Overview

The article presents an analysis of seven AI-driven debt collection software solutions tailored for financial institutions, emphasizing their effectiveness in enhancing operational efficiency, compliance, and borrower engagement. Each solution, including EQ Suite and Gaviti, employs automation and data-driven methodologies to optimize debt recovery processes. This strategic approach not only improves recovery rates but also significantly reduces operational costs, positioning these tools as essential in today’s competitive financial landscape.

Introduction

The landscape of debt collection is rapidly evolving, driven by technological advancements that are reshaping traditional practices. Financial institutions now have access to a suite of AI-driven debt collection software solutions that not only enhance operational efficiency but also improve borrower engagement and compliance. However, with an abundance of options available, organizations must discern which tools will truly optimize their debt recovery processes and meet the demands of an increasingly complex regulatory environment. This article delves into seven cutting-edge solutions that promise to transform the approach of financial institutions toward debt collection, offering insights into their unique features and benefits.

Equabli: Intelligent EQ Suite for Data-Driven Debt Recovery

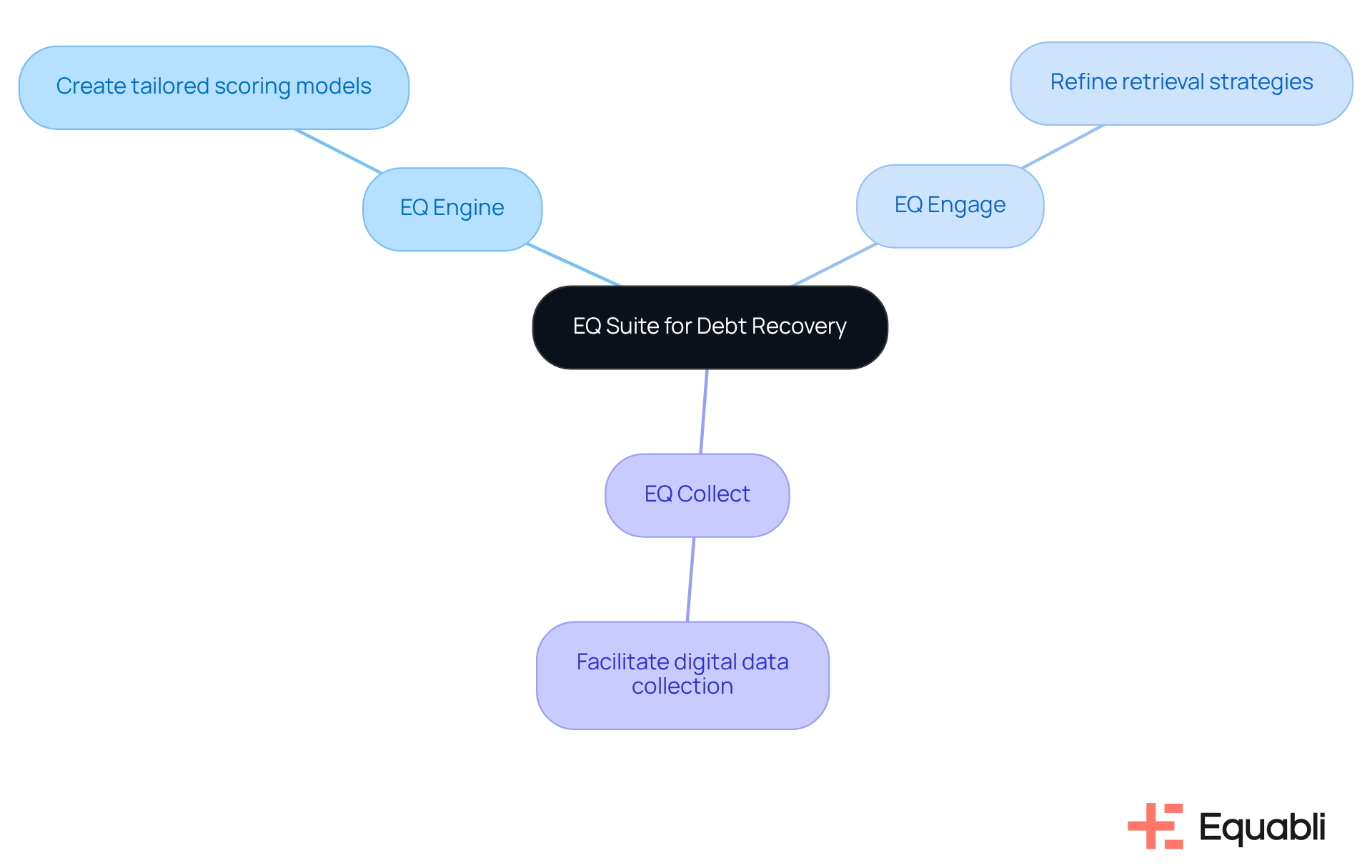

The EQ Suite represents a strategic advancement in debt recovery by leveraging AI-driven debt collection software solutions for enterprise financial institutions while emphasizing data protection. This comprehensive platform includes tools such as EQ Engine, EQ Engage, and EQ Collect, which empower financial institutions to:

- Create tailored scoring models

- Refine retrieval strategies

- Facilitate digital data collection

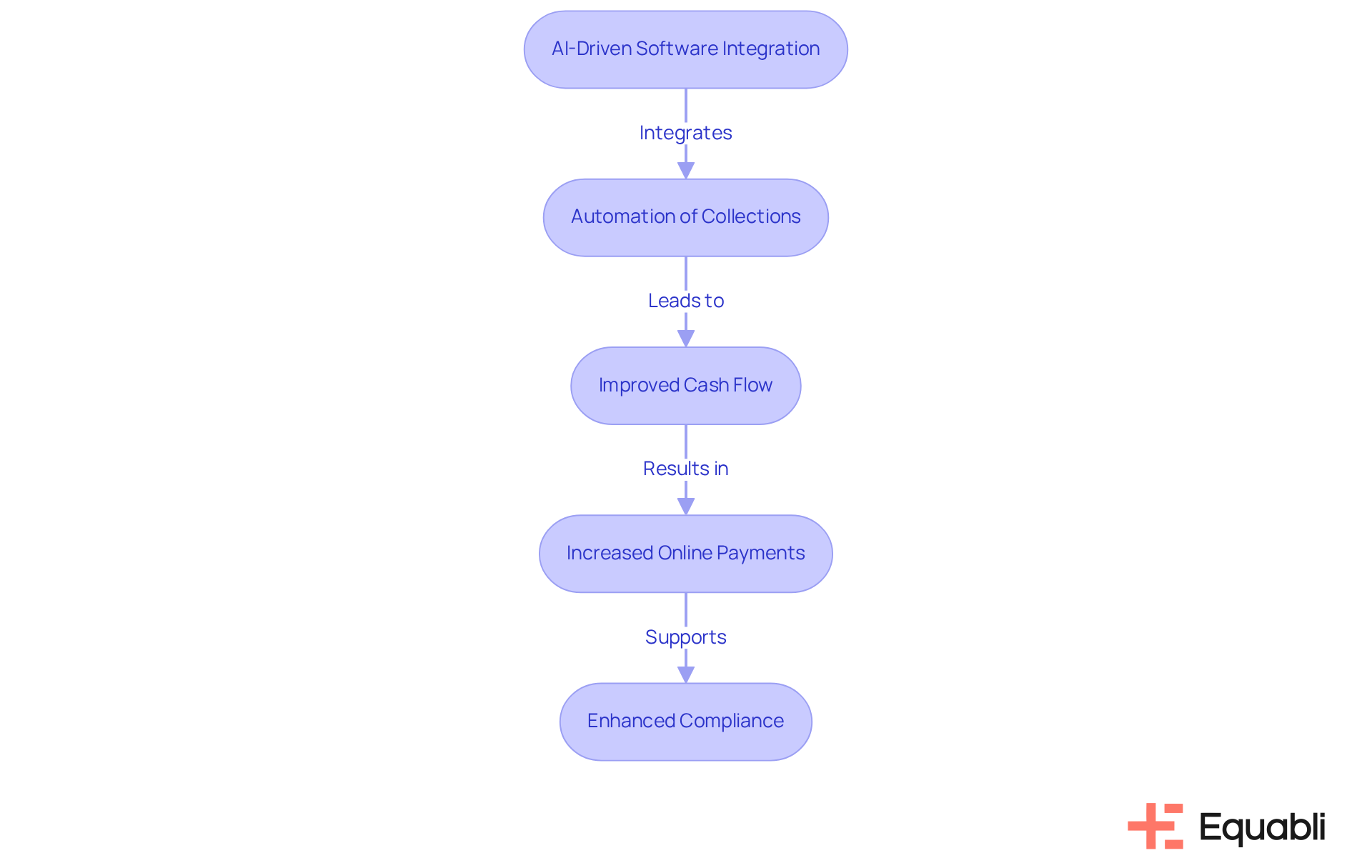

With capabilities like automated workflows, real-time reporting, and compliance oversight, the EQ Suite significantly enhances . By automating processes and adhering to industry-leading compliance standards, the platform offers AI-driven debt collection software solutions for enterprise financial institutions, enabling clients to reduce operational costs and bolster data security, thereby reinforcing its position as a frontrunner in modern debt recovery solutions.

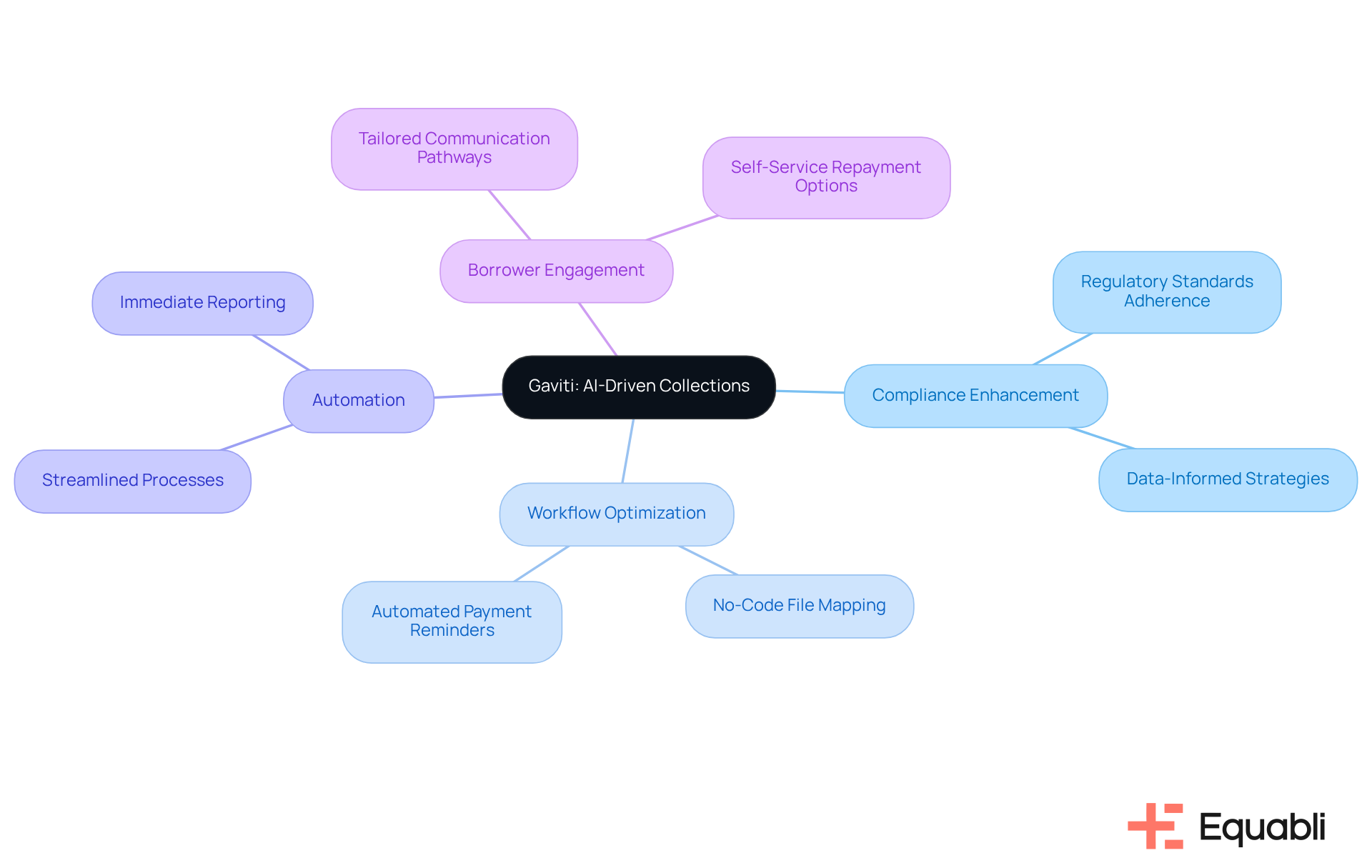

Gaviti: AI-Driven Collections for Enhanced Compliance and Workflow Optimization

The company offers ai-driven debt collection software solutions for enterprise financial institutions that are designed to enhance compliance and streamline processes. Its platform, EQ Collect, features a no-code file-mapping tool that simplifies vendor onboarding and automates key processes such as payment reminders. This functionality enables organizations to manage their receivables efficiently while adhering to regulatory standards.

By employing data-informed strategies and providing immediate reporting, the company supports clients in improving recovery rates and reducing manual errors, positioning itself as a valuable resource in modern financial recovery through ai-driven debt collection software solutions for enterprise financial institutions.

Furthermore, EQ Engage enhances borrower interactions through tailored communication pathways and self-service repayment options, thereby optimizing the overall recovery process.

To explore how our solution can , we invite you to schedule a call today.

Kolleno: User-Friendly Debt Collection Software with Automation Features

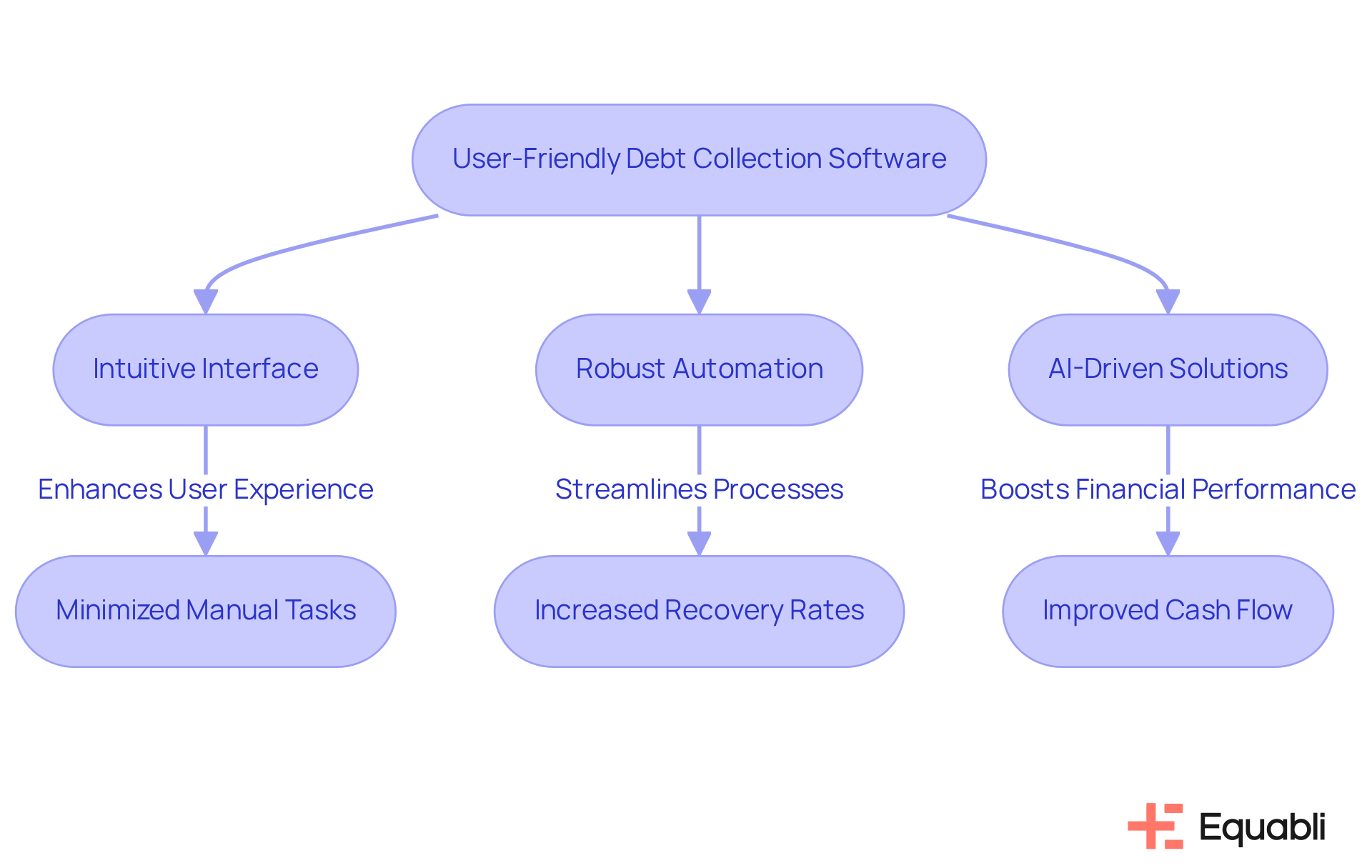

The company emphasizes user experience through its intuitive interface, which . Its robust automation capabilities simplify the process, covering aspects from sending timely reminders to efficiently tracking payments. By minimizing manual tasks, the company empowers teams to concentrate on strategic initiatives, significantly enhancing recovery rates and overall operational efficiency. Notably, the implementation of AI-driven debt collection software solutions for enterprise financial institutions has demonstrated a reduction in days sales outstanding (DSO) and an improvement in client retention rates, thereby bolstering cash flow. Success stories indicate that organizations leveraging AI-driven debt collection software solutions for enterprise financial institutions have achieved recovery rates as high as 90%, underscoring the effectiveness of these solutions in transforming receivable management processes. As articulated by the company, 'Our intelligent credit management solution illustrates how these tools can protect revenue retrieval while fostering strong client relationships.

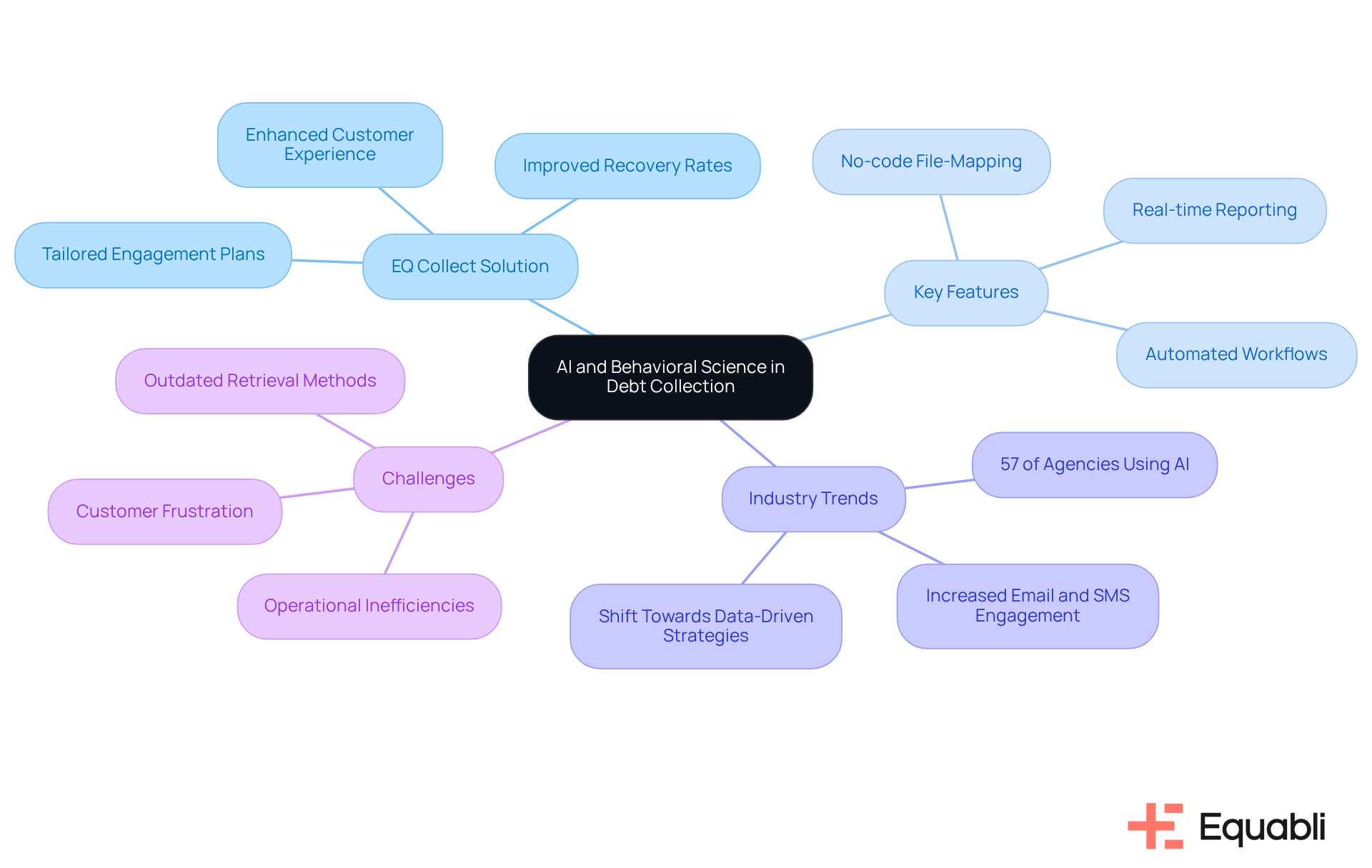

Symend: AI and Behavioral Science for Optimized Collection Outcomes

Equabli utilizes AI-driven debt collection software solutions for enterprise financial institutions, leveraging AI and behavioral science to optimize debt recovery outcomes through its EQ Collect solution. By meticulously analyzing customer behavior and preferences, EQ Collect formulates tailored engagement plans that effectively motivate past-due customers to take action. This not only significantly improves recovery rates but also enhances the overall customer experience.

Key features of AI-driven debt collection software solutions for enterprise financial institutions include:

- A no-code file-mapping tool that expedites vendor onboarding timelines

- Automated workflows that reduce execution errors

- Unparalleled visibility through real-time reporting

These features enable financial institutions to increase efficiency and drive revenue growth. Notably, 57% of debt recovery agencies are employing AI for account segmentation and predictive analytics, highlighting the rising trend towards data-driven methodologies within the industry.

Financial institutions face increasing challenges from outdated retrieval methods that often lead to customer frustration and operational inefficiencies. The methodology employed by EQ Collect aligns with the necessity for a modern, proactive approach to receivables, as evidenced by the success story 'Smarter Collections: A Data-Driven, Customer-Centric Approach,' which illustrates how banks can improve borrower retention and optimize recovery efforts through personalized engagement using AI-driven debt collection software solutions for enterprise financial institutions.

Furthermore, industry experts assert that institutions prioritizing compliance and customer trust will not only mitigate legal risks but also distinguish themselves from competitors. For financial organizations seeking to modernize their processes, adopting innovative strategies from this company can yield superior outcomes and enhance the customer experience.

HighRadius: Seamless Integration for Streamlined Accounts Receivable Management

This company provides ai-driven debt collection software solutions for enterprise financial institutions, offering a robust platform for accounts receivable management and facilitating seamless integration with existing financial systems. This integration empowers organizations to , effectively track payments, and enhance customer communications. By streamlining these operations, the company significantly improves cash flow and reduces days sales outstanding (DSO).

Evidence of the effectiveness of this automation is evident, with agencies reporting a 33% increase in online payments over the past three years, underscoring the success of digital engagement strategies. Furthermore, case studies illustrate that organizations leveraging these solutions have successfully transitioned to data-driven compliance strategies, resulting in improved retrieval outcomes and heightened operational efficiency.

As financial institutions increasingly embrace ai-driven debt collection software solutions for enterprise financial institutions, the positive impact on cash flow management becomes clear, allowing for more agile responses to evolving market conditions and consumer expectations. The organization is committed to safeguarding client information, ensuring that all interactions comply with a stringent privacy policy that prioritizes data security and regulatory adherence.

This dedication is further supported by our client success representatives, who bolster client engagement and foster product adoption, ensuring that financial institutions can fully capitalize on the benefits of our ai-driven debt collection software solutions for enterprise financial institutions.

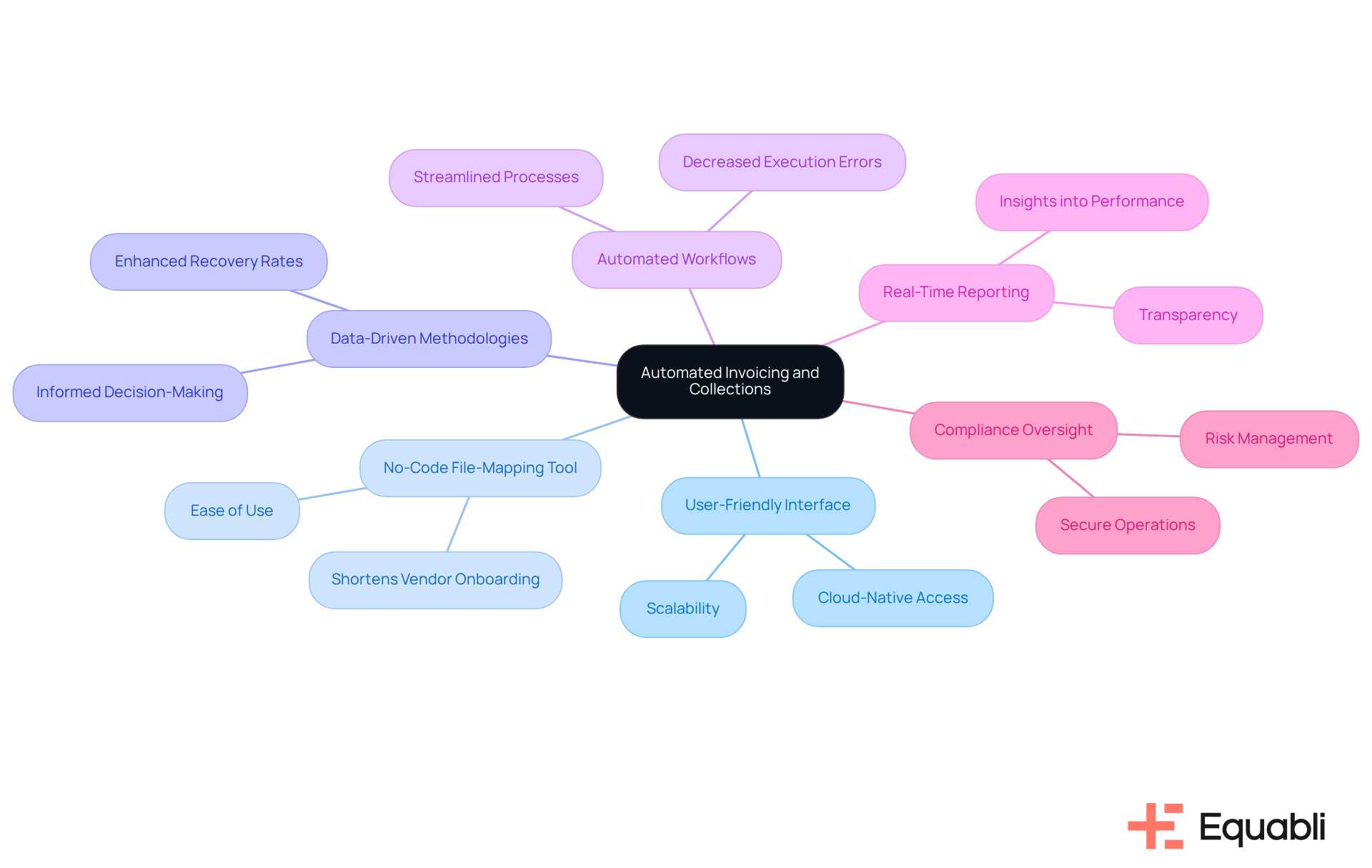

Invoiced: Automated Invoicing and Collections for Cost Reduction

Equabli specializes in providing ai-driven debt collection software solutions for enterprise financial institutions, a solution that markedly reduces operational expenses associated with invoicing and receivables. The platform streamlines the invoicing process, encompassing everything from invoice generation to payment tracking and reminder dispatch. By minimizing manual tasks, Equabli empowers organizations to focus on strategic initiatives, ensuring timely receivables and improved cash flow.

With EQ Collect, financial institutions can further through ai-driven debt collection software solutions for enterprise financial institutions. Key features include:

- A user-friendly, scalable, cloud-native interface

- A no-code file-mapping tool that shortens vendor onboarding timelines

- Data-driven methodologies that bolster recoveries

- Automated workflows that decrease execution errors

- Real-time reporting that offers unparalleled transparency and insights

- Leading compliance oversight that guarantees secure operations

This comprehensive strategy transforms debt recovery by utilizing ai-driven debt collection software solutions for enterprise financial institutions, which harness machine learning and automation to optimize net present value (NPV) and enhance recovery efficiency. The integration of these advanced technologies not only streamlines operations but also positions organizations to navigate the complexities of compliance and risk management effectively.

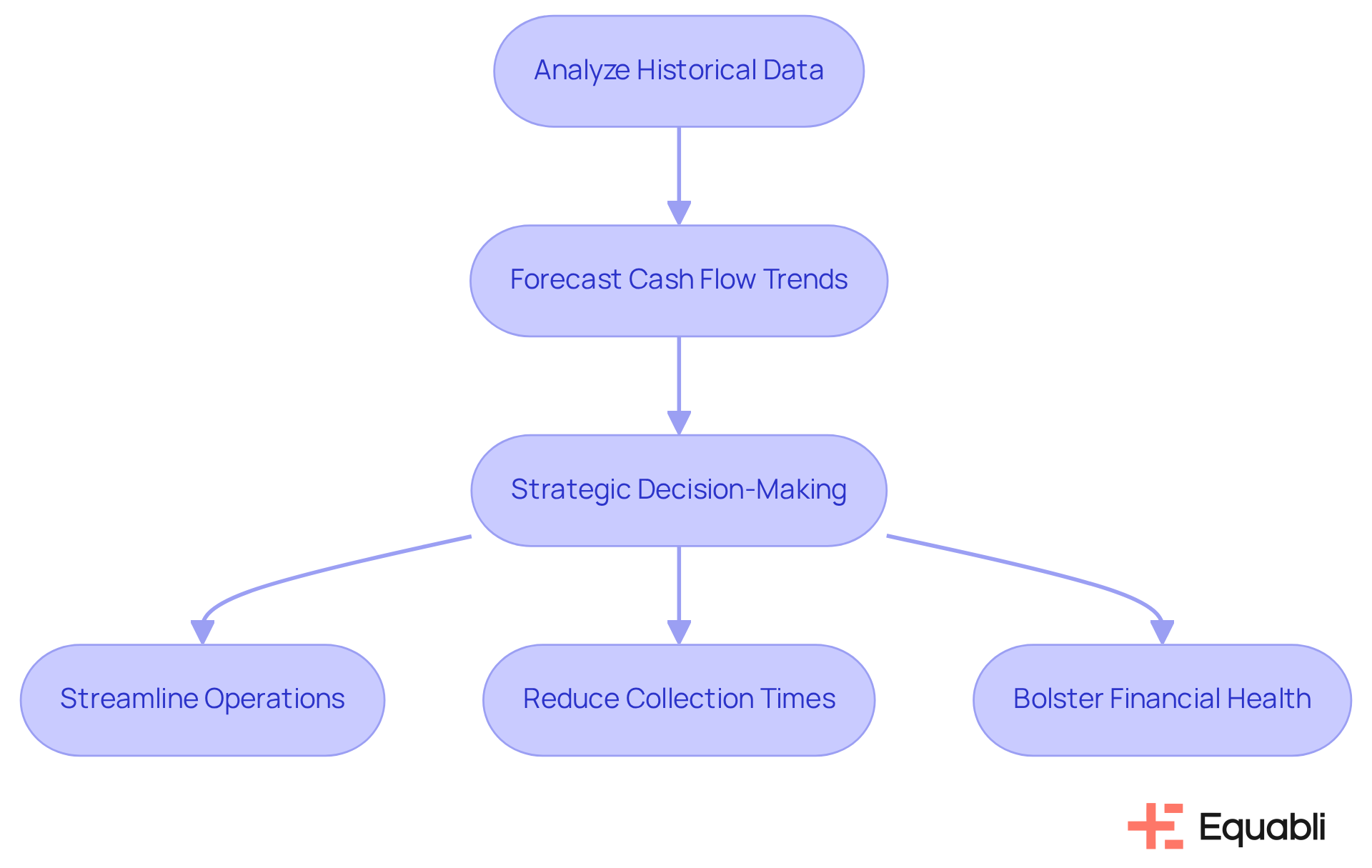

Tesorio: Predictive Analytics for Informed Cash Flow Management

Tesorio leverages predictive analytics to provide financial institutions with real-time insights into cash flow management. By meticulously analyzing historical data and payment behaviors, Tesorio enables organizations to accurately forecast cash flow trends. This capability empowers clients to make regarding receivables and payments, enhancing their financial strategies and improving liquidity.

Case studies from Tesorio demonstrate how institutions have effectively harnessed these insights to:

- Streamline operations

- Reduce collection times

- Bolster overall financial health

The examination of historical data not only informs current strategies but also shapes future approaches, ensuring organizations remain adaptable and responsive within an evolving financial landscape.

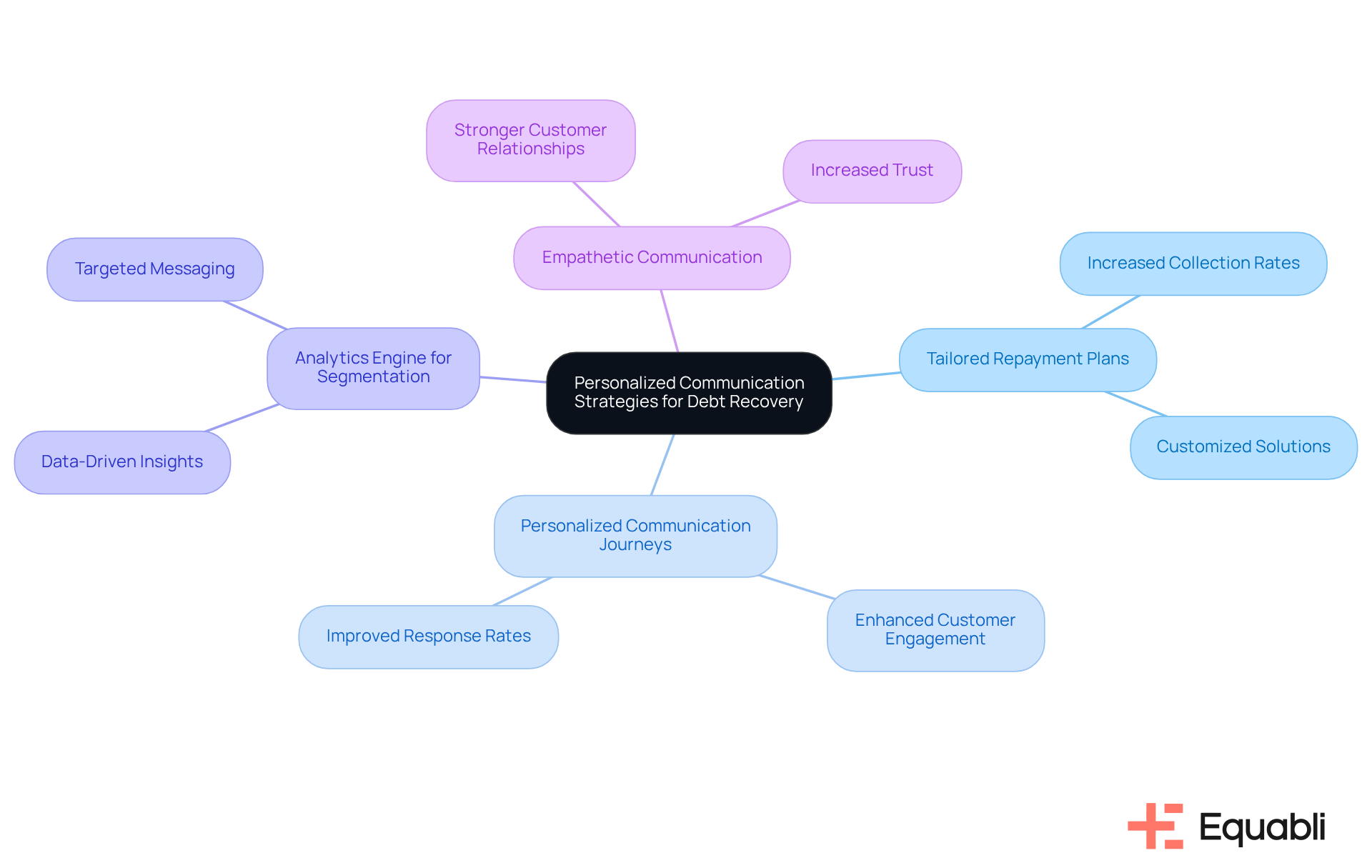

Upflow: Personalized Communication Strategies for Effective Debt Recovery

The company underscores the importance of personalized communication strategies to optimize financial recovery efforts via its EQ Engage platform. By harnessing features such as tailored repayment plans, personalized communication journeys, and an analytics engine for segmentation, Equabli adeptly customizes messages for individual debtors, reflecting their preferences and behaviors. This significantly enhances the probability of successful collections while maximizing net present value (NPV) in debt recovery. Furthermore, the platform facilitates borrower self-service through a user-friendly payment portal, thereby strengthening relationships between financial institutions and their customers. Empathetic communication is pivotal in ensuring debtors feel understood and valued, which further amplifies the effectiveness of these strategies. The Client Success Representatives play a crucial role in driving product adoption, ensuring that clients fully leverage these features to achieve optimal outcomes.

Chaser: Automation for Efficient Debt Collection Processes

Equabli provides ai-driven debt collection software solutions for enterprise financial institutions, offering a suite of automation tools designed to enhance debt recovery processes through its EQ Collect solution. This ai-driven debt collection software solutions for enterprise financial institutions automates follow-ups, payment reminders, and debtor communications, significantly reducing the manual workload for recovery teams. As a result, organizations can streamline operations by implementing ai-driven debt collection software solutions for enterprise financial institutions, allowing them to focus on strategic initiatives that ensure timely receivables and improved cash flow. For instance, EQ Collect empowers companies to increase efficiency and revenue through data-driven strategies, illustrating the effectiveness of automated workflows in securing payments.

Moreover, the ai-driven debt collection software solutions for enterprise financial institutions minimize execution errors and reliance on manual resources, delivering unparalleled transparency and insights through real-time reporting. With an average cost of merely €0.41 per reminder, present a cost-effective alternative to manual phone calls, which necessitate dedicated staff time. By utilizing ai-driven debt collection software solutions for enterprise financial institutions, users of EQ Collect can reclaim over 15 hours each week from routine tasks, enabling finance teams to manage growing volumes of accounts receivables without a corresponding rise in staffing levels. This efficiency not only boosts operational productivity but also cultivates stronger relationships with customers through consistent and personalized communication.

Furthermore, EQ Collect features industry-leading compliance oversight and automated monitoring, providing organizations with ai-driven debt collection software solutions for enterprise financial institutions to confidently navigate the complexities of debt collection. The solution also includes a no-code file-mapping tool and a user-friendly, scalable, cloud-native interface, ensuring accessibility for all users.

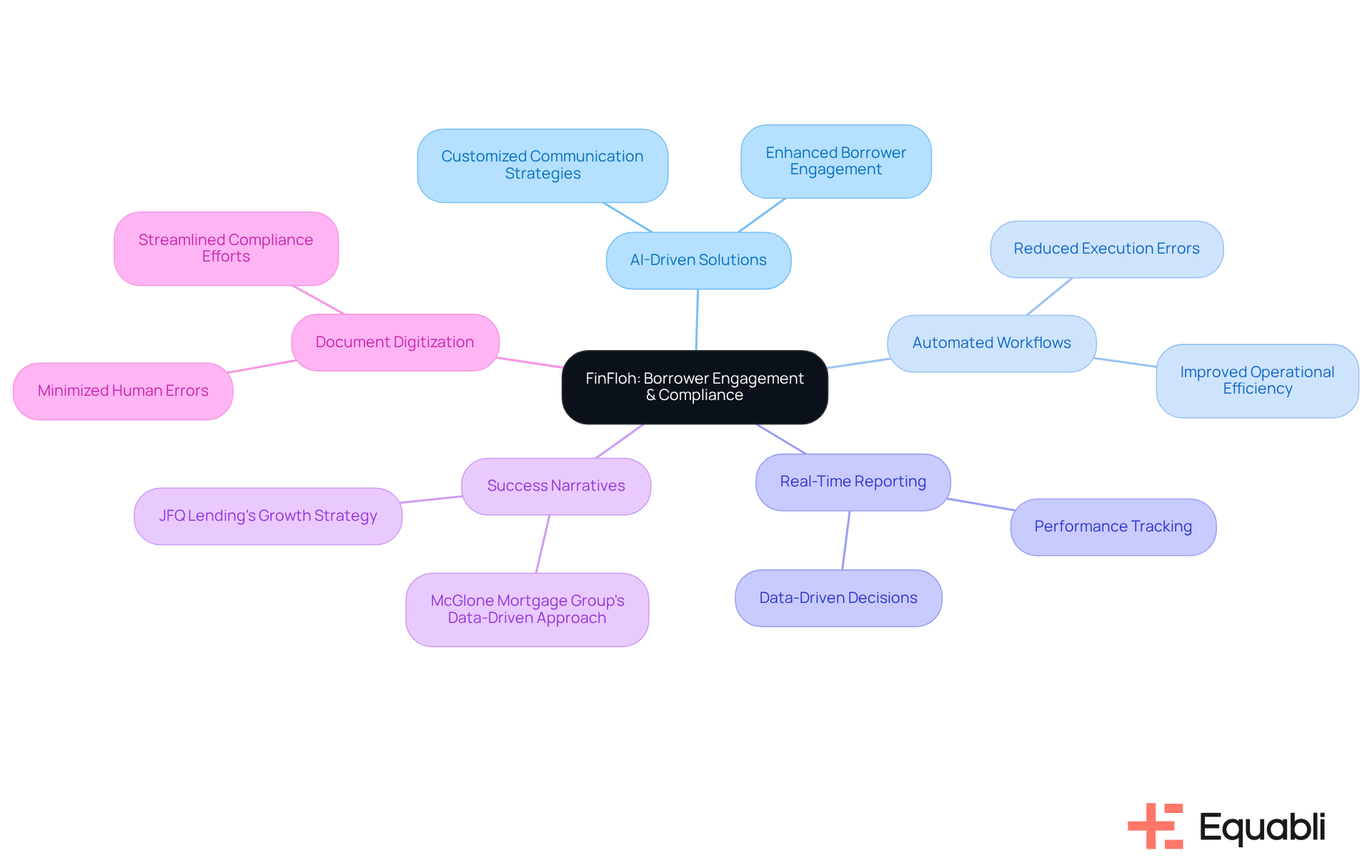

FinFloh: Innovative Solutions for Enhanced Borrower Engagement and Compliance

Equabli delivers cutting-edge solutions that significantly enhance borrower engagement while ensuring strict adherence to regulatory standards. By leveraging AI-driven debt collection software solutions for enterprise financial institutions, the EQ Collect platform customizes communication strategies, enabling organizations to connect with debtors more effectively.

Automated workflows and real-time reporting are key attributes that reduce execution errors and improve operational efficiency. This enables financial institutions to while remaining compliant with regulatory requirements.

Success narratives from Equabli illustrate how these innovative methods not only enhance compliance but also foster stronger connections with borrowers, ultimately leading to improved recovery outcomes. For instance, John Kresevic, CEO of JFQ Lending, highlighted the importance of continuous refinement in their processes, stating, 'We do one thing. We do really well over and over and over again and then refine that process right from start to finish.'

Furthermore, the digitization of documents has emerged as a game-changer, enhancing accuracy and streamlining compliance efforts, thereby reinforcing the effectiveness of AI-driven debt collection software solutions for enterprise financial institutions within the debt collection landscape.

Conclusion

The integration of AI-driven debt collection software solutions represents a pivotal opportunity for financial institutions to enhance recovery processes while ensuring compliance and operational efficiency. By leveraging advanced technologies, organizations can streamline workflows, improve borrower engagement, and ultimately boost recovery rates, thereby positioning themselves favorably in a competitive market.

Key insights have emerged from the exploration of platforms such as Equabli, Gaviti, and Kolleno, particularly regarding the effectiveness of:

- Tailored communication strategies

- Automation features

- Data-driven methodologies

These tools not only facilitate smoother operations but also foster stronger relationships with customers, which is essential in today’s financial landscape. The emphasis on compliance and security underscores the importance of adopting innovative solutions that meet regulatory standards while enhancing overall performance.

As financial institutions navigate the complexities of debt recovery, the adoption of AI-driven tools is not merely an option but a necessity for sustained success. Embracing these technologies empowers organizations to make informed decisions, optimize cash flow management, and ultimately create a more resilient financial ecosystem. The future of debt collection lies in the hands of those willing to innovate and adapt, ensuring they remain at the forefront of industry advancements.

Frequently Asked Questions

What is the EQ Suite and what does it offer?

The EQ Suite is an AI-driven debt collection software solution designed for enterprise financial institutions. It includes tools like EQ Engine, EQ Engage, and EQ Collect, which help create tailored scoring models, refine retrieval strategies, and facilitate digital data collection.

How does the EQ Suite enhance operational efficiency?

The EQ Suite enhances operational efficiency through automated workflows, real-time reporting, and compliance oversight, which help reduce operational costs and improve borrower engagement.

What is Gaviti and how does it contribute to debt collection?

Gaviti offers AI-driven debt collection software solutions that enhance compliance and streamline processes for enterprise financial institutions. Its EQ Collect platform features a no-code file-mapping tool to simplify vendor onboarding and automate processes like payment reminders.

How does Gaviti improve recovery rates?

Gaviti improves recovery rates by employing data-informed strategies and providing immediate reporting, which helps organizations manage their receivables efficiently while adhering to regulatory standards.

What features does Kolleno provide in its debt collection software?

Kolleno provides a user-friendly interface and robust automation capabilities that streamline debt recovery tasks, including sending timely reminders and tracking payments, which enhances recovery rates and operational efficiency.

What results have organizations seen using AI-driven debt collection software?

Organizations using AI-driven debt collection software have achieved recovery rates as high as 90%, reduced days sales outstanding (DSO), and improved client retention rates, leading to better cash flow.

How does EQ Engage improve borrower interactions?

EQ Engage enhances borrower interactions by offering tailored communication pathways and self-service repayment options, optimizing the overall recovery process.