Overview

Intelligent collections solutions in financial risk management significantly enhance recovery efforts while mitigating financial risks such as bad debts and inaccurate debtor information. Data-driven decision-making, personalized communication, and compliance with regulatory standards are critical in this context. These best practices not only improve recovery rates but also foster trust with clients, ultimately leading to more sustainable financial operations.

Introduction

In the complex realm of financial risk management, organizations encounter an escalating challenge as bad debts and compliance risks jeopardize their recovery efforts. Projections indicate a 15% increase in bad debts this year, underscoring the urgency for effective strategies. This article explores best practices for implementing intelligent collections solutions that not only enhance recovery rates but also cultivate stronger relationships with clients. How can organizations navigate these financial pitfalls while ensuring compliance and leveraging technology to optimize their collections processes?

Understand Key Financial Risks in Collections

In the landscape of credit collection, financial risks manifest in various forms, and utilizing intelligent collections solutions for enterprise financial risk management can significantly impact recovery efforts and overall financial health. Bad Debts represent a primary challenge, as recovering funds from borrowers who may be unable or unwilling to meet their obligations remains a pressing concern. In 2025, the prevalence of poor loans continues to strain financial institutions, necessitating proactive strategies to mitigate losses. Industry reports project a 15% increase in bad debts this year, underscoring the urgency for effective management strategies.

Inaccurate Debtor Information poses another critical risk. Relying on outdated or incorrect data can lead to inefficiencies, wasted resources, and missed opportunities. Entities that fail to maintain precise debtor records may experience a significant decline in recovery rates, as difficulties in contacting the correct individuals impede repayment efforts. A recent study revealed that 30% of retrieval attempts fail due to erroneous contact information, highlighting the essential need for data accuracy.

Compliance Risks are also paramount. Adhering to regulatory requirements is crucial; non-compliance can result in legal penalties and reputational damage. Financial institutions must remain informed about evolving regulations to avoid costly missteps. Experts emphasize that maintaining compliance not only protects against fines but also enhances consumer trust, which is vital for long-term success.

To effectively manage these risks, organizations should prioritize within their intelligent collections solutions for enterprise financial risk management to ensure accuracy and relevance. Implementing robust credit evaluation processes can help identify potential risks early, while staying updated on regulatory changes is essential for maintaining compliance. By comprehending and addressing these financial risks, companies can tailor their strategies to minimize potential losses and enhance recovery rates, ultimately fostering a more resilient recovery framework. As highlighted by industry leaders, "Empathy in debt retrieval is not merely a tactic; it's essential for establishing trust and enabling resolution.

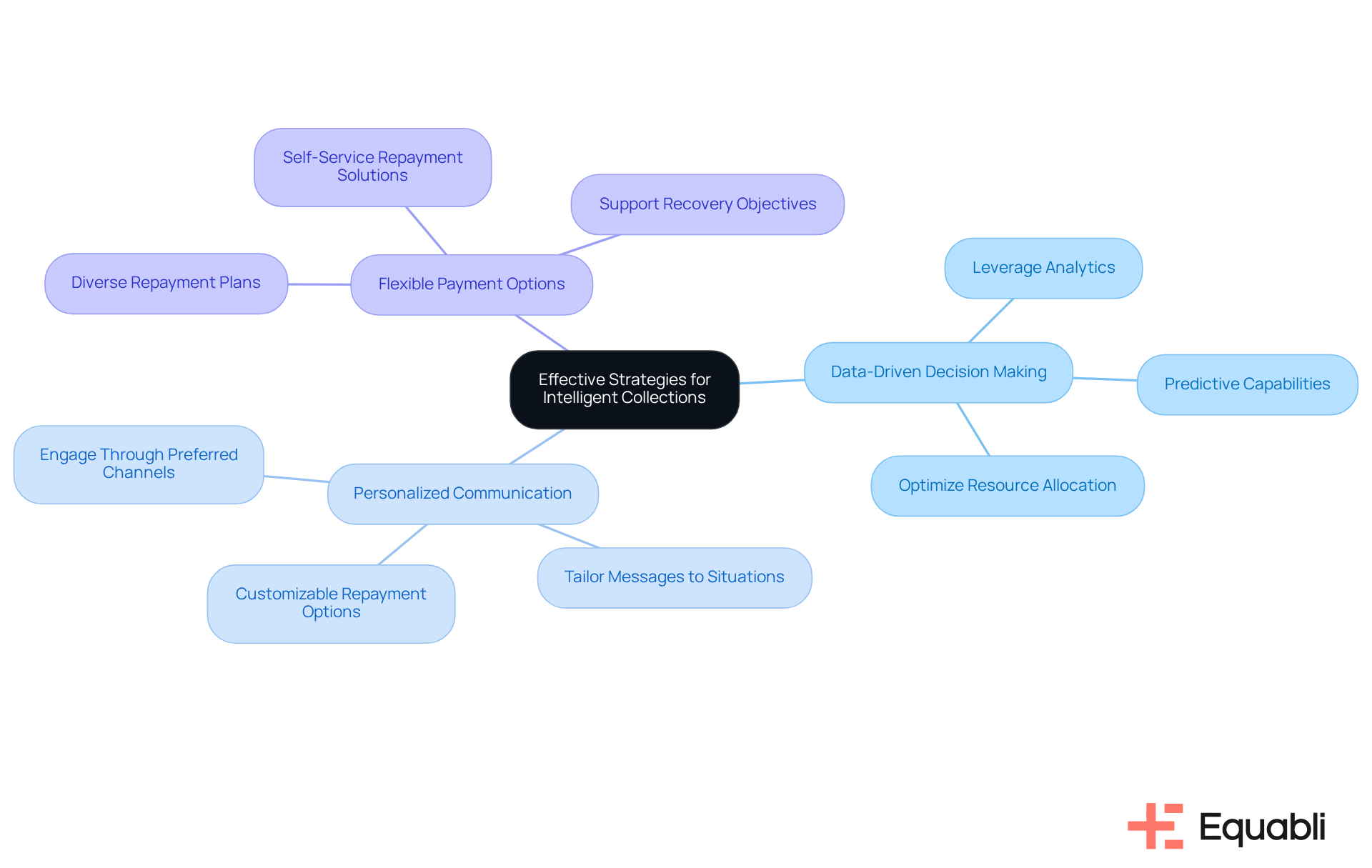

Implement Effective Strategies for Intelligent Collections

To enhance collections effectiveness, organizations should consider the following strategies:

- Data-Driven Decision Making: Organizations must leverage analytics to evaluate customer behavior and customize recovery strategies accordingly. For instance, the predictive capabilities of Equabli's EQ Engine can identify high-risk accounts, facilitating the development of intelligent collections solutions for enterprise financial risk management that improve efficiency and reduce roll rates. This approach not only optimizes resource allocation but also aligns recovery efforts with data-driven insights.

- Personalized Communication: Engaging individuals through their preferred channels—such as SMS or email—while tailoring messages to their specific situations is crucial. By utilizing EQ Engage, organizations can transform debt collection through customizable repayment options, significantly enhancing customer engagement and improving response rates. This level of personalization fosters stronger relationships and encourages timely repayments.

- Flexible Payment Options: Providing diverse repayment plans that cater to individuals' financial circumstances increases the likelihood of recovery. Incorporating self-service repayment solutions via EQ Engage can further enhance customer satisfaction and streamline compliance management. This flexibility not only supports recovery objectives but also positions organizations as responsive partners in the financial journey of their clients.

By implementing these strategies, companies can leverage intelligent collections solutions for enterprise financial risk management to establish a more responsive and effective recovery process. This not only enhances recovery rates but also with clients, ultimately transforming their debt recovery operations.

Leverage Technology for Enhanced Collection Efficiency

Organizations must leverage technology to enhance their resource management processes effectively. A critical focus area is automation. Implementing automated systems for sending reminders, processing payments, and managing follow-ups can significantly reduce manual workloads and minimize errors. Evidence indicates that collection agencies adopting automation report operational costs dropping by up to 90% and recovery rates improving by 15-25%. This transformation not only streamlines operations but also enhances overall efficiency.

Furthermore, the integration of AI and machine learning tools allows organizations to analyze borrower data, predicting repayment behaviors and enabling more targeted recovery strategies. For instance, predictive analytics can identify high-risk accounts early, facilitating proactive measures that improve recovery efficiency. The impact of such technologies is profound, offering organizations a .

Additionally, adopting cloud-based solutions ensures real-time data access and fosters collaboration among teams, enhancing communication and decision-making processes. Organizations utilizing cloud technology experience a 65% increase in debt recoveries and a 90% reduction in manual efforts. This shift not only optimizes resource allocation but also strengthens operational resilience.

By embracing these technologies, organizations can significantly enhance collection efficiency through intelligent collections solutions for enterprise financial risk management, reduce operational costs, and improve borrower engagement—ultimately leading to superior financial outcomes.

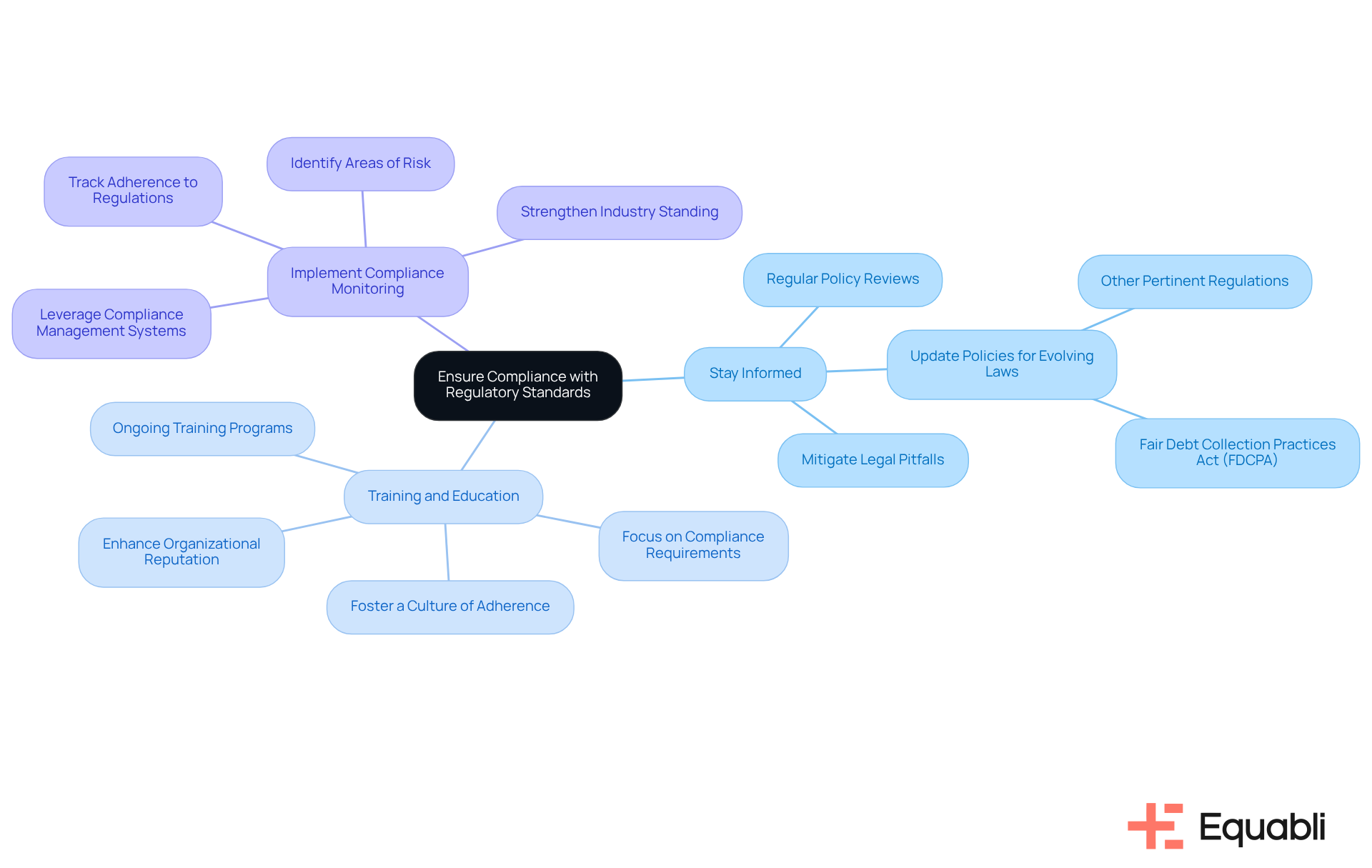

Ensure Compliance with Regulatory Standards

To ensure compliance with regulatory standards, organizations must adopt that reinforce their operational integrity.

- Stay Informed: Regularly reviewing and updating policies is essential to align with evolving laws, including the Fair Debt Collection Practices Act (FDCPA) and other pertinent regulations. This proactive approach not only helps organizations remain compliant but also mitigates potential legal pitfalls, thereby safeguarding their operational framework.

- Training and Education: Implementing ongoing training programs focused on compliance requirements and ethical gathering practices is crucial. Such initiatives foster a culture of adherence, equipping employees to navigate the complexities of debt collection regulations effectively. This investment in human capital enhances both compliance and organizational reputation.

- Implement Compliance Monitoring: Leveraging compliance management systems to track adherence to regulations is vital. By identifying potential areas of risk, this systematic approach enhances compliance and strengthens the entity's standing within the industry.

By prioritizing these compliance measures, organizations can significantly mitigate risks associated with legal violations, ultimately leading to improved operational integrity and trust within the financial sector.

Conclusion

Implementing intelligent collections solutions is not merely a trend; it is a crucial strategy for financial institutions navigating the complexities of financial risk management. By understanding and addressing key risks—such as bad debts, inaccurate debtor information, and compliance challenges—organizations can significantly enhance their recovery efforts and overall financial health.

The article highlights several best practices that can transform collections processes. These include:

- Data-driven decision-making

- Personalized communication

- Flexible payment options

Furthermore, leveraging technology through automation, AI, and cloud-based solutions profoundly boosts efficiency and operational effectiveness, enabling organizations to stay ahead of potential risks.

Ultimately, the significance of adopting these best practices cannot be overstated. As financial landscapes evolve, organizations must remain vigilant, proactive, and adaptive in their collections strategies. Embracing intelligent collections solutions not only mitigates financial risks but also fosters trust and positive relationships with clients, paving the way for sustainable success in the competitive realm of financial management.

Frequently Asked Questions

What are the main financial risks in collections?

The main financial risks in collections include bad debts, inaccurate debtor information, and compliance risks.

How do bad debts impact financial institutions?

Bad debts represent a significant challenge as they involve recovering funds from borrowers who may be unable or unwilling to meet their obligations. In 2025, a projected 15% increase in bad debts underscores the urgency for effective management strategies to mitigate losses.

Why is accurate debtor information important?

Accurate debtor information is crucial because relying on outdated or incorrect data can lead to inefficiencies, wasted resources, and missed opportunities in recovery efforts. A study showed that 30% of retrieval attempts fail due to erroneous contact information.

What are compliance risks in financial collections?

Compliance risks involve adhering to regulatory requirements. Non-compliance can lead to legal penalties and reputational damage, making it essential for financial institutions to stay informed about evolving regulations to avoid costly missteps.

How can organizations manage these financial risks effectively?

Organizations can manage financial risks by regularly assessing debtor data, implementing robust credit evaluation processes, and staying updated on regulatory changes to ensure compliance.

What role does empathy play in debt retrieval?

Empathy in debt retrieval is essential for establishing trust and enabling resolution, highlighting its importance beyond just a tactic in recovery efforts.