Overview

This article examines various collection analytics solutions that significantly enhance enterprise risk management by refining debt collection processes and compliance strategies. It underscores how tools such as the Equabli EQ Suite and FusionRM leverage intelligent analytics to optimize operations, reduce costs, and elevate recovery rates. This demonstrates the effectiveness of these solutions in modernizing risk management practices, providing actionable insights for executives in the financial sector.

Introduction

In an increasingly complex financial landscape, organizations encounter significant pressures to manage enterprise risks effectively while ensuring compliance with evolving regulations. The emergence of advanced collection analytics solutions presents a transformative opportunity for businesses to enhance their risk management strategies, streamline operations, and improve financial outcomes. However, as these tools become integral to operational success, enterprises must navigate the myriad options available and determine which solutions best align with their unique needs and objectives.

Equabli EQ Suite: Transforming Debt Collection with Intelligent Analytics

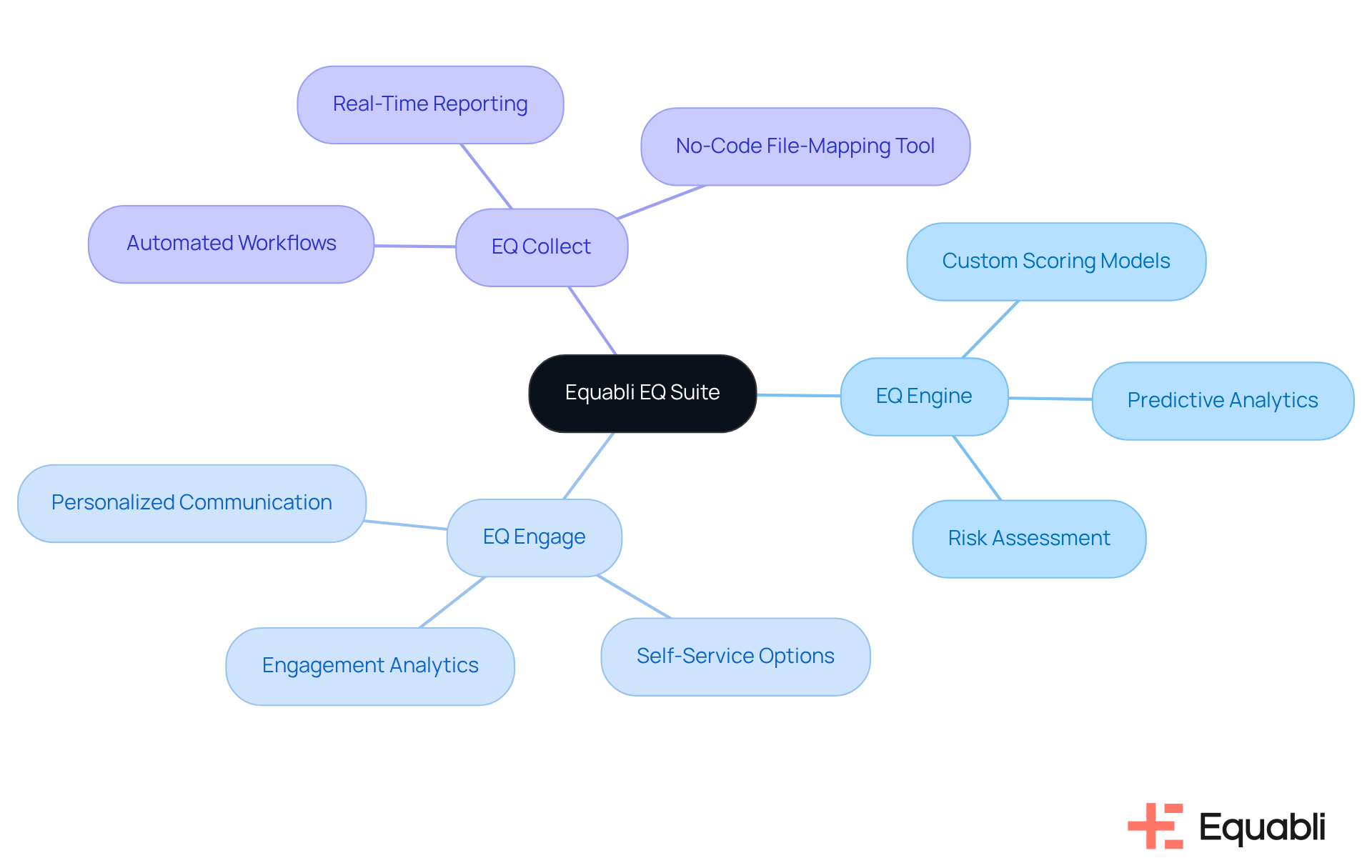

The Equabli EQ Suite represents a significant advancement in modernizing debt collection by leveraging collection analytics solutions for enterprise risk management through its intelligent analytics capabilities. This comprehensive platform includes tools such as EQ Engine, EQ Engage, and EQ Collect, enabling entities to implement that effectively predict repayment behaviors. Evidence shows that by optimizing collection strategies and facilitating digital collections, the EQ Suite leverages collection analytics solutions for enterprise risk management to reduce operational costs while enhancing borrower engagement. Agencies utilizing collection analytics solutions for enterprise risk management have reported recovery rate increases of up to 30%, underscoring the suite's effectiveness in transforming debt recovery processes.

As we approach 2025, the integration of intelligent analytics and collection analytics solutions for enterprise risk management, along with a focus on compliance and ethical practices, will be essential for agencies striving to streamline operations and enhance financial outcomes. The EQ Collect platform, with its no-code file-mapping tool, automated workflows, and real-time reporting, serves as one of the top collection analytics solutions for enterprise risk management, making it an invaluable asset for lenders and debt recovery agencies focused on innovation and efficiency. Furthermore, EQ Engage improves borrower engagement through personalized communication journeys and self-service repayment options, ensuring that agencies can connect with customers effectively while adhering to regulatory standards.

FusionRM: Integrated Business Continuity and Risk Management Solutions

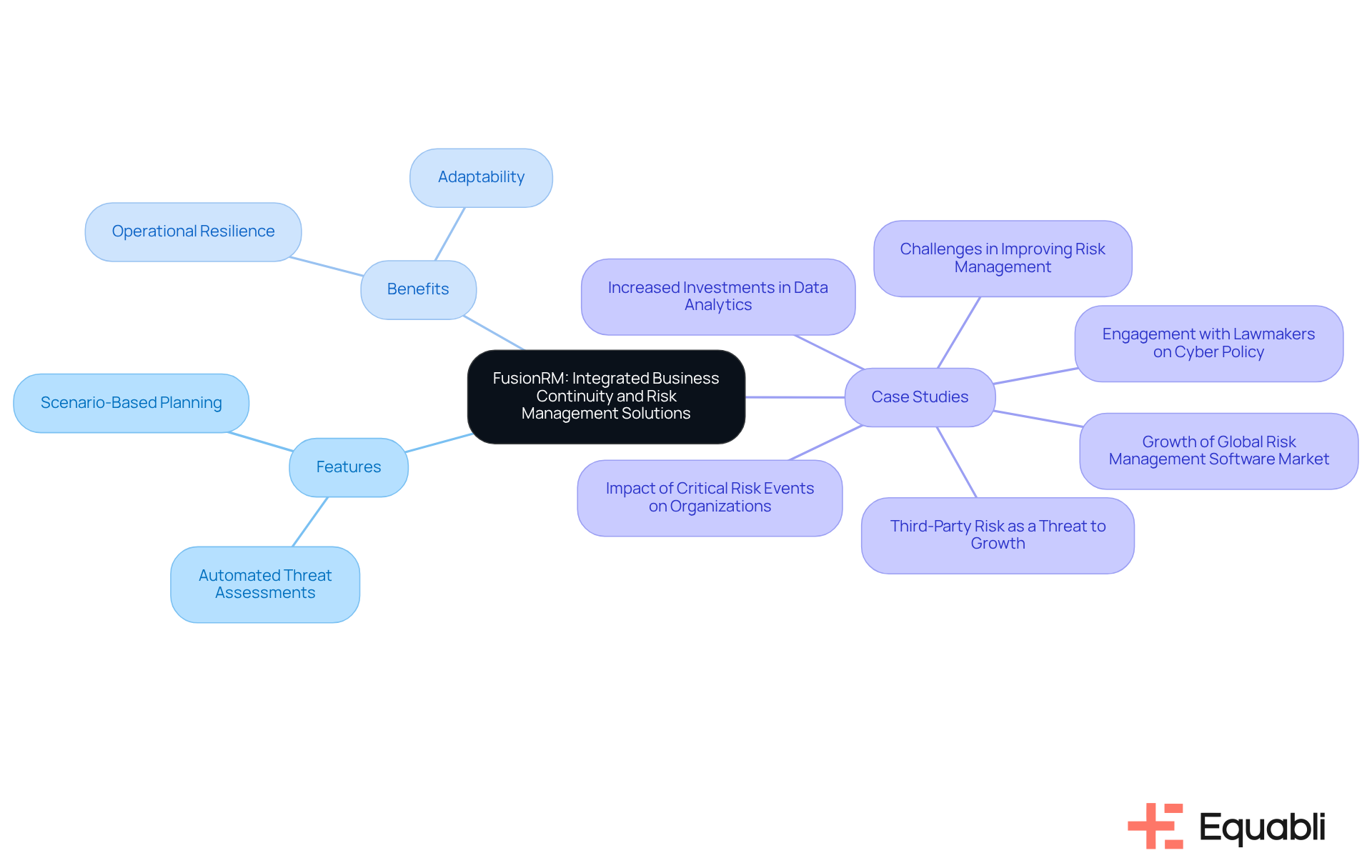

FusionRM provides a comprehensive platform that effectively integrates business continuity and threat mitigation solutions. This enables organizations to assess challenges efficiently and develop robust continuity strategies. The centralized framework not only enhances operational resilience but also equips organizations to respond adeptly to unforeseen challenges, thereby protecting their operations and reputation.

As organizations increasingly recognize the importance of cohesive threat management, FusionRM sets itself apart by offering innovative features aligned with current trends, such as:

- Automated threat assessments

- Scenario-based planning

Case studies across various sectors illustrate how organizations leveraging FusionRM have improved their strategies for navigating uncertainties, ensuring adaptability in a rapidly changing environment. With a focus on continuous improvement and flexibility, FusionRM is poised to lead the future of for 2025 and beyond.

Hyperproof: Comprehensive Enterprise Risk Management Framework

Hyperproof provides a comprehensive enterprise hazard control system that enables organizations to optimize compliance processes and mitigate risks. The platform supports various compliance frameworks, facilitating the automation of workflows and efficient audit preparation. By integrating collection analytics solutions for enterprise risk management into daily operations, Hyperproof enhances organizational agility and resilience, positioning itself as an essential tool for enterprises focused on managing risk. This capability not only but also empowers businesses to navigate complex regulatory landscapes effectively.

LogicManager: AI-Powered Insights for Proactive Risk Management

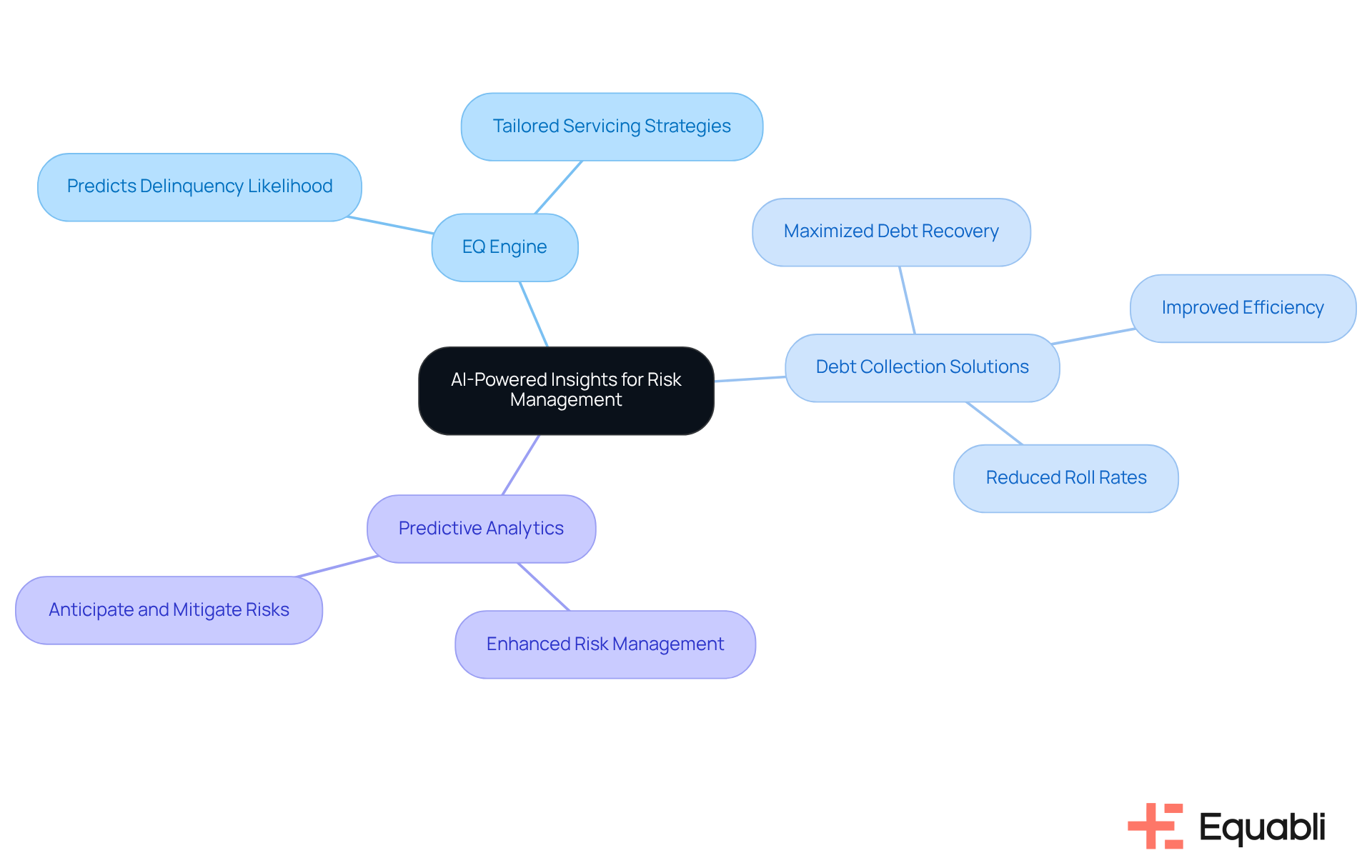

Equabli leverages AI-driven insights through its EQ Engine to deliver proactive debt collection solutions. The EQ Engine predicts the likelihood of delinquency in active accounts, enabling financial institutions to devise intelligent servicing strategies tailored for each communication channel. By utilizing predictive analytics, Equabli provides collection analytics solutions for enterprise risk management, enhancing entities' ability to anticipate and mitigate risks before they escalate, thereby maximizing debt recovery, fostering efficiency, and reducing roll rates. This approach significantly improves overall .

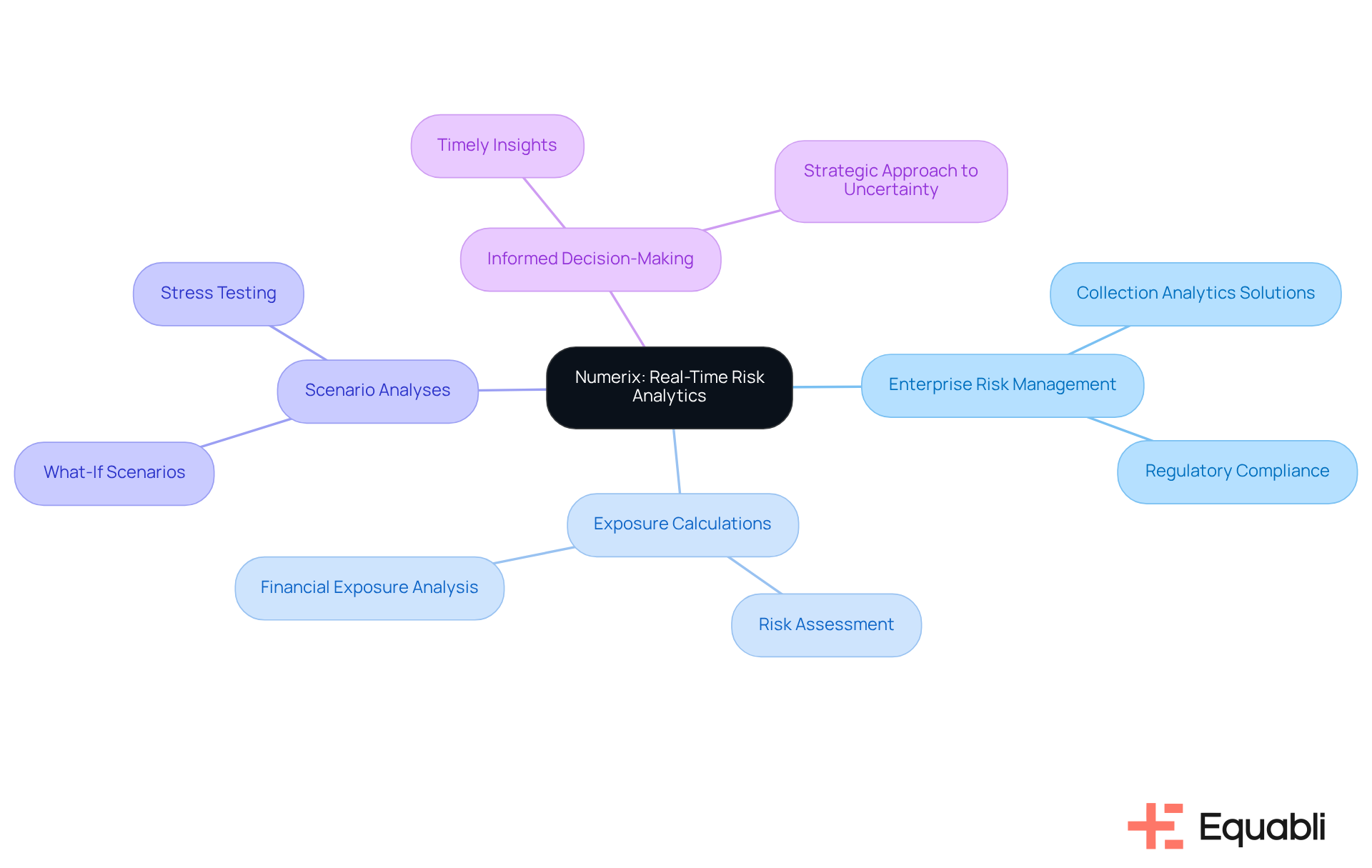

Numerix: Real-Time Risk Analytics for Financial Institutions

Numerix delivers real-time analytical insights tailored for financial organizations, utilizing collection analytics solutions for enterprise risk management to address a critical need. Its advanced analytics tools serve as collection analytics solutions for enterprise risk management, facilitating exposure calculations and scenario analyses, which are essential for navigating uncertainties and ensuring compliance with regulatory mandates.

By providing timely insights, Numerix empowers financial organizations to make informed decisions, thereby enhancing their strategic approach to uncertainty management. This capability is crucial in an environment where rapid, can significantly influence operational outcomes.

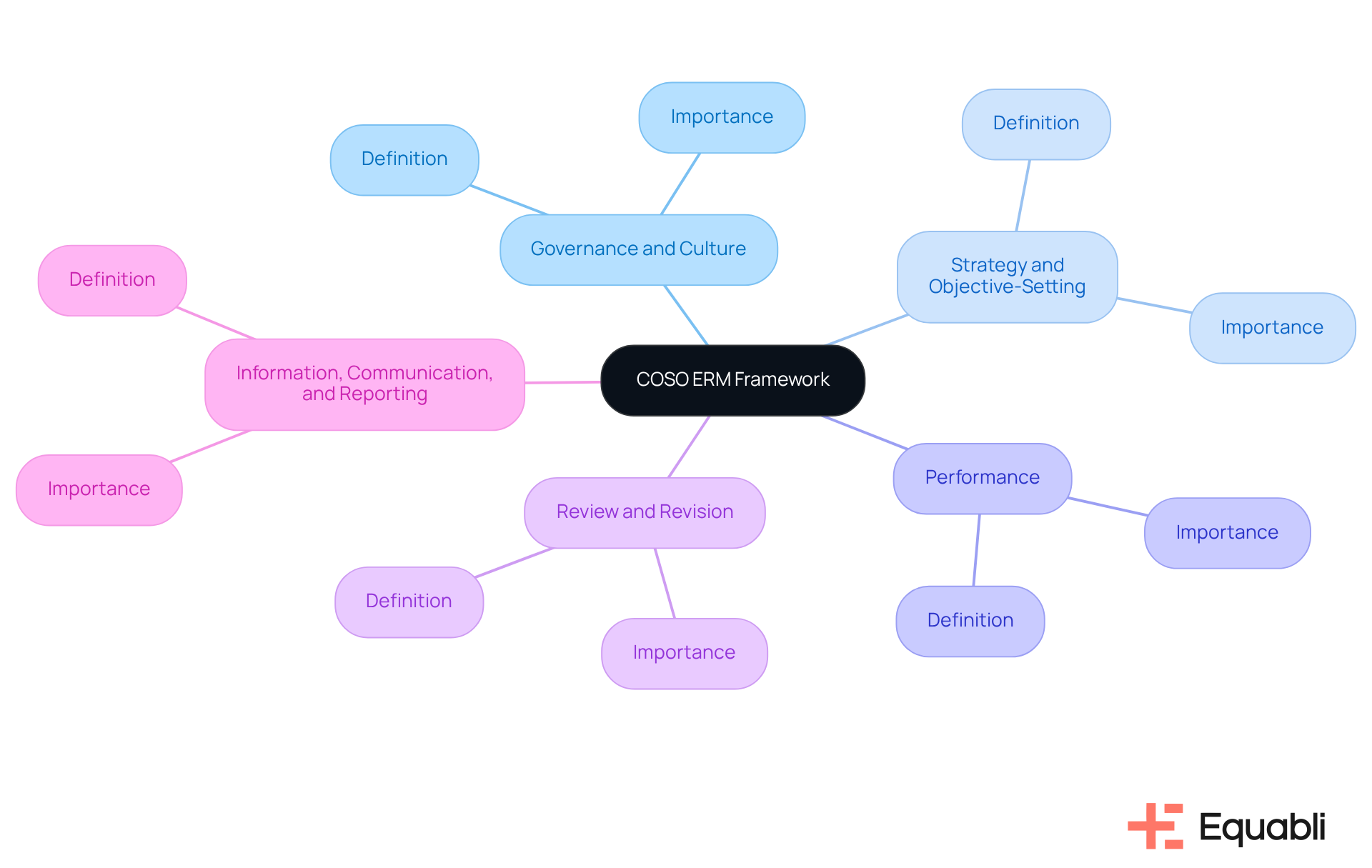

COSO ERM Framework: Structured Approach to Enterprise Risk Management

The COSO ERM Framework provides a structured approach for managing enterprise-level uncertainty, emphasizing the integration of risk oversight into organizational processes. This framework comprises five interrelated components:

- Governance and Culture

- Strategy and Objective-Setting

- Performance

- Review and Revision

- Information, Communication, and Reporting

By adopting the COSO model, organizations can refine their risk management strategies, ensuring alignment with strategic objectives and enhancing operational effectiveness.

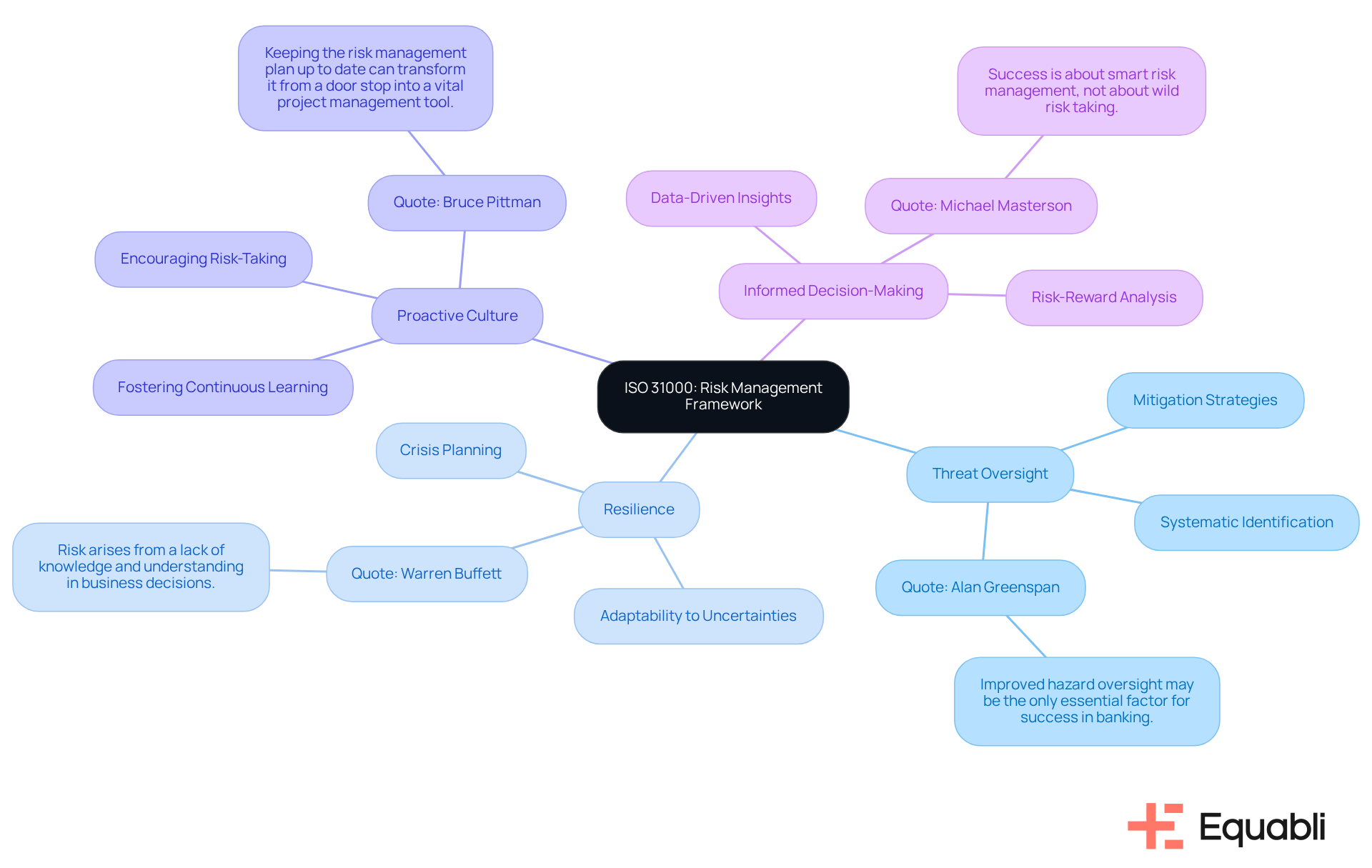

ISO 31000: Universal Guidelines for Effective Risk Management

ISO 31000 establishes a robust framework tailored to the specific needs of organizations, emphasizing the critical integration of threat oversight into all facets of operations and decision-making. As noted by Alan Greenspan, 'improved hazard oversight may be the only essential factor for success in banking.' This assertion underscores the necessity for organizations to adopt ISO 31000 to , enabling them to adeptly navigate uncertainties and confront challenges with increased efficacy.

Furthermore, this standard not only facilitates a systematic approach to identifying and mitigating threats but also fosters a culture of proactive oversight, which is essential for sustaining long-term success in today's ever-evolving business environment. Additionally, Warren Buffett's perspective on the importance of understanding uncertainty highlights the need for tailored uncertainty management frameworks, reinforcing the value of strategic oversight in informed decision-making across enterprises.

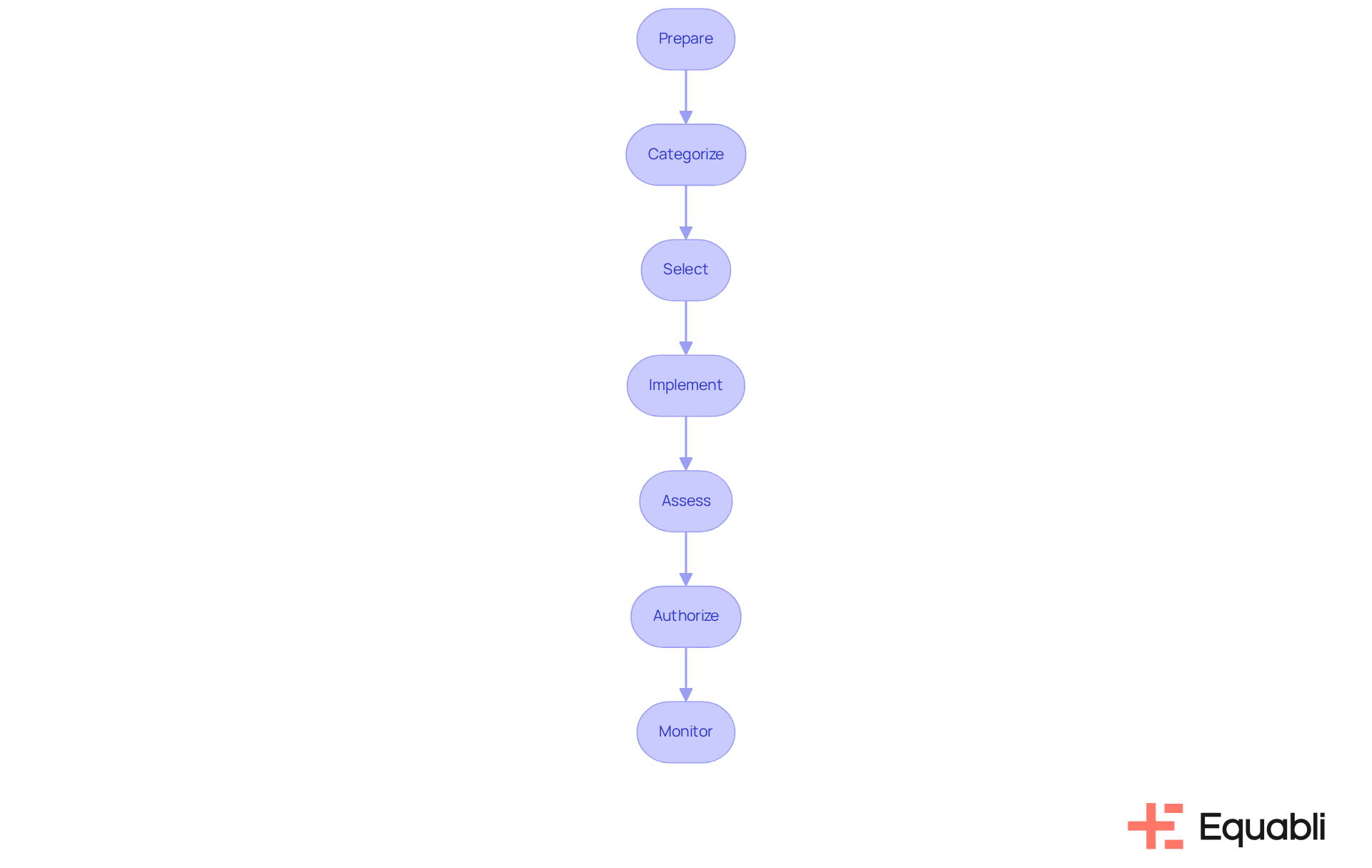

NIST Risk Management Framework: Integrating Security and Risk Management

The NIST Risk Management Framework (RMF) serves as a comprehensive approach for addressing threats associated with information systems. This framework encompasses a systematic, adaptable, and repeatable process that organizations can leverage to integrate security and management activities effectively. By adopting the NIST RMF, entities can enhance their cybersecurity posture while adeptly managing uncertainties that may arise during operations.

The RMF delineates critical steps:

- Prepare

- Categorize

- Select

- Implement

- Assess

- Authorize

- Monitor

These steps provide organizations with a structured pathway for effective application of the framework. As Jerome Powell highlighted, aligning organizational strategy with an appetite for uncertainty mitigates exposure to unforeseen losses, underscoring the importance of merging security measures with practices aimed at uncertainty reduction.

Furthermore, the integration of cybersecurity within governance frameworks, as emphasized by cybersecurity experts, is vital for developing effective strategies that adapt to evolving threats and regulatory requirements. This proactive alignment cultivates a , enabling organizations to respond efficiently to potential vulnerabilities and incidents. Additionally, corporate transparency, as noted by Dale E. Jones, is crucial for sustaining trust and accountability in enterprise operations.

Basel III: Regulatory Standards for Risk Management in Banking

Basel III represents a pivotal global regulatory framework designed to establish minimum capital standards and enhance oversight protocols for banks. Its primary objective is to fortify the regulation, oversight, and control practices within the banking sector, thereby bolstering resilience against financial crises. Under Basel III, have been significantly elevated, with Tier I capital requirements increasing from 4% in Basel II to 6% in Basel III. This includes 4.5% Common Equity Tier 1 and an additional 1.5% of additional Tier 1 capital. Furthermore, an additional 2.5% buffer capital requirement raises the total minimum to 7% for Basel compliance. This adjustment is aimed at ensuring that banks maintain sufficient capital buffers capable of absorbing potential losses, thus safeguarding the stability of the financial system.

As banks navigate the complexities of 2025 and beyond, the emphasis on collection analytics solutions for enterprise risk management becomes increasingly vital. The framework encourages organizations to adopt a comprehensive approach to managing uncertainties by leveraging collection analytics solutions for enterprise risk management, while recognizing the interconnections among various threat categories. The global financial crisis underscored the limitations of isolated systems in addressing uncertainties, highlighting the need for cohesive strategies. Consequently, banks are now required to demonstrate proficiency in their data and reporting structures by utilizing collection analytics solutions for enterprise risk management, ensuring compliance with evolving regulatory requirements.

Expert perspectives indicate that adherence to Basel III not only enhances capital sufficiency but also fosters a culture of proactive oversight. Real-world examples illustrate how banks have effectively implemented these standards to bolster operational resilience. For instance, numerous organizations have invested in collection analytics solutions for enterprise risk management and advanced data analytics technologies to better assess their exposure and refine decision-making processes. Additionally, the phased implementation of the Liquidity Coverage Ratio (LCR) serves as a practical application of Basel III standards. This strategic transition not only aligns with regulatory expectations but also positions banks to thrive in an increasingly volatile financial landscape.

Action-Oriented Matrix: Visualizing and Prioritizing Risk Management Strategies

An action-focused framework serves as a vital resource for organizations to effectively illustrate and prioritize their threat handling strategies. By categorizing uncertainties based on their likelihood and potential impacts, organizations can allocate resources with precision and develop targeted action strategies. This structured approach not only enhances decision-making but also ensures that enterprises concentrate on the most critical risks, thereby significantly improving their overall .

Conclusion

The exploration of collection analytics solutions for enterprise risk management underscores the transformative potential of intelligent analytics in contemporary financial practices. By leveraging advanced tools and frameworks, organizations can enhance operational efficiency while significantly improving risk management strategies. This evolution is essential for navigating the complexities of the financial landscape, particularly as agencies prepare for forthcoming challenges.

Key insights illustrate how platforms like the Equabli EQ Suite and FusionRM are reshaping risk management approaches. These tools empower organizations to implement customized scoring models, automate workflows, and utilize real-time analytics, resulting in improved recovery rates and enhanced compliance with regulatory standards. The focus on proactive risk management through frameworks such as COSO and ISO 31000 further emphasizes the necessity for a structured approach to mitigate uncertainties.

Ultimately, integrating collection analytics solutions into enterprise risk management transcends being a mere trend; it stands as a strategic imperative. As the financial sector continues to evolve, organizations are urged to adopt intelligent analytics tools to foster resilience and adaptability. By prioritizing innovative solutions and compliance, businesses can position themselves for sustainable success, ensuring they are well-equipped to confront future challenges head-on.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed to modernize debt collection through intelligent analytics. It includes tools like EQ Engine, EQ Engage, and EQ Collect, which help implement custom scoring models to predict repayment behaviors.

How does the EQ Suite improve debt collection?

The EQ Suite optimizes collection strategies and facilitates digital collections, which can reduce operational costs and enhance borrower engagement. Agencies using the suite have reported recovery rate increases of up to 30%.

What features does the EQ Collect platform offer?

The EQ Collect platform features a no-code file-mapping tool, automated workflows, and real-time reporting, making it a valuable asset for lenders and debt recovery agencies.

How does EQ Engage enhance borrower engagement?

EQ Engage improves borrower engagement through personalized communication journeys and self-service repayment options, allowing agencies to connect with customers effectively while adhering to regulatory standards.

What is FusionRM?

FusionRM is a comprehensive platform that integrates business continuity and threat mitigation solutions, enabling organizations to assess challenges and develop robust continuity strategies.

What innovative features does FusionRM offer?

FusionRM offers automated threat assessments and scenario-based planning, which help organizations improve their strategies for navigating uncertainties.

How does Hyperproof support enterprise risk management?

Hyperproof provides a comprehensive hazard control system that optimizes compliance processes, automates workflows, and prepares organizations for audits, enhancing agility and resilience.

What role does Hyperproof play in compliance?

Hyperproof integrates collection analytics solutions for enterprise risk management into daily operations, streamlining compliance efforts and helping businesses navigate complex regulatory landscapes.