Overview

The article identifies ten SaaS-based collections management solutions tailored for enterprises, aimed at enhancing debt recovery processes. Solutions such as Equabli EQ Suite and Salesforce are highlighted for their ability to improve operational efficiency, borrower engagement, and compliance through automation and data-driven strategies. These enhancements ultimately lead to better recovery outcomes for financial institutions, underscoring the critical role of technology in modern debt collection practices.

Introduction

The landscape of debt recovery is undergoing significant transformation, driven by enterprises increasingly adopting Software as a Service (SaaS) solutions to enhance their collections management strategies. These innovative tools not only streamline processes but also foster improved borrower engagement, which ultimately leads to higher recovery rates. However, the plethora of options available presents a challenge: identifying the most effective solutions that can adapt to the unique needs of each organization. This article examines ten leading SaaS-based collections management solutions, analyzing their features and benefits while exploring the transformative impact they can have on financial recovery efforts.

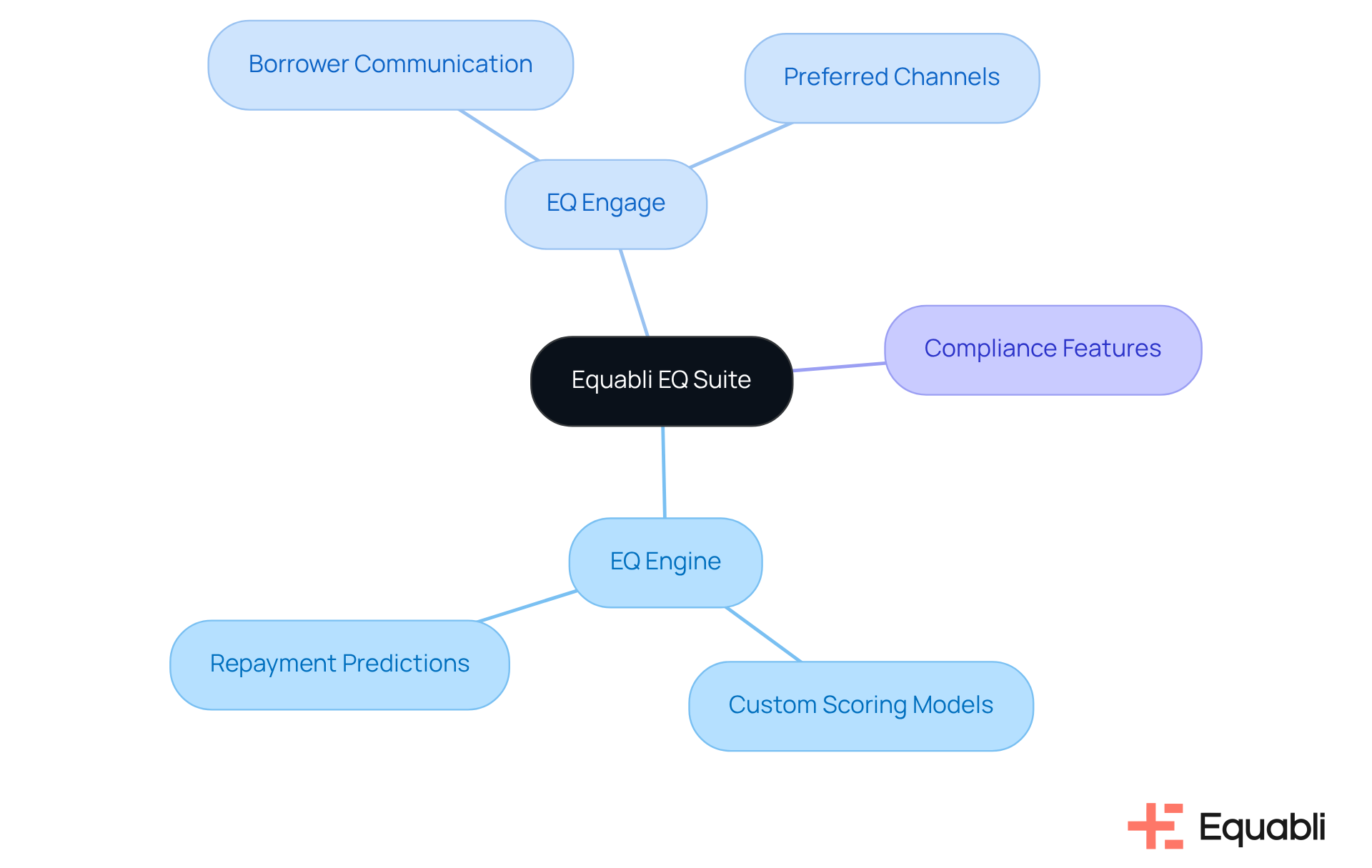

Equabli EQ Suite: Comprehensive Debt Collection Management

The Equabli EQ Suite serves as a robust platform aimed at enhancing financial recovery procedures for lenders and agencies. Central to this suite is the EQ Engine, which utilizes advanced custom scoring models to accurately predict repayment behaviors. This capability enables organizations to tailor their strategies effectively, ensuring optimized recovery efforts. Furthermore, EQ Engage improves borrower communication by leveraging preferred channels, fostering a more personalized interaction. This comprehensive suite not only automates strategy execution but also integrates , ensuring adherence to industry regulations. As the global debt retrieval software market is projected to reach $7.89 billion by 2031, the adoption of SaaS-based collections management solutions for enterprise financial operations, such as the EQ Suite, is essential for organizations seeking to modernize their recovery approach and enhance repayment outcomes.

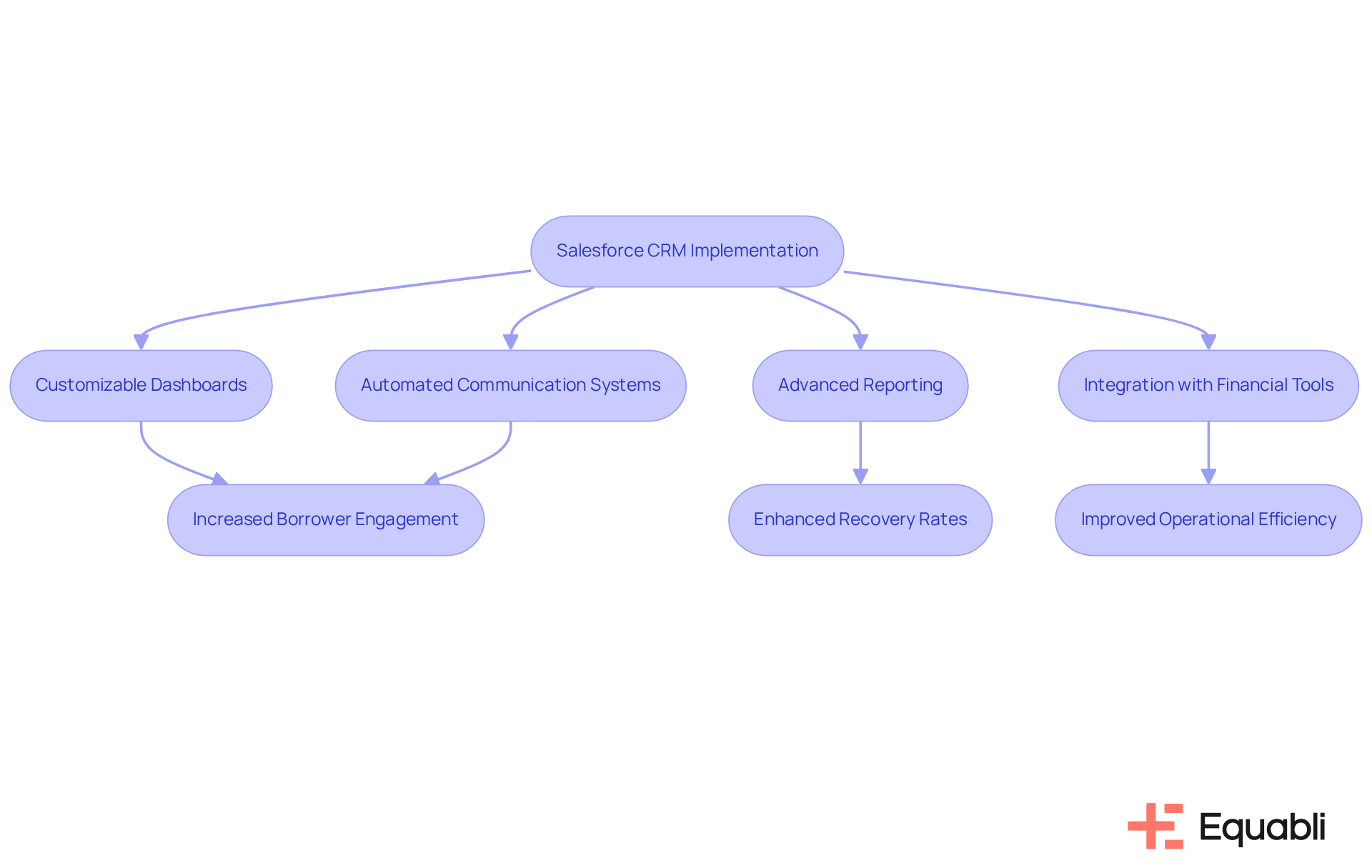

Salesforce: Leading CRM for Effective Collections Management

Salesforce stands out as a premier CRM solution, empowering businesses to optimize customer relationship management throughout the retrieval process. Its customizable dashboards and advanced reporting tools enable agencies to meticulously track interactions and payment histories, thereby ensuring timely and relevant follow-ups. By integrating Salesforce seamlessly with various financial recovery tools, organizations can craft a unified strategy that significantly boosts borrower engagement. This integration not only strengthens connections with debtors but also enhances recovery rates, as facilitate 24/7 communication and personalized outreach.

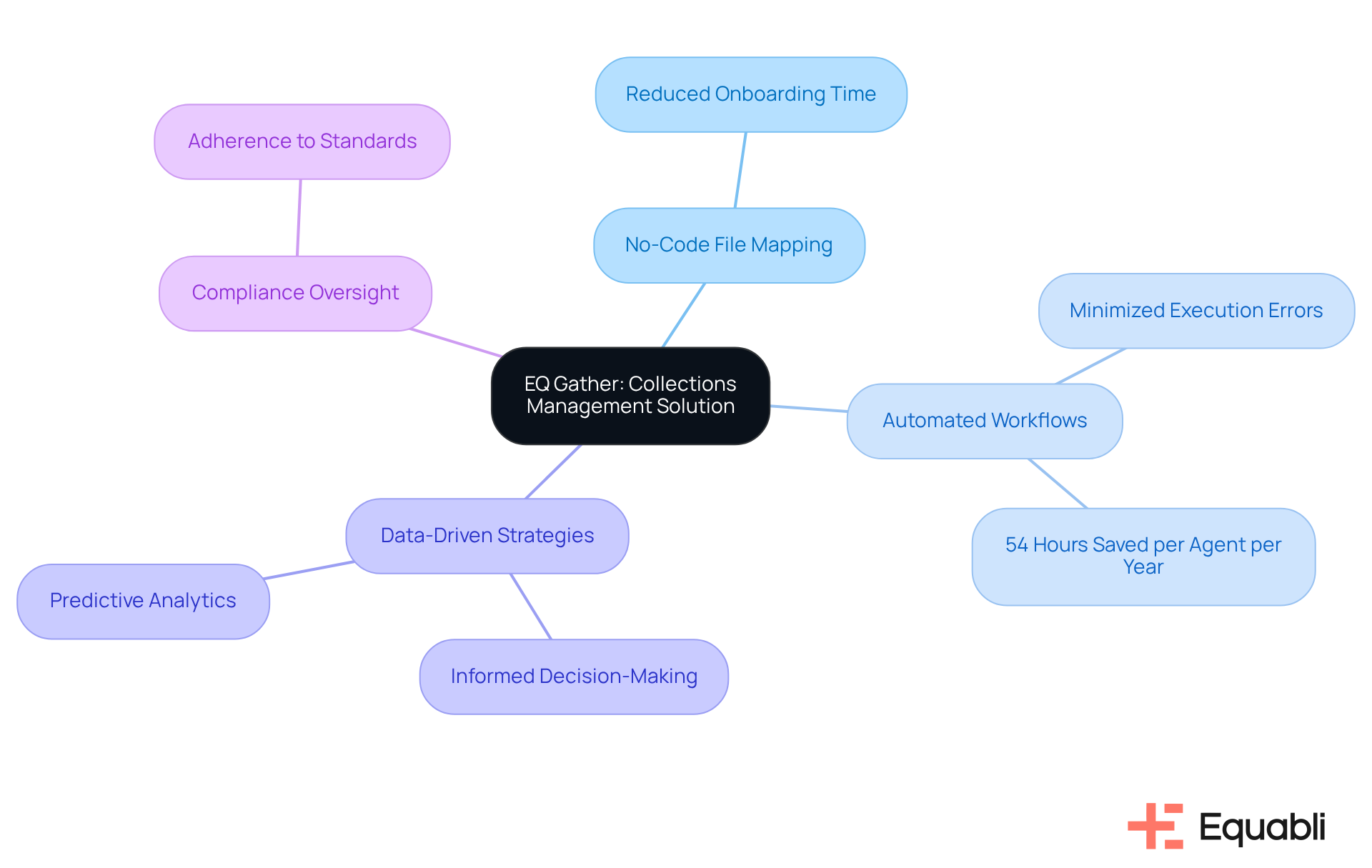

Furthermore, features such as EQ Collect's no-code file-mapping tool, automated workflows, and real-time reporting allow financial institutions to minimize execution errors and improve overall operational efficiency. Compliance oversight and transparency remain critical, as automated monitoring guarantees adherence to industry standards. As financial institutions increasingly embrace CRM solutions, the impact on debt recovery rates becomes increasingly apparent, with many reporting recovery increases of up to 30%. The flexibility of Salesforce allows institutions to tailor their strategies, ensuring competitiveness in a rapidly evolving environment.

Zendesk: Customer Service Solutions for Enhanced Communication

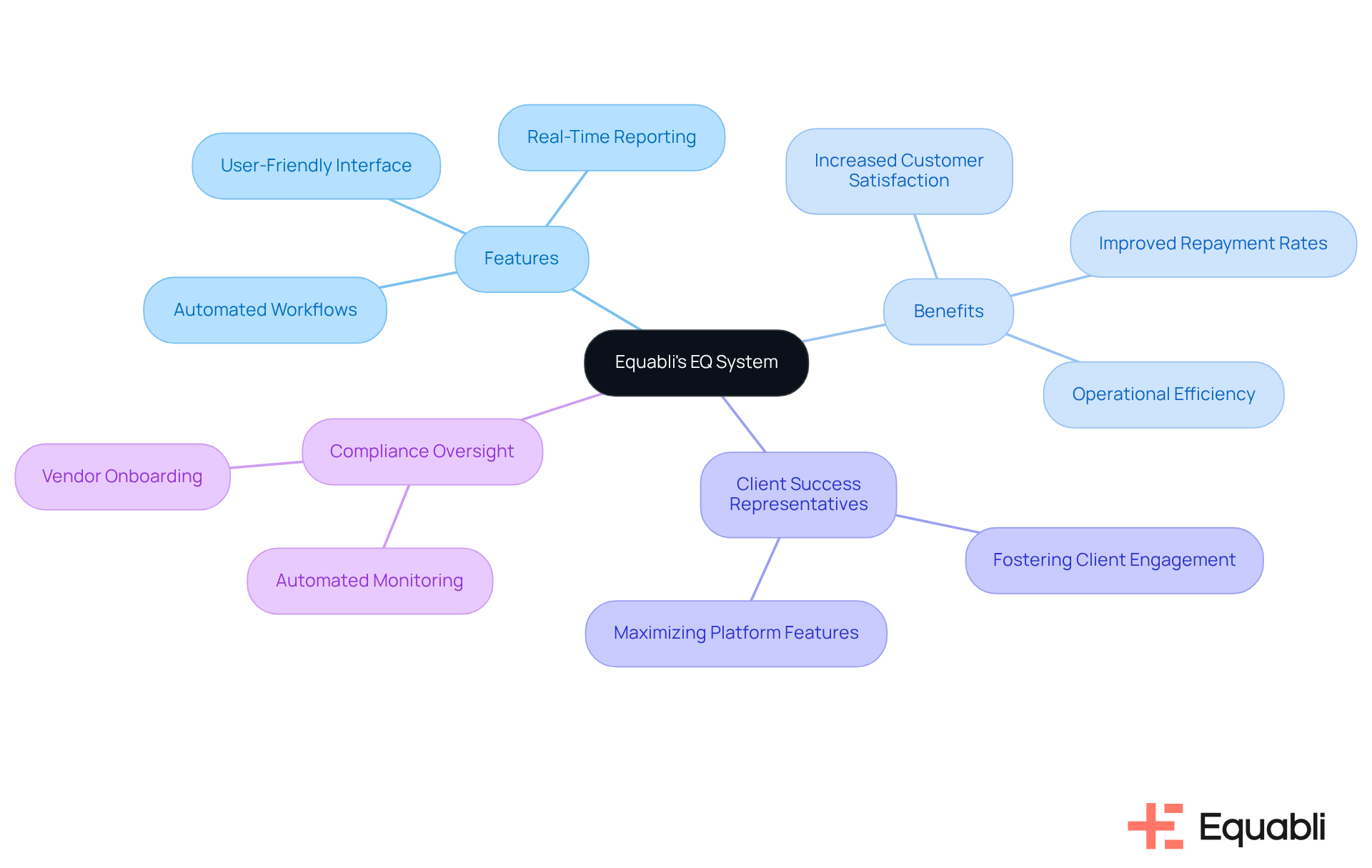

Equabli's EQ System represents a pivotal advancement in enhancing communication between collection agencies and loan recipients. By leveraging features such as automated workflows, real-time reporting, and a user-friendly, scalable, cloud-based interface, EQ empowers agencies with saas-based collections management solutions for enterprise financial operations to respond swiftly to inquiries, thereby ensuring efficient issue resolution. This responsiveness is critical; research indicates that can yield a 20% increase in customer satisfaction, which is directly linked to improved repayment rates.

Furthermore, through its data-driven strategies, EQ Gather optimizes net present value (NPV) in financial recovery, particularly for late-stage accounts. Agencies that implement saas-based collections management solutions for enterprise financial operations, such as EQ Collect's features, not only enhance their operational efficiency but also cultivate a more favorable environment for borrowers, ultimately contributing to increased repayment rates and superior outcomes in debt recovery.

Additionally, the role of Client Success Representatives at Equabli is instrumental in fostering client engagement and product adoption, ensuring that agencies can maximize the platform's features to meet their business objectives. The platform also streamlines vendor onboarding timelines with a straightforward, no-code file-mapping tool while ensuring industry-leading compliance oversight through automated monitoring, both internally and externally.

HubSpot: Marketing and Sales Tools for Streamlined Collections

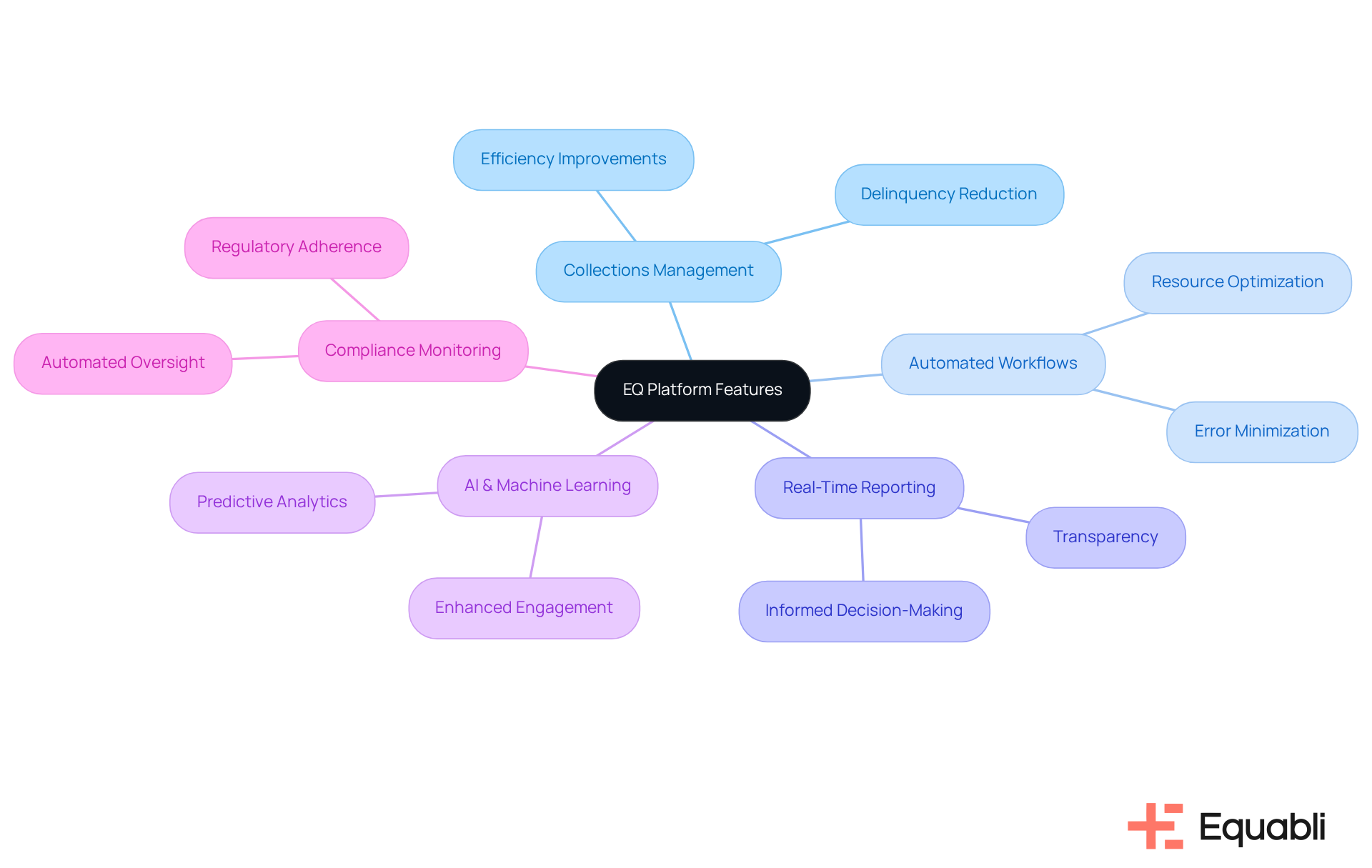

Equabli provides a robust suite of features through EQ, which includes SaaS-based collections management solutions for enterprise financial operations, significantly enhancing accounts receivable management for large financial institutions. The platform's no-code file-mapping tool facilitates reduced vendor onboarding timelines, which leads to improved efficiency in collections.

By employing data-driven strategies, EQ minimizes execution errors and manual resource usage through automated workflows, thereby streamlining processes. Furthermore, real-time reporting delivers unparalleled transparency and insights, enabling financial executives to make timely, informed decisions.

As industry experts assert, 'AI and machine learning are no longer optional tools; they’re essential for driving smarter, more efficient debt recovery.' With EQ's user-friendly, scalable, , financial institutions can effectively integrate operations and enhance overall performance through SaaS-based collections management solutions for enterprise financial operations.

Additionally, automated compliance monitoring guarantees industry-leading oversight, allowing organizations to uphold compliance both internally and externally. This proactive approach not only keeps borrowers informed but also encourages timely payments, ultimately resulting in a significant reduction in delinquency rates.

Freshdesk: Customer Support Software for Collections Inquiries

Equabli's EQ Gather serves as a robust solution among SaaS-based collections management solutions for enterprise financial operations, designed to empower financial institutions in refining their debt recovery processes. The platform's no-code file-mapping tool significantly reduces vendor onboarding timelines, facilitating streamlined operations and enhanced efficiency. Data-driven strategies within EQ Collect improve collections while minimizing execution errors through automated workflows, ensuring effective resource utilization.

In the context of 2025, where real-time insights in financial recovery are paramount, access to clear reporting allows agencies to make informed decisions that drive superior outcomes. Furthermore, EQ's industry-leading compliance oversight guarantees adherence to both internal and external standards, providing peace of mind amid a complex regulatory landscape. As financial institutions strive to bolster their recovery performance, Equabli's intelligent automation and machine learning solutions stand out, offering predictive analytics that optimize debt retrieval and strengthen borrower relationships.

By leveraging EQ Collect's user-friendly, scalable, cloud-based interface, agencies can enhance operational efficiency while implementing SaaS-based collections management solutions for enterprise financial operations to reinforce their overall management strategy for receivables. This strategic approach not only addresses current challenges but also positions institutions for .

DocuSign: E-Signature Solutions for Faster Documentation

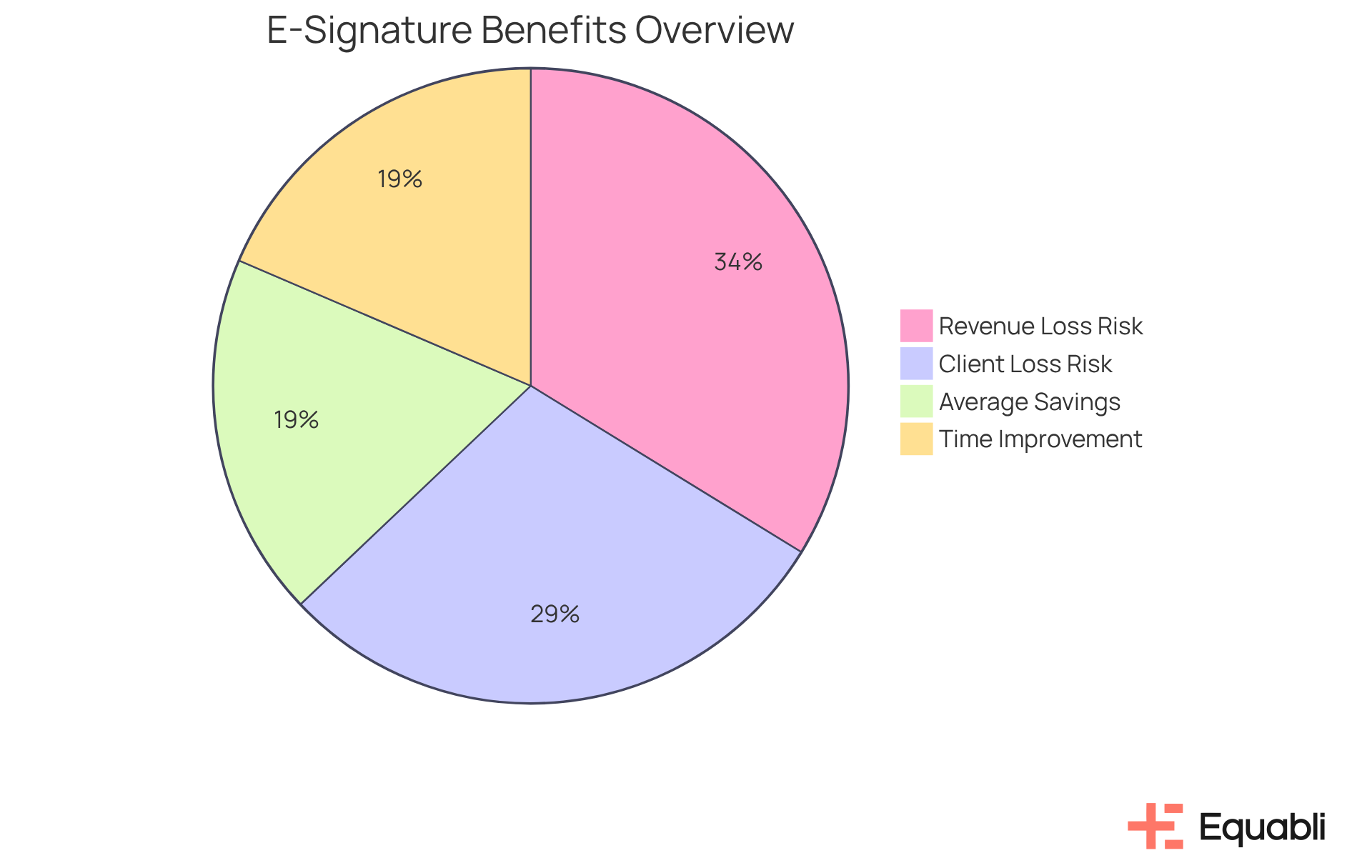

E-signature solutions significantly enhance the retrieval process by streamlining documentation. By enabling individuals to electronically sign agreements and repayment plans, agencies can eliminate the delays commonly associated with traditional paperwork. This transformation not only but also improves the overall borrower experience, facilitating adherence to repayment terms.

Organizations utilizing electronic signatures report an average savings of $28 per signed agreement, resulting in a 28% faster time to revenue. Furthermore, U.S. businesses incur $8 billion annually in managing paper documents, and companies that embrace digital documentation are half as likely to experience revenue loss compared to those relying solely on paper. Additionally, entities that depend exclusively on manual documentation risk losing 44% of their clients and 51% of their income, underscoring the critical role of e-signatures in contemporary account management.

However, it is crucial to acknowledge that customer reluctance to sign electronically remains the primary barrier to e-signature adoption, presenting challenges that agencies must navigate during this transition. Companies with fully digital documentation are also ten times less likely to lose customers than those utilizing manual processes, further reinforcing the necessity of adopting e-signatures.

Stripe: Payment Processing for Efficient Collections

Equabli serves as a robust payment processing platform that empowers agencies to accept payments with ease. The platform's features, including automated billing and customizable payment plans, facilitate user-friendly payment experiences tailored to individual needs. This flexibility enhances , as borrowers are more likely to fulfill their obligations when presented with convenient options.

For example, payment plans can achieve recovery rates as high as 90%, underscoring their effectiveness in practical applications. Moreover, businesses that implement saas-based collections management solutions for enterprise financial operations report enhanced collection rates; studies reveal that 91% of mid-sized firms employing these solutions experience increased savings and improved cash flow.

By utilizing EQ's data-driven strategies and automated workflows, Equabli not only ensures timely repayments but also enhances operational efficiency and compliance oversight with saas-based collections management solutions for enterprise financial operations. This comprehensive approach fosters a positive customer experience, ultimately leading to improved recovery outcomes.

Asana: Project Management for Organized Collections Efforts

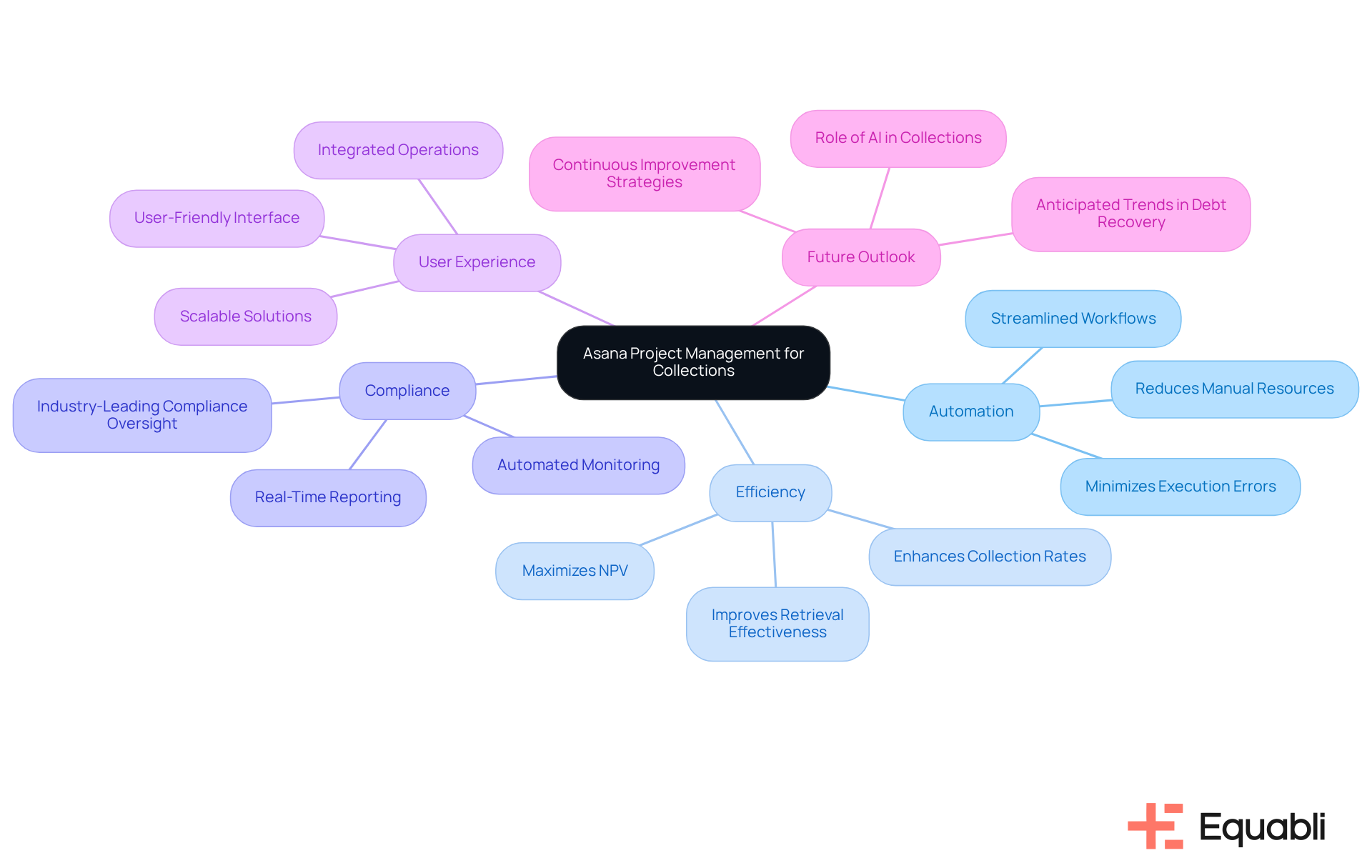

In the realm of accounts receivable management, EQ Gather stands out as a transformative solution that empowers teams to enhance efficiency by utilizing SaaS-based collections management solutions for enterprise financial operations. By utilizing an easy, no-code file-mapping tool, EQ Collect significantly shortens vendor onboarding periods. This enables teams to focus on what truly matters—recovering amounts owed. The platform's data-driven strategies enhance collection rates by utilizing SaaS-based collections management solutions for enterprise financial operations, ensuring organizations can maximize their net present value (NPV) in debt recovery, particularly for late-stage accounts.

At the core of EQ is automation, which minimizes execution errors and reduces the need for manual resources through streamlined workflows. This enhancement not only boosts but also provides unparalleled transparency and insights via real-time reporting. Such capabilities empower teams to make informed decisions swiftly.

Furthermore, EQ Gather, as one of the SaaS-based collections management solutions for enterprise financial operations, ensures industry-leading compliance oversight, both internally and externally, through automated monitoring—an essential feature for financial institutions operating in sensitive environments. Its user-friendly, scalable, cloud-native interface facilitates smarter orchestration and integrated operations, effectively transforming the financial recovery process.

As organizations strive for a net retrieval rate of 95% or greater to sustain robust cash flow, leveraging SaaS-based collections management solutions for enterprise financial operations can lead to significant improvements in retrieval effectiveness. In the evolving landscape of debt recovery anticipated in 2025, EQ Collect emerges as an indispensable resource for financial institutions seeking to enhance their recovery strategies.

Canva: Design Tools for Engaging Collections Communication

Canva functions as a robust graphic design platform that enables collection agencies to develop visually impactful communication materials. By leveraging Canva, agencies can produce a range of items, from payment reminders to informative brochures, that effectively engage clients.

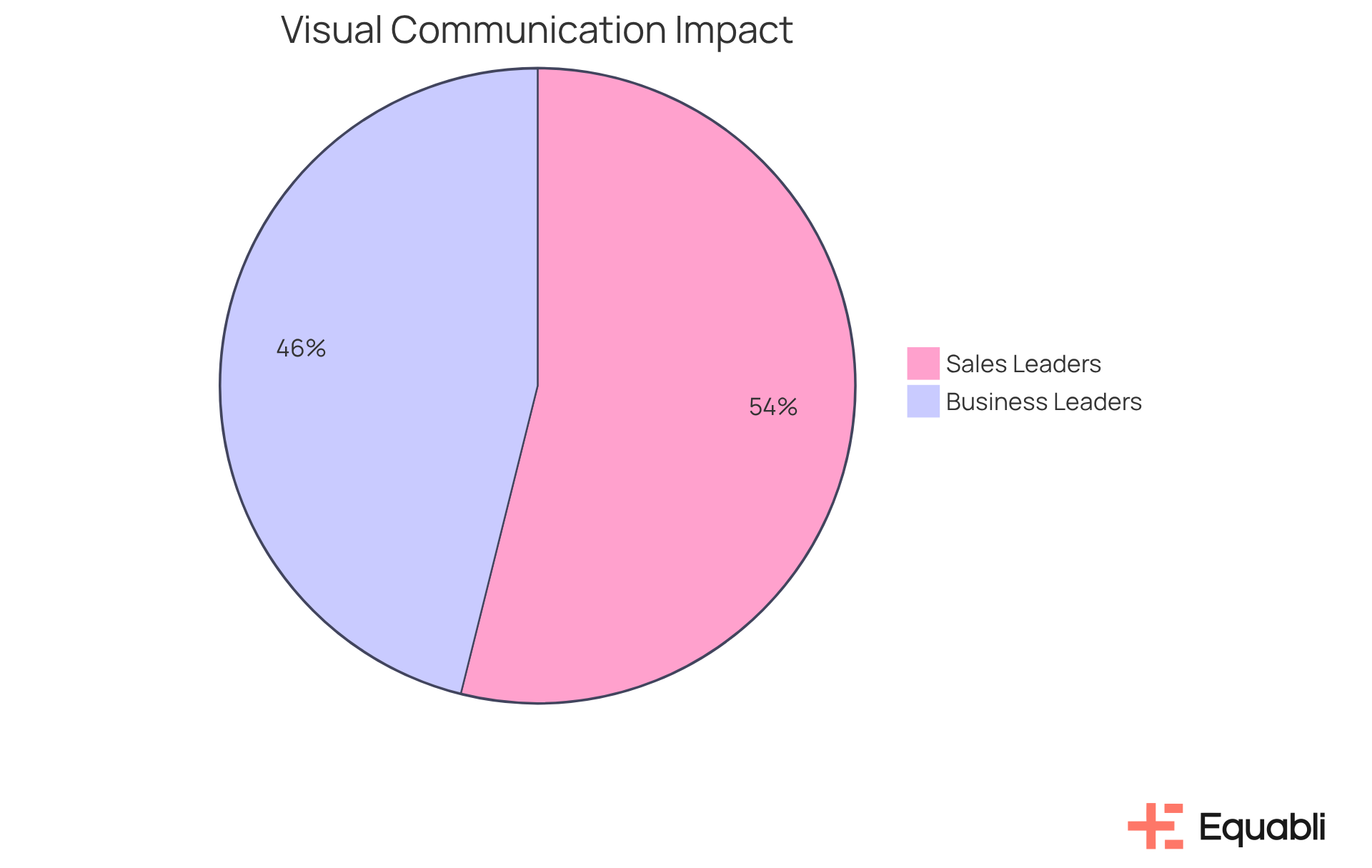

Research indicates that visually appealing payment reminders can significantly enhance engagement, with 77% of business leaders acknowledging that boosts overall performance. Furthermore, 90% of sales leaders surveyed reported that incorporating visuals in collateral expedites sales cycles, reinforcing the effectiveness of engaging design in elevating repayment rates.

In the context of financial recovery, engaging communication is vital; it not only fosters a connection with clients but also leads to higher repayment rates. As we advance into 2025, the impact of design on borrower engagement will remain a pivotal factor in effective recovery strategies. Canva's 2025 Design Trends toolkit encourages users to refine their visual storytelling, establishing it as an essential resource for recovery agencies.

Zoom: Virtual Meeting Platform for Collections Strategy Discussions

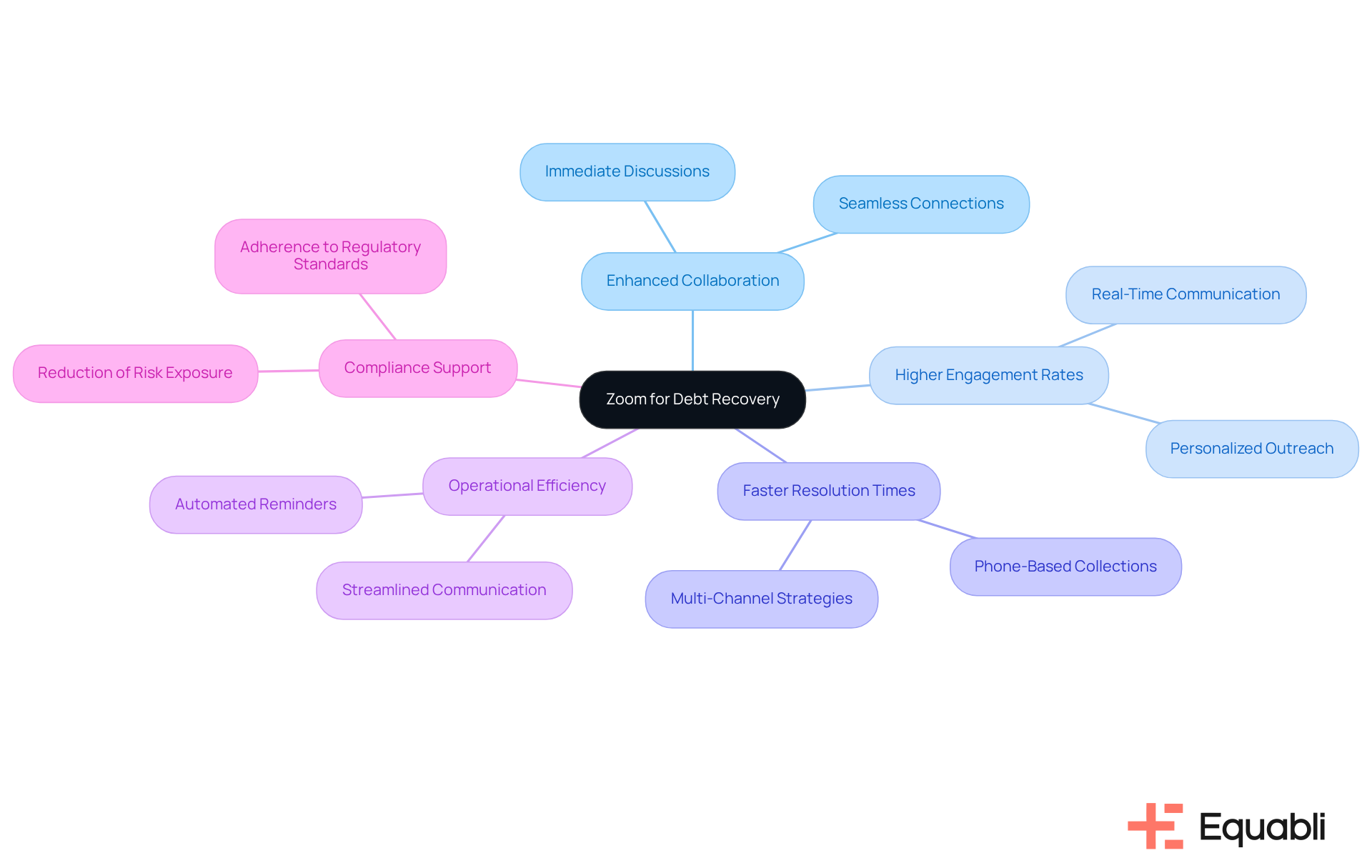

Zoom serves as a robust that enhances collaboration among debt recovery teams, facilitating seamless connections irrespective of physical locations. Evidence shows that organizations leveraging real-time communication tools like Zoom report significantly higher engagement rates and faster resolution times. This capability is critical for teams to strategize effectively and share essential insights on their initiatives.

The ability to conduct immediate discussions allows teams to address challenges promptly, refine their strategies, and enhance operational efficiency in debt collection management. This cooperative approach is vital for adapting strategies to meet the evolving needs of borrowers, which ultimately leads to improved recovery outcomes. From a compliance perspective, utilizing platforms like Zoom not only streamlines communication but also supports adherence to regulatory standards, thereby reducing risk exposure in debt collection processes.

Conclusion

The exploration of SaaS-based collections management solutions indicates a transformative shift in how enterprises approach debt recovery. By leveraging advanced technology, organizations can enhance operational efficiency, improve borrower communication, and ultimately boost recovery rates. Various platforms, including Equabli's EQ Suite, Salesforce, and Zendesk, each offer unique features tailored to the complexities of debt collection in today’s financial landscape.

Key insights emphasize the importance of automation, real-time reporting, and user-friendly interfaces in streamlining collections processes. Solutions like DocuSign for e-signatures and Stripe for payment processing exemplify how technology can significantly reduce delays and enhance user experience. Furthermore, the integration of marketing and communication tools, such as HubSpot and Canva, illustrates the necessity of engaging borrowers effectively to foster timely repayments.

As enterprises navigate the evolving challenges of debt recovery, adopting these innovative SaaS solutions is not merely beneficial but essential. The future of collections management lies in harnessing technology to create more efficient, compliant, and customer-centric approaches. Organizations are encouraged to evaluate these tools and implement strategies that will not only address current operational hurdles but also position them for sustained success in the dynamic financial landscape of 2025 and beyond.

Frequently Asked Questions

What is the Equabli EQ Suite?

The Equabli EQ Suite is a comprehensive platform designed to enhance financial recovery procedures for lenders and agencies, featuring the EQ Engine which utilizes advanced custom scoring models to predict repayment behaviors.

How does the EQ Engine improve debt collection strategies?

The EQ Engine helps organizations tailor their debt collection strategies by accurately predicting repayment behaviors, allowing for optimized recovery efforts.

What role does EQ Engage play in the EQ Suite?

EQ Engage improves borrower communication by utilizing preferred channels, fostering personalized interactions between agencies and borrowers.

What are the compliance features of the EQ Suite?

The EQ Suite includes built-in compliance features that ensure adherence to industry regulations during debt recovery processes.

What is the projected growth of the global debt retrieval software market?

The global debt retrieval software market is projected to reach $7.89 billion by 2031.

How does Salesforce contribute to collections management?

Salesforce is a leading CRM solution that helps businesses optimize customer relationship management throughout the debt retrieval process with customizable dashboards and advanced reporting tools.

What benefits does Salesforce provide for tracking interactions and payment histories?

Salesforce enables agencies to meticulously track interactions and payment histories, ensuring timely and relevant follow-ups, which can enhance borrower engagement and recovery rates.

What features of Salesforce help improve operational efficiency?

Features such as EQ Collect's no-code file-mapping tool, automated workflows, and real-time reporting minimize execution errors and improve overall operational efficiency.

What impact do CRM solutions like Salesforce have on debt recovery rates?

Many financial institutions report recovery increases of up to 30% after adopting CRM solutions like Salesforce.

How does Zendesk enhance communication in debt collection?

Zendesk, through Equabli's EQ System, enhances communication by providing automated workflows, real-time reporting, and a user-friendly interface, allowing agencies to respond swiftly to inquiries.

What is the significance of effective communication in debt recovery?

Effective communication can lead to a 20% increase in customer satisfaction, which is directly linked to improved repayment rates.

What role do Client Success Representatives play at Equabli?

Client Success Representatives help foster client engagement and product adoption, ensuring that agencies maximize the platform's features to meet their business objectives.

How does the EQ Suite facilitate vendor onboarding?

The EQ Suite streamlines vendor onboarding with a straightforward, no-code file-mapping tool.

What ensures compliance oversight within the EQ Suite?

The EQ Suite guarantees compliance oversight through automated monitoring, both internally and externally, ensuring adherence to industry standards.