Overview

The article delineates four essential steps for effectively recovering debt through technology:

- Understanding debt types

- Assessing the debt situation

- Initiating contact with debtors

- Leveraging advanced technological tools

Each step underscores the critical importance of clear communication, data analysis, and automated systems. By integrating technology into the debt recovery process, organizations can significantly enhance recovery rates and ensure compliance with legal standards. This strategic approach not only streamlines operations but also fosters a more efficient recovery environment.

Introduction

Navigating the intricate landscape of debt recovery presents a significant challenge for many organizations, particularly as financial environments shift and regulatory frameworks tighten. The integration of technology provides a pivotal opportunity to not only enhance recovery rates but also streamline operational processes. Yet, a critical question persists: how can businesses effectively harness these technological advancements to recover debts while simultaneously fostering improved relationships with debtors? This article explores four essential steps that leverage technology's potential, ensuring a more efficient and empathetic approach to debt recovery.

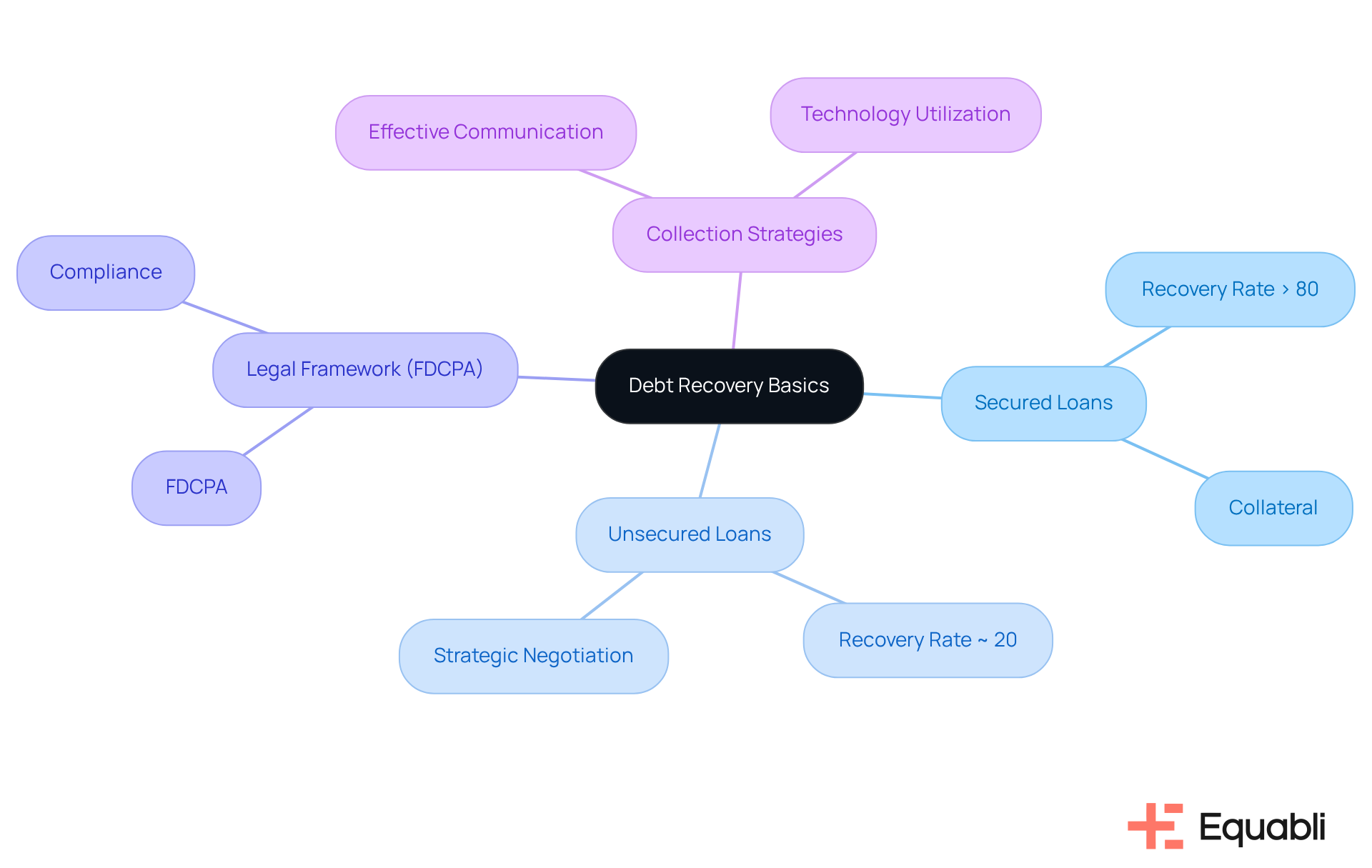

Understand the Basics of Debt Recovery

Collecting outstanding amounts from borrowers necessitates a clear understanding of the distinctions between secured and unsecured obligations, which is vital for effective collection. Secured loans, such as mortgages or car loans, are backed by collateral, while unsecured obligations, including credit card balances and medical bills, lack such support. Notably, secured loans typically boast higher recovery rates—often exceeding 80%—due to the ability to reclaim collateral. In contrast, unsecured loans usually see recovery rates around 20%, often requiring more strategic negotiation and adherence to legal standards.

Familiarizing oneself with the legal framework governing financial recovery, particularly the [Fair Debt Collection Practices Act (FDCPA)](https://equabli.com/solutions), is imperative. This act delineates the rights of both creditors and borrowers, ensuring that remain ethical and compliant. Effective financial collection strategies hinge on clear communication, understanding the debtor's financial situation, and leveraging technology to streamline the process while adhering to FDCPA regulations. Experts from the Consumer Financial Protection Bureau (CFPB) emphasize that a thorough grasp of secured versus unsecured obligations not only aids in recovery efforts but also enhances overall financial management strategies.

Recent industry advancements, such as the expanded RFDCPA in California, underscore the necessity for financial professionals to stay abreast of the complexities surrounding credit recovery regulations. Noncompliance with the FDCPA can result in significant legal consequences, including both actual and punitive damages, making adherence crucial. Furthermore, training staff and third-party collection vendors on new legal requirements is essential for upholding ethical standards and improving recovery rates.

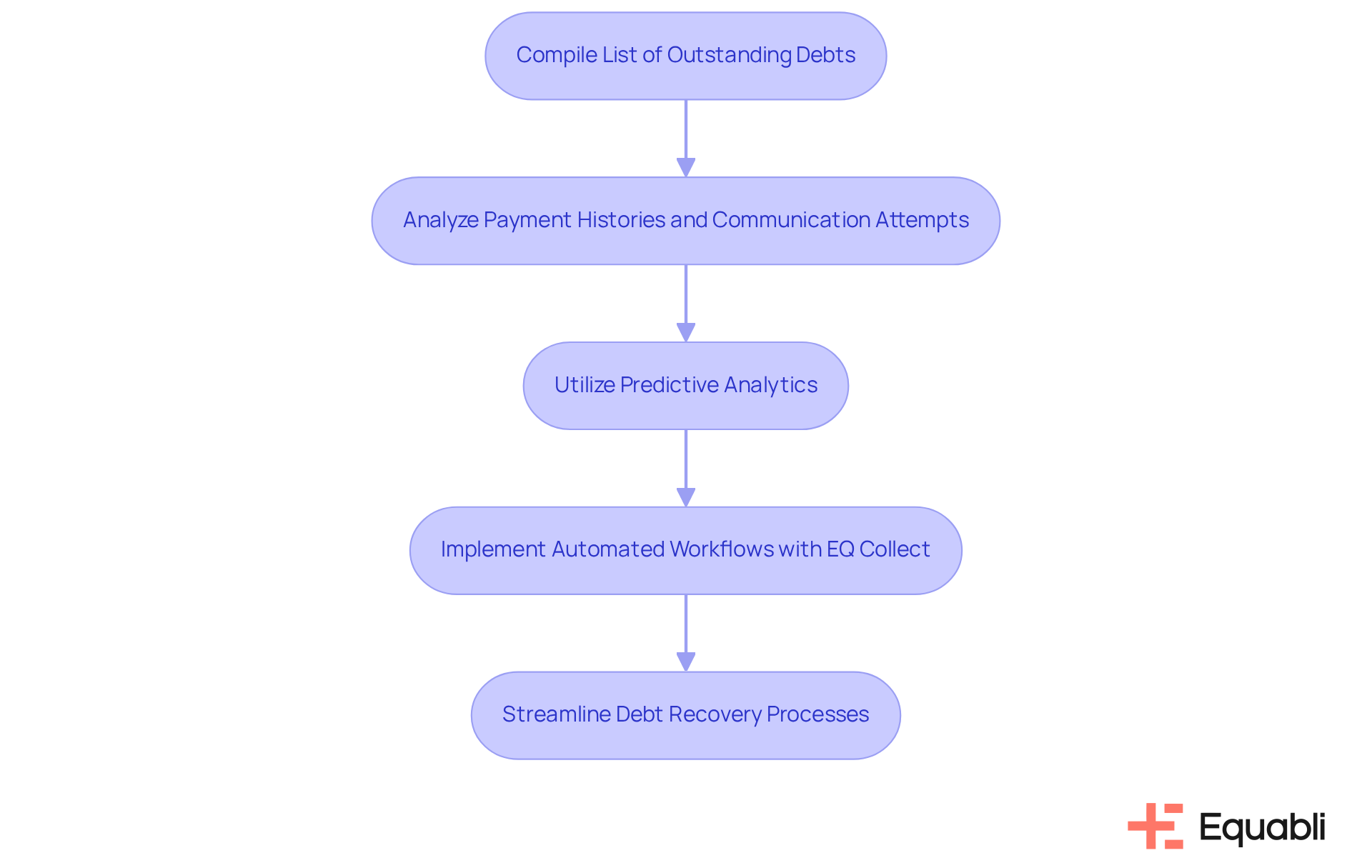

Assess Your Debt Situation and Gather Information

Begin by compiling a comprehensive list of all outstanding debts, detailing the amounts owed, the type of each obligation, and the contact information for each responsible individual. Analyzing payment histories and previous communication attempts is essential, as this data enables prioritization based on the amount owed and the debtor's repayment behavior.

Utilizing data analysis tools significantly enhances this process; for instance, can uncover trends in repayment behaviors, facilitating the development of targeted strategies. In 2025, the integration of sophisticated analytics will be vital; organizations leveraging these insights can boost success rates by approximately 10%.

The automated workflows within Equabli's EQ Collect reduce execution errors and manual resource requirements, empowering collection teams to implement proactive strategies, such as early payment reminders, which can enhance customer satisfaction and lower operational costs.

By concentrating on data-driven approaches and harnessing the innovative features of EQ Collect—such as compliance oversight and real-time reporting—businesses can streamline their processes for recovering debt and effectively adapt to evolving market conditions and consumer behaviors.

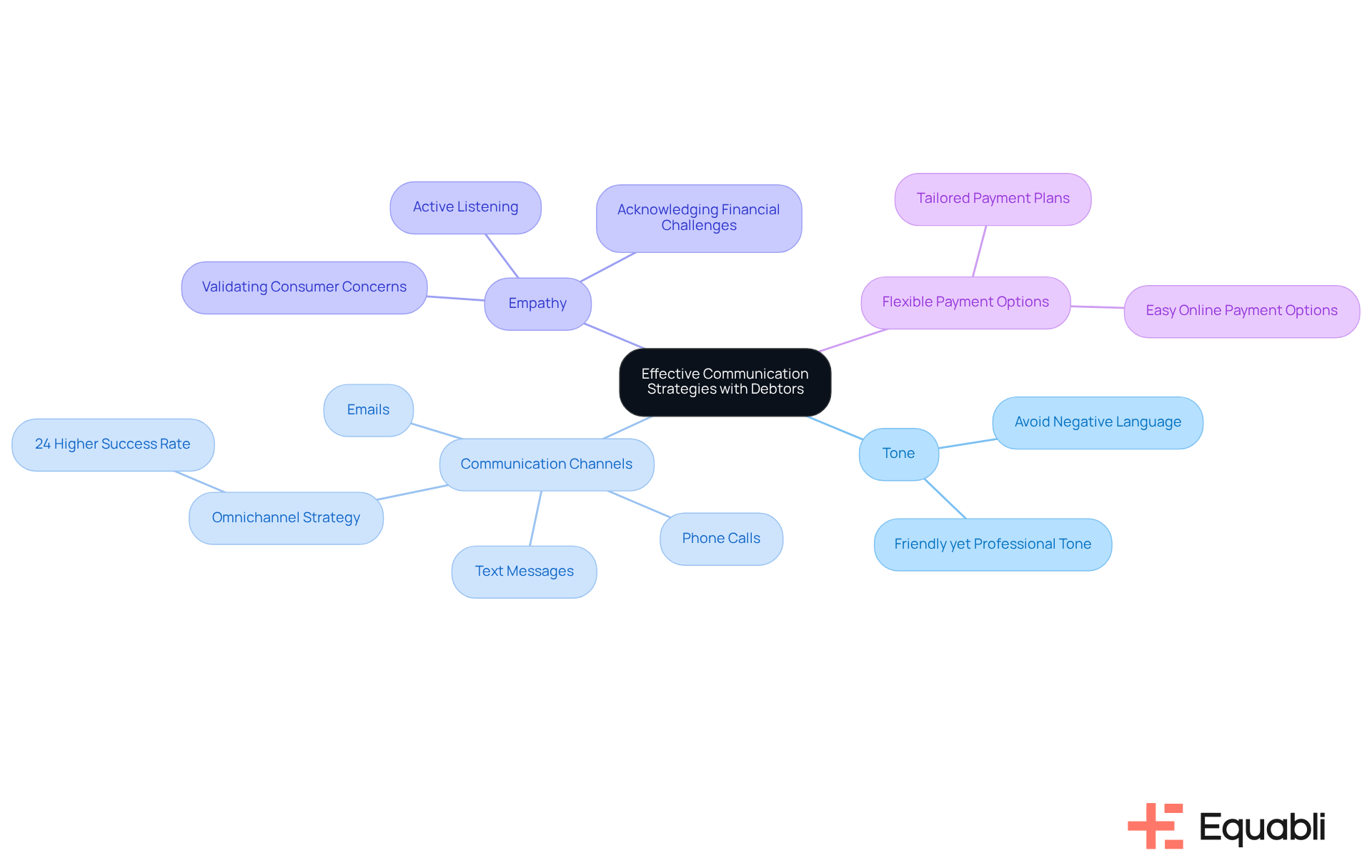

Initiate Contact with Debtors Using Effective Communication Strategies

When reaching out to individuals with outstanding balances, it is essential to adopt a . Start by introducing yourself and your organization, clearly stating the purpose of your communication. Utilizing various channels—such as phone calls, emails, and text messages—allows you to connect with individuals in their preferred manner, significantly improving engagement. Notably, studies indicate that organizations employing an omnichannel strategy report a 24% greater success rate compared to those relying on a single method.

Empathy is crucial in these interactions; actively listening to individuals' concerns fosters trust and encourages collaboration. For example, acknowledging their financial challenges can create a supportive environment conducive to negotiation. Furthermore, offering flexible payment options, such as tailored payment plans that align with their financial situations, can enhance cooperation and increase the likelihood of timely repayments. As Mary Shores aptly states, "The words we speak to consumers can determine the roadmap of our calls." By prioritizing empathy and effective communication, financial institutions can transform adversarial conversations into constructive dialogues, ultimately enhancing recovery outcomes.

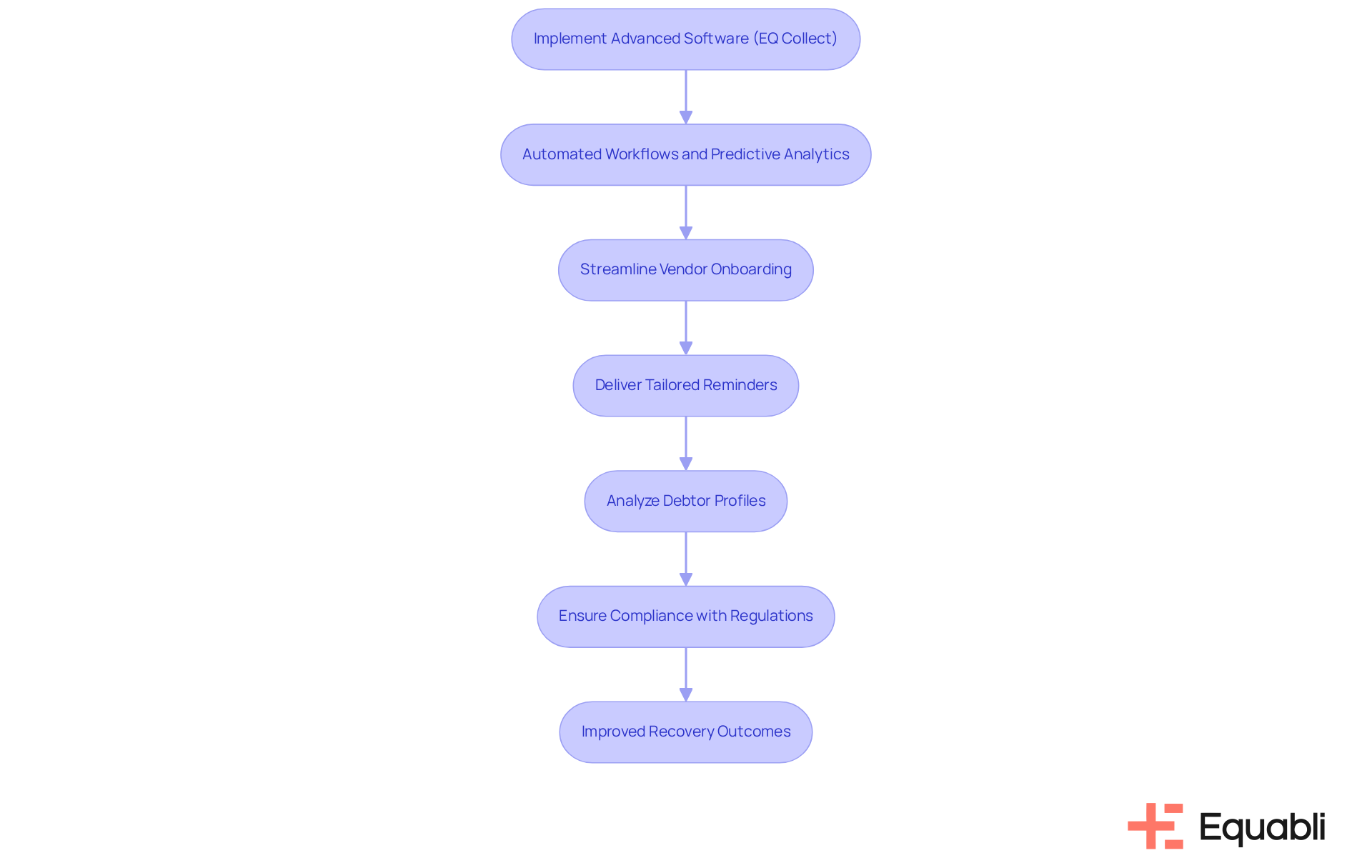

Leverage Technology for Streamlined Debt Recovery

Implement advanced software for recovering debt, such as EQ Collect, which features automated workflows, predictive analytics, and self-service payment options. These capabilities enhance communication with borrowers and significantly reduce manual workloads.

With EQ Collect's no-code file-mapping tool, organizations can , ensuring a smoother integration process. Automated systems can deliver reminders tailored to individual payment histories, resulting in significantly increased response rates.

For instance, a medical law firm focused on recovering debt reported a 20% revenue increase within six months of implementing such strategies. Predictive analytics empower agencies by identifying high-risk accounts that require immediate intervention, facilitating proactive management of delinquent accounts.

EQ Collect analyzes debtor profiles to predict repayment behaviors, enabling more precise and targeted collection strategies. Notably, up to 80% of delinquent accounts respond favorably to customized recovery methods, underscoring the necessity of incorporating these technologies for optimal recovering debt results.

Furthermore, compliance-first automation is essential in debt collection, adhering to regulations such as CFPB, FDCPA, and TCPA, ensuring agencies maintain ethical practices while leveraging advanced technologies.

As John Sanders, Managing Partner and CEO, asserts, 'Digital adoption is no longer optional—it’s a competitive necessity.

Conclusion

Effectively recovering debt in today’s financial landscape is predicated on a comprehensive understanding of both the legal frameworks and the technological tools available. Grasping the distinctions between secured and unsecured debts allows professionals to tailor their recovery strategies, maximizing success. The integration of technology not only streamlines processes but also enhances communication, facilitating more empathetic and effective interactions with debtors.

Key insights from this guide underscore the importance of meticulously assessing debt situations, utilizing data-driven approaches, and adopting advanced software solutions such as EQ Collect. These tools enable proactive management and ensure compliance with regulations, ultimately leading to improved recovery rates. Moreover, employing an omnichannel communication strategy fosters better engagement with debtors, transforming potentially adversarial encounters into constructive dialogues.

The significance of these strategies cannot be overstated. As the landscape of debt recovery continues to evolve, embracing technology and ethical practices is crucial for financial professionals. By prioritizing informed decision-making and empathetic communication, organizations can enhance their debt recovery outcomes and contribute to healthier financial relationships with their clients. Taking these steps today will pave the way for a more efficient and compassionate debt recovery process in the future.

Frequently Asked Questions

What is the difference between secured and unsecured debt?

Secured debt is backed by collateral, such as mortgages or car loans, while unsecured debt, like credit card balances and medical bills, lacks collateral.

What are the recovery rates for secured versus unsecured loans?

Secured loans typically have recovery rates exceeding 80% due to the ability to reclaim collateral, whereas unsecured loans usually see recovery rates around 20%.

Why is it important to understand the legal framework for debt recovery?

Understanding the legal framework, particularly the Fair Debt Collection Practices Act (FDCPA), is crucial as it outlines the rights of both creditors and borrowers, ensuring ethical and compliant collection practices.

What strategies are effective for financial collection?

Effective financial collection strategies include clear communication, understanding the debtor's financial situation, and leveraging technology while adhering to FDCPA regulations.

What recent developments in debt recovery regulations should financial professionals be aware of?

Recent advancements, such as the expanded RFDCPA in California, highlight the importance for financial professionals to stay informed about the complexities of credit recovery regulations.

What are the consequences of noncompliance with the FDCPA?

Noncompliance with the FDCPA can lead to significant legal consequences, including actual and punitive damages.

Why is training staff and third-party vendors important in debt recovery?

Training staff and third-party collection vendors on new legal requirements is essential for maintaining ethical standards and improving recovery rates.