Overview

The article delineates ten essential compliance standards for financial institutions concerning debt collection, underscoring the necessity of adherence to regulations such as the Fair Debt Collection Practices Act and the Bank Secrecy Act. This assertion is substantiated by illustrating how compliance not only mitigates legal risks but also bolsters operational efficiency and consumer trust. Furthermore, it highlights the vital role of tools like Equabli's EQ Suite in achieving these compliance standards, thereby linking operational practices to broader regulatory implications.

Introduction

Navigating the intricate web of compliance standards presents a significant challenge for financial institutions involved in debt collection. Regulations such as the Fair Debt Collection Practices Act and the Bank Secrecy Act are critical in shaping operational protocols. Adherence to these standards is paramount to avoid substantial penalties and reputational harm. This article examines ten essential compliance standards that not only protect institutions against legal repercussions but also bolster operational efficiency and consumer trust.

How can financial organizations effectively align their practices with these evolving regulations to thrive in a competitive landscape?

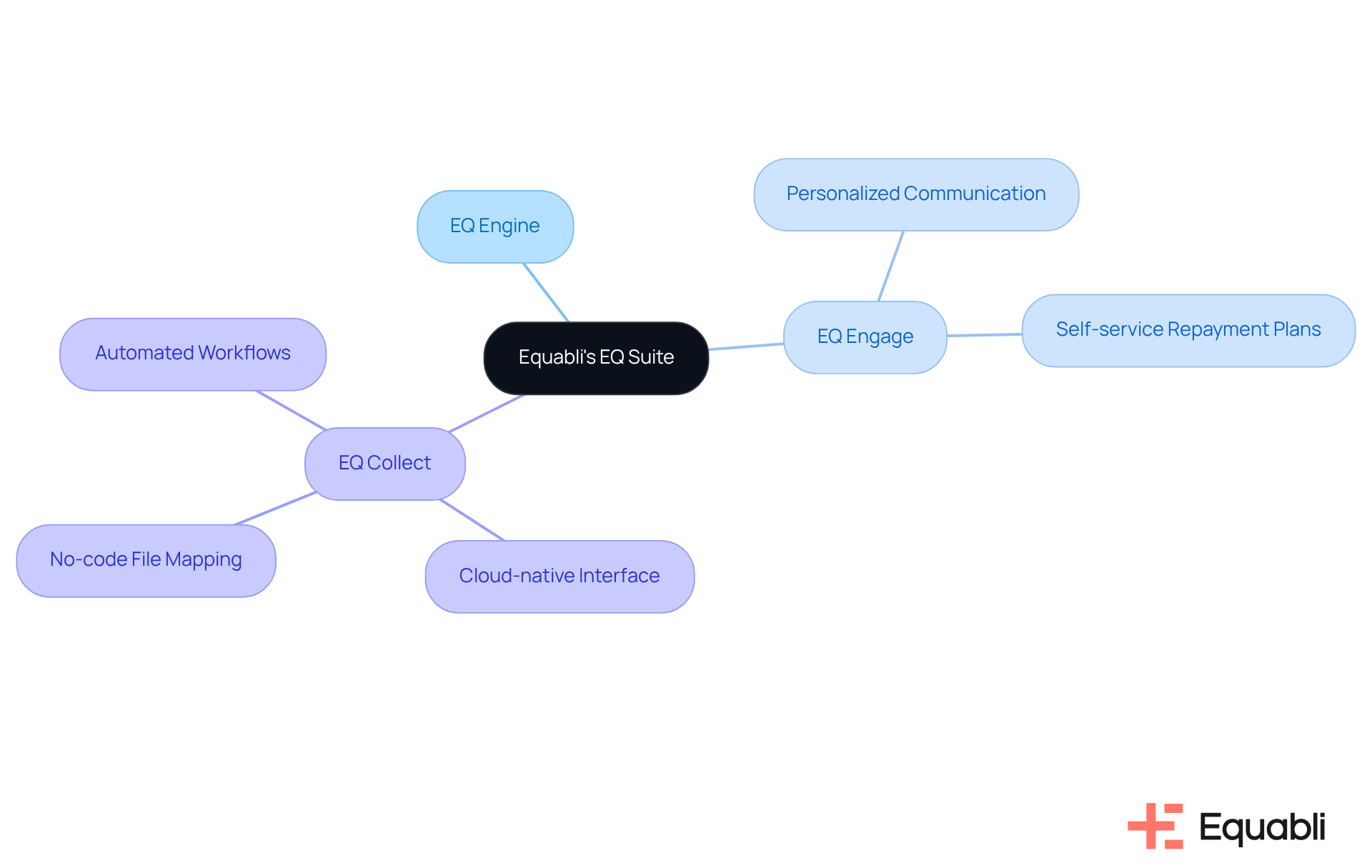

Equabli's EQ Suite: Comprehensive Compliance Solutions for Debt Collection

Equabli's EQ Suite delivers a robust suite of tools designed to assist financial institutions in navigating the complex landscape of debt collection regulations. The suite encompasses the EQ Engine, EQ Engage, and EQ Collect, collectively providing a comprehensive approach to regulatory compliance. EQ Collect features a cloud-native interface that is both user-friendly and scalable, complemented by a no-code file-mapping tool that significantly reduces vendor onboarding timelines. This enhancement of operational efficiency is achieved through automated workflows, which streamline processes and minimize compliance risks.

In addition, EQ Engage empowers organizations to craft, automate, and execute borrower contact strategies. This tool ensures that communication journeys are personalized, enabling borrowers to self-service with while maintaining their brand voice. Such capabilities not only enhance borrower engagement but also facilitate adherence to collection agency operational compliance standards for financial institutions, which is a critical aspect for those operating in a highly regulated environment.

The EQ Suite further enables organizations to implement custom scoring models and optimize collection strategies, thereby enhancing digital collections while ensuring adherence to collection agency operational compliance standards for financial institutions. By leveraging data-driven insights and real-time reporting, clients can maintain compliance with collection agency operational compliance standards for financial institutions while ensuring the effectiveness of their collection efforts. This strategic alignment between operational efficiency and regulatory adherence positions the EQ Suite as an essential asset for organizations aiming to excel in debt collection and risk management.

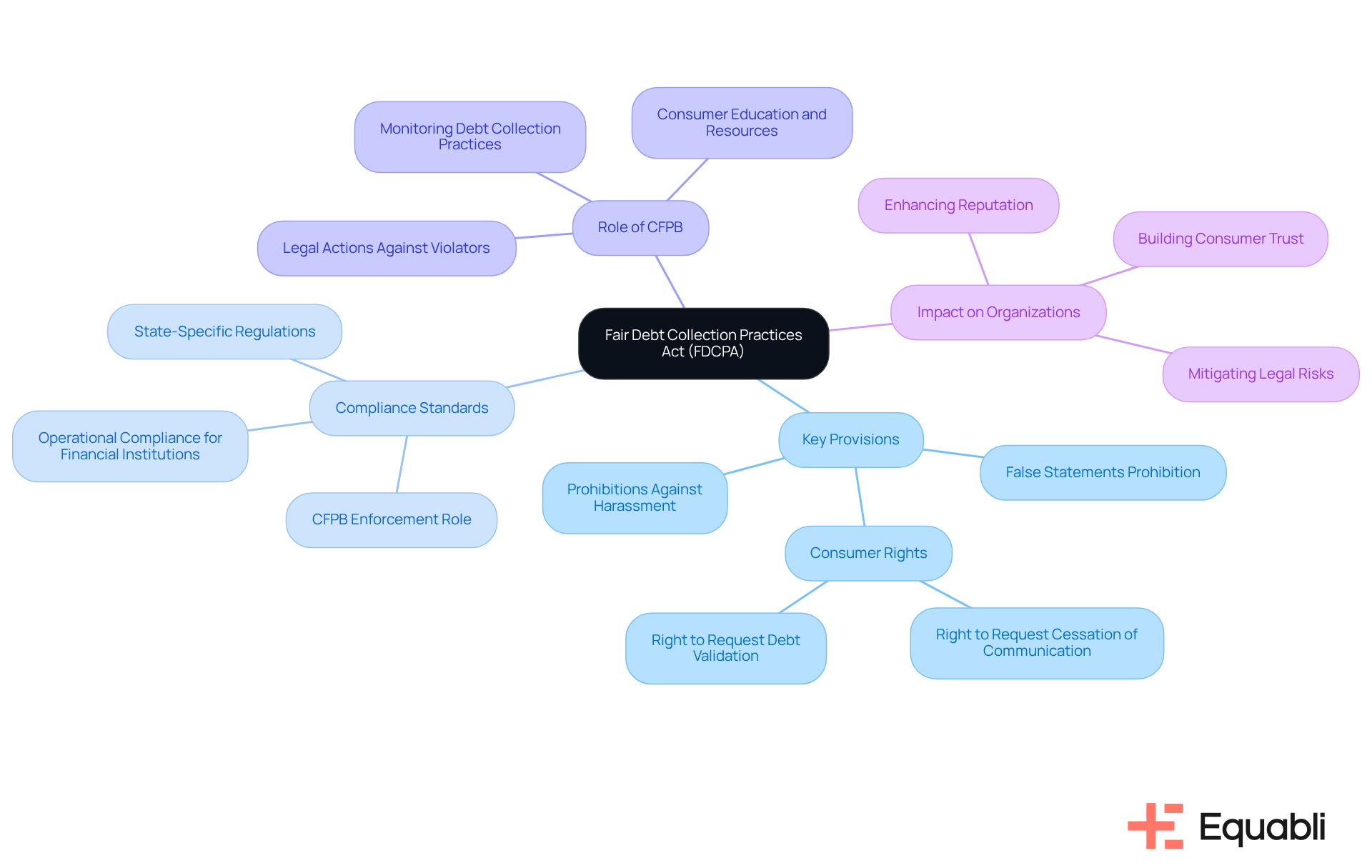

Fair Debt Collection Practices Act: Essential Legal Framework for Compliance

The (FDCPA) represents a critical legal framework that delineates essential guidelines for debt collectors, designed to shield individuals from abusive practices. Key provisions of the FDCPA impose stringent prohibitions against harassment, false statements, and other unfair practices. Financial organizations must ensure that their collection agencies are well-versed in the collection agency operational compliance standards for financial institutions to effectively mitigate legal risks. Adhering to the FDCPA not only protects clients but also enhances the organization's reputation, fostering trust and transparency in the debt recovery process.

Current trends indicate that organizations emphasizing FDCPA compliance are increasingly focusing on safeguarding individual rights, including the right to request cessation of communication from debt collectors. Furthermore, the Consumer Financial Protection Bureau (CFPB) plays a pivotal role in enforcing collection agency operational compliance standards for financial institutions, making it imperative for monetary establishments to remain vigilant regarding compliance matters. Organizations that embrace these practices are poised to cultivate stronger consumer relationships and reduce operational risks, ultimately promoting sustainable growth within the competitive economic landscape.

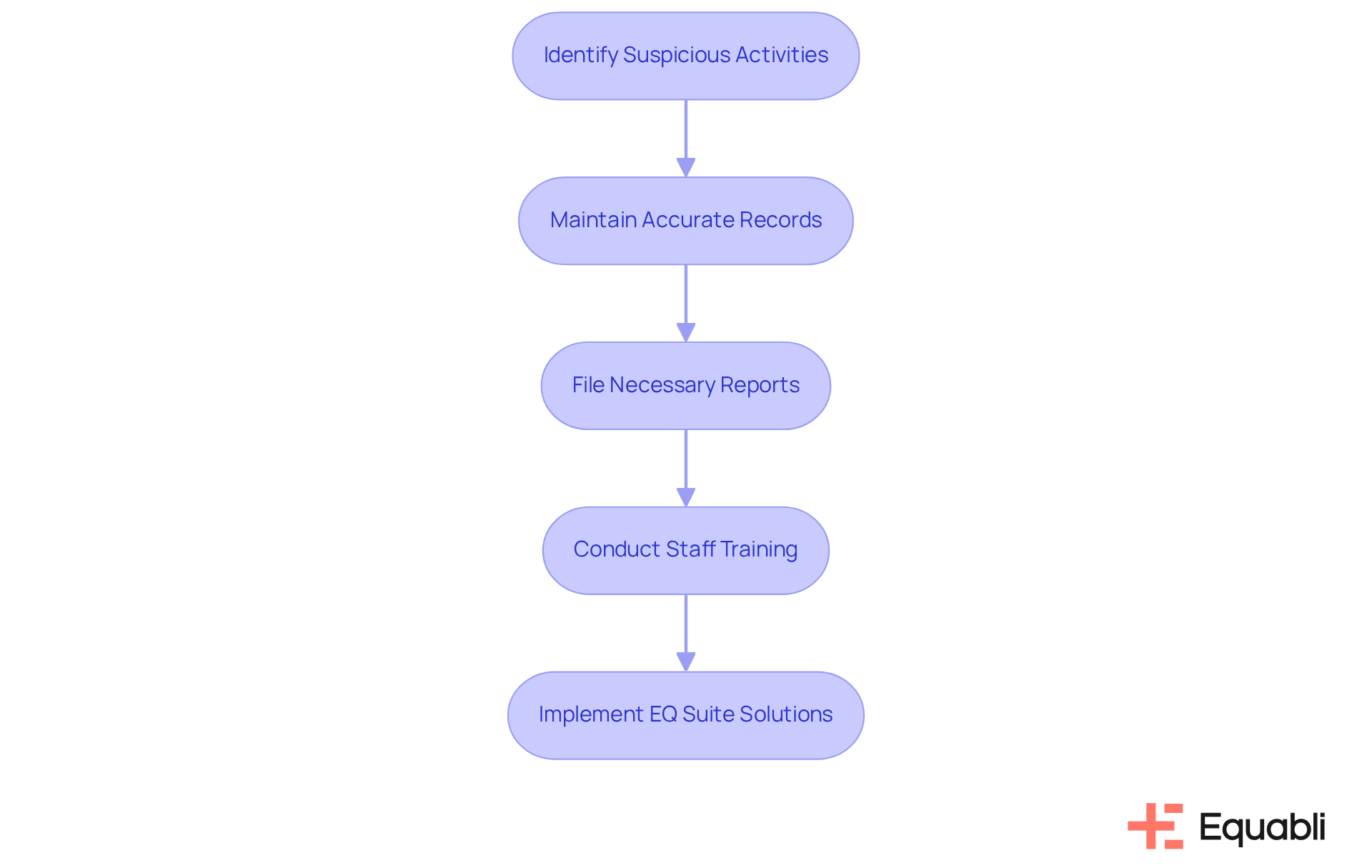

Bank Secrecy Act: Key Compliance Requirement for Financial Institutions

The Bank Secrecy Act (BSA) mandates that monetary establishments adopt robust measures to identify and report suspicious activities indicative of money laundering or fraud. Compliance requires maintaining accurate records, filing necessary reports, and conducting regular training for staff to effectively recognize and respond to suspicious behavior.

For debt collection agencies, following the collection agency operational compliance standards for financial institutions is essential not only to evade substantial penalties but also to ensure that their operations do not inadvertently facilitate illegal activities. Financial organizations often face challenges with manual debt recovery methods, including inefficiencies and difficulties in monitoring compliance.

By leveraging Equabli's EQ Suite, these organizations can transition to modern, data-informed collections that optimize operations and enhance performance. This strategy not only supports compliance with BSA requirements but also aligns with collection agency operational compliance standards for financial institutions, empowering lenders to effectively engage borrowers through customizable repayment options and comprehensive compliance management.

To implement these solutions, organizations should assess their current processes, identify areas for improvement, and utilize the EQ Suite's features to . Non-compliance with the collection agency operational compliance standards for financial institutions can result in severe consequences, including significant fines and reputational harm, highlighting the necessity of a proactive approach to BSA adherence.

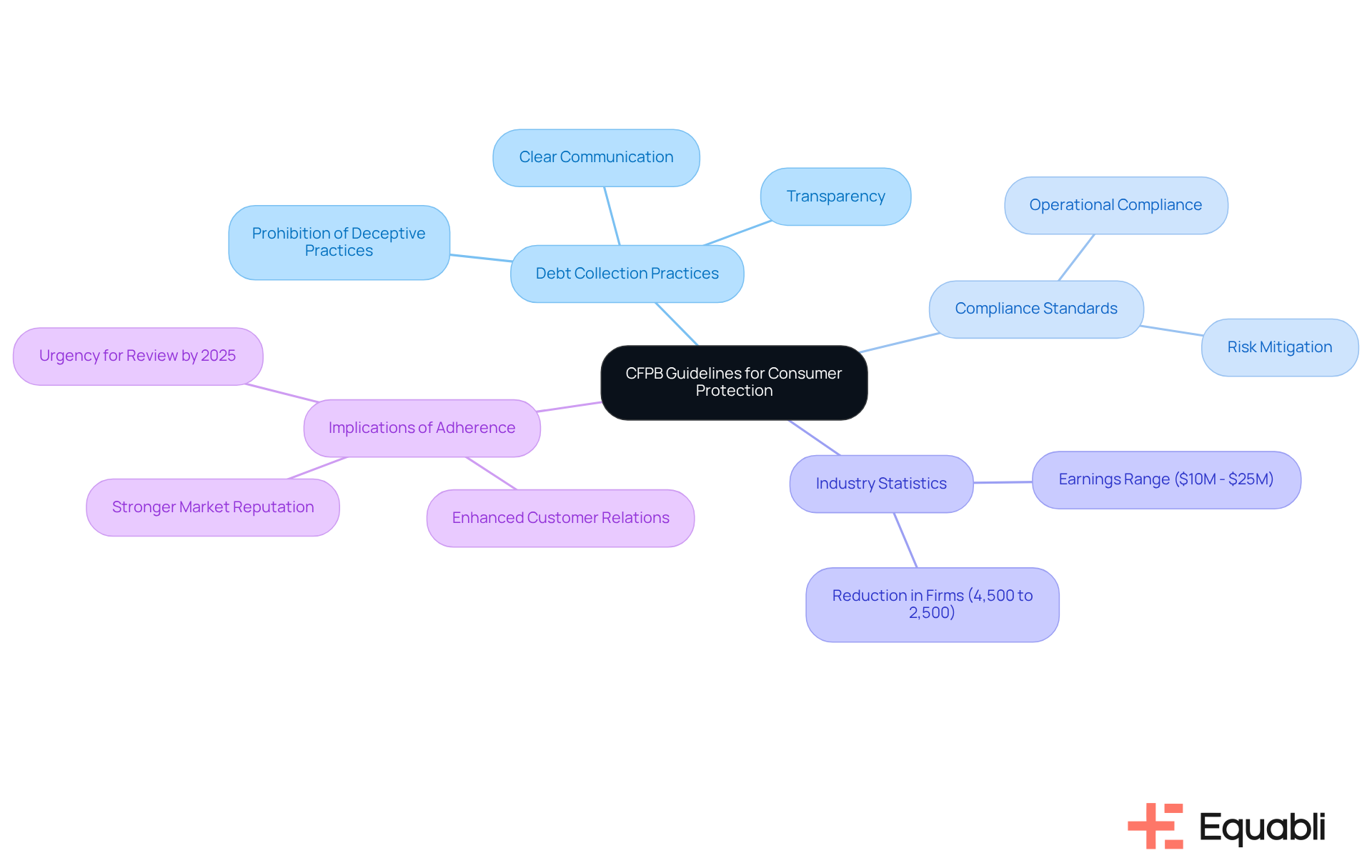

Consumer Financial Protection Bureau Guidelines: Standards for Consumer Protection

The Consumer Financial Protection Bureau (CFPB) establishes essential guidelines that govern debt collection practices, ensuring equitable treatment for clients. These guidelines mandate clear communication, transparency regarding fees, and the prohibition of deceptive practices. Financial institutions must align their debt collection strategies with the collection agency operational compliance standards for financial institutions to mitigate the risk of enforcement actions and promote trust among clients. Compliance with CFPB regulations not only enhances institutional frameworks but also significantly improves customer relations.

Recent data indicates that approximately half of the firms qualifying as larger participants earn between $10 million and $25 million, which aligns with the Small Business Administration's definition of a small business. This highlights the critical need for among a substantial segment of the industry. Furthermore, the CFPB is examining the larger participant regulation, which could influence the cost of adherence and impact rural consumers and servicemembers. Organizations that effectively adopt the collection agency operational compliance standards for financial institutions can anticipate enhanced adherence rates and a stronger reputation in the marketplace.

It is important to note that since the establishment of the $10 million threshold in 2012, the number of firms in the debt collection industry has decreased from about 4,500 to as few as 2,500, emphasizing the significance of adherence. Financial organizations should be aware that remarks on possible changes to the threshold are due by September 22, 2025, emphasizing the urgency to review their practices.

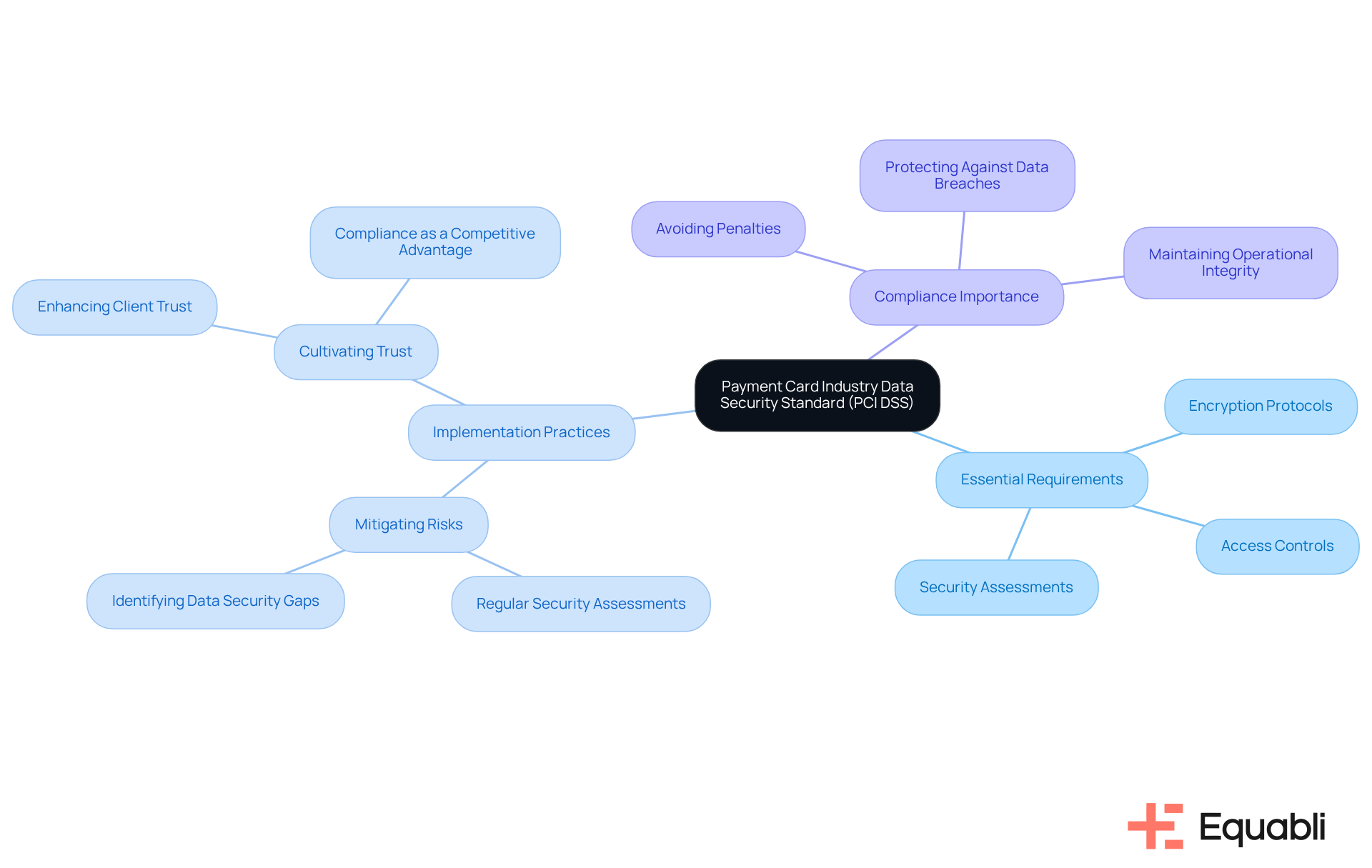

Payment Card Industry Data Security Standard (PCI DSS): Protecting Payment Information

The Payment Card Industry Data Security Standard (PCI DSS) establishes essential requirements for organizations managing credit card data, particularly for debt collection agencies involved in payment processing. Compliance with PCI DSS is critical, as it not only safeguards sensitive consumer information against breaches and fraud but also enhances trust in financial institutions.

To achieve compliance, organizations must implement a comprehensive suite of security measures, including:

- Encryption protocols

- Stringent access controls

- Regular security assessments

These practices are vital for mitigating risks associated with data breaches, which can lead to significant financial penalties and reputational damage. Furthermore, prioritizing PCI DSS compliance cultivates client trust in payment processes, ensuring organizations are well-equipped to protect payment details effectively.

As the compliance landscape evolves, particularly with the upcoming PCI DSS v4.0 requirements set for implementation on March 31, 2025, organizations must remain vigilant and proactive in their compliance strategies to maintain operational integrity and foster customer trust.

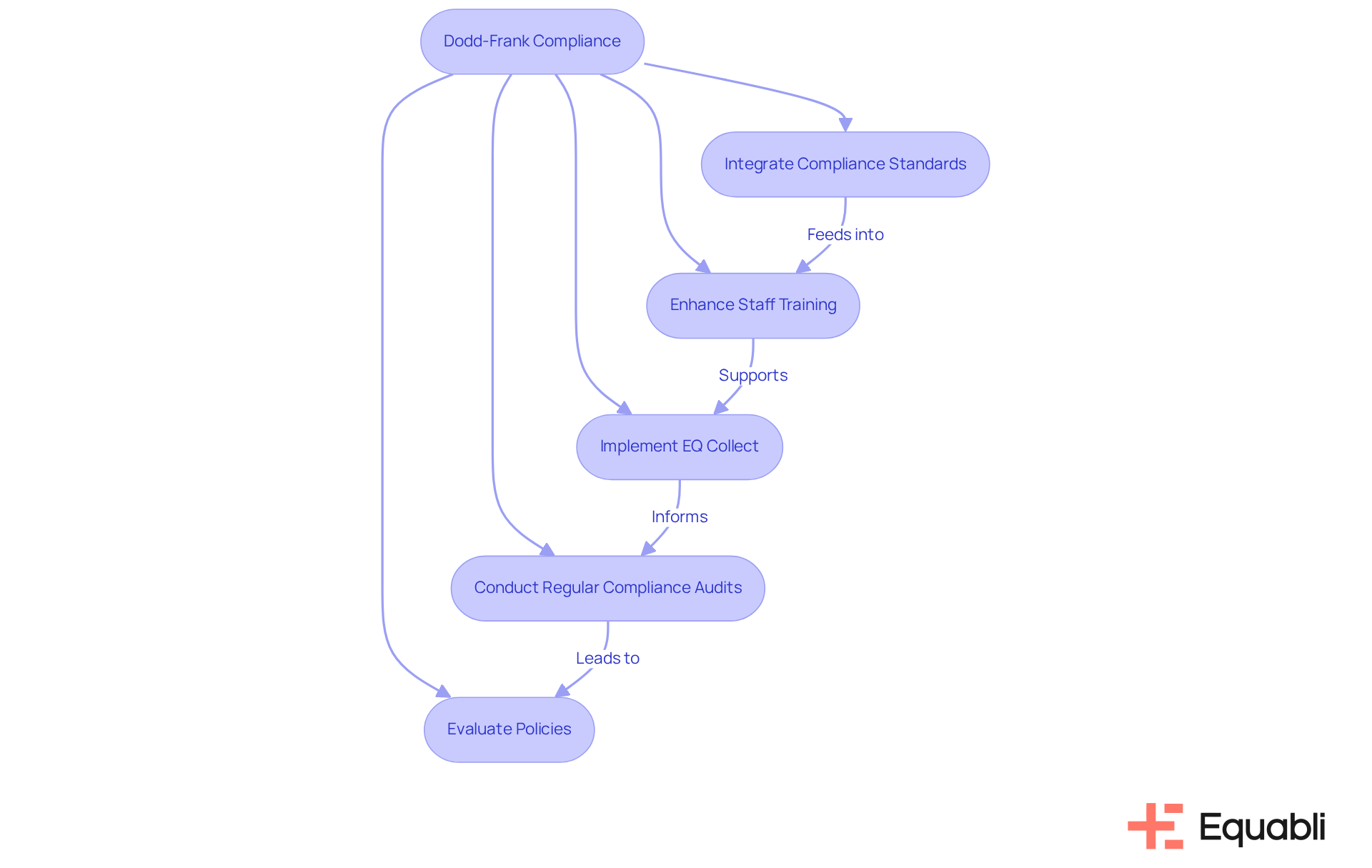

Dodd-Frank Act: Regulatory Reforms Affecting Financial Compliance

The Dodd-Frank Wall Street Reform and Protection Act has fundamentally transformed the regulatory environment for debt collection agencies, underscoring the importance of safeguarding individuals and ensuring economic stability. Adhering to Dodd-Frank regulations is not merely a legal obligation; it is critical for financial entities to avoid penalties while promoting equitable treatment of clients. Key elements of the Act include mandates for transparency in fees and practices, alongside stringent requirements for clear communication with clients regarding their debts.

Financial organizations are increasingly integrating collection agency operational compliance standards for financial institutions into their operational frameworks, demonstrating a commitment to meet evolving regulatory demands. For instance, numerous organizations have instituted enhanced training programs for staff to ensure compliance with the Act's provisions, leading to improved consumer interactions and reduced regulatory risks. Tools such as can significantly bolster these efforts. Its no-code file-mapping tool enables financial institutions to shorten vendor onboarding timelines, while automated workflows decrease execution errors and reliance on manual resources, ensuring efficient compliance with regulations. Furthermore, EQ Collect provides unparalleled transparency and insights through real-time reporting, coupled with secure, industry-leading compliance oversight—essential for navigating the complexities of regulatory requirements.

Moreover, the impact of Dodd-Frank extends to consumer protection in collections, establishing a framework that prioritizes consumer rights. This shift has compelled monetary organizations to reassess their collection strategies, emphasizing ethical practices that align with the Act's objectives. As the regulatory landscape continues to evolve, it remains crucial for monetary entities to keep pace with Dodd-Frank provisions to maintain compliance and foster trust with their clients. Institutions must also be aware of recent changes, such as the CFPB's reorganization of its enforcement strategy for 2025, which highlights clear consumer harm and may influence compliance approaches. To effectively implement the collection agency operational compliance standards for financial institutions, financial organizations should regularly evaluate their policies and training initiatives, ensuring alignment with the latest regulatory updates and best practices. Employing data-driven strategies and real-time reporting capabilities from EQ Collect can further enhance regulatory efforts and operational efficiency. As a best practice, organizations should consider scheduling regular compliance audits to identify areas for improvement and ensure adherence to evolving regulations.

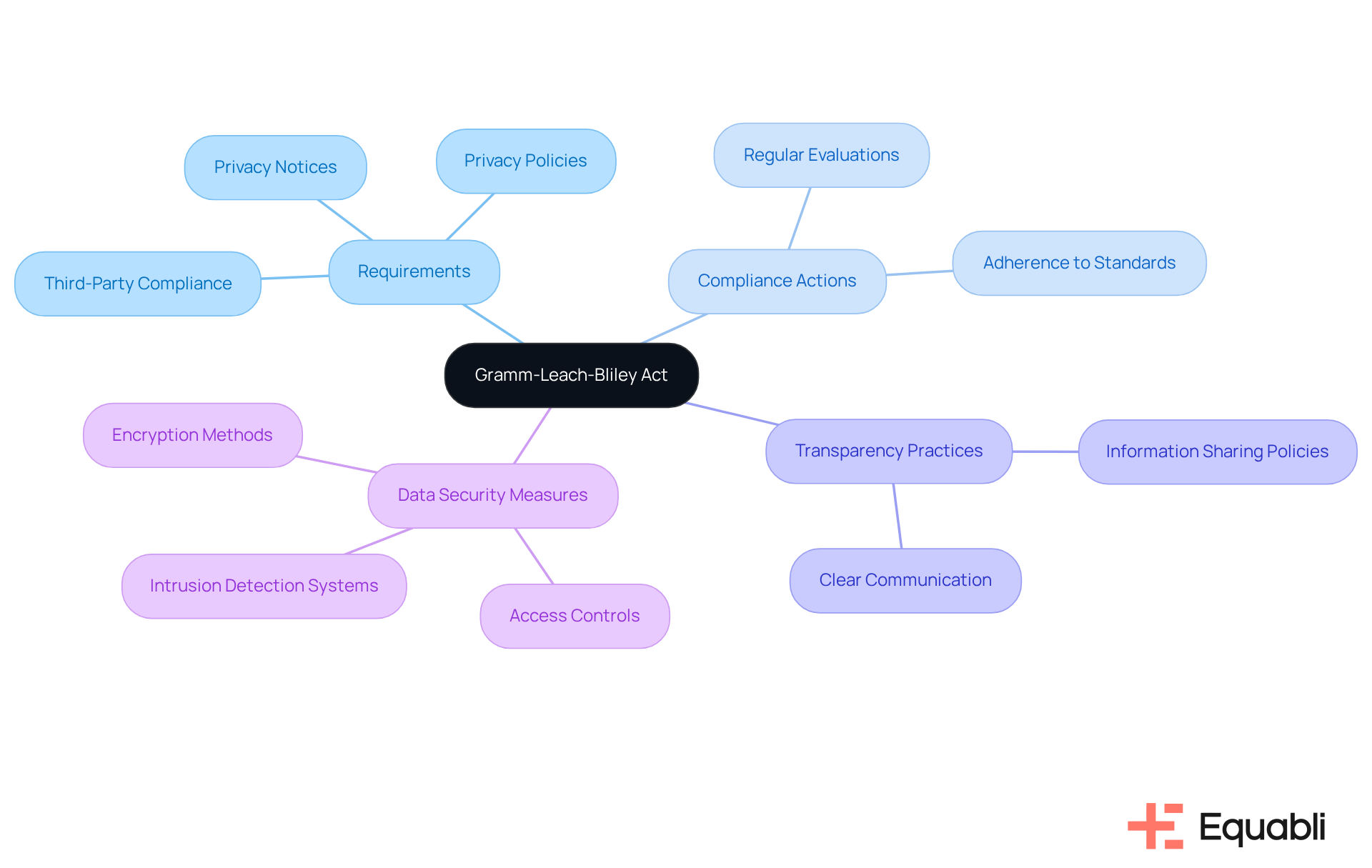

Gramm-Leach-Bliley Act: Transparency in Information Sharing Practices

The Gramm-Leach-Bliley Act (GLBA) establishes critical requirements for financial institutions to safeguard individuals' personal financial data while ensuring transparency in information-sharing practices. Compliance with GLBA necessitates the implementation of robust privacy policies, the provision of clear privacy notices to individuals, and the assurance that third-party service providers adhere to equivalent standards.

Equabli exemplifies this commitment through its stringent privacy policy, which explicitly prohibits the sale, rental, or leasing of customer information to third parties. For debt collection agencies, ensuring adherence to collection agency operational compliance standards for financial institutions under GLBA transcends mere regulatory obligation; it is a fundamental component of cultivating trust with clients and mitigating legal risks.

Organizations must prioritize , as alignment with GLBA requirements is essential for maintaining regulatory compliance and enhancing public confidence in the financial system. Furthermore, Equabli's commitment to data security is underscored by its use of encryption for personal data both in transit and at rest, alongside rigorous access controls, firewalls, and intrusion detection systems designed to protect sensitive information.

It is imperative for organizations to regularly evaluate their debt recovery strategies to ensure adherence to collection agency operational compliance standards for financial institutions, as ongoing assessments are crucial for adapting to the evolving regulatory landscape. Current trends indicate a heightened focus on data security and privacy, with financial institutions increasingly recognizing the importance of GLBA compliance in protecting consumer information and avoiding potential penalties.

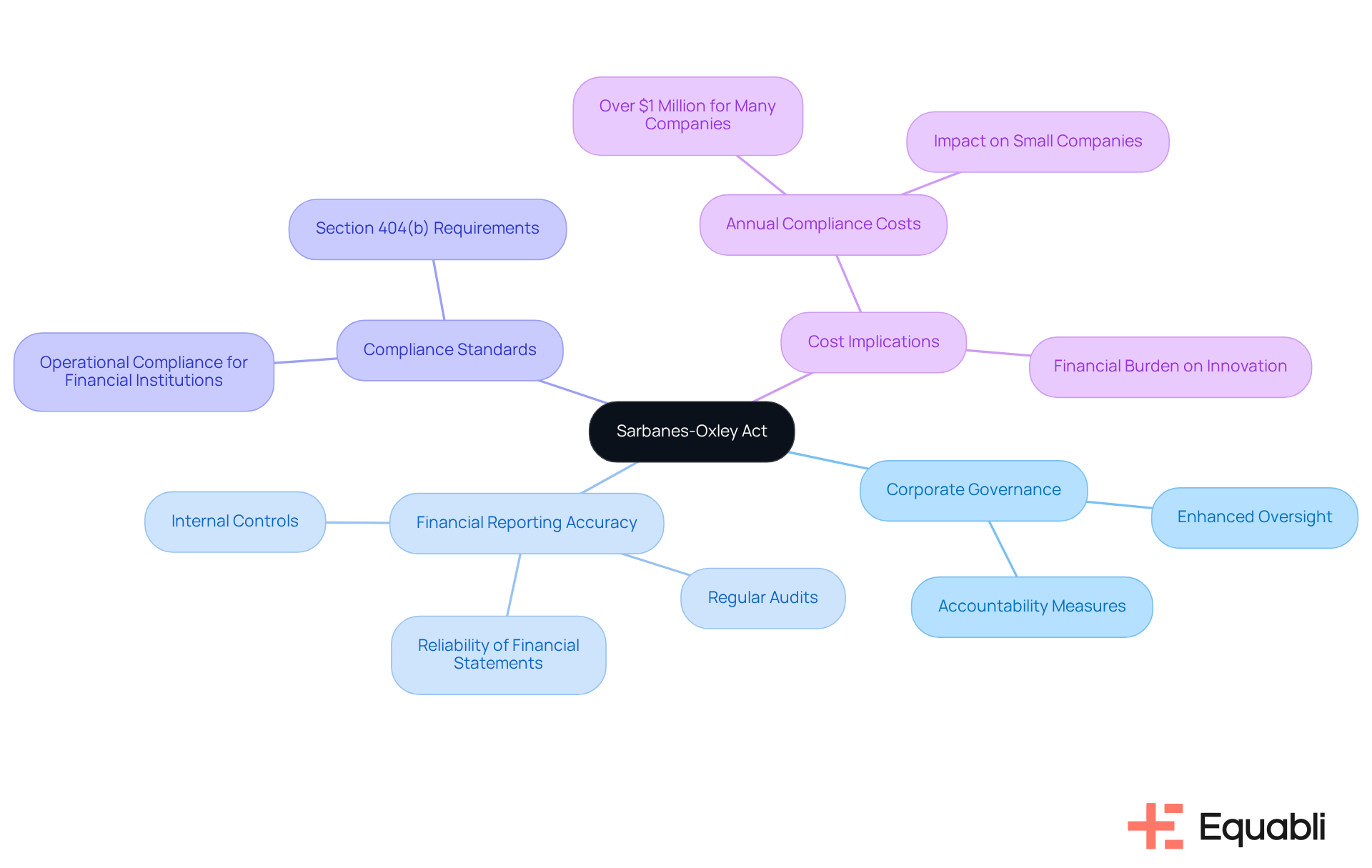

Sarbanes-Oxley Act: Ensuring Financial Reporting Accuracy and Compliance

The Sarbanes-Oxley Act (SOX) serves as a crucial regulatory framework designed to strengthen corporate governance and enhance the accuracy of financial reporting. While primarily targeting publicly traded companies, the principles embedded in SOX significantly impact the for financial institutions that interact with these entities.

Adherence to SOX mandates the implementation of robust internal controls, regular audits, and precise monetary disclosures. For financial organizations, compliance with SOX is essential not only for mitigating fraud risks but also for maintaining investor confidence.

Integrating SOX compliance into operational frameworks is imperative for aligning with collection agency operational compliance standards for financial institutions, thereby enabling agencies to effectively manage their financial responsibilities while fostering transparency and accountability.

Recent data indicates that many companies incur compliance costs exceeding one million dollars annually, underscoring the financial implications of these regulations. Moreover, the ramifications of SOX on the accuracy of financial reporting are substantial, as it necessitates organizations to adopt rigorous measures that bolster the reliability of their financial statements, ultimately benefiting all stakeholders involved.

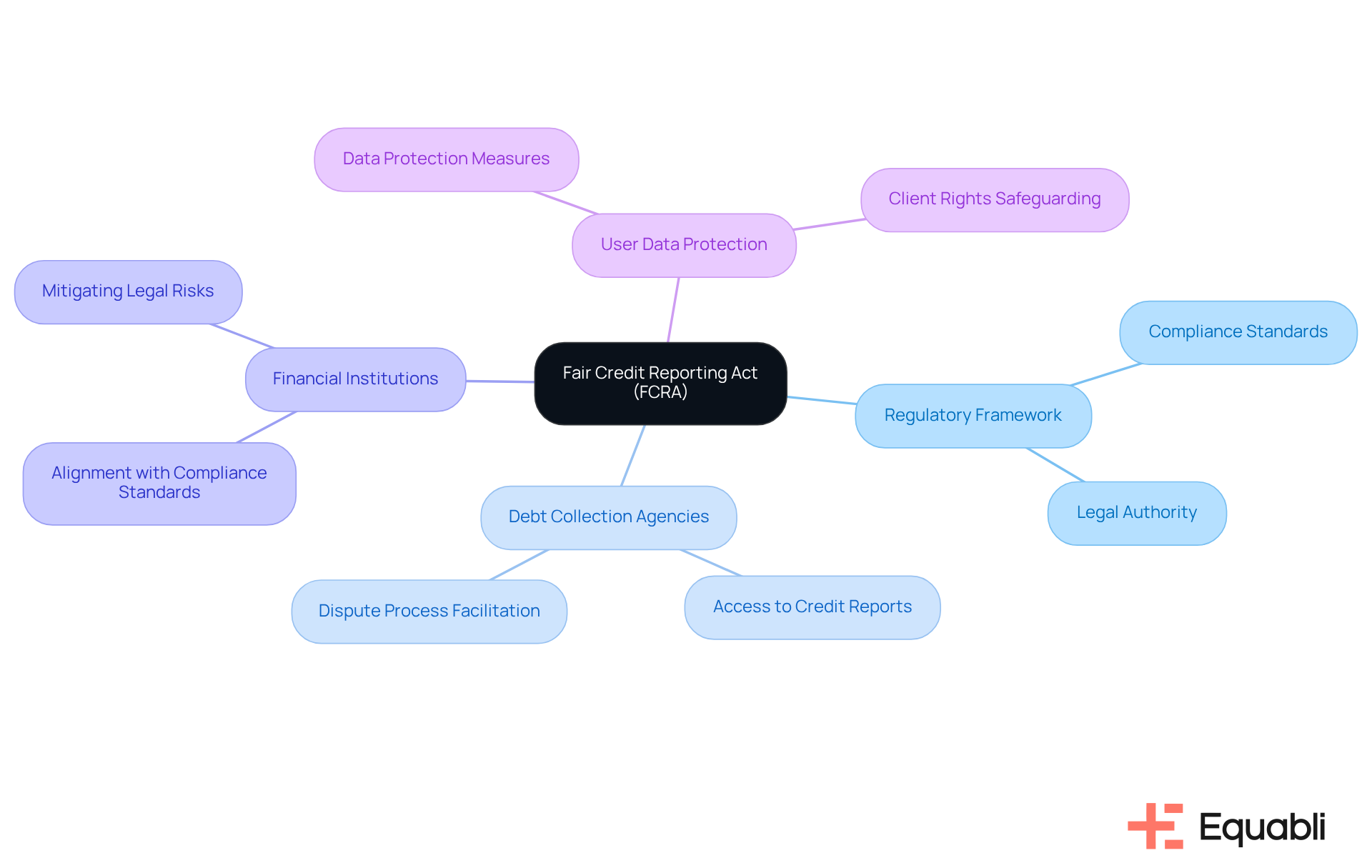

Fair Credit Reporting Act: Regulating Consumer Credit Information Practices

The Fair Credit Reporting Act (FCRA) serves as a critical regulatory framework governing the collection, dissemination, and utilization of credit information related to individuals. For debt collection agencies, adherence to collection agency operational compliance standards for financial institutions is essential to ensure the accuracy of reported information and uphold individuals' rights.

Agencies are mandated to provide individuals access to their credit reports and to facilitate the process for disputing inaccuracies. Financial institutions must align their collection practices with collection agency operational compliance standards for financial institutions and FCRA requirements to mitigate legal risks and maintain client trust.

Furthermore, as highlighted in Equabli's Privacy Policy, the protection of user data is paramount. Equabli is committed to safeguarding client rights through robust data protection measures, which are vital in the evolving landscape of debt collection solutions. This dedication not only fosters but also enhances the trust and confidence individuals place in financial organizations.

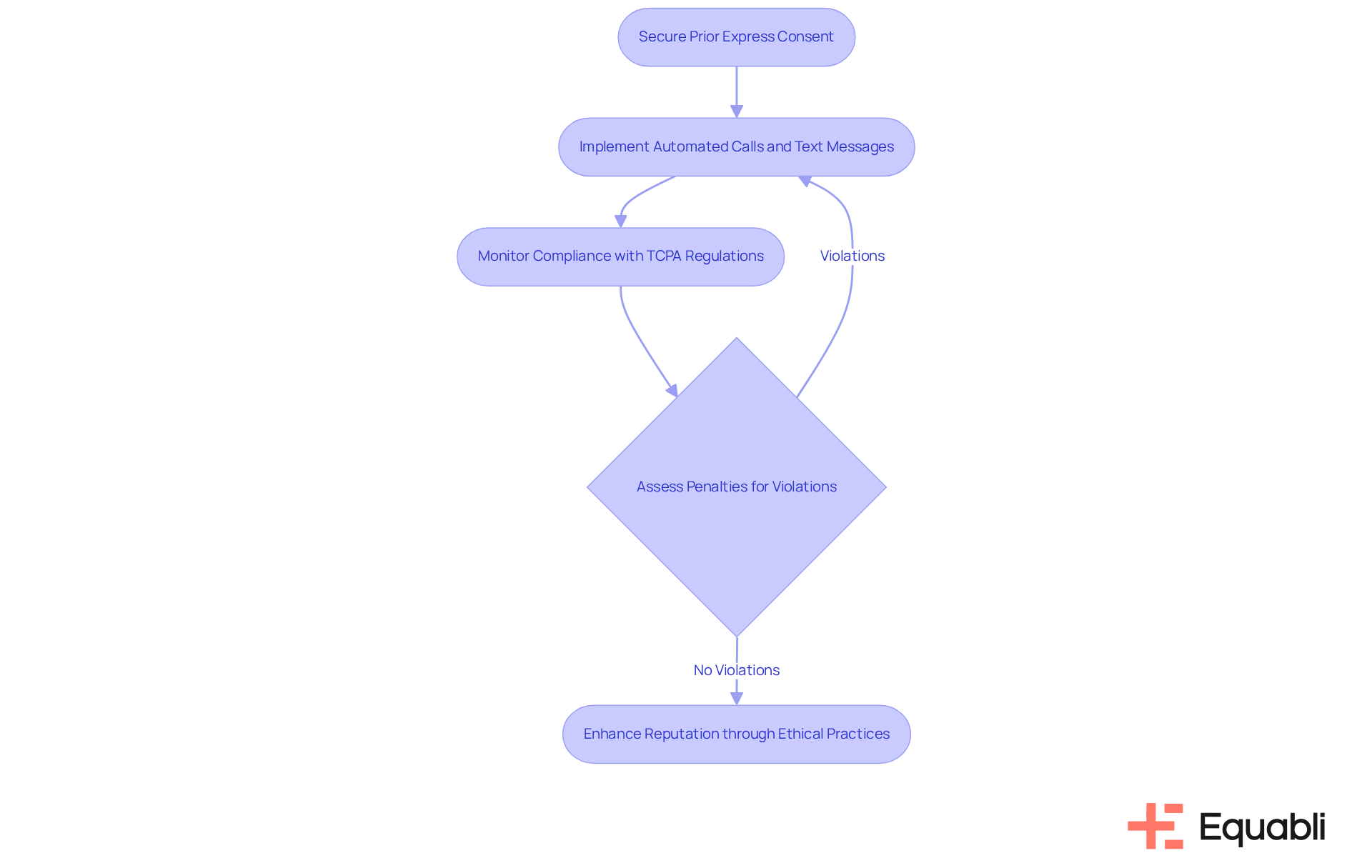

Telephone Consumer Protection Act: Compliance in Communication Practices

The Telephone Consumer Protection Act (TCPA) serves as a fundamental regulatory framework governing telemarketing calls, particularly those made by debt collectors. Compliance with the TCPA mandates that debt collection agencies secure prior express consent from individuals before deploying automated calls or sending text messages. Non-compliance with the collection agency operational compliance standards for financial institutions can lead to substantial penalties, underscoring the imperative for these institutions to implement rigorous regulatory protocols. By adhering to TCPA requirements, debt collectors foster respectful communication with clients while mitigating potential legal risks.

Recent data underscores the significance of compliance with TCPA regulations, revealing that violations can result in fines of up to $1,500 per incident. This highlights the critical importance of maintaining and consumer trust within the industry. Furthermore, financial institutions that effectively execute TCPA measures exemplify a commitment to ethical practices and adhere to collection agency operational compliance standards for financial institutions, thereby enhancing their reputation in the competitive landscape of debt collection. Such adherence not only aligns with regulatory expectations but also positions organizations as leaders in responsible financial management.

Conclusion

Navigating the intricate landscape of compliance standards is paramount for financial institutions involved in debt collection. Adhering to various regulations, such as:

- The Fair Debt Collection Practices Act

- The Bank Secrecy Act

- The Consumer Financial Protection Bureau guidelines

is essential. These frameworks not only safeguard consumer rights but also enhance operational integrity, ultimately fostering trust and transparency in financial dealings.

Utilizing advanced compliance solutions like Equabli's EQ Suite is critical in streamlining processes and mitigating risks associated with regulatory non-compliance. By implementing robust tools and adhering to standards such as:

- The Payment Card Industry Data Security Standard

- The Dodd-Frank Act

organizations can significantly improve their compliance posture. Moreover, the emphasis on ethical communication practices under the Telephone Consumer Protection Act underscores the necessity of maintaining respectful interactions with clients.

As the compliance landscape continues to evolve, financial institutions must remain proactive in their strategies. Regular evaluations of policies, training initiatives, and the adoption of innovative compliance technologies will ensure adherence to existing regulations while positioning organizations for sustainable growth in a competitive environment. Embracing these best practices is essential for cultivating strong consumer relationships and minimizing legal risks, ultimately contributing to a more responsible and transparent financial ecosystem.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed to assist financial institutions in complying with debt collection regulations. It includes the EQ Engine, EQ Engage, and EQ Collect, which together provide a robust approach to regulatory compliance.

What features does EQ Collect offer?

EQ Collect features a cloud-native interface that is user-friendly and scalable, along with a no-code file-mapping tool that reduces vendor onboarding timelines. It enhances operational efficiency through automated workflows that streamline processes and minimize compliance risks.

How does EQ Engage benefit organizations?

EQ Engage allows organizations to craft, automate, and execute personalized borrower contact strategies. It enables borrowers to self-service with tailored repayment plans while ensuring that communication aligns with the organization's brand voice.

What are the benefits of using the EQ Suite for debt collection?

The EQ Suite helps organizations implement custom scoring models and optimize collection strategies, enhancing digital collections while ensuring adherence to compliance standards. It provides data-driven insights and real-time reporting for effective collection efforts.

What is the Fair Debt Collection Practices Act (FDCPA)?

The FDCPA is a legal framework that sets guidelines for debt collectors to protect individuals from abusive practices. It prohibits harassment, false statements, and other unfair practices, requiring financial organizations to ensure their collection agencies comply with these standards.

Why is FDCPA compliance important for organizations?

Adhering to the FDCPA protects clients and enhances the organization's reputation, fostering trust and transparency in the debt recovery process. It also helps organizations safeguard individual rights, such as the right to request cessation of communication from debt collectors.

What does the Bank Secrecy Act (BSA) require from financial institutions?

The BSA mandates that financial institutions adopt measures to identify and report suspicious activities related to money laundering or fraud. This includes maintaining accurate records, filing reports, and conducting staff training to recognize suspicious behavior.

How can the EQ Suite help with BSA compliance?

The EQ Suite enables organizations to transition to modern, data-informed collections, optimizing operations while ensuring compliance with BSA requirements. It helps lenders engage borrowers through customizable repayment options and comprehensive compliance management.

What are the risks of non-compliance with collection agency operational compliance standards?

Non-compliance can lead to severe consequences, including significant fines and reputational harm. It is crucial for organizations to adopt a proactive approach to compliance to avoid these risks.