Overview

Credit and collection specialist solutions are essential for effective risk management, enabling financial entities to assess creditworthiness, establish credit limits, and monitor repayment behaviors. This proactive approach ultimately reduces potential losses from defaults. Evidence of this necessity is found in best practices and technological advancements that enhance credit assessment and collection strategies. By implementing a data-driven methodology, organizations can improve recovery rates and foster stronger relationships with borrowers, thereby aligning operational practices with strategic objectives.

Introduction

In the complex landscape of finance, effective risk management stands as a critical pillar for safeguarding assets and ensuring organizational stability. Credit and collection specialist solutions serve as essential instruments that not only evaluate creditworthiness but also refine recovery strategies, ultimately influencing the financial health of institutions. However, as organizations seek to enhance these processes, they frequently face the challenge of balancing comprehensive risk assessment with the necessity of nurturing personalized relationships with borrowers.

How can financial entities leverage these solutions to navigate this intricate balance and bolster their financial performance?

Understand the Role of Credit and Collection Solutions in Risk Management

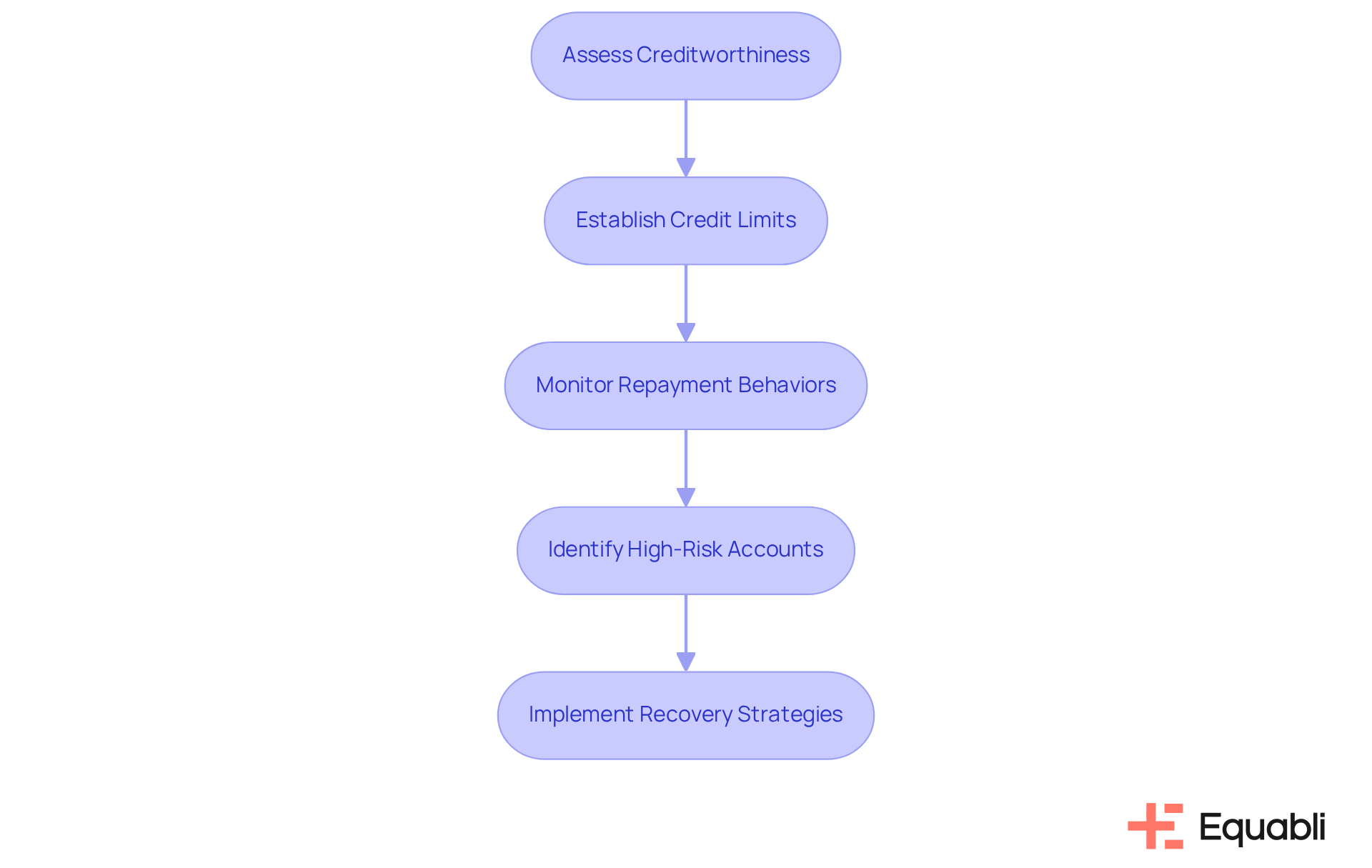

Credit and collection specialist solutions for enterprise financial risk management are essential components that enable financial entities to assess and mitigate potential losses associated with defaults. The credit and collection specialist solutions for enterprise financial risk management provide a structured approach to evaluating creditworthiness, establishing appropriate credit limits, and monitoring repayment behaviors. By employing data analysis and predictive modeling, organizations can identify high-risk accounts early and implement targeted recovery strategies. This proactive approach not only enhances recovery rates but also fosters stronger relationships with borrowers, ultimately contributing to improved financial wellbeing for the organization.

For instance, organizations utilizing sophisticated scoring models can predict repayment behaviors with greater accuracy, allowing them to tailor their recovery efforts accordingly. This is critical for effective management through credit and collection specialist solutions for enterprise financial risk management in today's dynamic financial landscape.

Implement Best Practices for Effective Credit and Collection Management

To achieve effective credit and collection management, institutions should adopt several best practices:

- Establish Clear Credit Policies: Defining credit limits, terms, and conditions is essential for ensuring consistency in decision-making. This clarity mitigates risks associated with credit extensions and enhances compliance with industry regulations.

- Conduct Thorough Credit Assessments: Comprehensive credit evaluations are vital for accurately determining the risk profiles of applicants. Utilizing robust can significantly improve credit and collection specialist solutions for enterprise financial risk management, enabling institutions to make informed lending decisions.

- Implement Proactive Communication: Maintaining regular contact with borrowers is crucial. By reminding them of upcoming payments and addressing concerns promptly, institutions can enhance borrower relationships and reduce delinquency rates.

- Leverage Data Analytics: Data-driven insights are instrumental in identifying trends in repayment behaviors. This allows organizations to modify recovery strategies proactively, aligning them with observed patterns to optimize collection efforts.

- Train Staff for Acquisitions: Equipping personnel with the necessary skills and knowledge to manage items empathetically and effectively is imperative. Well-trained staff can navigate complex borrower interactions, fostering a more positive collection environment.

By adhering to these best practices, financial organizations can enhance their retrieval processes, reduce delinquency rates, and ultimately improve their bottom line with credit and collection specialist solutions for enterprise financial risk management.

Leverage Technology for Enhanced Risk Assessment and Collection Strategies

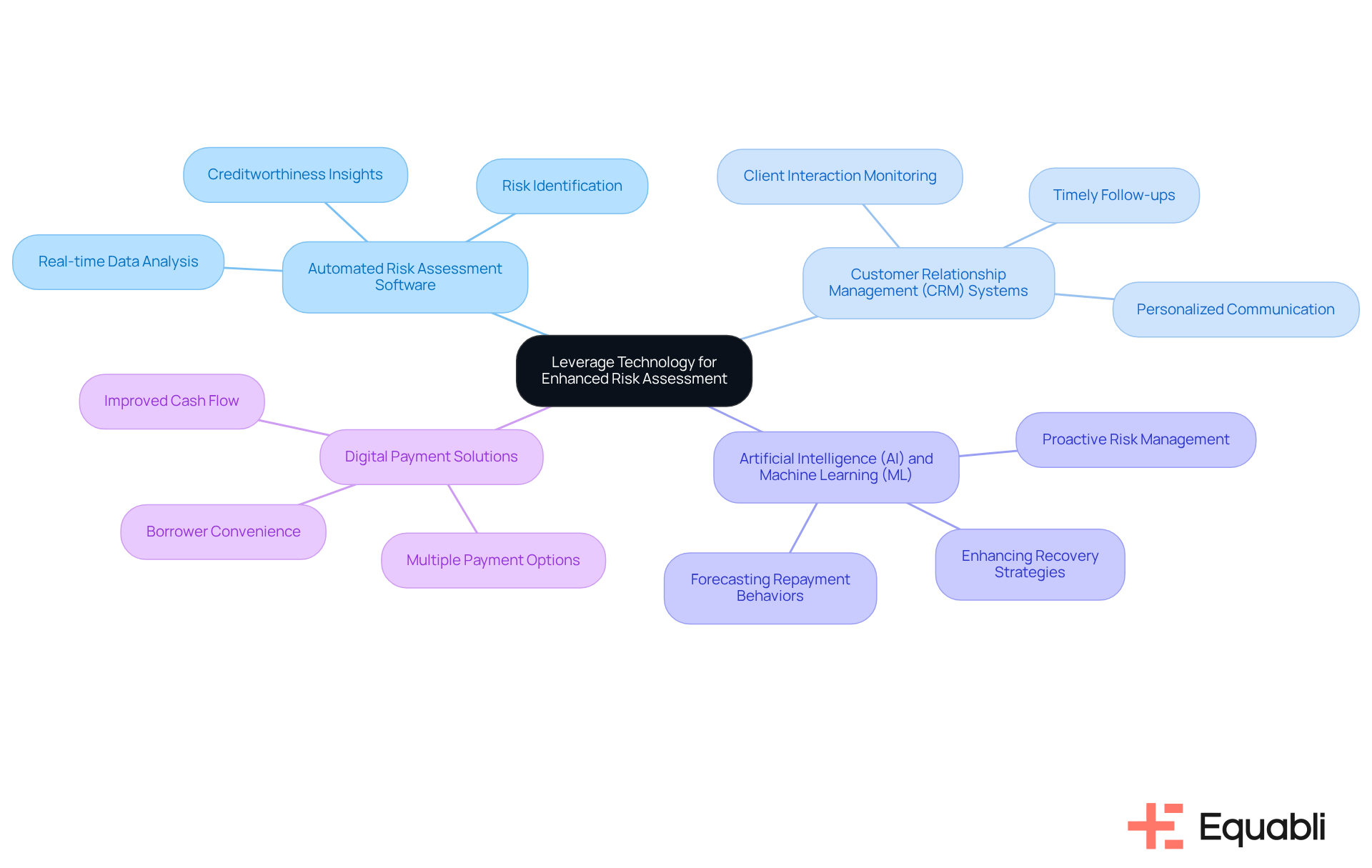

Technology plays a transformative role in evaluation and collection strategies. Financial institutions can utilize advanced tools to enhance their operations, including:

- Automated Risk Assessment Software: These tools analyze borrower data in real-time, providing insights into creditworthiness and potential risks, which is crucial for informed decision-making.

- Customer Relationship Management (CRM) Systems: CRMs assist in monitoring interactions with clients, ensuring timely follow-ups and personalized communication, thereby improving customer satisfaction and retention.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML algorithms can forecast repayment behaviors and enhance recovery strategies based on historical data, allowing organizations to proactively manage risk.

- Digital Payment Solutions: Offering multiple payment options enhances borrower convenience and increases the likelihood of timely repayments, directly impacting cash flow.

By incorporating these technologies, organizations can simplify their gathering processes, lower operational expenses, and enhance overall effectiveness in handling credit and collection specialist solutions for enterprise financial risk management. This strategic adoption not only but also positions institutions to better navigate the complexities of the financial landscape.

Customize Solutions to Meet Unique Financial Institution Needs

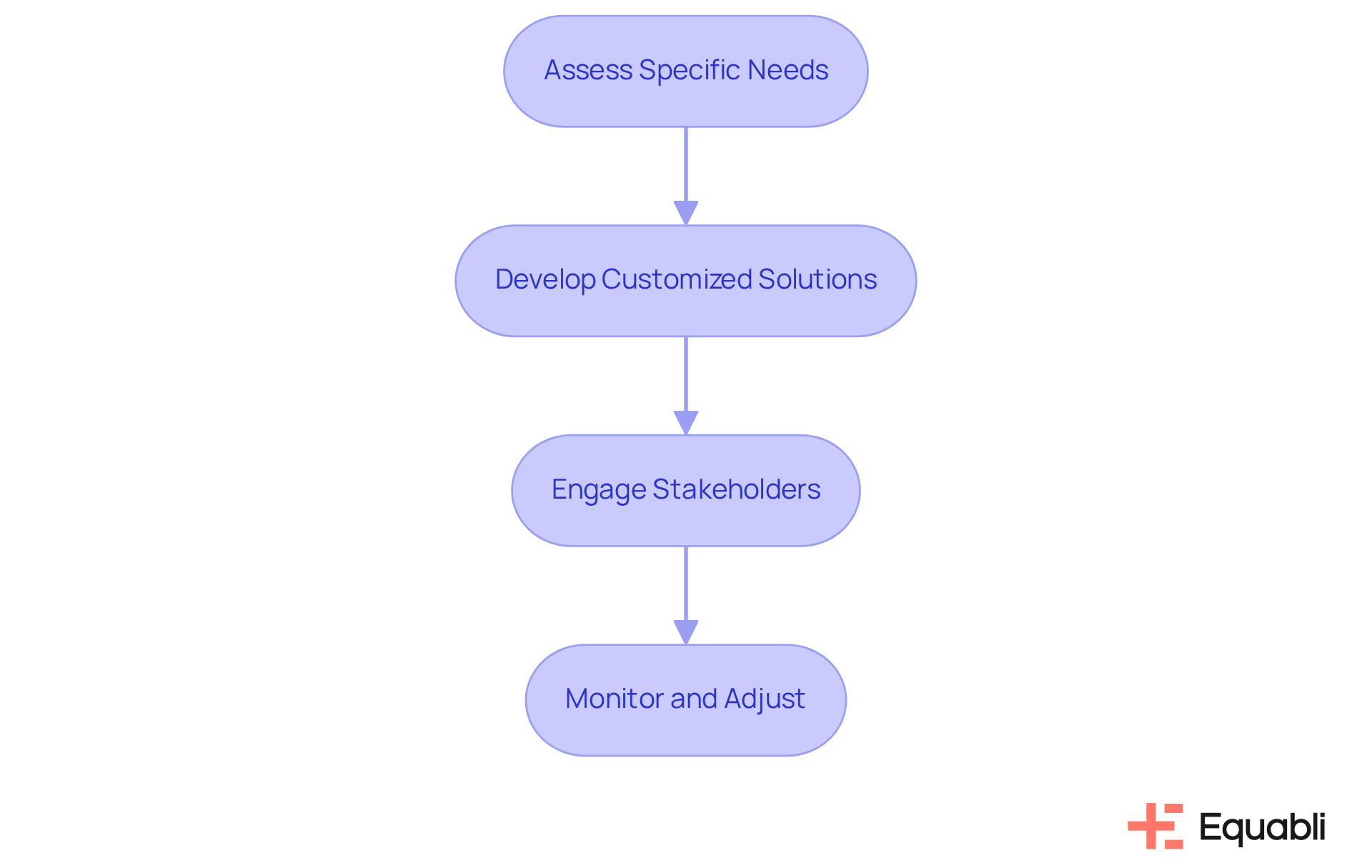

Each financial entity encounters unique challenges and requirements that can be addressed by credit and collection specialist solutions for enterprise financial risk management. To effectively address these, institutions should:

- Assess Specific Needs: Conduct a thorough analysis of the institution's current processes, challenges, and goals to identify areas for improvement. This foundational step ensures that subsequent strategies are tailored to the institution's specific context.

- Develop Customized Solutions: Create personalized credit policies and retrieval strategies that align with the organization's risk tolerance and operational capabilities. Customized solutions enhance relevance and effectiveness in addressing unique operational challenges.

- Engage Stakeholders: Involve key stakeholders in the customization process to ensure the developed solutions are practical and widely accepted. Stakeholder engagement fosters buy-in and enhances the likelihood of successful implementation.

- Monitor and Adjust: Continuously evaluate the effectiveness of the and make necessary adjustments to adapt to changing market conditions and borrower behaviors. Ongoing monitoring is critical to maintaining the relevance of strategies in a dynamic environment.

By focusing on customization, financial institutions can enhance their risk management efforts through credit and collection specialist solutions for enterprise financial risk management, leading to improved collection rates and reduced financial losses.

Conclusion

Effective risk management in credit and collection necessitates a comprehensive understanding of specialized solutions that empower financial institutions to assess and mitigate potential losses. By integrating structured evaluation processes, organizations can enhance their creditworthiness assessments, set appropriate credit limits, and monitor repayment behaviors. This proactive approach not only increases recovery rates but also fortifies borrower relationships, ultimately contributing to the financial health of the organization.

The article delineates several best practices essential for successful credit and collection management:

- Establishing clear credit policies

- Conducting thorough assessments

- Maintaining proactive communication

- Leveraging data analytics

- Training staff

These pivotal steps can significantly reduce delinquency rates and improve overall collection effectiveness. Furthermore, the integration of advanced technologies—such as automated risk assessment software and AI—further streamlines operations and enhances decision-making capabilities.

In conclusion, the significance of customized credit and collection solutions is paramount. By assessing specific needs, developing tailored strategies, engaging stakeholders, and continuously monitoring effectiveness, financial institutions can adeptly navigate the complexities of risk management. Embracing these practices not only mitigates financial risks but also positions organizations for sustainable growth in an ever-evolving landscape. Prioritizing effective credit and collection strategies is essential for fostering resilience and achieving long-term success in financial management.

Frequently Asked Questions

What are credit and collection specialist solutions?

Credit and collection specialist solutions are tools and methodologies used by financial entities to assess creditworthiness, establish credit limits, and monitor repayment behaviors to manage financial risk.

How do these solutions help in risk management?

They enable organizations to evaluate potential losses from defaults, identify high-risk accounts early, and implement targeted recovery strategies, thereby mitigating financial risks.

What role does data analysis play in credit and collection solutions?

Data analysis and predictive modeling are employed to accurately predict repayment behaviors, which helps organizations tailor their recovery efforts effectively.

Why is it important to establish appropriate credit limits?

Establishing appropriate credit limits is crucial to manage risk effectively, as it helps prevent overextending credit to borrowers who may not be able to repay.

How do credit and collection solutions enhance recovery rates?

By employing a proactive approach to monitor accounts and implementing targeted recovery strategies based on data insights, organizations can improve their recovery rates.

What is the benefit of fostering stronger relationships with borrowers?

Stronger relationships with borrowers can lead to better communication, increased trust, and ultimately contribute to improved financial wellbeing for the organization.

Why is a strategic alignment between credit evaluation and recovery processes important?

A strategic alignment is critical for effective management as it ensures that the credit evaluation process informs recovery efforts, leading to more efficient and effective risk management.