Overview

This article presents an overview of seven AI-driven debt collection chatbot solutions specifically designed for financial institutions. These solutions are effective in enhancing recovery rates and operational efficiency. They leverage advanced analytics and automation to streamline collection processes, improve borrower interactions, and ensure compliance. Ultimately, these innovations transform traditional debt recovery practices into more efficient, data-driven strategies, providing significant implications for enterprise-level operations.

Introduction

AI technology is fundamentally reshaping the debt collection landscape, providing financial institutions with innovative solutions to enhance their recovery processes. As organizations seek to improve efficiency and customer engagement, AI-driven debt collection chatbots have emerged as pivotal tools that not only streamline operations but also cultivate stronger borrower relationships.

However, with a myriad of options available, how can institutions ascertain which AI-driven solutions will optimally address their unique needs and yield significant results? This article examines seven cutting-edge AI-driven debt collection chatbot solutions poised to revolutionize financial recovery strategies in 2025 and beyond.

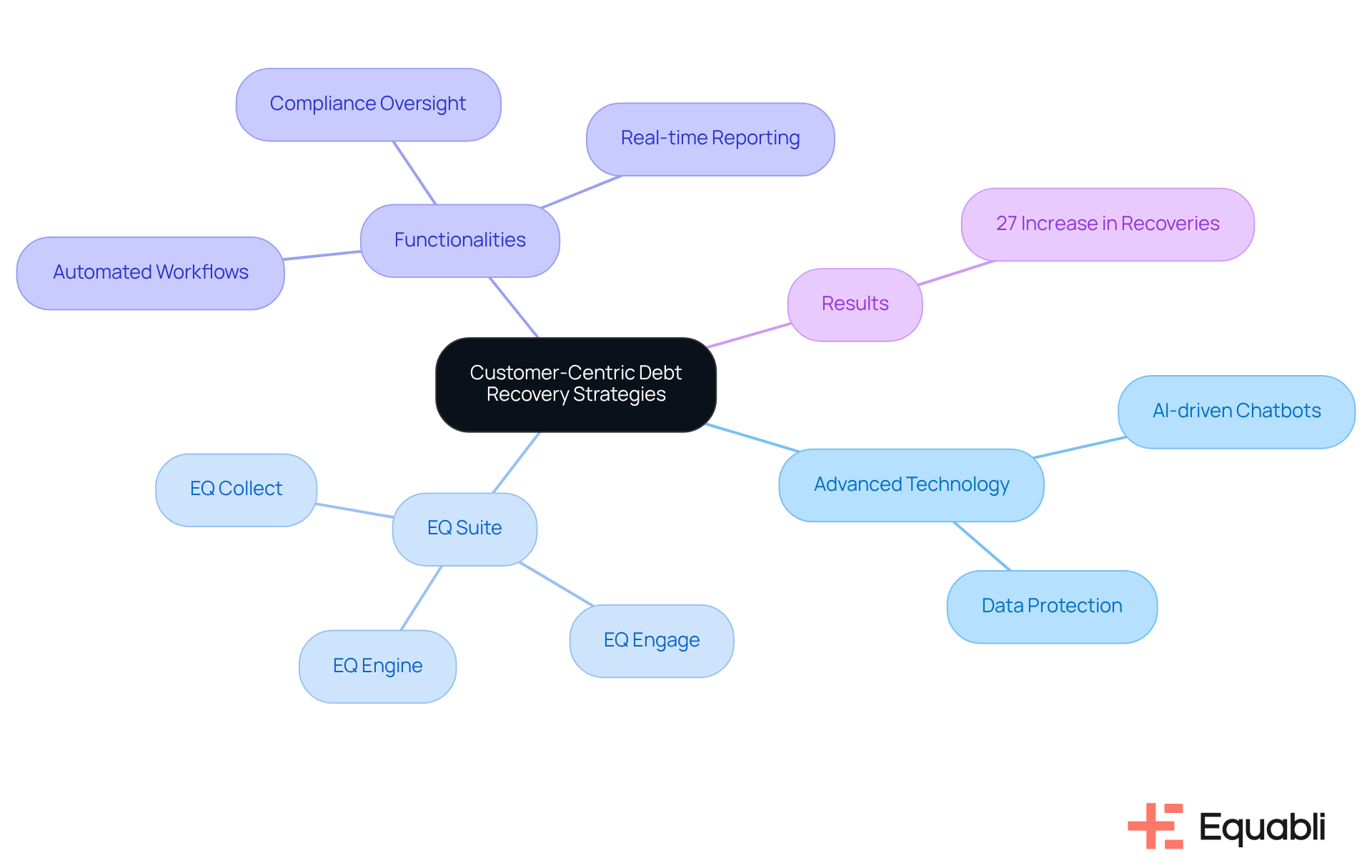

Equabli EQ Suite: Intelligent Solutions for Modern Debt Collection

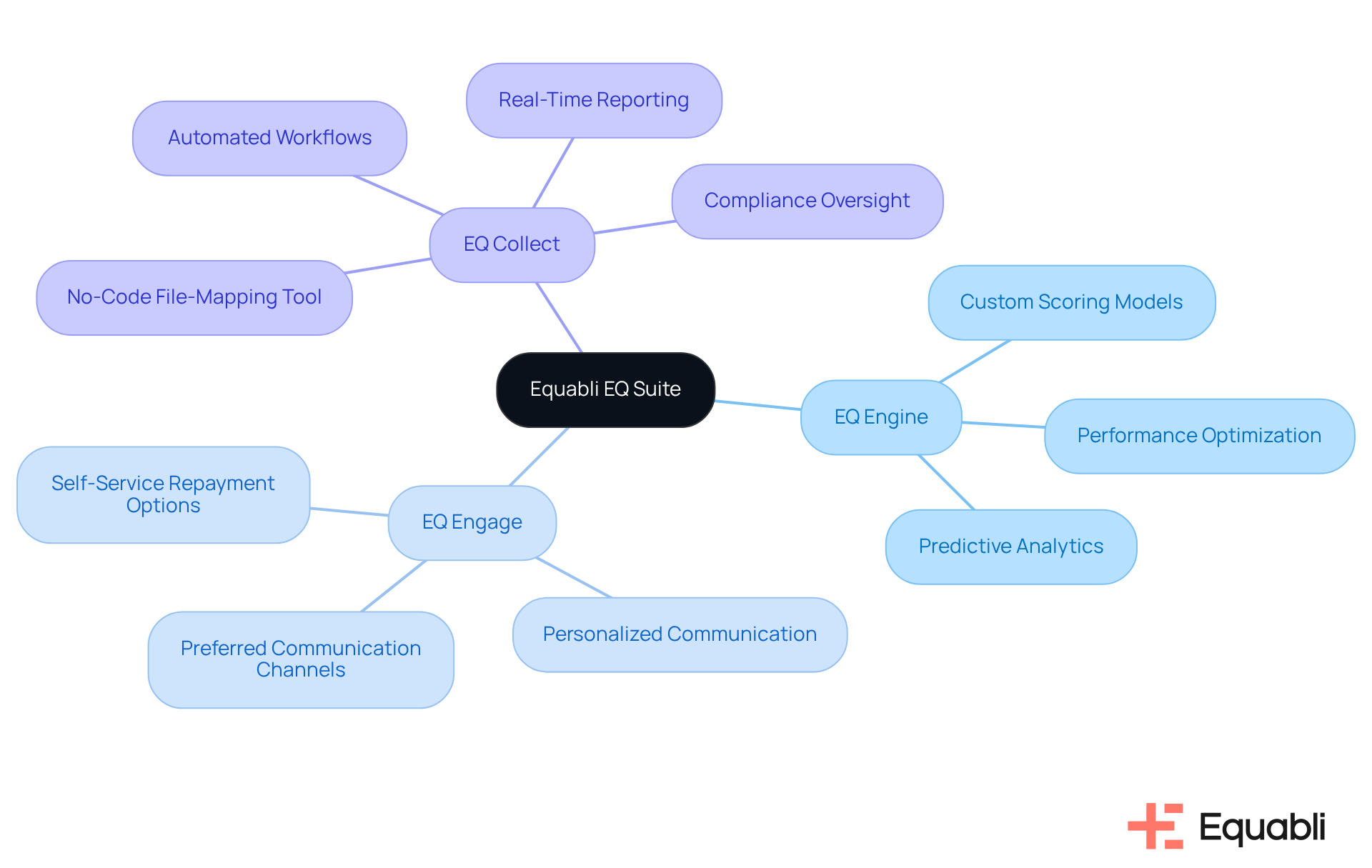

The Equabli EQ Suite represents a for financial organizations, designed to enhance receivable recovery methodologies through advanced technology. Comprising tools such as EQ Engine, EQ Engage, and EQ Collect, this suite leverages machine learning and predictive analytics to refine collection strategies. Notably, EQ Collect features:

- A no-code file-mapping tool that significantly shortens vendor onboarding timelines

- Automated workflows that reduce execution errors

- Real-time reporting that delivers exceptional transparency and insights

Furthermore, the EQ Suite ensures top-tier compliance oversight and provides a user-friendly, scalable, cloud-native interface. By integrating custom scoring models, the EQ Suite enables lenders to accurately predict repayment behaviors and tailor their strategies for individual borrowers. This approach not only improves recovery rates—potentially reducing loan delinquencies by over 25% and bad financial obligations by up to 20%—but also markedly lowers operational costs. As organizations shift from traditional recovery methods to more effective, data-driven strategies, the implementation of AI-driven debt collection chatbot solutions for financial institutions emerges as an essential solution for modernizing their operations. Additionally, the EQ Engage tool enhances the borrower experience by providing self-service repayment options, allowing borrowers to manage their obligations through personalized repayment plans and preferred communication channels. As Cody Owens, CEO of the company, points out, many recovery teams recognize the necessity for a modern approach, positioning the EQ Suite as vital in facilitating this transition.

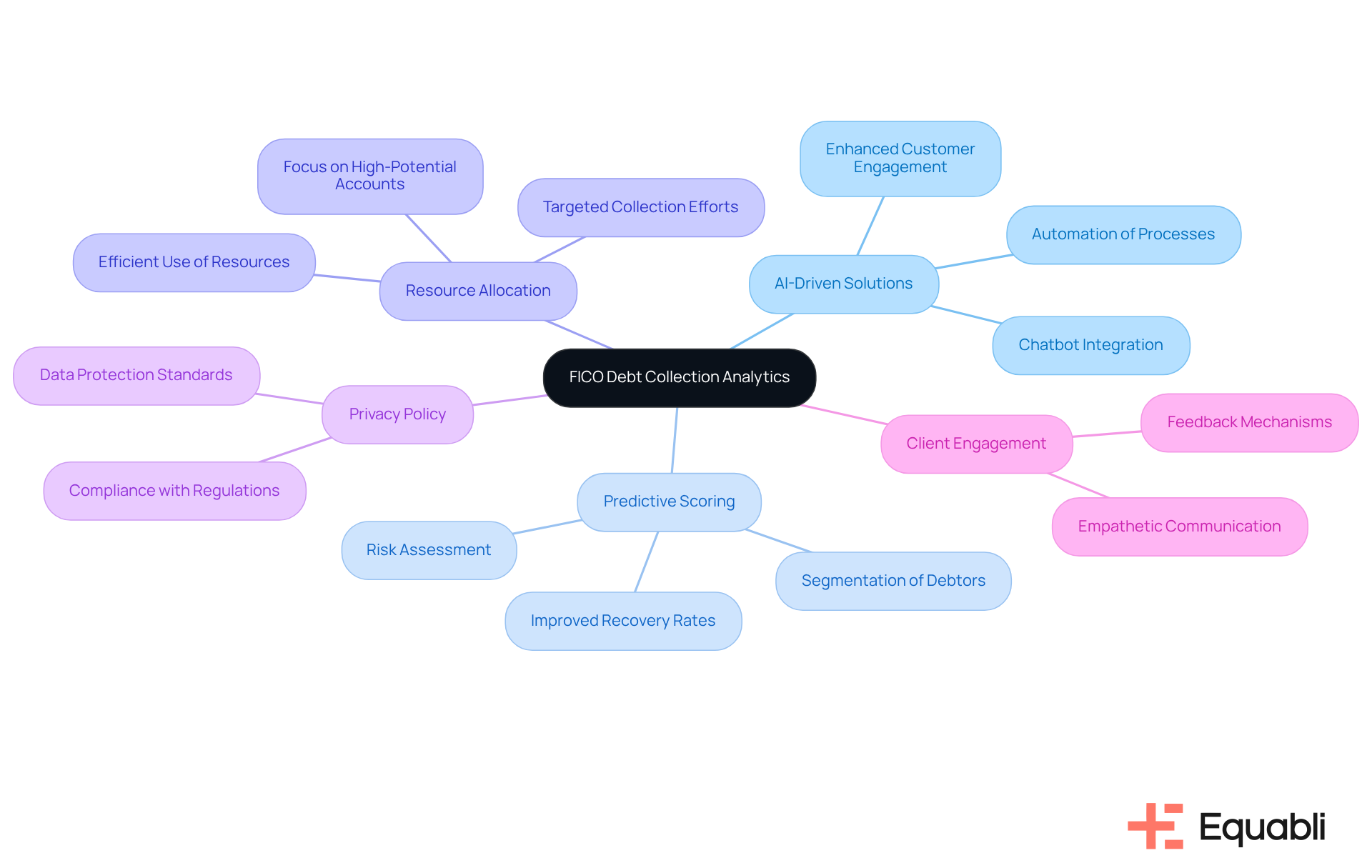

FICO Debt Collection Analytics: Enhancing Strategy with Predictive Scoring

Our company provides ai-driven debt collection chatbot solutions for financial institutions, allowing them to leverage advanced predictive scoring capabilities through our EQ Engine. By analyzing historical data and borrower behavior, this platform aids organizations in identifying accounts most likely to pay and those requiring more intensive recovery efforts. This targeted approach not only but also facilitates a more efficient allocation of resources, allowing teams to focus their efforts where they are most likely to yield results.

Protecting your private information remains our top priority, and our Privacy Policy outlines how we collect and utilize data in accordance with industry standards. As the integration of ai-driven debt collection chatbot solutions for financial institutions into financial recovery strategies becomes increasingly vital, organizations are compelled to navigate the complexities of borrower interactions. Our company is committed to promoting product utilization and client engagement through intelligent servicing strategies.

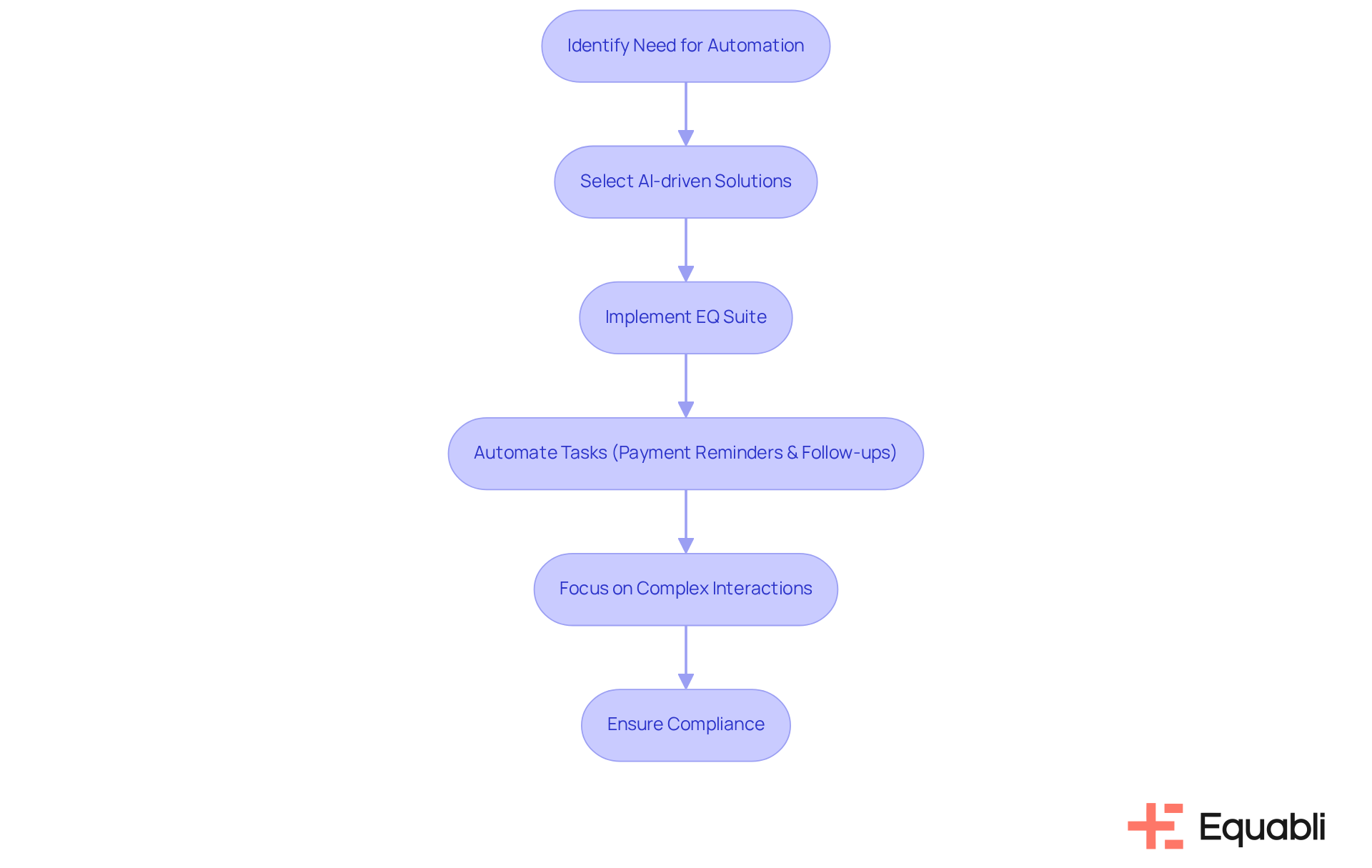

Pentafon Automated Debt Collection: Streamlining Processes for 2025

The company provides AI-driven debt collection chatbot solutions for financial institutions, designed for advanced automated debt recovery in 2025 and beyond. By leveraging AI and machine learning, the EQ Suite transforms manual processes, automating critical tasks such as payment reminders and follow-ups. This enables teams to focus on more complex interactions, thereby enhancing operational efficiency and ensuring compliance with evolving regulatory standards.

With the support of an expert team and a customized launch strategy, transitioning to these advanced, becomes seamless, empowering lenders to address the challenges inherent in traditional financial management.

As the demand for swift and efficient recovery methods escalates, Equabli's AI-driven debt collection chatbot solutions for financial institutions are strategically positioned to meet the needs of modern lenders and recovery agencies, ensuring their competitiveness in an increasingly digital landscape.

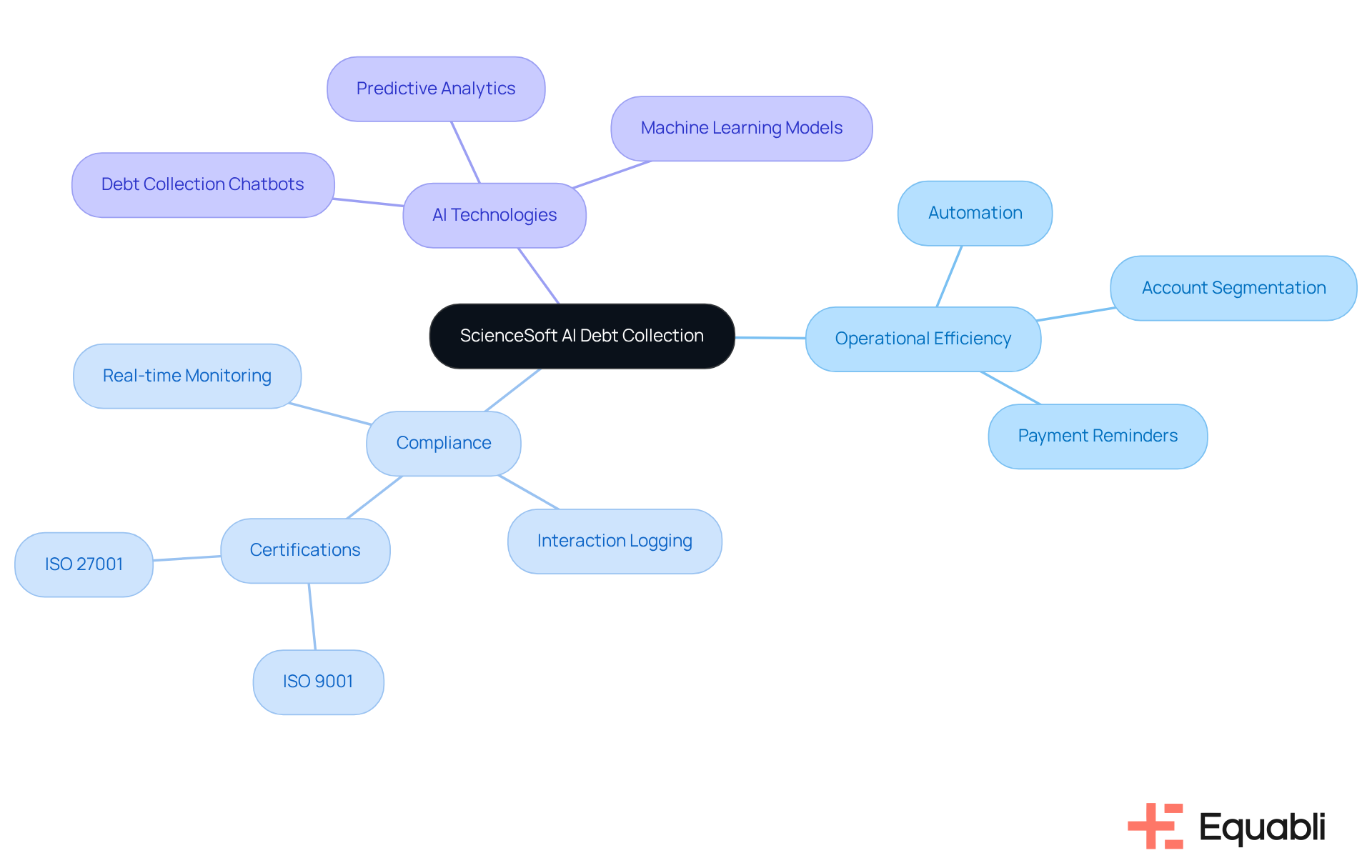

ScienceSoft AI Debt Collection: Boosting Efficiency and Compliance

ScienceSoft's AI-driven credit recovery systems are designed to enhance operational efficiency while ensuring strict compliance with industry regulations. By automating critical processes such as account segmentation and payment reminders, organizations can significantly reduce the risk of non-compliance and enhance recovery rates.

Advanced analytics capabilities enable real-time monitoring of compliance metrics, ensuring that all interactions adhere to legal standards. Furthermore, automated systems meticulously log every interaction with consumers, creating detailed records that are essential for compliance.

With , ScienceSoft establishes credibility and trust in its offerings. This strategic emphasis on efficiency and compliance positions ScienceSoft as an indispensable partner for financial institutions looking to modernize their receivables management strategies through AI-driven debt collection chatbot solutions for financial institutions in 2025.

Notably, leveraging AI in receivables management can yield a 2-4x increase in collector productivity.

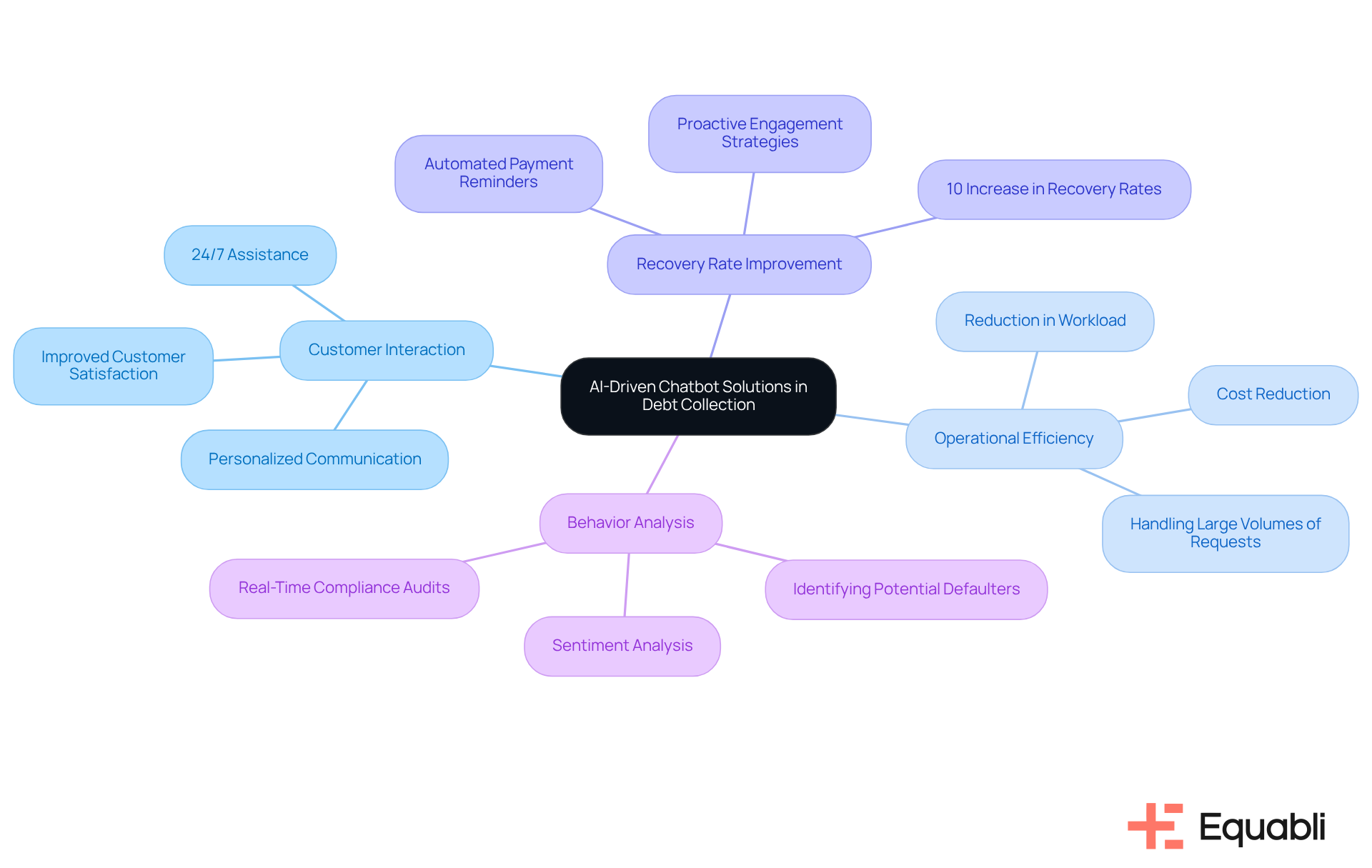

Chatbot Solutions: Revolutionizing Customer Interaction in Debt Collection

AI-driven debt collection chatbot solutions for financial institutions are transforming customer interactions within the financial recovery sector by delivering 24/7 assistance and personalized communication. These sophisticated tools effectively manage a variety of tasks, ranging from addressing common inquiries to facilitating payment arrangements, all while maintaining a consistent and empathetic tone.

By automating these interactions, financial institutions can significantly reduce the workload on human agents, allowing them to focus on more complex cases that require personal attention. This integration not only enhances but also improves customer satisfaction, as timely and relevant assistance becomes readily accessible.

Notably, organizations that have adopted AI chatbots report a 10% increase in recovery rates and a 40% reduction in operating expenses, highlighting the substantial benefits of this technology in modern financial recovery practices. Furthermore, chatbots can analyze debtor behavior to identify potential defaulters, enabling proactive engagement strategies that bolster overall recovery outcomes.

As the landscape of financial recovery evolves, the use of AI-driven debt collection chatbot solutions for financial institutions is becoming essential for organizations aiming to enhance customer engagement and optimize their processes.

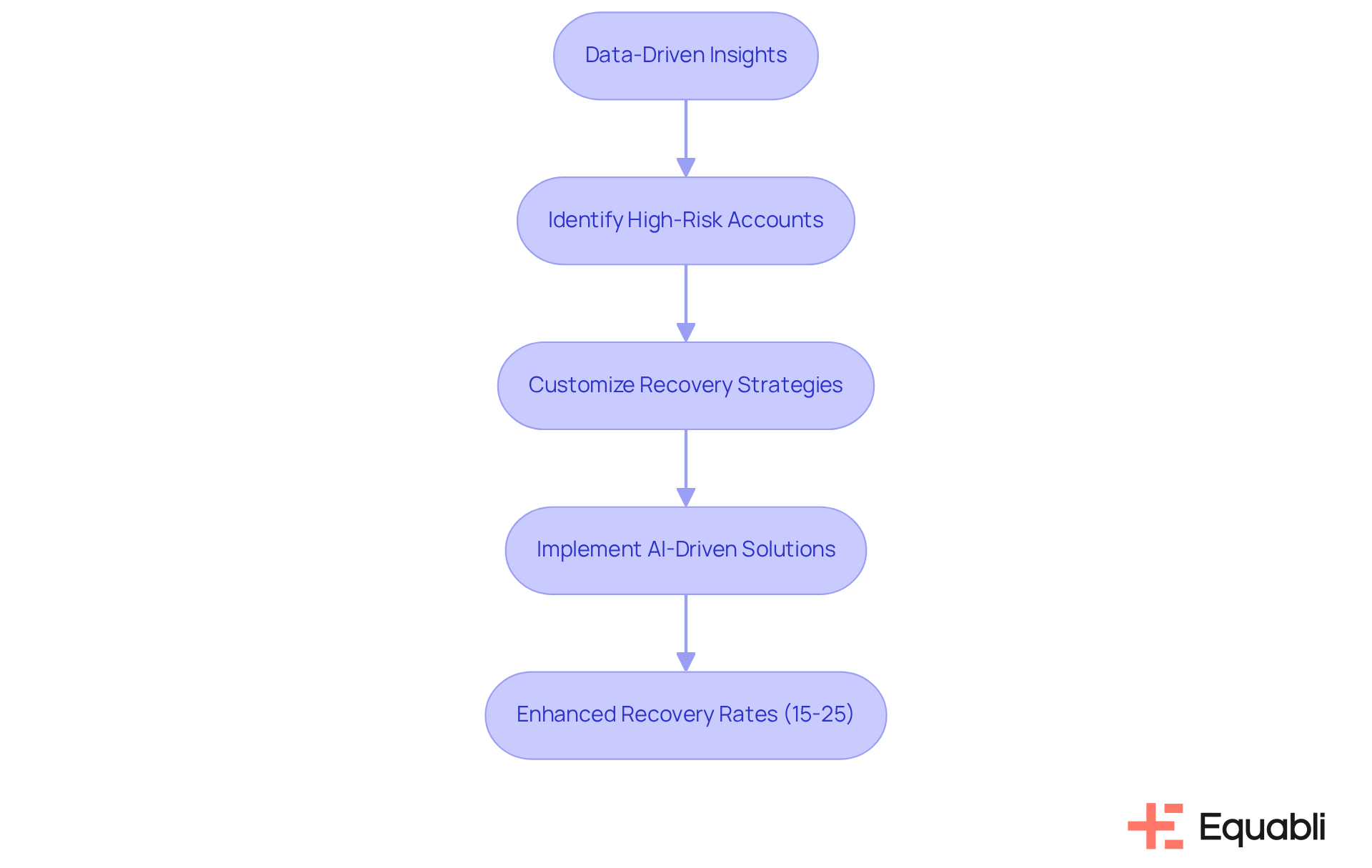

Zoot Enterprises Decision Management: Data-Driven Insights for Debt Recovery

Zoot Enterprises offers for financial institutions that empower these organizations to leverage data-driven insights in their recovery processes. By harnessing advanced analytics and machine learning, Zoot enables organizations to effectively identify high-risk accounts and customize their recovery strategies with ai-driven debt collection chatbot solutions for financial institutions.

This tailored approach not only enhances recovery rates—evidence indicates that organizations employing ai-driven debt collection chatbot solutions for financial institutions can realize recovery rate improvements of 15-25%—but also optimizes operational efficiency through improved resource allocation.

In a competitive receivables landscape, Zoot's ai-driven debt collection chatbot solutions for financial institutions offer a strategic advantage, enabling institutions to swiftly adapt to changing market conditions and consumer behaviors. A case in point is a medical recovery law firm that adopted contemporary financial recovery strategies, achieving a remarkable 20% revenue increase within just six months, underscoring the critical role of analytics in today’s financial retrieval initiatives.

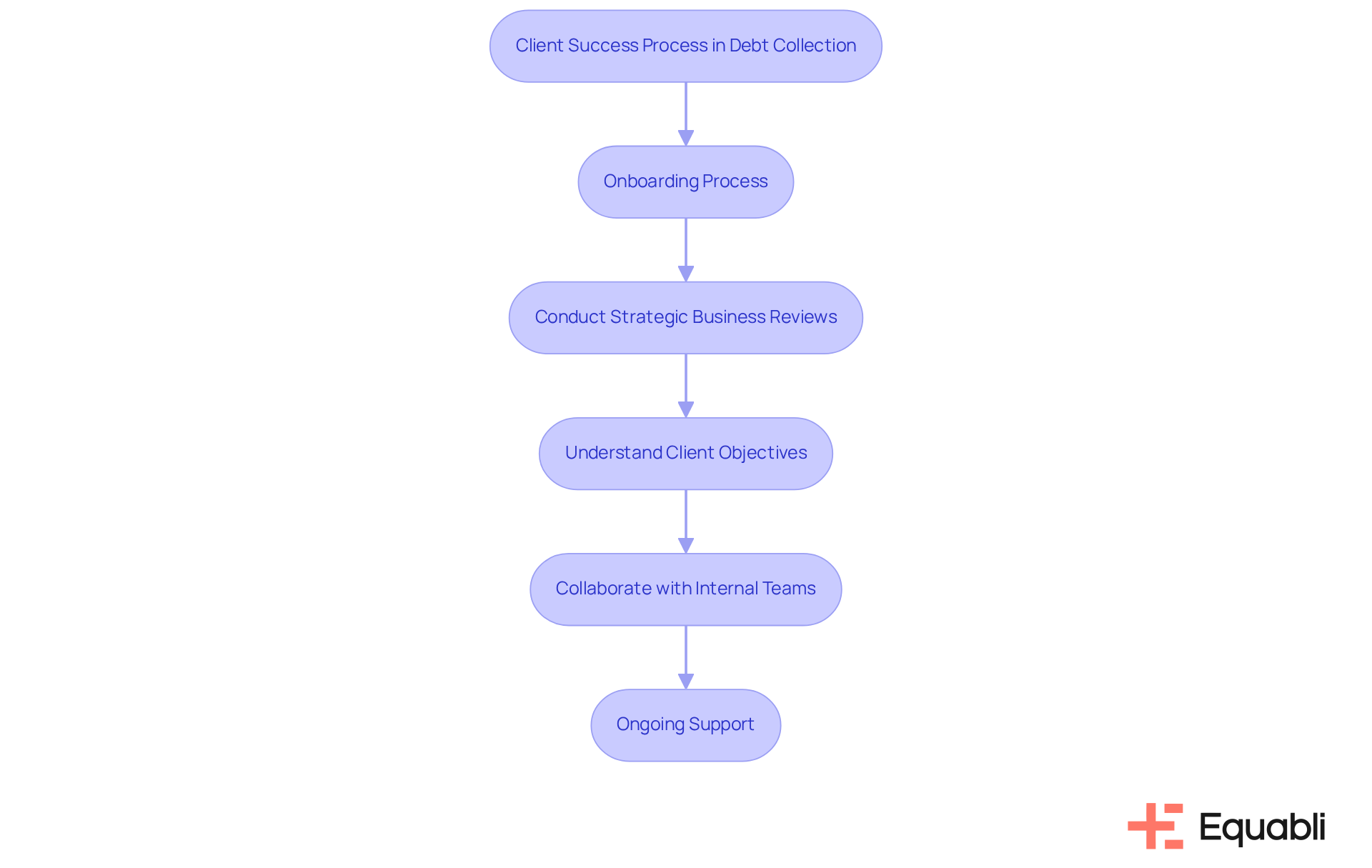

TrueAccord Machine Learning: Personalizing Debt Collection Efforts

Client Success Representatives are pivotal in enhancing client engagement and facilitating product adoption within the realm of modern debt recovery solutions. By spearheading the setup and implementation process during client onboarding, they guarantee a seamless transition from sales to service, thereby cultivating robust relationships from the outset. Their proactive methodology encompasses:

- Conducting strategic business reviews and check-ins, which not only disseminate insights and product usage trends but also pinpoint opportunities for upselling and cross-selling.

- Understanding client objectives and ensuring that the platform meets those needs, which is vital for developing a customized and effective recovery process.

- Collaborating closely with internal teams to enhance the overall customer experience.

As financial organizations increasingly strive to refine their recovery strategies, this company's focus on empowering client success through dedicated support and tailored approaches positions it as a leader in the industry.

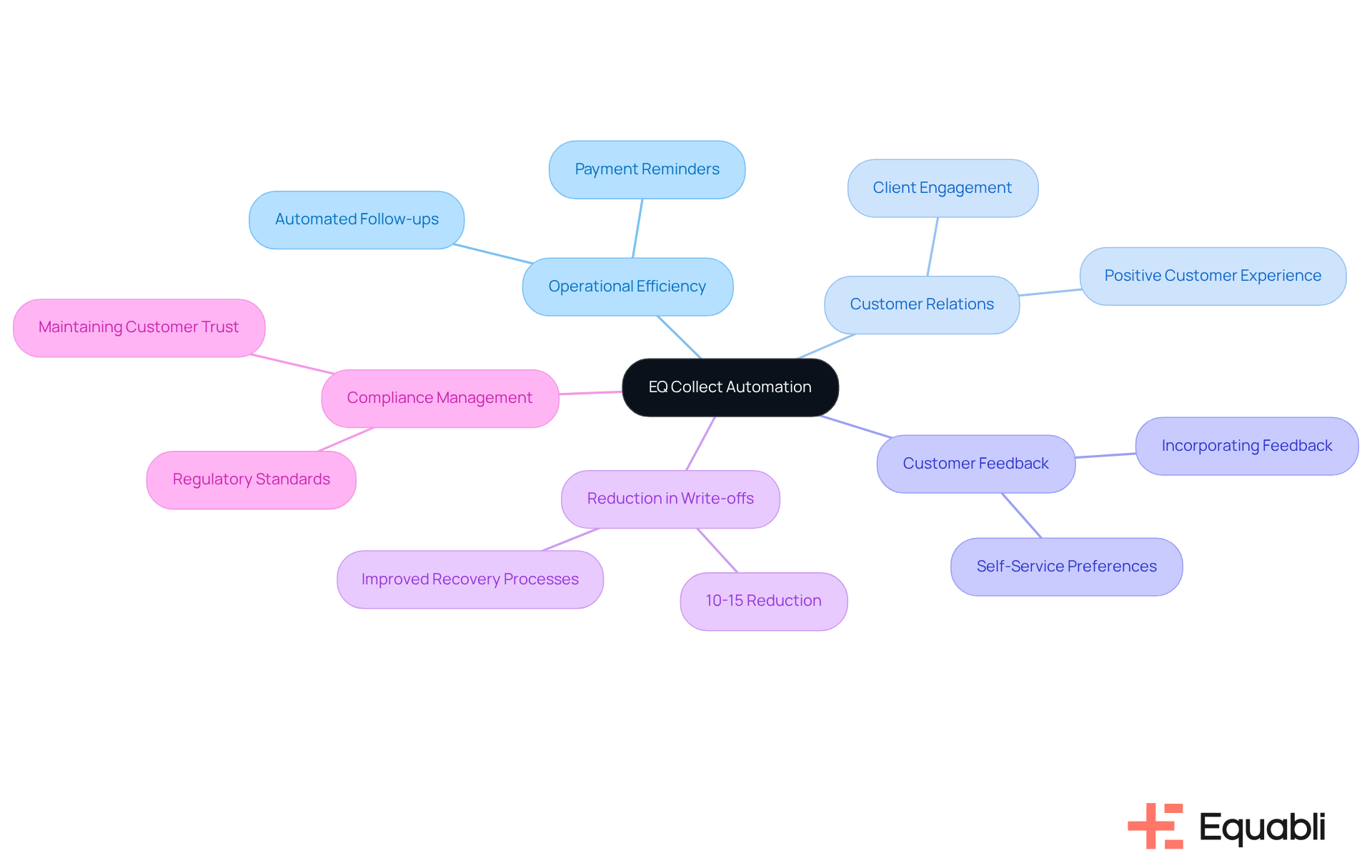

CollectAI Automation: Balancing Efficiency and Customer Relations

Equabli's EQ Collect provides ai-driven debt collection chatbot solutions for financial institutions that effectively balance operational efficiency with customer relations in receivables management. By utilizing ai-driven debt collection chatbot solutions for financial institutions to automate routine tasks such as payment reminders and follow-ups, recovery teams can allocate more time to nurturing relationships with borrowers. This strategy not only enhances operational efficiency but also fosters a more positive customer experience by implementing ai-driven debt collection chatbot solutions for financial institutions.

Furthermore, by incorporating customer feedback and preferences into the automation framework, EQ Collect ensures that its ai-driven debt collection chatbot solutions for financial institutions remain effective while being responsive to borrower needs. Notably, 63% of debtors prefer resolving issues online through self-service portals, emphasizing the necessity of implementing ai-driven debt collection chatbot solutions for financial institutions to adopt a customer-centric approach.

Additionally, the implementation of ai-driven debt collection chatbot solutions for financial institutions has proven capable of reducing poor receivable write-offs by 10-15%, underscoring their effectiveness in refining recovery processes. As financial institutions navigate these changes, compliance management becomes critical, particularly with the integration of ai-driven debt collection chatbot solutions for financial institutions, ensuring that all practices align with regulatory standards while preserving customer trust.

To explore how EQ Collect can and enhance performance, consider booking a call with us today. The role of Client Success Representatives at the company is vital in strengthening client engagement and promoting the adoption of ai-driven debt collection chatbot solutions for financial institutions, ensuring that these institutions fully leverage such innovative solutions.

InDebted Technology: Customer-Centric Strategies for Effective Collections

The company leverages advanced technology to implement customer-centric strategies in debt recovery, utilizing AI-driven debt collection chatbot solutions for financial institutions to enhance the borrower experience while prioritizing data protection.

Utilizing data analytics and machine learning through its EQ Suite—comprising the EQ Engine, EQ Engage, and EQ Collect—the company tailors its retrieval efforts to align with individual borrower preferences and behaviors. This strategy not only boosts recovery rates, as evidenced by a 27% increase in recoveries attributed to analytics, but also fosters trust and loyalty among borrowers.

With functionalities such as , real-time reporting, and industry-leading compliance oversight, the platform empowers financial institutions to manage their receivables efficiently and transparently, utilizing AI-driven debt collection chatbot solutions for financial institutions.

As financial institutions increasingly recognize the importance of customer relationships, Equabli's AI-driven debt collection chatbot solutions for financial institutions provide a compelling model for effective receivable management, demonstrating how modern solutions can transform traditional practices into more compassionate and efficient processes.

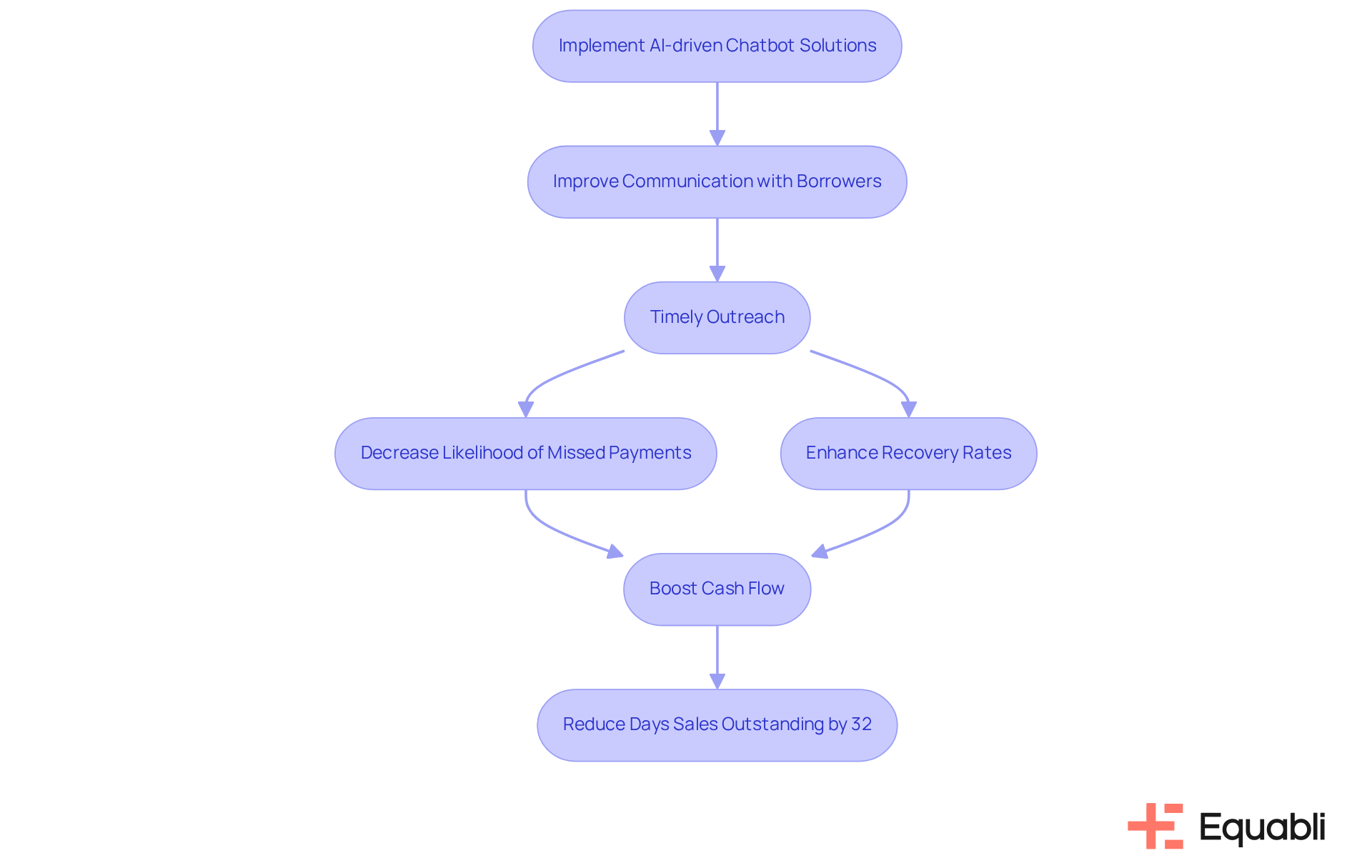

Dunning Automation: Insights for Optimizing Debt Recovery

Dunning automation, particularly through ai-driven debt collection chatbot solutions for financial institutions, is essential for optimizing debt recovery by improving communication with borrowers regarding overdue payments. Evidence suggests that financial institutions can achieve timely and consistent outreach by implementing ai-driven debt collection chatbot solutions for financial institutions, thereby significantly diminishing the likelihood of missed payments. This proactive approach not only enhances recovery rates but also bolsters cash flow by minimizing delays in payment retrieval.

Furthermore, with Equabli's EQ Suite, the use of ai-driven debt collection chatbot solutions for financial institutions provides tailored messages that encourage debtor cooperation and lower delinquency rates, thereby increasing the effectiveness of the dunning process. As organizations refine their financial recovery strategies, efficient dunning automation becomes vital for achieving sustainable outcomes.

Research indicates that automating the dunning process can lead to a potential 32% reduction in days sales outstanding within a year, as highlighted by industry studies. This underscores the importance of in maximizing recovery efficiency. Additionally, as ethical debt recovery strategies gain traction, integrating these considerations into automated processes will further enhance trust and compliance within the collections landscape.

Conclusion

The integration of AI-driven debt collection chatbot solutions is fundamentally transforming the financial sector, equipping institutions with essential tools to enhance their recovery processes. By adopting advanced technologies, financial organizations can modernize their strategies, streamline operations, and improve customer interactions, thereby achieving higher recovery rates and reduced operational costs.

Innovative solutions such as the Equabli EQ Suite, FICO Debt Collection Analytics, and ScienceSoft's automated systems exemplify this shift. These platforms leverage machine learning and predictive analytics to optimize collection strategies, ensure compliance, and enhance borrower experiences. The deployment of these AI-driven tools not only promotes efficient account management but also encourages a more empathetic approach to debt recovery, which is vital for maintaining customer trust.

As the debt collection landscape evolves, financial institutions must embrace these intelligent solutions to remain competitive. The adoption of AI-driven debt collection chatbot solutions is not merely a trend; it is an imperative for organizations seeking to enhance operational efficiency while prioritizing customer relationships. The future of debt recovery hinges on leveraging technology to foster a more responsive, data-informed, and customer-centric approach, ensuring sustainable success in the financial recovery domain.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a transformative platform designed for financial organizations to enhance receivable recovery methodologies using advanced technology, including tools like EQ Engine, EQ Engage, and EQ Collect.

What features does EQ Collect include?

EQ Collect features a no-code file-mapping tool for faster vendor onboarding, automated workflows to reduce execution errors, and real-time reporting for enhanced transparency and insights.

How does the EQ Suite improve debt recovery rates?

The EQ Suite integrates custom scoring models that help lenders predict repayment behaviors, potentially reducing loan delinquencies by over 25% and bad financial obligations by up to 20%.

What role does AI play in the EQ Suite?

AI is utilized to modernize debt collection strategies, including the implementation of AI-driven debt collection chatbot solutions, which streamline operations and improve borrower interactions.

How does EQ Engage enhance the borrower experience?

EQ Engage provides self-service repayment options, allowing borrowers to manage their obligations through personalized repayment plans and preferred communication channels.

What is the purpose of the FICO Debt Collection Analytics?

FICO Debt Collection Analytics enhances strategy with predictive scoring by analyzing historical data and borrower behavior to identify accounts likely to pay and those needing more intensive recovery efforts.

How does the EQ Suite ensure compliance?

The EQ Suite offers top-tier compliance oversight and is designed to adapt to evolving regulatory standards, ensuring that organizations remain compliant while improving operational efficiency.

What benefits do AI-driven debt collection chatbots provide?

AI-driven debt collection chatbots streamline processes, automate tasks like payment reminders and follow-ups, and allow recovery teams to focus on more complex interactions, enhancing operational efficiency.

What support does the company provide for transitioning to the EQ Suite?

The company offers an expert team and a customized launch strategy to ensure a seamless transition to the advanced, cloud-based systems of the EQ Suite.

Why is the EQ Suite considered vital for modern debt collection?

The EQ Suite is vital for modernizing debt collection practices by facilitating a shift from traditional methods to data-driven strategies, meeting the needs of contemporary lenders and recovery agencies.