Overview

The article delineates effective debt portfolio management strategies tailored for collection agencies, underscoring the necessity of comprehending various debt types and the implementation of customized communication and technology solutions. It substantiates this by illustrating how the categorization of debts into secured and unsecured types enables agencies to employ specific recovery tactics. Furthermore, it accentuates the significance of technology and empathetic communication in not only enhancing recovery rates but also in sustaining positive debtor relationships.

Introduction

Navigating the complexities of debt collection necessitates a nuanced understanding of various debt types and their implications. Collection agencies can significantly enhance recovery rates and foster positive relationships with debtors by mastering tailored debt portfolio management strategies. However, in light of the evolving landscape of consumer expectations and regulatory requirements, agencies must effectively balance assertive recovery tactics with compassionate communication. This article explores best practices that empower collection agencies to optimize their approaches, ensuring both efficiency in recovery and respect for the individuals they serve.

Understand Debt Types and Their Implications

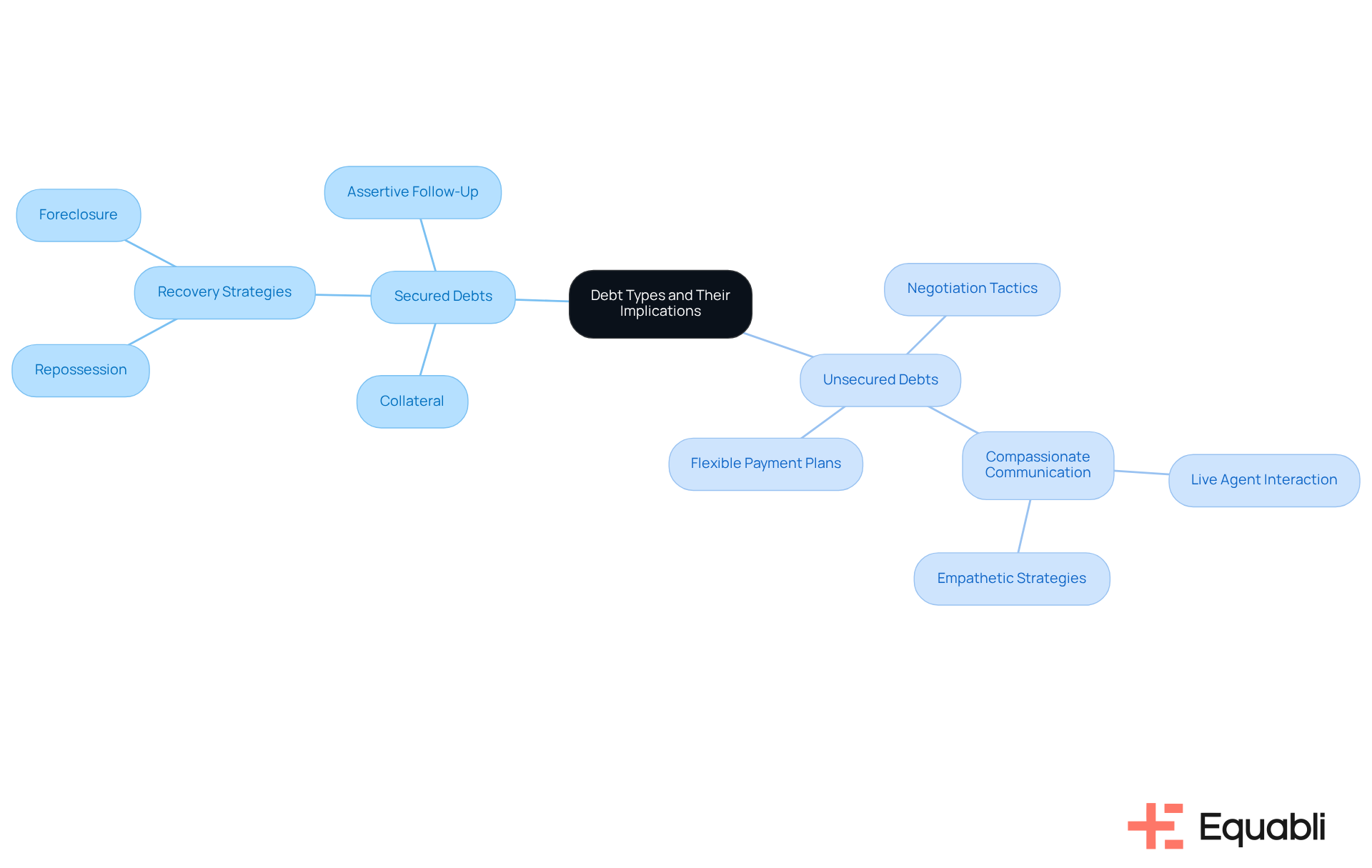

Effective recovery strategies rely on debt categorization, which is crucial for implementing debt portfolio management strategies for accounts sold to collection agencies, as each type presents distinct challenges and opportunities. Secured obligations, such as mortgages and auto loans, are underpinned by collateral, allowing recovery through repossession or foreclosure in the event of missed payments. This security enables collection agencies to implement more assertive follow-up strategies, significantly enhancing recovery rates. Conversely, unsecured obligations, such as credit card balances and medical bills, lack collateral, which necessitates implementing debt portfolio management strategies for accounts sold to collection agencies. Agencies may need to utilize negotiation tactics and flexible payment plans as debt portfolio management strategies for accounts sold to collection agencies to encourage repayment while preserving the debtor's trust. Notably, 50% of participants prefer engaging with a live representative by phone for customer service, underscoring the importance of compassionate communication strategies, particularly in consumer financial matters.

Understanding the is equally crucial. Consumer liabilities typically involve individual borrowers, necessitating compassionate communication methods that foster positive relationships. In contrast, business liabilities often encompass contractual responsibilities, which may require a more direct and assertive approach to ensure compliance and recovery.

For example, a debt recovery firm might create a comprehensive follow-up protocol for secured debts, leveraging the collateral as support, while adopting a gentler, more supportive approach for unsecured consumer debts. This tailored strategy incorporates debt portfolio management strategies for accounts sold to collection agencies, enhancing recovery rates and facilitating a constructive dialogue with debtors, ultimately yielding better long-term outcomes. Furthermore, organizations utilizing the Collect product can expect a 40% increase in recovery performance compared to traditional third-party unsecured consumer retrieval services, highlighting the effectiveness of customized strategies.

As the financial landscape evolves, organizations that adeptly classify and manage their portfolios will be better positioned to navigate the complexities of 2025 and beyond. The trend towards adopting empathetic communication strategies that prioritize respect and the rights of those in debt is essential for sustaining positive relationships with individuals, particularly in light of the shifting regulatory landscape that emphasizes ethical practices.

Establish Effective Communication Strategies

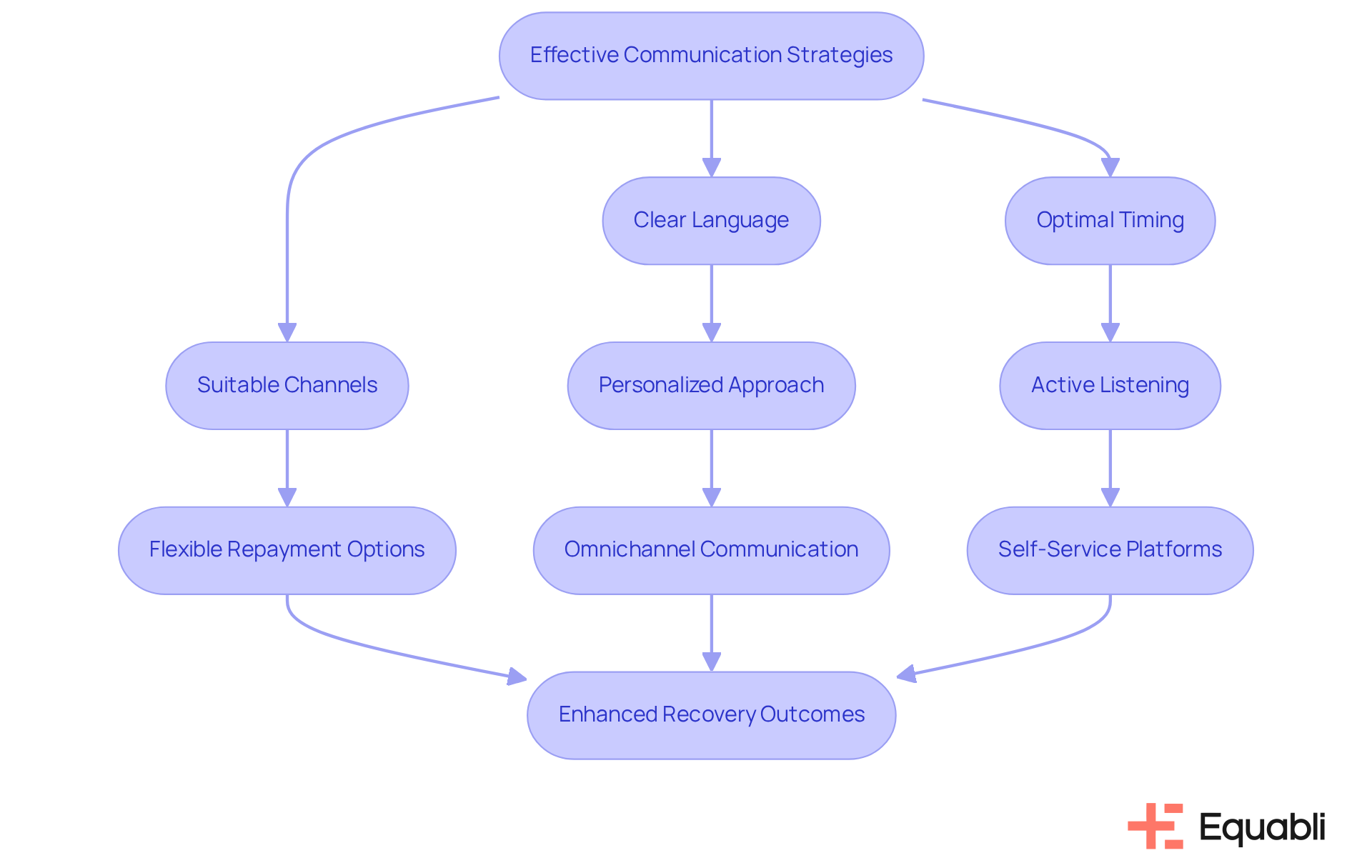

To enhance debt recovery, collection agencies must prioritize effective communication strategies as part of their debt portfolio management strategies for accounts sold to collection agencies. This involves employing clear and professional language, selecting optimal timing for outreach, and choosing suitable communication channels. For example, while phone calls can facilitate immediate feedback and clarification, emails and text messages may be more appropriate for less urgent matters.

A personalized approach is critical; tailoring messages to reflect the individual's unique situation fosters a more empathetic dialogue. Active listening during discussions enables agents to grasp the individual's concerns and financial circumstances, which is essential for negotiating feasible repayment plans. Providing flexible repayment options and ensuring transparency regarding charges and conditions can significantly enhance trust, which is crucial in implementing effective debt portfolio management strategies for accounts sold to collection agencies and encouraging borrowers to engage positively. Customizing interactions with borrowers is vital for improving repayment prospects, which highlights the importance of debt portfolio management strategies for accounts sold to collection agencies in successful recovery.

Real-world examples illustrate the effectiveness of these strategies. Agencies adopting omnichannel communication—integrating phone, email, and SMS—report elevated engagement rates and enhanced recovery outcomes. Furthermore, implementing self-service platforms empowers individuals to manage their accounts independently, further boosting recovery rates and customer satisfaction. By cultivating an environment of open dialogue and support, collection firms can utilize debt portfolio management strategies for accounts sold to collection agencies, which not only helps in recovering debts more efficiently but also in building long-term relationships with debtors, thereby reducing the likelihood of future delinquencies.

Moreover, leveraging EQ Collect's key features can significantly bolster these communication strategies. The platform's automated workflows reduce execution errors and manual resource requirements, allowing agents to concentrate on meaningful interactions. Real-time reporting offers insights that can refine communication tactics, ensuring outreach is timely and relevant. With industry-leading compliance oversight, organizations can maintain while fostering transparent communication. The no-code file-mapping tool and user-friendly interface of EQ Collect further streamline operations, facilitating the effective implementation of these strategies. By integrating these advanced tools, recovery firms can optimize their financial recuperation processes, ensuring smarter orchestration, enhanced performance, and ultimately, improved recovery results.

Leverage Technology for Enhanced Collection Processes

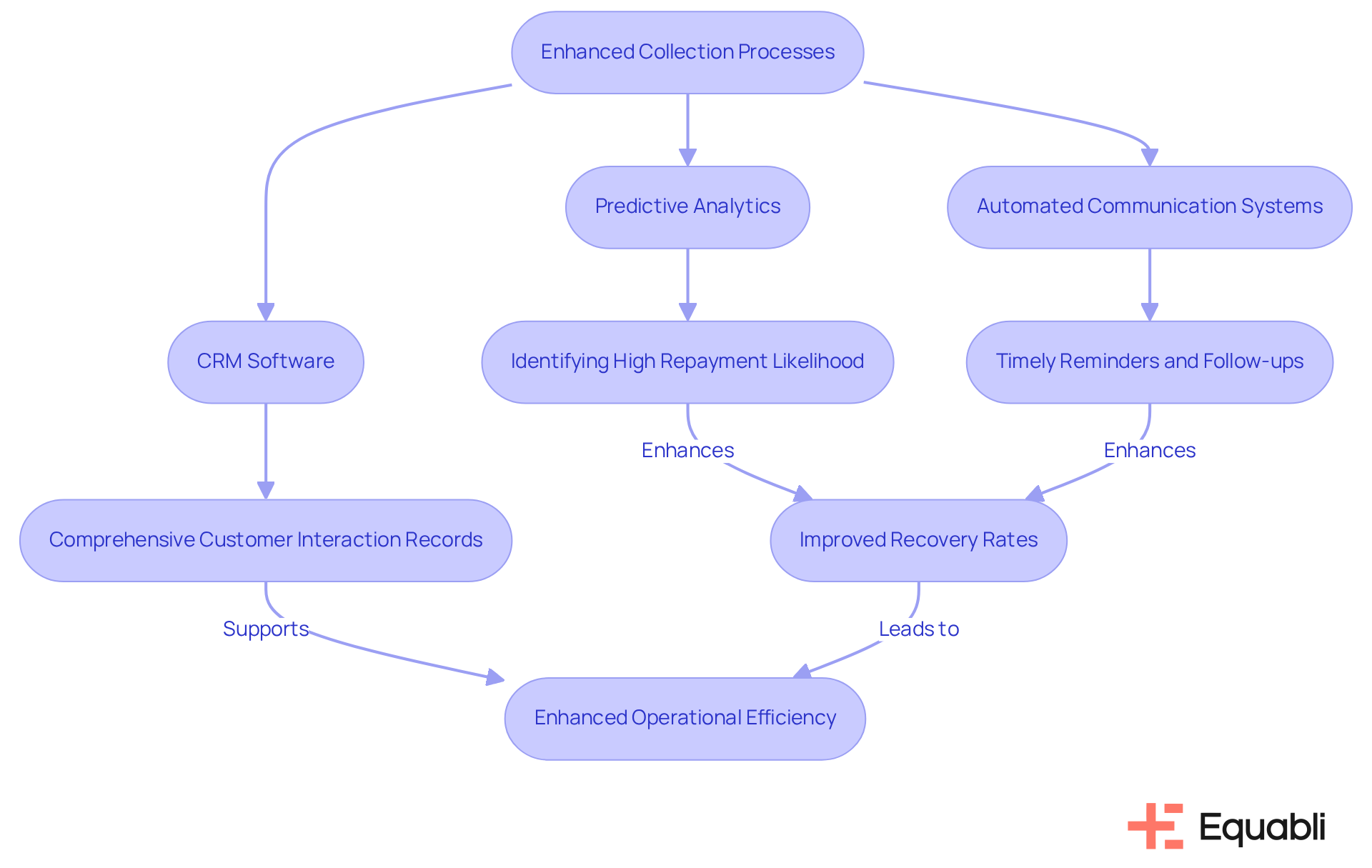

In today's competitive landscape of debt portfolio management strategies for accounts sold to collection agencies, the integration of technology is not merely advantageous; it is essential. Collection firms can leverage predictive analytics, automated communication systems, and customer relationship management (CRM) software to significantly enhance their operational processes while ensuring robust data protection practices in compliance with Equabli's Privacy Policy.

Predictive analytics serves as a vital tool for organizations, enabling them to identify accounts with the highest likelihood of repayment. This capability allows for the efficient prioritization of recovery efforts, optimizing resource allocation and enhancing recovery rates. For instance, agencies employing predictive analytics have reported substantial increases in recovery rates, with some achieving improvements of up to 25% in collections.

Automated communication systems further streamline outreach efforts by dispatching timely reminders and follow-ups without the need for manual intervention. This automation empowers agents to focus on more complex cases, thereby improving overall efficiency. Agencies that have adopted automated text messaging for payment reminders have witnessed a significant rise in response rates, underscoring the effectiveness of contemporary communication methods over traditional approaches.

Moreover, CRM systems play a crucial role in maintaining comprehensive records of customer interactions. By ensuring meticulous tracking of all communications, agents can access pertinent information during client engagements, fostering a more personalized and effective approach. This not only but also significantly improves the debtor experience.

Industry leaders emphasize the transformative impact of predictive analytics in debt management, noting that companies utilizing these tools can achieve a 40% reduction in operational costs while concurrently enhancing recovery rates by 10%. Additionally, 85% of consumers indicate a greater willingness to collaborate with organizations that demonstrate strong data protection policies, highlighting the importance of adopting modern financial recovery methods.

As the debt collection industry continues to evolve, the adoption of technology will be critical for agencies that are implementing debt portfolio management strategies for accounts sold to collection agencies in order to enhance their processes, reduce costs, and ultimately improve recovery rates. However, it remains essential to balance automation with a human touch to sustain meaningful connections with debtors—a principle that Equabli's client success representatives exemplify in their engagement strategies.

Conclusion

Mastering debt portfolio management strategies for collection agencies is essential for optimizing recovery efforts in an increasingly complex financial landscape. Understanding different types of debt—secured versus unsecured—is crucial for tailoring strategies accordingly. By recognizing the unique challenges associated with each debt type, collection agencies can implement more effective recovery tactics that enhance performance and foster positive relationships with debtors.

Key insights include:

- The necessity of compassionate communication

- The advantages of leveraging technology, such as predictive analytics and CRM systems

These strategies not only improve recovery rates but also ensure compliance with evolving regulatory standards, ultimately leading to better long-term outcomes for both agencies and debtors. The integration of effective communication methods and modern technological tools is critical for success in this field.

As the debt collection industry continues to evolve, embracing these best practices will be vital for agencies aiming to thrive in 2025 and beyond. By prioritizing tailored communication strategies and leveraging advanced technology, collection agencies can enhance their operational efficiency and recovery performance. This approach supports immediate financial goals while building a foundation for sustainable relationships with debtors, reinforcing the significance of ethical practices in debt management.

Frequently Asked Questions

Why is understanding debt types important for recovery strategies?

Understanding debt types is crucial because it allows for effective debt portfolio management strategies tailored to the unique challenges and opportunities presented by each type of debt, enhancing recovery rates.

What are secured obligations and how do they affect recovery efforts?

Secured obligations, such as mortgages and auto loans, are backed by collateral. This allows collection agencies to utilize assertive follow-up strategies, including repossession or foreclosure, significantly improving recovery rates.

How do unsecured obligations differ from secured obligations in terms of recovery?

Unsecured obligations, like credit card balances and medical bills, lack collateral, requiring collection agencies to implement negotiation tactics and flexible payment plans to encourage repayment while maintaining the debtor's trust.

What role does communication play in debt recovery?

Compassionate communication strategies are vital, especially in consumer financial matters, as they foster positive relationships. Notably, 50% of participants prefer engaging with a live representative by phone for customer service.

How do consumer and business financial obligations differ?

Consumer liabilities typically involve individual borrowers and require compassionate communication methods, while business liabilities often involve contractual responsibilities that may necessitate a more direct and assertive approach for compliance and recovery.

What is an example of a tailored debt recovery strategy?

A debt recovery firm might create a comprehensive follow-up protocol for secured debts using collateral to support recovery efforts, while adopting a gentler approach for unsecured consumer debts to facilitate constructive dialogue.

What is the expected impact of using the Collect product on recovery performance?

Organizations utilizing the Collect product can expect a 40% increase in recovery performance compared to traditional third-party unsecured consumer retrieval services, highlighting the effectiveness of customized strategies.

How is the financial landscape changing regarding debt management?

As the financial landscape evolves, organizations that effectively classify and manage their debt portfolios will be better equipped to navigate complexities and adhere to ethical practices, emphasizing empathetic communication and respect for debtors' rights.