Overview

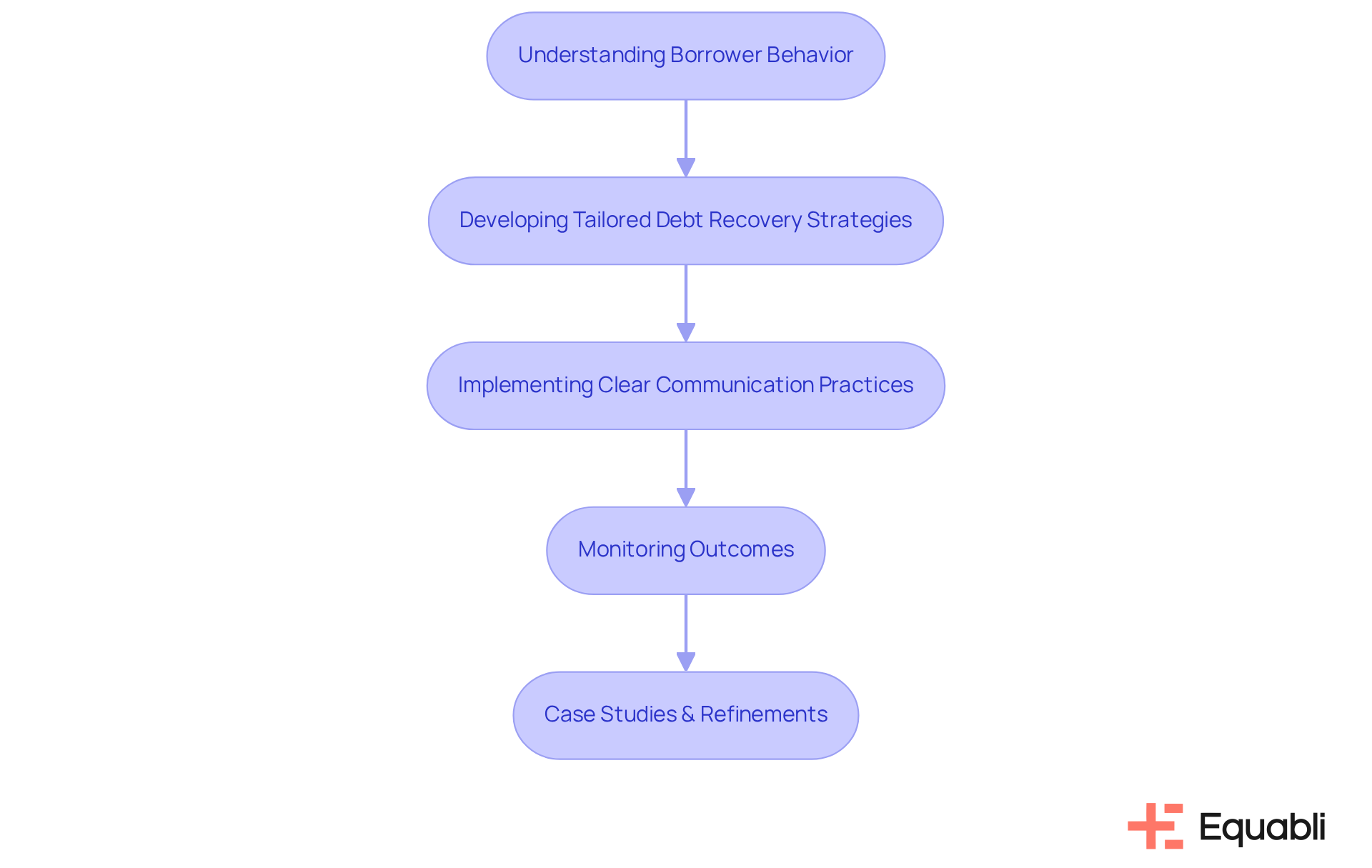

Optimal debt recovery strategies are crucial for financial institutions aiming to enhance cash flow and secure long-term financial stability. Tailoring approaches based on borrower behavior is essential; evidence shows that such customization can lead to improved recovery rates. Furthermore, leveraging technology for communication and analytics significantly enhances operational efficiency. Providing flexible repayment options not only boosts recovery rates but also fosters positive relationships with clients. This strategic alignment supports the overall success of financial institutions, emphasizing the need for a comprehensive approach to debt recovery.

Introduction

Optimal debt recovery serves not merely as a financial necessity; it represents a strategic imperative for institutions focused on sustaining robust portfolios and fostering long-term growth. Effective recovery strategies enable organizations to significantly reduce non-performing loans, enhance credit ratings, and cultivate investor confidence. As the landscape of debt management continues to evolve, financial institutions must adapt their approaches not only to reclaim overdue debts but also to strengthen relationships with borrowers. This article explores best practices and innovative solutions that can transform debt recovery efforts into a powerful tool for achieving financial success.

Understand the Importance of Debt Recovery in Portfolio Management

Optimal debt recovery strategies for financial institutions' portfolio management are a fundamental aspect of debt collection, significantly impacting both immediate cash flow and long-term financial stability. By prioritizing optimal debt recovery strategies for financial institutions' portfolio management, organizations can effectively reduce their non-performing loans (NPLs), thereby enhancing credit ratings and bolstering investor trust. For instance, banks that implement optimal debt recovery strategies for financial institutions' portfolio management frequently experience a notable increase in the retrieval of overdue debts, leading to improved overall financial health.

Moreover, a thorough understanding of borrower behavior and repayment patterns enables organizations to develop optimal debt recovery strategies for financial institutions' portfolio management. This not only fosters trust and encourages repayment but also mitigates losses while reinforcing customer relationships. Such proactive measures enhance cash flow and contribute to the development of a more resilient portfolio, positioning financial entities to implement optimal debt recovery strategies for financial institutions' portfolio management in a competitive landscape.

Implementing clear communication practices is essential. By providing their mobile number and giving consent, customers acknowledge their ownership rights or authorization for its use, which is critical for compliance in collection communications. Institutions must inform customers about message variability and the option to opt-out by texting STOP, ensuring respect for customer preferences and the maintenance of trust. Message and data rates may apply, and an opt-out confirmation will be sent to customers.

Case studies illustrate this effect: organizations that have embraced optimal debt recovery strategies for financial institutions' portfolio management report significant improvements in their fiscal stability. By leveraging data-driven insights, these organizations can refine their strategies to implement optimal debt recovery strategies for financial institutions' portfolio management, ensuring effective and empathetic engagement with customers. This alignment not only aids in reclaiming funds but also enhances the organization’s reputation and operational efficiency, creating a mutually beneficial scenario for both lenders and borrowers.

Implement Effective Debt Recovery Strategies for Financial Institutions

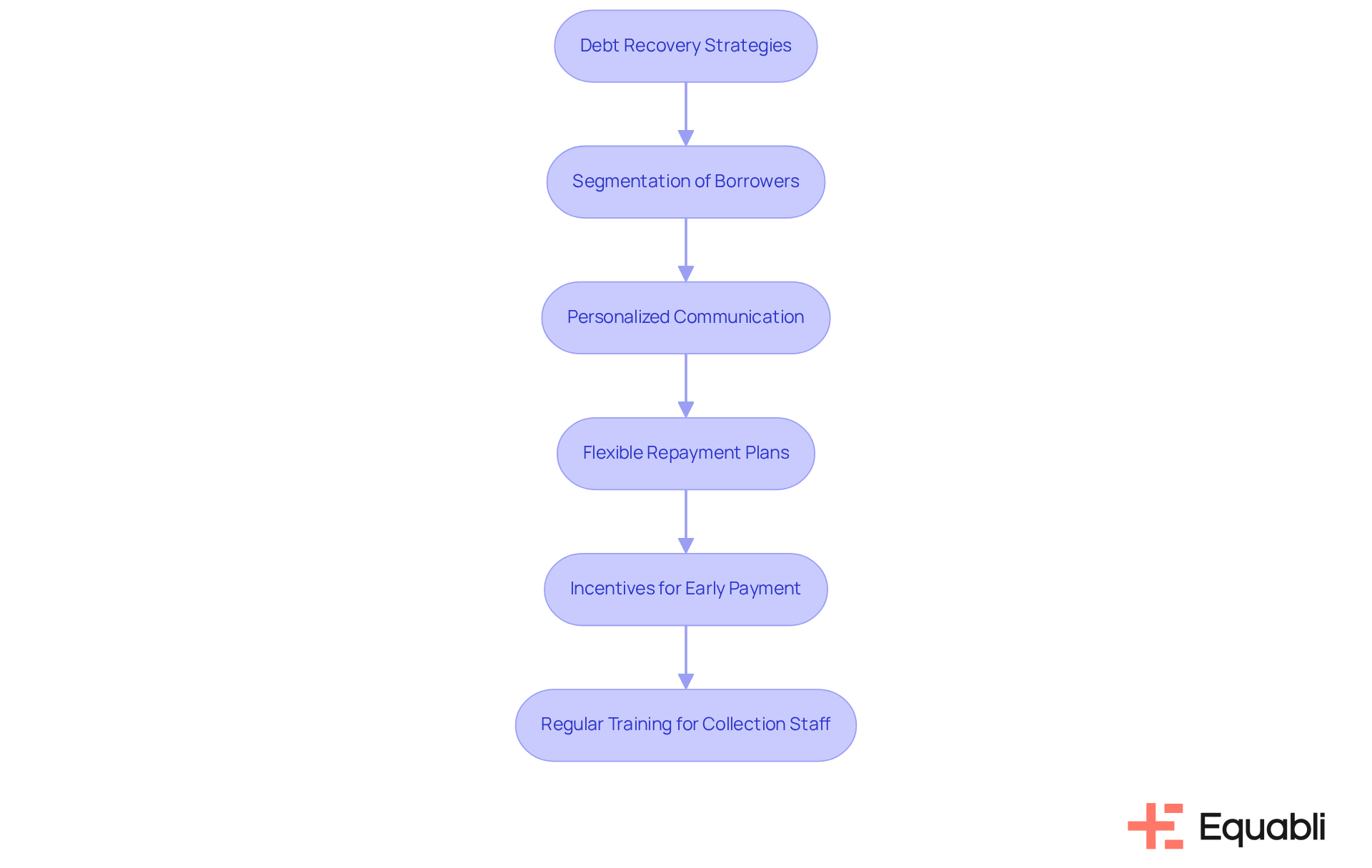

To implement optimal debt recovery strategies for financial institutions' portfolio management, a structured approach that emphasizes precision and actionable insights must be adopted.

Segmentation of Borrowers: Classifying borrowers based on their repayment behavior allows institutions to tailor their communication and recovery strategies. High-risk borrowers may require more aggressive follow-up, while low-risk individuals might benefit from gentle reminders. This targeted approach not only enhances recovery rates but also optimizes resource allocation.

Personalized Communication: Utilizing preferred communication channels for each individual significantly enhances engagement. Institutions should leverage data analytics to determine the best times and methods to reach out, whether through phone calls, emails, or text messages. Equabli's EQ Engage provides customizable communication options that can further improve borrower involvement and ensure messages resonate with individual borrowers, thereby fostering stronger relationships.

Flexible Repayment Plans: Providing tailored repayment options can motivate borrowers to resolve their accounts. Allowing for smaller, more manageable payments can lead to higher recovery rates. The EQ Suite offers tools that assist in developing these adaptable plans, simplifying the process for organizations to respond effectively to borrower needs, which ultimately supports financial stability.

Incentives for Early Payment: Offering discounts or rewards for early repayment encourages borrowers to settle their obligations sooner, enhancing cash flow for the organization. This strategy can be effectively communicated through the automated workflows available in EQ Collect, ensuring timely and consistent messaging that reinforces positive borrower behavior.

Regular Training for Collection Staff: Ensuring collection personnel are well-trained in negotiation techniques and customer service leads to more successful interactions with debtors, fostering a positive environment for collection. Utilizing the insights and of EQ Collect can help staff identify areas for improvement and adapt their strategies accordingly, thereby enhancing overall operational efficiency.

By implementing these tactics and leveraging the innovative aspects of Equabli's solutions, financial organizations can significantly enhance their debt collection processes, thereby developing optimal debt recovery strategies for financial institutions' portfolio management and achieving improved financial outcomes. Furthermore, addressing the challenges of manual financial management is essential for increasing efficiency and effectiveness in collection efforts.

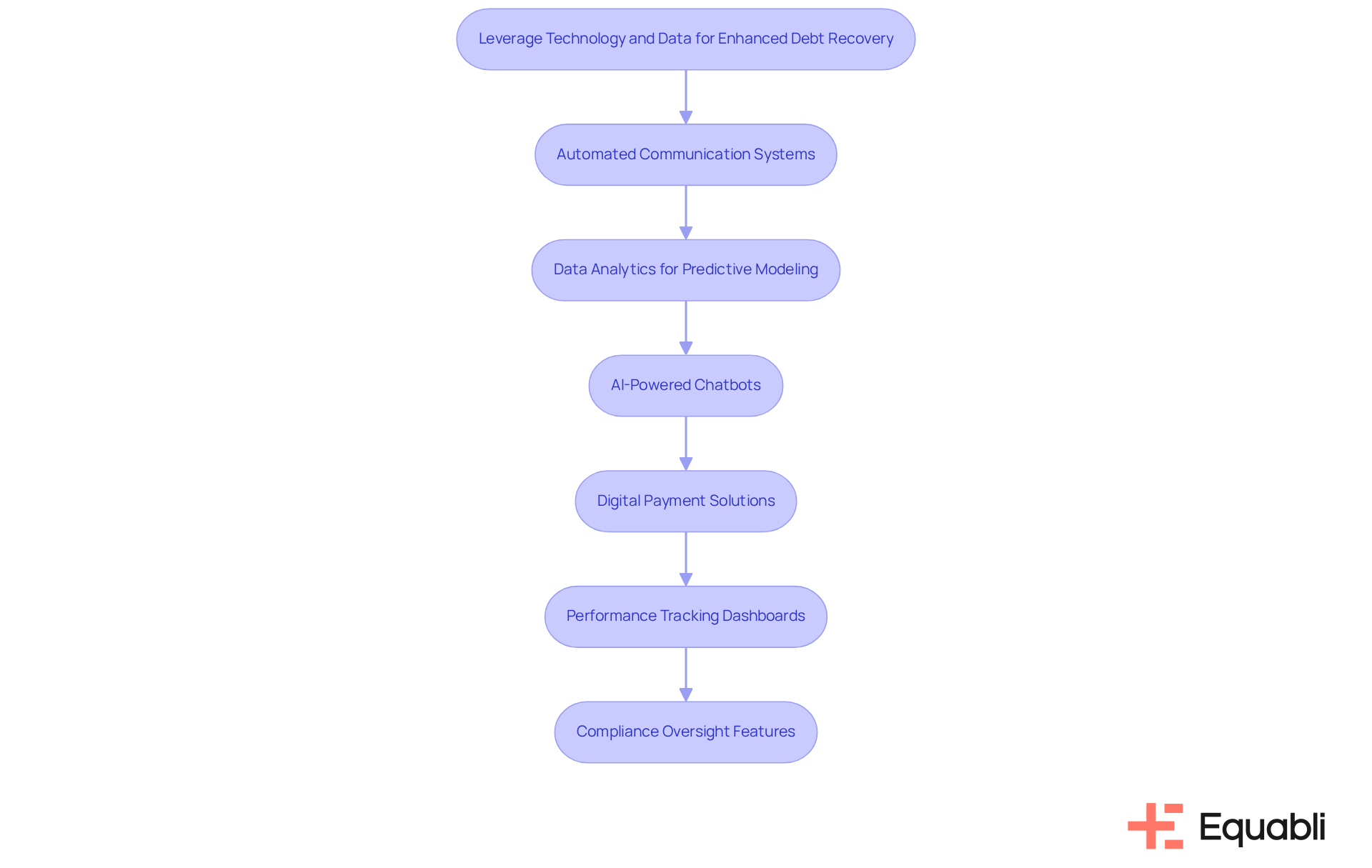

Leverage Technology and Data for Enhanced Debt Recovery

Utilizing technology and data analytics is essential for financial institutions to implement optimal debt recovery strategies for financial institutions' portfolio management. This integration can significantly streamline operations and improve recovery rates.

- Automated Communication Systems: Implementing automated systems for reminders and follow-ups is crucial for streamlining the recovery process. These systems facilitate prompt notifications to individuals with outstanding payments, effectively reducing the workload on collection staff while ensuring consistent communication.

- Data Analytics for Predictive Modeling: Leveraging data analytics to develop predictive models, such as those offered by Equabli's EQ Engine, enables organizations to identify borrowers most likely to repay. By analyzing historical data, institutions can prioritize recovery efforts on high-potential accounts, thereby maximizing recovery rates and mitigating delinquency risks.

- AI-Powered Chatbots: The deployment of AI chatbots enhances customer engagement by delivering instant responses to client inquiries. This technology not only facilitates payment arrangements but also addresses common inquiries, thereby improving the overall customer experience while reducing costs associated with manual follow-ups.

- Digital Payment Solutions: Offering diverse digital payment options, including mobile payments and online portals, simplifies the process for debtors to settle their accounts. The convenience of digital payments often results in quicker resolutions, empowering borrowers with self-service repayment plans.

- Performance Tracking Dashboards: Establishing dashboards that monitor performance in real-time allows organizations to evaluate the effectiveness of their strategies. Utilizing tools like EQ Collect, this enables rapid modifications to strategies, ensuring optimal results while providing unmatched clarity and insights.

- Compliance Oversight Features: Integrating compliance oversight features within these technologies is essential for ensuring that financial organizations adhere to regulatory obligations, thereby minimizing risks associated with financial collection processes.

By embracing technology and data analytics, particularly through Equabli's intelligent EQ Suite, financial institutions can modernize their debt recovery processes by implementing optimal debt recovery strategies for financial institutions' portfolio management. This modernization leads to increased efficiency, enhanced compliance, and improved recovery rates.

Conclusion

Optimal debt recovery strategies are essential for the success and sustainability of financial institutions. By adopting a comprehensive approach that integrates borrower understanding, personalized communication, and innovative technology, organizations can significantly enhance their debt recovery processes. This strategy not only improves immediate cash flow but also fosters long-term financial stability and trust with investors.

Key strategies such as:

- Borrower segmentation

- Flexible repayment plans

- Automated communication systems

are critical components in optimizing debt recovery. Furthermore, leveraging data analytics and AI technologies can streamline operations and boost recovery rates, ensuring that financial institutions maintain competitiveness in an ever-evolving landscape.

As financial institutions anticipate future challenges, embracing these optimal debt recovery strategies will be vital for navigating obstacles and seizing opportunities. By prioritizing effective communication, innovative technology, and a customer-centric approach, organizations can reclaim overdue debts and strengthen their overall portfolio management. The commitment to continuous improvement in debt recovery practices is the pathway to financial resilience and success, paving the way for sustainable growth and enhanced stakeholder confidence.

Frequently Asked Questions

Why is debt recovery important in portfolio management for financial institutions?

Debt recovery is crucial in portfolio management as it significantly impacts immediate cash flow and long-term financial stability. Effective debt recovery strategies help reduce non-performing loans (NPLs), improve credit ratings, and enhance investor trust.

How do optimal debt recovery strategies affect financial institutions?

Financial institutions that implement optimal debt recovery strategies often experience an increase in the retrieval of overdue debts, leading to improved overall financial health and stability.

What role does understanding borrower behavior play in debt recovery?

A thorough understanding of borrower behavior and repayment patterns allows organizations to develop tailored debt recovery strategies that foster trust, encourage repayment, and mitigate losses while reinforcing customer relationships.

What communication practices should financial institutions implement for debt recovery?

Clear communication practices are essential, including informing customers about message variability and providing options to opt-out. Customers should consent to receive messages, and institutions must respect their preferences to maintain trust.

What are the potential costs associated with debt recovery communications?

Message and data rates may apply to customers receiving debt recovery communications, and an opt-out confirmation will be sent to ensure compliance and respect for customer choices.

What benefits have organizations reported from embracing optimal debt recovery strategies?

Organizations that have adopted optimal debt recovery strategies report significant improvements in fiscal stability, enhanced reputation, and operational efficiency, leading to a mutually beneficial scenario for both lenders and borrowers.

How can data-driven insights improve debt recovery strategies?

Leveraging data-driven insights allows organizations to refine their debt recovery strategies, ensuring effective and empathetic engagement with customers, which aids in reclaiming funds and enhancing overall operational effectiveness.