Overview

The article delineates four pivotal strategies for managing aged debt portfolios within financial institutions:

- Ensuring data accuracy

- Segmenting debt portfolios by risk and value

- Leveraging technology and automation

- Implementing tailored communication strategies

Evidence indicates that these strategies lead to significant enhancements in recovery rates and operational efficiency. This underscores the notion that effective management of aged debt is contingent upon a synthesis of accurate data, thorough risk assessment, technological integration, and personalized debtor engagement.

Introduction

In the intricate landscape of finance, managing aged debt portfolios presents a substantial challenge for institutions aiming to uphold profitability while ensuring compliance. This article explores four critical strategies capable of transforming debt recovery approaches, highlighting the significance of:

- Data accuracy

- Risk segmentation

- Technology integration

- Tailored communication

As financial institutions implement these strategies, they face a crucial question: how can they effectively balance efficiency and empathy in their debt recovery efforts to optimize outcomes without alienating their clients?

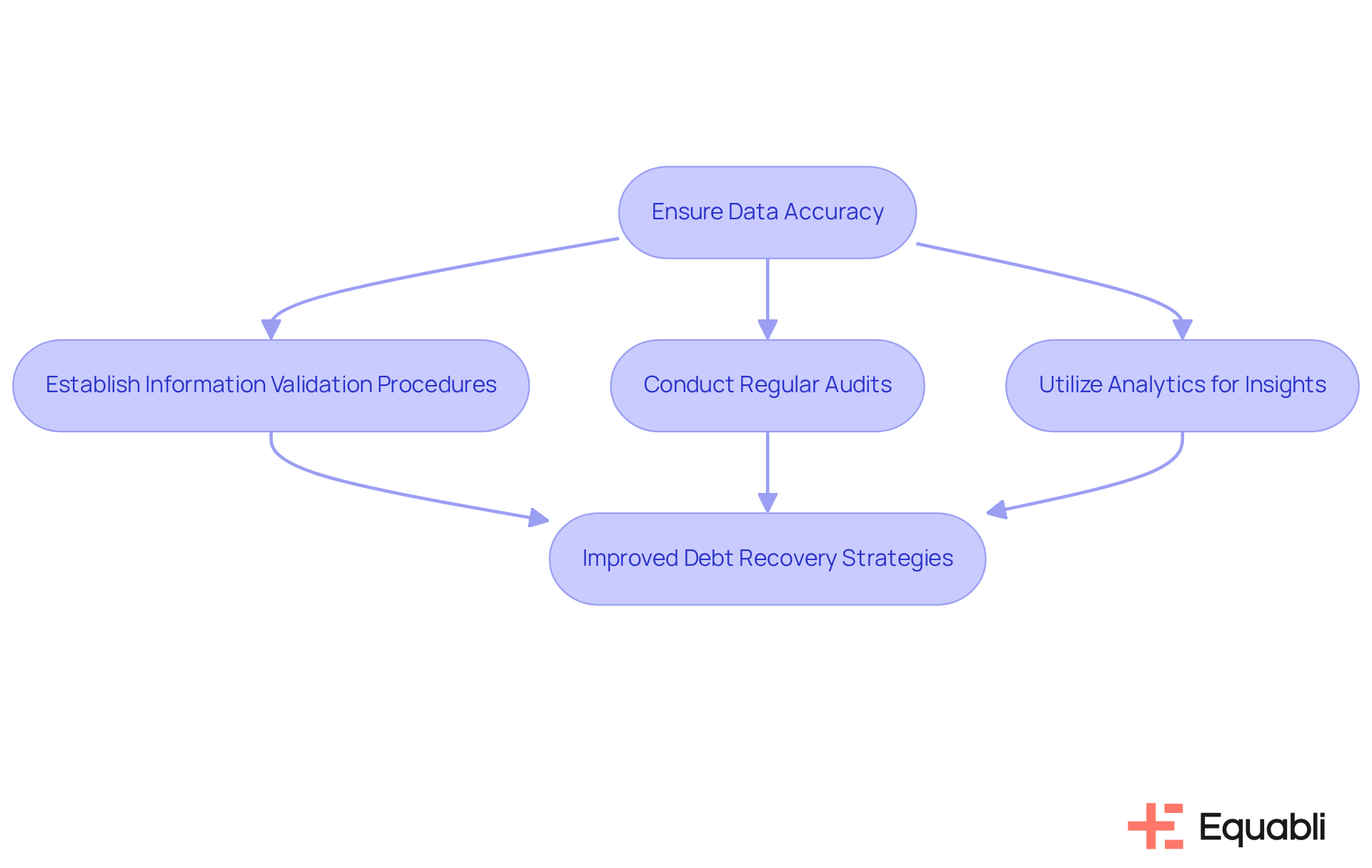

Ensure Data Accuracy for Effective Debt Management

Effective oversight of legacy debt collections relies on the strategies for managing and recovering aged debt portfolios in financial institutions. Establishing robust information validation procedures is essential to ensure that debtor details remain precise and current. Regular audits and significantly reduce duplicates and inaccuracies, which often lead to costly errors in collections.

For example, a financial institution that committed to enhancing data accuracy reported a remarkable 30% reduction in operational expenses, attributed to fewer disputes and expedited resolution times.

Furthermore, leveraging advanced analytics tools offers real-time insights into debtor behavior, empowering organizations to make informed decisions regarding collection strategies. By upholding stringent data accuracy standards, organizations can markedly improve their strategies for managing and recovering aged debt portfolios in financial institutions, leading to enhanced recovery rates.

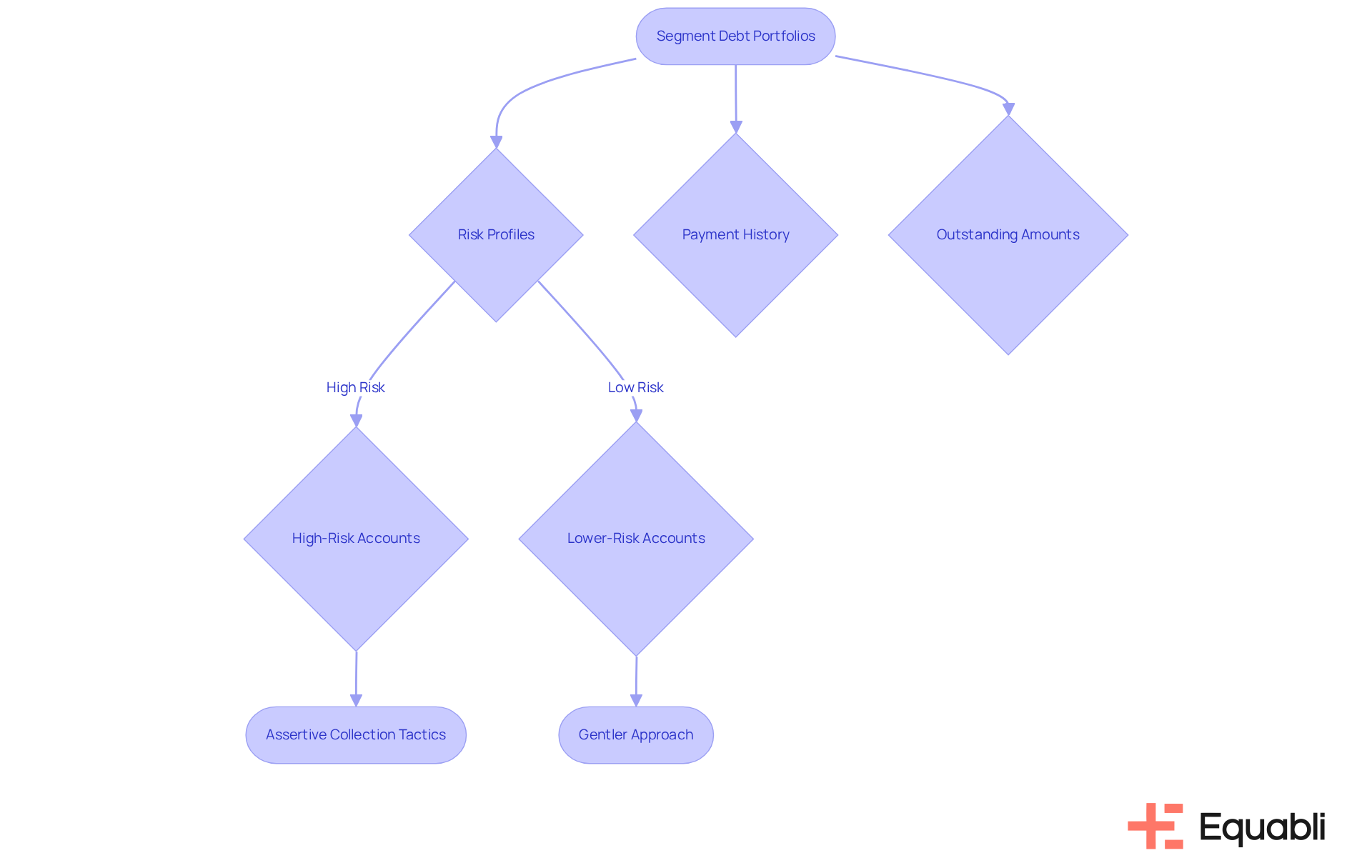

Segment Debt Portfolios by Risk and Value

Effective segmentation of debt portfolios is essential for applying strategies for managing and recovering aged debt portfolios in financial institutions to optimize recovery efforts. By categorizing debts based on risk profiles, payment history, and outstanding amounts, organizations can develop strategies for managing and recovering aged debt portfolios in financial institutions more effectively. For instance, high-risk accounts may require more assertive collection tactics, whereas lower-risk accounts could benefit from a gentler approach. Evidence from a notable case study illustrates that a leading bank's implementation of a risk-based segmentation strategy resulted in a significant 25% improvement in recovery rates within just six months. This demonstrates the tangible benefits of effective segmentation as part of the strategies for managing and recovering aged debt portfolios in financial institutions to enhance recovery outcomes.

Moreover, the integration of plays a critical role in improving segmentation accuracy by identifying patterns in repayment behavior. Machine learning systems further enhance this process by recognizing complex patterns and adapting to new information over time. This capability not only refines segmentation approaches but also allows organizations to remain agile in a rapidly changing financial landscape. However, organizations must navigate [challenges such as information fragmentation and compliance risks](https://ibscdc.org/Case_Studies/Business Strategy/Business Strategy/American Express-Risk-Corporate Strategy-Case Study.htm), which can hinder effective segmentation efforts.

To maintain effectiveness, it is imperative for organizations to regularly assess and adjust their strategies for managing and recovering aged debt portfolios in financial institutions, ensuring alignment with evolving market conditions and debtor behaviors. Establishing robust data governance policies is also crucial for maintaining data accuracy and compliance in segmentation initiatives. By doing so, organizations can mitigate risks and enhance their strategic positioning in the debt collection landscape.

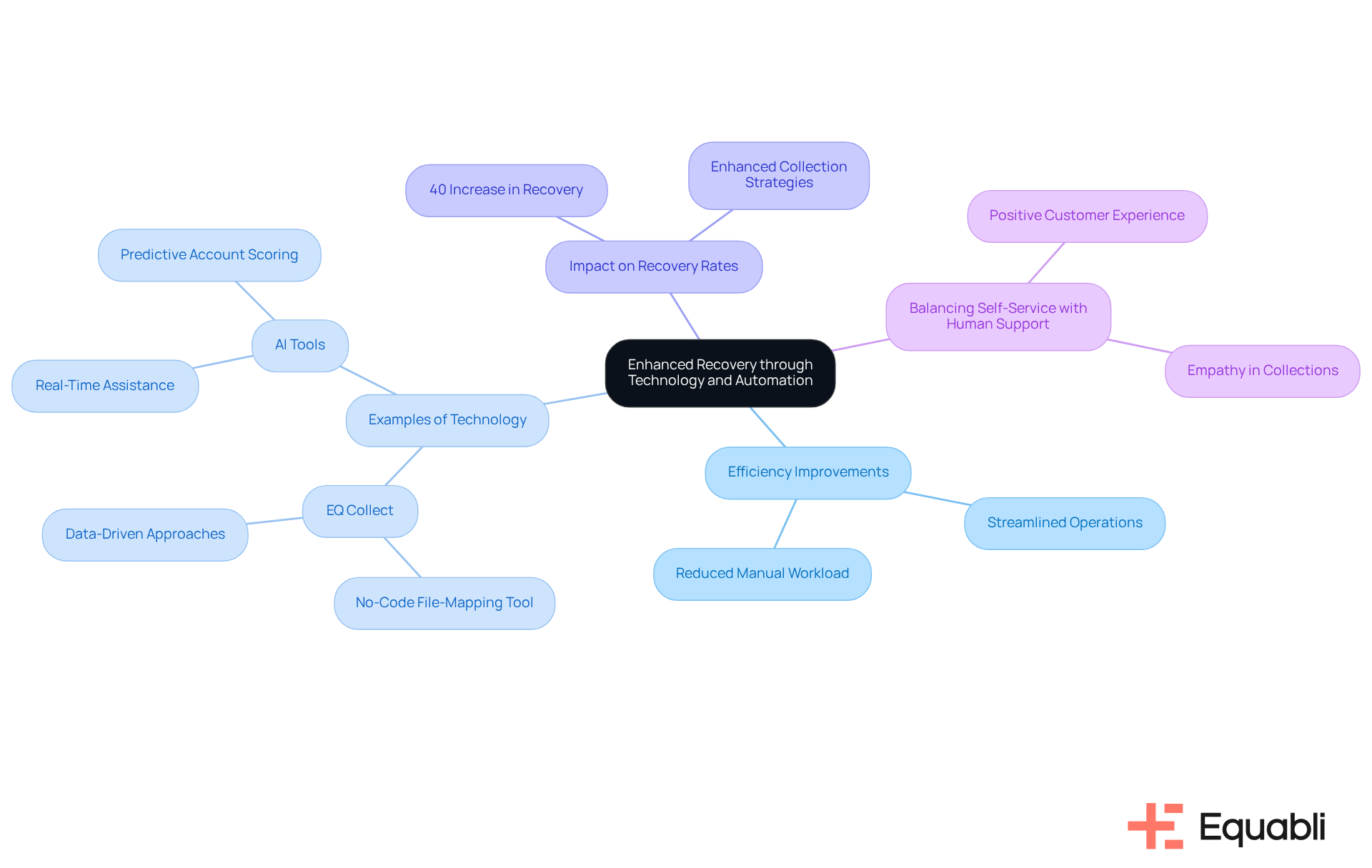

Leverage Technology and Automation for Enhanced Recovery

Incorporating technology and automation into strategies for managing and recovering aged debt portfolios in financial institutions significantly enhances efficiency for these organizations. Evidence shows that investing in automated systems to manage routine tasks—such as sending reminders, tracking payments, and handling communications—streamlines operations and reduces manual workload.

For instance, Equabli's EQ Collect offers a no-code file-mapping tool that shortens vendor onboarding timelines, while its data-driven approaches enhance efficiency and boost collections. This integration reduces execution mistakes and manual resource demands, enabling organizations to focus on .

Research indicates that organizations implementing strategies for managing and recovering aged debt portfolios in financial institutions through automation experience a remarkable 40% increase in recovery rates compared to those relying solely on traditional methods. Furthermore, the integration of data analytics tools allows organizations to identify the most effective strategies for managing and recovering aged debt portfolios in financial institutions, tailored to different borrower segments, thus enhancing recovery efforts.

It is essential to balance self-service capabilities with human support to ensure a positive customer experience. By leveraging these technological advancements—such as the unmatched clarity and insights provided by EQ Collect's real-time reporting and its user-friendly, scalable, cloud-native interface—while adhering to compliance regulations like the Fair Debt Collection Practices Act, financial organizations can not only increase operational efficiency but also improve the overall experience for borrowers. This fosters stronger relationships and enhances results.

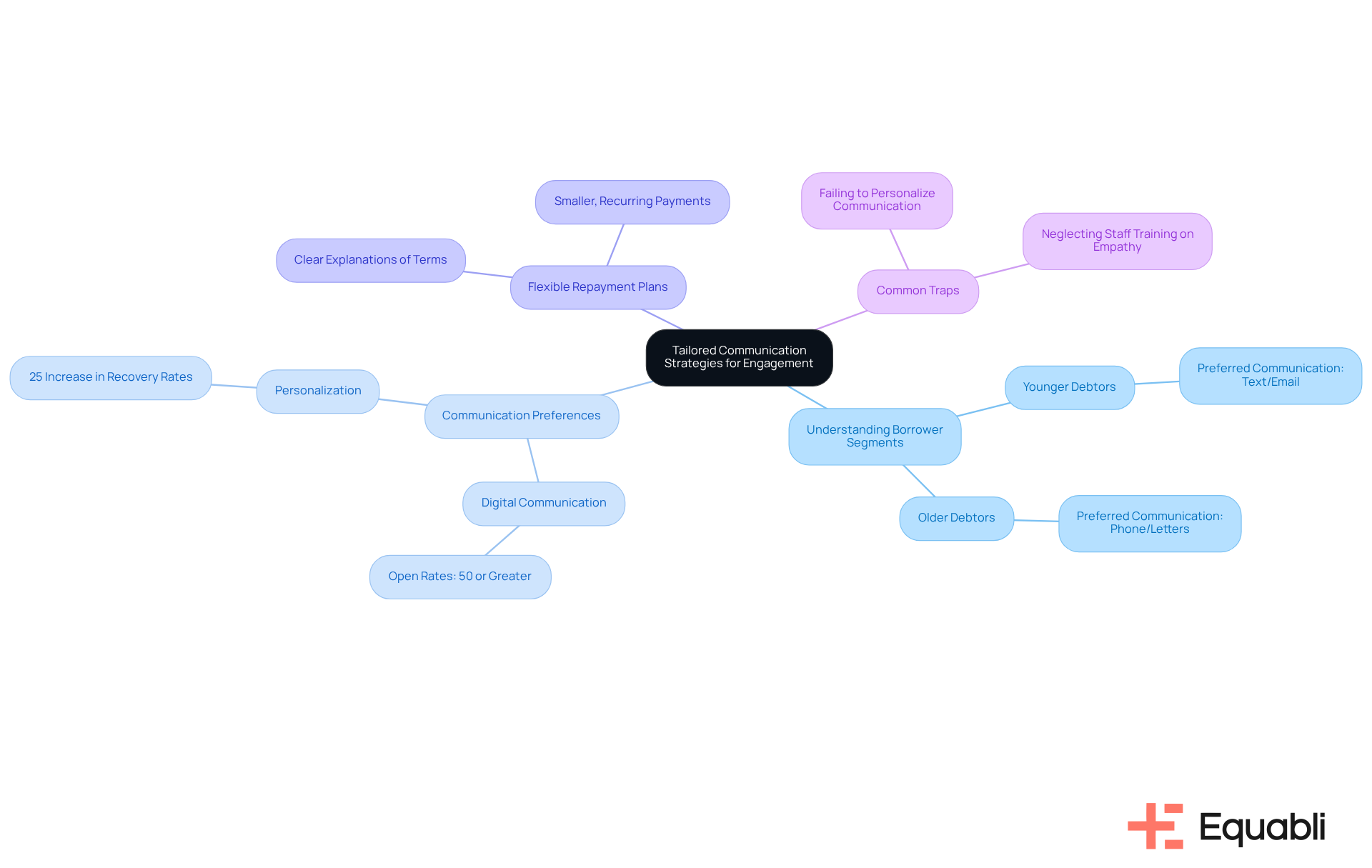

Implement Tailored Communication Strategies for Engagement

To effectively manage aged debt portfolios, financial institutions must adopt strategies for managing and recovering aged debt portfolios in financial institutions that include tailored communication strategies resonating with individual debtors. Understanding the is crucial, necessitating adjustments in communication methods. For example, younger individuals may respond more favorably to text messages or emails, while older clients might prefer phone calls or letters. Research indicates that digital communications can achieve open rates of 50% or greater, significantly enhancing recovery outcomes.

Furthermore, institutions should consider offering flexible repayment plans, as studies show that providing clear explanations of repayment terms fosters engagement. By fostering open lines of communication and demonstrating empathy—an approach that has been shown to yield more positive responses compared to confrontational tactics—organizations can build trust with debtors. This ultimately leads to improved recovery rates and stronger financial relationships.

However, it is essential to recognize common traps in applying these approaches, such as:

- Failing to personalize communication effectively

- Neglecting to train staff on empathetic engagement techniques

Addressing these challenges is vital for financial institutions aiming to maximize the effectiveness of their communication strategies, particularly through strategies for managing and recovering aged debt portfolios in financial institutions.

Conclusion

Effective management of aged debt portfolios in financial institutions is fundamentally reliant on the implementation of strategic practices that enhance recovery outcomes. By prioritizing data accuracy, segmentation, technology integration, and tailored communication, organizations can markedly improve their debt recovery efforts and operational efficiency. Each of these strategies is essential in addressing the challenges associated with legacy debt collections, ultimately fostering better financial health for institutions.

Key insights from this discussion underscore the necessity of maintaining accurate debtor information, which serves to reduce disputes and operational costs. Segmentation based on risk and value facilitates more targeted collection strategies, while the integration of technology and automation streamlines processes and enhances recovery rates. Furthermore, employing customized communication approaches cultivates better engagement with debtors, thereby increasing the likelihood of successful repayments.

As financial institutions confront the complexities of debt management, adopting these strategies is not merely advantageous but imperative. Organizations are urged to take a proactive approach, consistently assessing and refining their methodologies to align with evolving market dynamics and debtor behaviors. By emphasizing these best practices, institutions can not only improve their recovery rates but also forge stronger relationships with their clients, ultimately contributing to a more sustainable financial ecosystem.

Frequently Asked Questions

Why is data accuracy important for debt management?

Data accuracy is crucial for effective debt management as it ensures debtor details are precise and current, reducing the risk of costly errors in collections.

How can financial institutions improve data accuracy?

Financial institutions can improve data accuracy by establishing robust information validation procedures, conducting regular audits, and implementing data cleansing initiatives.

What are the benefits of enhancing data accuracy in debt collections?

Enhancing data accuracy can lead to a significant reduction in operational expenses, fewer disputes, and expedited resolution times, as evidenced by a financial institution that reported a 30% reduction in costs.

How do advanced analytics tools contribute to debt management?

Advanced analytics tools provide real-time insights into debtor behavior, enabling organizations to make informed decisions regarding their collection strategies.

What impact does data accuracy have on recovery rates for aged debt portfolios?

Upholding stringent data accuracy standards markedly improves strategies for managing and recovering aged debt portfolios, leading to enhanced recovery rates.