Overview

The article emphasizes the optimization of debt recovery management systems (DCMS) for financial institutions by identifying essential features and best practices that significantly enhance collection efficiency. Key components such as data management, communication tools, and compliance features are detailed, collectively demonstrating their impact on improving repayment rates and fostering stronger relationships with borrowers. This structured approach not only highlights operational benefits but also underscores the strategic importance of effective debt recovery management in today's regulatory landscape.

Introduction

In an era where financial institutions face the pressing challenge of increasing overdue payments, optimizing debt recovery management systems (DCMS) has become paramount. Advanced software solutions enable organizations to enhance their collection processes, leading to improved efficiency and better borrower relationships. However, navigating the multitude of features and best practices for effective implementation presents a significant challenge.

What strategies can financial institutions adopt to streamline their debt recovery efforts while fostering a more empathetic approach to client interactions?

Understand Debt Recovery Management Systems

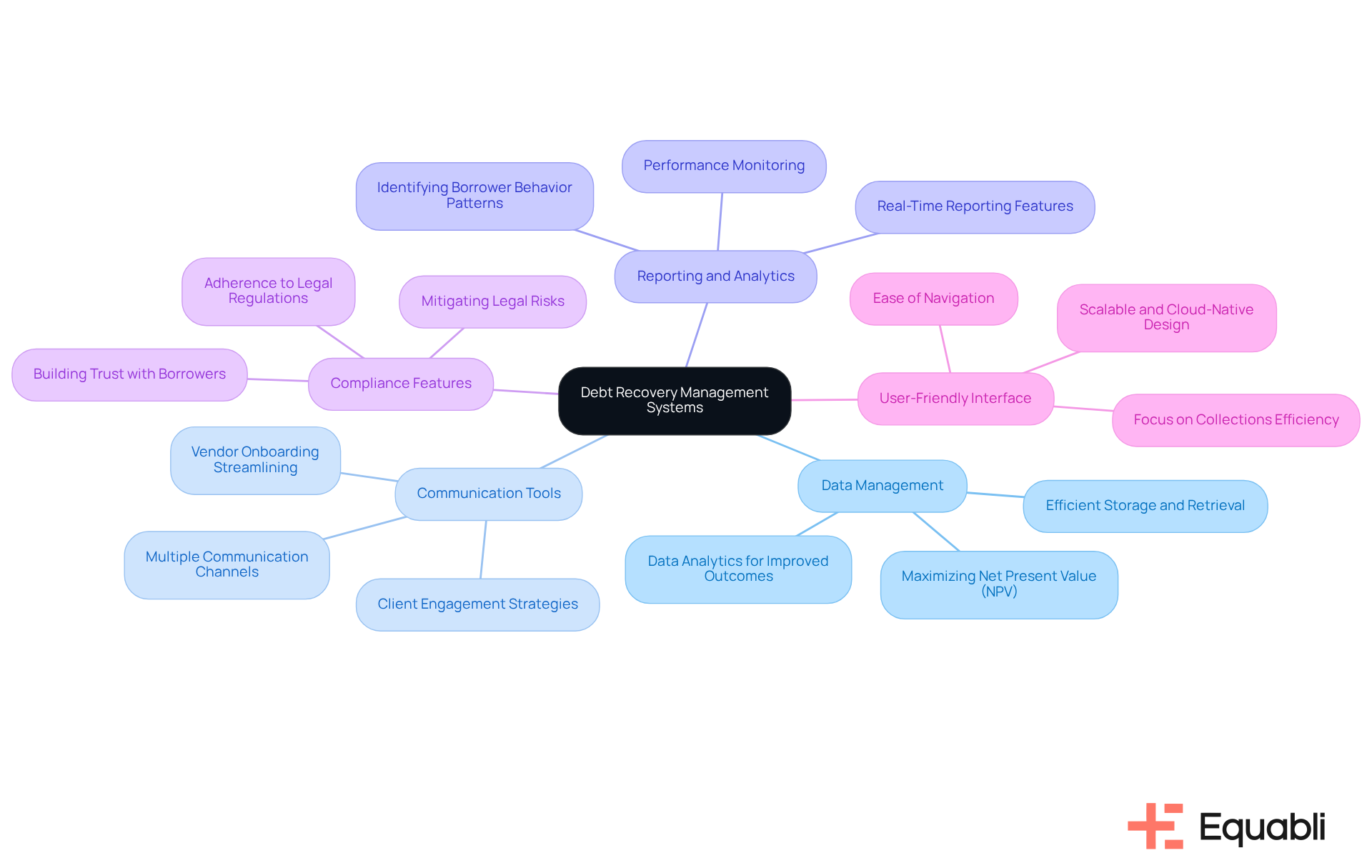

Debt collection management systems (DCMS) are vital for debt recovery management system optimization for financial institutions that aim to improve the collection of overdue payments. These specialized software solutions encompass critical functionalities, including tracking unpaid balances, automating client communications, and analyzing repayment behaviors. To enhance your debt recovery management system, a comprehensive understanding of its core components is imperative:

- Data Management: A robust DCMS must excel in data management, allowing institutions to efficiently store, retrieve, and analyze borrower information. Effective data management is vital, as it directly influences repayment rates; organizations that focus on debt recovery management system optimization for financial institutions and leverage extensive data analytics frequently observe significant improvements in collection outcomes. With EQ Collect, financial institutions can achieve for financial institutions by refining their data-driven strategies, thereby maximizing net present value (NPV) in debt recovery, particularly for late-stage accounts.

- Communication Tools: It is crucial to select systems that offer a variety of communication channels, such as SMS, email, and phone calls. Engaging clients through their preferred methods increases the likelihood of successful interactions and timely repayments. EQ Collect further streamlines vendor onboarding timelines with its intuitive, no-code file-mapping tool, ensuring seamless communication.

- Reporting and Analytics: A high-quality DCMS should provide comprehensive reporting capabilities that enable institutions to monitor performance and identify patterns in borrower behavior. This insight is invaluable for refining sourcing strategies and supports the debt recovery management system optimization for financial institutions, enhancing overall effectiveness. With EQ Collect's real-time reporting features, institutions gain unparalleled clarity and insights into their revenue processes.

- Compliance Features: It is essential to ensure that the system complies with legal regulations governing debt recovery practices. Adhering to these regulations not only mitigates legal risks but also fosters trust with loan recipients, which is critical for successful recoveries. EQ Collect offers industry-leading compliance oversight, both internally and externally, through automated monitoring.

- User-Friendly Interface: A user-friendly, scalable, cloud-native interface is vital for enabling financial institutions to navigate and utilize the system effortlessly. EQ Collect's design prioritizes usability, allowing teams to concentrate on collections rather than becoming overwhelmed by complex software.

By familiarizing yourself with these components, you can effectively evaluate and enhance your existing debt recovery management system optimization for financial institutions and processes. Incorporating empathy into communication can further improve outcomes by making borrowers feel understood and valued, ultimately leading to more effective financial resolutions.

Identify Key Features for Optimization

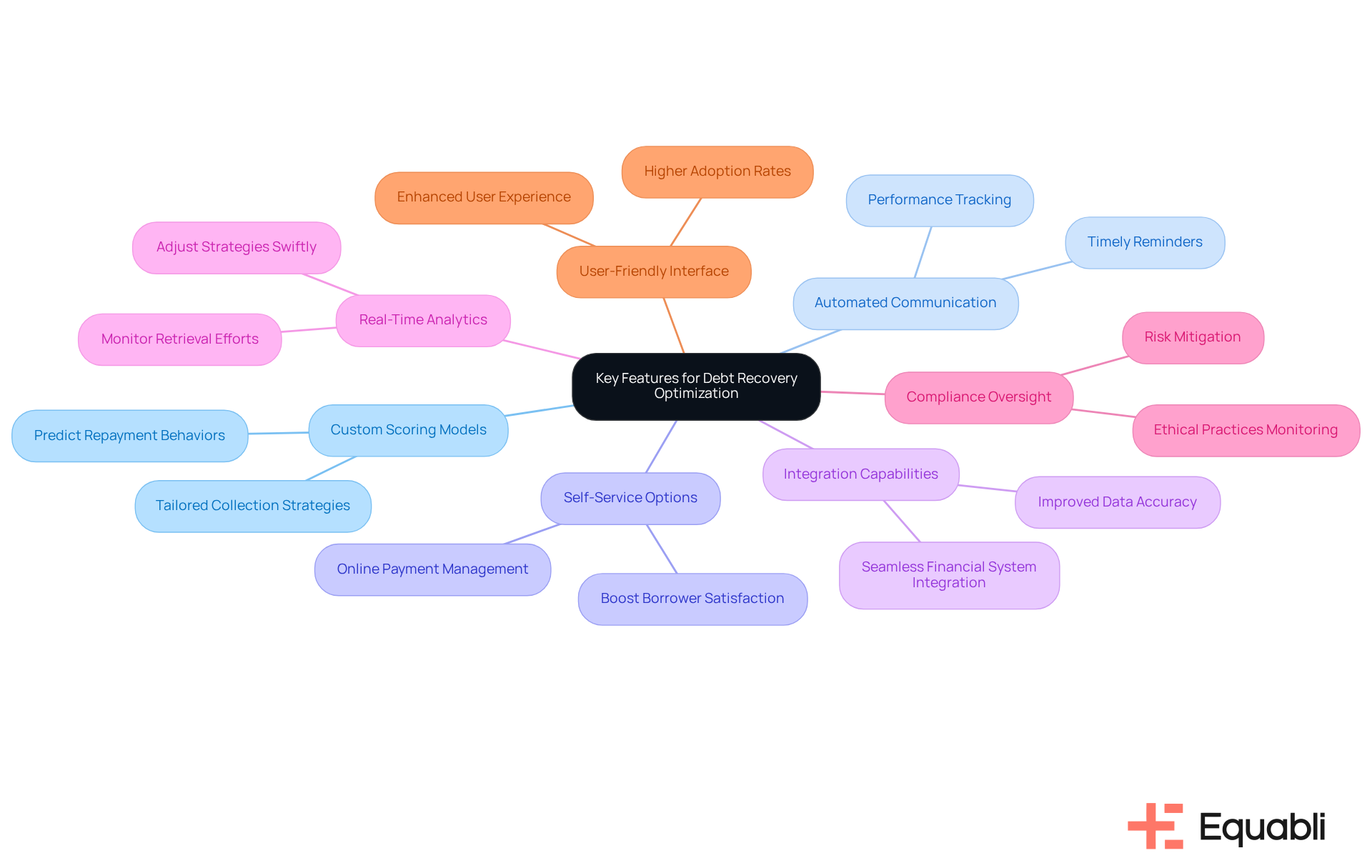

To optimize your debt recovery management system effectively, prioritize the following key features:

- Custom Scoring Models: Implement scoring models that analyze historical data to predict repayment behaviors. This enables the development of tailored collection strategies, significantly enhancing recovery rates. The use of data-driven insights ensures that collection efforts are strategically aligned with borrower profiles, leading to improved outcomes for financial institutions.

- Automated Communication: Utilize automation tools to send timely reminders and follow-ups to loan recipients. This method conserves resources while promoting consistent communication, resulting in heightened participant engagement and responsiveness. Furthermore, automation tools enhance efficiency by tracking performance and ensuring no accounts are overlooked, thereby minimizing execution errors and reliance on manual resources.

- Self-Service Options: Introduce that enable individuals to manage their payments online. This convenience boosts borrower satisfaction and can accelerate repayment timelines. By empowering borrowers with control over their payment processes, institutions can foster a more positive relationship with clients.

- Integration Capabilities: Ensure your debt collection management system (DRMS) seamlessly integrates with other financial systems and tools. This integration enhances workflow efficiency and improves data accuracy across platforms, reducing vendor onboarding timelines with a simple, no-code file-mapping tool. Streamlined integration is crucial for maintaining operational agility in a competitive landscape.

- Real-Time Analytics: Utilize real-time analytics to monitor retrieval efforts and swiftly adjust strategies as needed. This agility is essential for enhancing return rates and adapting to evolving client behaviors. Real-time insights allow institutions to refine their approaches based on current data trends, ensuring smarter orchestration and better performance outcomes.

- Compliance Oversight: Maintain industry-leading compliance supervision both internally and externally with automated monitoring to ensure ethical practices in receivable management. A robust compliance framework not only mitigates risk but also enhances the institution's reputation in the marketplace.

- User-Friendly Interface: Enjoy a user-friendly, scalable, cloud-native interface that enhances the overall user experience and operational efficiency. A well-designed interface facilitates ease of use, promoting higher adoption rates among staff and clients alike.

By focusing on these aspects, financial institutions can achieve debt recovery management system optimization for financial institutions, creating a more efficient and effective management system for collections that aligns with the needs of both the organization and its clients. Furthermore, maintaining awareness of consumer rights is essential for ethical practices in financial collection, fostering positive relationships and compliance.

Implement Best Practices for Debt Recovery

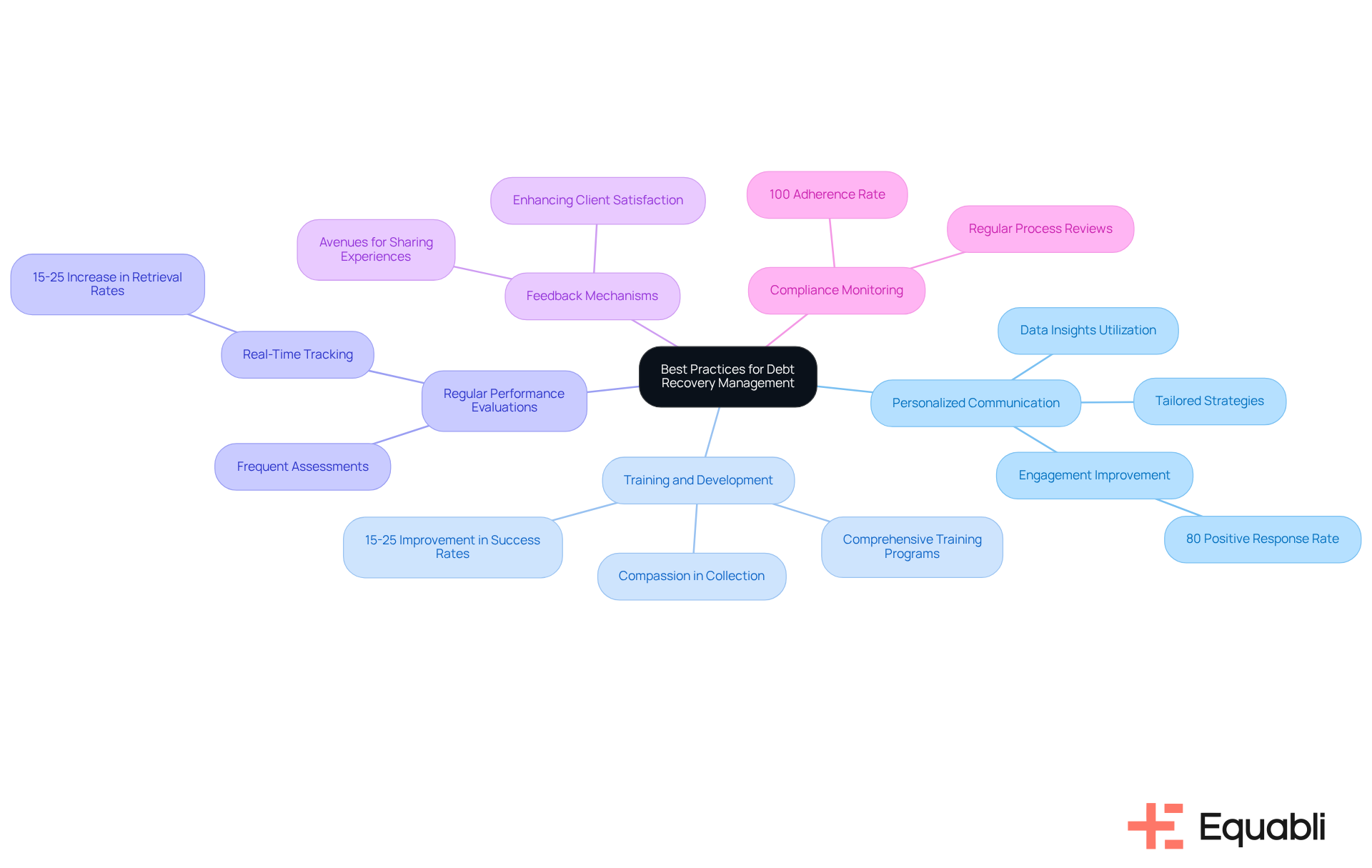

To effectively implement an optimized debt recovery management system, consider the following best practices:

- Personalized Communication: Tailor communication strategies to align with individual client preferences. Utilizing data insights can help identify optimal times and channels for outreach, significantly enhancing engagement. Research indicates that up to 80% of delinquent accounts respond positively to targeted recovery strategies, underscoring the importance of personalization. Leveraging EQ Engage's features can further enhance borrower engagement through customizable repayment options and personalized communication.

- Training and Development: Investing in comprehensive training programs for retrieval staff is crucial. Well-trained staff not only understand the technical aspects of the Debt Recovery Management System (DRMS) but also recognize the in financial collection. Case studies reveal that organizations emphasizing training experience a 15-25% improvement in success rates, as staff become adept at handling sensitive discussions and building trust. Furthermore, training enhances overall performance and productivity, equipping teams with best practices to navigate complex situations effectively, especially when utilizing integrated solutions like EQ Collect.

- Regular Performance Evaluations: Conducting frequent assessments of financial collection strategies and system performance is essential. These reviews help identify areas for improvement, allowing institutions to adapt their approaches based on real-time data and feedback. Agencies employing real-time tracking have reported a 15-25% increase in retrieval rates by promptly addressing bottlenecks and recognizing payment patterns more swiftly, which is critical for enhancing retrieval efforts. Implementing EQ Collect can streamline these processes, ensuring better performance and timely reporting.

- Feedback Mechanisms: Establishing avenues for individuals to share their experiences with the debt collection process is vital. This practice not only aids in recognizing pain points but also enhances overall satisfaction, resulting in stronger relationships with clients. Engaging with loan recipients can uncover insights that promote ongoing improvements in recovery strategies. EQ Engage can facilitate this engagement through self-service repayment solutions, enabling individuals to manage their payments conveniently.

- Compliance Monitoring: Regularly reviewing processes to ensure compliance with industry regulations is critical. This not only protects your institution from potential legal issues but also fosters trust with clients, who value transparency and adherence to standards. Organizations executing efficient compliance strategies report a 100% adherence rate in their collection efforts, highlighting the importance of maintaining strict oversight in financial collection practices. Utilizing EQ Collect can automate compliance monitoring, ensuring that all activities align with regulatory requirements.

By adopting these best practices and utilizing Equabli's innovative solutions, financial institutions can achieve debt recovery management system optimization for financial institutions, significantly enhancing their debt recovery efforts and leading to improved repayment rates and stronger relationships with borrowers.

Conclusion

Optimizing a debt recovery management system is imperative for financial institutions aiming to enhance their collection processes and improve repayment rates. Understanding the critical components of a debt collection management system (DCMS) and implementing essential features allows organizations to establish a robust framework that streamlines operations and fosters positive relationships with borrowers.

Key strategies for effective debt recovery management system optimization include:

- Prioritizing data management and communication tools

- Leveraging reporting and analytics

- Ensuring compliance

- Adopting user-friendly interfaces

Furthermore, implementing personalized communication strategies, investing in staff training, and establishing feedback mechanisms significantly contribute to improved collection outcomes. By concentrating on these areas, financial institutions can navigate the complexities of debt recovery with heightened efficiency and effectiveness.

In summary, the significance of optimizing debt recovery management systems is paramount. As financial institutions adapt to evolving consumer behaviors and regulatory landscapes, embracing best practices and innovative solutions becomes crucial. By proactively optimizing their debt recovery processes, institutions not only enhance operational efficiency but also cultivate trust and satisfaction among clients, ultimately leading to more successful financial recoveries.

Frequently Asked Questions

What is a Debt Collection Management System (DCMS)?

A Debt Collection Management System (DCMS) is a specialized software solution designed to optimize debt recovery management for financial institutions, focusing on improving the collection of overdue payments.

What are the key functionalities of a DCMS?

Key functionalities of a DCMS include tracking unpaid balances, automating client communications, and analyzing repayment behaviors.

Why is data management important in a DCMS?

Effective data management is crucial as it influences repayment rates. Institutions that leverage extensive data analytics often see significant improvements in collection outcomes.

How does EQ Collect enhance data management for financial institutions?

EQ Collect helps financial institutions optimize their debt recovery management by refining data-driven strategies, which maximizes net present value (NPV) in debt recovery, especially for late-stage accounts.

What communication tools should a DCMS provide?

A DCMS should offer various communication channels, such as SMS, email, and phone calls, to engage clients through their preferred methods, increasing the likelihood of successful interactions and timely repayments.

What reporting and analytics features are important in a DCMS?

A high-quality DCMS should provide comprehensive reporting capabilities to monitor performance and identify patterns in borrower behavior, which supports the optimization of debt recovery strategies.

How does EQ Collect assist with reporting and analytics?

EQ Collect features real-time reporting capabilities that provide institutions with clarity and insights into their revenue processes, aiding in performance monitoring.

Why are compliance features essential in a DCMS?

Compliance features are essential to ensure adherence to legal regulations governing debt recovery practices, which mitigates legal risks and fosters trust with loan recipients.

What user experience does EQ Collect offer?

EQ Collect offers a user-friendly, scalable, cloud-native interface that allows financial institutions to navigate and utilize the system effortlessly, enabling teams to focus on collections without being overwhelmed by complex software.

How can empathy in communication improve debt recovery outcomes?

Incorporating empathy into communication can make borrowers feel understood and valued, leading to more effective financial resolutions and improved recovery outcomes.