Overview

This article emphasizes the critical need for financial institutions to optimize internal collections through the implementation of effective strategies, including:

- Clear communication

- Technology utilization

- Data-driven approaches

Evidence suggests that these strategies significantly enhance recovery rates and compliance. By outlining best practices, the article demonstrates how tailored strategies and advanced analytics can lead to improved operational efficiency and stronger customer relationships. Such improvements not only streamline processes but also position institutions to better navigate compliance challenges and enhance overall performance.

Introduction

In an increasingly competitive landscape, financial institutions recognize the critical importance of optimizing their internal collections processes. By focusing on methodologies that recover late payments directly from clients, these organizations enhance recovery rates and preserve valuable customer relationships.

However, as regulatory pressures and technological advancements evolve, institutions face the challenge of navigating compliance complexities while maximizing efficiency.

This article delves into strategic approaches and best practices that empower financial entities to refine their internal collections, leveraging data-driven insights and innovative technologies to achieve sustainable success.

Understand Internal Collections in Financial Institutions

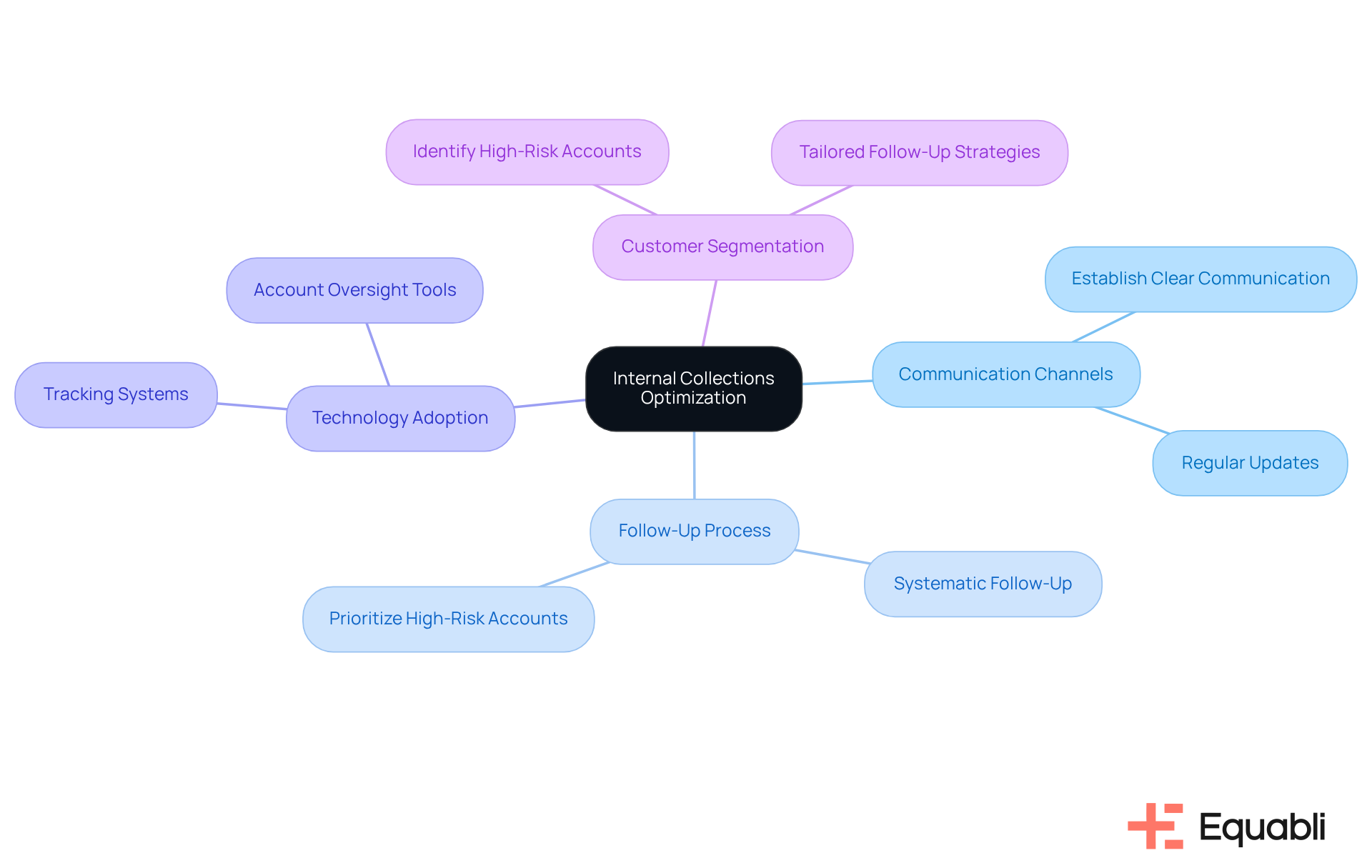

Internal collections optimization strategies for financial institutions encompass the methodologies that financial entities utilize to recover late payments directly from clients before resorting to external agencies. This approach not only allows organizations to maintain customer relationships but also enhances recovery rates. Key elements of effective internal management include:

- Establishment of clear communication channels

- Implementation of a systematic follow-up process

- Adoption of technology for tracking and overseeing accounts

By understanding the unique challenges and opportunities within their management processes, financial organizations can tailor their internal collections optimization strategies for financial institutions to improve both efficiency and effectiveness.

For instance, organizations can segment their customer base to identify high-risk accounts, prioritizing follow-ups accordingly. This targeted strategy not only but also reduces operational costs associated with retrieval efforts.

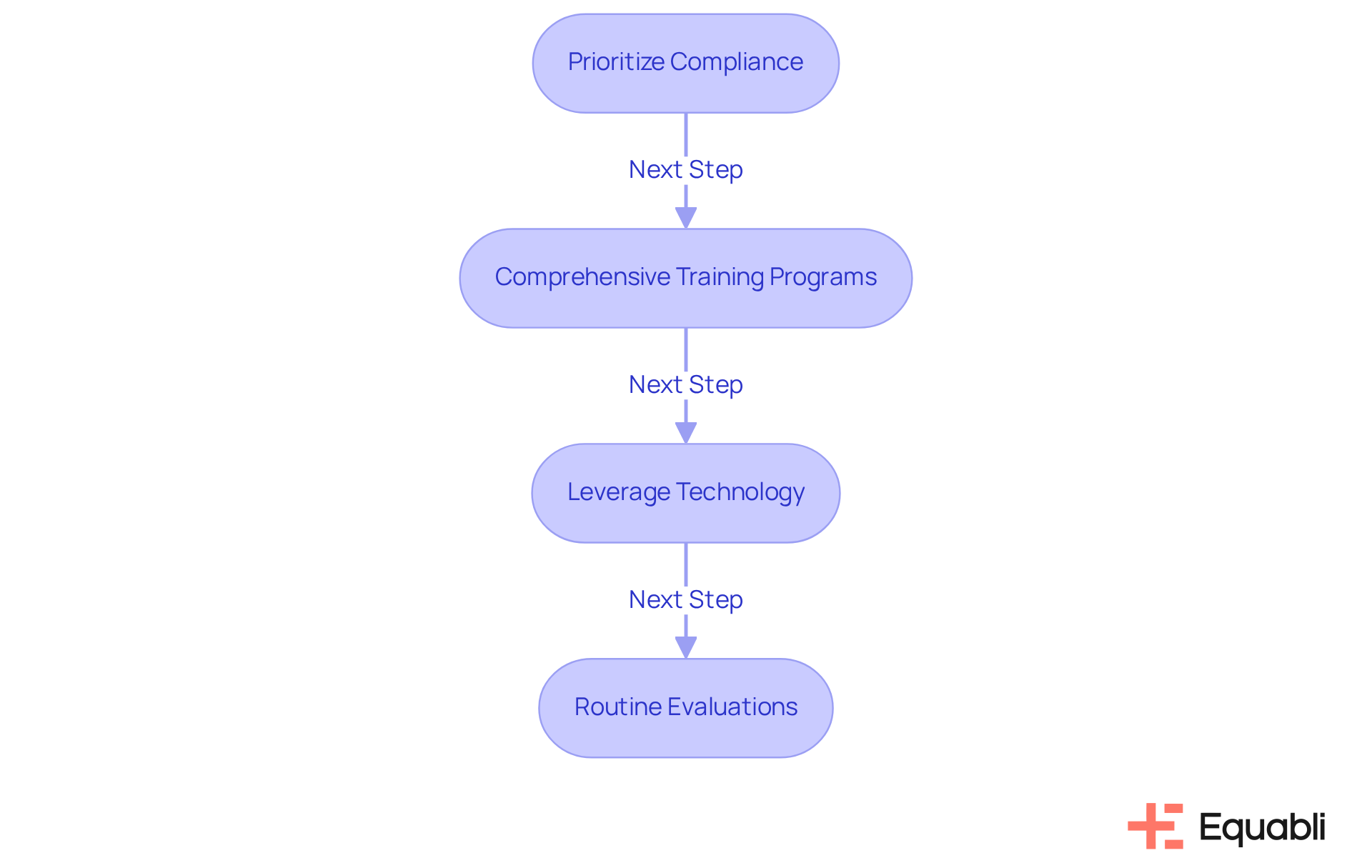

Prioritize Compliance in Collections Processes

Financial institutions must prioritize compliance in their recovery processes to mitigate legal risks and uphold a positive reputation. This necessity is underscored by regulations such as the Fair Debt Recovery Practices Act (FDCPA) and other relevant laws governing . Implementing comprehensive training programs for personnel is essential to ensure awareness of compliance requirements and best practices.

Moreover, leveraging technology can enhance compliance efforts by automating documentation and communication tasks. This automation guarantees that all customer interactions are properly documented and adhere to regulatory standards. Routine evaluations of these practices are crucial for identifying areas for improvement, ensuring continuous adherence to compliance mandates.

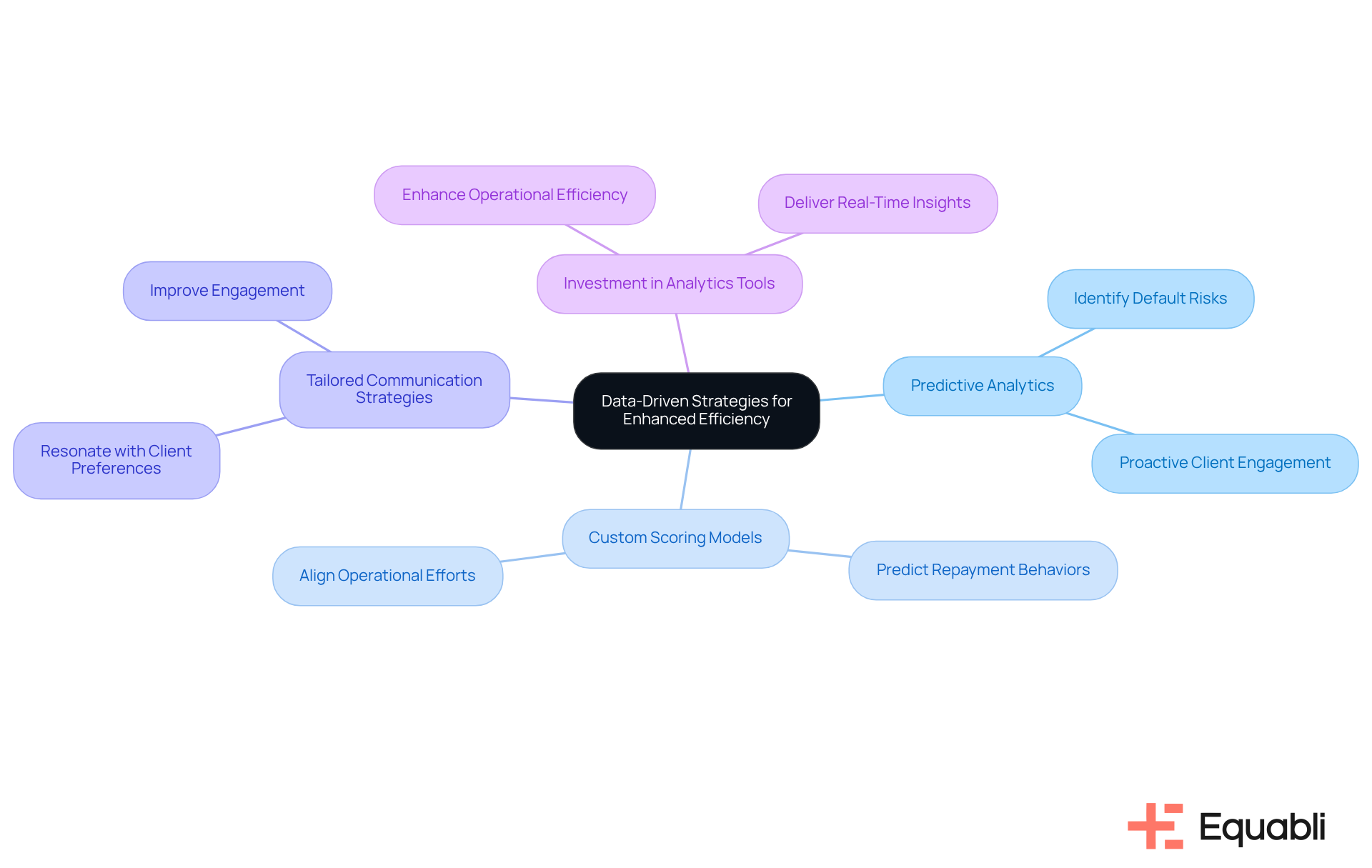

Leverage Data-Driven Strategies for Enhanced Efficiency

Utilizing represents a transformative approach for financial organizations seeking to enhance their internal collections optimization strategies for financial institutions. Equabli's intelligent EQ Suite empowers organizations to implement custom scoring models that predict repayment behaviors and align operational efforts accordingly. By examining client data, organizations can identify trends and patterns that inform their internal collections optimization strategies for financial institutions. For example, predictive analytics can help organizations ascertain which clients are most likely to default, enabling proactive engagement before delinquencies occur.

Furthermore, the EQ Suite allows institutions to implement internal collections optimization strategies for financial institutions by customizing their communication strategies, ensuring messages resonate with clients based on their preferences and behaviors. This tailored approach not only improves engagement but also contributes to the effectiveness of internal collections optimization strategies for financial institutions, thereby increasing the likelihood of successful recoveries. Institutions are encouraged to invest in sophisticated analytics tools, such as those provided by Equabli, which can enhance internal collections optimization strategies for financial institutions by delivering real-time insights into customer behavior. This capability enables dynamic strategy adjustments, ultimately enhancing overall operational efficiency.

Implement Best Practices for Internal Collections Optimization

To optimize internal collections, financial institutions should adopt several best practices:

- Establish Clear Policies: Develop and communicate explicit guidelines regarding collections methods, including timelines for follow-ups and escalation procedures. Clear policies ensure compliance and operational consistency, minimizing the risk of regulatory breaches.

- Utilize Technology: Implement Equabli's , which automates routine tasks, tracks client interactions, and provides analytics for performance monitoring. This modern solution transforms manual processes into intelligent, data-driven operations, enhancing efficiency and recovery rates.

- Train Staff Regularly: Conduct regular training sessions for collections staff to keep them updated on compliance requirements, service techniques, and effective communication strategies. Ongoing training reinforces adherence to regulations and improves the overall effectiveness of collections efforts.

- Foster Client Relationships: Interact with clients through various channels, providing adaptable payment options and tailored communication with tools like EQ Engage. This approach enhances borrower engagement and increases the likelihood of repayment, ultimately benefiting recovery outcomes.

- Monitor Performance Metrics: Regularly review key performance indicators (KPIs) such as recovery rates, client engagement levels, and compliance adherence to identify areas for improvement. Continuous performance monitoring enables institutions to adjust strategies proactively, ensuring sustained operational excellence.

By implementing these best practices and leveraging Equabli's innovative solutions, financial institutions can significantly enhance their internal collections optimization strategies, which will lead to improved recovery rates and customer satisfaction.

Conclusion

Optimizing internal collections within financial institutions is essential for enhancing recovery rates while preserving robust customer relationships. Effective communication, systematic follow-ups, and the strategic use of technology are critical for streamlining processes and improving overall efficiency. By tailoring strategies to meet the unique challenges of each client segment, financial entities can prioritize high-risk accounts and reduce operational costs.

Key insights underscore the necessity of compliance, the significance of data-driven strategies, and the implementation of best practices. Financial institutions must prioritize adherence to regulations, such as the Fair Debt Recovery Practices Act, while integrating automation and analytics to refine their collections processes. Regular training for staff and the utilization of advanced tools like Equabli's EQ Suite are vital for ensuring that teams remain informed and effective in their collection efforts.

In conclusion, the importance of optimizing internal collections is paramount. As financial institutions navigate the complexities of debt recovery, embracing innovative technologies and best practices will enhance recovery outcomes and strengthen client relationships. A proactive approach that integrates compliance, data analytics, and customer engagement strategies will facilitate sustainable success in internal collections, ultimately benefiting both organizations and their clients.

Frequently Asked Questions

What are internal collections in financial institutions?

Internal collections refer to the methodologies that financial institutions use to recover late payments directly from clients before involving external agencies.

What are the benefits of optimizing internal collections?

Optimizing internal collections helps maintain customer relationships and enhances recovery rates for financial institutions.

What are key elements of effective internal collections management?

Key elements include establishing clear communication channels, implementing a systematic follow-up process, and adopting technology for tracking and overseeing accounts.

How can financial organizations improve their internal collections strategies?

Financial organizations can improve their strategies by understanding the unique challenges and opportunities in their management processes and tailoring their approaches accordingly.

What is the importance of customer segmentation in internal collections?

Customer segmentation allows organizations to identify high-risk accounts and prioritize follow-ups, which improves recovery rates and reduces operational costs related to retrieval efforts.