Overview

The article examines best practices for financial risk management executives within the collections industry. It asserts that implementing customizable solutions, effective communication strategies, and robust underwriting standards significantly enhances debt recovery processes. Supporting evidence demonstrates that these practices not only improve compliance but also reduce financial risks for organizations. Consequently, adopting these strategies positions organizations to navigate the complexities of debt collection more effectively.

Introduction

In a landscape where financial institutions grapple with evolving risks and compliance challenges, the significance of effective debt collection practices is paramount. This article examines ten industry best practices specifically designed for financial risk management executives, providing insights into innovative strategies and technologies that can enhance recovery rates and operational efficiency. As organizations seek to balance borrower engagement with stringent regulatory demands, the pressing question emerges: how can they integrate these best practices to not only survive but thrive in a competitive market?

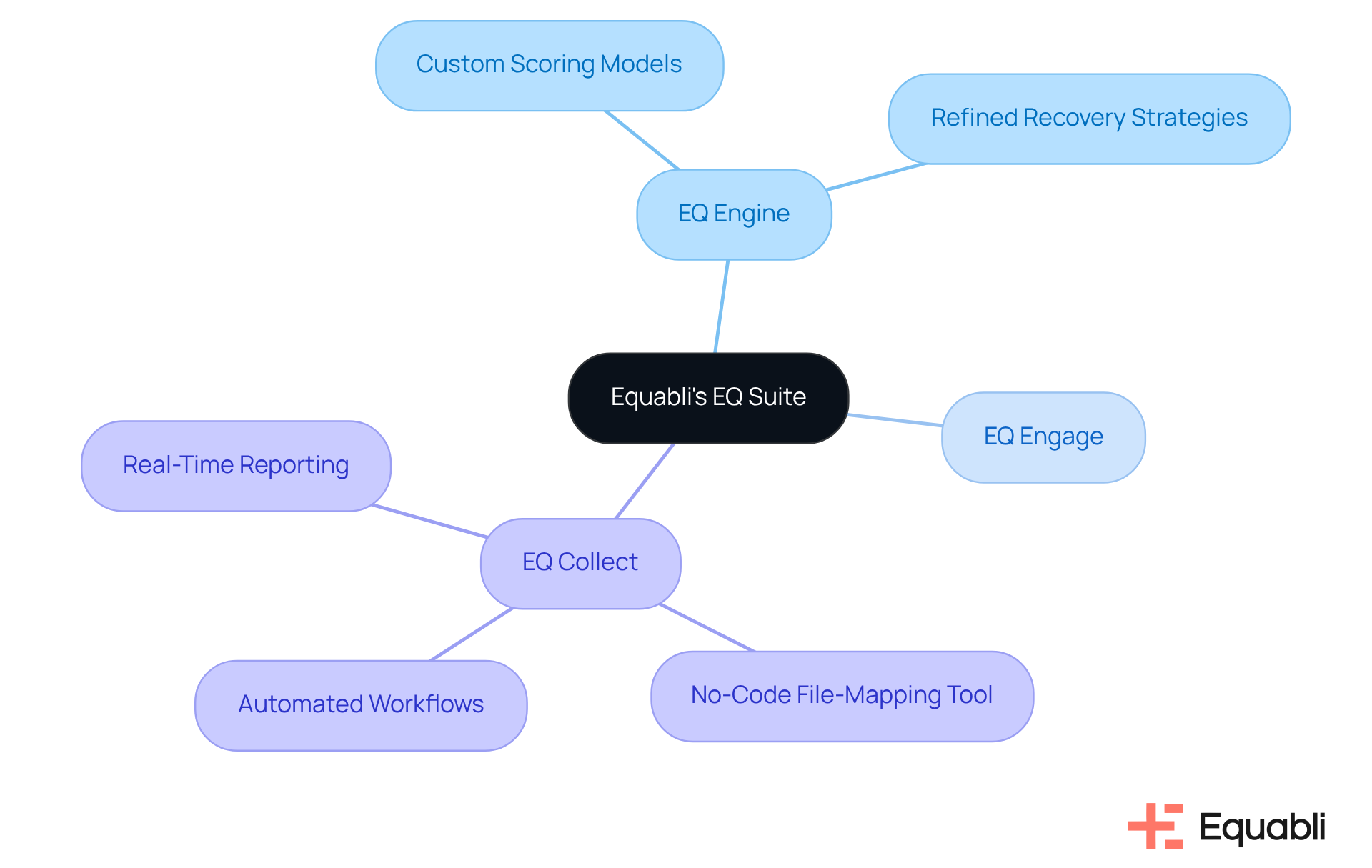

Equabli's EQ Suite: Customizable Solutions for Debt Collection

Equabli's EQ Suite represents a significant advancement in modernizing debt recovery processes, with a strong emphasis on data protection and compliance. The suite comprises the EQ Engine, EQ Engage, and EQ Collect, which empower clients to:

- Develop custom scoring models

- Refine recovery strategies

- Facilitate digital repayments through self-service repayment plans

Notably, the inclusion of a no-code file-mapping tool, automated workflows, and real-time reporting within EQ Collect enhances operational efficiency and minimizes execution errors, thereby allowing organizations to substantially reduce retrieval costs.

Furthermore, the suite prioritizes industry-leading compliance oversight, enabling clients to effectively manage delinquency while fostering borrower engagement through preferred communication channels. By leveraging these advanced technologies, organizations can fundamentally transform their debt recovery processes, enhance operational efficiency, and uphold rigorous data protection practices. This strategic approach not only addresses but also positions enterprises to thrive in a competitive landscape.

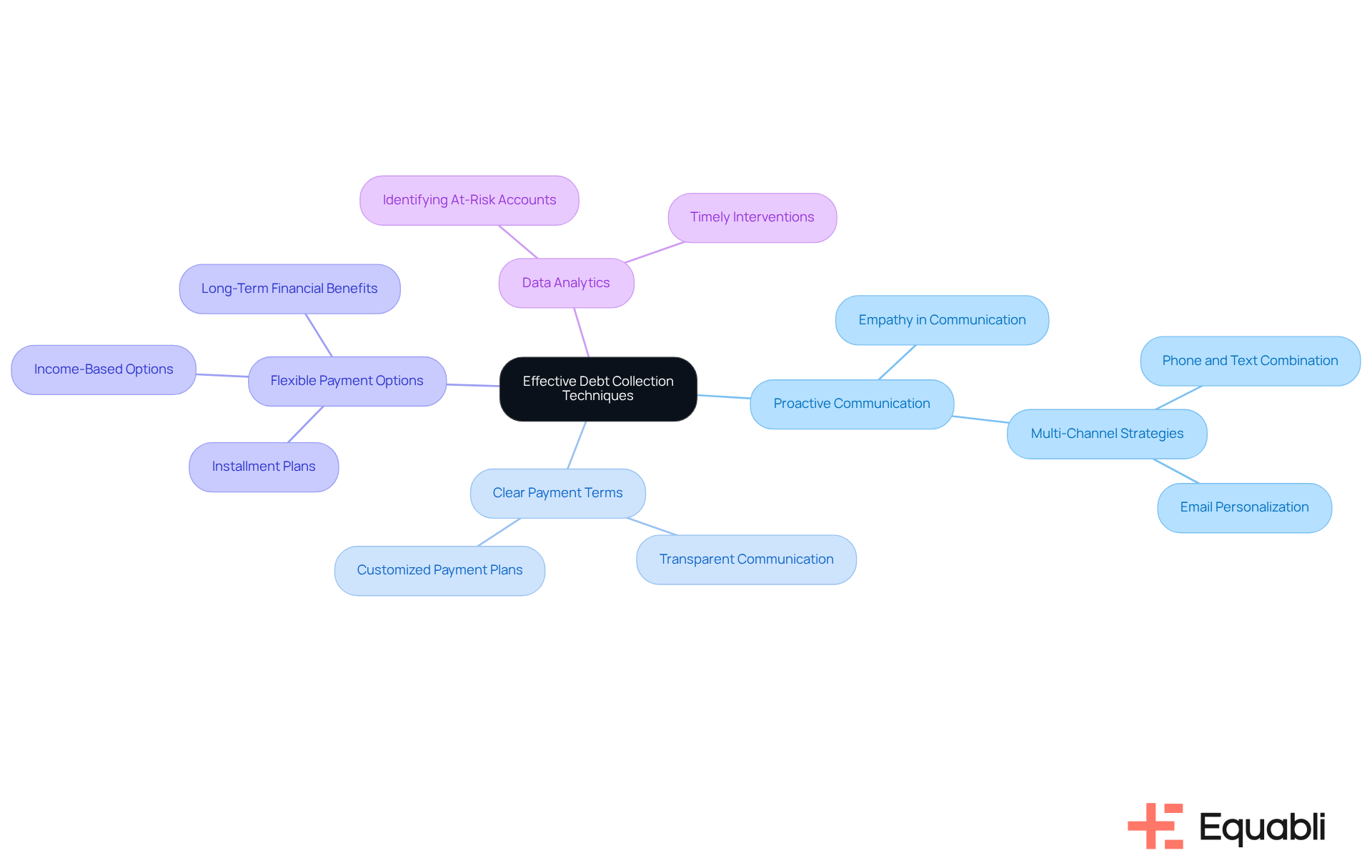

HighRadius: Effective Debt Collection Techniques to Reduce Bad Debts

HighRadius offers a range of effective debt recovery methods designed to mitigate bad debts. These methods encompass proactive communication strategies, the establishment of clear payment terms, and the provision of . By implementing these techniques, organizations can cultivate improved relationships with debtors, resulting in enhanced recovery rates. Additionally, HighRadius emphasizes the critical role of data analytics in identifying at-risk accounts early, facilitating timely interventions and tailored recovery strategies that resonate with borrowers.

Case studies, such as the "Long-Term Financial Benefits of Flexible Payment Options," exemplify the efficacy of these strategies, demonstrating that organizations utilizing flexible payment options have experienced notable enhancements in cash flow and customer loyalty. By allowing clients to choose suitable payment options, companies have transformed potential losses into recovered income, thereby fostering economic growth.

Furthermore, research indicates that multi-channel communication strategies, including the integration of phone calls with follow-up texts, can elevate promise-to-pay rates by 18%. In fact, 60% of successful recoveries involve at least two distinct communication channels, underscoring the necessity of employing diverse methods to effectively engage debtors, ensuring outreach aligns with their preferences. Moreover, the incorporation of empathy into debt recovery practices can fortify customer relationships and improve recovery outcomes, reflecting an understanding of borrowers' financial challenges.

In conclusion, acknowledging the obstacles faced by debt recovery agencies due to outdated systems and inflexible payment methods underscores the necessity for these proposed strategies. The adoption of these optimal methods not only alleviates economic uncertainty but also aligns organizations with collections industry best practices for financial risk management executives, ensuring sustained success in the collections landscape.

Anaptyss: Comprehensive Guide to Credit Risk Management Best Practices

A comprehensive approach to financial exposure management is essential for financial institutions, underscoring the importance of thorough evaluations, robust underwriting standards, and well-defined lending policies. By implementing these optimal methods, organizations can effectively assess borrower creditworthiness, significantly minimizing the likelihood of defaults.

Ongoing observation and prompt modifications to lending policies are crucial in addressing evolving market conditions and borrower behaviors. This proactive strategy not only enhances management efforts but also positions institutions to within a competitive landscape.

As Martin Germanis observes, effective debt management transcends mere protection; it serves as a source of competitive advantage and operational efficiency, enabling institutions to allocate capital judiciously and foster sustainable growth.

Furthermore, banks that invest in sophisticated loan evaluation monitoring experience a 30% improvement in detection capabilities and a 25% reduction in compliance expenses, emphasizing the critical role of strong financial assessments.

Regulatory compliance remains a foundational element of credit risk management, ensuring that institutions adhere to sound lending practices while integrating ESG considerations into their credit evaluations to remain aligned with contemporary economic trends.

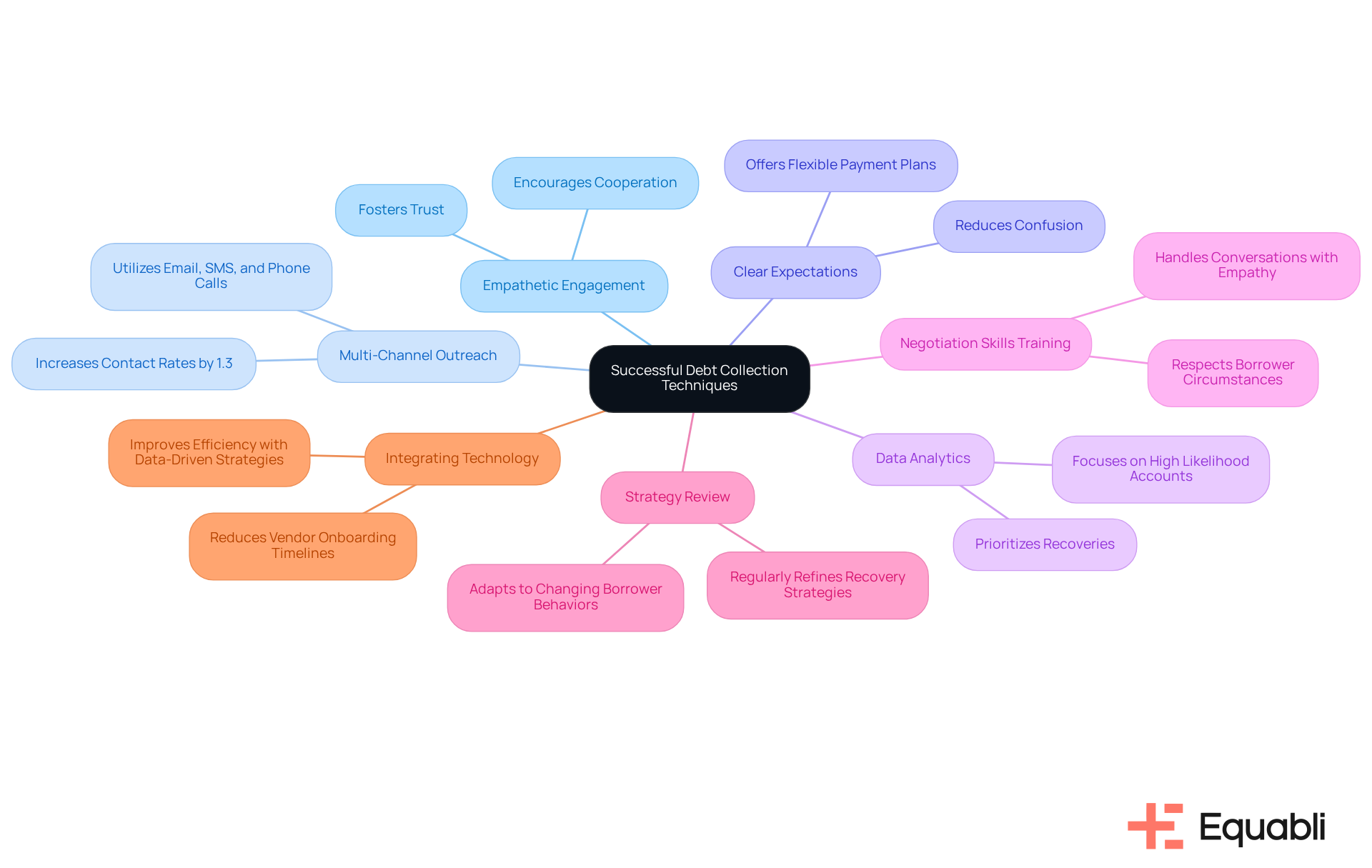

HighRadius: 7 Successful Debt Collection Techniques

HighRadius identifies seven successful debt recovery techniques that can significantly enhance recovery rates.

- Empathetic engagement with debtors fosters trust and encourages cooperation.

- Evidence shows that multi-channel outreach, utilizing various communication methods such as email, SMS, and phone calls, leads to a 1.3% increase in contact rates by meeting customers where they are.

- Setting clear expectations regarding payment terms reduces confusion and anxiety, while offering flexible payment plans caters to individual borrower circumstances.

- Furthermore, utilizing data analytics to prioritize recoveries ensures efforts focus on accounts with the highest likelihood of recovery.

- Training agents in allows them to handle conversations with empathy and respect.

- Lastly, regularly reviewing and refining recovery strategies based on performance metrics helps organizations adapt to changing borrower behaviors.

By adopting collections industry best practices for financial risk management executives, organizations can create a more effective and borrower-friendly recovery process, ultimately leading to a 6% increase in recovery rates and a 3% decrease in cost per recovery for major financial clients.

Integrating Equabli's EQ Collect can further enhance these strategies by reducing vendor onboarding timelines with a no-code file-mapping tool, improving efficiency through data-driven strategies, and minimizing execution errors with automated workflows. This combination of collections industry best practices for financial risk management executives and advanced technology positions organizations to achieve superior performance in debt collection.

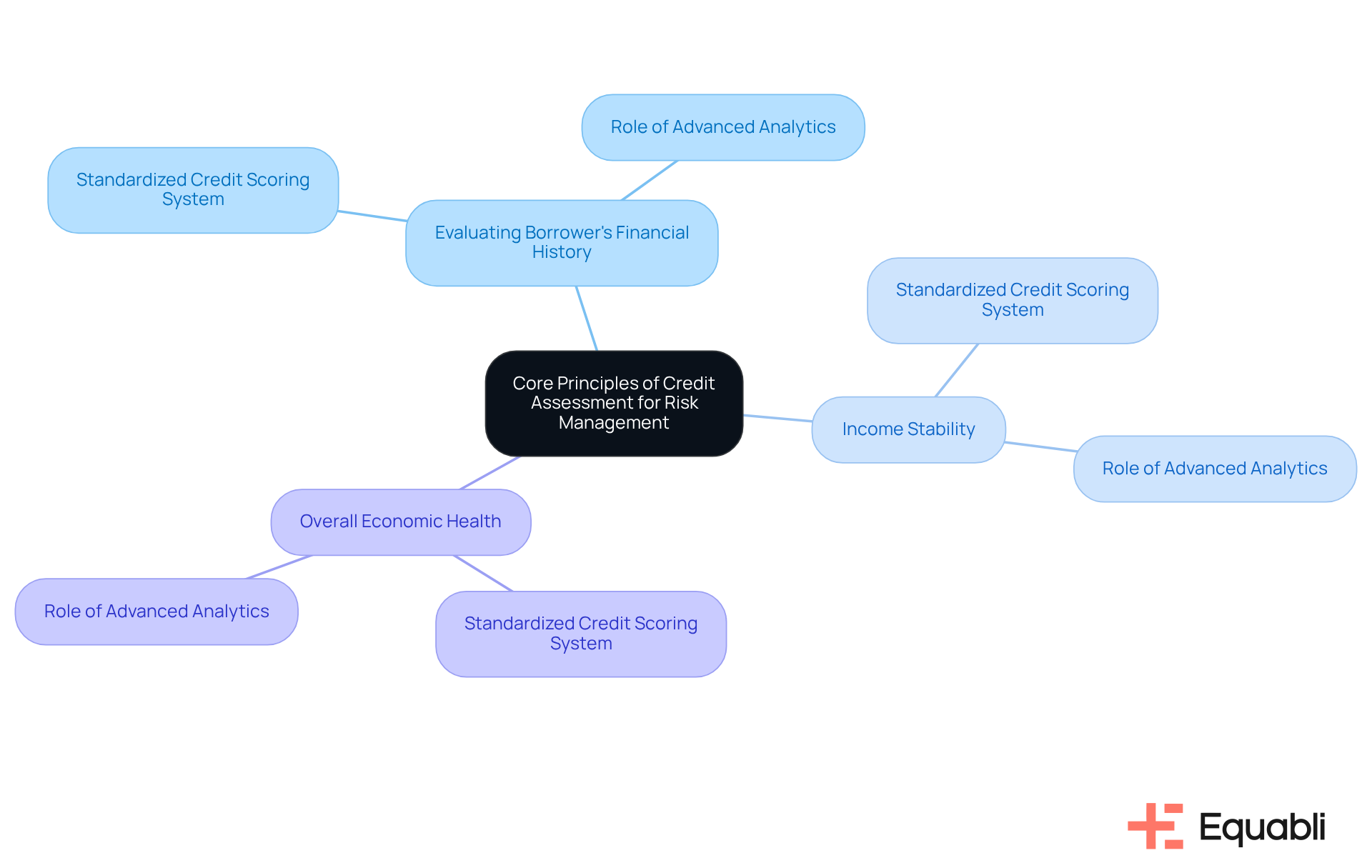

Anaptyss: Core Principles of Credit Assessment for Risk Management

Anaptyss delineates essential principles of lending assessment that are crucial for effective risk management. These principles include:

- Evaluating a borrower's financial history

- Income stability

- Overall economic health

Furthermore, organizations should adopt a standardized credit scoring system to promote consistency in decision-making. As Camille C. Schmidt notes, "Institutions engaged in CRE lending should conduct continuous evaluations to identify concentrations and should implement CRE management processes that are suitable for the size of the portfolio and the degree and type of concentrations."

Adhering to these principles enables institutions to more accurately assess the risks associated with lending, facilitating informed decisions that align with their risk appetite. Current trends underscore the importance of integrating advanced analytics and technology, such as AI and machine learning, into the evaluation of borrower creditworthiness, thereby providing more nuanced insights into financial behaviors.

Anaptyss: Importance of Clear Credit Policies & Procedures

Establishing clear financial policies and procedures is essential for effectively guiding lending decisions. These policies should delineate criteria for loan approvals, repayment terms, and the processes for managing delinquencies. By implementing well-defined policies, organizations can align their teams in credit management practices, significantly reducing confusion and enhancing compliance with regulatory standards.

Furthermore, clear policies improve communication with borrowers, fostering an environment of trust and transparency. This alignment not only supports adherence to but also cultivates a culture focused on collections industry best practices for financial risk management executives, ultimately leading to improved financial outcomes.

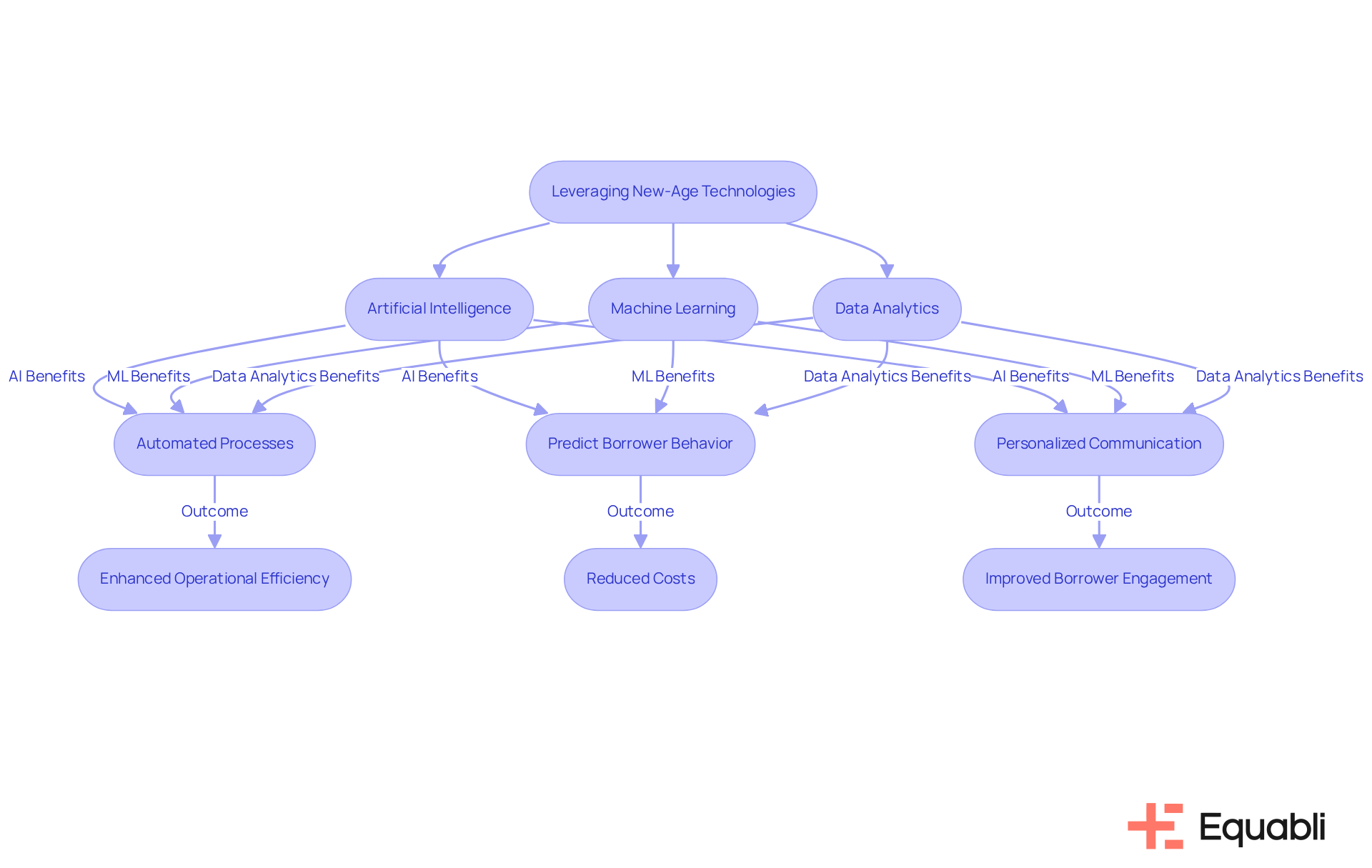

Leveraging New-Age Technologies for Modern Debt Collection

Utilizing new-age technologies is essential for implementing for financial risk management executives in debt recovery practices. Technologies such as artificial intelligence, machine learning, and data analytics empower organizations to automate processes, predict borrower behavior, and personalize communication strategies. This technological integration enhances operational efficiency, reduces costs, and improves borrower engagement.

For instance, with EQ Collect, organizations can significantly decrease vendor onboarding timelines through a simple, no-code file-mapping tool, while automated workflows minimize execution errors and reliance on manual resources. AI-driven chatbots efficiently manage routine inquiries, allowing human agents to concentrate on more complex cases, thereby optimizing resource allocation. Notably, 50% of survey participants report time and energy savings with automated debt retrieval technology.

Furthermore, predictive analytics enables organizations to adopt collections industry best practices for financial risk management executives by identifying high-risk accounts early, with 57% of debt collection agencies employing AI for account segmentation and predictive analytics. This proactive strategy facilitates the development of personalized repayment plans, ultimately leading to improved recovery rates.

Businesses that integrate AI generative tools could experience a 10% increase in recoveries, while AI can proactively identify consumer vulnerability by analyzing patterns across millions of interactions. As Jo Mikleus, Non-Executive Director at Avenue Bank, states, 'The most valuable AI investments will be those that prioritize transparency, personalization, and proactive engagement.'

By embracing these technologies, including the unparalleled transparency and insights provided by EQ Collect's real-time reporting, organizations position themselves for sustainable growth in an increasingly competitive landscape.

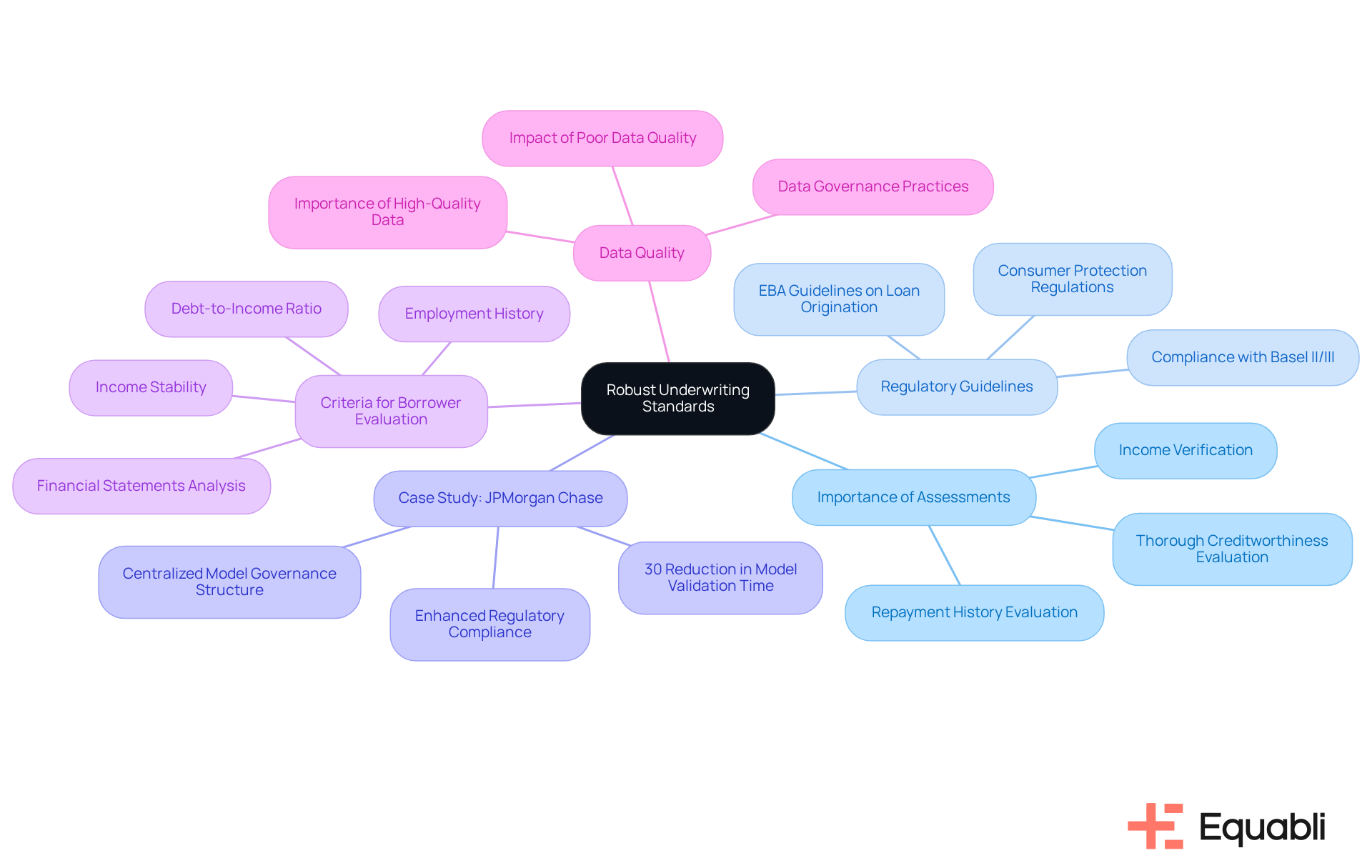

Anaptyss: Establishing Robust Underwriting Standards

Anaptyss underscores the critical need for strong underwriting standards to effectively manage credit challenges. These standards must encompass thorough assessments of a borrower's creditworthiness, income verification, and an evaluation of their repayment history. By implementing stringent underwriting protocols, lending organizations can mitigate the risk of defaults and ensure that loans are extended to borrowers who are likely to meet their obligations. Additionally, regular reviews and updates of these standards are essential to adapt to evolving market conditions and borrower profiles.

The European Banking Authority's (EBA) Guidelines on loan origination further emphasize the necessity of developing robust standards to guarantee fair consumer treatment and transparency in borrower assessments. For example, JPMorgan Chase's recent enhancements to their Model Risk Management (MRM) framework illustrate the efficacy of rigorous standards. By adopting a centralized model governance structure, they achieved a 30% reduction in model validation time, which not only bolstered regulatory compliance but also streamlined their lending processes. This case exemplifies how a can enhance decision-making and operational efficiency.

Moreover, effective borrower assessments depend on a comprehensive evaluation of various criteria, including employment history, income stability, and financial statements. A lower debt-to-income ratio, for instance, signifies that a borrower is not excessively burdened by debt, rendering them a more reliable candidate for loans. Transparency in these assessments cultivates customer trust and aligns with consumer protection regulations, as highlighted by the EBA's Guidelines.

Furthermore, the importance of data quality in credit assessment cannot be overstated. Poor data quality is a significant source of model risk, and ensuring high-quality data is vital for accurate borrower evaluations. In summary, lending institutions must prioritize the establishment of robust underwriting standards and continuously refine their assessment processes to promote responsible lending and minimize potential losses.

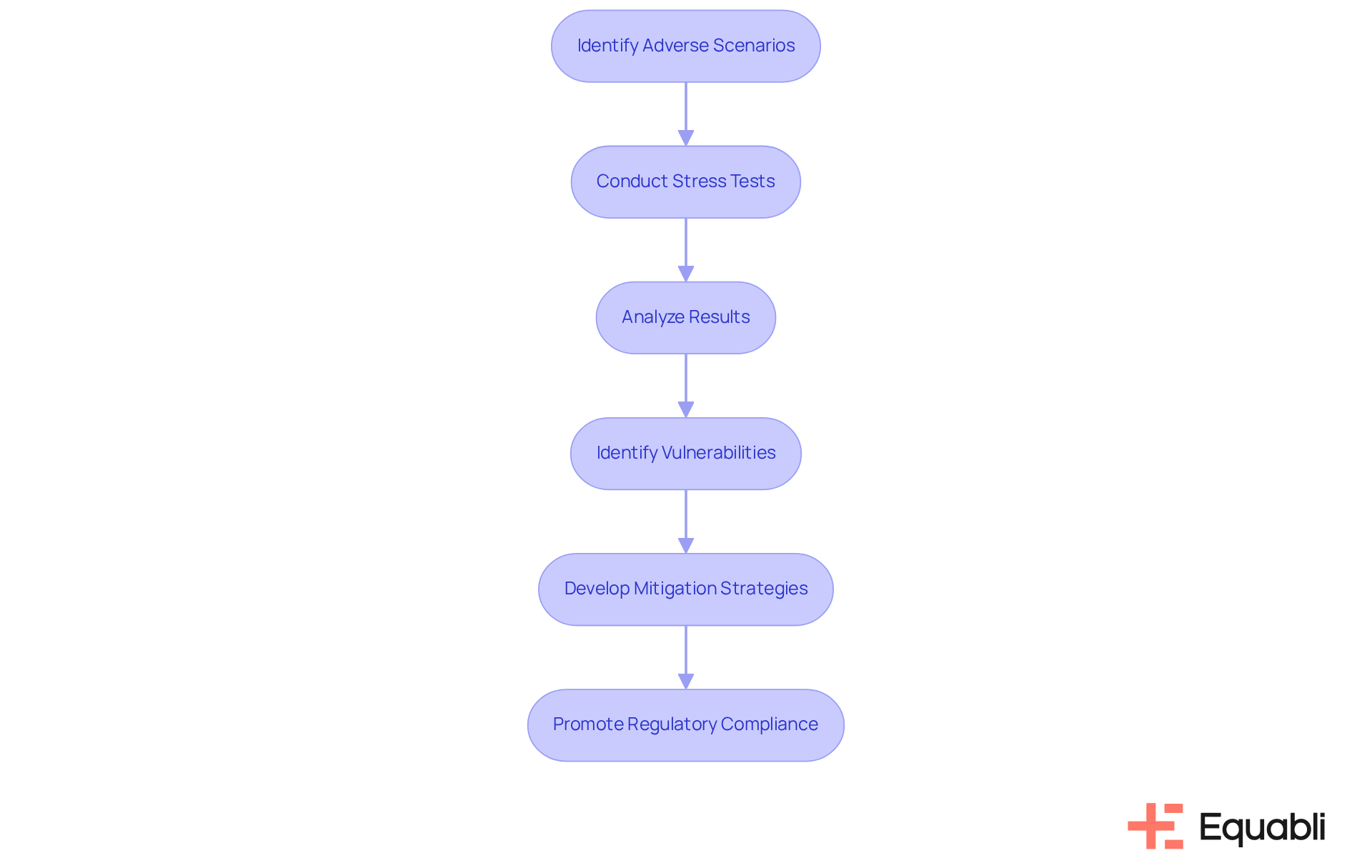

Anaptyss: Conducting Stress Testing and Scenario Analysis

Performing stress testing and scenario analysis is critical for institutions to assess their resilience against adverse economic conditions. Anaptyss advocates for the implementation of regular stress tests, which evaluate how various scenarios—such as economic downturns or fluctuations in interest rates—could affect the organization's financial health. By analyzing these situations, institutions can identify vulnerabilities in their portfolios and develop strategies to mitigate potential risks. This proactive approach not only enhances the management of uncertainties but also promotes and instills confidence among stakeholders.

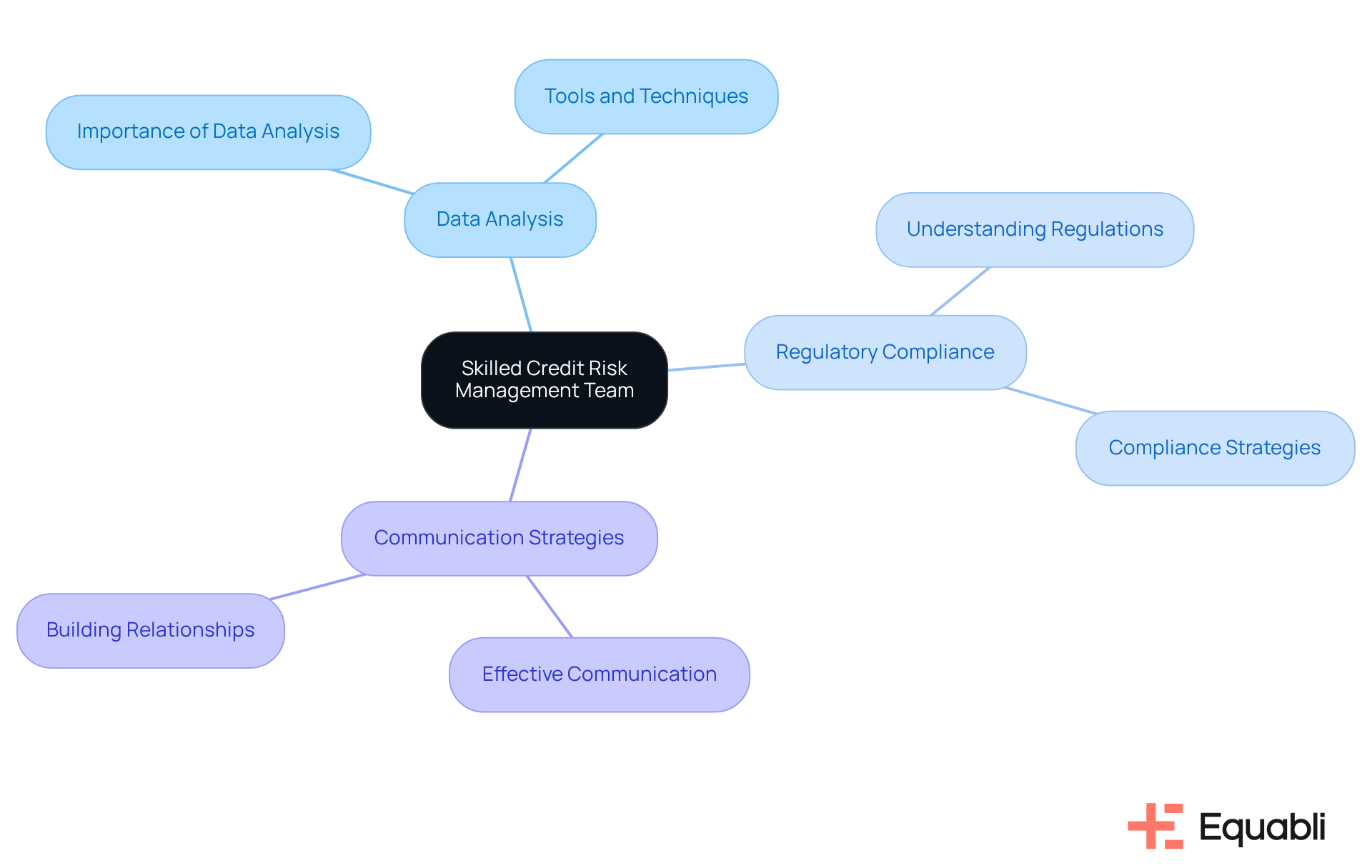

Anaptyss: Building a Skilled Credit Risk Management Team

Establishing an effective financial assessment management group is imperative for implementing collections industry best practices for financial risk management executives and ensuring the success of any financial institution. Evidence suggests that investing in comprehensive training and development initiatives equips team members with the essential skills required to evaluate financial exposure adeptly. This training should encompass:

- Data analysis

- Regulatory compliance

- Communication strategies

Thereby enabling team members to navigate the complexities of financial challenges confidently. A well-trained team is strategically positioned to make informed lending decisions and implement effective collection strategies that adhere to collections industry best practices for financial risk management executives, ultimately enhancing the organization's economic stability and fostering sustainable growth.

As industry specialists assert, the importance of continuous education in credit evaluation is paramount; it is a foundational element that enhances both individual and organizational performance in managing economic challenges. Allison Dunn underscores that these insights are tools meant for application rather than mere observation, highlighting the necessity of integrating perspectives from industry leaders into training programs.

Furthermore, neglecting training can introduce significant risks, as a lack of knowledge may result in poor decision-making and increased monetary exposure. To , financial institutions must routinely assess their programs and adapt them to align with collections industry best practices for financial risk management executives and evolving industry standards.

Conclusion

Implementing best practices in the collections industry is crucial for financial risk management executives who seek to enhance their debt recovery strategies. The integration of advanced technologies, such as Equabli's EQ Suite and HighRadius's effective communication techniques, exemplifies how organizations can modernize their approaches to debt collection. By prioritizing compliance, employing data-driven strategies, and fostering borrower engagement, organizations not only improve recovery rates but also cultivate stronger relationships with their clients.

Key insights from the article underscore the significance of:

- Customizable solutions

- Proactive communication

- Robust credit assessment methodologies

The focus on empathetic engagement, flexible payment options, and continuous evaluation of lending policies illustrates a comprehensive approach to managing financial risk. Additionally, the importance of training and development in cultivating skilled teams emerges as a critical factor in navigating the complexities of credit risk management.

Ultimately, embracing these best practices positions organizations for sustainable growth within a competitive landscape. Financial risk management executives are urged to adopt these strategies and leverage new-age technologies to enhance operational efficiency and borrower satisfaction. By doing so, they mitigate potential losses and ensure their organizations thrive in the ever-evolving collections industry.

Frequently Asked Questions

What is Equabli's EQ Suite and what does it include?

Equabli's EQ Suite is a modern solution for debt recovery processes focused on data protection and compliance. It includes the EQ Engine, EQ Engage, and EQ Collect, which help clients develop custom scoring models, refine recovery strategies, and facilitate digital repayments through self-service repayment plans.

How does EQ Collect enhance operational efficiency?

EQ Collect features a no-code file-mapping tool, automated workflows, and real-time reporting, which enhance operational efficiency and minimize execution errors, allowing organizations to significantly reduce retrieval costs.

What compliance benefits does Equabli's EQ Suite offer?

The EQ Suite prioritizes industry-leading compliance oversight, enabling clients to manage delinquency effectively while promoting borrower engagement through preferred communication channels.

What techniques does HighRadius recommend for reducing bad debts?

HighRadius suggests proactive communication strategies, clear payment terms, and flexible payment options to improve relationships with debtors and enhance recovery rates.

How does data analytics play a role in debt recovery according to HighRadius?

Data analytics is crucial for identifying at-risk accounts early, allowing organizations to intervene timely and tailor recovery strategies that resonate with borrowers.

What impact do flexible payment options have on cash flow and customer loyalty?

Organizations that implement flexible payment options have seen notable improvements in cash flow and customer loyalty, transforming potential losses into recovered income.

How important is multi-channel communication in debt recovery?

Multi-channel communication is vital, as research indicates that 60% of successful recoveries involve at least two distinct communication channels, which enhances engagement with debtors.

What is the significance of empathy in debt recovery practices?

Incorporating empathy into debt recovery can strengthen customer relationships and improve recovery outcomes by acknowledging borrowers' financial challenges.

What best practices are essential for credit risk management according to Anaptyss?

Best practices include thorough evaluations, robust underwriting standards, and well-defined lending policies to assess borrower creditworthiness and minimize defaults.

Why is ongoing observation and modification of lending policies important?

Ongoing observation and prompt modifications to lending policies are crucial for addressing evolving market conditions and borrower behaviors, enhancing management efforts and seizing emerging opportunities.

What benefits do banks experience from investing in loan evaluation monitoring?

Banks that invest in sophisticated loan evaluation monitoring see a 30% improvement in detection capabilities and a 25% reduction in compliance expenses.

How does regulatory compliance factor into credit risk management?

Regulatory compliance is foundational in credit risk management, ensuring institutions adhere to sound lending practices while integrating ESG considerations into their credit evaluations.