Overview

Best practices for debt recovery management solutions in finance emphasize the utilization of automated communication tools, the implementation of data analytics, and the assurance of regulatory compliance. These elements are critical in enhancing efficiency and effectiveness in collection efforts. Evidence supports that these practices not only streamline operations but also cultivate improved relationships with debtors. Consequently, this strategic approach leads to enhanced recovery rates and sustainable financial performance.

Introduction

In an increasingly complex financial landscape, effective debt recovery management has emerged as a critical focus for organizations aiming to sustain profitability and cultivate robust relationships with debtors. The implementation of best practices in debt recovery management solutions not only streamlines collection processes but also enhances overall operational efficiency. Given the multitude of strategies and technologies available, organizations must strategically identify the most impactful approaches to optimize their debt recovery efforts.

Define Key Components of Debt Recovery Management Solutions

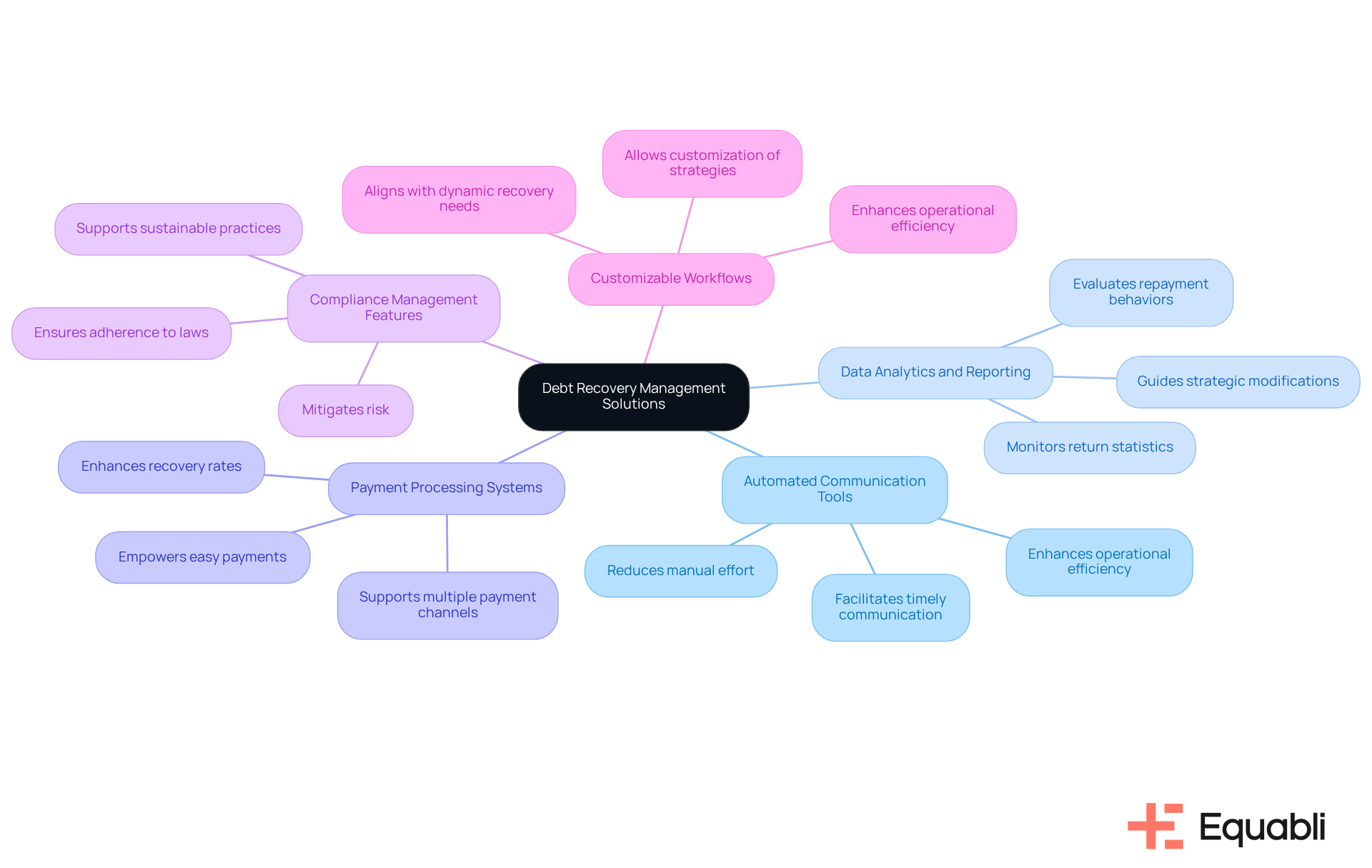

Debt recovery management solutions encompass several key components that are essential for effective enterprise-level operations:

- Automated Communication Tools: These tools facilitate timely and consistent communication with debtors through various channels, including SMS, email, and phone calls. Automation reduces manual effort and ensures that reminders and follow-ups are sent promptly, thereby enhancing operational efficiency.

- Data Analytics and Reporting: Advanced analytics capabilities enable organizations to evaluate repayment behaviors, monitor return statistics, and produce reports that guide strategic modifications. This data-focused approach improves decision-making and streamlines recovery efforts, ultimately impacting the bottom line positively.

- : Efficient payment processing systems empower debtors to make payments easily through multiple channels, such as online portals or mobile apps. This flexibility can significantly enhance recovery rates, aligning with organizational goals for financial performance.

- Compliance Management Features: Given the regulatory environment surrounding credit collection, solutions must include compliance management tools that ensure adherence to laws such as the Fair Debt Collection Practices Act (FDCPA). This compliance focus mitigates risk and supports sustainable business practices.

- Customizable Workflows: Organizations should seek solutions that allow customization of workflows to fit their specific collection strategies and business needs. This adaptability enhances operational efficiency and aligns with the dynamic nature of debt recovery.

By integrating these elements, companies can establish a robust financial collection management system that utilizes debt recovery management solutions for financial institutions, enhancing both efficiency and effectiveness in their collection efforts.

Adopt Strategic Practices for Effective Debt Recovery

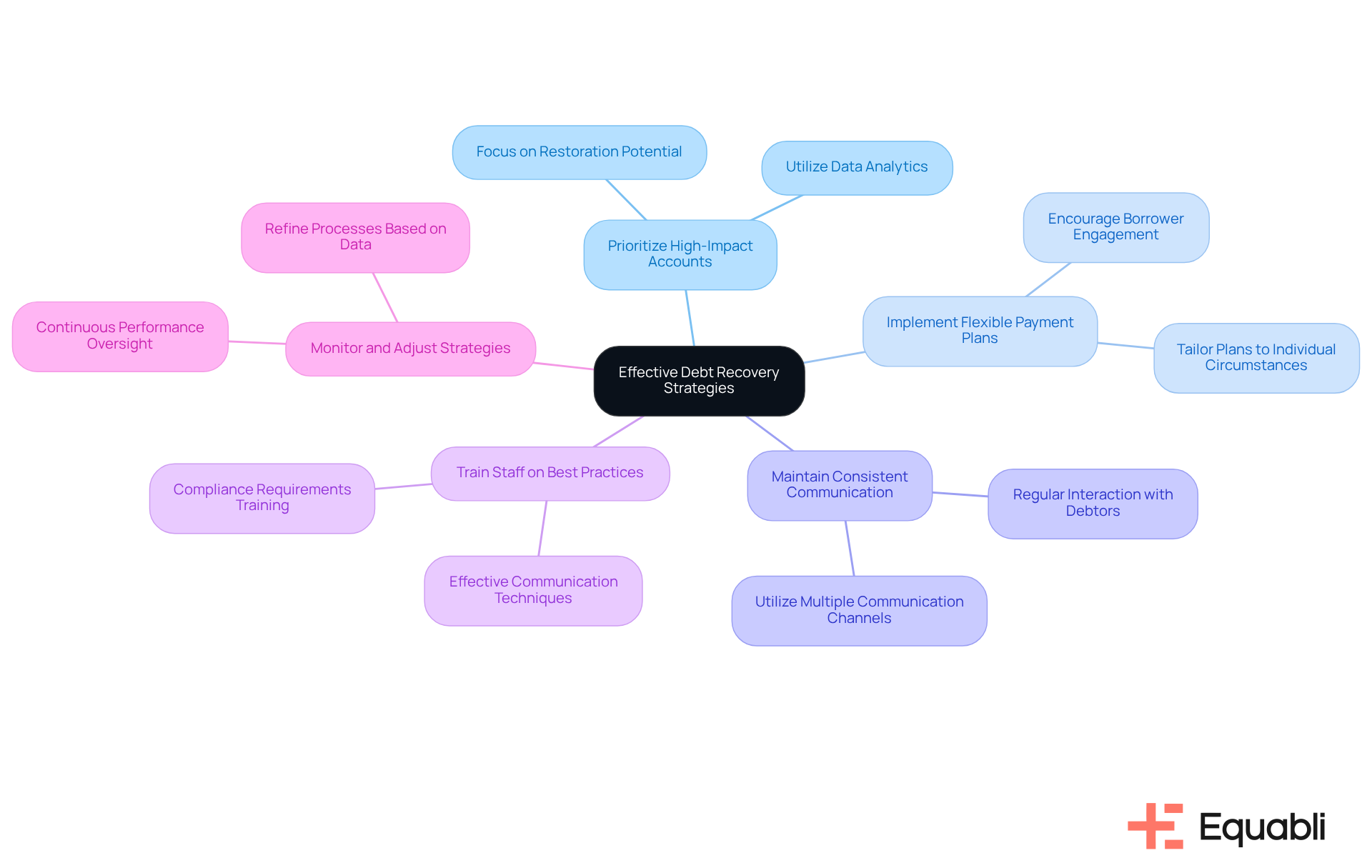

To enhance debt recovery effectiveness, organizations should adopt the following strategic practices:

- Prioritize High-Impact Accounts: Organizations should utilize data analytics to identify accounts with the greatest potential for restoration. By concentrating efforts on these accounts, organizations can significantly enhance return rates, ultimately improving overall recovery performance.

- Implement Flexible Payment Plans: Providing adaptable payment options can motivate borrowers to engage and commit to repayment. Tailoring plans to individual circumstances not only fosters greater participation but also leads to higher recovery rates, thus benefiting the organization’s bottom line.

- Maintain Consistent Communication: Regular and empathetic interaction with debtors fosters trust and encourages repayment. By utilizing multiple channels, organizations can reach individuals where they feel most comfortable, enhancing the likelihood of successful recovery.

- Train Staff on Best Practices: Ensuring that collection staff are well-trained in and compliance requirements is crucial. This training improves interactions with debtors and enhances overall collection results, aligning with best practices in the industry.

- Monitor and Adjust Strategies: Continuously overseeing restoration efforts and modifying strategies based on performance data is essential. This iterative method enables organizations to refine their processes and enhance results over time, ensuring sustained effectiveness in debt recovery.

By employing these strategic methods, organizations can establish a more efficient collection framework that utilizes debt recovery management solutions for financial institutions, boosting retrieval rates and strengthening debtor relationships, thereby positioning themselves for long-term success in the financial landscape.

Leverage Technology for Enhanced Debt Recovery Efficiency

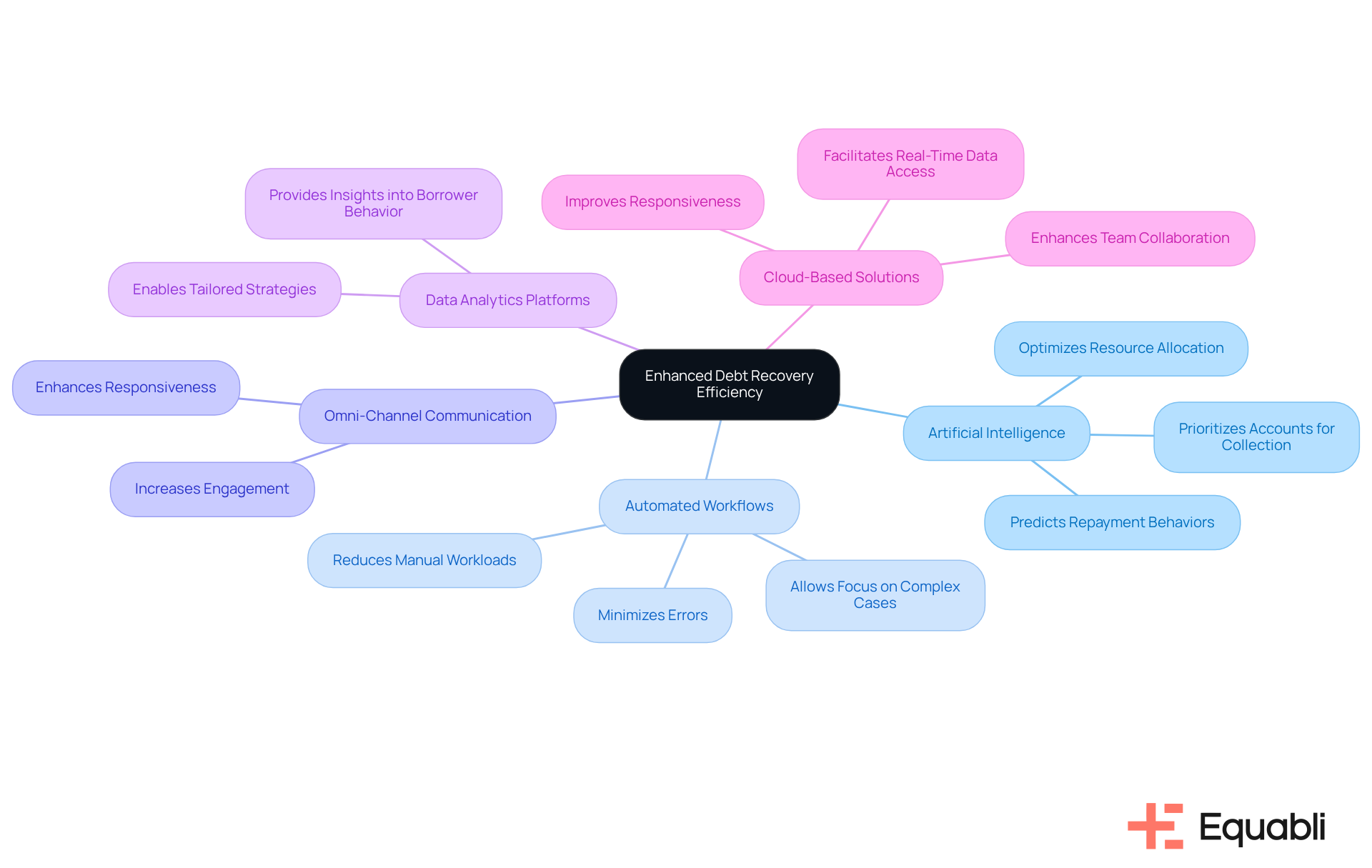

Utilizing technology is essential for improving . Organizations should consider several technological advancements that can enhance their operations.

- Artificial Intelligence (AI) serves as a pivotal tool in analyzing extensive datasets to predict repayment behaviors and prioritize accounts for collection efforts. Evidence shows that AI-powered tools can significantly enhance success rates in debt recovery, thereby optimizing resource allocation.

- Automated Workflows streamline routine tasks such as sending reminders and processing payments, effectively reducing manual workloads and minimizing errors. This automation allows staff to concentrate on more complex recovery cases, thereby improving overall operational efficiency.

- Omni-Channel Communication is crucial for ensuring that individuals receive messages through their preferred methods, such as email, SMS, or phone calls. This multi-channel approach increases the likelihood of engagement and responsiveness from debtors.

- Data Analytics Platforms provide valuable insights into borrower behavior, enabling organizations to tailor their strategies effectively. By understanding when and how to contact debtors, entities can make informed decisions that enhance recovery rates.

- Cloud-Based Solutions facilitate real-time access to data and collaboration among team members, regardless of their location. This flexibility not only enhances operational efficiency but also improves responsiveness to changing circumstances.

By adopting these technological innovations, organizations can improve their financial collection processes through debt recovery management solutions for financial institutions, reduce expenses, and enhance overall efficiency, positioning themselves for success in a competitive landscape.

Ensure Compliance and Ethical Standards in Debt Recovery

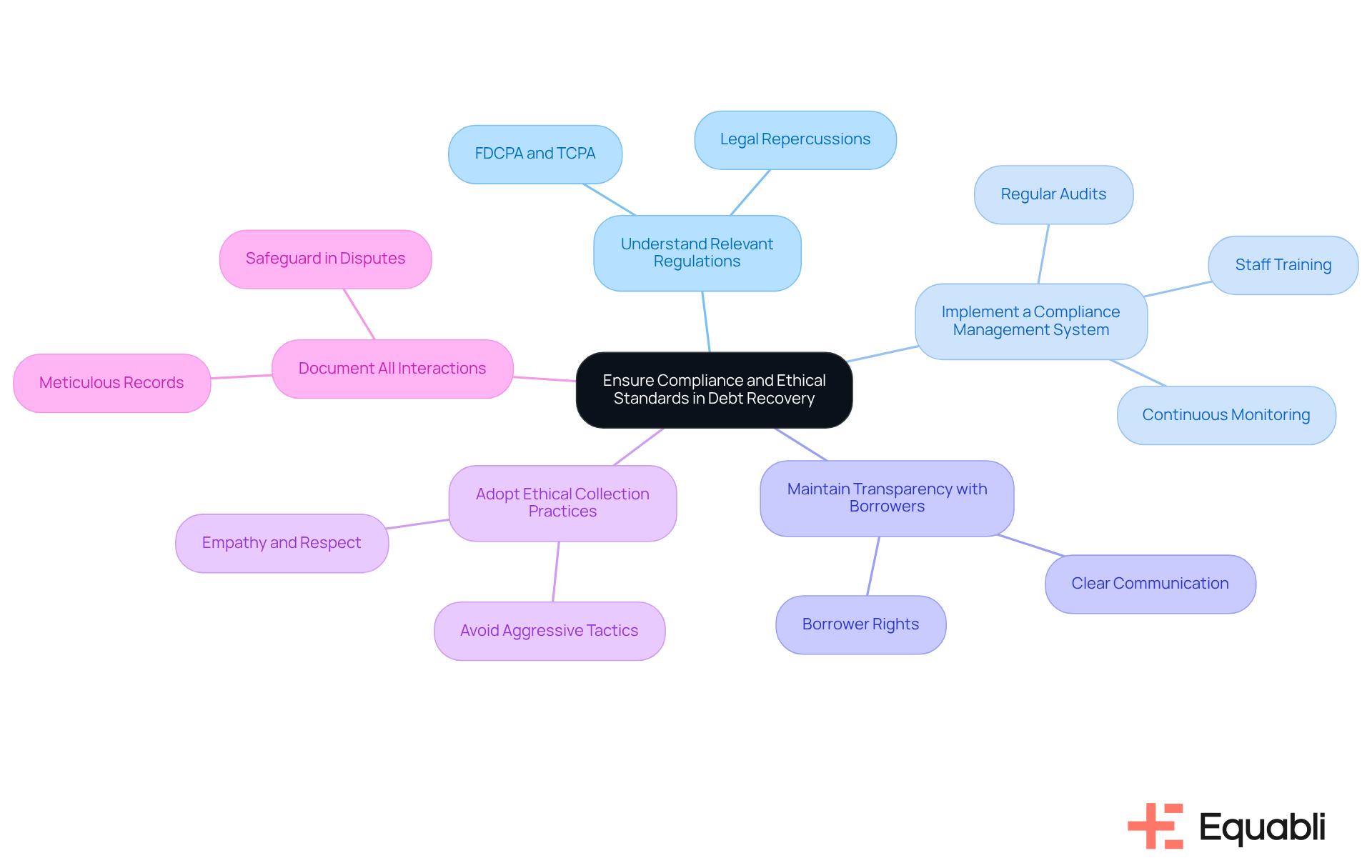

Ensuring adherence to compliance and ethical standards in financial collection is paramount. Organizations must prioritize the following aspects:

- Understand : Familiarize yourself with laws such as the Fair Debt Collection Practices Act (FDCPA) and the Telephone Consumer Protection Act (TCPA). Compliance with these regulations is essential to avoid legal repercussions and maintain operational integrity.

- Implement a Compliance Management System: Establish a robust system that continuously monitors adherence to all applicable laws and regulations. This system should incorporate regular audits and comprehensive staff training, ensuring that compliance is not only met but consistently upheld.

- Maintain Transparency with Borrowers: Clearly communicate repayment conditions and provide borrowers with essential information regarding their rights. Transparency fosters trust, which can significantly enhance repayment outcomes and strengthen borrower relationships.

- Adopt Ethical Collection Practices: Equip staff with training that emphasizes empathy and respect in debt collection efforts. Avoid aggressive tactics that could adversely affect the financial well-being of individuals, thereby promoting a more humane approach to debt recovery.

- Document All Interactions: Maintain meticulous records of all communications and transactions with debtors. This documentation is critical for compliance purposes and serves as a safeguard for the organization in the event of disputes.

By prioritizing compliance and ethical standards, organizations can enhance their reputation within the industry while effectively utilizing debt recovery management solutions for financial institutions.

Conclusion

Implementing effective debt recovery management solutions is essential for financial institutions seeking to optimize their collection processes. By concentrating on key components such as automated communication tools, data analytics, and compliance management, organizations can significantly enhance their operational efficiency and recovery rates. This multifaceted approach not only streamlines workflows but also nurtures better relationships with debtors, thereby supporting sustainable financial practices.

The article outlines strategic practices that further strengthen debt recovery efforts. These include:

- Prioritizing high-impact accounts

- Offering flexible payment plans

- Maintaining consistent communication

Additionally, leveraging technology like AI and automated workflows can transform the debt collection landscape, enabling organizations to make data-driven decisions that improve engagement and responsiveness. The emphasis on compliance and ethical standards ensures that organizations not only adhere to regulations but also build trust with their borrowers.

In conclusion, adopting these best practices and integrating technological innovations positions financial institutions for success in an increasingly competitive environment. By embracing a comprehensive debt recovery management strategy, organizations can achieve higher recovery rates while upholding ethical standards and compliance. The importance of these practices is paramount; they are critical for fostering long-term financial health and stability within the finance sector.

Frequently Asked Questions

What are debt recovery management solutions?

Debt recovery management solutions are systems designed to help organizations effectively manage the process of collecting debts owed to them, incorporating various key components for enterprise-level operations.

What role do automated communication tools play in debt recovery management?

Automated communication tools facilitate timely and consistent communication with debtors through channels such as SMS, email, and phone calls. They reduce manual effort and ensure that reminders and follow-ups are sent promptly, enhancing operational efficiency.

How does data analytics contribute to debt recovery management?

Data analytics provides organizations with the ability to evaluate repayment behaviors, monitor return statistics, and produce reports that guide strategic modifications. This data-focused approach improves decision-making and streamlines recovery efforts.

Why are payment processing systems important in debt recovery?

Efficient payment processing systems enable debtors to make payments easily through various channels, such as online portals or mobile apps. This flexibility can significantly enhance recovery rates and align with organizational financial performance goals.

What is the significance of compliance management features in debt recovery solutions?

Compliance management features ensure adherence to regulations such as the Fair Debt Collection Practices Act (FDCPA). This focus on compliance mitigates risk and supports sustainable business practices in debt collection.

How can customizable workflows benefit organizations in debt recovery?

Customizable workflows allow organizations to tailor their collection strategies and business needs, enhancing operational efficiency and adapting to the dynamic nature of debt recovery processes.

What is the overall benefit of integrating these components into debt recovery management solutions?

By integrating automated communication tools, data analytics, payment processing systems, compliance management features, and customizable workflows, companies can establish a robust financial collection management system that enhances both efficiency and effectiveness in their collection efforts.