Overview

This article examines various automated debt collection solutions that aim to enhance enterprise financial operations through increased efficiency and improved borrower engagement. Notable solutions, including the Equabli EQ Suite and CR Software, feature capabilities such as:

- Predictive analytics

- Automated reminders

- Digital payment integrations

These elements collectively streamline processes, reduce operational costs, and significantly enhance recovery rates for organizations managing receivables. By adopting these advanced tools, enterprises can not only optimize their debt collection strategies but also align with compliance requirements and industry best practices.

Introduction

The landscape of debt collection is undergoing a significant transformation, as enterprises increasingly adopt automated solutions to streamline operations. This shift is driven by the imperative to enhance recovery rates and improve customer interactions. Organizations are uncovering numerous benefits associated with the integration of advanced technology into their financial processes. However, the rise of these automated systems brings forth a critical question: how can businesses effectively navigate the complexities of implementation while ensuring compliance and fostering positive relationships with debtors?

This article examines seven innovative automated debt collection solutions that have the potential to revolutionize enterprise operations, emphasizing their features, benefits, and the challenges they address.

Equabli EQ Suite: Comprehensive Automated Debt Collection Solutions

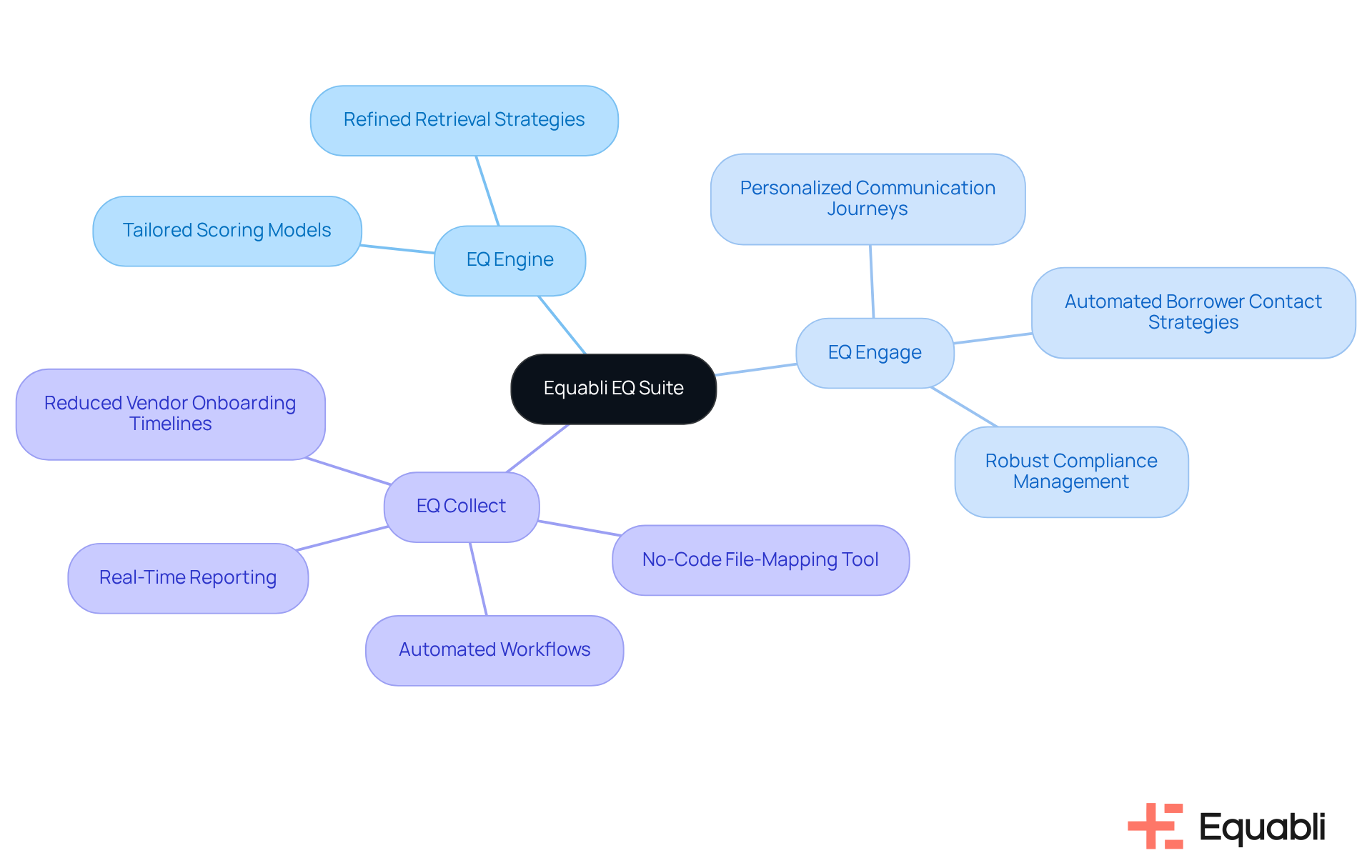

The Equabli EQ Suite serves as a pivotal platform for enhancing receivable management efficiency through automated debt collection solutions for enterprise financial operations. Comprising tools such as EQ Engine, EQ Engage, and EQ Collect, this suite enables lenders and agencies to implement tailored scoring models, refine retrieval strategies, and streamline digital processes. Notably, EQ Collect features a no-code file-mapping tool that significantly reduces vendor onboarding timelines, automated workflows that decrease execution errors, and real-time reporting that delivers unparalleled transparency and insights.

Furthermore, EQ Engage empowers organizations to design, automate, and execute borrower contact strategies, ensuring personalized communication journeys alongside robust compliance management. By automating workflows and providing real-time analytics, the EQ Suite—characterized by its intuitive, scalable, cloud-based interface—enables organizations to utilize automated debt collection solutions for enterprise financial operations, which helps reduce operational expenses and enhance borrower interaction. This positions the EQ Suite as an indispensable solution for addressing contemporary .

CR Software: Advanced Automated Debt Collection Software

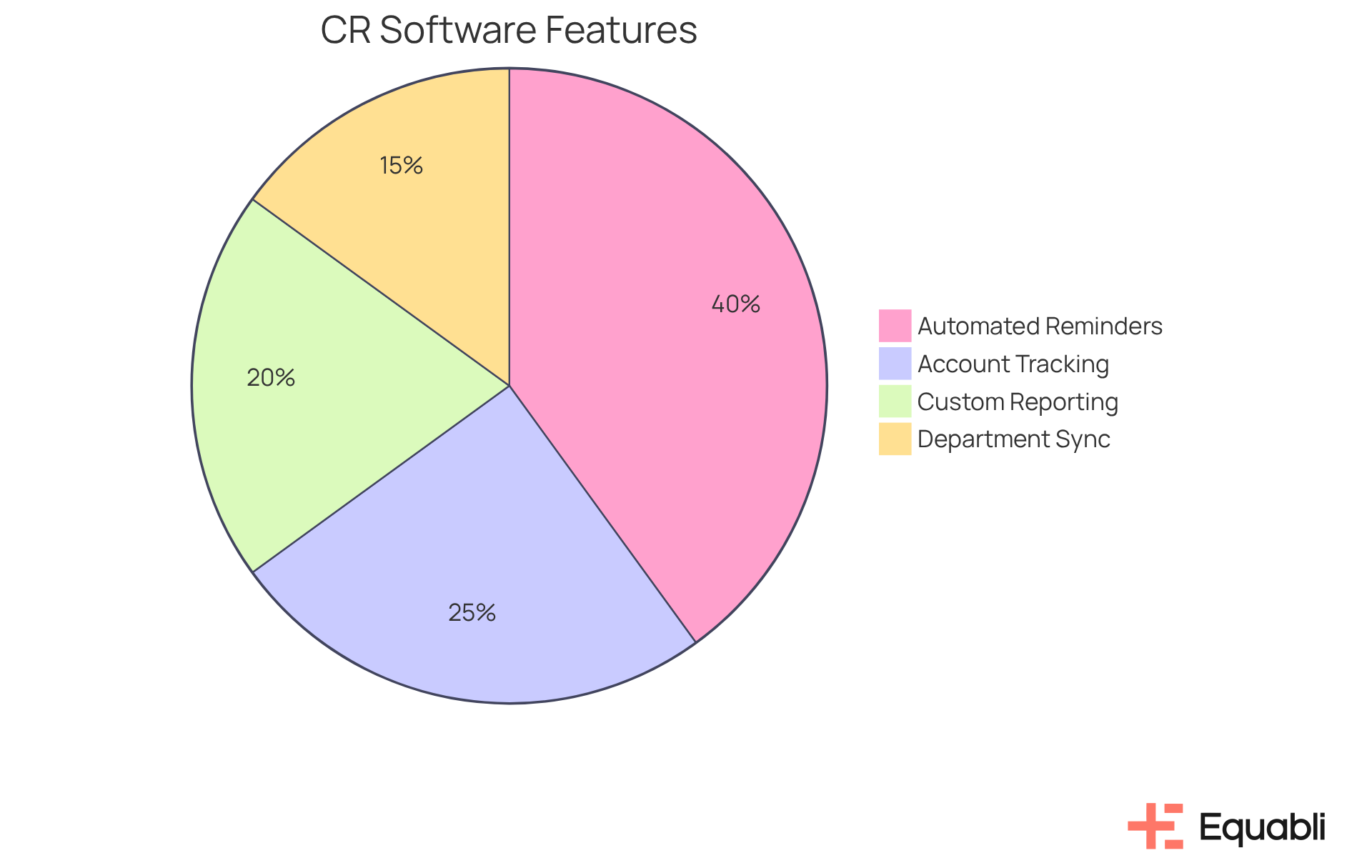

CR Software delivers advanced automated debt collection solutions for enterprise financial operations that markedly enhance the collection process. By integrating features such as automated billing reminders, account tracking, and customizable reporting tools, organizations can streamline operations and mitigate manual errors. Evidence indicates that this sophisticated platform can elevate recovery rates by as much as 57%, enabling institutions to focus on high-value claims and effectively optimize cash flows.

For example, companies employing automated reminders have documented a staggering increase in self-serve payments, with one case study revealing a growth of 1861% following the adoption of these strategies. Moreover, CR Software's capacity to and centralize customer data facilitates improved analytics and task prioritization, ultimately cultivating a more efficient workflow.

As the need for innovative receivable management techniques escalates, CR Software positions itself as a premier choice for financial institutions aiming to modernize operations through automated debt collection solutions for enterprise financial operations and achieve sustainable growth.

Convin.ai: AI-Powered Debt Collection Automation

Convin.ai leverages artificial intelligence to enhance receivables management processes with remarkable efficiency. The AI-driven voice agents effectively handle high-volume recovery calls, provide personalized reminders, and prioritize high-risk accounts. This innovative technology not only boosts but also significantly enhances customer engagement through timely and relevant communication. Organizations implementing automated debt collection solutions for enterprise financial operations can expect a substantial increase in retrieval rates while adhering to industry compliance standards, thereby transforming their recovery strategies.

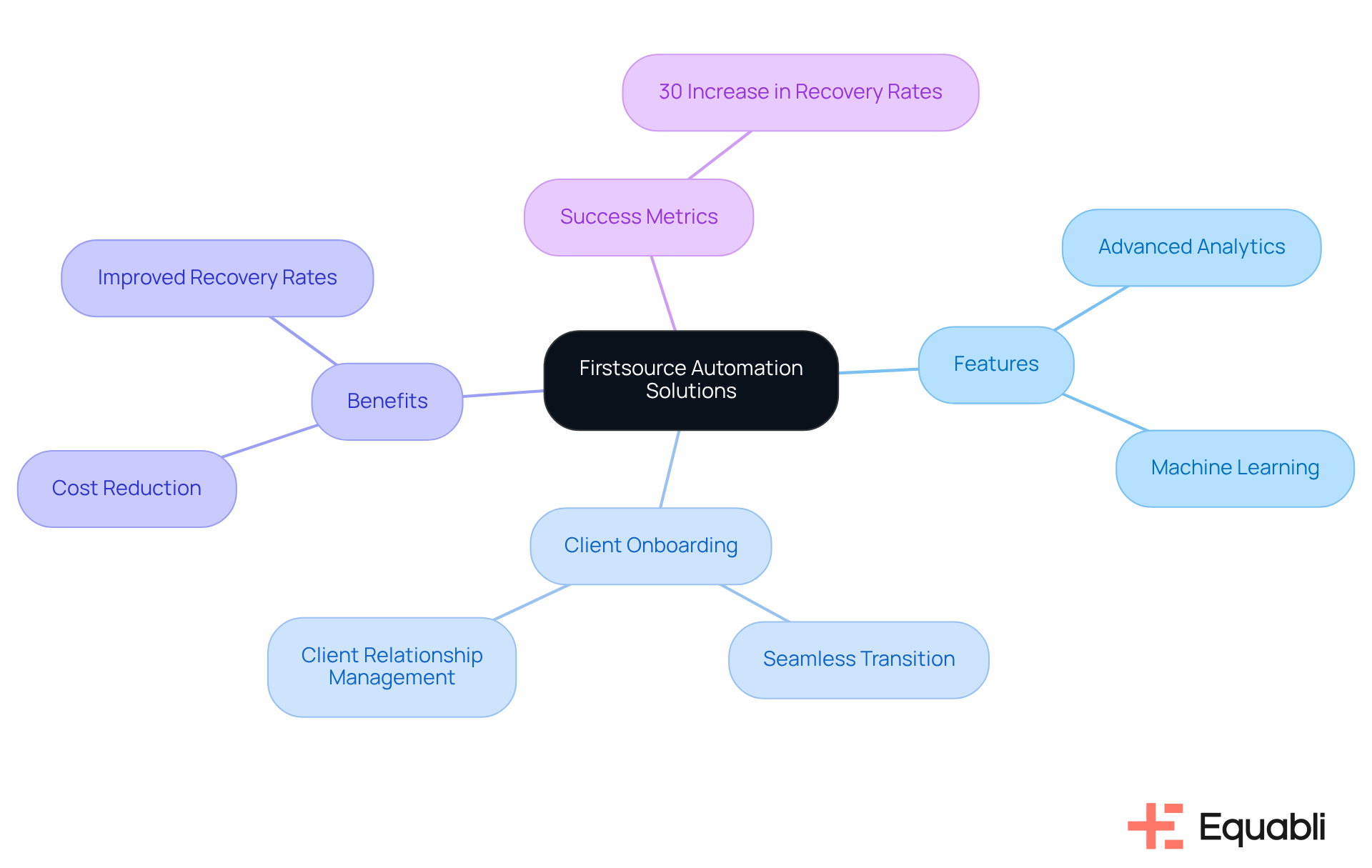

Firstsource: Automation Solutions for FinTech Debt Collection

The company offers automated debt collection solutions for enterprise financial operations, specifically tailored to enhance debt recovery efficiency in the FinTech sector. Their platform leverages advanced analytics and machine learning to optimize collection strategies and improve customer interactions. By guiding the setup and implementation process during client onboarding, the company ensures a seamless transition from sales to client relationship management. This proactive strategy not only drives product adoption but also fosters , aligning with the business objectives of financial institutions.

By automating routine tasks and utilizing data-driven insights, the company offers automated debt collection solutions for enterprise financial operations, helping organizations reduce costs and improve recovery rates, thereby establishing itself as a valuable partner for FinTech firms. Furthermore, the company actively identifies upsell and cross-sell opportunities, which contribute to sustained client growth and satisfaction. Success metrics, including a notable 30% increase in recovery rates for clients using their platform, underscore the effectiveness of their solutions.

HES FinTech: Predictive Analytics in Automated Debt Collection

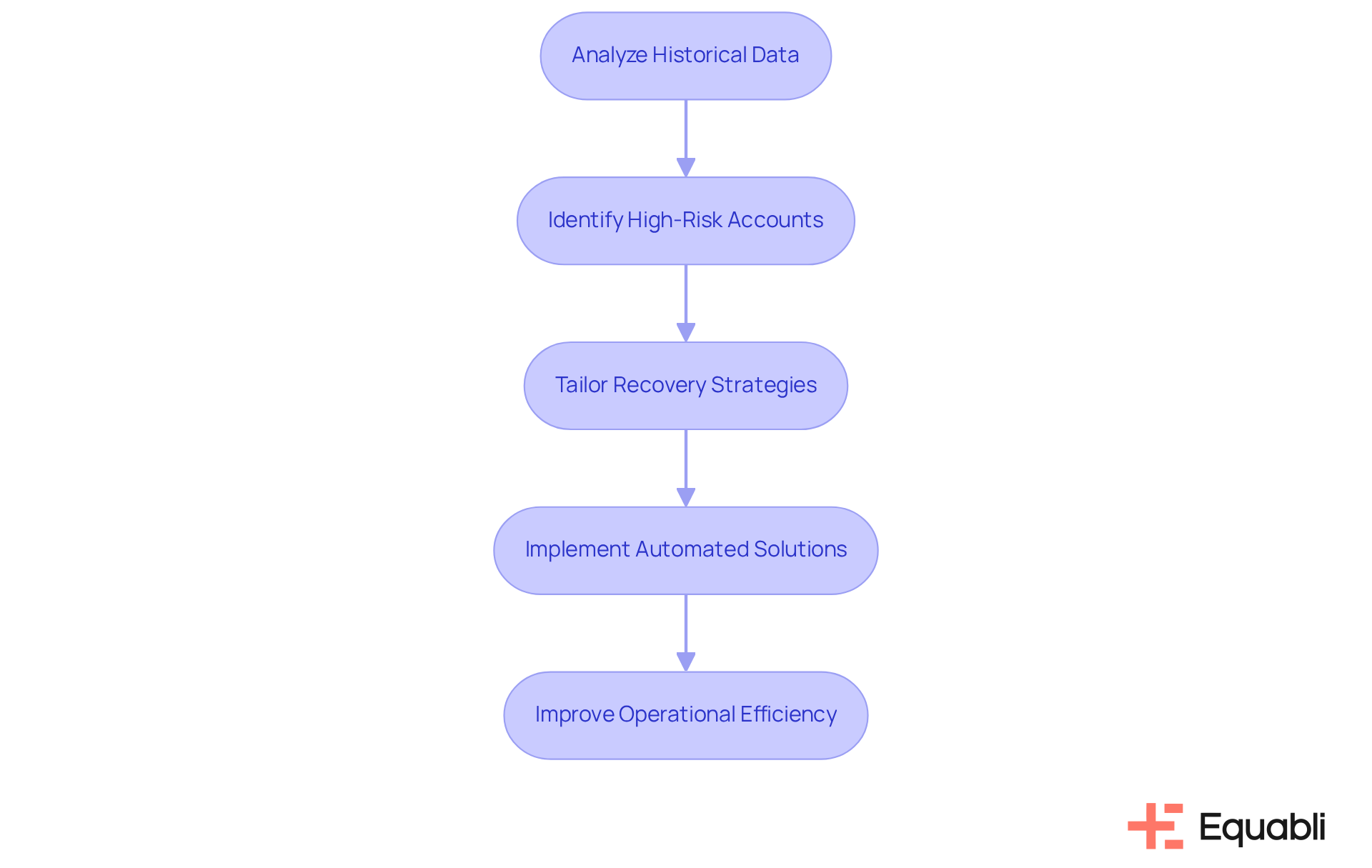

Equabli leverages predictive analytics and machine learning to enhance automated debt collection solutions for enterprise financial operations. By thoroughly analyzing historical data and payment behaviors, the EQ Engine identifies high-risk accounts and tailors recovery strategies to meet distinct needs. This proactive approach not only but also significantly mitigates the risk of bad debts.

Furthermore, Equabli's solutions empower organizations to scale their operations effectively without sacrificing performance. As organizations implement these data-driven strategies, they enhance their collection efforts with automated debt collection solutions for enterprise financial operations, resulting in improved operational efficiency and superior financial outcomes.

The integration of predictive analytics and intelligent automation is becoming essential; industry experts note that organizations prioritizing data as a strategic asset will thrive in the evolving landscape of financial recovery.

IBS Home: Automated Debt Collection for Banks and Credit Unions

Equabli offers automated debt collection solutions for enterprise financial operations that are specifically designed for banks and credit unions, significantly enhancing the recovery process. With U.S. as of 2024, the demand for automated debt collection solutions for enterprise financial operations has become critical.

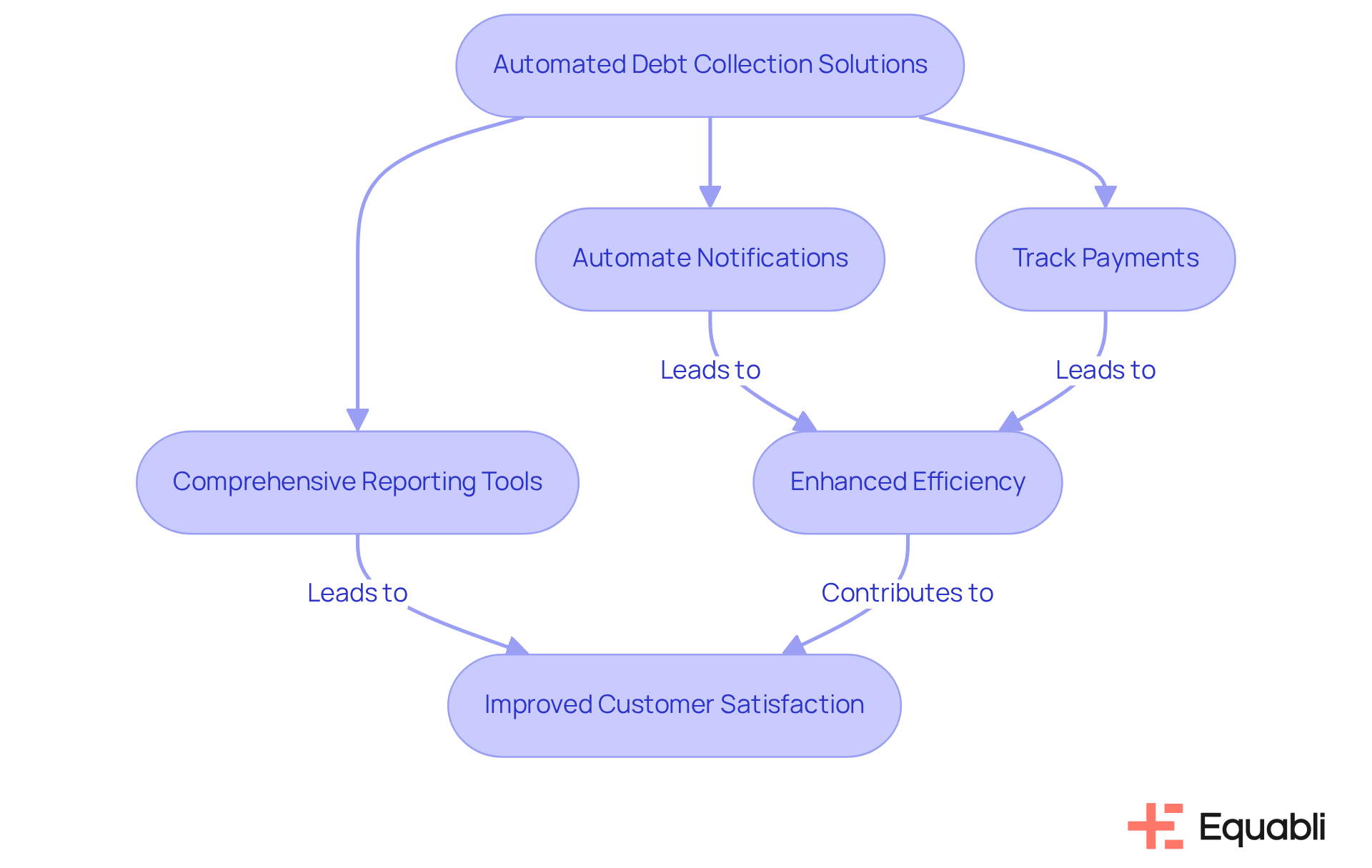

By utilizing automated debt collection solutions for enterprise financial operations, financial institutions can:

- Automate notifications

- Track payments

- Offer comprehensive reporting tools to streamline operations and reduce manual errors

This automation, specifically utilizing automated debt collection solutions for enterprise financial operations, not only enhances operational efficiency but also improves customer satisfaction, enabling institutions to engage with debtors more effectively and empathetically.

The Client Success Representative at Equabli is instrumental in this process, overseeing setup and implementation during client onboarding, conducting proactive check-ins, and identifying upsell opportunities to ensure a seamless transition and robust start to the client relationship. They facilitate product adoption and client engagement by understanding business objectives and ensuring that the platform aligns with those goals.

For example, the case study "Smarter Collections: A Data-Driven, Customer-Centric Approach" demonstrates how banks can improve borrower retention and optimize recovery efforts through contemporary strategies. Consequently, recovery outcomes are significantly enhanced, positioning Equabli as a vital partner for credit unions seeking automated debt collection solutions for enterprise financial operations to modernize their receivables strategy.

Furthermore, our organization is committed to protecting client data, as outlined in our Privacy Policy, ensuring that all interactions comply with stringent data protection standards. The integration of automated debt collection solutions for enterprise financial operations aligns with the increasing trend of leveraging technology to create a seamless communication experience, ultimately fostering stronger relationships with customers and improving overall recovery rates.

BillingPlatform: Centralized Debt Management and Collections System

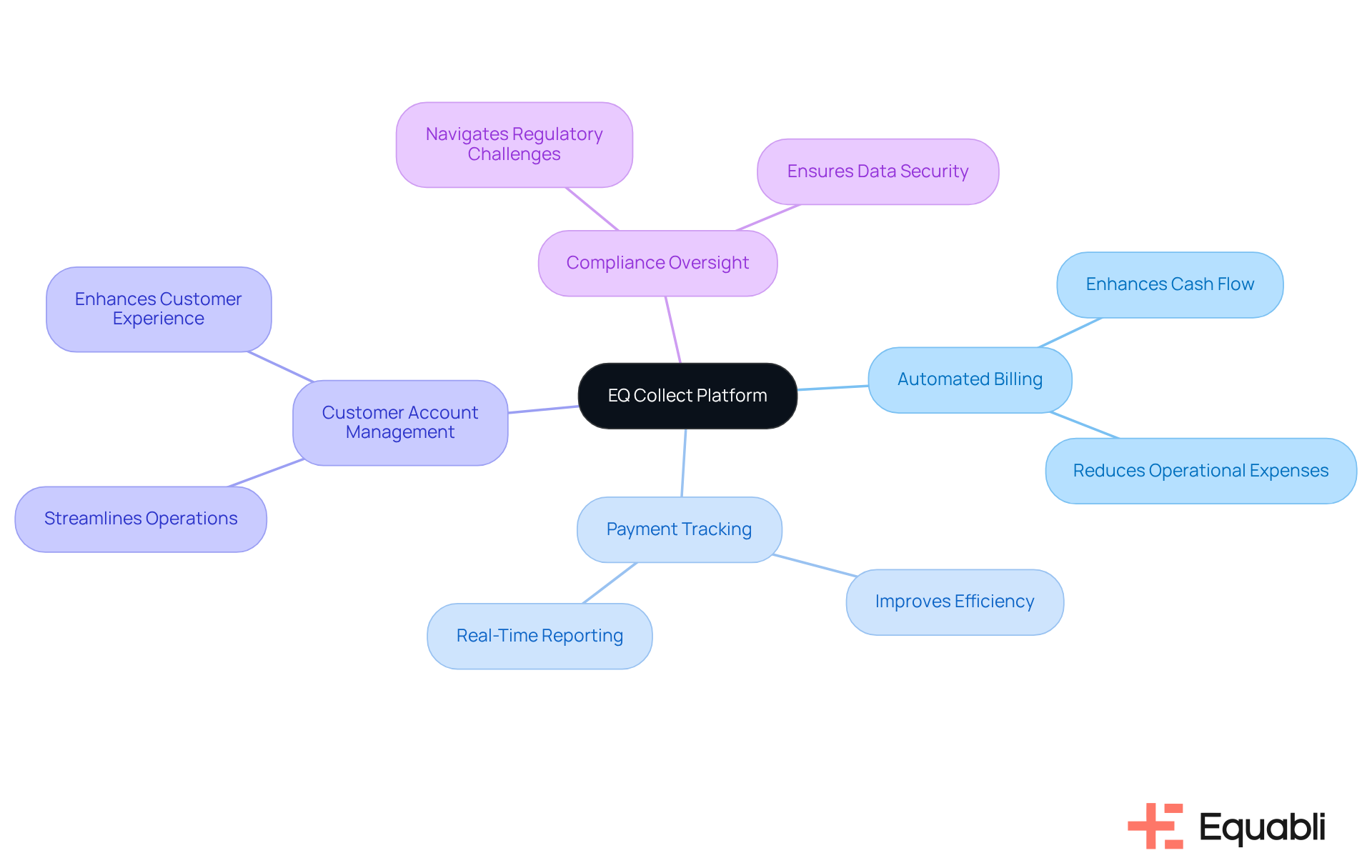

Equabli offers a centralized financial management and recovery system through its EQ Collect platform, which streamlines the recovery process significantly. By automating billing, tracking payments, and managing customer accounts within a unified, cloud-native interface, organizations can enhance their cash flow effectively. This centralized approach not only reduces operational expenses but also improves overall efficiency in fund recovery.

In 2025, industry leaders emphasize the critical role of automated debt collection solutions for enterprise financial operations in optimizing cash flow and reducing manual tasks. The platform features a no-code file-mapping tool, automated workflows, and real-time reporting, empowering financial institutions to redefine their recovery strategies.

As noted by industry experts, "By leveraging intelligent automation and machine learning, organizations can unlock new levels of efficiency and borrower engagement." Additionally, Equabli's commitment to compliance oversight enables organizations to navigate regulatory challenges seamlessly.

Thus, Equabli has established itself as an essential resource for modern organizations seeking to improve their receivable management practices through for enterprise financial operations and achieve sustainable financial growth.

Digital Payment Integration Tools: Streamlining Debt Collection

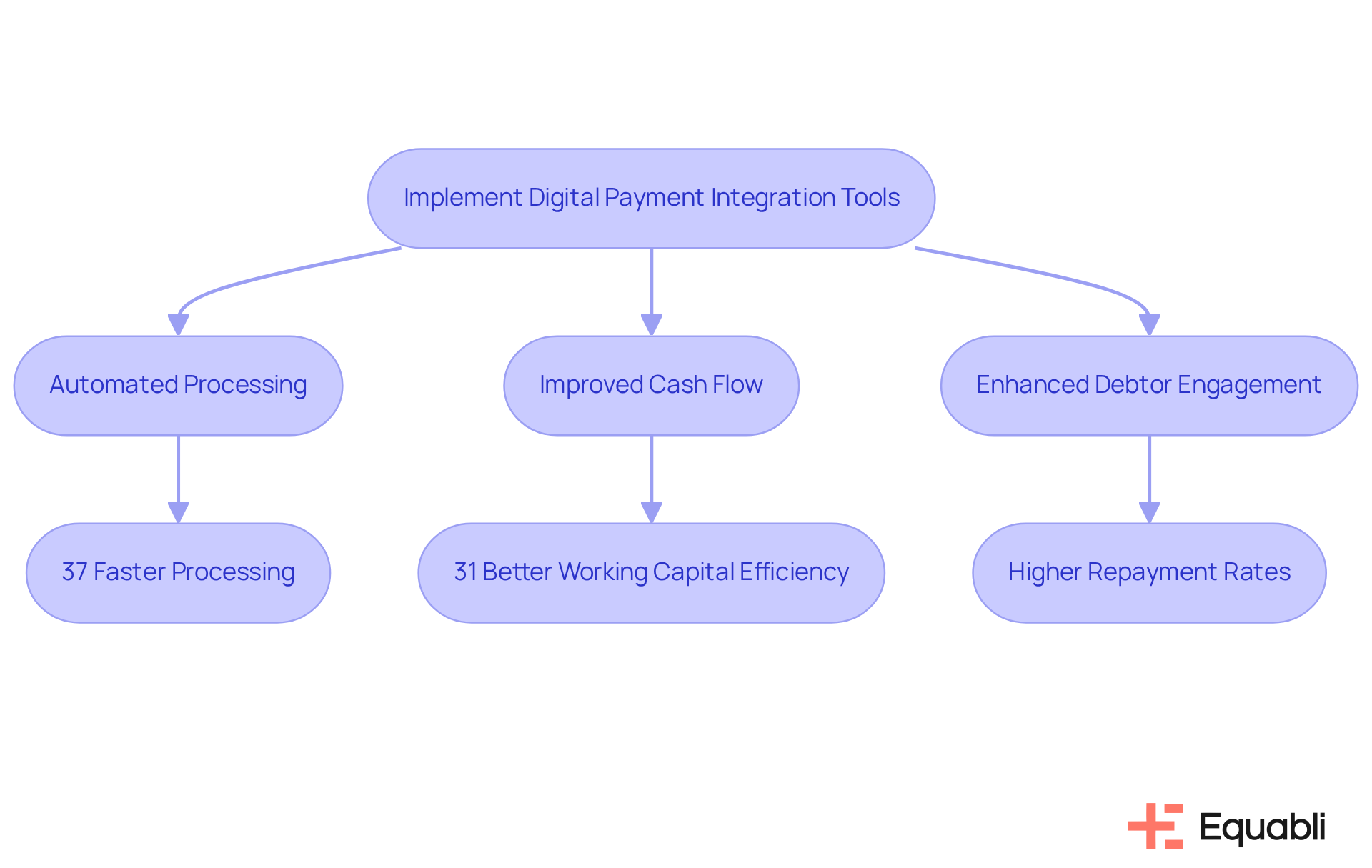

Digital transaction integration tools are essential for enhancing automated debt collection solutions for enterprise financial operations. By offering a variety of transaction alternatives, these tools not only elevate customer convenience but also automate processing, significantly reducing delays.

Organizations that use automated debt collection solutions for enterprise financial operations can anticipate improved cash flow and increased overall collection efficiency. For example, businesses utilizing integrated digital transaction systems report processing speeds that are 37% faster, while those employing real-time transaction solutions observe a 31% improvement in working capital efficiency.

Furthermore, the versatility of various transaction methods fosters greater debtor engagement, leading to enhanced repayment rates. This modern approach to transactions is vital for organizations aiming to bolster their through automated debt collection solutions for enterprise financial operations and achieve sustainable growth.

By leveraging EQ Collect's features—such as automated workflows, a no-code file-mapping tool, and real-time reporting—financial institutions can further refine their recovery strategies, ensuring more intelligent orchestration and enhanced performance.

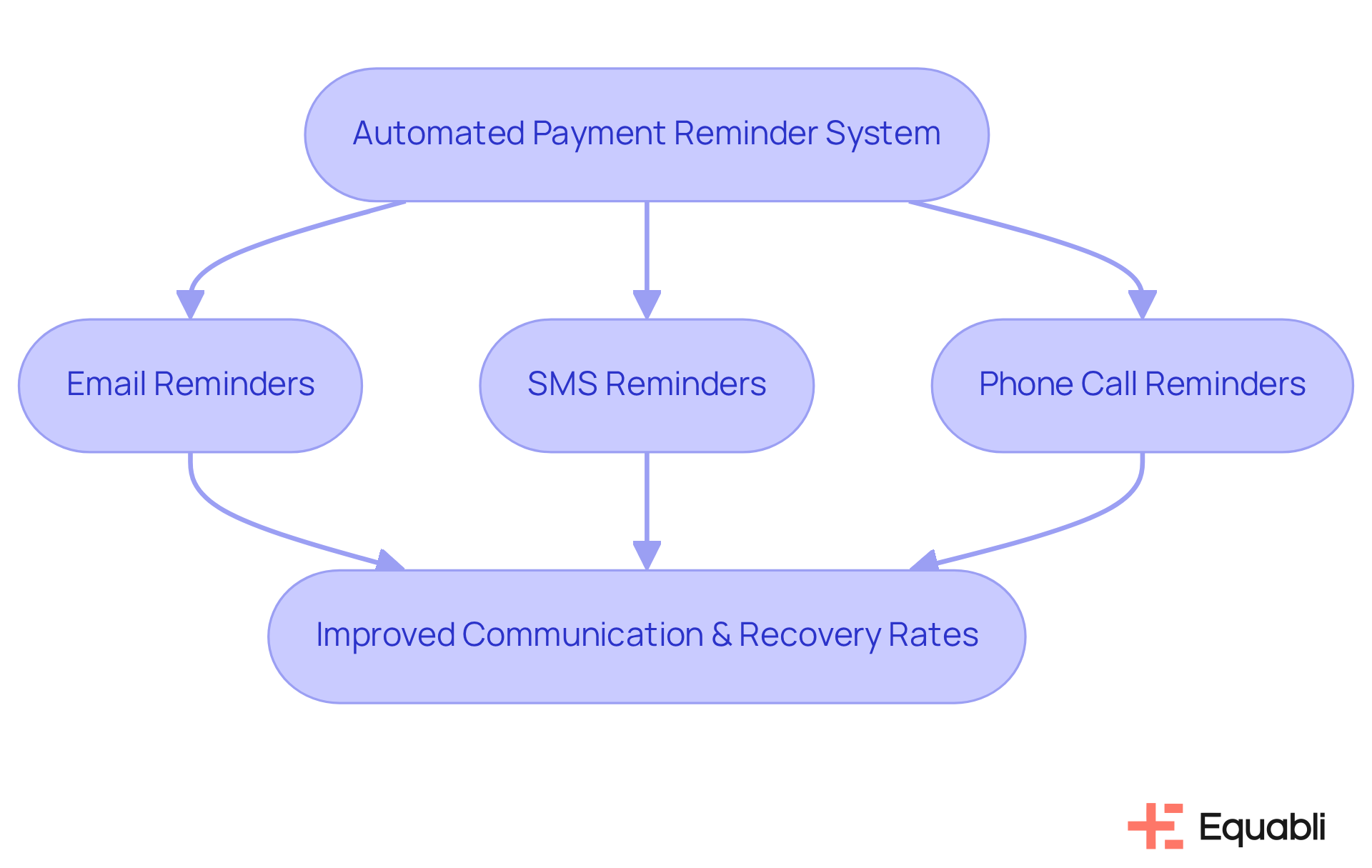

Automated Payment Reminder Systems: Enhancing Communication in Collections

Automated reminder systems are integral to enhancing communication in the debt collection process. The EQ Suite enables these systems to deliver timely reminders via email, SMS, or phone calls, ensuring debtors are aware of upcoming dues. This automation significantly reduces missed payments, enhances customer engagement, and ultimately . Such a proactive approach is essential for maintaining positive relationships with borrowers and represents a fundamental aspect of Equabli's innovative automated debt collection solutions for enterprise financial operations, which are designed to streamline operations and enhance performance in modern receivables management.

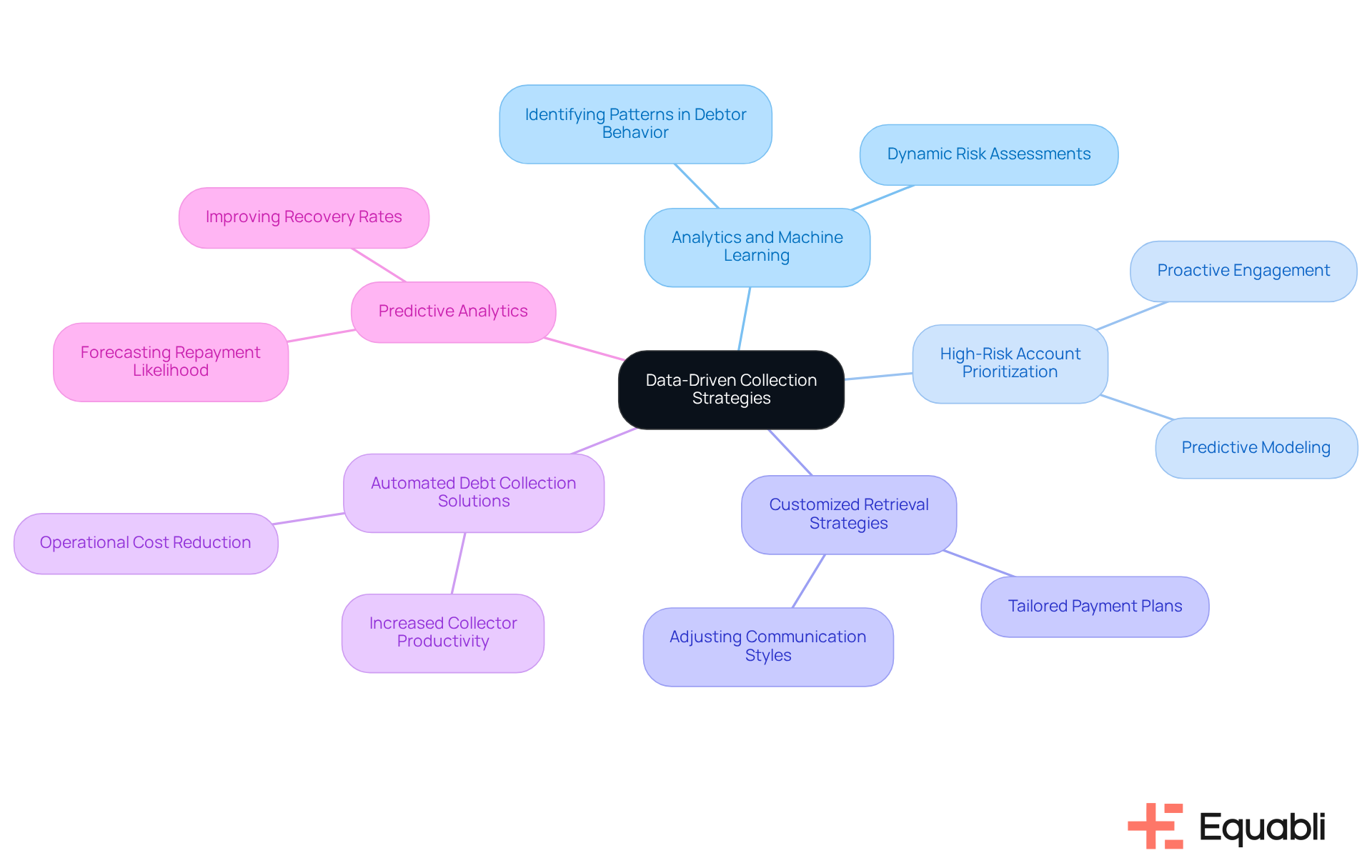

Data-Driven Collection Strategies: Optimizing Debt Recovery Efforts

Data-driven gathering strategies are essential for enhancing recovery efforts within today's financial environment. By leveraging analytics and machine learning, organizations can identify patterns in debtor behavior, allowing them to prioritize high-risk accounts effectively. This proactive approach facilitates that align with individual debtor preferences, thereby significantly improving engagement and repayment rates.

Furthermore, the strategic application of data within automated debt collection solutions for enterprise financial operations not only boosts recovery rates but also reduces operational costs, solidifying its role as a vital component of contemporary debt retrieval practices.

As the industry progresses, the utilization of predictive analytics has emerged as a cornerstone for financial institutions seeking to transform their collections into a more efficient and customer-centric operation.

Conclusion

The landscape of automated debt collection solutions for enterprise financial operations is undergoing rapid transformation, propelled by innovative technologies and data-driven strategies. Organizations leveraging these solutions not only streamline their collection processes but also enhance customer engagement and improve recovery rates. The integration of advanced tools, such as the Equabli EQ Suite, CR Software, and AI-driven platforms like Convin.ai, exemplifies the potential for modern debt collection to be both efficient and customer-centric.

Key insights throughout the article underscore the significance of automation in enhancing operational efficiency, minimizing manual errors, and fostering improved communication with debtors. Solutions such as predictive analytics that identify high-risk accounts and automated reminder systems that ensure timely notifications are designed to address the increasing demands of receivables management. The advantages of adopting these technologies are evident, with numerous organizations reporting substantial improvements in recovery rates and overall financial performance.

As the industry evolves, embracing automated debt collection solutions will be vital for financial institutions striving to remain competitive and responsive to market dynamics. Organizations are encouraged to explore these innovative tools to optimize their debt recovery efforts and cultivate stronger relationships with their customers. The future of debt collection hinges on the ability to leverage technology and data, transforming challenges into opportunities for sustainable growth and enhanced operational success.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a platform designed to enhance receivable management efficiency through automated debt collection solutions. It includes tools such as EQ Engine, EQ Engage, and EQ Collect, which help lenders and agencies implement tailored scoring models and streamline digital processes.

What features does EQ Collect offer?

EQ Collect features a no-code file-mapping tool for faster vendor onboarding, automated workflows to reduce execution errors, and real-time reporting for enhanced transparency and insights.

How does EQ Engage assist organizations?

EQ Engage allows organizations to design, automate, and execute borrower contact strategies, ensuring personalized communication and robust compliance management.

What are the benefits of using the EQ Suite?

The EQ Suite helps reduce operational expenses, enhances borrower interaction, and provides an intuitive, scalable, cloud-based interface for automated debt collection solutions.

What is CR Software and its purpose?

CR Software provides advanced automated debt collection solutions that enhance the collection process for enterprise financial operations, integrating features like automated billing reminders and account tracking.

How does CR Software improve recovery rates?

Evidence suggests that CR Software can elevate recovery rates by as much as 57%, allowing institutions to focus on high-value claims and optimize cash flows.

What is a notable result from using automated reminders in CR Software?

Companies using automated reminders have reported a significant increase in self-serve payments, with one case study showing a growth of 1861%.

How does CR Software facilitate improved workflow?

CR Software synchronizes relevant departments and centralizes customer data, which enhances analytics and task prioritization for a more efficient workflow.

What role does Convin.ai play in debt collection?

Convin.ai utilizes artificial intelligence to improve receivables management by handling high-volume recovery calls, providing personalized reminders, and prioritizing high-risk accounts.

What are the expected outcomes of implementing Convin.ai?

Organizations using Convin.ai can expect increased retrieval rates and improved customer engagement while adhering to industry compliance standards.