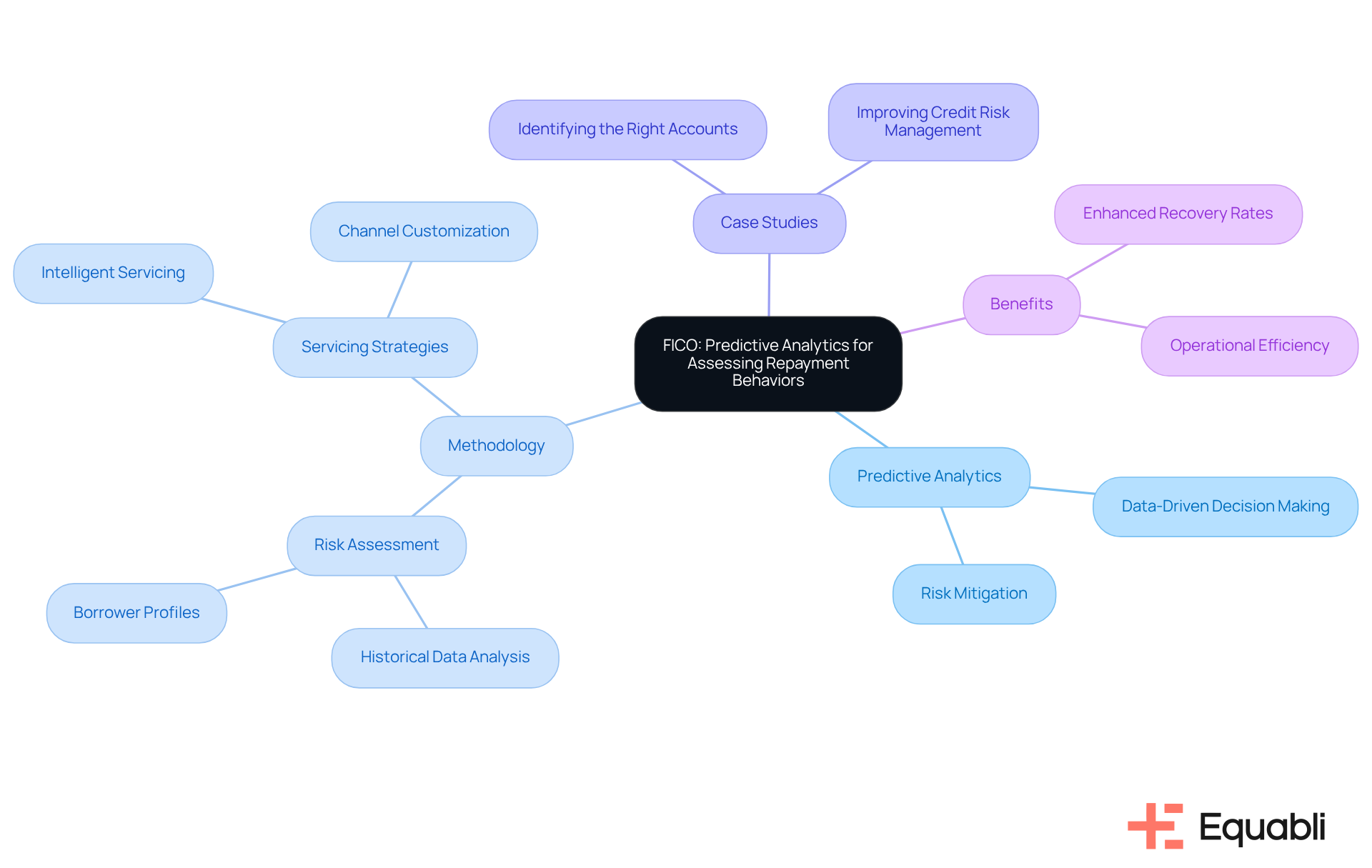

FICO: Predictive Analytics for Assessing Repayment Behaviors

Equabli stands out in the financial sector by leveraging predictive analytics through its EQ Engine, enabling institutions to effectively assess repayment behaviors. Evidence from historical data and borrower profiles demonstrates that Equabli's advanced tools empower lenders to anticipate the risk of delinquency in active accounts, allowing for tailored approaches. This proactive methodology not only enhances recuperation rates but also mitigates losses, positioning Equabli as a vital asset for enhanced recovery solutions for corporate lending portfolios.

The predictive capabilities of the EQ Engine facilitate the design of intelligent servicing strategies customized for each communication channel, thereby creating operational efficiency and reducing roll-rates.

Case studies, such as 'Identifying the Right Accounts' and 'Improving Credit Risk Management with Predictive Analytics,' provide compelling evidence that institutions utilizing Equabli's analytics have achieved significant improvements in their outcomes. This reinforces the critical importance of in the contemporary financial landscape.

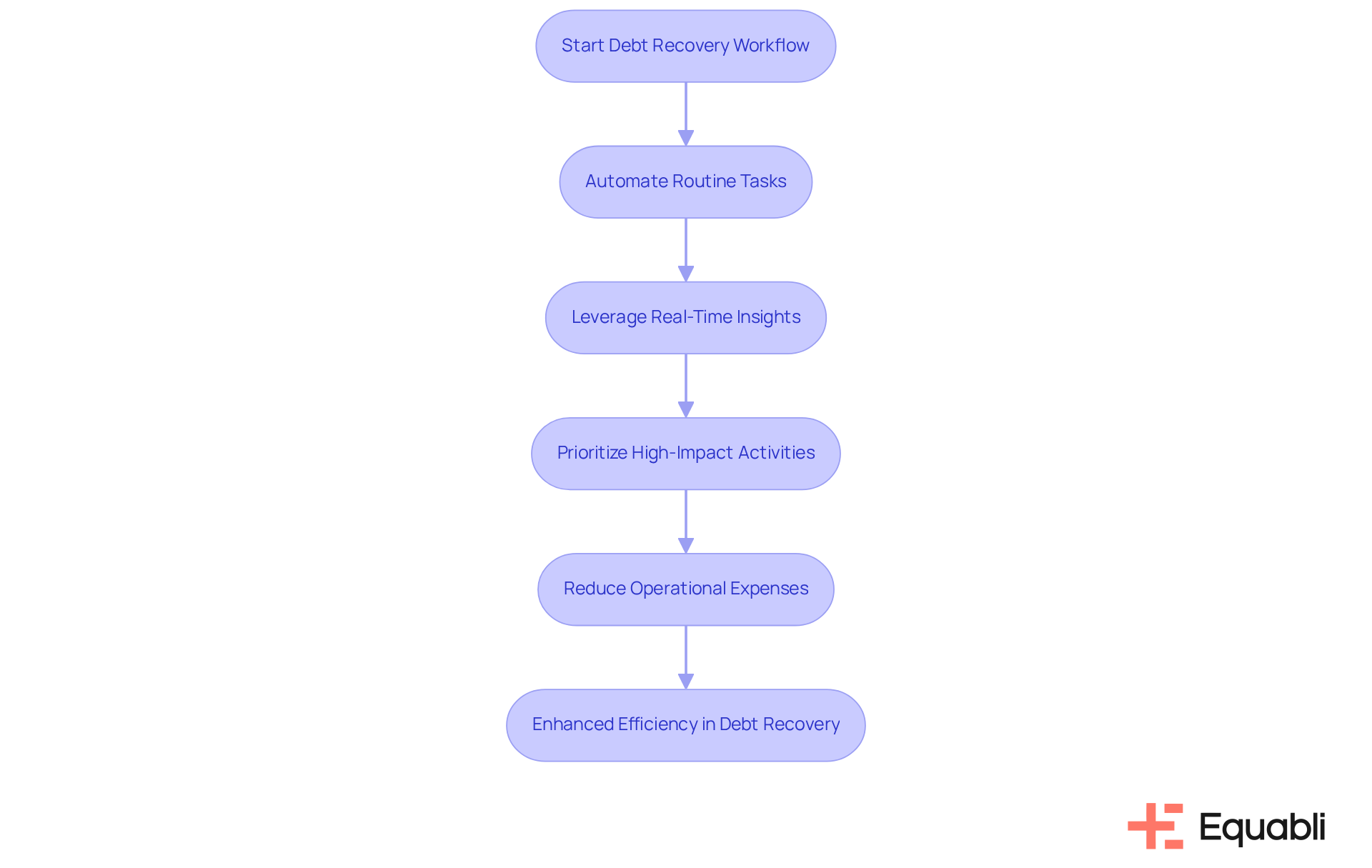

TransUnion: Streamline Debt Recovery Workflows for Enhanced Efficiency

Equabli provides innovative solutions that streamline financial collection processes, which serve as enhanced recovery solutions for corporate lending portfolios, significantly enhancing efficiency for lenders. By automating routine tasks and leveraging real-time insights, organizations can concentrate on high-impact restoration activities. This transformation not only reduces operational expenses but also and effectiveness of financial collection efforts.

Automation tools can decrease the time allocated to customer engagement tasks by up to 62%, enabling teams to prioritize strategic initiatives over manual processes. Furthermore, companies utilizing automated accounts receivable systems have reported a 10-15% reduction in bad financial write-offs, underscoring the tangible benefits of these technologies.

As the debt collection landscape evolves, financial institutions aiming to implement enhanced recovery solutions for corporate lending portfolios must embrace automation and real-time data analytics to improve their recovery rates and maintain compliance within an increasingly complex regulatory environment.

Dun & Bradstreet: Insights into Consumer Credit Risk for Informed Recovery Strategies

Dun & Bradstreet provides critical insights into consumer credit risk, enabling financial institutions to formulate informed strategies for reclaiming funds. By meticulously analyzing credit data and market trends, these institutions acquire a comprehensive understanding of their borrowers' risk profiles. This nuanced knowledge facilitates more targeted restitution efforts, significantly enhancing outcomes in .

For example, organizations employing advanced scoring analytics have reported reductions in loan charge-offs by as much as 10%, underscoring the effectiveness of data-driven approaches. As lenders adapt to the evolving economic landscape, integrating enhanced recovery solutions for corporate lending portfolios into their revitalization strategies is essential for improving performance and fostering stronger customer connections.

Equabli's EQ Collect further amplifies this strategy by:

- Streamlining vendor onboarding timelines through a simple, no-code file-mapping tool

- Enhancing efficiency with data-driven methodologies

- Reducing execution errors via automated workflows

The platform offers unparalleled transparency and insights through real-time reporting, ensuring industry-leading compliance oversight through automated monitoring, all within a user-friendly, scalable, cloud-native interface.

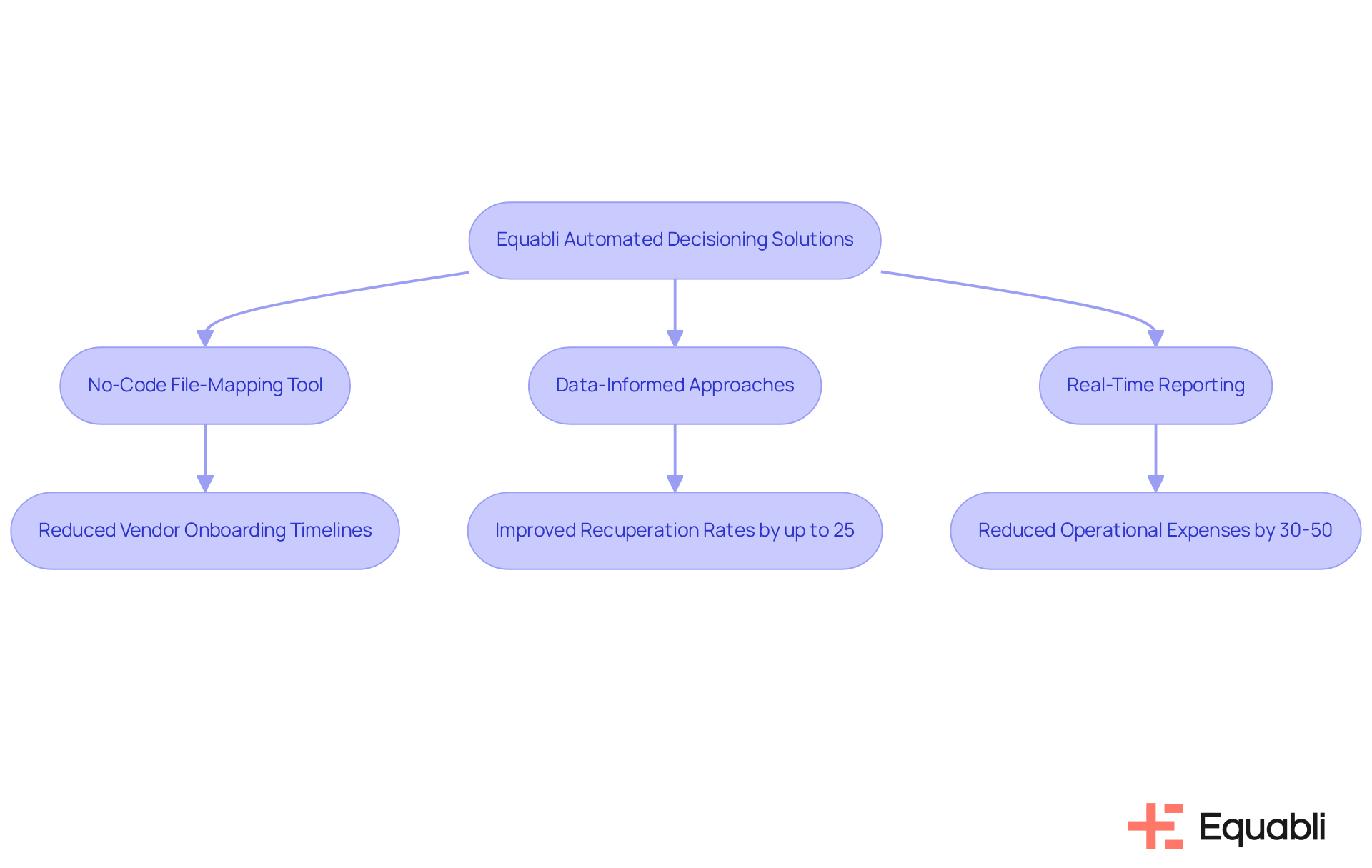

Zoot Enterprises: Automated Decisioning Solutions for Compliance and Efficiency

Equabli provides automated decisioning solutions that significantly enhance compliance and operational efficiency in debt recovery. By streamlining decision-making processes through EQ Collect, lenders can ensure adherence to regulatory requirements while improving their operational effectiveness.

For instance, key features such as a no-code file-mapping tool reduce vendor onboarding timelines, and data-informed approaches enhance efficiency and increase collections. This automation is particularly impactful, having been shown to by up to 25% and reduce operational expenses by 30-50%.

Furthermore, real-time reporting and automated monitoring deliver unparalleled transparency and compliance oversight, making these tools essential for corporate financiers aiming to adopt enhanced recovery solutions for corporate lending portfolios in 2025 and beyond.

Case studies illustrate that organizations leveraging Equabli's solutions experience significant improvements in compliance management and overall productivity, underscoring the value of intelligent automation and machine learning in the evolving landscape of collections.

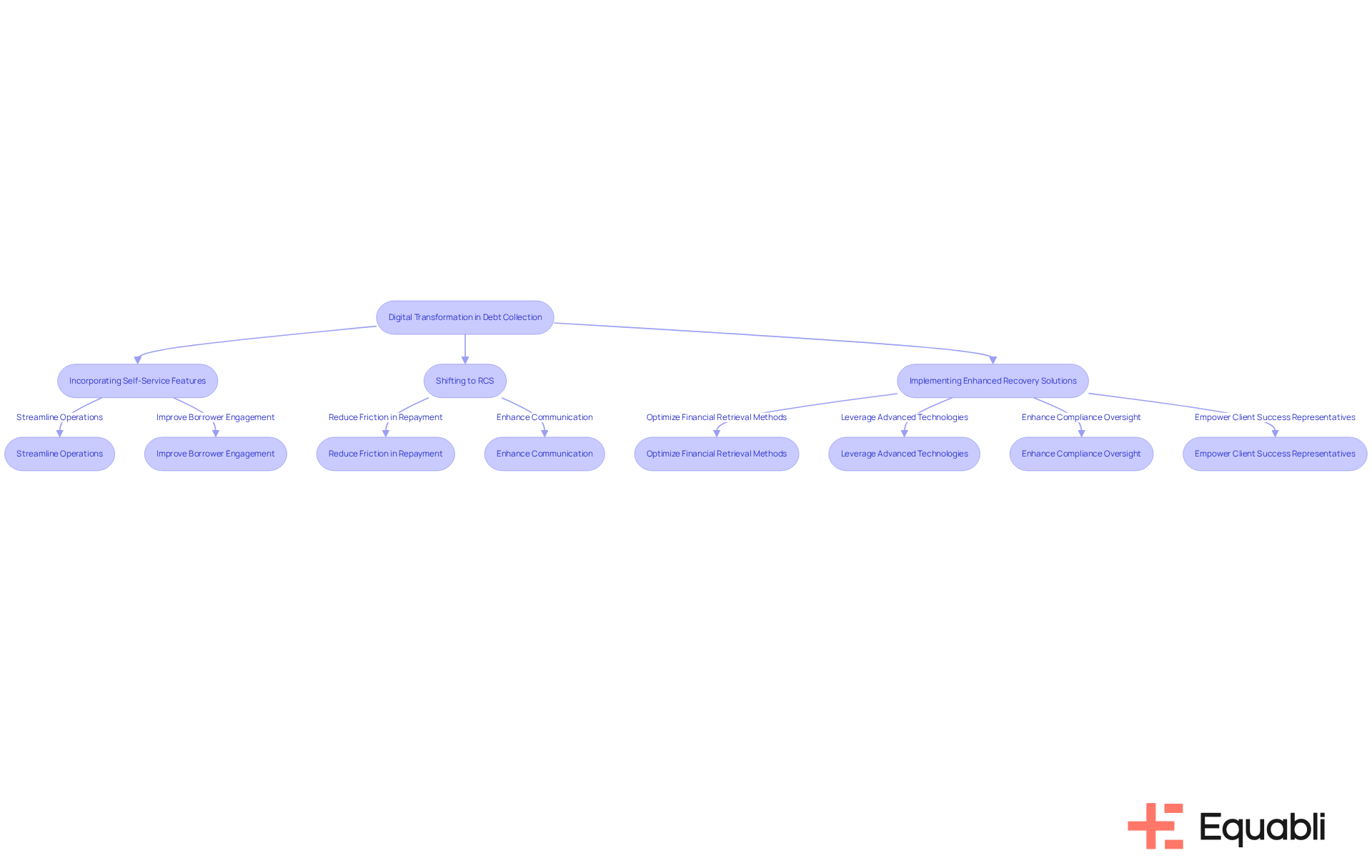

Cognizant: Digital Transformation Services for Modernizing Debt Collection

Cognizant plays a crucial role in assisting financial institutions to modernize their debt collection processes through digital transformation services. This modernization is essential for financial institutions aiming to remain competitive in an increasingly dynamic market. By leveraging advanced technologies and innovative strategies, organizations can significantly enhance their recovery efforts by implementing enhanced recovery solutions for corporate lending portfolios and improve borrower engagement. For instance, the incorporation of self-service features enables financial providers to streamline operations, allowing live agents to concentrate on more intricate cases, thereby improving overall efficiency and influence.

Moreover, the shift from traditional SMS to Rich Communication Services (RCS) has revolutionized consumer engagement. This transformation allows for , which reduces friction in the repayment process and fosters better repayment outcomes. As financial entities adapt to these developments, they position themselves not only to recover funds more effectively but also to enhance customer relationships through structured repayment options that guide decision-making, ultimately driving enhanced recovery solutions for corporate lending portfolios.

Furthermore, features from EQ Collect enable financial institutions to:

- Shorten vendor onboarding timelines with a no-code file-mapping tool

- Enhance efficiency through data-informed approaches

- Decrease execution errors via automated workflows

The platform also provides real-time reporting for unparalleled transparency and insights, ensuring compliance oversight with automated monitoring. This smart automation and machine learning method not only improves collection performance but also empowers Client Success Representatives at Equabli to promote product adoption and client involvement. As a result, financial institutions can optimize their financial retrieval methods by implementing enhanced recovery solutions for corporate lending portfolios.

SAS: Advanced Analytics Tools for Improving Debt Recovery Outcomes

Equabli provides advanced analytical tools that empower financial institutions to significantly enhance their collection results. By leveraging data analytics capabilities, lenders can uncover critical insights into borrower behaviors, facilitating the development of tailored collection strategies. This analytical approach not only improves success rates—often exceeding the industry average of 20-30%—but also promotes informed decision-making, establishing Equabli as a vital entity in the evolving financial landscape.

Key features from EQ Collect include:

- A no-code file-mapping tool that streamlines vendor onboarding timelines

- Automated workflows that reduce execution errors

- Unparalleled transparency through real-time reporting

These features further optimize efficiency and boost collections. Evidence from case studies reveals that organizations utilizing predictive analytics have achieved up to 30% higher collection rates and reduced operational expenses by 40%. This underscores the tangible benefits of data-driven methodologies in financial collection.

Moreover, Equabli emphasizes the importance of compliance and ethical considerations in AI and data analytics, ensuring that recovery strategies are not only effective but also responsible. This commitment to adherence positions Equabli as a in navigating the complexities of enterprise-level debt collection.

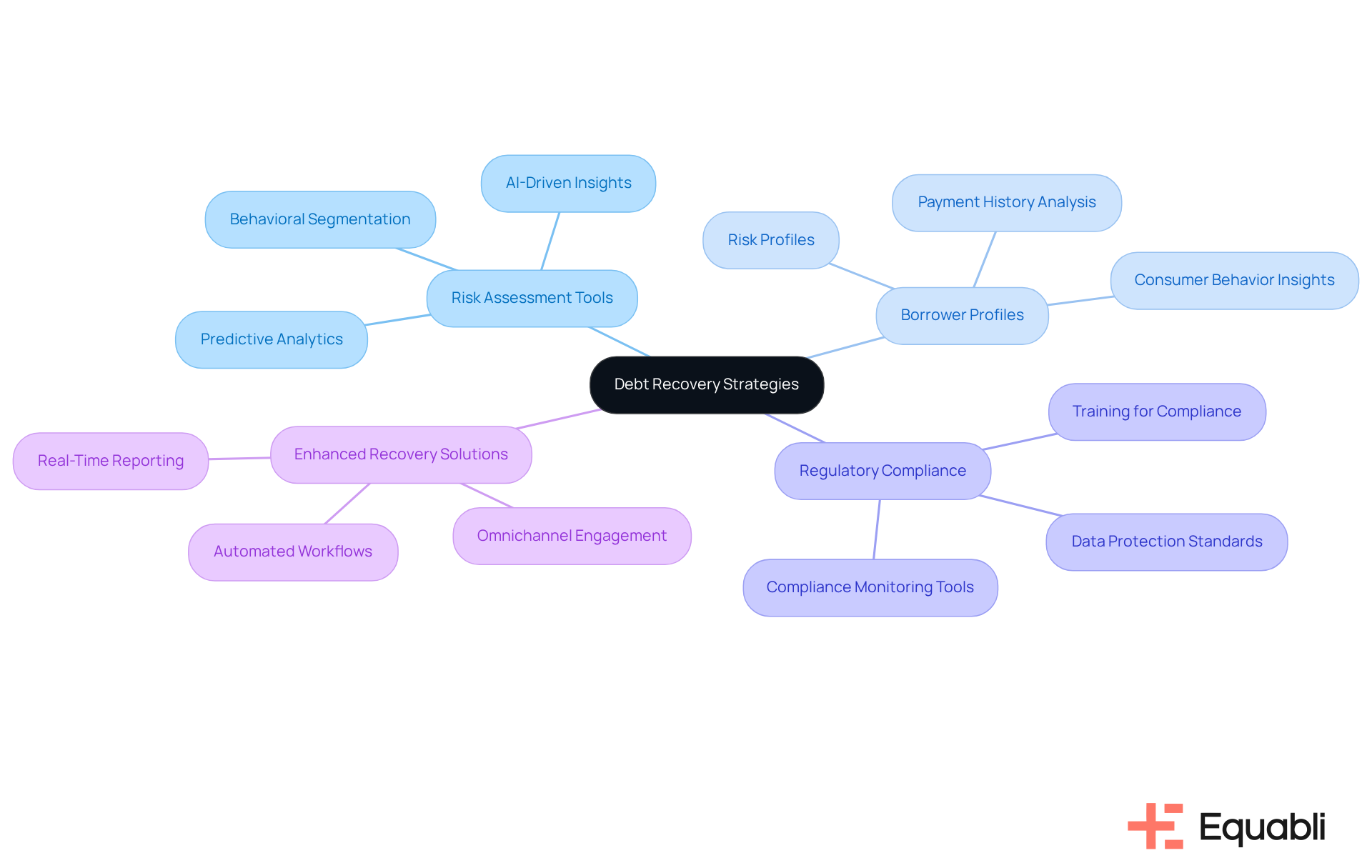

Moody's Analytics: Risk Assessment Tools for Enhancing Debt Recovery Strategies

Moody's Analytics provides advanced risk evaluation tools that significantly enhance debt collection strategies for creditors. These tools deliver comprehensive insights into borrower risk profiles and current market conditions, empowering organizations to make data-driven decisions about enhanced recovery solutions for corporate lending portfolios. This strategic approach not only improves outcomes but also enables lenders to implement enhanced recovery solutions for corporate lending portfolios, allowing them to manage their portfolios with increased accuracy.

Understanding allows financial organizations to tailor their collection methods, ensuring that they engage with clients in alignment with their specific risk levels. As the regulatory landscape continues to evolve, integrating predictive analytics into enhanced recovery solutions for corporate lending portfolios will be essential for addressing compliance challenges and optimizing debt recovery efforts.

In this context, Equabli's EQ Collect presents a suite of features aimed at further enhancing collection efficiency. With a no-code file-mapping tool, lenders can streamline vendor onboarding timelines and reduce execution errors through automated workflows. Real-time reporting offers unparalleled transparency and insights, while industry-leading compliance oversight guarantees adherence to regulations.

As the industry advances toward 2025 and beyond, leveraging enhanced recovery solutions for corporate lending portfolios will be crucial for achieving sustainable growth.

Conclusion

The exploration of enhanced recovery solutions for corporate lending portfolios reveals a transformative landscape where data-driven insights and innovative technologies converge. By adopting these advanced methodologies, financial institutions can not only improve their collection rates but also foster stronger relationships with borrowers, ensuring a more sustainable approach to debt recovery.

Key solutions such as Equabli's EQ Suite, LexisNexis's alternative data insights, and Experian's predictive analytics serve as essential tools for optimizing debt collection strategies. Each tool offers unique features that enhance operational efficiency, increase right-party contact rates, and empower lenders to make informed decisions based on comprehensive risk assessments. The integration of automation and advanced analytics further underscores the importance of adapting to the evolving financial landscape.

As the industry moves toward 2025 and beyond, embracing these enhanced recovery solutions is crucial for achieving long-term success in corporate lending. Financial institutions are encouraged to invest in these technologies and methodologies, not only to improve recovery outcomes but also to navigate the complexities of compliance and borrower engagement effectively. Adopting a proactive, data-driven approach will ultimately position lenders to thrive in an increasingly competitive environment.

Frequently Asked Questions

What is the EQ Suite by Equabli?

The EQ Suite by Equabli is a collection of enhanced recovery solutions designed for corporate lending portfolios, focusing on data security and regulatory compliance in credit collection. It includes tools like EQ Engine, EQ Engage, and EQ Collect.

What features does the EQ Suite offer to lenders?

The EQ Suite allows lenders to develop custom scoring models, refine collection strategies, and implement digital collections through self-service repayment plans. Notably, EQ Collect includes a no-code file-mapping tool for streamlined vendor onboarding.

How does LexisNexis Risk Solutions enhance debt recovery?

LexisNexis Risk Solutions utilizes alternative data to provide deep insights into consumer behavior and creditworthiness, helping lenders refine their collection strategies and improve decision-making processes, which increases contact rates and the likelihood of successful financial recovery.

What role does data analytics play in improving right-party contact rates?

Advanced data analytics help lenders accurately identify and engage individuals responsible for repayment, enhancing the likelihood of successful collections and fostering stronger borrower relationships.

What impact do predictive analytics have on recovery rates?

Organizations that utilize predictive analytics have reported a 25% increase in recovery rates, showcasing the effectiveness of tailored communication methods and data-driven strategies in debt recovery.

Why is customizing strategies for individual debtor profiles important?

Customizing strategies is critical because a one-size-fits-all approach is often ineffective. Tailored communication methods informed by data insights enhance engagement and repayment success.

How can financial institutions improve their debt recovery approach?

Financial institutions can enhance their debt recovery by prioritizing right-party contact, employing sophisticated analytics, and incorporating empathy into communication. Regular training sessions on empathy and data analytics are also recommended to improve team capabilities.