Overview

The article provides a critical comparison of advanced debt collection software solutions tailored for enterprises, underscoring their pivotal role in optimizing collection processes and enhancing operational efficiency. Notably, modern solutions, such as Equabli's EQ Suite, deliver customizable features, automation, and data-driven insights. These elements collectively enhance borrower engagement, reduce operational costs, and ensure compliance with evolving regulatory standards, addressing the dynamic demands of the financial landscape.

Introduction

In a rapidly evolving financial landscape, enterprises increasingly recognize the necessity of advanced debt collection software solutions to enhance operational efficiency and borrower engagement. These modern tools streamline collection processes and provide critical insights that can significantly impact recovery rates. However, with numerous options available, organizations must determine which software best meets their unique needs and compliance requirements. This article presents a comparative analysis of leading debt collection software solutions, exploring their features, benefits, and strategic advantages for enterprises aiming to modernize their financial recovery efforts.

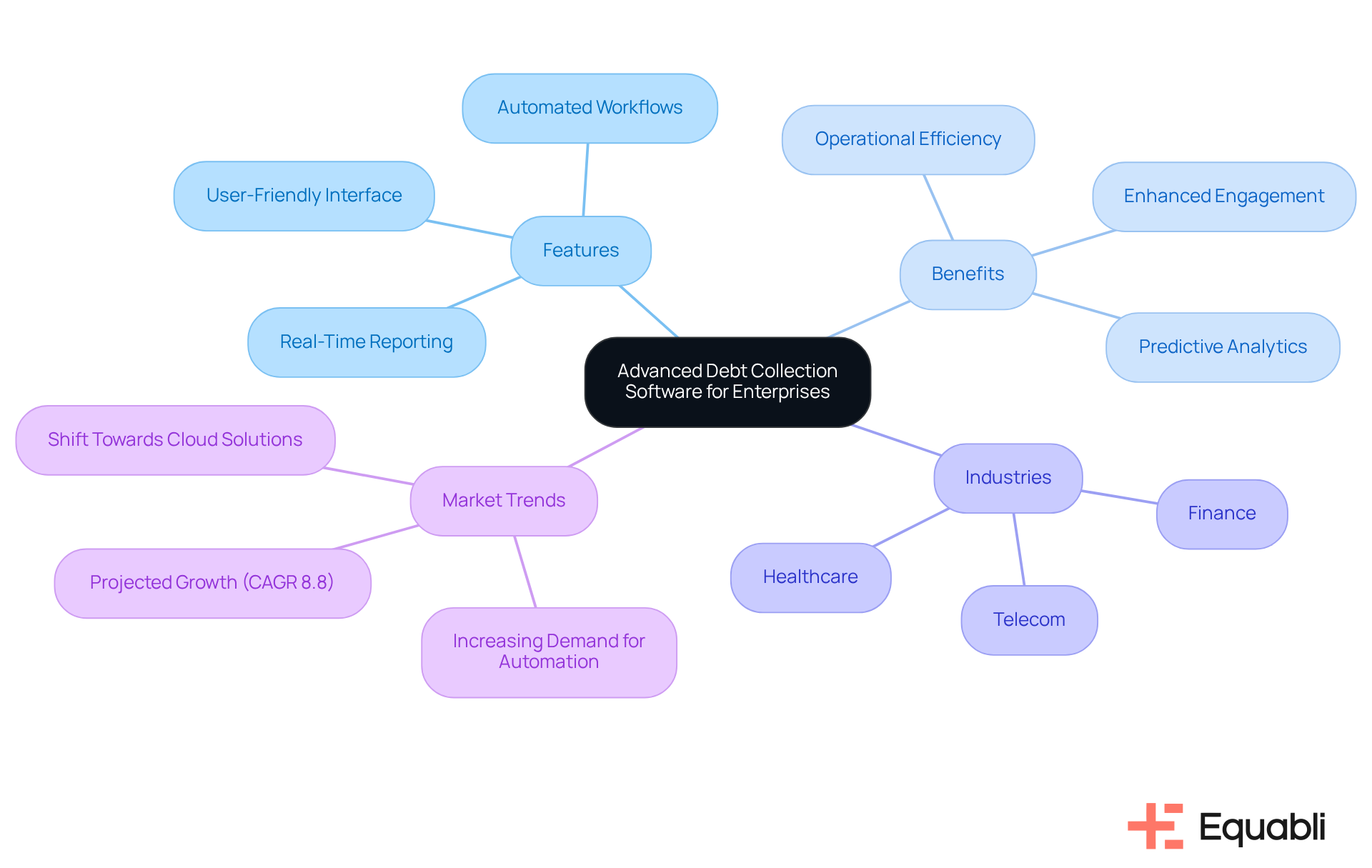

Overview of Advanced Debt Collection Software for Enterprises

For enterprises seeking to optimize their collection processes, advanced debt collection software solutions for enterprise financial institutions are essential. Traditional methods often result in inefficiencies, increased operational costs, and missed opportunities. In contrast, modern solutions, such as those offered by Equabli, utilize advanced debt collection software solutions for enterprise financial institutions to streamline workflows, enhance borrower engagement, and ensure compliance with regulatory standards. These software solutions are tailored for various industries, including finance, telecom, and healthcare, providing customizable features that address specific business requirements.

EQ Collect provides advanced debt collection software solutions for enterprise financial institutions, featuring a user-friendly, scalable, cloud-native interface, automated workflows, and real-time reporting, which significantly enhance operational efficiency and reduce execution errors. Additionally, EQ Engage empowers organizations to create, automate, and implement advanced debt collection software solutions for enterprise financial institutions, enhancing personalized communication journeys that improve borrower engagement and satisfaction. The integration of artificial intelligence and data analytics is increasingly vital, as it allows organizations to leverage advanced debt collection software solutions for enterprise financial institutions to accurately predict repayment behaviors and refine recovery strategies.

Significantly, the global receivables management platform market is projected to grow substantially, with a compound annual growth rate (CAGR) of 8.8%. This trend underscores the and efficiency in recovery processes. Such a shift highlights the critical role of advanced debt collection software solutions for enterprise financial institutions in modernizing financial recovery, which ultimately enhances operational performance and customer satisfaction.

Key Features to Consider in Debt Collection Software

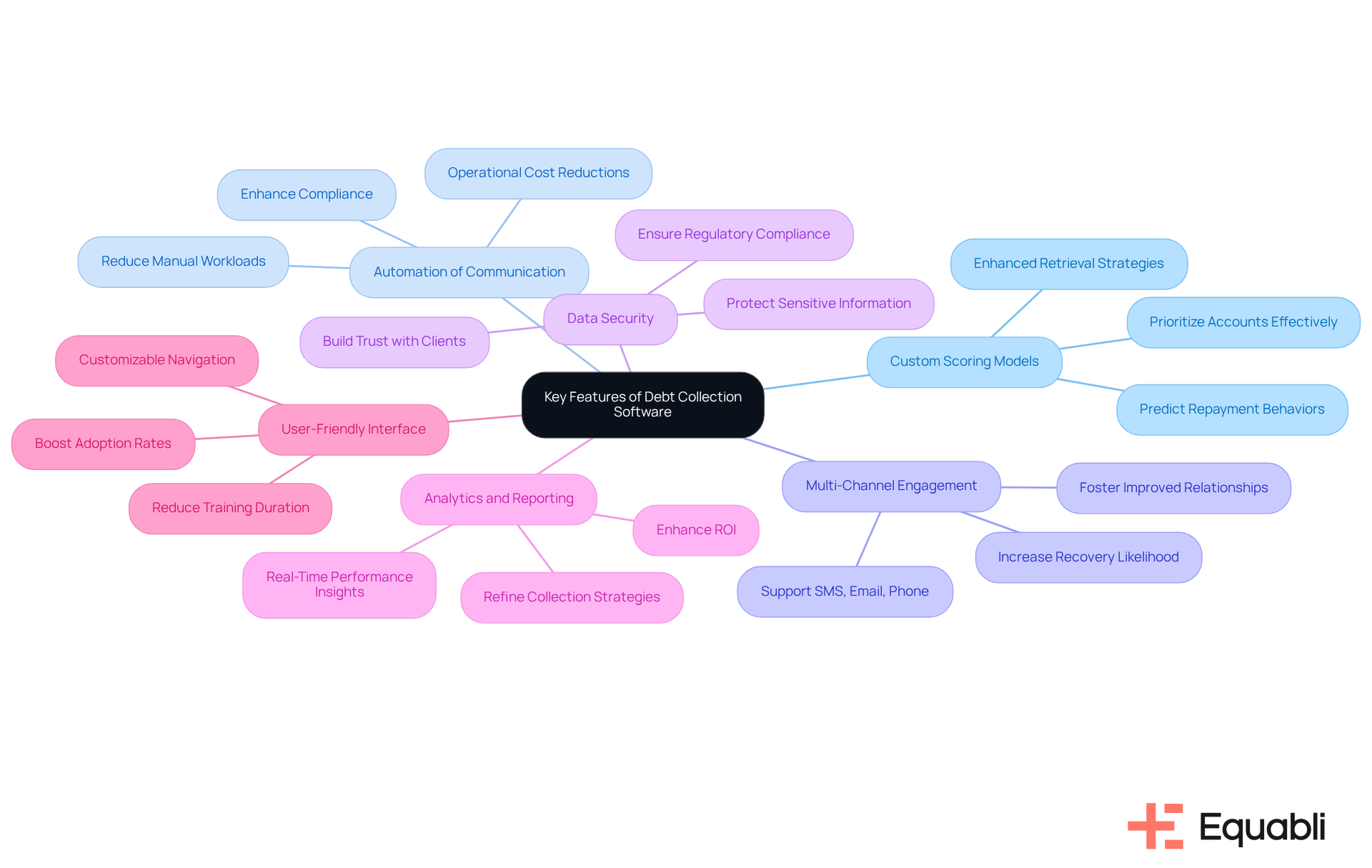

When evaluating debt collection software, enterprises should prioritize several essential features:

- Custom Scoring Models: Tailored scoring models are vital for accurately predicting repayment behaviors and effectively prioritizing accounts. Evidence shows that organizations utilizing advanced debt collection software solutions for enterprise financial institutions can significantly enhance their retrieval strategies, leading to improved recovery rates.

- The implementation of advanced debt collection software solutions for enterprise financial institutions is crucial for automating communication and strategy execution, which helps reduce manual workloads and enhance compliance. Case studies indicate that companies implementing advanced debt collection software solutions for enterprise financial institutions have achieved operational cost reductions of up to 90%, allowing their teams to focus more on strategic initiatives instead of routine tasks.

- Multi-Channel Engagement: Advanced debt collection software solutions for enterprise financial institutions enhance borrower engagement by supporting various communication channels—such as SMS, email, and phone. By allowing clients to choose their preferred means of communication, companies can foster improved relationships and increase the likelihood of successful recoveries.

- Data Security: Given the sensitivity of financial data, robust security measures are essential to protect against breaches and ensure regulatory compliance. A secure platform, such as advanced debt collection software solutions for enterprise financial institutions, not only safeguards sensitive information but also builds trust with clients and consumers.

- Analytics and Reporting: Advanced debt collection software solutions for enterprise financial institutions provide essential insights into collection performance, enabling organizations to refine their strategies and enhance ROI. Companies leveraging advanced debt collection software solutions for enterprise financial institutions and real-time data analytics have reported recovery rate improvements of 15-25%, underscoring the value of informed decision-making.

- User-Friendly Interface: A is crucial for ensuring that users can navigate the application efficiently. This reduces training duration and boosts adoption rates, ultimately resulting in more effective utilization of the software across the organization.

Benefits of Implementing Advanced Debt Collection Solutions

Implementing advanced debt collection software solutions for enterprise financial institutions presents significant advantages for these enterprises.

- Increased Efficiency: Automation and streamlined processes significantly reduce the time allocated to manual tasks. This enables staff to concentrate on higher-value activities, thereby enhancing overall productivity.

- Enhanced Borrower Engagement: By leveraging preferred communication channels and personalized strategies, organizations can cultivate stronger relationships with borrowers. This approach is instrumental in achieving higher repayment rates, ultimately benefiting the bottom line.

- Cost Reduction: Advanced debt collection software solutions for enterprise financial institutions effectively lower retrieval costs by curtailing operational inefficiencies and reducing the reliance on extensive manual intervention. This results in more .

- Enhanced Adherence: Integrated compliance functionalities empower entities to navigate the complex regulatory landscape with greater efficiency. This capability minimizes the risk of penalties, ensuring that organizations remain compliant in their operations.

- Data-Driven Insights: Access to analytics equips organizations with the ability to make informed decisions based on real-time information. This enhances gathering strategies and improves overall performance, positioning enterprises for sustained success in the debt collection arena.

Comparative Analysis of Leading Debt Collection Software Solutions

In the landscape of advanced [debt collection software solutions](https://researchandmarkets.com/report/debt-collection-software?srsltid=AfmBOor2BAJbkkWPTIU0dapuUz8IF-yjz0840gugjnsCzIKTjJFDDcr-) for enterprise financial institutions, several key factors distinguish the offerings available.

Equabli's EQ Suite stands out due to its intuitive interface and customizable features. Tools such as EQ Engine, EQ Engage, and EQ Collect significantly enhance borrower interaction and optimize recovery strategies. The suite's robust focus on data security and compliance positions it as an ideal choice for enterprises prioritizing these critical aspects in their operations.

Competitor A is recognized for its strong automation capabilities; however, it may fall short in the depth of analytics provided by Equabli. While it offers a , its less intuitive user interface could result in longer training periods for staff, potentially impacting overall efficiency.

Competitor B excels in analytics, distinguished by its advanced reporting features, yet it lacks the same level of customization that Equabli provides. Although its security measures are satisfactory, enterprises with stringent data protection requirements may find Equabli's comprehensive offerings more appealing.

Competitor C is known for its multi-channel engagement capabilities but struggles with automation, which can lead to increased operational costs. While it establishes a strong base for inventory, its lack of advanced functionalities may restrict efficiency in comparison to Equabli's comprehensive suite.

Overall, Equabli's extensive suite of tools, dedication to user experience, and emphasis on data-driven strategies reinforce its status as a top option for enterprises seeking advanced debt collection software solutions for enterprise financial institutions to modernize their financial recovery processes. The EQ Suite not only addresses the immediate needs of debt collection but also aligns with the evolving demands of the financial landscape, ensuring that organizations can navigate challenges effectively while maximizing their operational impact.

Conclusion

The evolution of debt collection software solutions is fundamentally reshaping how enterprises approach financial recoveries. By harnessing modern technology, organizations can streamline operations, enhance borrower engagement, and maintain stringent compliance with regulatory standards. Transitioning from traditional methods to these advanced solutions not only mitigates operational costs but also markedly boosts the effectiveness of debt recovery initiatives.

Key features such as customizable scoring models, multi-channel engagement, and robust data security are critical considerations for enterprises in selecting appropriate software. The implementation of these solutions yields significant benefits, including heightened efficiency, improved borrower relationships, and strengthened compliance adherence. Furthermore, insights derived from advanced analytics empower organizations to refine their strategies, resulting in elevated recovery rates and overall performance enhancements.

As the demand for sophisticated debt collection solutions escalates, enterprises must thoroughly evaluate their options. The right software can modernize financial recovery processes and strategically position organizations for enduring success in a competitive landscape. Embracing these advanced technologies is not merely a strategic choice; it is imperative for adapting to the evolving demands of the financial sector and achieving operational excellence.

Frequently Asked Questions

What is the purpose of advanced debt collection software for enterprises?

Advanced debt collection software is designed to optimize collection processes for enterprises, reducing inefficiencies, operational costs, and missed opportunities compared to traditional methods.

How do modern debt collection software solutions improve workflows?

Modern solutions streamline workflows, enhance borrower engagement, and ensure compliance with regulatory standards, making the collection process more efficient.

Which industries benefit from advanced debt collection software?

Industries such as finance, telecom, and healthcare can benefit from advanced debt collection software, as these solutions offer customizable features tailored to specific business requirements.

What are some key features of EQ Collect?

EQ Collect features a user-friendly, scalable, cloud-native interface, automated workflows, and real-time reporting, which enhance operational efficiency and reduce execution errors.

How does EQ Engage improve borrower communication?

EQ Engage allows organizations to create, automate, and implement personalized communication journeys, thereby improving borrower engagement and satisfaction.

What role does artificial intelligence play in debt collection software?

Artificial intelligence and data analytics help organizations predict repayment behaviors and refine recovery strategies, making debt collection more effective.

What is the projected growth of the global receivables management platform market?

The global receivables management platform market is projected to grow at a compound annual growth rate (CAGR) of 8.8%, indicating a rising demand for automation and efficiency in recovery processes.

Why is advanced debt collection software critical for enterprises?

Advanced debt collection software is crucial for modernizing financial recovery processes, enhancing operational performance, and improving customer satisfaction.