Overview

Effective financial debt recovery solutions for corporate risk management prioritize structured processes, technology integration, and compliance adherence to enhance recovery rates. Evidence indicates that personalized interactions, flexible payment options, and automated systems significantly improve recovery outcomes. Case studies illustrate that organizations implementing these strategies experience enhanced performance metrics. Thus, it is crucial for enterprises to adopt these advanced recovery methodologies to optimize their financial risk management.

Introduction

Understanding the complexities of corporate debt recovery is essential for organizations aiming to mitigate financial risks and enhance their bottom line. Effective strategies and innovative technologies can transform debt recovery processes, providing insights into optimizing approaches for better outcomes. However, as companies navigate these solutions, they often encounter the challenge of balancing compliance with the need for efficiency.

How can organizations ensure ethical practices while maximizing recovery rates? This article will explore these critical considerations.

Understand the Debt Recovery Process in Corporate Risk Management

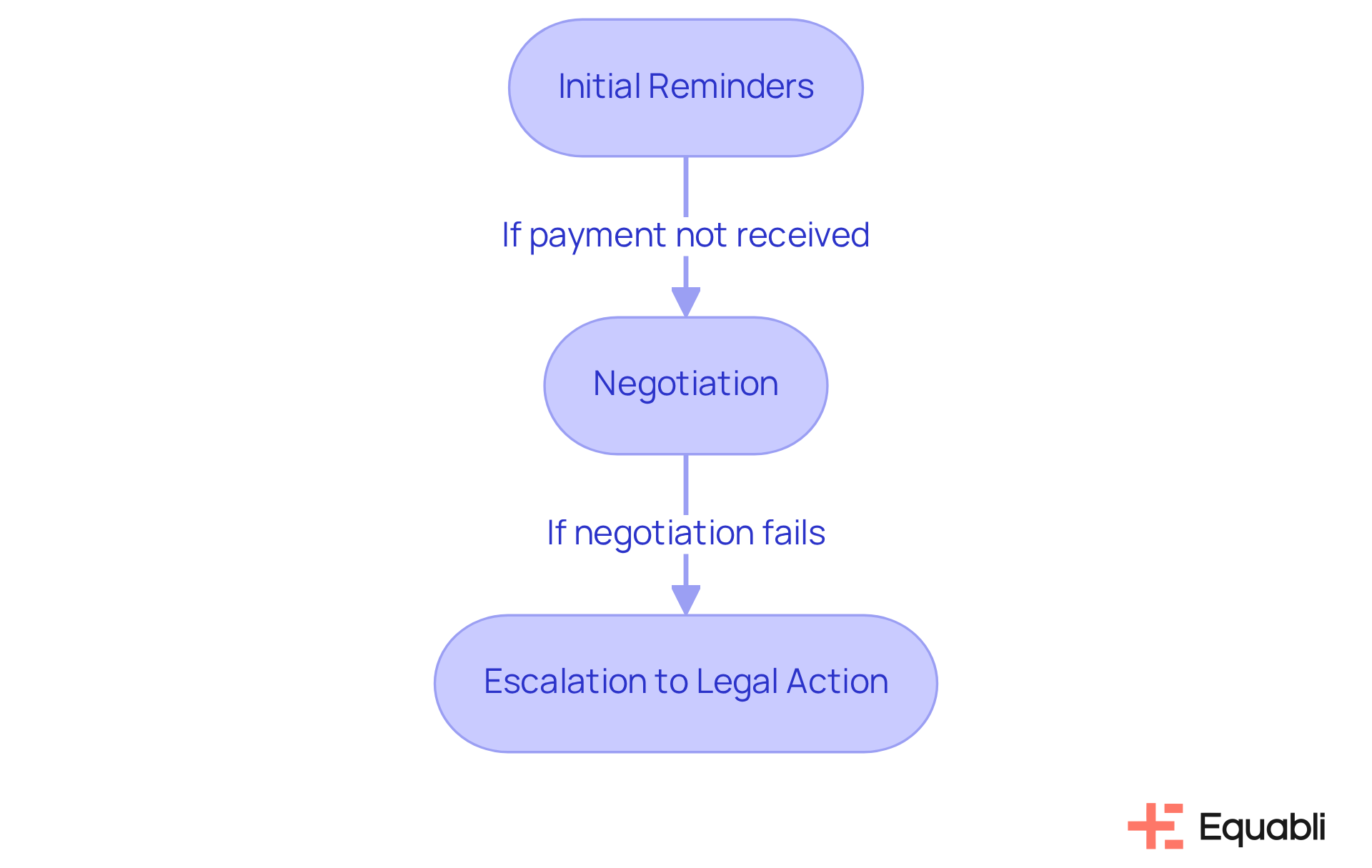

The debt collection process encompasses several critical stages: initial reminders, negotiation, and potential escalation to legal action. Establishing clear communication pathways with debtors is essential; timely and consistent reminders significantly influence repayment outcomes. A thorough understanding of the debtor's financial situation enables organizations to negotiate effectively, offering flexible payment plans tailored to individual capabilities. Furthermore, awareness of legal implications, such as adherence to the Fair Debt Collection Practices Act (FDCPA), is crucial for upholding ethical standards in collection efforts.

Organized restoration methods have proven effective in enhancing financial debt recovery solutions for corporate risk management. For example, a telecom firm that implemented a phased approach to financial collection experienced a 20% increase in collection rates by prioritizing early intervention and tailored communication strategies. This aligns with industry insights that stress the importance of mapping out the entire recovery process, particularly financial debt recovery solutions for corporate risk management, to identify critical touchpoints, ultimately optimizing strategies to minimize losses and enhance recovery outcomes. As Chris Hopkins, an expert in product management, states, "Smart data analysis and machine learning are the foundations of successful debt collection strategies," underscoring the pivotal role of technology in refining these processes.

Equabli's EQ Collect provides key features that can significantly enhance these processes. By streamlining vendor onboarding timelines with a straightforward, no-code file-mapping tool, companies can improve efficiency and boost collections through data-driven strategies. The platform reduces execution errors and manual resource requirements through automated workflows, ensuring smarter orchestration and superior performance. Additionally, real-time reporting delivers unmatched clarity and insights, empowering organizations to make informed decisions promptly. Notably, EQ Collect ensures secure, industry-leading compliance supervision, both internally and externally, which is vital for maintaining ethical standards in restoration efforts. Organizations can anticipate a 40% increase in performance from structured restoration products compared to conventional methods, highlighting the effectiveness of these strategies. Moreover, AI capabilities have demonstrated a 10% improvement in recoveries, emphasizing the significance of integrating technology into financial debt recovery solutions for corporate risk management. With 59.5% of consumers preferring email as their primary contact method for collections, leveraging through EQ Collect is essential for enhancing engagement and compliance.

Implement Effective Strategies for Debt Recovery

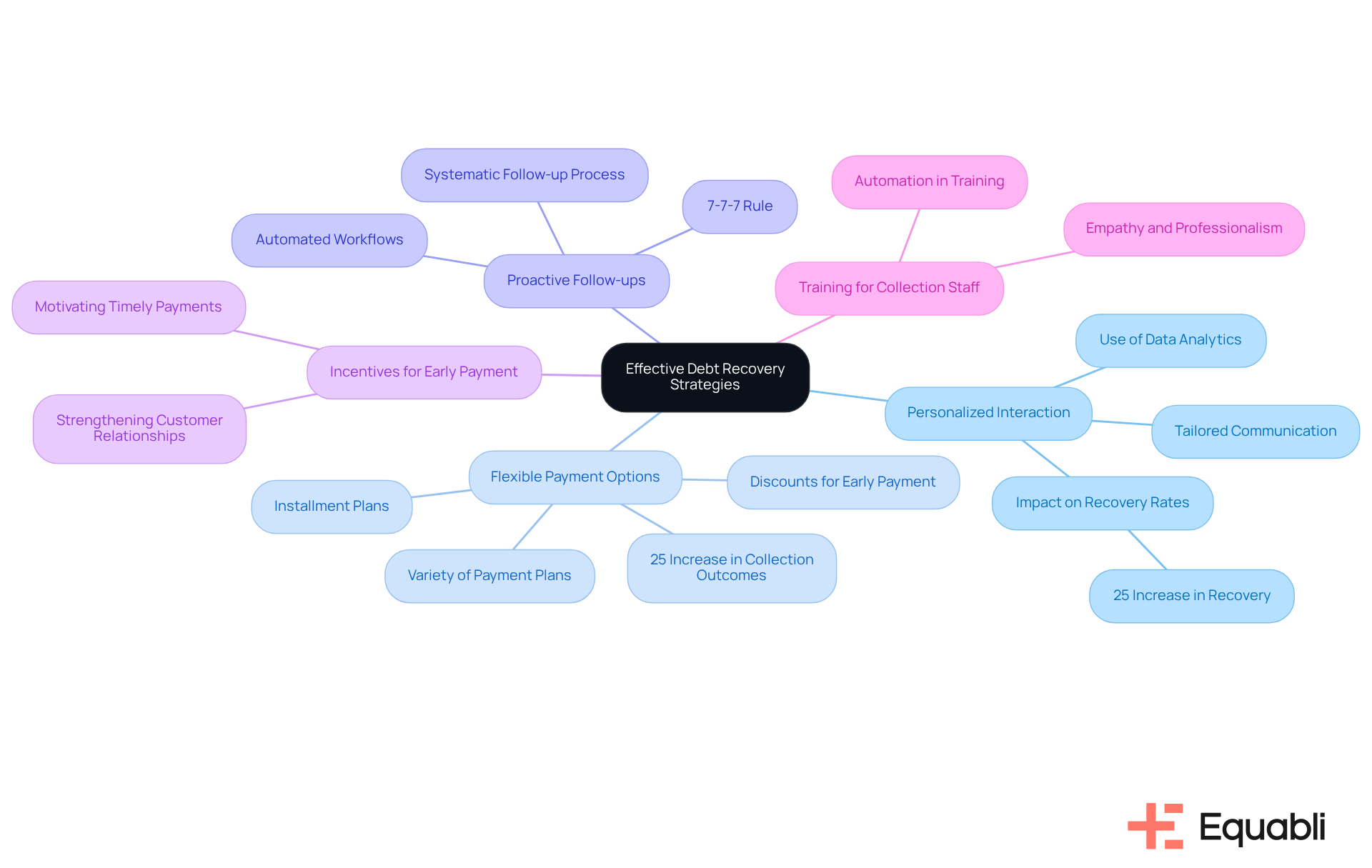

To implement effective debt recovery strategies, organizations should consider the following best practices:

- Personalized Interaction: Tailoring interactions to the debtor's unique circumstances is essential. Utilizing data analytics to assess payment history and preferences enables more effective outreach, fostering a sense of understanding and connection. For instance, Equabli's EQ Engage provides innovative features that facilitate personalized interaction, making it one of the effective financial debt recovery solutions for corporate risk management, ensuring that each engagement is relevant and impactful for the borrower.

- Flexible Payment Options: Offering a variety of payment plans that cater to diverse financial situations is critical. Options such as installment plans or discounts for early payment can significantly enhance collection rates, with evidence indicating that flexible arrangements can lead to a 25% increase in collection outcomes. The EQ Suite includes customizable repayment options that empower borrowers to select plans that best align with their financial debt recovery solutions for corporate risk management.

- Proactive Follow-ups: Establishing a systematic follow-up process is vital for reminding debtors of their obligations. Consistent interaction can prevent debts from escalating, in line with the 7-7-7 rule, which emphasizes timely outreach to maximize recovery potential. With EQ Collect's , organizations can implement financial debt recovery solutions for corporate risk management, streamlining follow-up processes to ensure timely and consistent engagement with debtors.

- Incentives for Early Payment: Providing incentives for debtors who pay early or in full can effectively motivate timely payments and enhance cash flow. This strategy not only encourages prompt repayment but also fortifies customer relationships. By leveraging financial debt recovery solutions for corporate risk management through data-driven strategies from EQ Collect, organizations can identify optimal incentives to offer, maximizing their effectiveness.

- Training for Collection Staff: Equipping staff with the skills to handle sensitive conversations with empathy and professionalism is crucial. A well-trained team can navigate challenging discussions regarding financial debt recovery solutions for corporate risk management, resulting in better outcomes and increased debtor trust. Integrating automation into training processes can enhance staff efficiency, allowing them to concentrate on high-value interactions while EQ Collect manages routine tasks.

For example, a healthcare provider that embraced tailored interaction and adaptable payment choices experienced a remarkable 30% rise in recovery rates within six months, showcasing the effectiveness of financial debt recovery solutions for corporate risk management in practical scenarios. Furthermore, integrating automation through EQ Collect can significantly enhance the efficiency of these processes by managing up to 70% of customer interactions, thereby reducing operational costs and improving compliance with legal requirements.

Leverage Technology for Enhanced Debt Recovery Efficiency

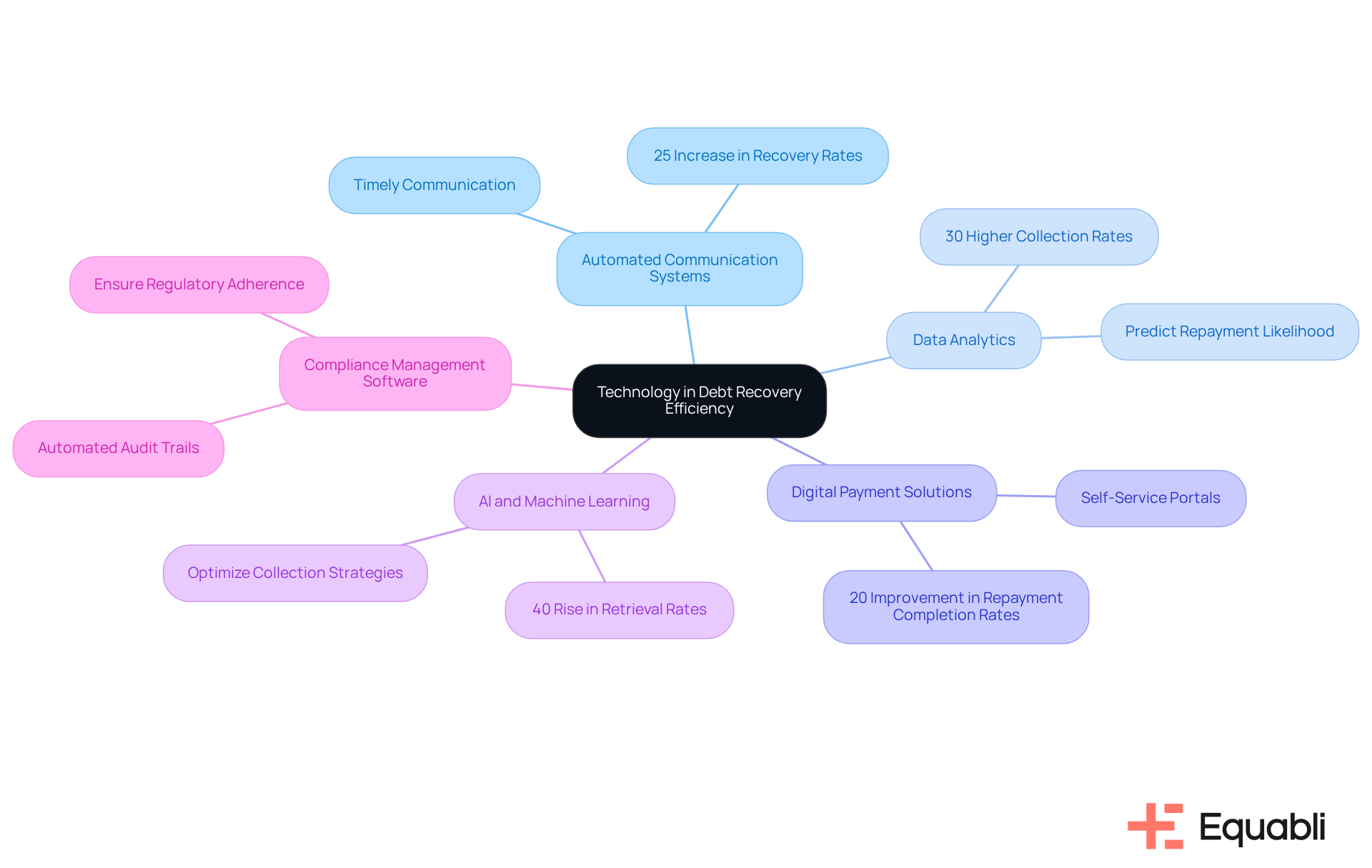

Technology is fundamentally transforming debt collection by offering financial debt recovery solutions for corporate risk management, empowering organizations to enhance operational efficiency through an array of innovative tools and platforms. Notable components include:

- Automated Communication Systems: The implementation of automated systems for reminders and follow-ups significantly reduces manual effort while ensuring timely communication. This approach has led to a reported 25% increase in recovery rates among agencies utilizing these systems, thereby underscoring their effectiveness in improving engagement rates.

- Data Analytics: By leveraging data analytics, organizations can assess debtor behavior and predict repayment likelihood. Such insights inform collection strategies, allowing agencies to prioritize high-impact cases and optimize resource allocation. Organizations that apply predictive analytics have reported collection rates up to 30% higher, highlighting the value of data-driven strategies in enhancing operational outcomes.

- Digital Payment Solutions: Providing online payment options through self-service portals significantly enhances the payment experience for debtors. This shift has resulted in a 20% improvement in , empowering consumers to manage their accounts independently and fostering a sense of control and satisfaction.

- AI and Machine Learning: The employment of AI-driven tools optimizes collection strategies based on real-time data. These technologies identify the most effective times and methods for contacting debtors, thereby enhancing right-party contact (RPC) rates and overall operational efficiency.

- Compliance Management Software: Utilizing compliance-focused software is crucial for ensuring adherence to regulatory requirements, thereby reducing the risk of legal issues. Automated audit trails and standardized communication practices bolster compliance, which is increasingly critical in today’s regulatory landscape.

For example, a fintech firm that integrated AI into its collection process reported an impressive 40% rise in retrieval rates, attributed to enhanced targeting and operational efficiency. This case illustrates the substantial impact that technology can have on the effectiveness of financial debt recovery solutions for corporate risk management.

Ensure Compliance and Risk Management in Debt Recovery

Adherence to collection regulations is essential for entities aiming to utilize financial debt recovery solutions for corporate risk management to effectively mitigate risks. Implementing best practices can enhance compliance and protect against potential legal challenges:

- Regular Training: Ongoing training for staff on compliance requirements, including the Fair Debt Collection Practices Act (FDCPA) and other pertinent laws, is vital. The Consumer Financial Protection Bureau indicates that only 17% of charged-off credit card balances were recovered within four years, underscoring the importance of educating personnel to prevent violations and cultivate a culture of ethical conduct within the organization.

- Documentation and Record-Keeping: Maintaining thorough records of all communications and transactions related to debt collection is crucial. Such documentation acts as critical evidence in disputes, reinforcing the entity's commitment to compliance. Research shows that organizations employing comprehensive documentation practices significantly improved their recovery rates, emphasizing the necessity of financial debt recovery solutions for corporate risk management.

- Risk Assessment: Conducting regular risk evaluations enables entities to proactively identify potential compliance issues. Developing strategies that include financial debt recovery solutions for corporate risk management can avert costly legal challenges and enhance overall operational efficiency. Notably, 72% of compliance and risk professionals concur that third-party due diligence substantially reduces risks, emphasizing the importance of proactive risk management.

- Consumer Rights Awareness: It is imperative that all staff members are well-versed in consumer rights. Treating debtors with respect and dignity fosters positive relationships and aligns with .

- Third-Party Vendor Compliance: When engaging third-party collection agencies, ensuring they adhere to the same compliance standards as your organization is essential. This alignment helps maintain a consistent approach to risk management across all collection efforts, utilizing financial debt recovery solutions for corporate risk management.

For instance, a financial institution that implemented a robust compliance program reported a 50% reduction in legal disputes, illustrating the effectiveness of proactive risk management in debt recovery. Furthermore, agencies that modernized their communication methods, as highlighted in a recent case study, experienced improved engagement rates and compliance adherence, further demonstrating the impact of these best practices.

Conclusion

Effective financial debt recovery serves as a cornerstone of corporate risk management, enabling organizations to sustain healthy cash flow while minimizing losses. By comprehensively understanding the intricacies of the debt recovery process and implementing tailored strategies, companies can leverage technology to significantly enhance their recovery outcomes. The integration of personalized interactions, flexible payment options, proactive follow-ups, and robust compliance measures fosters a comprehensive approach that not only strengthens relationships with debtors but also aligns with regulatory requirements.

This article highlights several key strategies that have proven effective in improving debt recovery rates. Utilizing data analytics for targeted communication and implementing automated systems for efficient follow-ups are among the insights provided, demonstrating how organizations can adapt their practices to the evolving landscape of debt collection. Moreover, case studies illustrate the tangible benefits of these strategies, showcasing significant increases in recovery rates and operational efficiency.

In conclusion, the importance of adopting effective financial debt recovery solutions cannot be overstated. As businesses navigate the complexities of corporate risk management, embracing innovative technologies and best practices will be vital for optimizing recovery efforts. Organizations are advised to assess their current strategies, explore new technological advancements, and prioritize compliance to enhance their debt recovery processes and secure their financial stability in an increasingly competitive market.

Frequently Asked Questions

What are the main stages of the debt recovery process in corporate risk management?

The main stages of the debt recovery process include initial reminders, negotiation, and potential escalation to legal action.

Why is communication important in the debt recovery process?

Establishing clear communication pathways with debtors is essential, as timely and consistent reminders significantly influence repayment outcomes.

How can organizations effectively negotiate with debtors?

Organizations can negotiate effectively by understanding the debtor's financial situation and offering flexible payment plans tailored to individual capabilities.

What legal considerations should organizations be aware of during debt collection?

Organizations must adhere to the Fair Debt Collection Practices Act (FDCPA) to uphold ethical standards in their collection efforts.

What strategies can enhance financial debt recovery solutions?

Organized restoration methods, such as prioritizing early intervention and tailored communication strategies, can enhance financial debt recovery solutions.

How did a telecom firm improve its collection rates?

A telecom firm experienced a 20% increase in collection rates by implementing a phased approach to financial collection.

What role does technology play in debt collection strategies?

Technology, including smart data analysis and machine learning, is crucial for refining debt collection processes and optimizing recovery strategies.

What features does Equabli's EQ Collect provide to improve debt recovery?

EQ Collect offers a no-code file-mapping tool for vendor onboarding, automated workflows to reduce errors, real-time reporting for informed decision-making, and secure compliance supervision.

How much can organizations expect to improve performance by using structured restoration products?

Organizations can anticipate a 40% increase in performance from structured restoration products compared to conventional methods.

What impact does AI have on debt recovery?

AI capabilities have demonstrated a 10% improvement in recoveries, highlighting the importance of integrating technology into financial debt recovery solutions.

What is the preferred contact method for consumers regarding collections?

59.5% of consumers prefer email as their primary contact method for collections, making it essential to leverage digital channels for engagement and compliance.