Overview

The article examines four credit recovery solutions that enhance enterprise risk management by strengthening financial health through effective debt collection strategies. It substantiates this by detailing practices such as:

- Account segmentation

- Personalized communication

- The utilization of technology

These approaches can significantly mitigate financial losses and enhance cash flow for organizations, thereby underscoring their relevance in the current regulatory landscape.

Introduction

In the intricate realm of enterprise risk management, the importance of credit recovery is paramount. Organizations face significant financial implications from delinquent accounts, making effective credit collection strategies essential for enhancing cash flow and minimizing losses. Navigating the complexities of credit recovery, however, requires a steadfast commitment to compliance and ethical practices.

How can businesses harness innovative solutions to recover debts while strengthening their overall risk management framework? This article examines four critical credit recovery solutions that empower enterprises to confront these challenges directly, fostering improved financial stability and operational resilience.

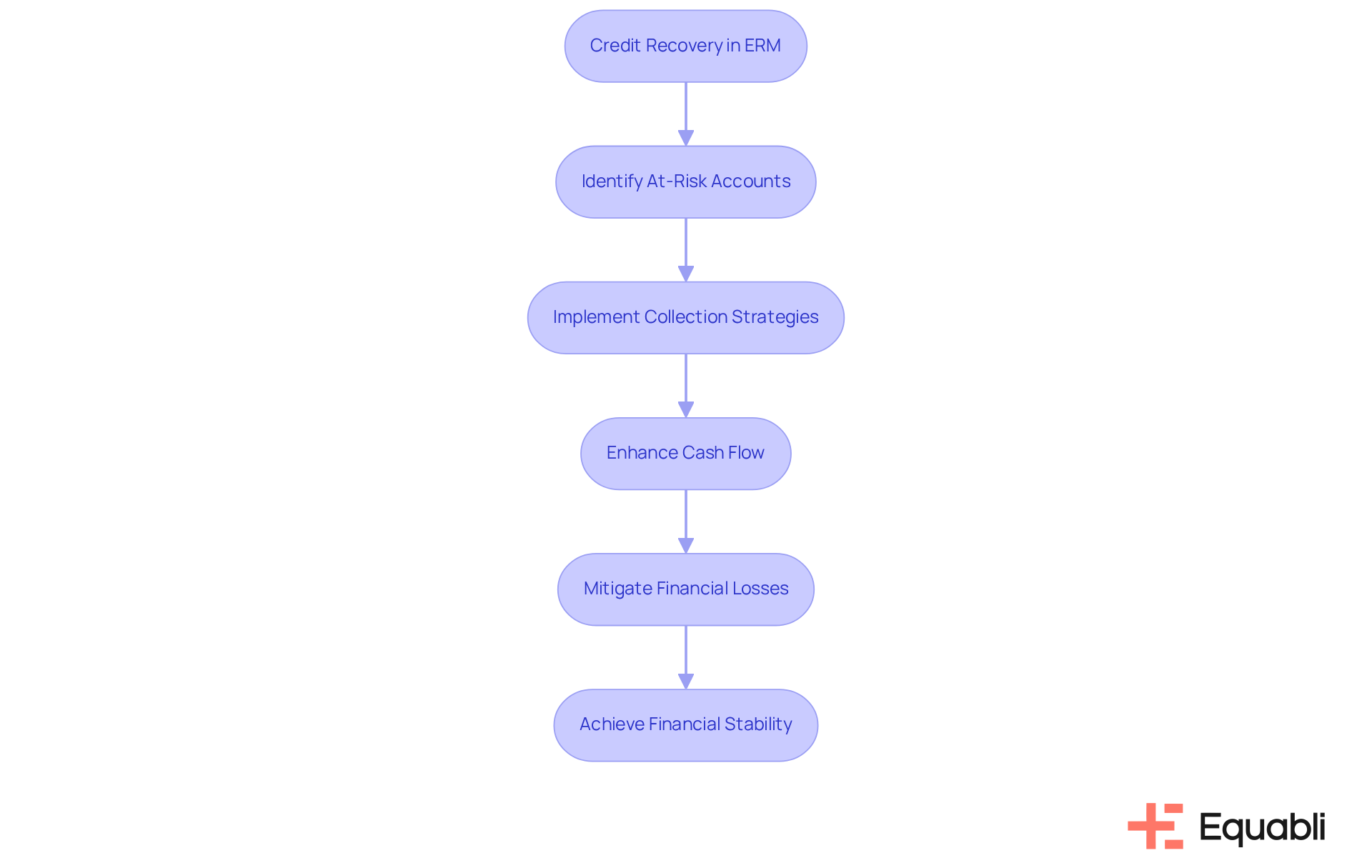

Understand the Role of Credit Recovery in Enterprise Risk Management

Credit restoration plays a crucial role in enterprise risk management (ERM), significantly impacting the financial health of organizations by addressing delinquent accounts. Effective credit collection strategies not only enhance cash flow but also mitigate the risk of financial losses. By proactively identifying at-risk accounts, businesses can implement timely interventions that prevent defaults, leading to a notable reduction in write-offs. For instance, financial institutions employing a proactive credit retrieval strategy have reported significant improvements in their risk profiles, with some banks achieving up to a 10% decrease in loan charge-offs through data-driven collection methods.

Incorporating credit recovery solutions for enterprise risk management strategies within ERM frameworks allows entities to promptly address emerging risks, thereby enhancing financial stability and operational resilience. As the landscape of credit management evolves, prioritizing credit recovery solutions for enterprise risk management strategies becomes essential for companies aiming to safeguard their financial future.

Equabli's EQ Collect offers advanced features that enhance debt recovery efficiency, such as a no-code file-mapping tool that expedites vendor onboarding timelines and automated workflows that reduce execution errors.

By leveraging data-informed approaches, EQ Collect empowers entities to improve collections and optimize net present value (NPV) in debt retrieval, particularly for late-stage accounts. Additionally, EQ Collect provides an intuitive, scalable, cloud-based interface, real-time reporting, and top-tier compliance supervision, ensuring that entities can navigate the complexities of credit restoration with confidence. Recognizing the interconnectedness of businesses and the risks associated with is vital for effective credit management.

Implement Effective Strategies for Credit Recovery

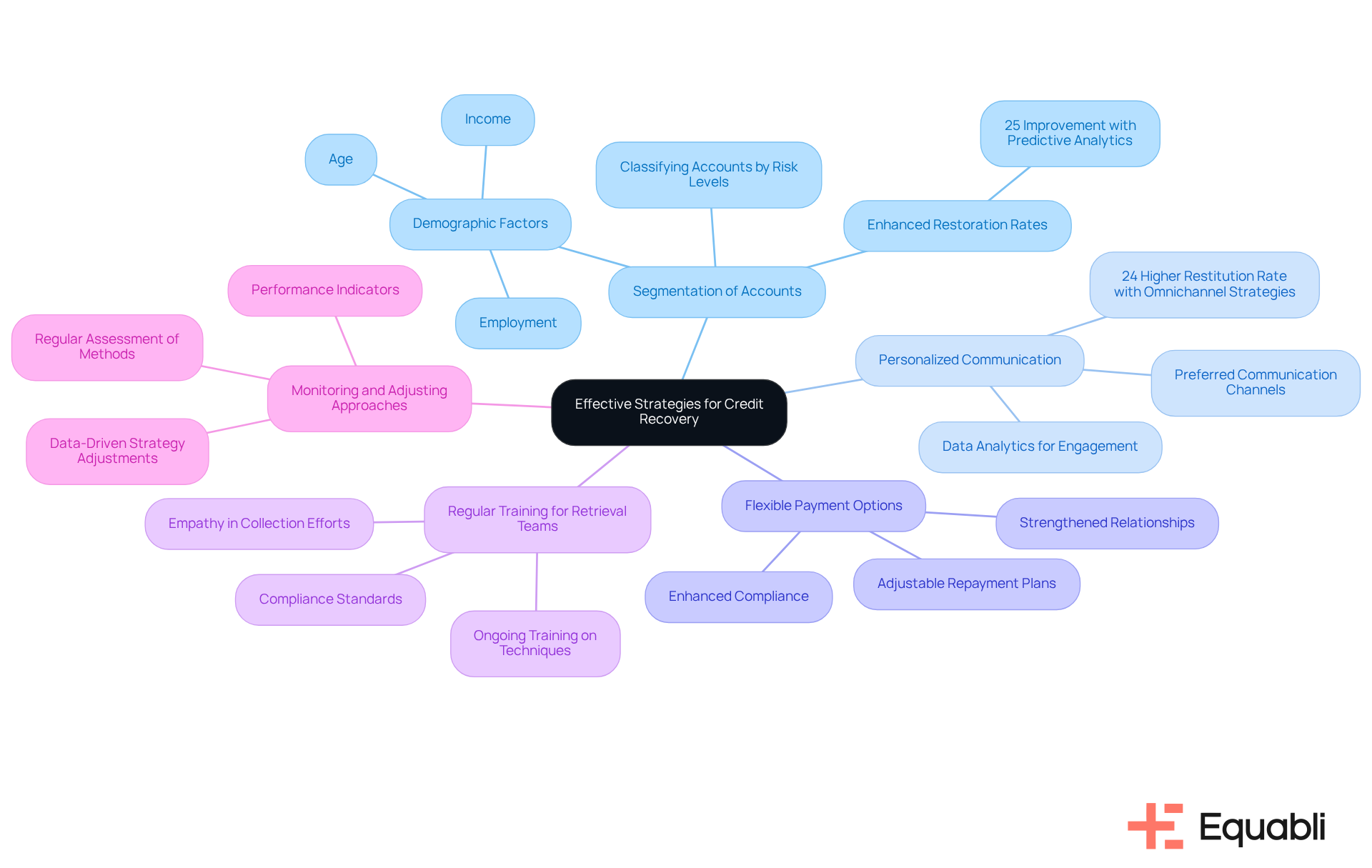

To implement effective credit recovery strategies, organizations should focus on several key practices:

- Segmentation of Accounts: Classifying accounts according to risk levels and demographic factors—such as age, income, and employment—is vital for customizing collection approaches. High-risk accounts necessitate more assertive follow-up techniques, whereas lower-risk accounts can be addressed with gentler methods. This focused strategy can yield a 25% enhancement in restoration rates when predictive analytics and behavioral scoring models are employed. Utilizing Equabli's EQ Engine allows entities to anticipate the risk of delinquency in active accounts, facilitating the development of that further improve collection efforts.

- Personalized Communication: Engaging debtors through their preferred communication channels significantly increases the likelihood of repayment. By leveraging data analytics to understand debtor preferences, organizations can enhance engagement and foster a more positive repayment experience. Businesses that employ omnichannel strategies report a 24% higher restitution rate compared to those relying solely on single-channel approaches. Equabli's intelligent automation solutions streamline this process, ensuring communication is both timely and effective.

- Flexible Payment Options: Offering adjustable repayment plans can significantly boost collection rates. Allowing debtors to select payment terms that align with their financial situations not only enhances compliance but also strengthens the relationship between the institution and the debtor, fostering long-term trust. Insights indicate that flexible repayment choices can lead to improved return outcomes, particularly when supported by predictive analytics that inform the best options for each debtor.

- Regular Training for Retrieval Teams: Ongoing training ensures that retrieval teams are well-informed about the latest techniques and compliance standards, enhancing their efficiency in collection efforts. A knowledgeable team is better equipped to handle diverse debtor situations with empathy and understanding, which is essential in today’s regulatory environment, especially with the FCA's Consumer Duty regulation effective in 2023. This regulation underscores the need for fair treatment of customers, making it crucial for collection teams to be trained in ethical practices and compliance.

- Monitoring and Adjusting Approaches: Regularly assessing revitalization methods based on performance indicators enables organizations to adapt to changing conditions and enhance results. This proactive approach allows for timely modifications that can lead to more efficient debt collection processes, ultimately safeguarding revenue and improving customer relations. Employing predictive analytics, facilitated by Equabli's solutions, can illustrate how data-driven strategies yield improved outcomes.

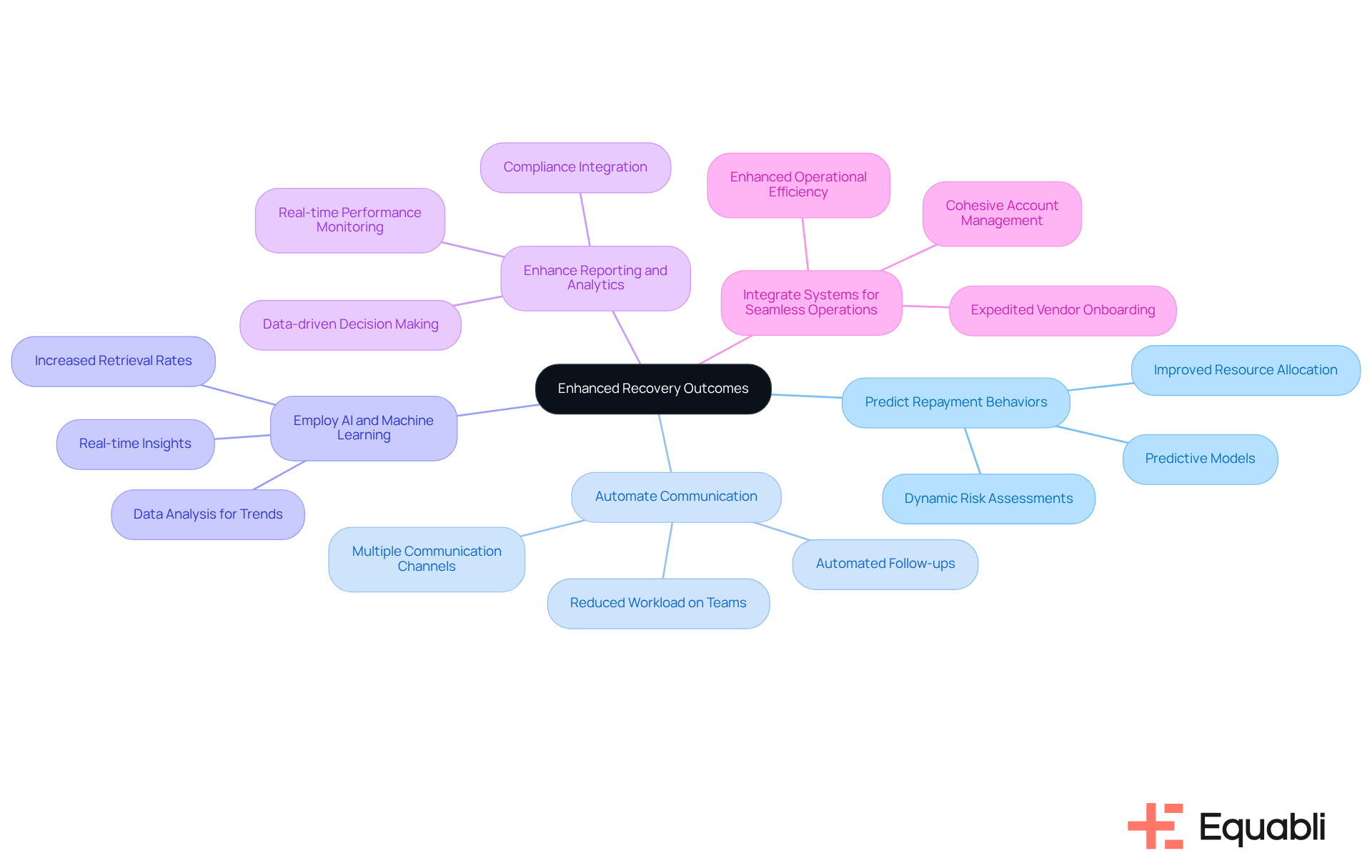

Leverage Technology and Data Analytics for Enhanced Recovery Outcomes

In today's digital environment, leveraging technology and data analytics is crucial for enhancing credit collection outcomes. Organizations can harness advanced analytics to:

- Predict Repayment Behaviors: By analyzing historical data, organizations can create predictive models that accurately identify debtors most likely to repay. This targeted strategy enables more effective restoration efforts, with studies indicating that predictive analytics can significantly enhance the precision of repayment likelihood forecasting. Furthermore, predictive models can prioritize accounts based on dynamic risk assessments, ensuring effective resource allocation.

- Automate Communication: The implementation of automated communication tools streamlines follow-ups and reminders, guaranteeing that debtors receive timely notifications. This approach not only alleviates the workload on collection teams but also enhances debtor engagement, as modern consumers prefer multiple communication channels for debt collection. EQ Collect optimizes this process with automated workflows that minimize execution errors and reduce reliance on manual resources, ensuring effective communication.

- Employ AI and Machine Learning: AI-powered tools analyze large volumes of data to identify trends and refine improvement strategies. Agencies that utilize AI for predictive analytics have reported a 25% increase in retrieval rates, underscoring the effectiveness of these technologies in enhancing operational efficiency. EQ Collect employs smart automation and machine learning solutions to transform debt collection, enabling entities to adapt their strategies based on real-time insights. Nonetheless, it is vital to consider the ethical implications of AI-driven debt collections, including the avoidance of bias and the necessity for transparency in decision-making processes.

- Enhance Reporting and Analytics: Robust reporting tools provide insights into recovery performance, empowering entities to make data-driven decisions. Tools such as Qlik or Tableau deliver into key performance indicators, facilitating continuous refinement of strategies based on actionable insights. Additionally, EQ Collect offers unparalleled transparency and insights with real-time reporting, integrating compliance-focused technologies to assist organizations in adhering to regulatory requirements while driving efficiency in collections.

- Integrate Systems for Seamless Operations: The integration of credit restoration tools with existing financial systems ensures a cohesive approach to account management. This integration not only enhances operational efficiency but also incorporates credit recovery solutions for enterprise risk management strategies, fostering a more effective restoration environment. With EQ Collect's user-friendly, no-code file-mapping tool, companies can expedite vendor onboarding timelines and ensure more intelligent orchestration of their processes.

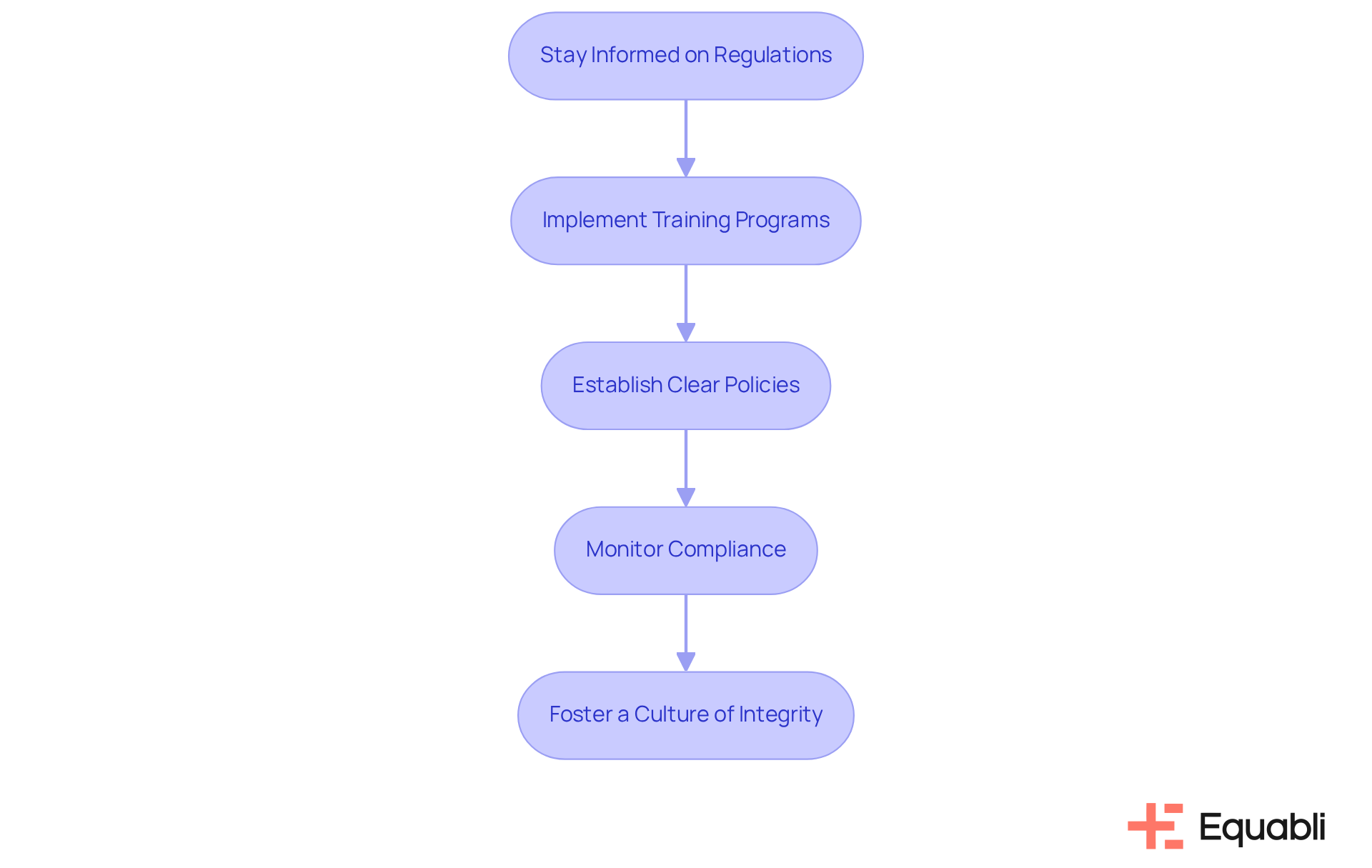

Ensure Compliance and Ethical Practices in Credit Recovery

Compliance and ethical practices are essential in credit recovery, safeguarding both the organization and its clients. Organizations must:

- Stay Informed on Regulations: It is crucial to regularly update policies to reflect the evolving laws and regulations governing debt recovery, such as the Fair Debt Recovery Practices Act (FDCPA). This ensures that organizations remain compliant and mitigate legal risks.

- Implement Training Programs: Conducting training sessions for retrieval staff on compliance and ethical standards is vital. Such programs ensure that all team members comprehend their responsibilities, fostering a knowledgeable workforce that adheres to best practices.

- Establish Clear Policies: Developing and communicating transparent guidelines regarding retrieval practices is imperative. This ensures that all actions taken are fair and respectful to debtors, thereby enhancing the organization’s credibility and operational integrity.

- Monitor Compliance: Regular audits of collection practices are necessary to ensure adherence to legal and ethical standards. Promptly addressing any identified issues mitigates risks and reinforces a commitment to compliance.

- Foster a Culture of Integrity: Encouraging a culture that prioritizes ethical behavior in all debtor interactions enhances the organization’s reputation and fosters long-term relationships. This strategic focus on integrity can lead to in debt recovery efforts.

Conclusion

Incorporating effective credit recovery solutions into enterprise risk management is essential for safeguarding an organization's financial health. By addressing delinquent accounts proactively, businesses can significantly reduce financial losses and improve overall cash flow. The integration of advanced technologies and data analytics not only streamlines the credit recovery process but also enhances the precision of debt collection strategies, ensuring that organizations can navigate the complexities of credit risks with greater confidence.

Key strategies for successful credit recovery include:

- Account segmentation

- Personalized communication

- Flexible payment options

- Ongoing training for retrieval teams

These practices, supported by technology such as AI and machine learning, empower organizations to predict repayment behaviors and automate communication, leading to improved recovery outcomes. Furthermore, maintaining compliance with evolving regulations and fostering a culture of ethical practices is crucial in building trust and credibility with clients, ultimately reinforcing the effectiveness of credit recovery efforts.

As businesses look towards the future, prioritizing credit recovery solutions within their risk management frameworks is not just a best practice—it's a necessity. Organizations that embrace these strategies and leverage technology will be better equipped to mitigate risks and enhance their financial stability. The commitment to ethical and compliant practices in credit recovery will not only protect the organization but also contribute to a more resilient and trustworthy financial landscape.

Frequently Asked Questions

What is the role of credit recovery in enterprise risk management (ERM)?

Credit recovery plays a crucial role in ERM by addressing delinquent accounts, enhancing cash flow, and mitigating the risk of financial losses for organizations.

How do effective credit collection strategies impact financial health?

Effective credit collection strategies improve cash flow and reduce the risk of financial losses by proactively identifying at-risk accounts and implementing timely interventions to prevent defaults.

What improvements have financial institutions seen by employing proactive credit retrieval strategies?

Financial institutions using proactive credit retrieval strategies have reported significant improvements in their risk profiles, with some banks achieving up to a 10% decrease in loan charge-offs through data-driven collection methods.

Why is it essential to incorporate credit recovery solutions within ERM frameworks?

Incorporating credit recovery solutions within ERM frameworks allows organizations to promptly address emerging risks, enhancing their financial stability and operational resilience.

What features does Equabli's EQ Collect offer for debt recovery?

EQ Collect offers advanced features such as a no-code file-mapping tool for expedited vendor onboarding, automated workflows to reduce execution errors, real-time reporting, and top-tier compliance supervision.

How does EQ Collect improve collections for late-stage accounts?

EQ Collect leverages data-informed approaches to improve collections and optimize net present value (NPV) in debt retrieval, particularly for late-stage accounts.

Why is it important to recognize the interconnectedness of businesses in credit management?

Recognizing the interconnectedness of businesses and the risks associated with increasing supplier defaults is vital for effective credit management, as it helps organizations navigate potential financial challenges.