Overview

The article provides an authoritative overview of optimizing credit risk management for financial institutions, underscoring its essential role in identifying, assessing, and mitigating potential losses stemming from borrower defaults. It presents evidence of the challenges faced, including:

- Data quality

- Regulatory compliance

- Economic volatility

Furthermore, it advocates for the integration of advanced technologies, such as AI and data analytics, to enhance decision-making and operational efficiency. This strategic approach not only addresses current challenges but also contributes to improving overall financial stability.

Introduction

Effective credit risk management serves as a cornerstone of stability for financial institutions, playing a pivotal role in safeguarding against potential losses from defaults. In an increasingly complex lending landscape, the necessity of refining assessment frameworks and enhancing decision-making processes is paramount. Institutions encounter a myriad of challenges, ranging from data quality issues to the rapid pace of technological change. Therefore, financial organizations must strategically navigate these hurdles to optimize their credit risk management strategies and secure a competitive edge.

Define Credit Risk Management and Its Importance

Credit exposure oversight is a critical process for financial institutions, encompassing the identification, assessment, and mitigation of potential losses stemming from a borrower's inability to repay loans or meet contractual obligations. This oversight is essential for maintaining the and safeguarding against significant losses.

Evidence indicates that effective financial exposure strategies not only enhance decision-making but also lead to increased profitability and reduced default rates. By implementing robust financial assessment frameworks, institutions are better positioned to navigate economic fluctuations and secure a competitive advantage in the market.

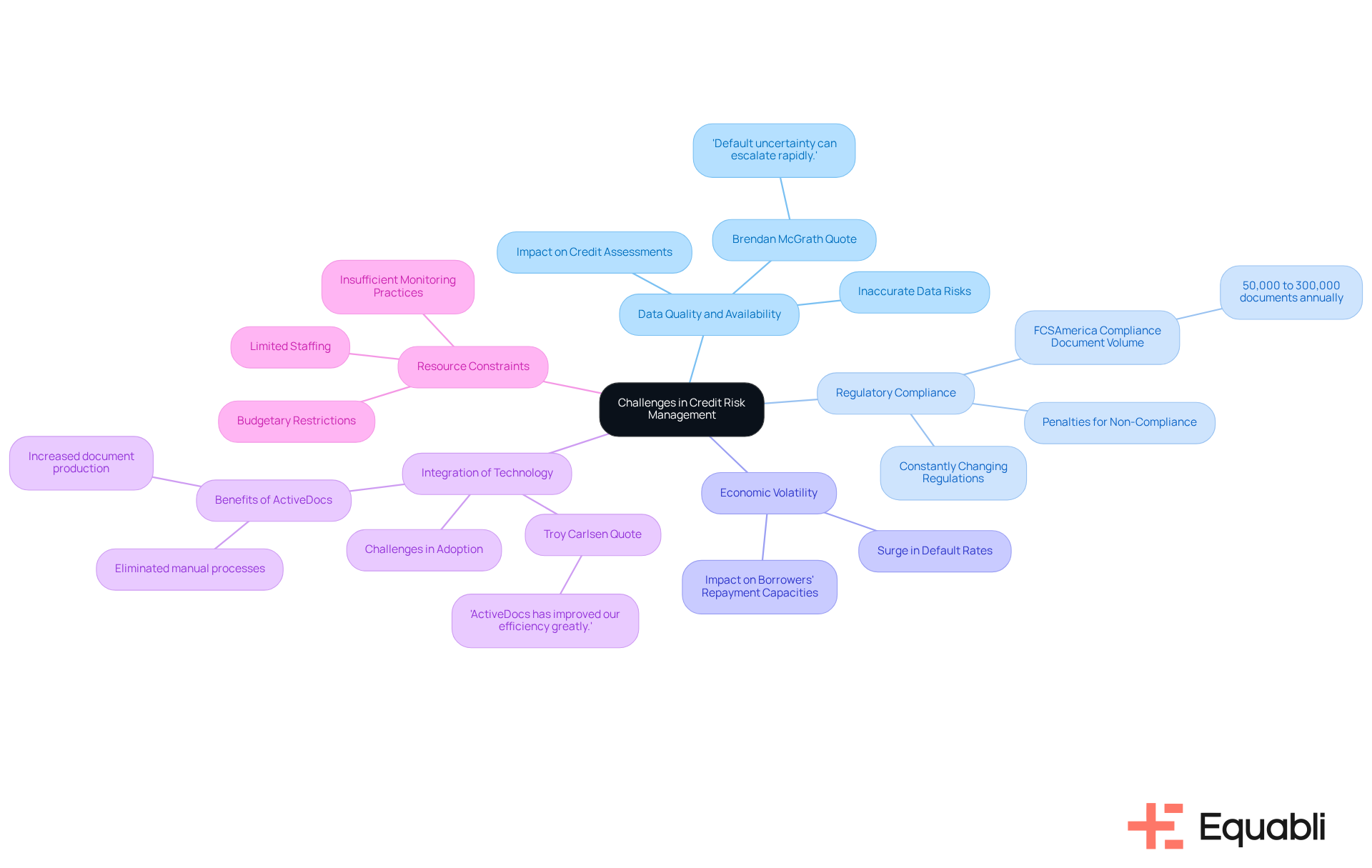

Identify Common Challenges in Credit Risk Management

Financial organizations encounter significant challenges in managing loan assessment, particularly concerning information quality, which can profoundly influence lending evaluations and overall exposure to uncertainty. Key issues include:

- Data Quality and Availability: Inaccurate or incomplete data can lead to flawed credit assessments, thereby increasing the risk of defaults. A lack of reliable borrower information may result in misjudging repayment capabilities, ultimately leading to financial losses. As Brendan McGrath observes, 'In general, default uncertainty can escalate rapidly and with few warning signs,' underscoring the urgency of addressing information quality concerns.

- Regulatory Compliance: The regulatory landscape is in constant flux, necessitating diligent navigation by institutions. Non-compliance can incur substantial penalties, complicating management efforts related to financing. For instance, FCSAmerica produces between 50,000 to 300,000 compliance documents annually, emphasizing the critical need for maintaining accurate data to meet regulatory standards.

- Economic Volatility: Economic fluctuations directly impact borrowers' repayment capacities, complicating accurate forecasts of lending uncertainties. During economic downturns, for example, default rates may unexpectedly surge, catching institutions unprepared.

- Integration of Technology: Many financial organizations struggle to adopt advanced technologies that enhance credit evaluation processes. The failure to leverage analytics tools can hinder the ability to identify and address challenges effectively. Troy Carlsen highlights that "ActiveDocs has completely eliminated as a manual process while increasing the volume FCSAmerica can produce and lowering its costs," illustrating the advantages of technology in managing data quality.

- Resource Constraints: Limited staffing and budgetary restrictions often impede the implementation of comprehensive lending vulnerability management strategies. This can result in insufficient monitoring and assessment practices, heightening vulnerability to defaults.

Addressing these challenges is essential for financial organizations aiming to enhance their lending assessment frameworks through comprehensive credit risk management process optimization for financial institutions and improve overall performance. By prioritizing information quality and leveraging technology, institutions can refine their evaluations and adeptly navigate the complexities of the financial landscape. The case of FCSAmerica exemplifies this; by integrating ActiveDocs, they not only automated document production but also significantly improved operational efficiency, enabling staff to concentrate on more value-generating tasks.

Leverage Technology for Enhanced Credit Risk Management

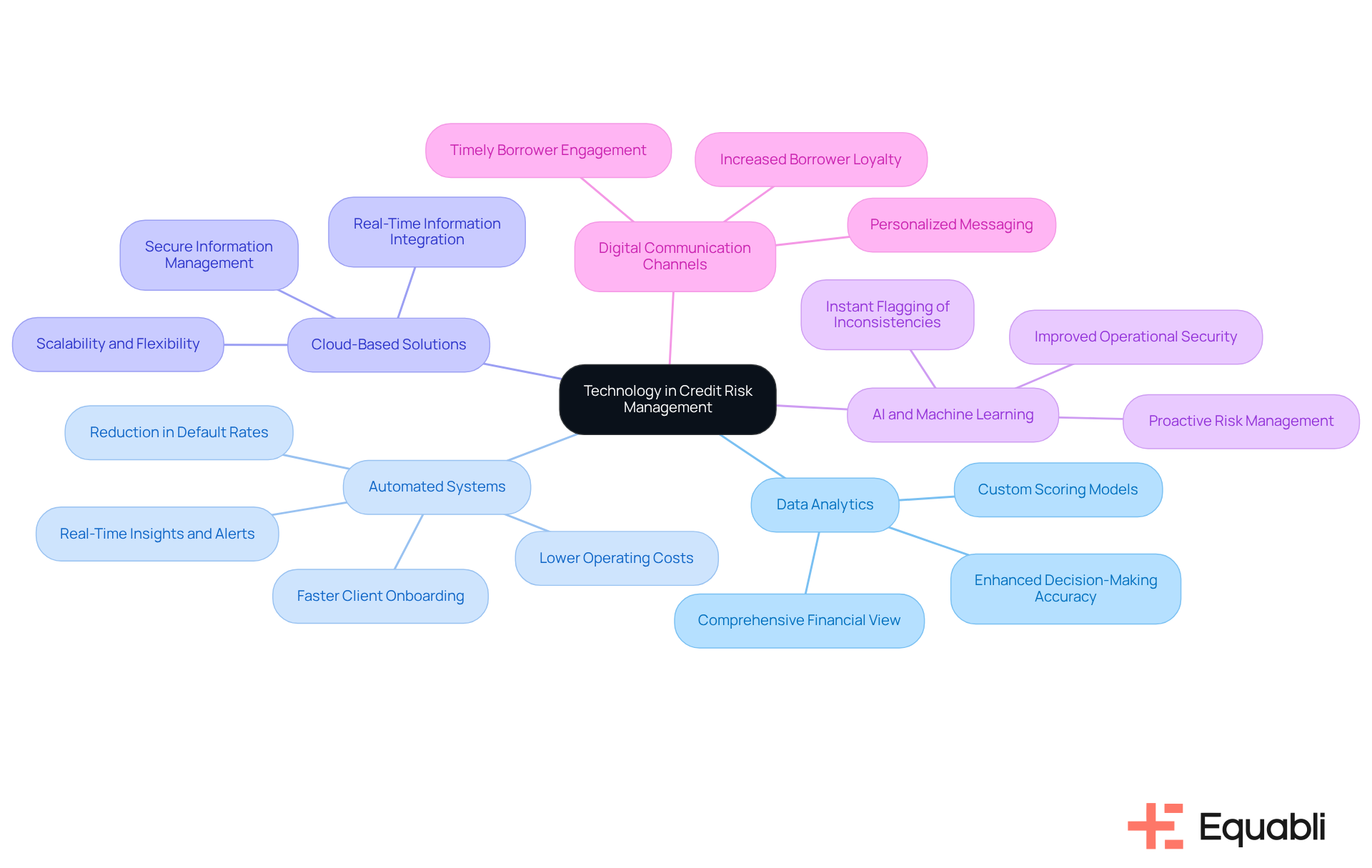

Financial institutions must leverage technology in several impactful ways to achieve comprehensive credit risk management process optimization for financial institutions.

- Data Analytics: Advanced analytics tools are essential for assessing borrower behavior and predicting repayment likelihood. This approach facilitates the development of custom scoring models that enhance decision-making accuracy. Automated lending systems analyze a wide range of data points, including banking activity and cash flow patterns, providing a comprehensive view of financial reliability.

- Automated Systems: The utilization of automated systems for monitoring financial exposure delivers real-time insights and alerts for potential issues. These platforms can , significantly expediting client onboarding and reducing operational bottlenecks. Banks employing AI in loan risk management have reported a 20% reduction in default rates and a 15% decrease in operating costs.

- Cloud-Based Solutions: Embracing cloud-based platforms offers scalability and flexibility, enabling institutions to manage information securely and efficiently. These solutions enhance information utilization and integration with external sources, streamlining assessments and improving overall efficiency. Real-time information integration allows for immediate scoring, increasing precision and eliminating delays associated with manual techniques.

- Integration of AI and Machine Learning: AI and machine learning algorithms are pivotal in examining extensive volumes of information, thereby enhancing the precision of assessments and facilitating proactive risk management. Automated decision systems can instantly flag inconsistencies in financial applications, improving information accuracy and operational security. These automated checks rapidly identify errors, bolstering operational integrity.

- Digital Communication Channels: Enhancing borrower engagement through preferred communication channels fosters timely interactions and improves repayment rates. Personalized messaging can significantly increase borrower loyalty and satisfaction, ultimately driving better financial outcomes.

By adopting these technological innovations, financial institutions can achieve comprehensive credit risk management process optimization for financial institutions, markedly enhancing their lending assessment procedures, leading to improved outcomes and reduced operational expenses. Furthermore, it is crucial to consider the regulatory landscape, such as the RBI Guidelines of 2024, which mandate Indian banks to incorporate macroeconomic data and expected credit loss models in their credit risk monitoring.

Conclusion

Effective credit risk management is crucial for financial institutions aiming to sustain stability and profitability amid a dynamic economic landscape. By identifying, assessing, and mitigating potential losses from borrower defaults, organizations can enhance decision-making processes, reduce default rates, and navigate regulatory complexities more effectively.

This article underscores several critical challenges in credit risk management, such as:

- Data quality issues

- Regulatory compliance demands

- Economic volatility

- Technological integration

- Resource constraints

Addressing these hurdles is essential for institutions striving to optimize their lending assessment frameworks. The integration of advanced technologies, including data analytics, automated systems, and AI, can significantly improve credit evaluations and operational efficiency, as illustrated by successful case studies like FCSAmerica.

Ultimately, the significance of robust credit risk management cannot be overstated. Financial institutions must prioritize the incorporation of innovative technologies and strategies to maintain competitiveness and resilience. By adopting this proactive approach, they not only protect their operations from potential losses but also contribute to a more stable financial environment, ensuring improved outcomes for both the institutions and their clients. Embracing this strategy will be vital as the financial landscape continues to evolve.

Frequently Asked Questions

What is credit risk management?

Credit risk management is the process of identifying, assessing, and mitigating potential losses that may arise from a borrower's inability to repay loans or meet contractual obligations.

Why is credit risk management important for financial institutions?

Credit risk management is essential for maintaining the stability of the financial system and protecting against significant losses, which ultimately helps safeguard the institution's financial health.

How does effective credit risk management impact decision-making and profitability?

Effective credit risk management enhances decision-making, leads to increased profitability, and reduces default rates for financial institutions.

What benefits do robust financial assessment frameworks provide to institutions?

Robust financial assessment frameworks enable institutions to better navigate economic fluctuations and secure a competitive advantage in the market.