Overview

The trends shaping consumer lending in 2025 are poised to redefine the industry. Key factors such as the integration of technology, personalization, and sustainable practices are at the forefront of this transformation. Advancements like AI-driven lending, digital platforms, and alternative credit scoring are not just enhancements; they are essential for significantly improving borrower experiences and operational efficiencies. This evolution will ultimately reshape the lending landscape, urging stakeholders to adapt and innovate in order to meet emerging consumer expectations.

Introduction

As the landscape of consumer lending evolves, financial institutions stand at the forefront of transformative trends set to redefine borrower engagement by 2025. The integration of advanced AI algorithms and the rise of personalized lending solutions are not just innovations; they promise to enhance efficiency, improve customer satisfaction, and foster greater inclusivity in the lending process.

Yet, as lenders embrace these advancements, they must confront the challenges of regulatory compliance and the necessity for robust data analytics to ensure responsible lending practices.

What strategies will financial institutions implement to remain competitive and address the diverse needs of consumers in this rapidly changing environment?

Equabli's EQ Suite: Transforming Consumer Lending with Intelligent Debt Collection Solutions

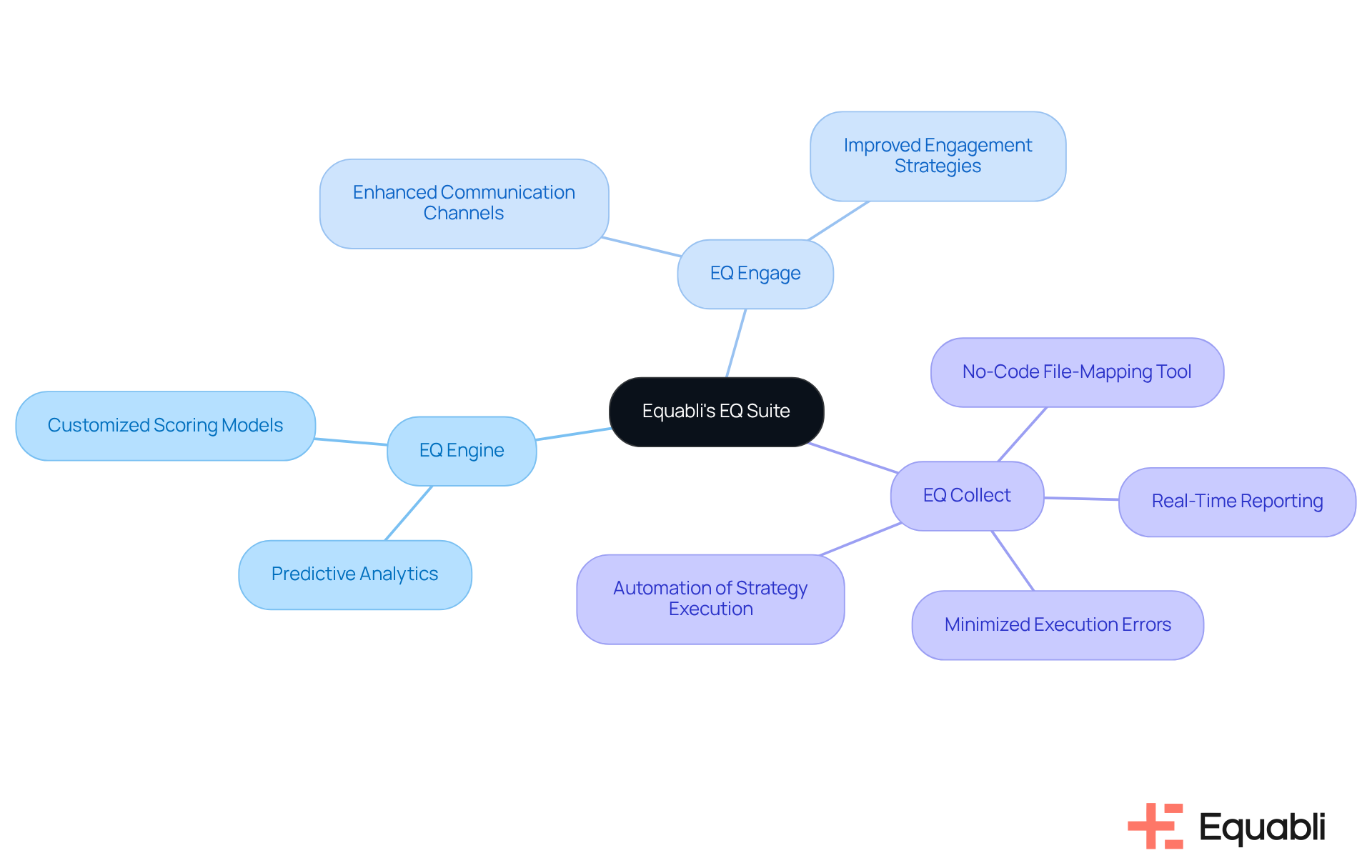

Equabli's EQ Suite is revolutionizing debt collection processes for financial institutions by providing a comprehensive array of tools designed to enhance efficiency and effectiveness, all while prioritizing data protection. This suite features the EQ Engine, EQ Engage, and EQ Collect, which leverage predictive analytics to optimize repayment strategies and ensure adherence to industry standards.

These tools empower financial institutions to craft customized scoring models that accurately forecast borrower behaviors, thereby improving engagement through preferred communication channels. Notably, with 57% of debt collection agencies already employing AI for account segmentation and predictive analytics, the EQ Suite aligns seamlessly with this industry trend, positioning financial institutions to remain competitive.

Furthermore, as 56% of agencies utilize self-service portals, the EQ Suite's automation of strategy execution not only strengthens compliance but also significantly reduces operational costs, promoting digital engagement. With functionalities such as a no-code file-mapping tool and , EQ Collect minimizes execution errors and manual resource usage, delivering unparalleled transparency and insights.

Consequently, the EQ Suite emerges as an essential asset for financial institutions striving to excel in the competitive landscape of 2025, where data-driven decision-making is critical. John Sanders emphasizes, "Consumers expect instant, secure, and frictionless self-service options that empower them to manage their finances," underscoring the significance of these features in contemporary debt collection.

AI-Driven Lending: Leveraging Advanced Algorithms for Smarter Consumer Loan Decisions

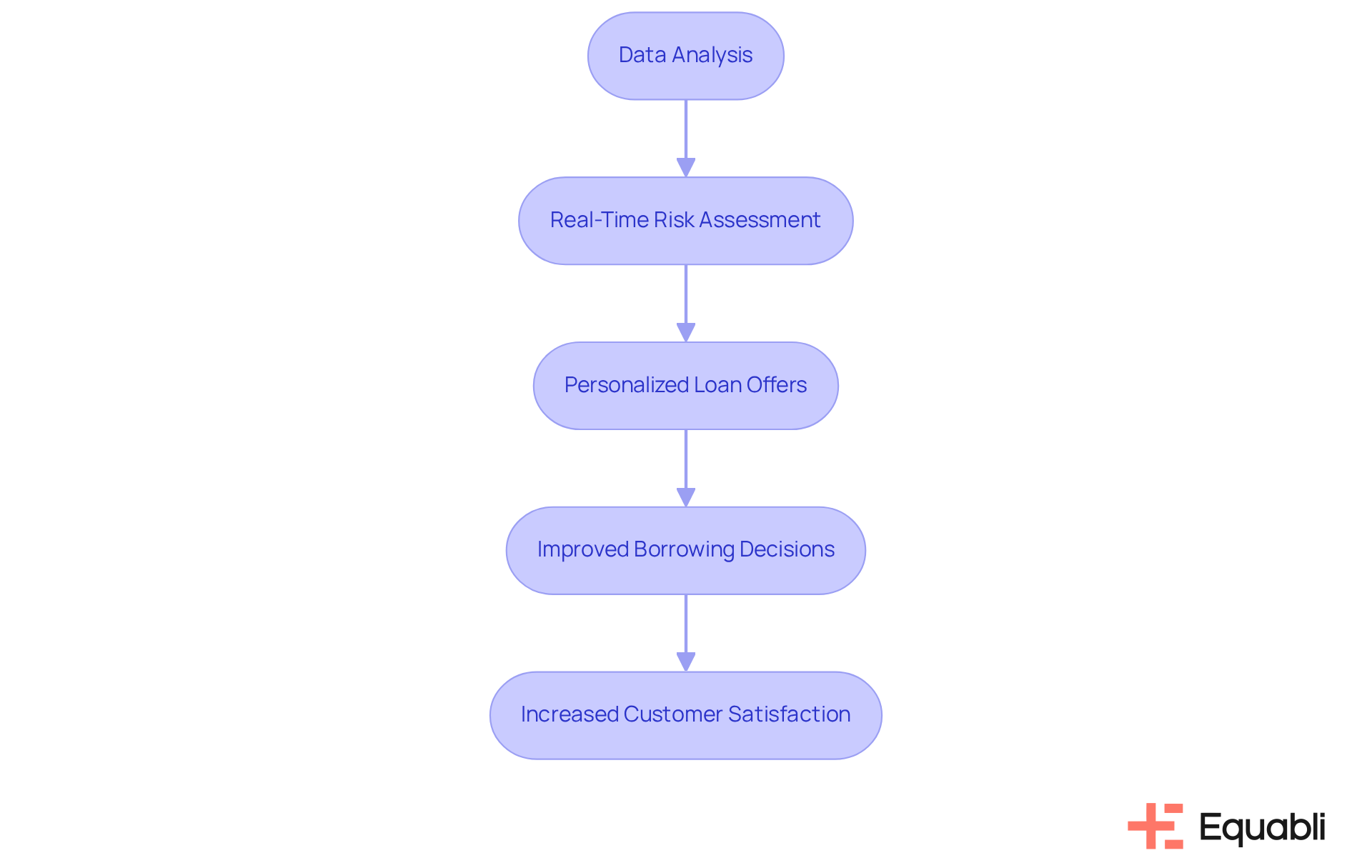

In 2025, AI-driven consumer lending is set to revolutionize how financial institutions assess creditworthiness. By harnessing advanced algorithms, these institutions can analyze vast datasets, resulting in more precise and informed decision-making. This technology enables real-time risk assessments in consumer lending, facilitating quicker approvals and personalized loan offers tailored to the profiles of individual borrowers.

Equabli's EQ Engine enhances this process by predicting the risk of delinquency across diverse communication channels for active accounts, empowering financial institutions to devise intelligent servicing strategies that boost efficiency and reduce roll-rates. For example, advanced credit risk evaluation algorithms have significantly improved borrowing decisions, decreasing default risks while enhancing customer satisfaction.

As one industry leader emphasized, the integration of AI streamlines processes and deepens the understanding of borrower behavior in consumer lending, ultimately yielding better outcomes for both lenders and consumers. Moreover, the adoption of AI solutions has resulted in a remarkable 40-point increase in Net Promoter Score (NPS), reflecting improved customer interactions and the positive impact of AI on satisfaction.

To fully leverage the benefits of AI in lending, institutions must continually refine their predictive models and servicing strategies based on the evolving data and behaviors of borrowers. With these advancements, AI is emerging as a , enabling institutions to navigate complexities with greater agility and accuracy.

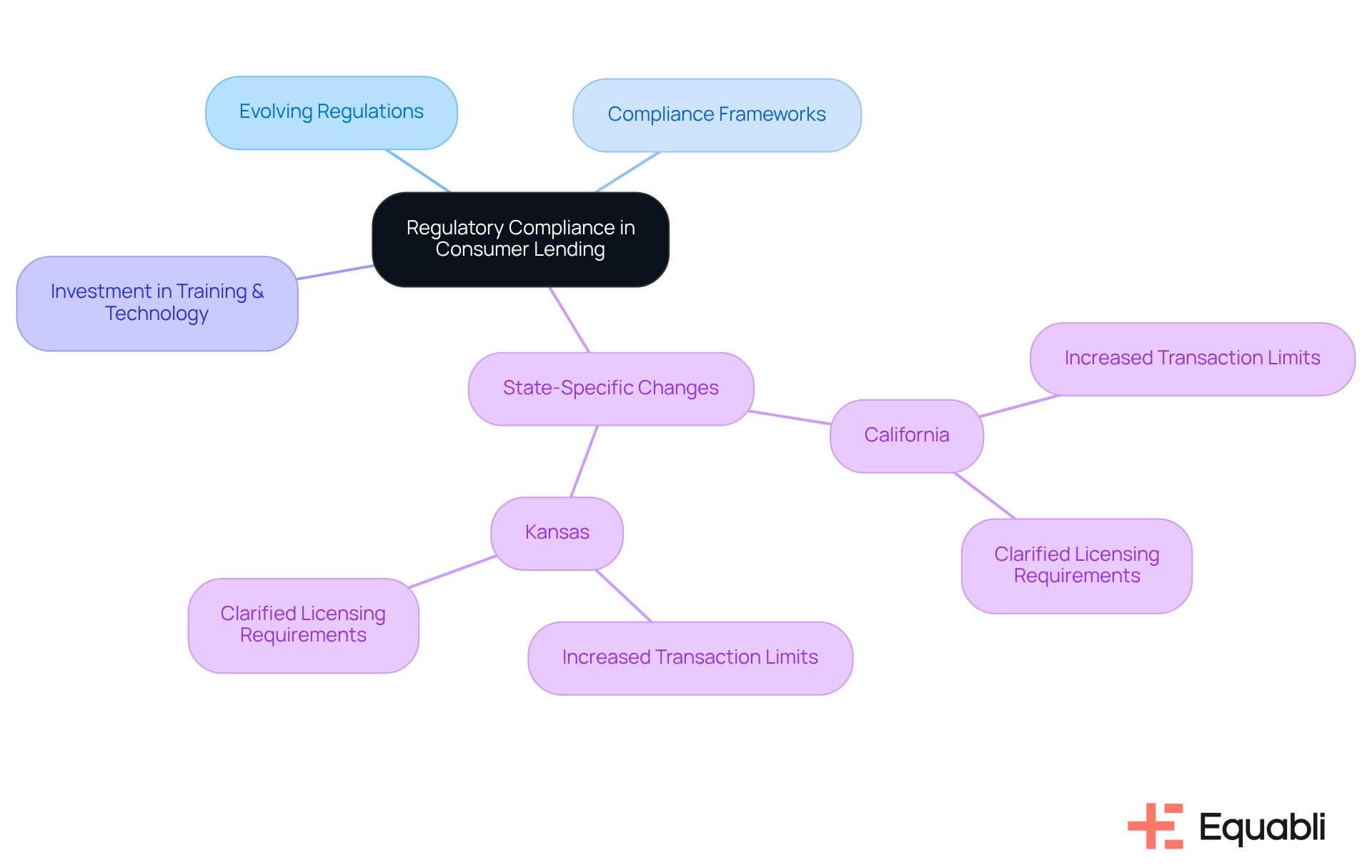

Regulatory Compliance: Navigating New Standards in Consumer Lending Practices

As borrowing regulations evolve, financial institutions must proactively adapt to new compliance standards. By 2025, lenders will face intensified scrutiny concerning fair lending practices and data protection. This reality necessitates the implementation of to mitigate risks associated with non-compliance.

Investing in training and technology is crucial for ensuring adherence to these regulations, which not only safeguards operations but also enhances public trust. Notably, states such as California and Kansas are enacting significant changes to their credit regulations, including:

- Increased transaction limits

- Clarified licensing requirements

These developments underscore the critical role of compliance in preserving operational integrity and consumer confidence. Experts assert that a well-structured compliance strategy can lead to enhanced risk management and operational efficiency, positioning lenders for sustainable growth in a competitive landscape. By prioritizing compliance, financial institutions can effectively navigate the complexities of new borrowing regulations while fostering a culture of accountability and transparency.

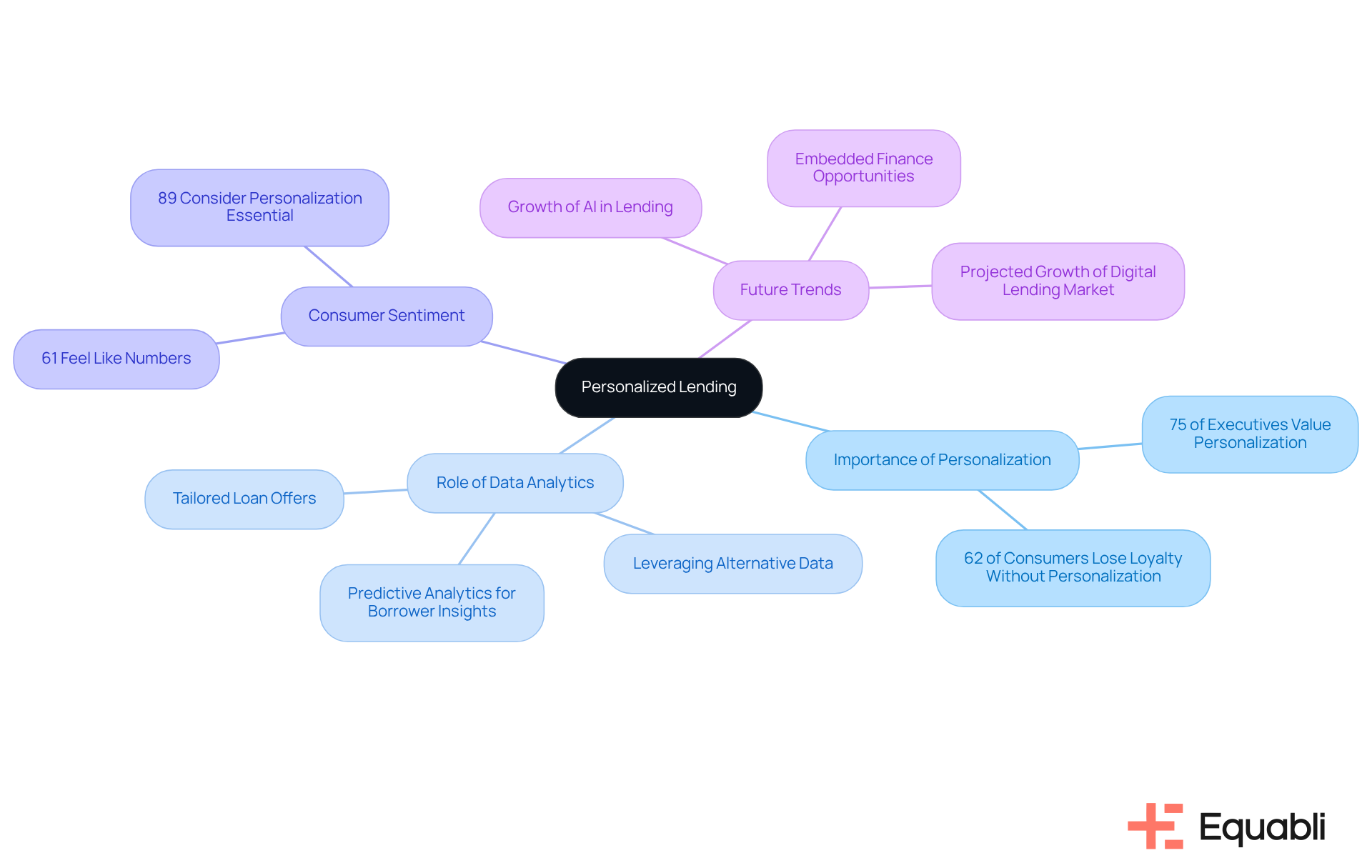

Personalized Lending: Tailoring Financial Products to Meet Individual Consumer Needs

Consumer lending that is personalized is increasingly essential as consumers demand products tailored to their unique situations. By 2025, financial institutions will harness data analytics to craft customized loan offers that reflect individual financial profiles and behaviors. This strategy not only boosts but also significantly enhances rates of consumer lending acceptance.

For instance, institutions leveraging advanced analytics can predict borrower preferences and repayment capabilities, leading to more relevant loan options. Afolakemi Sulaiman notes that data analytics is revolutionizing the operations of financial institutions, enabling them to tailor loan products to meet each borrower's specific needs.

Furthermore, 75% of company executives regard personalization as crucial for digital experiences, highlighting its significance in consumer lending. The incorporation of alternative data sources allows financial institutions to assess creditworthiness more accurately, addressing the concerns of borrowers who often feel like mere numbers—61% of customers share this feeling.

Consequently, lenders prioritizing personalization in consumer lending can build stronger relationships with borrowers, fostering loyalty and enhancing overall engagement. This shift towards data-driven customization is expected to reshape the borrowing landscape, positioning personalized solutions as a cornerstone of successful financing strategies in 2025.

Digital Lending Platforms: Streamlining Access to Consumer Loans Through Technology

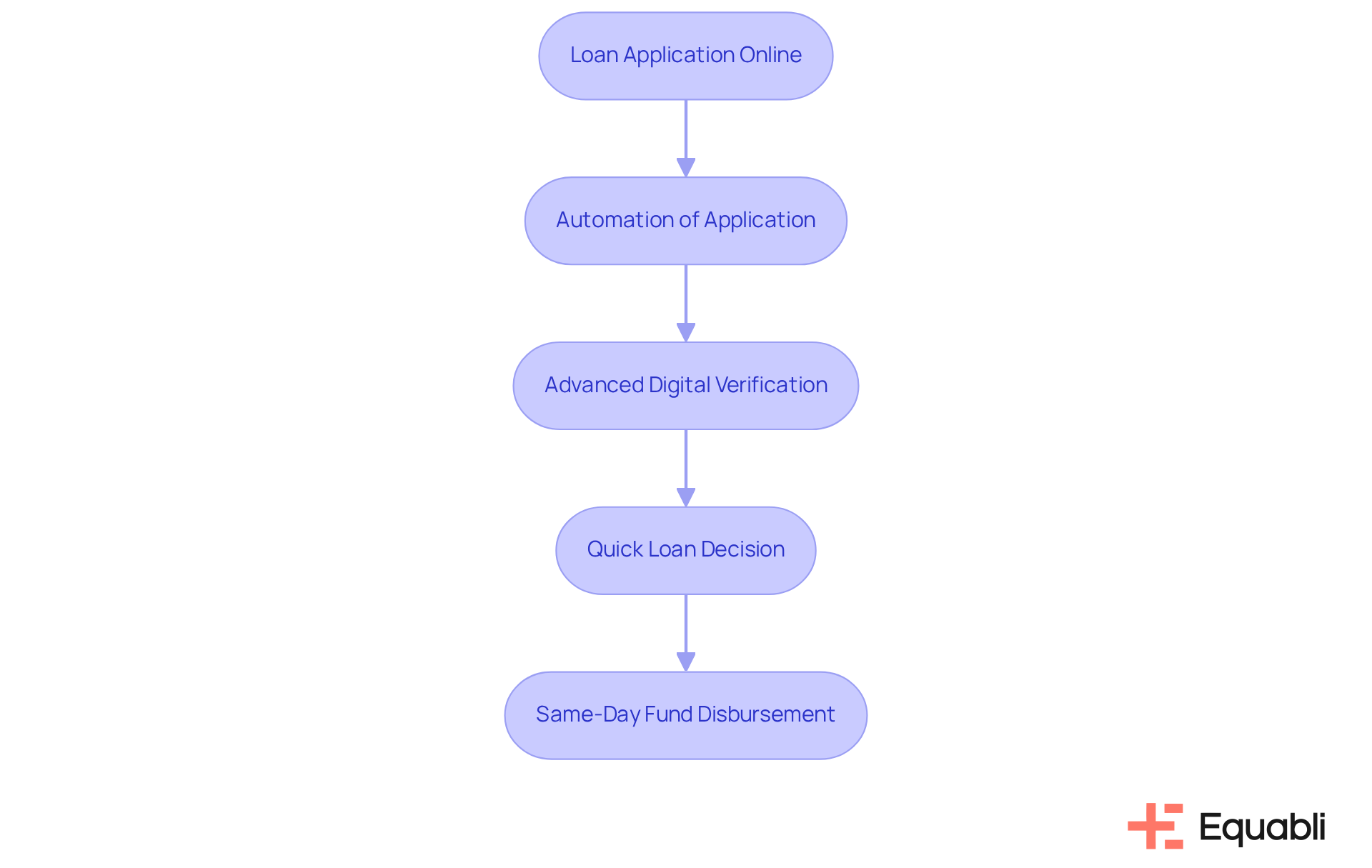

Digital borrowing platforms are revolutionizing the consumer lending landscape by streamlining access to funds. By 2025, these platforms will enable borrowers to complete loan applications online, drastically reducing the time and paperwork typically associated with lending. The automation of the application process, coupled with advanced digital verification techniques, allows financial institutions to enhance operational efficiency and improve the overall customer experience. Applications that once required hours can now be processed in mere minutes, with borrowers receiving loan decisions in seconds rather than weeks. Some platforms even offer same-day fund disbursement.

This shift towards digitalization effectively addresses the increasing in consumer lending, while also positioning financial institutions to remain competitive in a rapidly evolving environment. Moreover, the integration of technologies such as Open Banking mitigates potential risks and fraud by facilitating secure, regulated information collection and disclosure. This empowers lenders to make informed decisions, thereby enhancing customer engagement.

As the digital borrowing market continues to expand, focusing on personalized, tech-enabled financing options will be essential for meeting the diverse needs of borrowers. The future of lending is not just about providing funds; it’s about delivering a seamless, efficient, and tailored experience that resonates with today’s consumers.

Sustainable Lending: Integrating Environmental and Social Governance into Consumer Financing

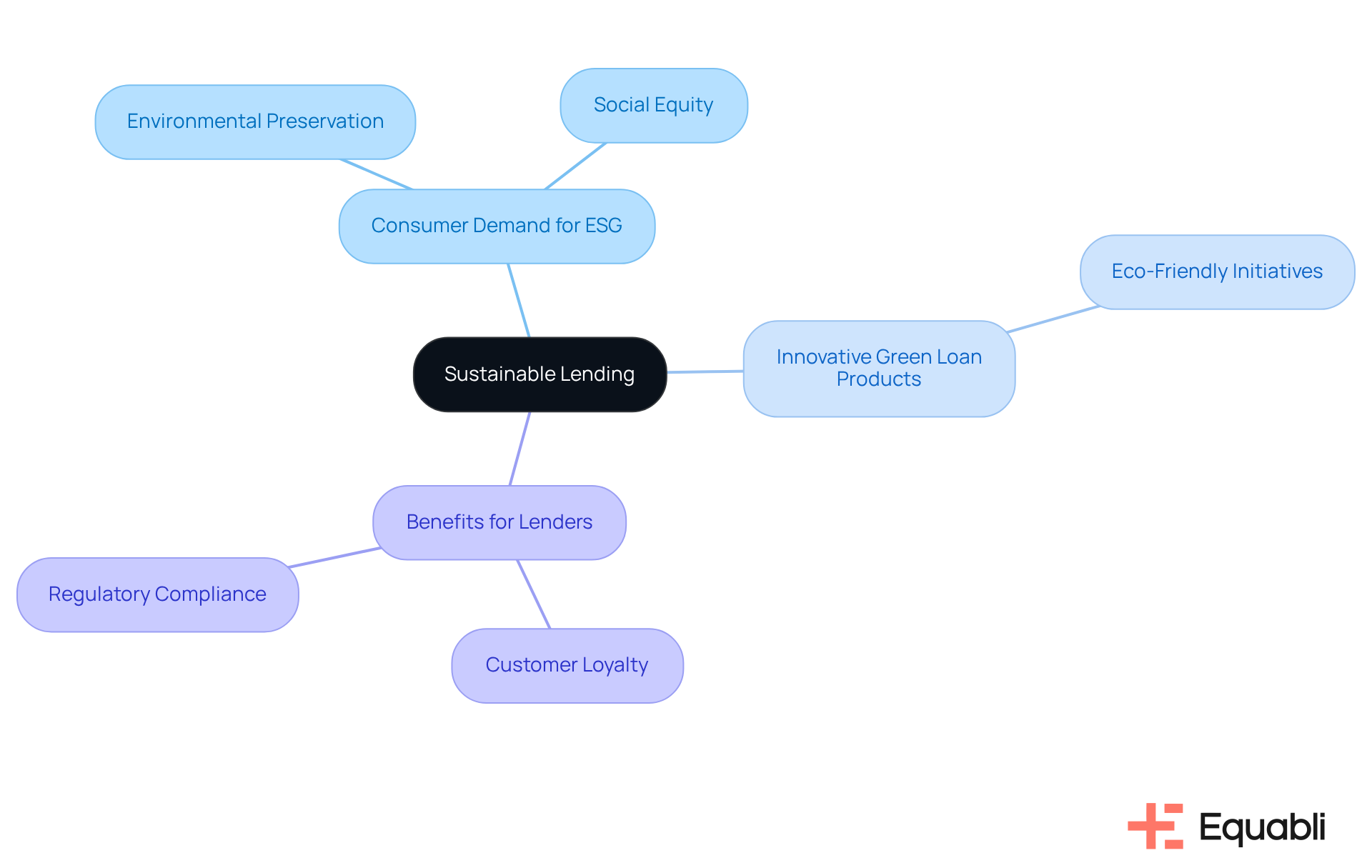

Sustainable borrowing is rapidly becoming a cornerstone of personal financing as individuals increasingly prioritize environmental and social governance (ESG) factors in their financial choices. By 2025, it is imperative for lenders to integrate sustainability into their financing practices, aligning with client expectations and complying with evolving regulatory frameworks. This transition encompasses the introduction of that support environmentally sustainable projects, reflecting a broader commitment to responsible lending.

The demand for ESG-compliant financial offerings is evident, with research indicating that consumers are more likely to engage with organizations demonstrating a commitment to sustainability. A significant portion of consumers actively seeks products that resonate with their values, particularly those that contribute to environmental preservation and social equity.

Numerous lending institutions are already at the forefront by providing innovative green loan products. These loans not only facilitate funding for eco-friendly initiatives but also enhance the lender's market appeal by attracting a conscientious customer base. By embedding ESG elements into their borrowing strategies, institutions can comply with regulatory standards while fostering a positive social impact, ultimately boosting customer loyalty and satisfaction.

As the borrowing landscape evolves, the integration of ESG factors will be crucial for institutions aiming to thrive in a competitive market. Embracing these principles not only meets market demand but also positions financial institutions as responsible stewards of capital, paving the way for sustainable growth within the financial sector.

Data Analytics: Enhancing Consumer Insights for Better Lending Outcomes

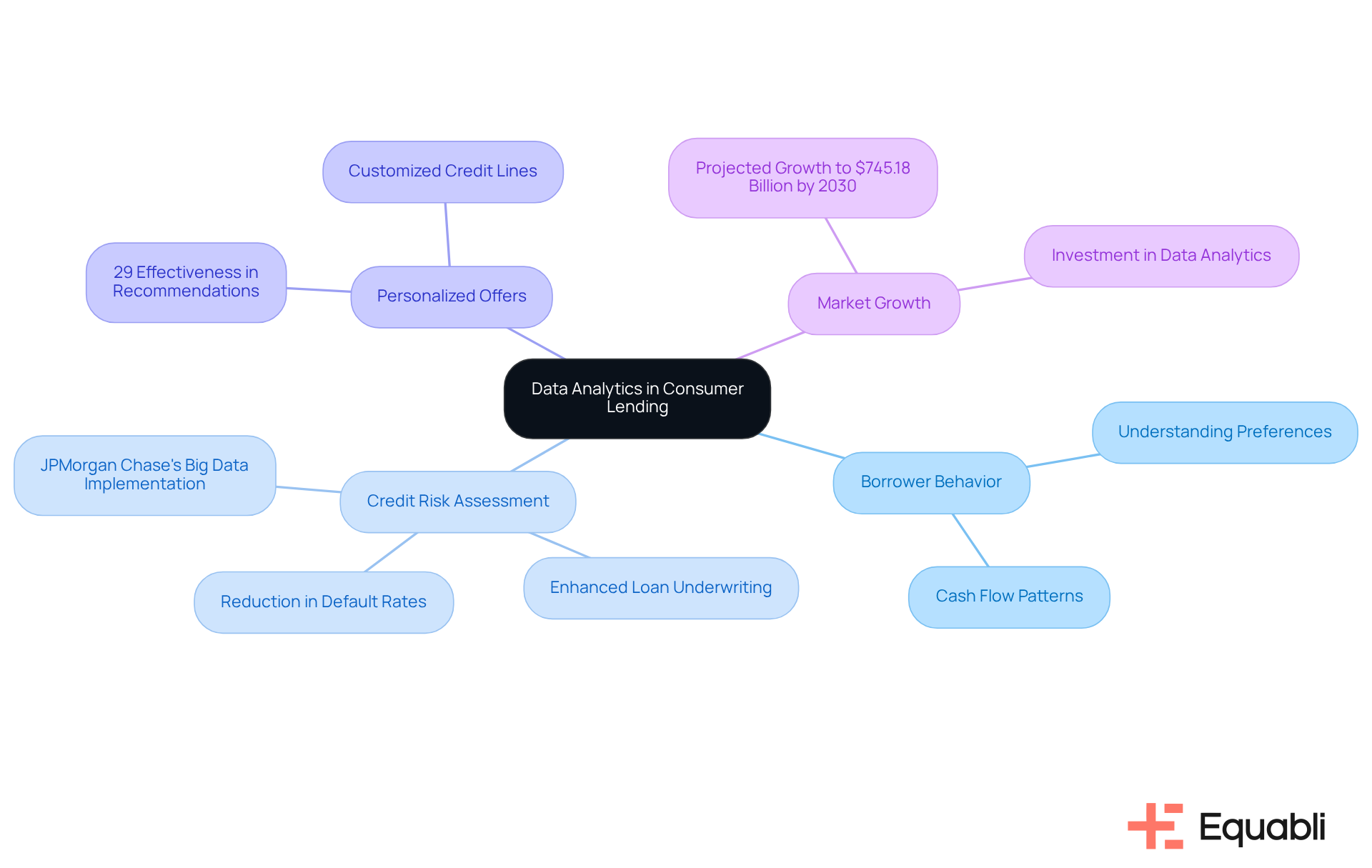

Data analytics is revolutionizing consumer lending by delivering profound insights into borrower behavior and preferences. By 2025, lenders will increasingly rely on analytics to enhance credit risk assessments in consumer lending and tailor loan products. Leveraging historical data and analyzing consumer patterns enables banking organizations to make informed decisions in consumer lending, which not only boosts profitability but also significantly reduces default rates.

For example, JPMorgan Chase's implementation of big data analytics has refined its credit risk assessment capabilities, resulting in more precise loan underwriting and a reduction in defaults. This data-centric approach is crucial for and bolstering overall business performance.

Moreover, as financial institutions embrace advanced analytics, they will be better equipped to uncover opportunities for personalized consumer lending offers, ultimately fostering stronger relationships with borrowers and promoting sustainable growth. However, it is noteworthy that only 29% of regional and community financial institutions feel they are effective at delivering data-driven, relevant product recommendations, underscoring the challenges in effectively leveraging data analytics.

The global Big Data Analytics in the Banking market is anticipated to grow from $307.54 billion in 2023 to $745.18 billion by 2030, highlighting the escalating significance and investment in data analytics within the banking sector. Additionally, the success of predictive analytics in other industries, such as Massachusetts General Hospital's 22% reduction in hospital readmissions, exemplifies the versatility and impact of data analytics across various fields.

Alternative Credit Scoring: Expanding Access to Loans for Underrepresented Borrowers

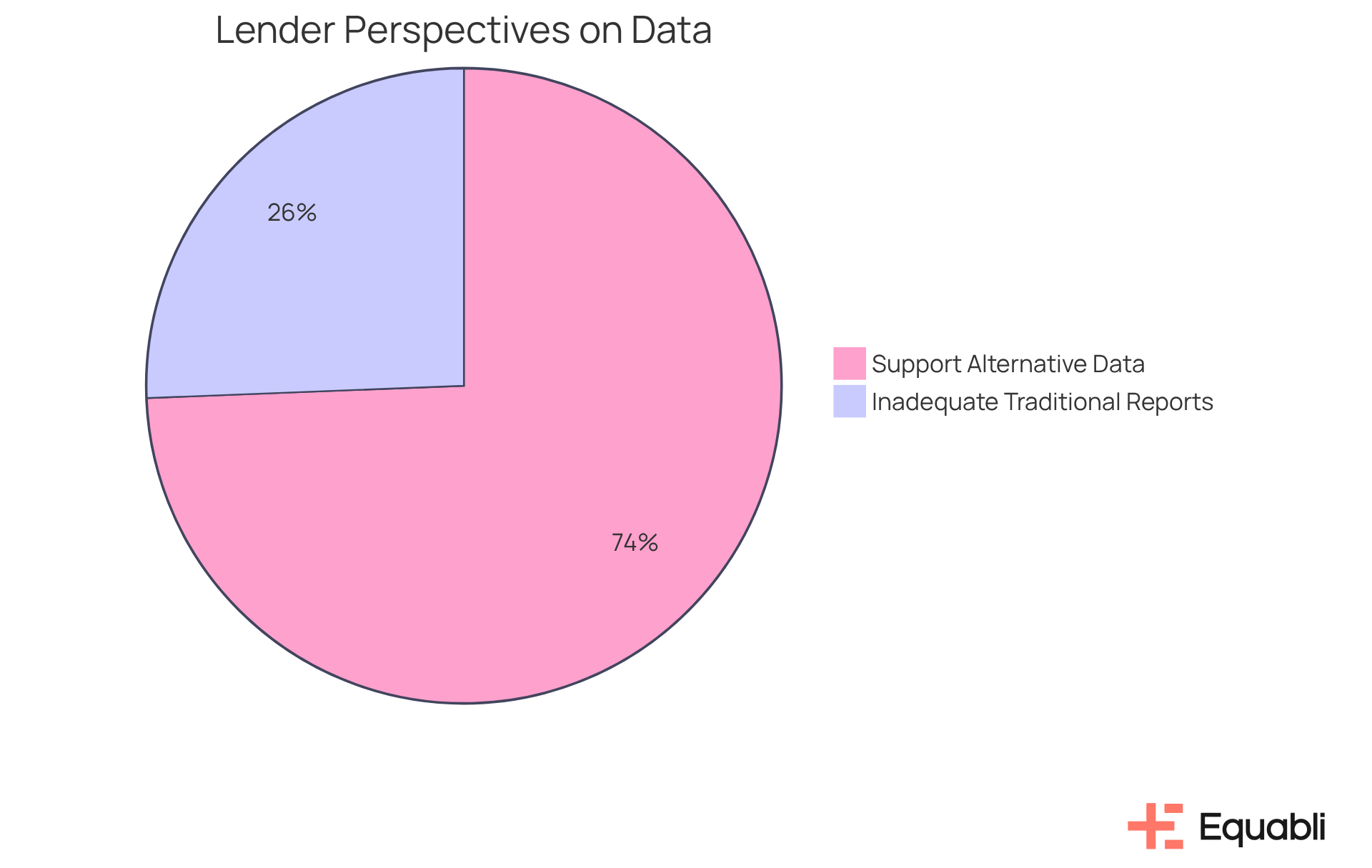

In 2025, alternative credit scoring techniques are paramount as financial institutions strive to broaden access to consumer lending for underrepresented borrowers. By leveraging non-traditional data sources—such as utility payments, rental histories, and employment records—lenders can gain a more nuanced understanding of creditworthiness. This shift not only inherent in traditional consumer lending practices but also paves the way for individuals who have been previously marginalized by the credit system.

Consider this:

- 90% of financial institutions believe that increased access to alternative data will facilitate the approval of more deserving borrowers, particularly those with limited credit histories.

- Furthermore, 31% of financial institutions assert that traditional credit reports fail to provide a comprehensive view of a consumer’s finances, underscoring the necessity for alternative methods.

As the landscape evolves, embracing alternative credit scoring is essential for promoting financial inclusion and cultivating a diverse borrower base, ultimately fostering sustainable growth within the finance sector. Lenders are urged to explore partnerships with alternative data providers to enhance their credit assessment processes.

Fintech Partnerships: Bridging the Gap Between Traditional Banking and Innovative Lending Solutions

Fintech partnerships are essential for traditional banks looking to innovate and maintain competitiveness in 2025. By collaborating with fintech companies, lenders can leverage advanced technologies that significantly enhance their consumer lending processes and elevate customer experiences. These alliances enable the creation of more , effectively meeting the evolving demands of consumers.

As the economic landscape rapidly transforms, leveraging fintech partnerships will be crucial for driving growth and ensuring sustained market relevance. Consider this: banks that integrate real-time payment technologies through fintech partnerships can redefine convenience, positioning themselves as leaders in frictionless financial experiences. The demand for real-time payments is surging as individuals increasingly expect instant, seamless transactions.

Moreover, with 55% of banks anticipating that fintech partnerships will play a very important role in their strategies by 2025—up from 32% today—the urgency for effective collaboration is evident. By adopting structured frameworks for partner selection and governance, banks can optimize these relationships, ultimately enhancing their innovation capabilities and market responsiveness.

However, it is important to acknowledge that approximately 40% of bank-fintech partnerships fail to operationalize due to poor alignment around strategy and execution, underscoring the necessity for careful planning and execution in these collaborations.

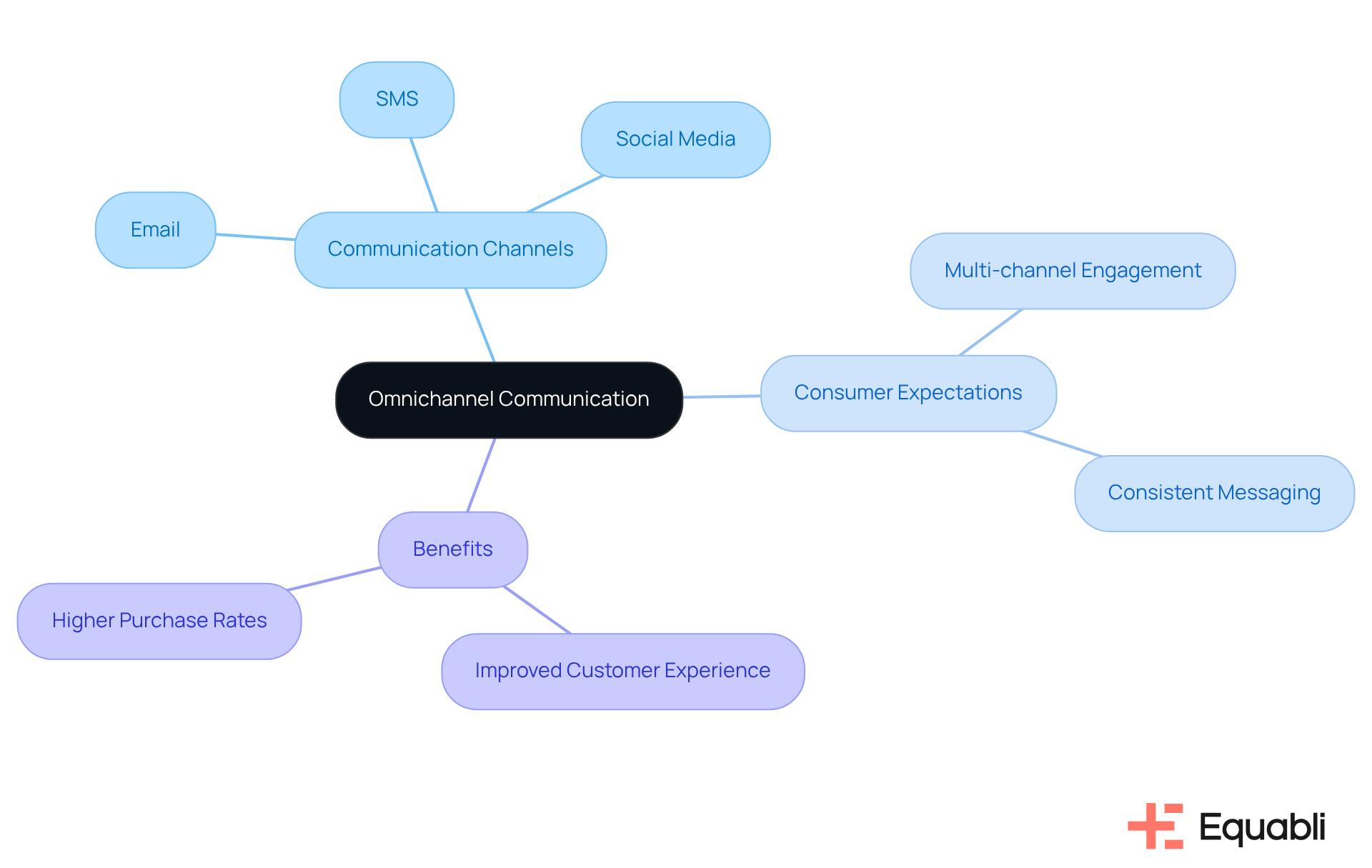

Omnichannel Communication: Improving Consumer Engagement in the Lending Process

In 2025, omnichannel communication will be essential for enhancing customer engagement throughout the consumer lending process. By leveraging various communication channels—such as email, SMS, and social media—lenders can deliver timely updates and personalized interactions that resonate with borrowers. This strategy not only improves the overall but also builds trust and loyalty, which are crucial for long-term success.

Research indicates that over 60% of customers engage through multiple channels, expecting consistent messaging across all platforms. Furthermore, companies employing omnichannel strategies can achieve a 287% higher purchase rate compared to single-channel approaches. As consumer expectations evolve, implementing effective omnichannel strategies will be vital for lenders in consumer lending seeking to meet these demands and foster deeper connections with their clients.

Conclusion

The landscape of consumer lending in 2025 is set for a significant transformation, driven by technological advancements, evolving consumer expectations, and a commitment to sustainability. Financial institutions must adapt to these changes by embracing innovative solutions that enhance efficiency, foster personalized experiences, and ensure compliance with emerging regulations.

Key trends such as:

- AI-driven lending

- Personalized financial products

- The rise of digital lending platforms

are reshaping how lenders engage with borrowers. The integration of data analytics and alternative credit scoring methods empowers institutions to make informed decisions, expanding access to credit for underrepresented populations. Furthermore, partnerships with fintech companies are vital in bridging the gap between traditional banking and modern lending practices, ensuring that institutions remain competitive in a rapidly changing market.

As the consumer lending sector evolves, it is imperative for financial institutions to prioritize these trends to meet the demands of today’s borrowers. By investing in technology, enhancing customer engagement through omnichannel communication, and committing to sustainable practices, lenders can improve operational efficiency and build lasting relationships with consumers. The future of consumer lending transcends mere loan provision; it revolves around creating a seamless, responsible, and personalized experience that resonates with the values and needs of borrowers in 2025 and beyond.

Frequently Asked Questions

What is Equabli's EQ Suite and how does it benefit financial institutions?

Equabli's EQ Suite is a comprehensive set of tools designed to enhance the efficiency and effectiveness of debt collection processes for financial institutions. It includes the EQ Engine, EQ Engage, and EQ Collect, which utilize predictive analytics to optimize repayment strategies while prioritizing data protection.

How does the EQ Suite leverage predictive analytics?

The EQ Suite allows financial institutions to create customized scoring models that accurately forecast borrower behaviors, improving engagement through preferred communication channels and aligning with the trend of AI use in debt collection.

What are the key features of the EQ Collect tool?

EQ Collect features a no-code file-mapping tool and real-time reporting, which help minimize execution errors and reduce manual resource usage, providing transparency and insights in the debt collection process.

How does AI influence consumer lending in 2025?

AI-driven consumer lending is set to transform creditworthiness assessments by analyzing vast datasets for more precise decision-making, enabling real-time risk assessments and personalized loan offers.

What advantages does Equabli's EQ Engine provide in lending?

The EQ Engine enhances lending processes by predicting the risk of delinquency across various communication channels, allowing financial institutions to create intelligent servicing strategies that improve efficiency and reduce roll-rates.

What impact does AI have on customer satisfaction in lending?

The adoption of AI solutions has led to a significant increase in Net Promoter Score (NPS) by 40 points, indicating improved customer interactions and satisfaction due to better understanding of borrower behavior.

What regulatory challenges will financial institutions face by 2025?

By 2025, lenders will encounter increased scrutiny regarding fair lending practices and data protection, necessitating robust compliance frameworks to mitigate risks associated with non-compliance.

What changes are being enacted in state credit regulations?

States like California and Kansas are implementing significant changes to credit regulations, including increased transaction limits and clarified licensing requirements.

Why is compliance important for financial institutions?

A well-structured compliance strategy enhances risk management, operational efficiency, and public trust, positioning lenders for sustainable growth in a competitive environment. Prioritizing compliance helps institutions navigate new borrowing regulations effectively.