Overview

This article identifies effective outsourced collection agency solutions that enhance enterprise risk management. It emphasizes that utilizing specialized services from agencies such as Equabli, Gaviti, and Atradius can lead to improved recovery rates and reduced operational risks. These agencies leverage advanced technologies and tailored strategies to manage debt collection efficiently, ensuring compliance while fostering positive relationships with debtors. The strategic implementation of these services positions enterprises to navigate complex compliance challenges and optimize recovery efforts.

Introduction

The landscape of enterprise risk management is experiencing a significant transformation, driven by the increasing complexities of debt recovery and the necessity for effective strategies to mitigate financial losses. Outsourced collection agency solutions have emerged as a pivotal tool for organizations aiming to enhance their recovery processes while managing risks more efficiently. This article explores ten innovative solutions that empower enterprises to navigate the challenges of debt collection, providing insights into how these strategies can optimize recovery rates and foster stronger relationships with borrowers.

However, as businesses adopt these outsourced solutions, they confront critical questions:

- How can they balance efficiency with compliance?

- What are the potential pitfalls of relinquishing control over debt recovery?

Examining these dynamics reveals the intricate interplay between opportunity and risk in modern debt management.

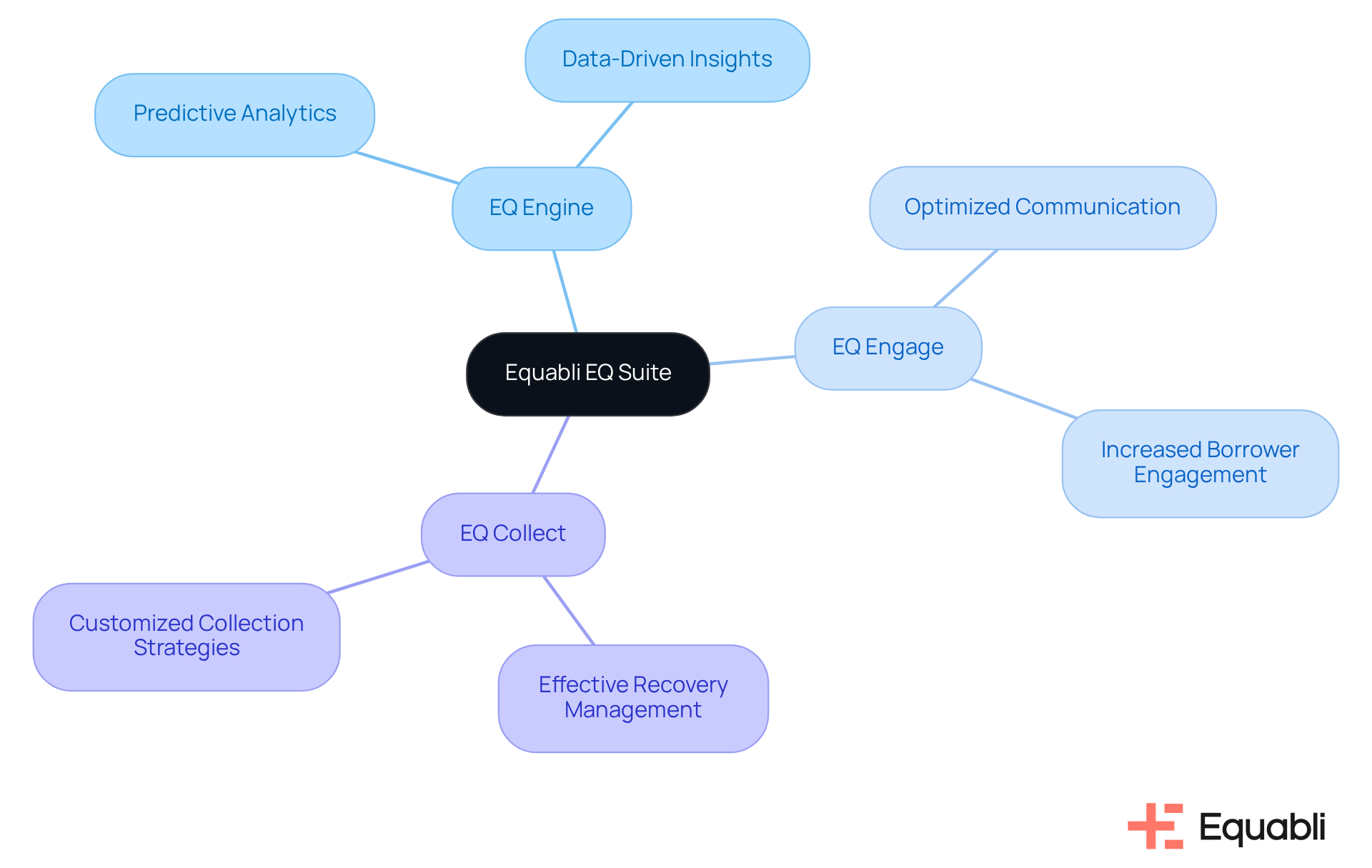

Equabli EQ Suite: Comprehensive Debt Collection Solutions for Risk Management

The Equabli EQ Suite presents a comprehensive suite of tools designed to streamline debt recovery processes and enhance the management of potential challenges. The EQ Engine facilitates predictive analytics, EQ Engage optimizes borrower communication, and EQ Collect ensures effective recovery management. Together, these features empower organizations to customize their collection strategies informed by data-driven insights. This adaptability is crucial for effectively addressing enterprise challenges by utilizing outsourced collection agency solutions for enterprise risk management, enabling businesses to proactively respond to delinquency trends and borrower behaviors.

Utilizing the EQ Suite allows businesses to , improve compliance, and increase borrower engagement. These enhancements contribute to higher recovery rates and a diminished risk of potential losses.

Atradius Collections: Tailored Services for Effective Risk Management

Equabli provides customized debt recovery solutions specifically designed for financial institutions and agencies. This approach merges local knowledge with cutting-edge technology, ensuring clients receive effective solutions that align with their management goals. Utilizing and a dedicated Client Success Representative, Equabli enhances recovery strategies, improves debtor communication, and ultimately increases recovery rates.

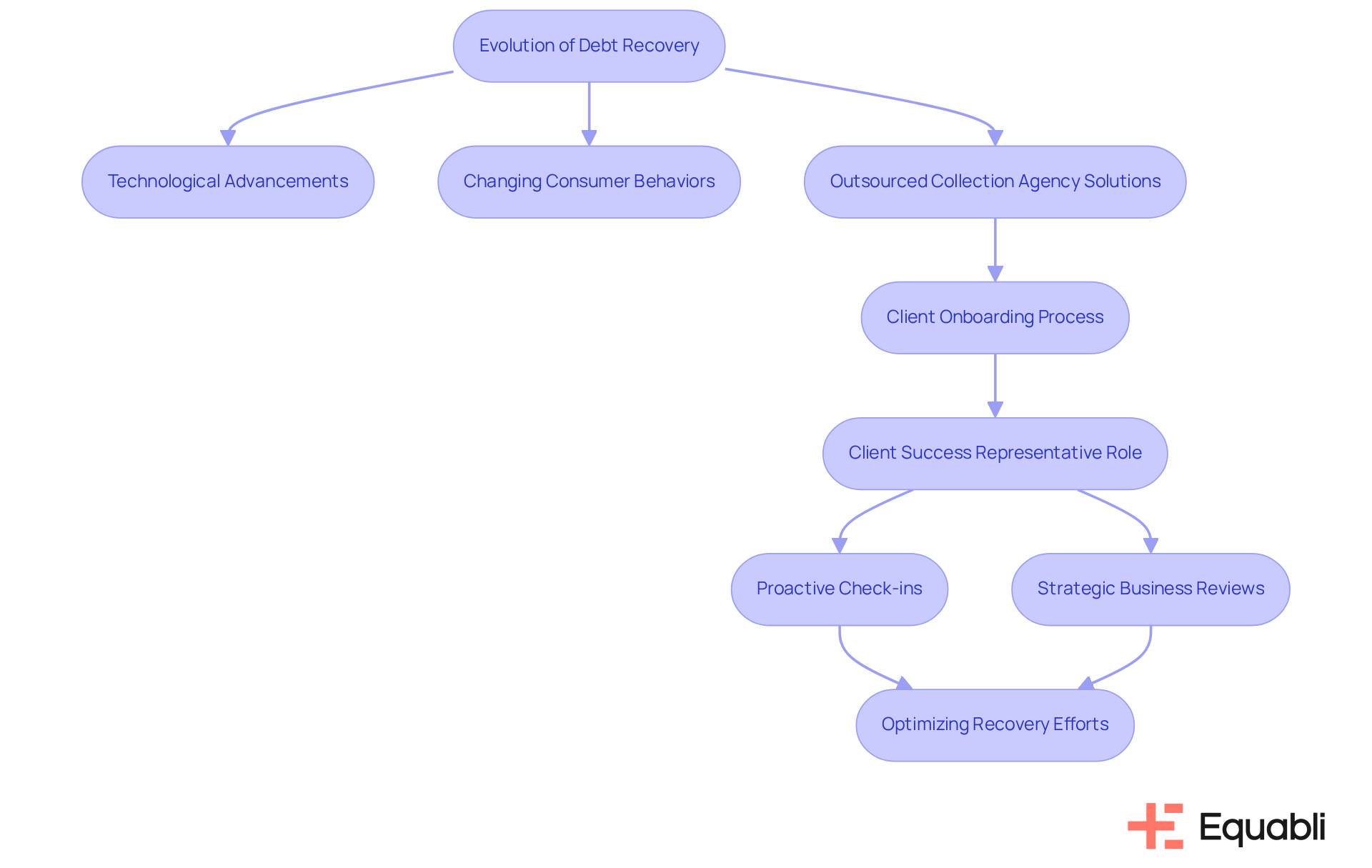

The Client Success Representative is integral to this process, overseeing the setup and implementation during client onboarding to facilitate a seamless transition from sales to service. They manage a portfolio of customer accounts, fostering trust and serving as the primary point of contact. By comprehensively understanding clients' business objectives, they drive product adoption and engagement, conducting proactive check-ins and strategic business reviews to share insights and identify expansion opportunities.

Equabli's services, which encompass advanced data analytics and tailored acquisition strategies, offer outsourced collection agency solutions for enterprise risk management, enabling enterprises to effectively manage risk while maintaining robust relationships with their customers. This dedication to client success not only enhances the onboarding experience but also cultivates long-term partnerships that empower lenders and agencies through the EQ Suite.

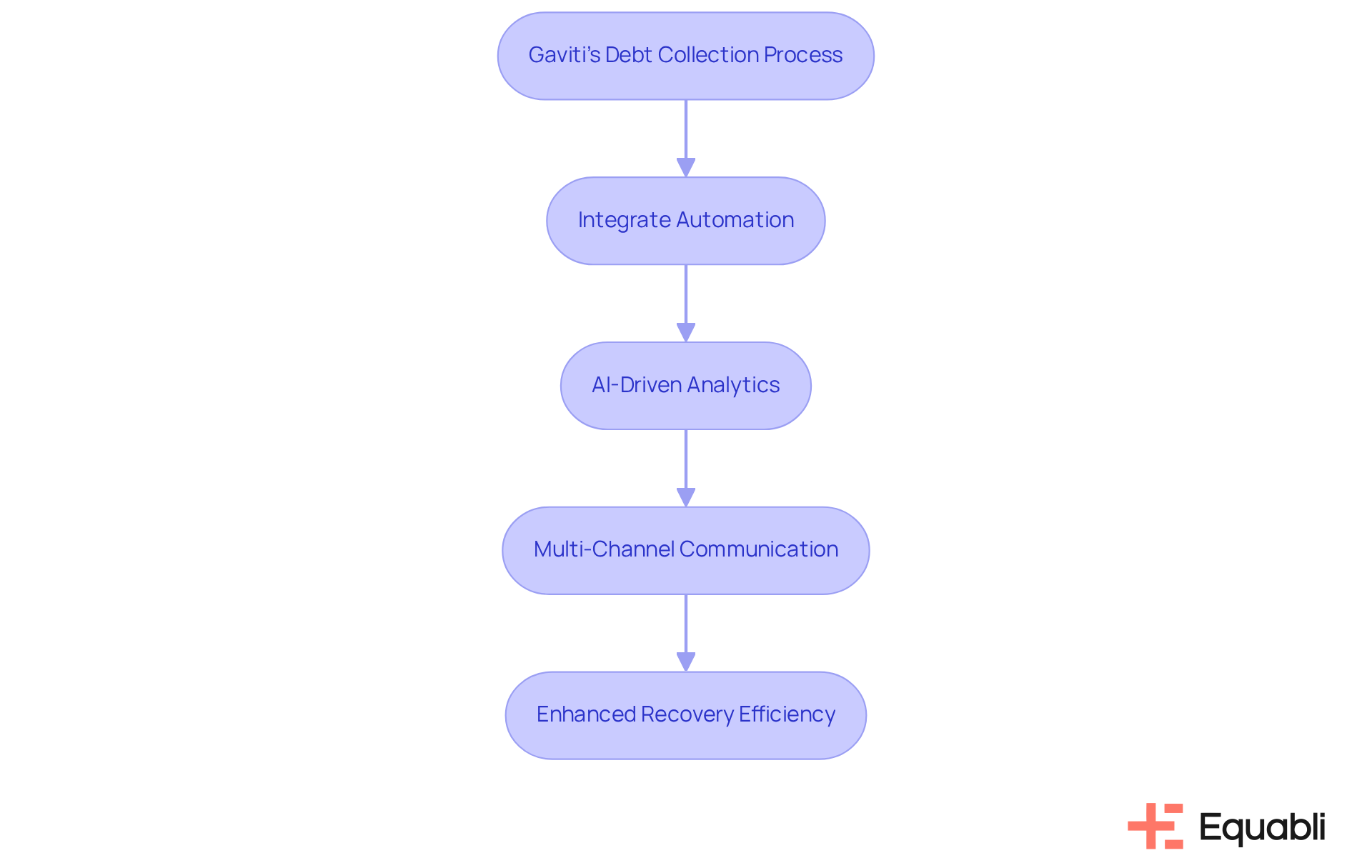

Gaviti: Innovative Outsourcing Solutions for Enhanced Debt Collection Efficiency

Gaviti provides innovative outsourcing solutions that enhance debt recovery efficiency. Their platform integrates automation and AI-driven analytics, which significantly streamlines the retrieval process. This allows businesses to focus on core operations while simultaneously . Gaviti employs multi-channel communication strategies that effectively engage debtors, ensuring timely payments and reducing the risk of delinquency.

By outsourcing to Gaviti, businesses can take advantage of outsourced collection agency solutions for enterprise risk management, leveraging specialized expertise and advanced technology to achieve a more effective collection process that aligns with their management objectives.

The Evolution of Debt Recovery: Adapting to Modern Risk Management Challenges

The landscape of financial recovery has evolved significantly in recent years, driven by technological advancements and changing consumer behaviors. This evolution necessitates that companies adjust their strategies to effectively manage contemporary threat management challenges through for enterprise risk management. The integration of digital tools, data analytics, and customer-centric approaches prioritizes communication and engagement. At Equabli, the Client Success Representative plays a pivotal role in this transformation. By leading the setup and implementation process during client onboarding, they ensure a smooth transition from sales to a robust client relationship. Their emphasis on understanding client business objectives enhances product utilization and involvement, which is essential for navigating the complexities of financial recovery.

As organizations confront increasing regulatory scrutiny and heightened consumer expectations, adapting to these changes through outsourced collection agency solutions for enterprise risk management is critical for maintaining compliance and optimizing recovery efforts. The proactive check-ins and strategic business reviews conducted by Client Success Representatives not only share insights and product usage trends but also identify opportunities for expansion. Organizations must embrace innovative solutions that enhance efficiency while fostering constructive relationships with debtors—a goal actively supported by Equabli's client success team through their unwavering commitment to delivering high-quality customer experiences.

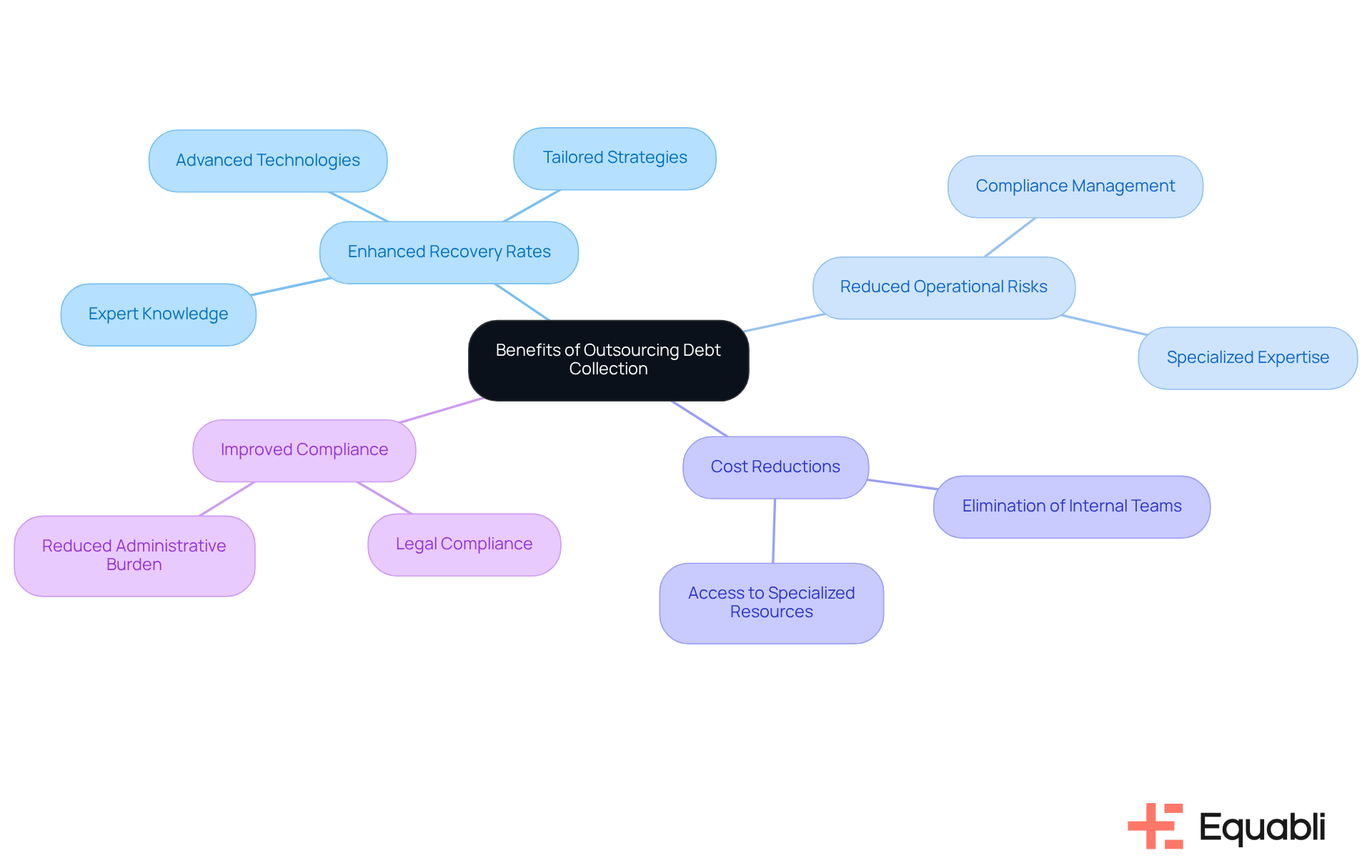

Benefits of Outsourcing Debt Collection: Enhancing Recovery and Reducing Risk

Outsourcing debt recovery by utilizing outsourced collection agency solutions for enterprise risk management offers significant advantages for enterprises, particularly in enhancing recovery rates and minimizing operational risks. By partnering with specialized agencies that provide outsourced collection agency solutions for enterprise risk management, businesses gain access to expert knowledge and resources, which enables the development of retrieval strategies tailored to their unique needs. This collaboration allows companies to concentrate on their core operations while ensuring that receivables are managed through outsourced collection agency solutions for enterprise risk management, which are proficient in compliance and debtor interaction.

Moreover, utilizing outsourced collection agency solutions for enterprise risk management can lead to substantial cost reductions by eliminating the need for internal retrieval teams and their associated overhead costs. This strategic decision not only but also mitigates the challenges linked to utilizing outsourced collection agency solutions for enterprise risk management. For example, agencies equipped with advanced technologies and established processes have shown improved recovery rates, as they can efficiently track and follow up on delinquent accounts. Empirical evidence suggests that businesses utilizing outsourced collection agency solutions for enterprise risk management frequently experience lower delinquency rates, which can be attributed to the specialized expertise and resources provided by these agencies.

Additionally, outsourced collection agency solutions for enterprise risk management enhance compliance initiatives by ensuring that agencies remain updated on the latest regulations governing financial recovery practices. This reduces the administrative burden on companies and diminishes the risk of costly legal repercussions. In summary, the strategic choice to implement outsourced collection agency solutions for enterprise risk management not only bolsters recovery rates but also fortifies a company's financial health.

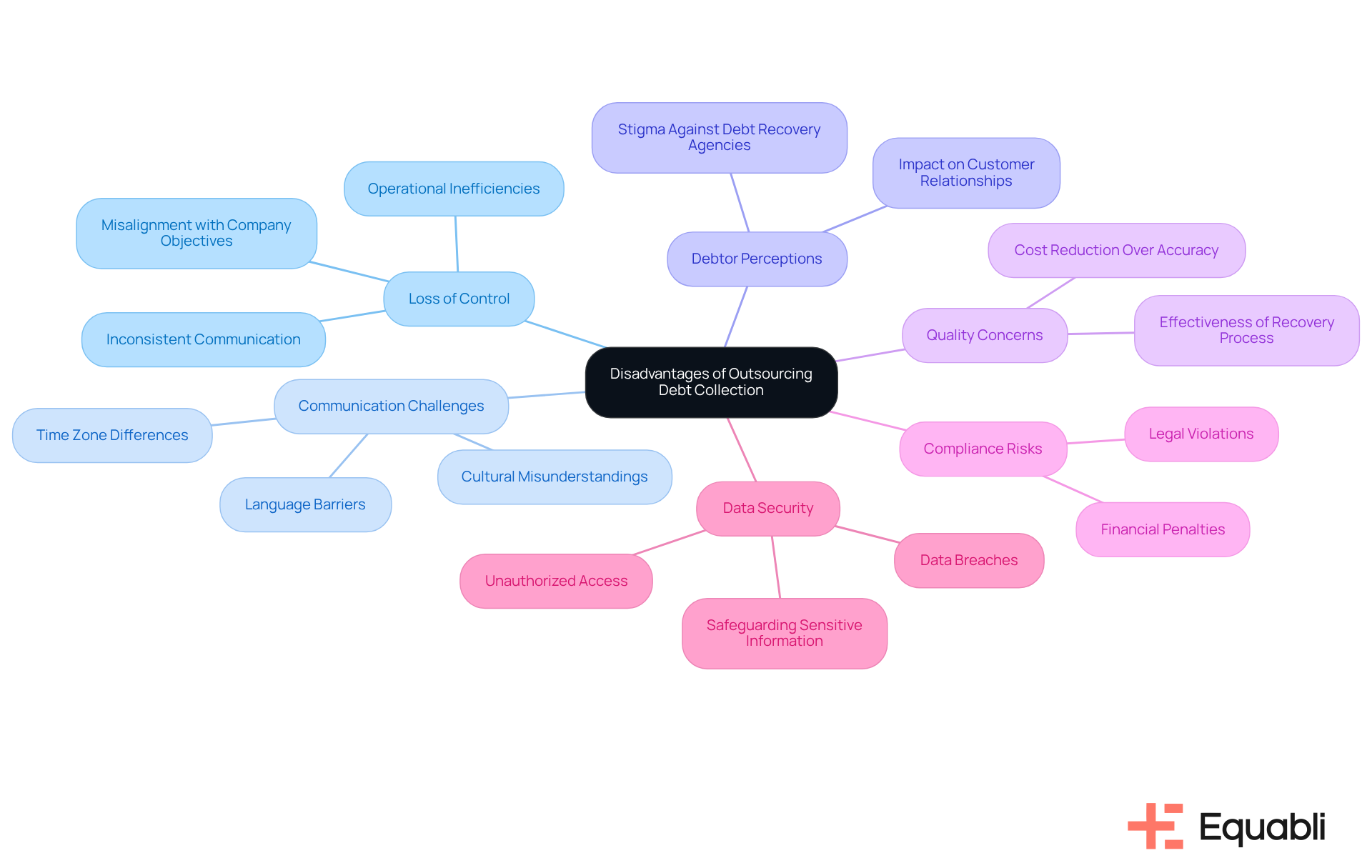

Disadvantages of Outsourcing Debt Collection: Risks and Considerations for Enterprises

Outsourcing debt recovery presents significant advantages; however, it also entails various risks that businesses must carefully evaluate. A primary concern is the potential loss of control over the collection process, which can result in inconsistent communication and the implementation of strategies. This lack of oversight may lead to operational inefficiencies and misalignment with the company's objectives. Furthermore, communication challenges, including time zone differences, language barriers, and cultural misunderstandings, can complicate the relationship between enterprises and their outsourced partners.

Moreover, third-party agency involvement can adversely affect debtor perceptions. Many individuals harbor a stigma against debt recovery agencies, which can damage customer relationships and hinder future engagement. Data indicates that a substantial segment of debtors views third-party recovery agencies unfavorably, underscoring the importance of maintaining a positive brand reputation during debt management.

also arise when outsourcing, as certain providers may prioritize cost reduction over accuracy, thereby impacting the overall effectiveness of the recovery process. Enterprises must ensure that their outsourced partners comply with all relevant laws and regulations; any violations can result in significant legal repercussions and financial penalties. Conducting thorough due diligence when selecting an outsourcing partner is essential to mitigate these challenges and ensure alignment with the enterprise's compliance framework.

Additionally, the risks of data breaches and unauthorized access are significant when outsourcing service recovery. Safeguarding sensitive information is critical, and enterprises must verify that their partners implement robust security measures.

In conclusion, while outsourcing can enhance efficiency and reduce costs, it is crucial for enterprises to remain vigilant regarding potential downsides, particularly concerning control, customer perceptions, compliance adherence, and data security. Employing strategies such as regular inspections, transparent communication protocols, and selecting trustworthy partners can help mitigate these challenges.

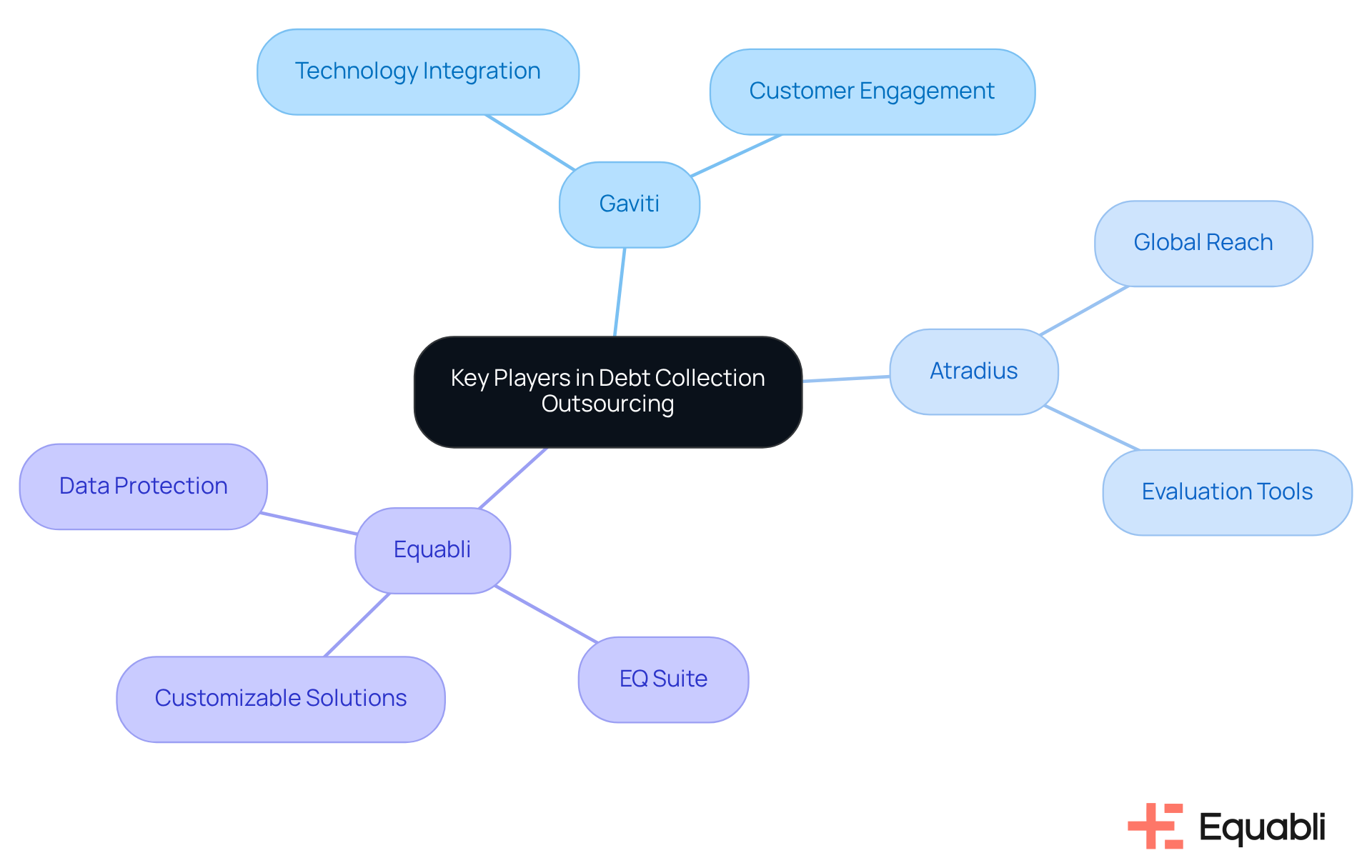

Key Players in Debt Collection Outsourcing: Options for Enterprise Risk Management

The debt recovery outsourcing market is characterized by several key participants, each providing outsourced collection agency solutions for enterprise risk management. Gaviti, Atradius, and Equabli distinguish themselves by providing specialized services that cater to the diverse requirements of various industries, all while ensuring compliance and implementing effective recovery strategies.

Gaviti leads in integrating technology with customer engagement, offering data-driven insights that optimize retrieval processes. Atradius, known for its global reach, supplies extensive evaluation tools that aid companies in navigating international debt recovery challenges. Equabli, through its innovative EQ Suite, empowers clients with customizable solutions that harness advanced analytics and digital transformation, thereby improving collection efficiency. The company's dedication to client data protection is evident in its comprehensive privacy policy, which delineates specific data protection measures and usage practices, ensuring compliance with industry standards and client expectations.

By meticulously evaluating the strengths and weaknesses of these providers, enterprises can pinpoint partners that resonate with their specific management objectives, particularly those offering outsourced collection agency solutions for enterprise risk management. Understanding each firm's capabilities, particularly in and customer engagement strategies, is crucial for making informed outsourcing decisions. This strategic approach not only enhances recovery rates but also cultivates stronger relationships with customers, ultimately contributing to sustainable growth.

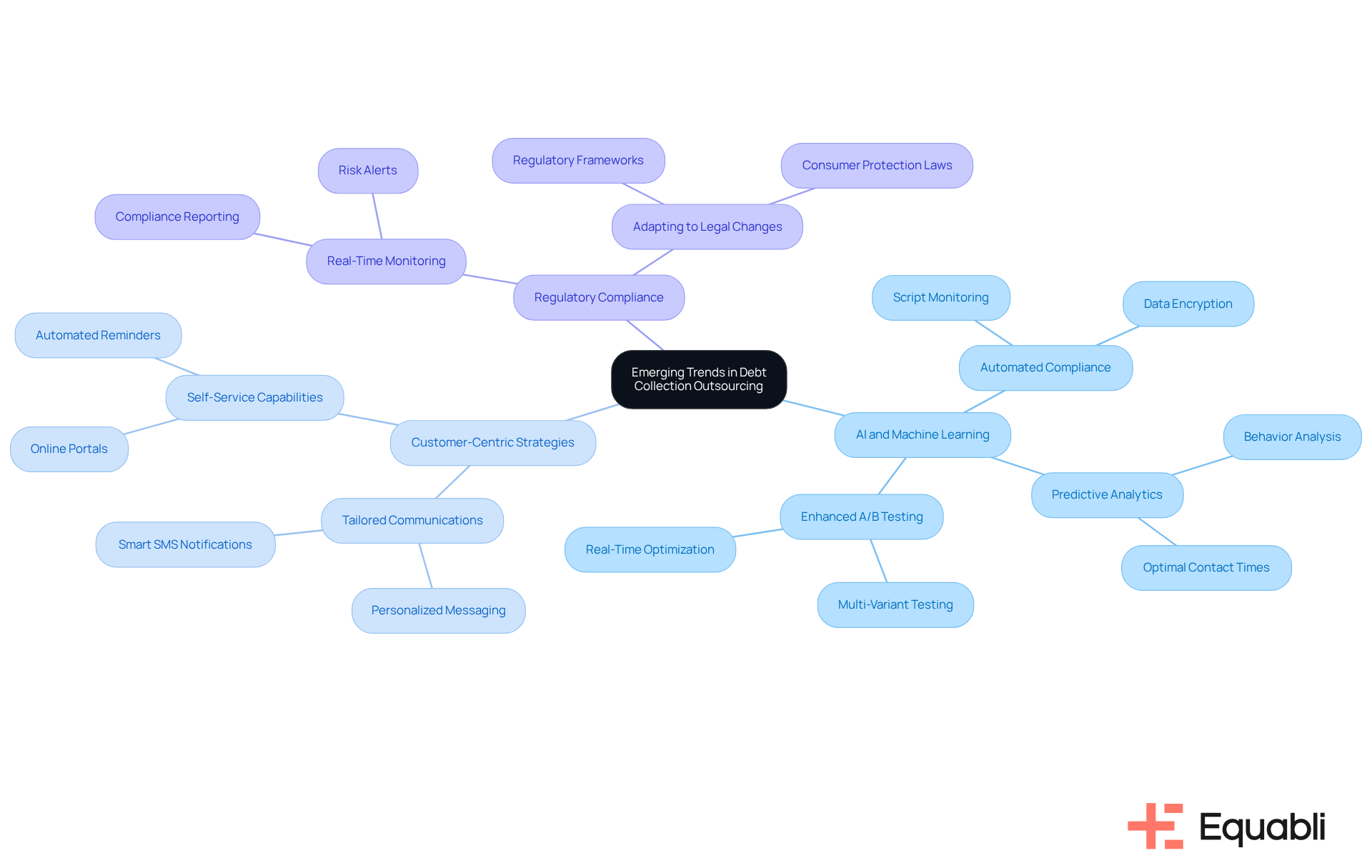

Emerging Trends in Debt Collection Outsourcing: Staying Ahead in Risk Management

The landscape of debt management outsourcing is rapidly evolving, especially with the adoption of outsourced collection agency solutions for enterprise risk management, driven by emerging trends that significantly enhance risk management strategies. A key trend is the integration of artificial intelligence (AI) and machine learning, which are transforming predictive analytics. These technologies empower agencies to customize their retrieval strategies through in-depth analyses of debtor behavior, leading to more effective engagement and improved recovery rates. For instance, AI tools can process millions of data points to determine optimal contact times and preferred communication channels, thereby enhancing customer interactions and ensuring compliance with regulations such as the Fair Debt Collection Practices Act (FDCPA).

Furthermore, the emphasis on customer-centric strategies is gaining momentum, highlighting the necessity of cultivating positive relationships with debtors. By leveraging AI-driven insights, agencies can tailor communications to resonate with individual preferences and behaviors. This approach not only boosts engagement but also facilitates timely repayments, as evidenced by data indicating that can increase revenues by up to 30% while reducing costs by as much as 40%.

As regulatory frameworks continue to develop, outsourcing partners must remain nimble, adjusting their practices to meet new legal requirements and standards. The capacity to utilize AI for real-time monitoring and compliance reporting is becoming crucial, enabling agencies to adeptly navigate the complexities of the regulatory landscape. Staying abreast of these trends is vital for businesses aiming to refine their financial recovery strategies and utilize outsourced collection agency solutions for enterprise risk management to mitigate uncertainties in an increasingly competitive environment.

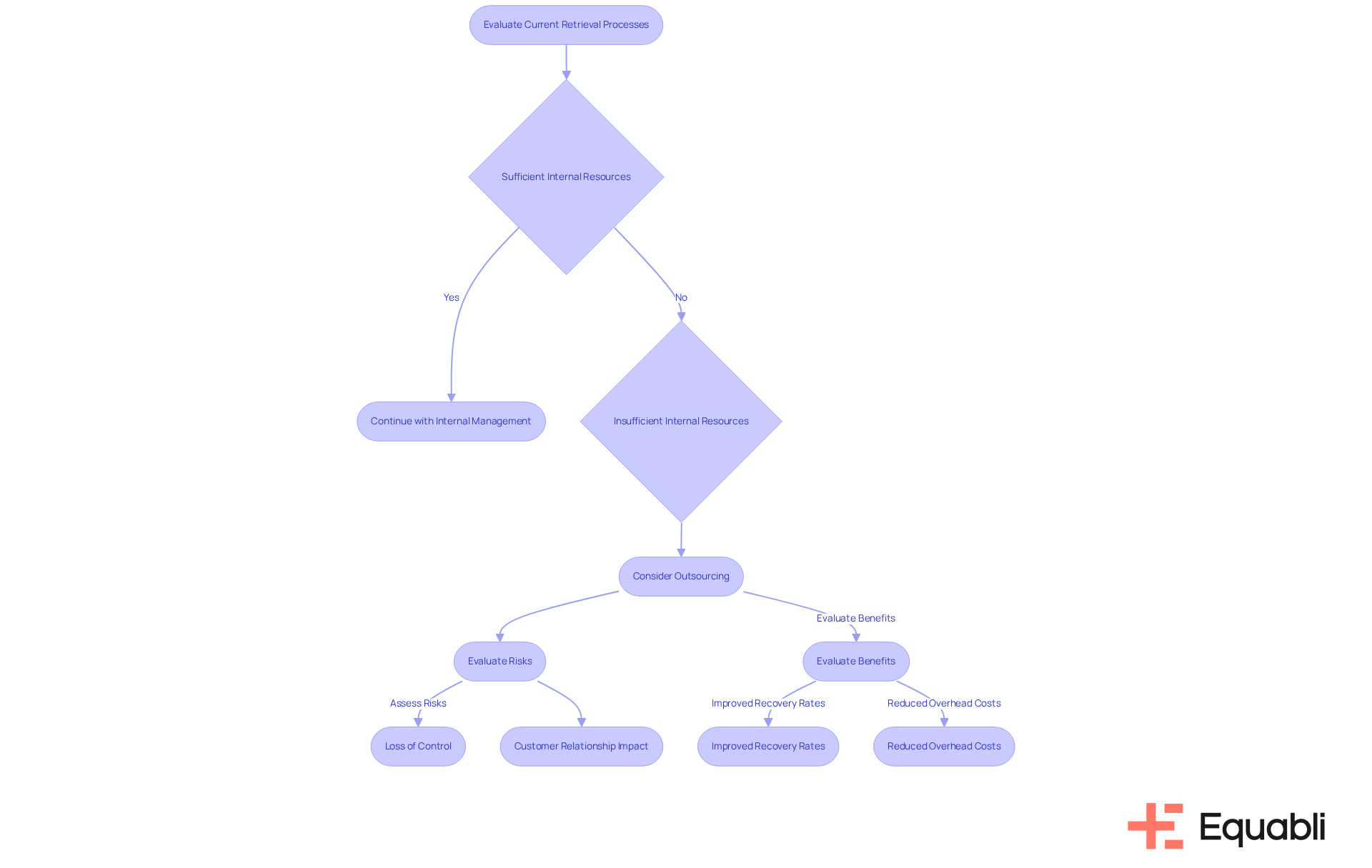

Is Debt Collection Outsourcing Good for Your Company? Evaluating Risks and Benefits

Assessing the appropriateness of debt recovery outsourcing for your organization necessitates a meticulous examination of both the associated risks and advantages. Organizations should begin by evaluating their current retrieval processes, the volume of overdue accounts, and the internal resources available for debt management. When internal capabilities are insufficient, utilizing for enterprise risk management can serve as an effective strategy to enhance recovery rates and alleviate operational burdens. As highlighted by South District Group, "Professional collectors know how to recover funds while preserving customer goodwill—a delicate balance that internal teams sometimes struggle to maintain."

However, it is essential to evaluate potential risks, such as the loss of control over the recovery process and the possible negative impact on customer relationships. The most effective recovery operations employ predictive scoring to categorize accounts into treatment pathways, underscoring the importance of tailored communication strategies in preserving customer goodwill. A comprehensive cost-benefit analysis, combined with an assessment of the reputation and compliance history of potential outsourcing partners, can yield valuable insights to inform decisions regarding outsourced collection agency solutions for enterprise risk management. South District Group emphasizes the necessity of a compliance-focused management system, stating, "We strictly adhere to state and federal laws with our compliance-focused management system."

For example, organizations that have successfully implemented outsourced collection agency solutions for enterprise risk management frequently report a 25-30% improvement in recovery rates compared to in-house efforts, illustrating the efficacy of strategic partnerships in enhancing operational efficiency and customer engagement. Furthermore, outsourcing can result in reduced overhead costs associated with staffing, training, and technology investments, rendering it a financially prudent option for many enterprises.

How Gaviti Ensures Timely Payments: A Key to Effective Risk Management

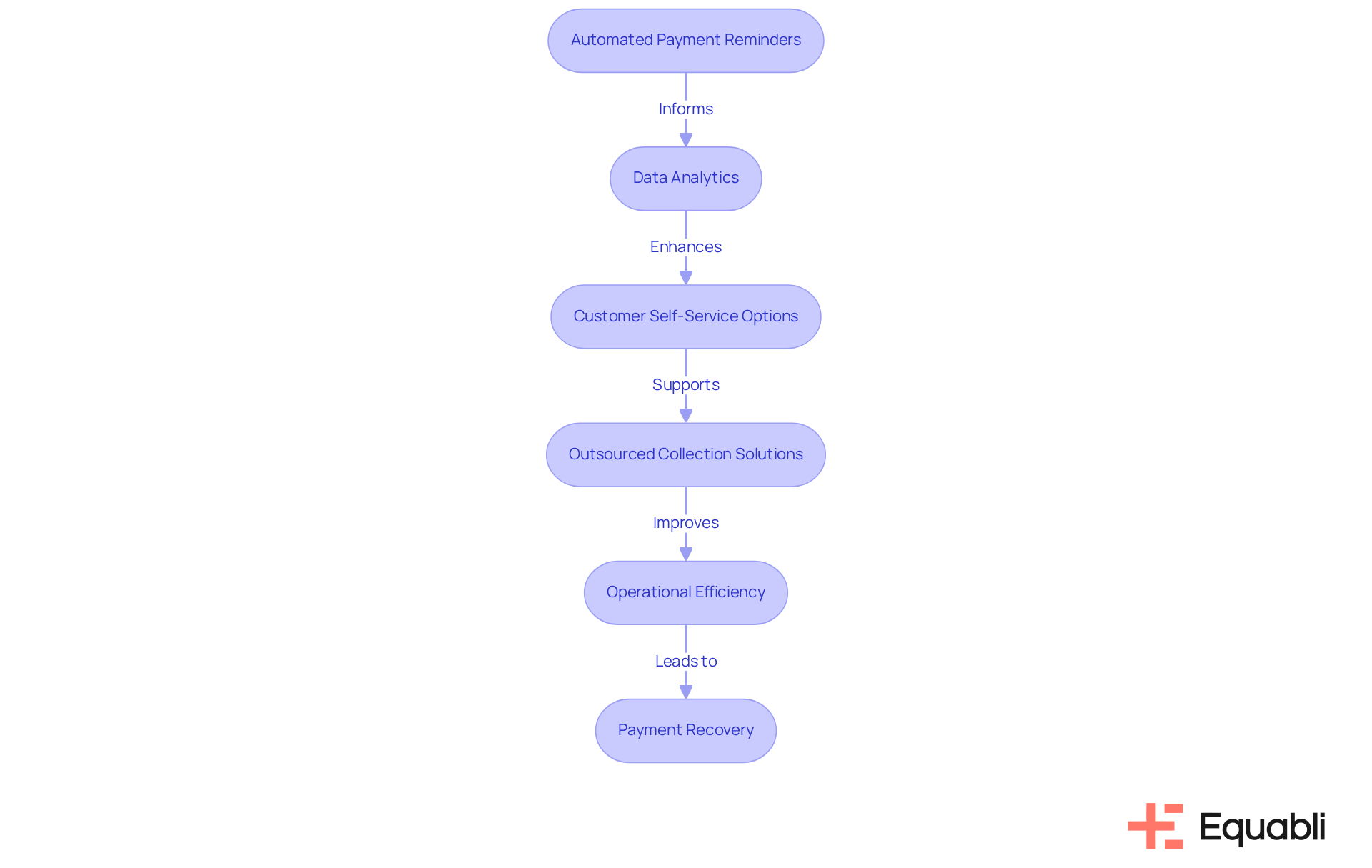

Equabli employs a multifaceted strategy to ensure timely payments, a critical component in effectively managing uncertainties. By automating payment reminders and notifications through EQ Collect, the platform significantly decreases the probability of missed payments. Data analytics are integral, enabling EQ Collect to identify debtor behavior patterns and tailor communication strategies that enhance engagement and encourage prompt repayment.

Research demonstrates that digital-first customers who receive automated reminders are 12 percent more likely to fulfill payment obligations compared to those contacted through traditional methods. This proactive strategy not only for organizations but also incorporates outsourced collection agency solutions for enterprise risk management to alleviate risks associated with delinquency and non-payment. Furthermore, the costs associated with managing non-performing loans can be 15 to 25 times higher than those for performing loans, underscoring the financial imperative of adopting effective recovery practices.

Additionally, EQ Collect's focus on customer self-service options empowers debtors to conveniently manage their payments, reflecting the increasing demand for flexible and digital payment solutions. The platform incorporates a no-code file-mapping tool, automated workflows, and real-time reporting, which collectively improve operational efficiency and transparency. By integrating these methodologies, Equabli substantially boosts debt recovery effectiveness while cultivating stronger relationships with debtors.

Financial institutions are advised to implement automated reminders and data analytics tools, while utilizing outsourced collection agency solutions for enterprise risk management and the features of EQ Collect, to optimize their collection processes.

Conclusion

Outsourced collection agency solutions for enterprise risk management represent a strategic avenue for organizations aiming to enhance their debt recovery processes while mitigating operational risks. Leveraging specialized expertise and advanced technologies allows businesses to tailor their collection strategies to unique challenges, ultimately fostering stronger customer relationships and improving recovery rates.

Key players in the debt collection outsourcing landscape include:

- Equabli

- Atradius

- Gaviti

These companies offer distinct solutions that cater to the evolving needs of enterprises. Equabli's comprehensive EQ Suite integrates predictive analytics and borrower communication, while Gaviti's innovative automation strategies provide tools that empower organizations to navigate modern risk management challenges effectively. Understanding potential disadvantages, including loss of control and customer perceptions, underscores the necessity of thorough evaluation when considering outsourcing options.

In a rapidly changing financial landscape, staying ahead of emerging trends is crucial for businesses refining their debt collection strategies. Essential components for success include:

- Embracing technology

- Prioritizing customer relationships

- Ensuring compliance with evolving regulations

By adopting outsourced collection agency solutions for enterprise risk management, organizations can enhance their recovery efforts and position themselves for sustainable growth in an increasingly competitive environment.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive set of tools designed to streamline debt recovery processes and enhance risk management. It includes features such as the EQ Engine for predictive analytics, EQ Engage for optimizing borrower communication, and EQ Collect for effective recovery management.

How does the EQ Suite benefit organizations?

The EQ Suite allows organizations to customize their collection strategies based on data-driven insights, reducing operational costs, improving compliance, and increasing borrower engagement. These enhancements contribute to higher recovery rates and a lower risk of potential losses.

What role does the Client Success Representative play in Equabli's services?

The Client Success Representative oversees the setup and implementation during client onboarding, manages customer accounts, fosters trust, and serves as the primary point of contact. They help drive product adoption and conduct strategic business reviews to share insights and identify expansion opportunities.

How does Atradius Collections tailor its services?

Atradius Collections provides customized debt recovery solutions for financial institutions and agencies by merging local knowledge with advanced technology. This approach incorporates data analytics and dedicated support to enhance recovery strategies and improve debtor communication.

What innovative solutions does Gaviti offer for debt collection?

Gaviti offers innovative outsourcing solutions that integrate automation and AI-driven analytics to enhance debt recovery efficiency. Their platform employs multi-channel communication strategies to effectively engage debtors, ensuring timely payments and reducing delinquency risk.

How can businesses benefit from outsourcing to Gaviti?

By outsourcing to Gaviti, businesses can leverage specialized expertise and advanced technology to achieve a more effective collection process, allowing them to focus on core operations while improving recovery rates.