Overview

This article addresses advanced debt collection strategies tailored for financial executives, emphasizing the critical role of technology and data-driven methodologies in enhancing recovery rates. Evidence is provided through the examination of tools such as the EQ Suite, which incorporates predictive analytics, borrower engagement techniques, and automation. These elements are specifically designed to optimize the debt recovery process and bolster operational efficiency, particularly within a competitive financial environment.

Introduction

In an increasingly competitive financial landscape, effective debt recovery presents a significant challenge for executives aiming to optimize their strategies. Advanced debt collection techniques are not merely advantageous; they are essential for enhancing operational efficiency and improving recovery rates. As organizations navigate this complex terrain, the pivotal question emerges: how can financial leaders leverage innovative tools and data-driven insights to transform their debt collection processes? This inquiry is critical for fostering stronger relationships with borrowers while ensuring compliance and mitigating risks.

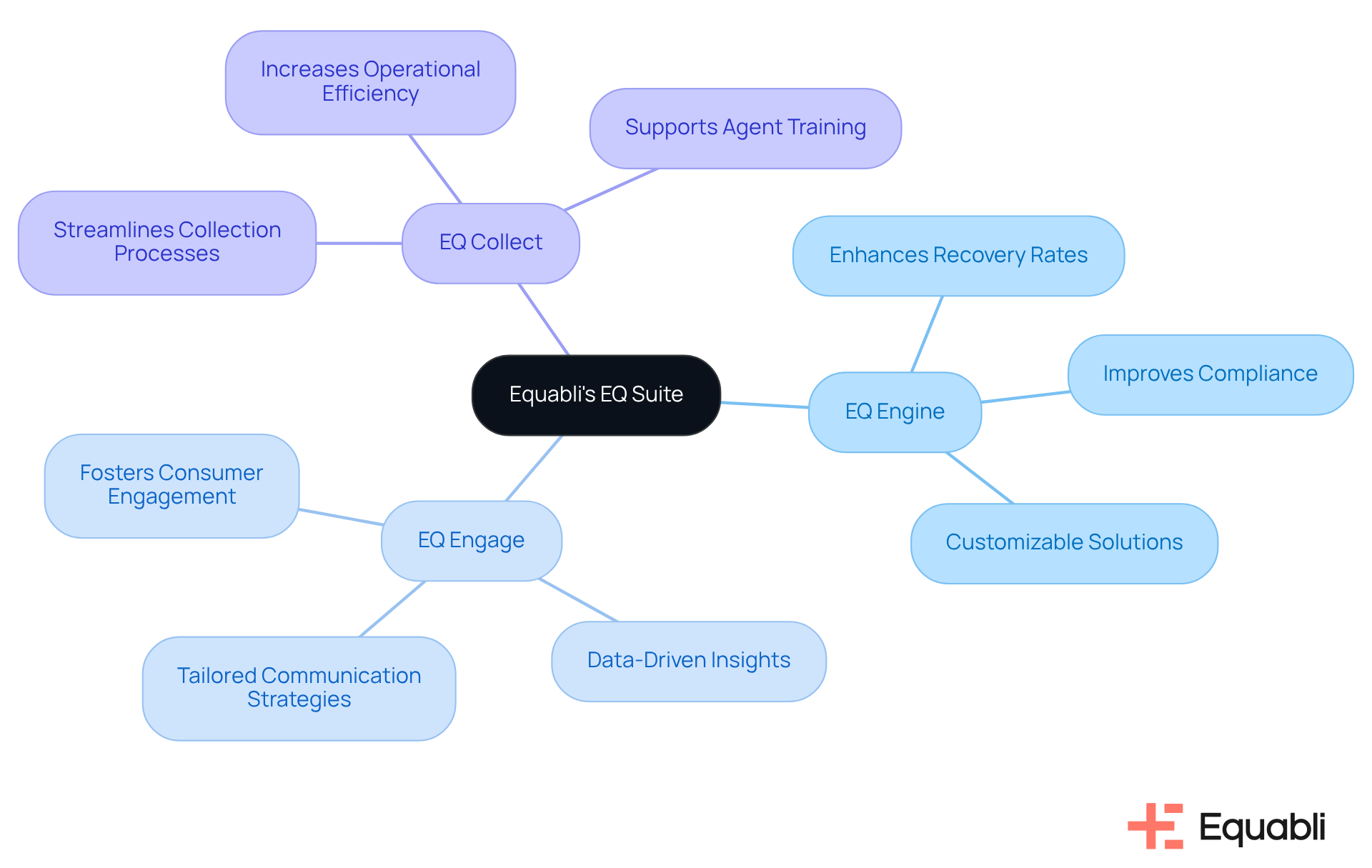

Equabli's EQ Suite: Intelligent Solutions for Data-Driven Debt Recovery

Equabli's EQ Suite represents a robust suite of tools designed to enhance recovery through advanced debt collection strategies for financial institutions executives. This suite, which includes the EQ Engine, EQ Engage, and , addresses specific challenges within the financial collection landscape.

By leveraging these intelligent solutions, organizations in the finance sector can enhance operational efficiency and ensure compliance while employing advanced debt collection strategies for financial institutions executives to significantly improve recovery rates.

The emphasis on customization within the EQ Suite empowers organizations to tailor the tools to their unique requirements, fostering a more effective and responsive approach to advanced debt collection strategies for financial institutions executives.

Such adaptability is essential in a rapidly evolving economic environment, where data-driven insights can facilitate improved decision-making and strategic outcomes.

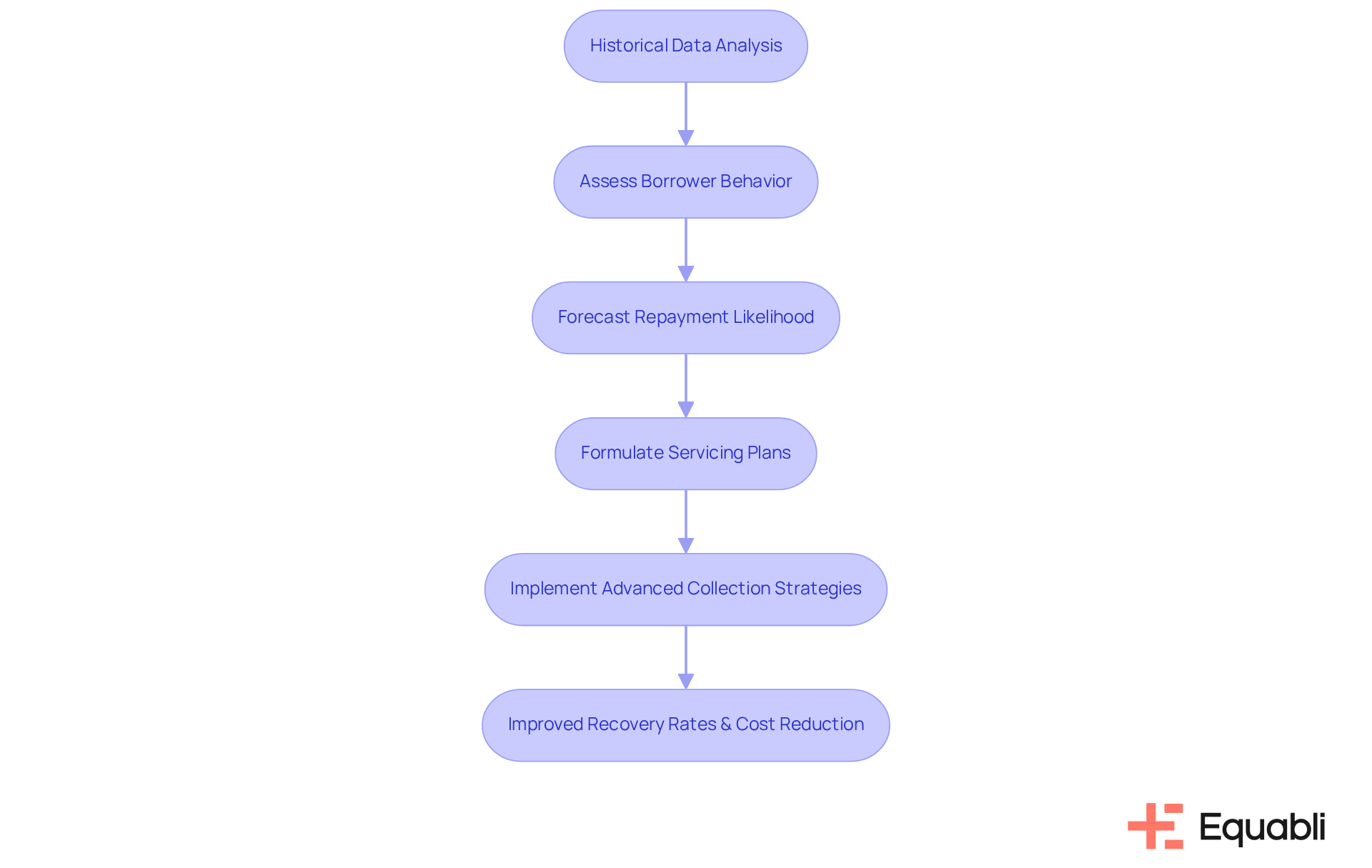

EQ Engine: Predictive Analytics for Enhanced Collection Strategies

The EQ Engine leverages advanced predictive analytics to assess borrower behavior and forecast repayment likelihood. By meticulously analyzing historical data and recognizing patterns, the EQ Engine empowers financial institutions executives to implement advanced debt collection strategies for financial institutions with precision. This proactive approach not only but significantly reduces costs typically associated with conventional retrieval methods. By predicting the risk of delinquency in active accounts, financial executives can formulate intelligent servicing plans that harness the EQ Engine’s predictive capabilities across diverse communication channels. The optimization of advanced debt collection strategies for financial institutions executives, particularly for late-stage accounts, ensures that resources are allocated more strategically.

Ongoing training for recovery teams is essential to enhance efficiency and ensure compliance with industry standards. Ethical practices, including fostering empathy and professionalism in collections, are critical for cultivating positive customer relationships. As the debt collection landscape evolves, the shift from volume-based methods to precision-driven, analytical approaches emphasizes the significance of advanced debt collection strategies for financial institutions executives, exemplified by tools like the EQ Engine, in maximizing debt collection effectiveness. For practical implementation, finance executives should consider adopting targeted communication strategies informed by predictive insights to further improve recovery outcomes.

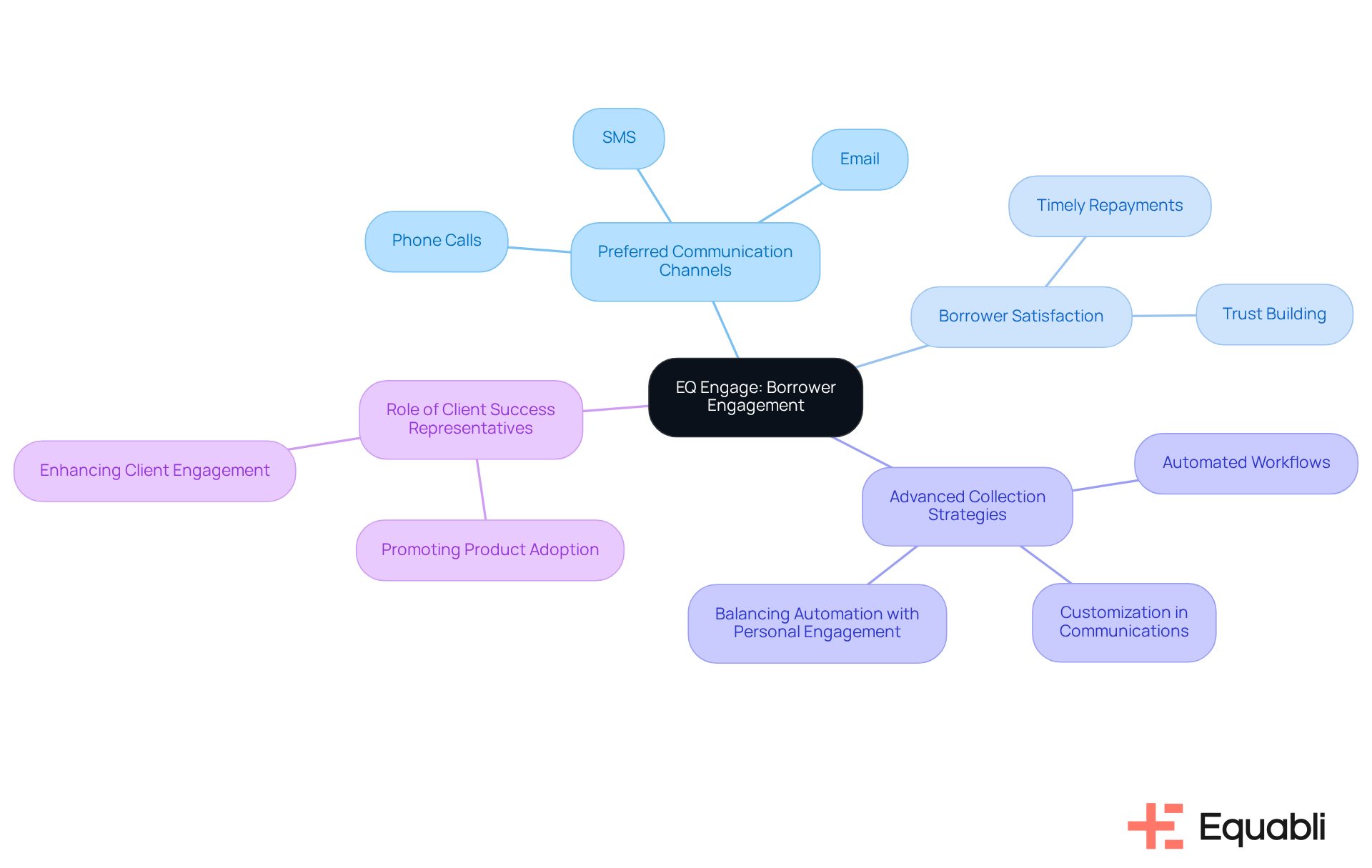

EQ Engage: Boosting Borrower Engagement Through Preferred Communication Channels

EQ Engage enhances borrower engagement by leveraging preferred communication channels, enabling borrowers to select their method of contact—SMS, email, or phone calls. This personalization elevates and significantly increases the likelihood of timely repayments. Financial institutions can cultivate trust and foster long-term relationships with borrowers by prioritizing advanced debt collection strategies for financial institutions executives. Research indicates that customers contacted via their preferred channels tend to pay 15% faster on average, underscoring the effectiveness of aligning communication methods with borrower preferences.

Furthermore, implementing advanced debt collection strategies for financial institutions executives, which involve customization in communications and balancing automation with personal engagement, allows them to drive improved repayment rates and enhance overall borrower satisfaction in their recovery efforts. Incorporating EQ Collect's features—such as the no-code file-mapping tool, automated workflows, real-time reporting, and compliance oversight—further optimizes the recovery process, ensuring that institutions not only interact effectively with borrowers but also operate efficiently.

The role of Client Success Representatives at Equabli is vital in this context, as they promote product adoption and client engagement, ensuring that institutions utilize these advanced features to optimize their recovery strategies.

EQ Collect: Streamlined Digital Collections for Modern Financial Institutions

EQ Collect provides a robust platform for managing digital assets, allowing institutions to automate various aspects of the recovery process. This tool offers self-service repayment options, empowering borrowers to conveniently oversee their payments. By minimizing manual tasks and enhancing operational efficiency, EQ Collect assists organizations in reducing costs and improving recovery rates.

Furthermore, the role of the Client Success Representative at Equabli is pivotal in fostering product adoption and client engagement, ensuring that institutions fully leverage the benefits of EQ Collect. Through proactive support and strategic insights, Equabli enables clients, particularly financial institutions executives, to adeptly navigate the evolving debt recovery landscape using .

Financial executives should consider the adoption of advanced debt collection strategies for financial institutions executives to maintain competitiveness and strengthen client relationships.

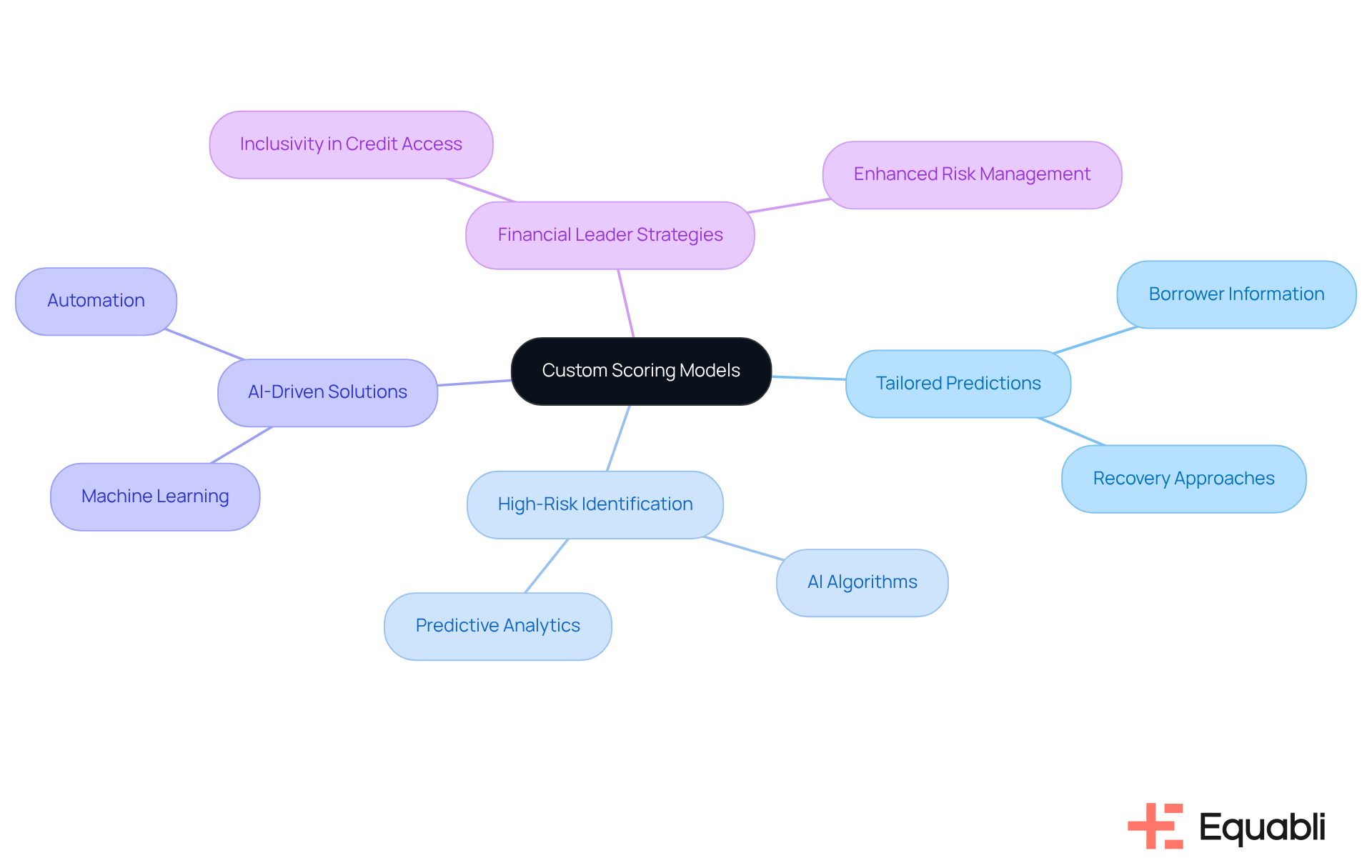

Custom Scoring Models: Tailored Predictions for Repayment Behaviors

Custom scoring models empower institutions to generate tailored predictions regarding borrower repayment behaviors. By utilizing specific borrower information, these models efficiently identify high-risk accounts and direct recovery approaches accordingly. This focused strategy enables organizations to concentrate their resources on accounts with the highest likelihood of repayment, significantly enhancing recovery rates.

For instance, AI-driven solutions, such as those provided by Equabli, analyze diverse data points, including payment history and spending habits, to create a nuanced understanding of borrower risk. Leveraging machine learning and automation allows organizations to operate more efficiently, forecasting the risk of delinquency for active accounts swiftly, thereby enhancing recovery rates and expanding retrieval operations without compromising performance.

As Dr. Andrada Pacheco noted, the attributes of VantageScore 4.0 offer lenders a more reliable and inclusive understanding of consumer risk, which is crucial for developing effective scoring models. Financial leaders should prioritize the creation and execution of these tailored scoring models, utilizing Equabli's smart automation and machine learning tools to refine advanced debt collection strategies for financial institutions executives. This strategy not only aims for superior monetary results but also for underserved groups.

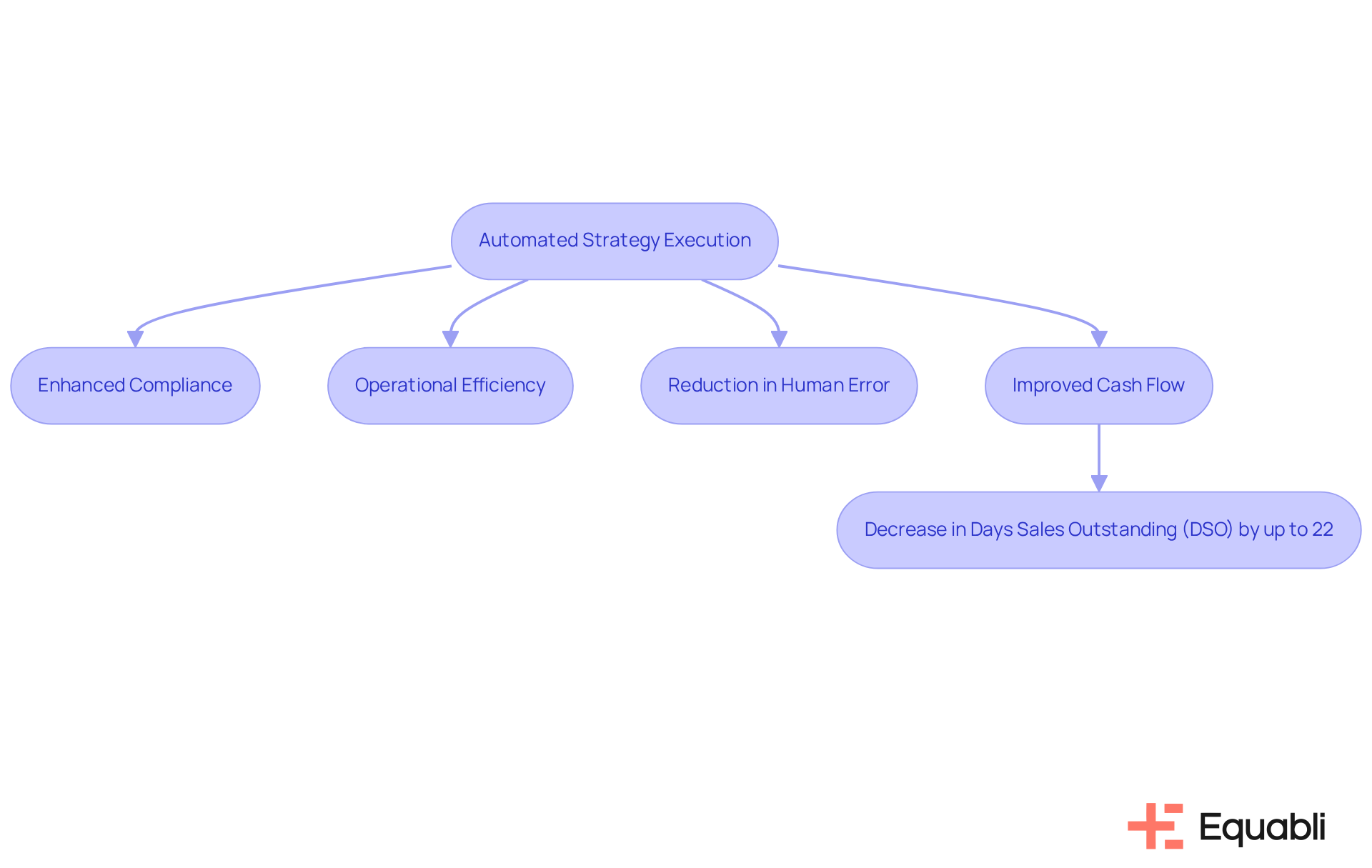

Automated Strategy Execution: Enhancing Compliance and Operational Efficiency

Automated strategy execution is essential for enhancing compliance and operational efficiency in receivable collection. By automating routine tasks such as payment reminders and follow-ups, financial institutions can significantly mitigate the risk of human error while ensuring adherence to regulatory requirements. This not only bolsters compliance but also allows staff to focus on more complex tasks requiring human intervention.

For example, companies that employ automated reminders have observed a marked decrease in overdue debts, as these notifications keep borrowers informed about payment due dates. Furthermore, automation can reduce Days Sales Outstanding (DSO) by up to 22%, demonstrating its effectiveness in improving cash flow.

Financial executives should prioritize automation as part of their advanced debt collection strategies for financial institutions executives to refine their collection processes, enhance operational efficiency, and maintain compliance with industry regulations.

With EQ Collect, institutions can:

- Shorten vendor onboarding timelines through a straightforward, no-code file-mapping tool.

- Enhance efficiency with data-driven strategies.

- Access real-time reporting for unparalleled transparency.

Additionally, EQ Collect minimizes execution errors and manual resource usage through automated workflows, enabling companies utilizing AR automation to reallocate resources to high-value tasks, ultimately improving financial outcomes and reducing poor account write-offs by 10-15%. Companies implementing AR automation typically experience a 10-15% decrease in negative receivable write-offs, further underscoring the financial advantages of adopting these technologies.

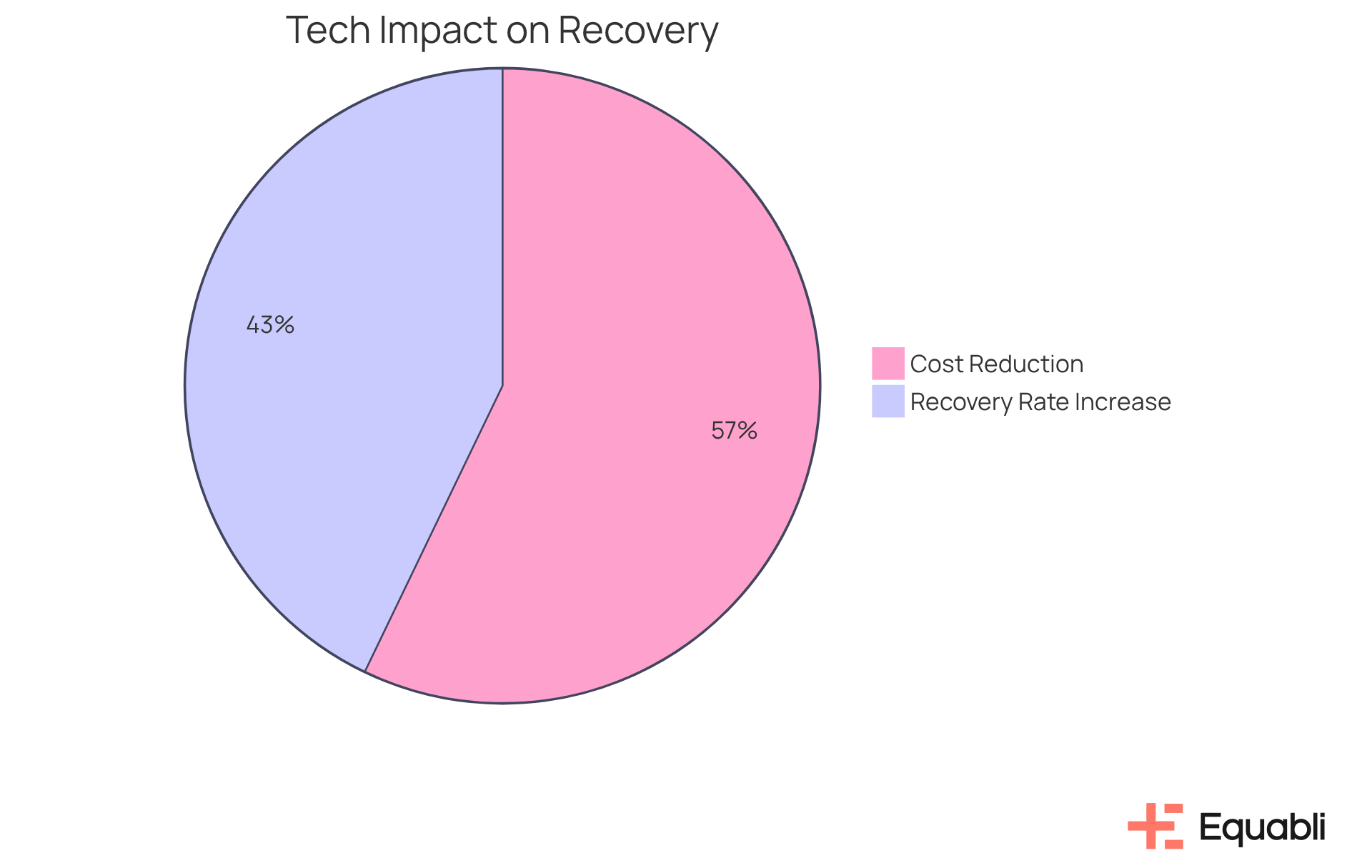

Advanced Technology Integration: Reducing Costs and Improving Effectiveness

Incorporating advanced technology into financial recovery processes yields substantial cost savings and enhances operational efficiency. Evidence shows that AI and machine learning empower organizations to analyze extensive datasets, identify trends, and refine data gathering strategies. For example, AI-driven systems can elevate recovery rates by up to 30% while simultaneously reducing operational costs by as much as 40%. Financial institutions that embrace these technologies not only streamline their decision-making processes but also optimize resource allocation, leading to improved recovery outcomes.

Significantly, the is projected to expand considerably, reaching USD 41.7 billion by 2033, driven by the increasing adoption of AI solutions. Financial leaders must proactively seek opportunities for technology integration to harness these advancements and implement advanced debt collection strategies for financial institutions executives to achieve sustainable growth in their recovery efforts.

Ethical Debt Collection Practices: Balancing Compliance and Stakeholder Trust

Adopting moral practices for receivables management is essential for institutions aiming to align adherence with stakeholder confidence. Organizations must navigate a complex landscape of legal regulations while ensuring borrowers are treated with respect and dignity. By cultivating a culture centered on ethical practices, institutions can foster trust with clients, ultimately enhancing their market reputation.

Emphasizing ethical factors in financial recovery approaches not only strengthens stakeholder relationships but also aligns with the growing demand for transparency and fairness in monetary transactions. Recent legislative initiatives, such as Virginia's House Bill 1725, which seeks to protect patients from unjust medical financial recovery practices, underscore the increasing importance of ethical standards.

Financial executives must recognize that a commitment to ethical practices can yield improved compliance outcomes and a more favorable perception among consumers. Furthermore, acquiring user consent for SMS communications, ensuring message variability is understood, and providing clear opt-out procedures are critical components of ethical financial recovery. These practices enhance , aligning with the objectives of SMS policy.

Additionally, it is vital to inform clients that message and data rates may apply, ensuring they are fully aware of the implications of their consent. By establishing these transparent communication guidelines, monetary institutions can further demonstrate their commitment to ethical credit recovery practices.

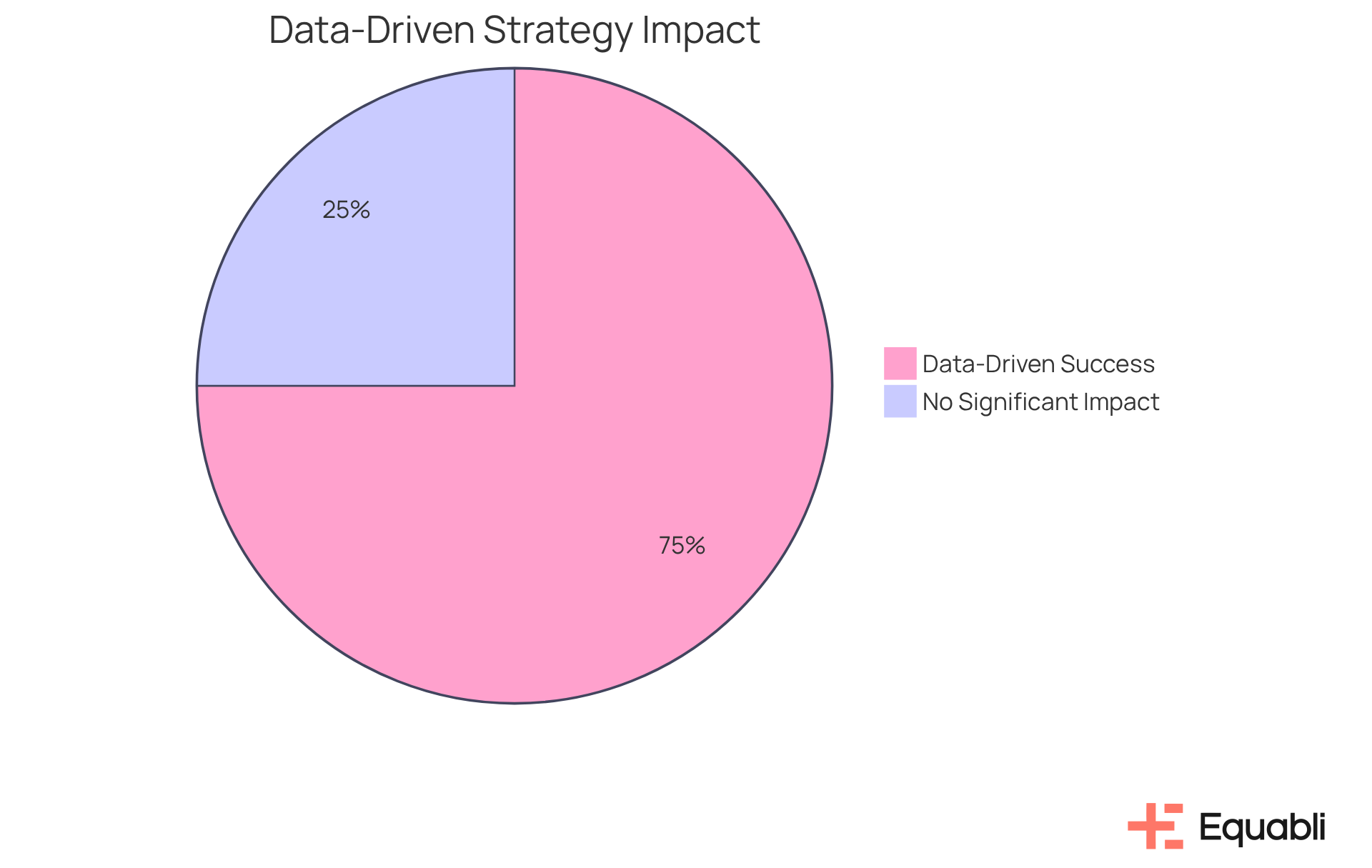

Data-Driven Strategies: Maximizing ROI in Debt Collection

Applying data-informed approaches is essential for enhancing ROI in receivable management. Utilizing analytics to assess borrower behavior and repayment trends allows financial institutions executives to implement for financial institutions executives that significantly improve their retrieval efforts. This analytical approach enables organizations to identify high-value accounts, thereby prioritizing resources effectively.

For instance, organizations that adopt data-driven decision-making are three times more likely to report substantial improvements in operational efficiency compared to those that do not. Financial leaders should prioritize the creation of robust data strategies to enhance recovery processes, ultimately leading to improved financial outcomes.

Current trends indicate that organizations employing advanced debt collection strategies for financial institutions executives are not only refining their retrieval methods but also achieving greater recovery rates, underscoring the transformative impact of data in the financial recovery landscape.

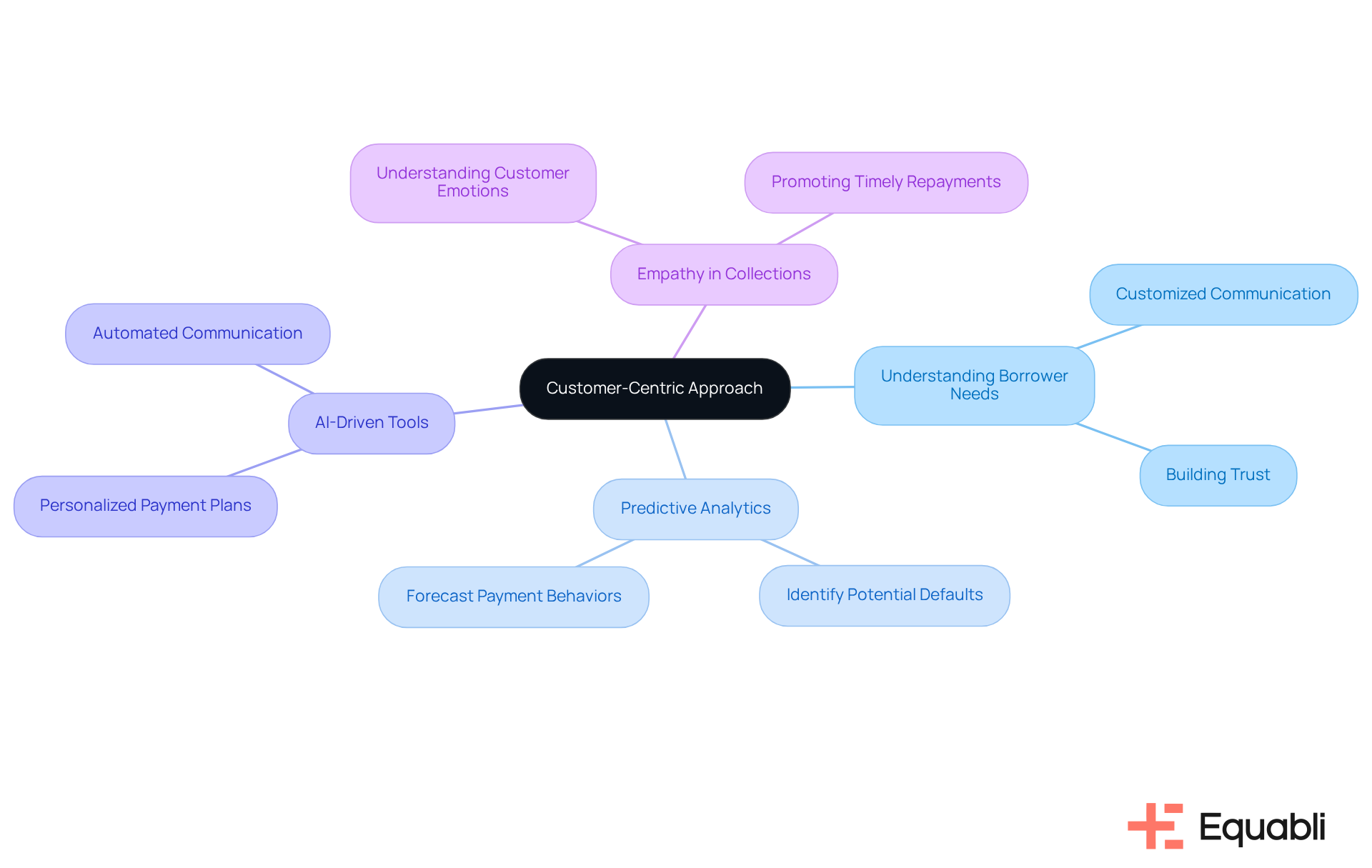

Customer-Centric Approach: Enhancing Borrower Relationships for Better Recovery

A customer-centric approach in debt management is crucial for enhancing borrower relationships and improving recovery rates. By comprehensively understanding the unique needs and preferences of borrowers, financial institutions can customize their communication and collection strategies. Such not only build trust but also promote timely repayments.

For example, predictive analytics can effectively identify potential payment defaults, enabling institutions to intervene proactively. Moreover, AI-driven tools can offer personalized payment plans that reflect individual financial behaviors, thereby increasing engagement and satisfaction.

Financial leaders must prioritize advanced debt collection strategies for financial institutions executives, as these strategies have been demonstrated to enhance overall loan recovery efforts and cultivate lasting relationships with borrowers.

As highlighted by industry experts, emphasizing empathy and understanding in collections can significantly improve outcomes, positioning this as a vital element of contemporary debt recovery strategies.

Conclusion

Implementing advanced debt collection strategies is essential for financial executives seeking to enhance recovery rates and operational efficiency. Intelligent solutions, such as Equabli's EQ Suite, empower institutions to leverage data-driven insights, predictive analytics, and customized communication, optimizing their debt recovery processes. By integrating these advanced tools, organizations not only improve their recovery outcomes but also cultivate stronger relationships with borrowers through ethical and customer-centric practices.

Key insights emphasize:

- The importance of predictive analytics in assessing borrower behavior

- The role of preferred communication channels in boosting engagement

- The benefits of automation in streamlining operations

Furthermore, the focus on ethical practices and tailored scoring models highlights the necessity of maintaining stakeholder trust while ensuring compliance. Collectively, these strategies illustrate how financial institutions can adapt to a rapidly changing economic landscape by prioritizing data-driven decision-making and enhancing borrower relationships.

In conclusion, financial executives are urged to adopt these advanced debt collection strategies to remain competitive and effective in their recovery efforts. By embracing technology and a customer-centric approach, organizations can maximize their return on investment while contributing to a more transparent and respectful debt collection environment. The insights provided in this article serve as a roadmap for navigating the complexities of debt recovery, underscoring the need for innovation and ethical practices in achieving sustainable financial success.

Frequently Asked Questions

What is Equabli's EQ Suite?

Equabli's EQ Suite is a comprehensive set of tools designed to enhance debt recovery through advanced collection strategies tailored for financial institutions. It includes the EQ Engine, EQ Engage, and EQ Collect, addressing specific challenges in the financial collection landscape.

How does the EQ Engine improve debt collection strategies?

The EQ Engine uses advanced predictive analytics to assess borrower behavior and forecast repayment likelihood. By analyzing historical data, it allows financial institutions to implement precise collection strategies, improving recovery rates and reducing costs associated with traditional methods.

What are the key features of EQ Engage?

EQ Engage enhances borrower engagement by allowing borrowers to choose their preferred communication channels, such as SMS, email, or phone calls. This personalization increases borrower satisfaction and the likelihood of timely repayments.

How does borrower engagement impact repayment rates?

Research shows that customers contacted through their preferred channels tend to pay 15% faster on average, highlighting the effectiveness of aligning communication methods with borrower preferences as part of advanced debt collection strategies.

What role does EQ Collect play in the recovery process?

EQ Collect optimizes the recovery process with features like a no-code file-mapping tool, automated workflows, real-time reporting, and compliance oversight, ensuring that financial institutions can interact effectively with borrowers while operating efficiently.

Why is ongoing training important for recovery teams?

Ongoing training is essential for enhancing efficiency and ensuring compliance with industry standards. It helps recovery teams adopt ethical practices and fosters positive customer relationships, which are critical in the evolving debt collection landscape.

How does the EQ Suite support customization for financial institutions?

The EQ Suite emphasizes customization, allowing organizations to tailor the tools to their specific needs. This adaptability is crucial in a rapidly changing economic environment, enabling better decision-making and strategic outcomes.