Overview

The article delineates ten essential regulatory compliance frameworks for financial institutions, underscoring the criticality of adhering to various laws and guidelines to mitigate risks and enhance operational efficiency. It supports this assertion by detailing specific frameworks such as:

- The Fair Debt Collection Practices Act

- The Dodd-Frank Act

Furthermore, it highlights tools like Equabli's EQ Suite, which automates compliance processes, thereby enabling institutions to navigate complex regulations effectively.

Introduction

Navigating the intricate landscape of regulatory compliance presents a formidable challenge for financial institutions, where adherence to a multitude of laws and guidelines is not merely a necessity but a strategic imperative. This article examines ten essential regulatory compliance frameworks that equip financial organizations with the tools and insights necessary to enhance operational efficiency and mitigate risks. As regulations evolve and the stakes rise, the pressing question emerges: how can institutions effectively integrate these frameworks to not only comply but also thrive in a competitive environment?

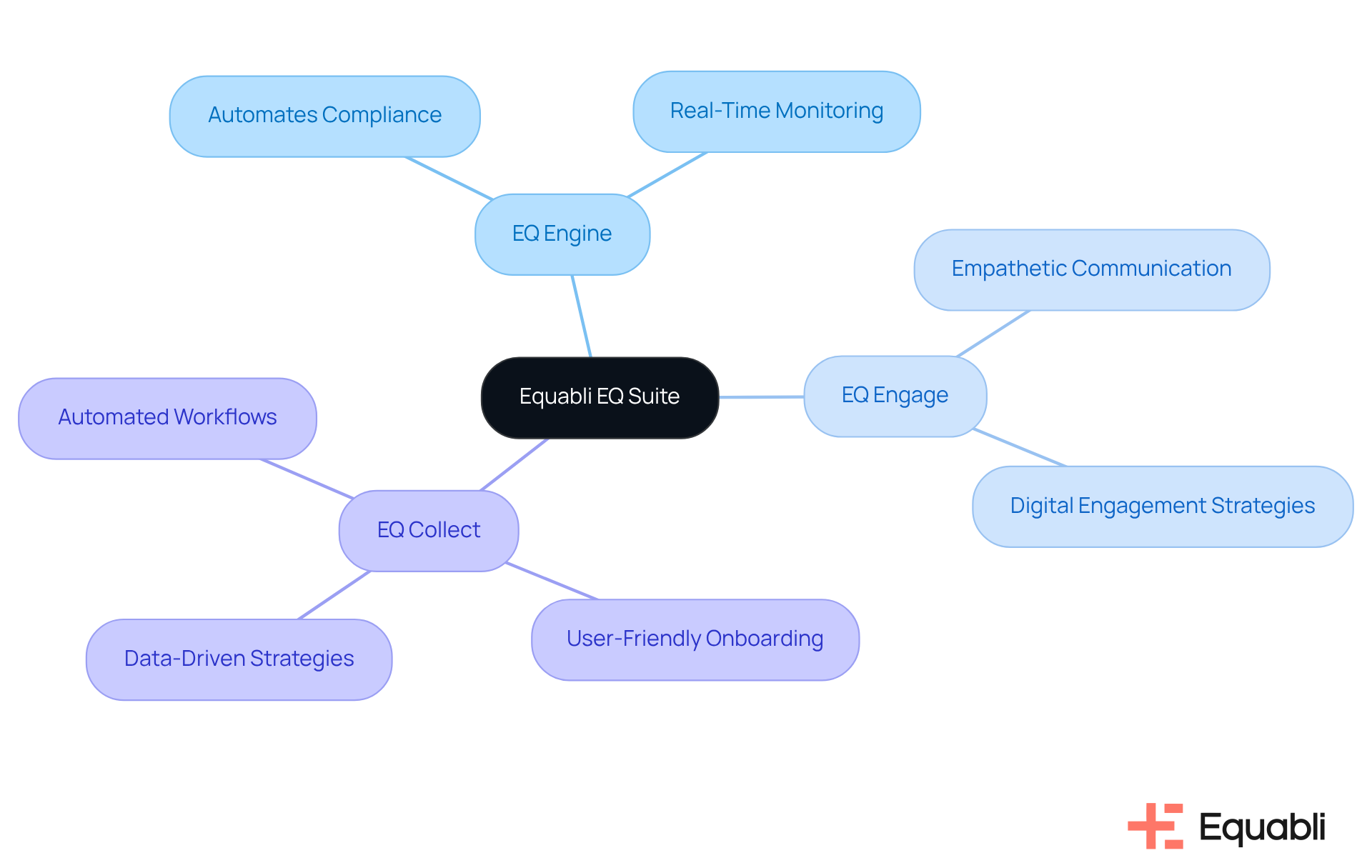

Equabli EQ Suite: Comprehensive Compliance Management for Collections

Equabli's EQ Suite serves as a comprehensive framework for managing collections regulatory compliance frameworks for financial institutions in receivables. It features tools such as EQ Engine, EQ Engage, and EQ Collect, which enable financial institutions to automate their collections regulatory compliance frameworks for financial institutions. This automation ensures adherence to collections regulatory compliance frameworks for financial institutions while enhancing retrieval strategies. For instance, EQ Collect facilitates shorter vendor onboarding timelines through a user-friendly, no-code file-mapping tool. This enhancement not only boosts operational efficiency but also leverages and minimize execution errors through automated workflows.

Furthermore, the integration of AI-driven regulatory tools supports real-time monitoring, an essential aspect of collections regulatory compliance frameworks for financial institutions, as regulatory agencies increasingly recognize the value of automated compliance. The EQ Suite thus positions itself as an essential resource for lenders and recovery firms aiming to navigate the complexities of debt recovery effectively. Access to unparalleled transparency and insights through real-time reporting further augments operational efficiency and mitigates the risk of non-compliance penalties.

Financial Compliance Regulations: Understanding the Regulatory Landscape

Financial adherence regulations encompass a wide array of laws and guidelines that organizations must comply with, notably the Fair Debt Collection Practices Act (FDCPA) and the regulations set forth by the Consumer Financial Protection Bureau (CFPB). Understanding these regulations is crucial for developing . It ensures that all collection practices are not only compliant but also align with legal standards, thereby mitigating risks associated with non-compliance. This understanding serves as a foundational element in the broader context of enterprise-level debt collection and risk management.

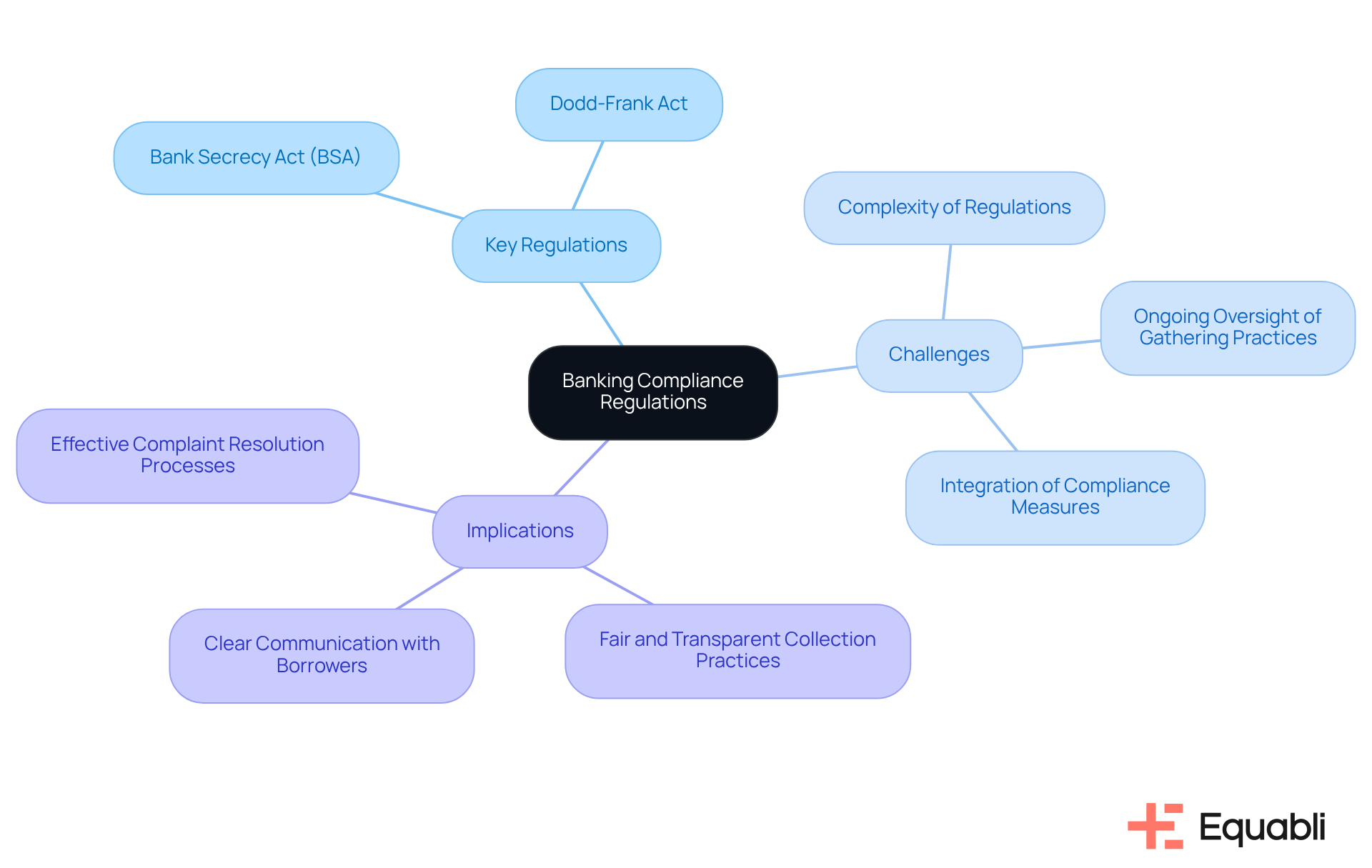

Banking Compliance Regulations: Key Requirements for Financial Institutions

Key banking regulations, particularly the Bank Secrecy Act (BSA) and the Dodd-Frank Act, impose strict requirements on financial entities regarding reporting and transparency. Compliance with these regulations is crucial for maintaining operational licenses and avoiding legal repercussions. The Dodd-Frank Act, for instance, mandates that organizations establish robust collections regulatory compliance frameworks for financial institutions to ensure equitable lending practices and clarity in retrieval activities. This includes adhering to specific criteria, such as in gathering and ensuring clear communication with borrowers.

Financial organizations frequently encounter significant challenges in achieving compliance with the Dodd-Frank Act. These challenges include:

- The complexity of the regulations

- The need for ongoing oversight of gathering practices

- The integration of compliance measures into existing operational workflows

Recent enforcement actions against companies like Block Inc. underscore the importance of adhering to anti-money laundering laws and the potential consequences of non-compliance, which may entail substantial fines and reputational harm.

Moreover, the implications of the Dodd-Frank Act extend to collection practices, compelling organizations to adopt fair and transparent methods in their interactions with borrowers. This encompasses the necessity for clear disclosures regarding fees and charges, as well as implementing effective complaint resolution processes. As financial organizations navigate these regulatory environments, they must prioritize collections regulatory compliance frameworks for financial institutions to mitigate risks, enhance their operational efficiency, and bolster customer confidence.

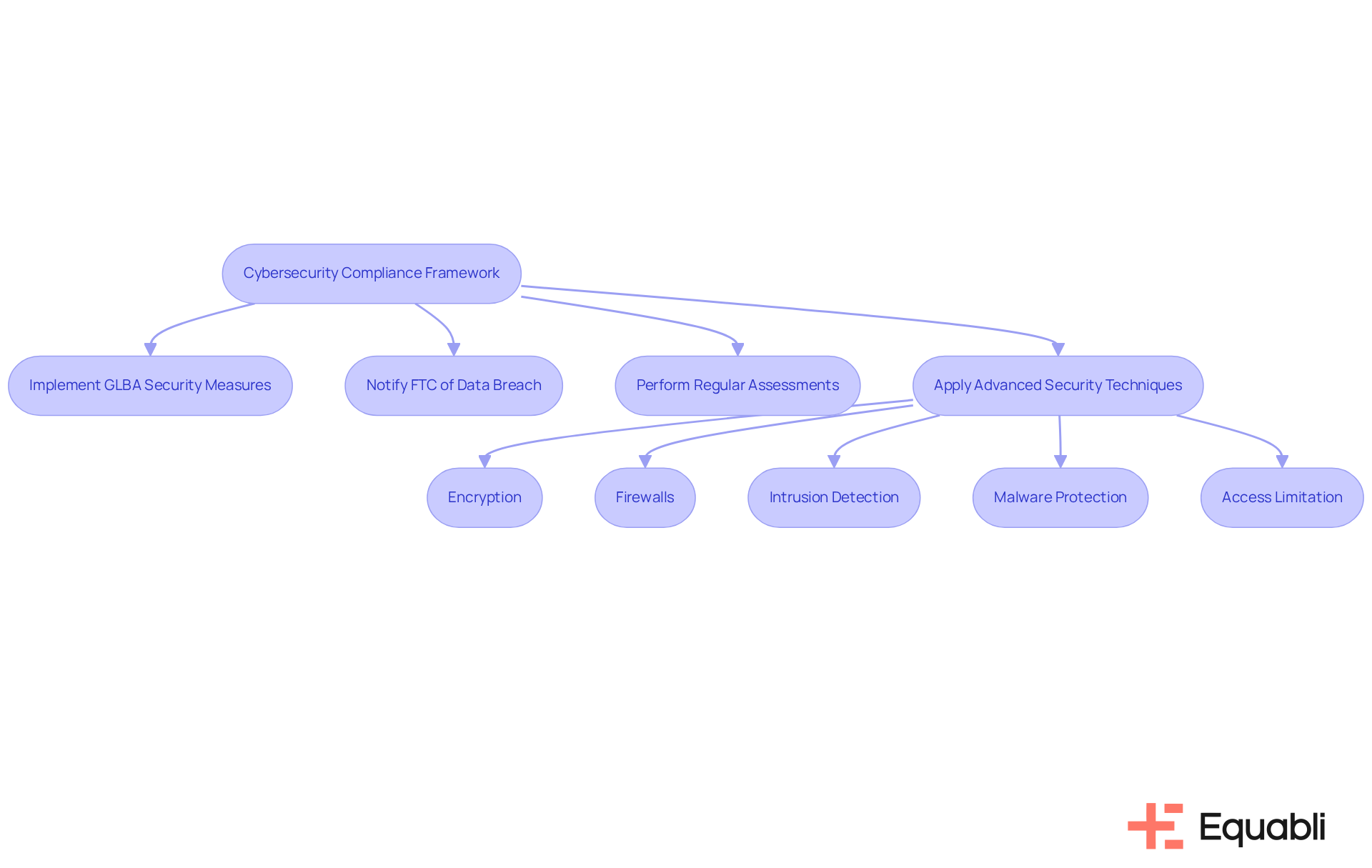

Cybersecurity Compliance Framework: Safeguarding Sensitive Financial Data

A robust cybersecurity compliance framework is critical for the protection of sensitive monetary information. The Gramm-Leach-Bliley Act (GLBA) mandates that financial institutions implement to safeguard customer information. Equabli exemplifies this commitment through its comprehensive privacy policy, which guarantees that customer data is neither sold, rented, nor leased to third parties.

Recent amendments to the GLBA have heightened the requirements for data protection, compelling organizations to notify the FTC within 30 days of any data breach affecting personal information of 500 individuals or more. While compliance rates in the financial sector have shown improvement, challenges remain, with the average cost of a data breach in this industry approximating $5.97 million.

Institutions must perform regular assessments of their cybersecurity protocols to align with industry standards and mitigate risks linked to data breaches. Equabli secures personal information through advanced techniques, including:

- Encryption during transmission and storage

- Firewalls

- Intrusion detection and prevention services

- Malware protection

- Limiting access to authorized personnel only

Real-world instances underscore the necessity of these measures; for example, the FTC's reinforced Safeguards Rule highlights the need for comprehensive security programs to effectively protect customer data. By adhering to these guidelines and implementing robust data protection strategies, banking entities not only fulfill legal obligations but also enhance their reputation and reliability within the market.

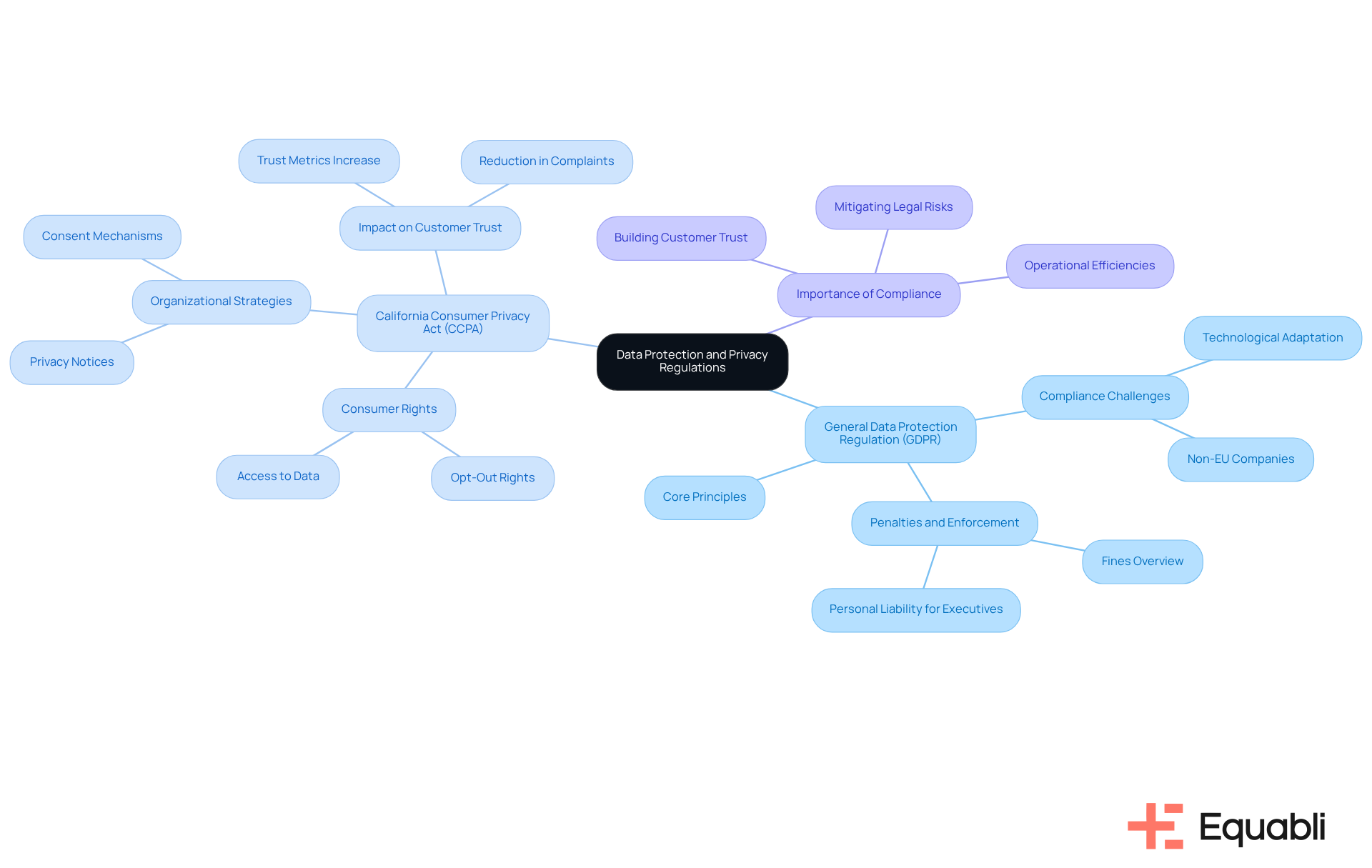

Data Protection and Privacy Regulations: Ensuring Customer Trust and Compliance

Data protection and privacy regulations, including the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), necessitate that institutions manage customer data with the utmost responsibility. Compliance with the collections regulatory compliance frameworks for financial institutions transcends mere legal obligation; it represents a strategic imperative that bolsters customer trust, a critical element for sustained success in the collections industry.

The CCPA, for instance, empowers consumers with rights over their personal data, enabling them to opt out of data sales and access information regarding the usage of their data. This transparency is essential for , particularly in financial services where data sensitivity is paramount. A recent study indicated that organizations demonstrating robust CCPA adherence experienced a 20% increase in customer trust metrics, underscoring the direct correlation between regulatory compliance and consumer confidence.

Real-world examples illustrate the importance of CCPA adherence in debt recovery. Businesses that have implemented strong regulatory strategies, such as:

- Clear privacy notices

- User-friendly consent mechanisms

report enhanced customer relationships and a reduction in complaints. For instance, a debt collection agency that revised its privacy policies to comply with CCPA standards noted a significant decrease in customer disputes, showcasing how proactive compliance can yield operational efficiencies and increased customer satisfaction.

Moreover, the evolving landscape of data privacy laws necessitates that banking entities stay informed about collections regulatory compliance frameworks for financial institutions, particularly updates to the CCPA. Recent modifications from the California Privacy Protection Agency have expanded consumer rights and intensified penalties for non-compliance, making it vital for organizations to regularly evaluate and update their collections regulatory compliance frameworks for financial institutions. By prioritizing CCPA adherence, organizations not only mitigate legal risks but also position themselves as trustworthy stewards of customer data, ultimately fostering long-term loyalty and engagement.

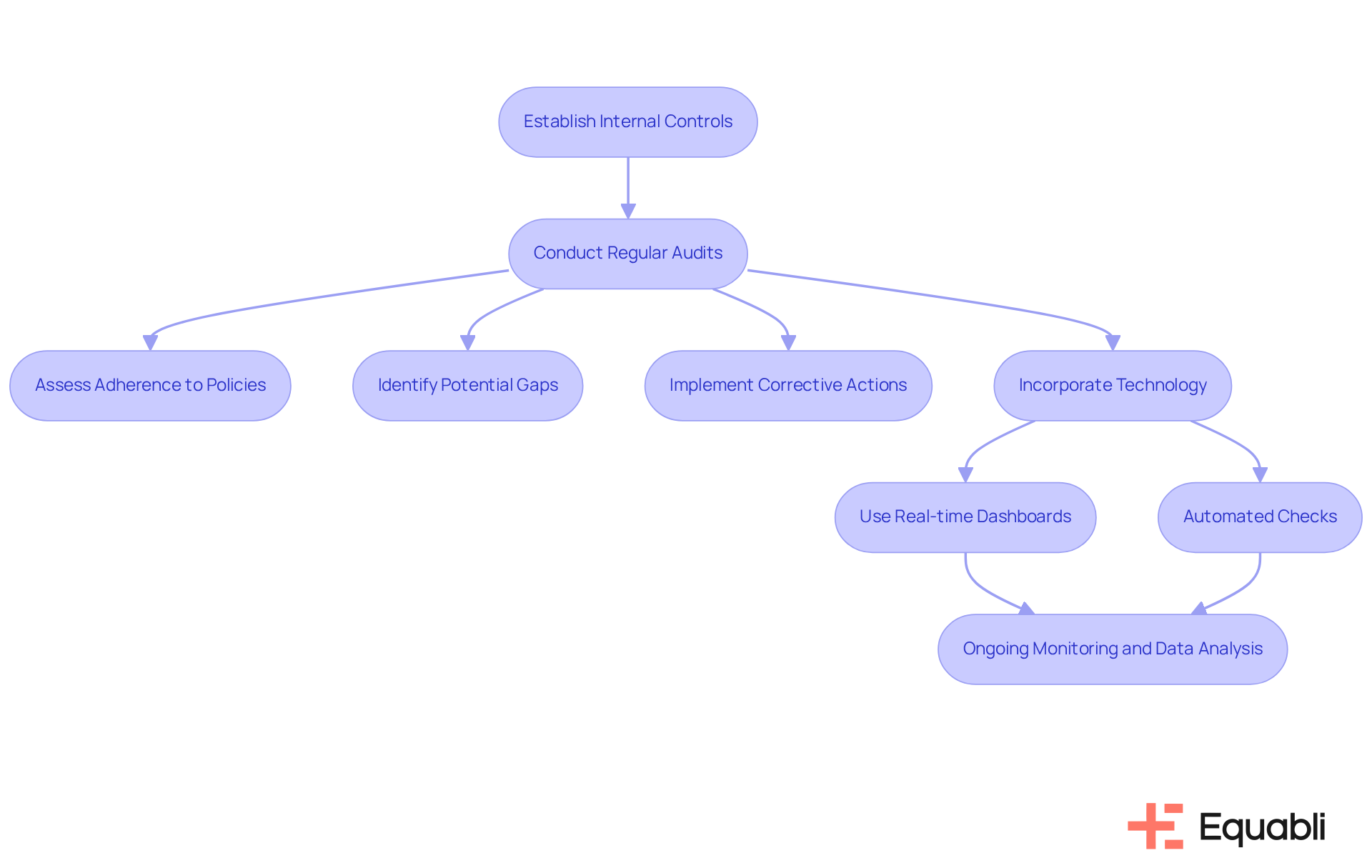

Internal Controls and Auditing: Monitoring Compliance Effectively

Creating robust internal controls and conducting regular audits are vital for effective oversight within financial institutions. Establishing transparent guidelines and processes for retrievals is essential for ensuring that all personnel understand their responsibilities within the collections regulatory compliance frameworks for financial institutions. Regular audits function as a mechanism to assess adherence to these policies, identify potential gaps, and implement corrective actions promptly. This proactive approach not only mitigates regulatory risks but also enhances operational integrity within the collections regulatory compliance frameworks for financial institutions.

Manual debt collection methods often lead to inefficiencies and regulatory challenges, making it imperative for organizations to adopt collections regulatory compliance frameworks for financial institutions. For instance, organizations with well-developed regulatory programs report 50 percent fewer regulatory inquiries annually, underscoring the effectiveness of systematic auditing. Moreover, incorporating technology in auditing methods—such as real-time dashboards and automated regulatory checks—streamlines operations and enhances accuracy. Financial organizations can leverage these tools to refine their auditing practices, ensuring adaptability in the face of evolving regulatory environments.

Current trends indicate a shift towards ongoing monitoring and data analysis in auditing, which supports the collections regulatory compliance frameworks for financial institutions, enabling organizations to detect irregularities in real-time and respond swiftly to potential regulatory concerns. By prioritizing education and fostering a culture of accountability, financial institutions can establish resilient systems that not only comply with regulations but also promote operational excellence. To further enhance adherence initiatives, consider utilizing Equabli's EQ Suite, which and supports a comprehensive recovery lifecycle.

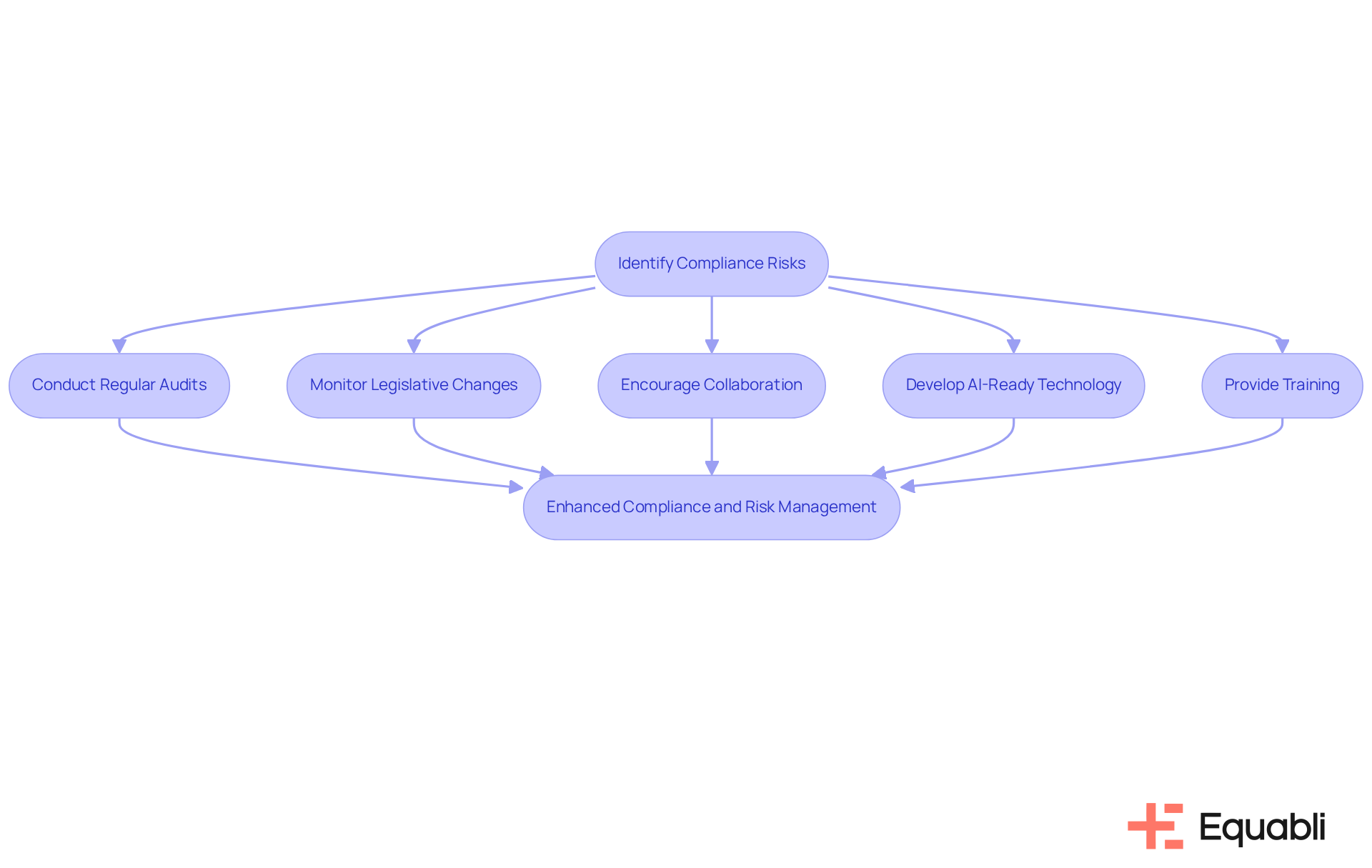

Risk Assessment and Management: Identifying Compliance Risks

Regular risk evaluations are crucial for identifying risks within collections regulatory compliance frameworks for financial institutions in the collection processes. Financial organizations must assess their operations, pinpoint potential weaknesses, and devise strategies to mitigate these risks. By proactively addressing regulatory challenges, organizations can bolster their resilience and ensure compliance with legal requirements.

Current trends reveal a movement towards the integration of advanced technologies, such as generative AI, to enhance risk assessment practices. These technologies facilitate the automation of regulatory risk detection, enabling organizations to respond swiftly to emerging threats. Moreover, there is a growing trend among organizations to adopt a holistic approach to risk management, aligning regulatory strategies with overarching business objectives.

To effectively identify compliance risks in collections, institutions should establish a structured framework that encompasses:

- Regular audits of collection practices to ensure alignment with regulatory standards.

- Continuous monitoring of legislative changes and industry best practices.

- Collaboration between regulatory teams and operational personnel to foster a culture of compliance.

- Development of a secure, generative AI-ready technology stack to manage regulatory risks efficiently.

- Training for new users on the capabilities and limitations of generative AI.

By addressing regulatory challenges proactively, financial organizations can enhance their resilience, improve operational efficiency, and ensure compliance with legal requirements. This approach ultimately fosters greater trust and engagement with clients.

Customer Due Diligence: Meeting Anti-Money Laundering Requirements

Customer due diligence (CDD) represents a critical component of anti-money laundering (AML) compliance, requiring financial entities to establish rigorous procedures for confirming customer identities, assessing risks, and monitoring transactions for suspicious activities. In 2025, the evolving regulatory landscape underscores the necessity for organizations to adapt their CDD practices to meet stringent AML standards. For instance, comprehensive identity verification processes are essential to mitigate risks associated with money laundering and terrorist financing, a fact underscored by the significant penalties faced by institutions like Deutsche Bank and UBS due to AML deficiencies.

The operational impact of AML regulations is profound, with 99% of monetary entities reporting increased compliance costs, totaling approximately $61 billion annually in the U.S. and Canada. This financial burden highlights the importance of , which not only protect organizations from legal repercussions but also enhance the integrity of the financial system. Furthermore, 83% of monetary institutions have noted that rising AML compliance costs are outpacing revenue growth, necessitating a strategic approach to resource allocation. Matt Michaud, Global Head of Financial Crime Oversight, emphasizes that organizations must adopt collections regulatory compliance frameworks for financial institutions to address fiscal crime effectively.

Real-world examples further illustrate the effectiveness of robust CDD practices. Organizations implementing comprehensive verification procedures can substantially reduce the risk of economic crime, as evidenced by the 72% of regulatory professionals who believe that effective due diligence programs significantly mitigate risks. Additionally, the importance of verifying customer identities extends to recoveries, where accurate identification is crucial for maintaining compliance and ensuring successful retrieval efforts. As financial institutions navigate the complexities of AML regulations, prioritizing CDD within the collections regulatory compliance frameworks for financial institutions will be essential for sustaining operational integrity and fostering trust within the financial ecosystem.

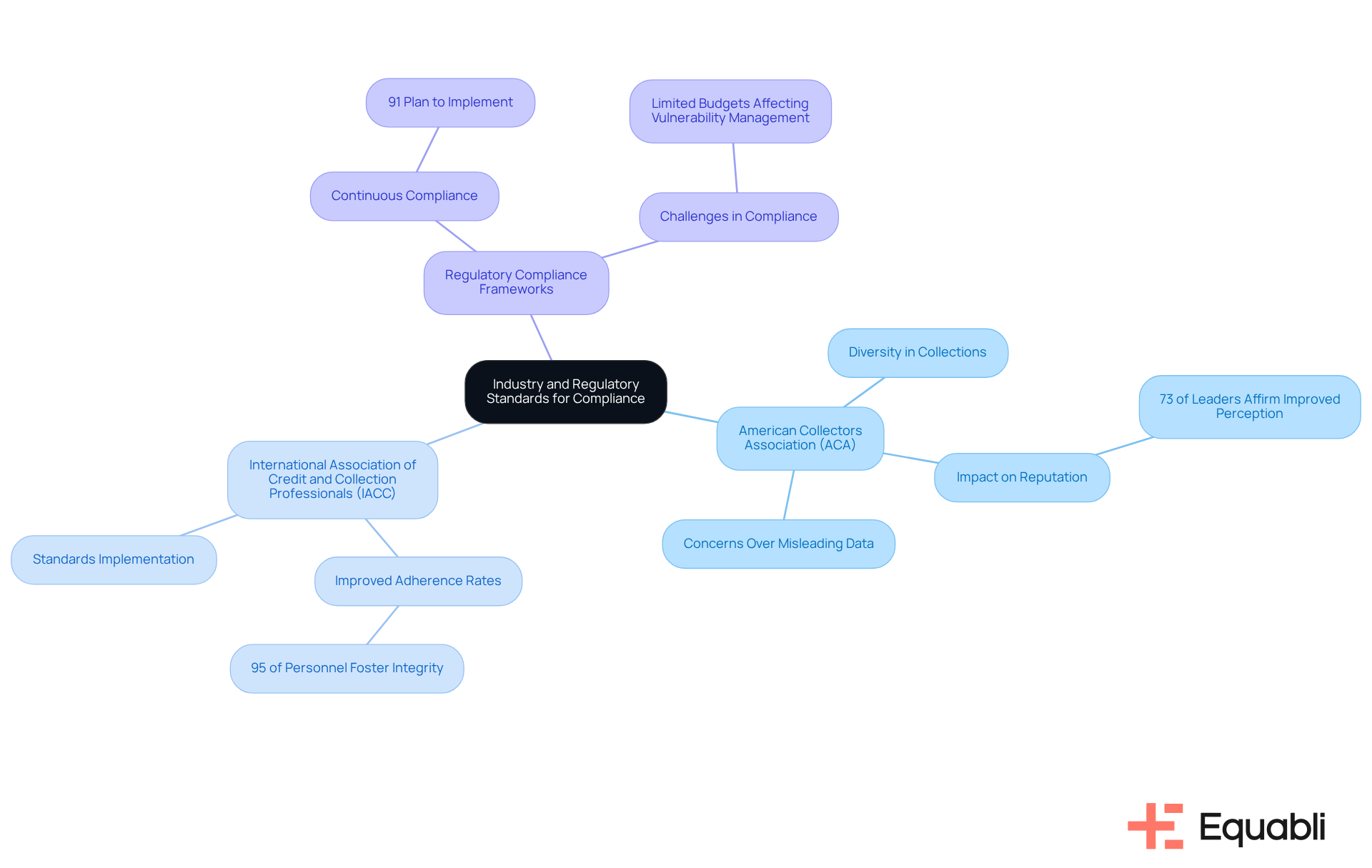

Industry and Regulatory Standards: Benchmarks for Compliance

Compliance in retrievals is fundamentally rooted in adherence to established industry and regulatory standards. Organizations such as the American Collectors Association (ACA) and the International Association of Credit and Collection Professionals (IACC) are instrumental in defining benchmarks for . For instance, the ACA's recent white paper underscores the importance of diversity within the collections sector, illustrating how inclusive practices can bolster adherence and operational effectiveness. Furthermore, the IACC's implementation of standards has been linked to improved adherence rates among monetary entities, with 95% of adherence personnel actively fostering a culture of integrity.

Consistently evaluating and aligning practices with collections regulatory compliance frameworks for financial institutions not only ensures compliance but also empowers these institutions to adeptly navigate the evolving regulatory landscape. As noted by ACA specialists, 'Meeting regulatory standards improves the perception of our business,' with 73% of leaders affirming that adherence to these standards enhances their organization's reputation. Additionally, the ACA has expressed concerns regarding misleading data within the regulatory environment, highlighting the challenges organizations face.

By integrating these standards into their operations and leveraging resources such as RMAI's certification programs, organizations can fortify their collections regulatory compliance frameworks for financial institutions while promoting sustainable growth.

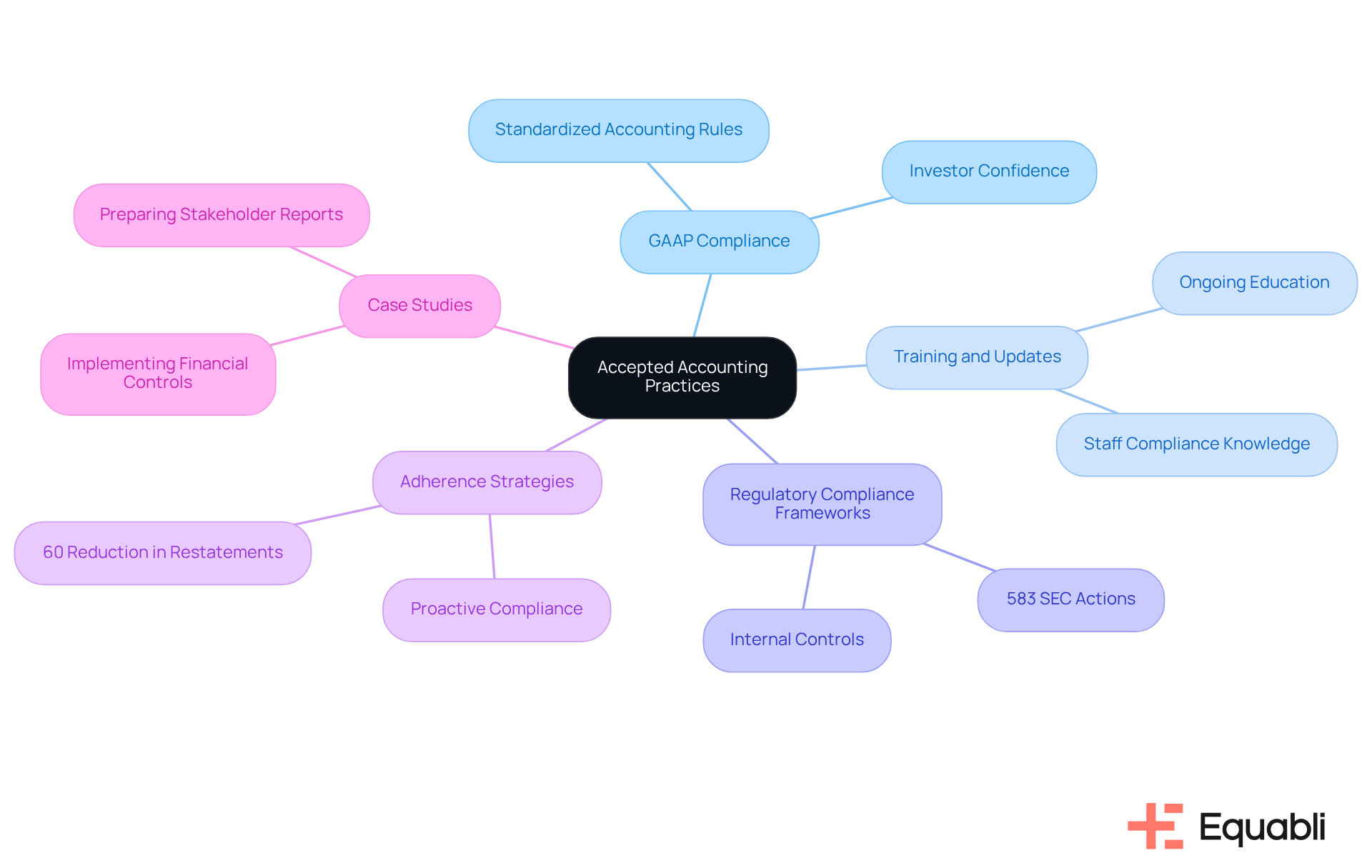

Accepted Accounting Practices: Ensuring Accurate Financial Reporting

Recognized accounting standards, particularly Generally Accepted Accounting Principles (GAAP), are crucial for ensuring precise reporting within collections. Monetary organizations must rigorously adhere to these standards to meet regulatory requirements and provide clear fiscal information to stakeholders. In fiscal year 2024, the SEC initiated 583 enforcement actions, underscoring the importance of adherence in preventing legal repercussions and preserving investor confidence.

Consistent training and updates on accounting standards are essential for staff to ensure ongoing compliance. Organizations that implement strong collections regulatory compliance frameworks for financial institutions report significantly fewer regulatory inquiries and enhanced reporting precision. The 'GAAP Compliance' case study illustrates how adherence to guarantees consistent and transparent fiscal reports, which is vital for public trust.

Moreover, proactive adherence strategies can reduce restatements by as much as 60%, showcasing the tangible benefits of integrating robust accounting practices into economic operations. As the acceptance of cloud-based accounting software grows, monetary organizations can leverage technology to bolster compliance efforts. By prioritizing these practices, financial institutions not only protect their operations but also enhance their reputation, fostering trust among investors and clients alike.

Conclusion

In navigating the intricate world of financial compliance, understanding and implementing essential collections regulatory compliance frameworks is paramount for institutions. These frameworks not only ensure adherence to legal standards but also enhance operational efficiency and foster trust with customers. By leveraging advanced tools like Equabli's EQ Suite, financial organizations can streamline their compliance processes, automate workflows, and gain real-time insights, ultimately positioning themselves for success in a complex regulatory landscape.

Throughout this discussion, the importance of understanding financial compliance regulations such as the FDCPA and the BSA is underscored. Robust cybersecurity measures under the GLBA are necessary, as is the critical role of customer due diligence in meeting AML requirements. Furthermore, the significance of internal controls, risk assessment, and adherence to industry standards emerges as foundational elements for maintaining compliance and operational integrity. Each of these components contributes to a comprehensive approach that mitigates risks and enhances the reputation of financial institutions.

As the regulatory environment continues to evolve, it is crucial for financial organizations to remain proactive in their compliance efforts. By staying informed about the latest regulations and integrating best practices into their operations, institutions can not only avoid legal repercussions but also build lasting relationships with their clients. Embracing these compliance frameworks is not merely a necessity; it is an opportunity to establish a culture of integrity and trust that will serve as a competitive advantage in the financial sector.

Frequently Asked Questions

What is the EQ Suite by Equabli?

The EQ Suite is a comprehensive framework designed for managing collections regulatory compliance for financial institutions in receivables. It includes tools like EQ Engine, EQ Engage, and EQ Collect to automate compliance processes and enhance retrieval strategies.

How does EQ Collect improve operational efficiency?

EQ Collect facilitates shorter vendor onboarding timelines through a user-friendly, no-code file-mapping tool, which improves operational efficiency and leverages data-driven strategies to enhance receivables while minimizing execution errors through automated workflows.

What role does AI play in the EQ Suite?

The EQ Suite integrates AI-driven regulatory tools that support real-time monitoring, which is essential for compliance with collections regulations. This automation is increasingly recognized by regulatory agencies as valuable for maintaining compliance.

Why is understanding financial compliance regulations important?

Understanding financial compliance regulations, such as the Fair Debt Collection Practices Act (FDCPA) and Consumer Financial Protection Bureau (CFPB) guidelines, is crucial for developing effective adherence strategies that align with legal standards and mitigate risks associated with non-compliance.

What are the key banking compliance regulations that financial institutions must follow?

Key banking regulations include the Bank Secrecy Act (BSA) and the Dodd-Frank Act, which impose strict requirements on financial entities regarding reporting, transparency, and equitable lending practices.

What challenges do financial organizations face in complying with the Dodd-Frank Act?

Financial organizations often encounter challenges such as the complexity of the regulations, the need for ongoing oversight of gathering practices, and the integration of compliance measures into existing operational workflows.

What are the implications of non-compliance with financial regulations?

Non-compliance can result in substantial fines, reputational harm, and legal repercussions, as illustrated by recent enforcement actions against companies like Block Inc.

How can financial organizations enhance customer confidence in their collections practices?

By adopting fair and transparent methods in interactions with borrowers, providing clear disclosures regarding fees and charges, and implementing effective complaint resolution processes, financial organizations can enhance customer confidence in their collections practices.